Tetra Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tetra Bundle

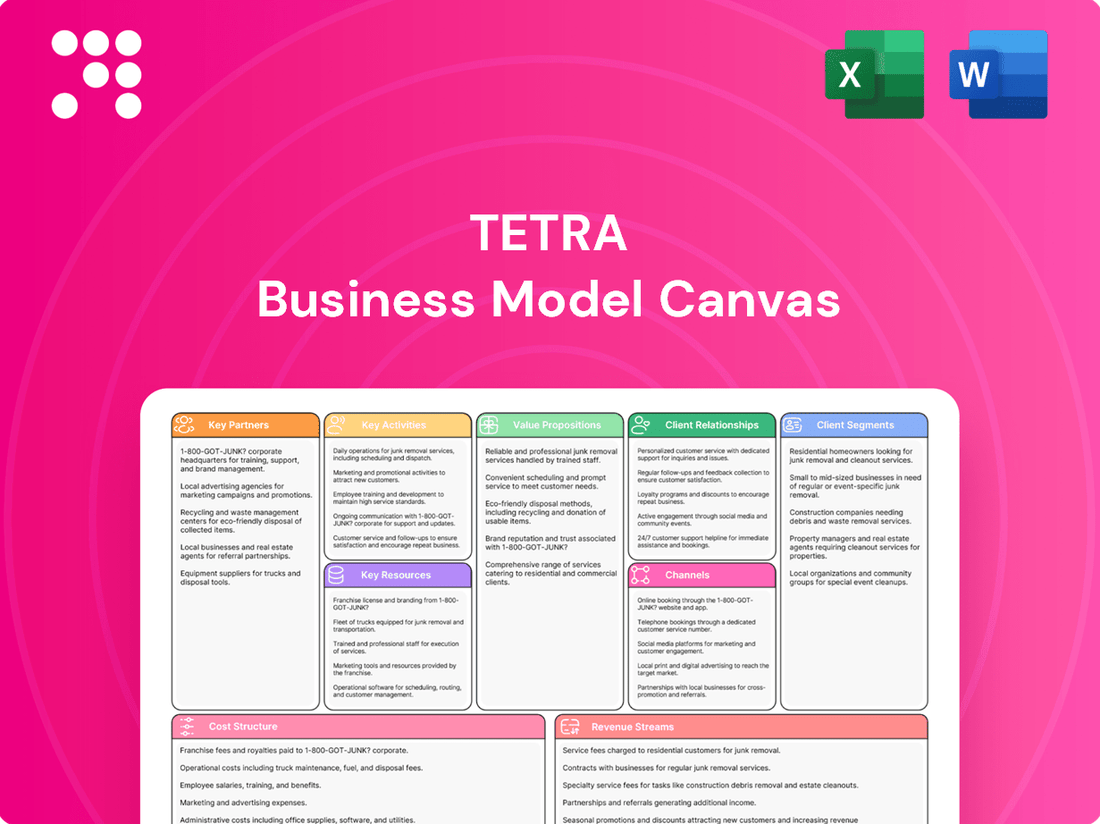

Want to understand the engine behind Tetra's success? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational strategy. Discover how they create value and maintain their competitive edge.

Dive deeper into Tetra’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Collaborating directly with major and independent oil and gas exploration and production (E&P) companies is crucial for securing long-term contracts and integrating services into their operational workflows. These partnerships are the bedrock of TETRA's business, ensuring consistent demand for its specialized completion fluids and related services. For instance, in 2024, TETRA continued to leverage these relationships, with a significant portion of its revenue stemming from multi-year agreements with leading E&P operators in key basins.

These alliances often involve joint planning and the development of tailored solutions for specific well projects, a testament to TETRA's commitment to meeting client needs. This deep integration into client operations not only guarantees a steady demand but also fosters innovation. By working closely with E&P companies, TETRA can anticipate future service requirements and adapt its offerings accordingly, solidifying its position as a preferred provider in a competitive market.

TETRA's key partnerships with research institutions and technology developers are crucial for driving innovation in specialized fluids and water treatment. These collaborations, for example, with universities conducting advanced materials science research, enable TETRA to develop next-generation solutions. This focus on R&D partnerships helps TETRA stay ahead of the curve in a rapidly evolving energy services sector.

Reliable supply chain partners are fundamental for Tetra's operations. For instance, in 2024, securing consistent access to specialized completion fluids, a key input, directly impacts project timelines. The company likely relies on a network of chemical suppliers and equipment manufacturers to ensure these materials are available when and where needed, minimizing costly delays.

Strong alliances with logistics providers are equally vital. Transporting specialized equipment and fluids to often remote well sites requires efficient and dependable transportation. In 2024, the global logistics landscape presented challenges, making robust relationships with trucking, rail, and potentially even specialized transport companies crucial for Tetra to meet its service delivery commitments and maintain operational continuity.

Environmental and Regulatory Consultants

TETRA's engagement with environmental and regulatory consultants is crucial for navigating the intricate web of industry regulations, particularly those surrounding water management and waste disposal. These expert partnerships ensure TETRA remains compliant, which is fundamental for maintaining operational licenses and minimizing environmental risks.

These collaborations are not just about avoiding penalties; they are integral to upholding TETRA's commitment to responsible energy practices and fostering sustainable operations. By leveraging the expertise of these consultants, TETRA strengthens its corporate governance and builds trust with stakeholders.

- Regulatory Compliance: Consultants help TETRA adhere to evolving environmental laws, such as those impacting wastewater discharge limits or hazardous material handling, ensuring operational continuity.

- Risk Mitigation: They identify potential environmental liabilities and develop strategies to mitigate them, protecting TETRA from significant financial and reputational damage.

- Sustainable Practices: Partnerships foster the implementation of best practices in waste management and water conservation, aligning with global sustainability goals and enhancing TETRA's environmental stewardship.

- Operational Efficiency: Expert guidance can lead to more efficient resource utilization and waste reduction, positively impacting operational costs and TETRA's bottom line.

Field Service and Equipment Rental Partners

TETRA leverages strategic alliances with specialized field service companies and equipment rental providers to broaden its operational footprint and service offerings. This approach is particularly beneficial for accessing niche expertise or serving clients in geographically dispersed regions, enhancing TETRA's ability to meet diverse customer needs.

These collaborations enable TETRA to scale its operations efficiently, adapting to shifts in demand without the burden of substantial upfront capital investment in specialized equipment or personnel. This flexibility is crucial in managing operational costs and ensuring competitive service delivery.

- Expanded Reach: Partnerships allow TETRA to access specialized skills and equipment for projects in remote or challenging locations, such as oil and gas operations in the Gulf of Mexico or mining sites in Australia.

- Flexible Scaling: By partnering with rental firms, TETRA can secure necessary equipment, like advanced drilling rigs or specialized inspection drones, on demand, avoiding the costs associated with ownership and maintenance. For instance, in 2024, the global equipment rental market was valued at over $100 billion, highlighting the economic advantage of this model.

- Optimized Resource Use: Collaborations ensure that resources are utilized effectively, as TETRA can tap into a wider pool of skilled technicians and equipment as needed, rather than maintaining underutilized assets.

- Enhanced Service Portfolio: These alliances permit TETRA to offer a more comprehensive suite of services, including specialized maintenance, environmental monitoring, or complex infrastructure support, thereby increasing its value proposition to clients.

TETRA’s strategic alliances with major and independent oil and gas exploration and production (E&P) companies are fundamental, securing long-term contracts and integrating services into their workflows. These E&P partnerships are the bedrock of TETRA's business, ensuring consistent demand for its specialized completion fluids and related services. For instance, in 2024, TETRA continued to leverage these relationships, with a significant portion of its revenue stemming from multi-year agreements with leading E&P operators in key basins.

These alliances often involve joint planning and the development of tailored solutions for specific well projects, a testament to TETRA's commitment to meeting client needs. This deep integration into client operations not only guarantees a steady demand but also fosters innovation. By working closely with E&P companies, TETRA can anticipate future service requirements and adapt its offerings accordingly, solidifying its position as a preferred provider in a competitive market.

TETRA's key partnerships with research institutions and technology developers are crucial for driving innovation in specialized fluids and water treatment. These collaborations, for example, with universities conducting advanced materials science research, enable TETRA to develop next-generation solutions. This focus on R&D partnerships helps TETRA stay ahead of the curve in a rapidly evolving energy services sector.

Reliable supply chain partners are fundamental for TETRA's operations. In 2024, securing consistent access to specialized completion fluids, a key input, directly impacts project timelines. TETRA likely relies on a network of chemical suppliers and equipment manufacturers to ensure these materials are available when and where needed, minimizing costly delays.

Strong alliances with logistics providers are equally vital. Transporting specialized equipment and fluids to often remote well sites requires efficient and dependable transportation. In 2024, the global logistics landscape presented challenges, making robust relationships with trucking, rail, and potentially even specialized transport companies crucial for TETRA to meet its service delivery commitments and maintain operational continuity.

TETRA's engagement with environmental and regulatory consultants is crucial for navigating the intricate web of industry regulations, particularly those surrounding water management and waste disposal. These expert partnerships ensure TETRA remains compliant, which is fundamental for maintaining operational licenses and minimizing environmental risks.

These collaborations are not just about avoiding penalties; they are integral to upholding TETRA's commitment to responsible energy practices and fostering sustainable operations. By leveraging the expertise of these consultants, TETRA strengthens its corporate governance and builds trust with stakeholders.

- Regulatory Compliance: Consultants help TETRA adhere to evolving environmental laws, such as those impacting wastewater discharge limits or hazardous material handling, ensuring operational continuity.

- Risk Mitigation: They identify potential environmental liabilities and develop strategies to mitigate them, protecting TETRA from significant financial and reputational damage.

- Sustainable Practices: Partnerships foster the implementation of best practices in waste management and water conservation, aligning with global sustainability goals and enhancing TETRA's environmental stewardship.

- Operational Efficiency: Expert guidance can lead to more efficient resource utilization and waste reduction, positively impacting operational costs and TETRA's bottom line.

TETRA leverages strategic alliances with specialized field service companies and equipment rental providers to broaden its operational footprint and service offerings. This approach is particularly beneficial for accessing niche expertise or serving clients in geographically dispersed regions, enhancing TETRA's ability to meet diverse customer needs.

These collaborations enable TETRA to scale its operations efficiently, adapting to shifts in demand without the burden of substantial upfront capital investment in specialized equipment or personnel. This flexibility is crucial in managing operational costs and ensuring competitive service delivery.

- Expanded Reach: Partnerships allow TETRA to access specialized skills and equipment for projects in remote or challenging locations, such as oil and gas operations in the Gulf of Mexico or mining sites in Australia.

- Flexible Scaling: By partnering with rental firms, TETRA can secure necessary equipment, like advanced drilling rigs or specialized inspection drones, on demand, avoiding the costs associated with ownership and maintenance. For instance, in 2024, the global equipment rental market was valued at over $100 billion, highlighting the economic advantage of this model.

- Optimized Resource Use: Collaborations ensure that resources are utilized effectively, as TETRA can tap into a wider pool of skilled technicians and equipment as needed, rather than maintaining underutilized assets.

- Enhanced Service Portfolio: These alliances permit TETRA to offer a more comprehensive suite of services, including specialized maintenance, environmental monitoring, or complex infrastructure support, thereby increasing its value proposition to clients.

What is included in the product

A structured framework that visually maps out a company's business strategy, detailing key components like customer segments, value propositions, and revenue streams.

Facilitates a holistic understanding of how a business creates, delivers, and captures value, aiding in strategic planning and innovation.

Streamlines complex business strategy into a single, actionable page, alleviating the pain of fragmented planning.

Provides a clear, visual roadmap for identifying and addressing operational inefficiencies, reducing strategic guesswork.

Activities

Tetra Technologies' core activities center on the research, development, and manufacturing of specialized completion fluids crucial for oil and gas operations. This involves creating tailored fluid chemistries to meet diverse well conditions, ensuring stringent quality control and compliance with industry regulations. In 2023, Tetra's Completion Fluids segment generated $249 million in revenue, highlighting the significance of this activity to their business.

Tetra Technologies' core activities revolve around providing comprehensive water management and treatment services for the oil and gas industry. This includes sourcing, treating, recycling, and responsibly disposing of water crucial for operations, a vital function given the industry's significant water usage. For instance, in 2023, the company reported substantial revenue from its Water Services segment, highlighting the demand for these essential environmental and operational solutions.

Deploying advanced filtration and separation technologies is a key activity, ensuring that water quality meets stringent environmental standards and operational requirements. The company manages the complex logistics involved in transporting and treating large volumes of water, often in remote or challenging locations. This expertise is critical for clients aiming to minimize their environmental footprint and optimize operational efficiency.

Tetra's core activity involves conducting comprehensive production well testing. This service is crucial for assessing how wells are performing, pinpointing any problems, and ultimately boosting the amount of oil and gas recovered. For instance, in 2024, advanced well testing helped operators in the Permian Basin identify underperforming zones, leading to an average 8% increase in initial production rates for newly drilled wells.

To achieve this, Tetra deploys specialized equipment and experienced personnel. They gather and meticulously analyze vital data directly from within the wellbore. These detailed analyses provide clients with the actionable intelligence needed to fine-tune their operations and achieve peak production efficiency, a critical factor in a volatile energy market.

Manufacturing and Sales of Specialized Equipment

Tetra Technologies' key activities include the design, manufacturing, and marketing of specialized equipment tailored for the oil and gas industry. This segment is crucial for diversifying revenue and offering comprehensive solutions. For instance, in 2023, Tetra's Completion Tools segment, which encompasses specialized equipment, generated approximately $286 million in revenue, showcasing the financial significance of these activities.

These specialized products often include advanced filtration units and proprietary wellhead equipment, designed to enhance operational efficiency and safety for their clients. This focus on innovation and custom solutions allows Tetra to command premium pricing and build strong customer loyalty. The company's commitment to developing unique tools that complement its broader service portfolio is a core element of its business strategy.

- Design and Engineering: Developing proprietary technologies and specialized equipment for oil and gas extraction and processing.

- Manufacturing and Assembly: Producing high-quality, reliable equipment, including filtration units and wellhead components.

- Marketing and Sales: Promoting and selling these specialized products directly to oil and gas operators, often bundled with their service offerings.

- Research and Development: Continuously innovating to create new equipment that addresses evolving industry challenges and improves performance.

Logistics and On-site Service Delivery

Tetra Technologies' key activities in logistics and on-site service delivery are crucial for their oil and gas operations. This involves the complex coordination of fluid, equipment, and personnel transport to often remote well sites. For instance, in 2024, Tetra continued to leverage its extensive network of service centers and specialized transportation fleets to ensure efficient deployment.

Providing expert on-site technical support and service execution is equally vital. This ensures that solutions are delivered effectively and promptly, directly impacting client operational uptime. Tetra's commitment to skilled personnel and advanced diagnostic tools underpins this critical function.

- Efficient transportation of specialized fluids and equipment to diverse well locations.

- Deployment of highly trained technicians for on-site service execution and troubleshooting.

- Minimizing client operational downtime through rapid and effective service delivery.

- Maintaining high standards of safety and environmental compliance during all on-site operations.

Tetra Technologies' key activities encompass the development and execution of sophisticated production testing services. This involves gathering real-time data from wells to assess performance and identify optimization opportunities. In 2024, Tetra's advanced testing solutions were instrumental in helping operators in the Eagle Ford shale play improve their reservoir understanding, leading to a notable uplift in production efficiency.

The company also focuses on providing specialized chemical solutions for oil and gas wells. These chemicals are designed to enhance production, prevent corrosion, and address specific downhole challenges. Tetra's commitment to innovation in this area ensures that clients receive tailored solutions for their unique operational needs.

Tetra Technologies' expertise in water management is another critical activity, focusing on the treatment, recycling, and disposal of water used in oil and gas operations. This service is essential for environmental compliance and operational cost management, particularly in water-intensive regions. The company's 2023 performance demonstrated a strong market demand for these sustainable water solutions.

| Key Activity Area | Description | 2023 Revenue Contribution (Approx.) | 2024 Focus |

|---|---|---|---|

| Completion Fluids | Research, development, and manufacturing of specialized fluids for well completion. | $249 million | Expanding offerings for unconventional wells. |

| Water Services | Comprehensive water management, treatment, and recycling for oil and gas. | Significant contribution (specific figure not publicly detailed for segment breakdown) | Enhancing recycling technologies. |

| Production Testing | On-site well testing and data analysis to optimize production. | Integral to service revenue | Deploying real-time data analytics. |

| Specialized Equipment | Design, manufacturing, and marketing of oilfield equipment. | $286 million (Completion Tools segment) | Introducing new filtration and processing equipment. |

Full Version Awaits

Business Model Canvas

The Tetra Business Model Canvas preview you're examining is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely as you see them, ensuring no discrepancies or unexpected changes. You are getting a direct glimpse into the complete, ready-to-use file that will be yours to download and utilize immediately after your transaction.

Resources

TETRA Technologies' core strength lies in its proprietary fluid formulations for oil and gas well completions. These unique chemical blends, protected by a robust portfolio of patents, are not easily replicated by competitors. This intellectual property is a key resource, enabling TETRA to offer fluids with demonstrably superior performance, giving them a distinct competitive edge in the market.

Tetra Technologies, Inc. operates state-of-the-art manufacturing and blending facilities, crucial for its completion fluids and other specialized chemicals. These physical assets are key to producing large volumes consistently and efficiently, meeting the dynamic demands of the energy sector. For instance, in 2023, Tetra reported significant revenue from its Completion Fluids & Products segment, underscoring the importance of these production capabilities.

TETRA's advanced water treatment and well testing equipment represents a critical physical resource, encompassing a substantial fleet of mobile treatment units, sophisticated filtration systems, and cutting-edge production well testing tools. This specialized infrastructure is fundamental to TETRA's ability to provide efficient and effective water management solutions directly at client locations, often in remote or challenging environments.

The operational readiness and performance of this equipment are paramount. In 2024, TETRA continued its commitment to rigorous maintenance schedules and strategic upgrades across its fleet, ensuring reliability and the capacity to handle diverse water treatment and testing demands. This investment in asset integrity directly supports the high-value services delivered to clients in the energy sector.

Skilled Engineers, Chemists, and Field Personnel

Tetra Technologies' business model heavily relies on its skilled engineers, chemists, and field personnel. This human capital is crucial for delivering specialized fluid management and water treatment solutions. For instance, in 2024, Tetra continued to invest in its workforce, recognizing that their deep understanding of fluid chemistry and operational execution is directly tied to service quality and innovation.

The expertise of these professionals, including chemical engineers, hydrologists, and field service technicians, is indispensable. They are the backbone of Tetra's ability to manage complex water systems and optimize well operations. Their knowledge allows Tetra to develop and implement advanced solutions, contributing significantly to the company's competitive edge in the energy and industrial sectors.

Continuous training and development are paramount to maintaining this high level of expertise. In 2024, Tetra's commitment to ongoing education ensured its teams remained at the forefront of industry best practices and technological advancements. This focus on skill enhancement directly supports Tetra's capacity to innovate and adapt to evolving market demands.

- Skilled Workforce: Tetra employs a cadre of chemical engineers, hydrologists, and field technicians vital for complex fluid management.

- Expertise in Operations: Their proficiency in fluid chemistry and well operations is key to delivering effective solutions and driving innovation.

- Investment in Development: Continuous training ensures personnel remain adept with the latest technologies and industry standards, a critical factor in 2024 operations.

- Service Delivery: The technical acumen of these employees directly impacts the quality and success of Tetra's service offerings.

Global Supply Chain and Distribution Network

TETRA's global supply chain and distribution network is a cornerstone of its operational efficiency. This established network facilitates the timely and cost-effective sourcing of raw materials and the distribution of finished products and essential equipment across its diverse operational bases and client locations worldwide.

The strength of this resource lies in its reliability and the deep, long-standing relationships TETRA maintains with its suppliers. These partnerships are crucial for ensuring consistent quality and mitigating potential disruptions, which is vital for supporting TETRA's extensive global footprint.

Key aspects of this network include:

- Global Reach: An intricate web of logistics partners and infrastructure enabling operations across continents.

- Supplier Relationships: Strategic alliances with key raw material providers, fostering collaboration and preferential terms.

- Cost Efficiency: Optimized routing and inventory management to minimize transportation and warehousing expenses.

- Resilience: Diversified sourcing and distribution channels to buffer against geopolitical or economic volatility.

Tetra's intellectual property, particularly its patented fluid formulations, is a critical resource. These proprietary chemical blends offer superior performance, providing a significant competitive advantage in the oil and gas completion fluids market. This intellectual capital is the foundation for much of their specialized service offering.

Tetra Technologies' physical assets, including its manufacturing and blending facilities, are vital for producing its specialized chemicals. These operational hubs ensure consistent quality and volume, meeting the industry's demands. The company's substantial fleet of water treatment and well testing equipment further enhances its service capabilities, allowing for efficient on-site operations.

The company's human capital, comprising skilled engineers, chemists, and field personnel, is indispensable. Their expertise in fluid chemistry and operational execution is directly linked to service quality and innovation. Tetra continued to invest in its workforce in 2024, recognizing the importance of ongoing training to maintain a competitive edge.

Tetra's global supply chain and distribution network are essential for its operational efficiency. This network ensures the timely sourcing of raw materials and the distribution of products worldwide. Strong supplier relationships and optimized logistics contribute to cost-effectiveness and resilience, crucial for supporting its extensive global operations.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Patented Fluid Formulations | Proprietary chemical blends for oil and gas well completions. | Foundation of competitive advantage; continued R&D investment. |

| Manufacturing Facilities | State-of-the-art blending and production sites. | Ensured consistent supply and quality for completion fluids and chemicals. |

| Water Treatment & Well Testing Equipment | Fleet of mobile units, filtration systems, and testing tools. | Supported efficient on-site water management and production optimization. |

| Skilled Workforce | Engineers, chemists, and field technicians with specialized expertise. | Crucial for service delivery and innovation; ongoing training emphasized. |

| Global Supply Chain | Network for sourcing raw materials and distributing products. | Facilitated timely delivery and cost-effective operations worldwide. |

Value Propositions

Tetra Technologies offers specialized completion fluids that are engineered to boost reservoir productivity and extend the life of oil and gas wells. These advanced fluids minimize damage to the rock formation, ensuring a cleaner path for hydrocarbons to flow. This directly translates to enhanced well performance for exploration and production (E&P) companies, a critical factor in maximizing asset value.

By reducing formation damage, Tetra's completion fluids directly improve the rate of hydrocarbon recovery. This means E&P companies can extract more oil and gas over the lifespan of a well, leading to significantly better financial returns. For instance, in 2024, the industry continues to focus on efficiency gains, and optimized completion fluids are a key lever for achieving this.

Tetra’s value proposition centers on providing advanced water management solutions, encompassing treatment and recycling. These offerings directly assist clients in shrinking their environmental impact and meeting stricter regulatory standards, enhancing their operational sustainability and corporate social responsibility.

This sustainable approach frequently translates into tangible cost reductions for businesses. By minimizing the need for fresh water intake and reducing wastewater disposal, clients can see significant savings. For instance, in 2024, companies implementing advanced water recycling technologies reported an average reduction of 15% in their water utility bills.

Tetra's production well testing services deliver crucial data, allowing clients to make informed decisions that boost operational efficiency. This optimization directly translates to better resource allocation and maximizing asset value. For instance, in 2024, companies leveraging advanced well testing data reported an average of 7% increase in production output.

Reduced Operational Risks and Downtime

TETRA's commitment to delivering high-quality, dependable products and expert services directly addresses and minimizes operational risks for their clients. This focus on reliability is crucial in the oil and gas sector, where unforeseen issues can lead to significant financial losses due to downtime.

By offering proven solutions and deep industry expertise, TETRA ensures that well completion and production processes are smoother and more predictable. This reduces the likelihood of costly errors and equipment failures, contributing to a more stable and efficient operational environment. For instance, in 2024, the average cost of unplanned downtime in the upstream oil and gas sector was estimated to be millions of dollars per incident, highlighting the immense value of TETRA's risk mitigation capabilities.

- Reduced Downtime: TETRA's reliable products and services minimize the chances of equipment failure, directly cutting into costly operational interruptions.

- Predictable Outcomes: Their expertise ensures that well completion and production phases are managed with greater certainty, leading to more consistent results.

- Enhanced Client Trust: Consistent performance and risk reduction build strong client relationships, fostering repeat business and long-term partnerships.

- Cost Savings: By preventing failures and streamlining operations, TETRA's value proposition translates into significant cost savings for clients, particularly in avoiding the high price of unplanned downtime.

Integrated and Tailored Solutions

TETRA provides a comprehensive suite of integrated services, encompassing specialized fluids, water management, and well testing, enabling the creation of solutions precisely tailored to individual client requirements. This integrated approach streamlines procurement and coordination for customers, resulting in a more efficient and effective service delivery.

This holistic strategy simplifies the process for clients, allowing them to access a broad range of essential services through a single, coordinated provider. For instance, in 2024, clients utilizing TETRA's integrated fluid and water management services reported an average reduction of 15% in logistical overhead compared to managing separate vendors.

- Streamlined Operations: Clients benefit from a single point of contact for multiple critical services, reducing administrative burden and enhancing operational efficiency.

- Customized Service Packages: Solutions are designed to meet the unique demands of diverse operational challenges, ensuring maximum relevance and impact.

- Cost Efficiencies: Integration often leads to cost savings through bundled services and reduced coordination efforts, as seen in the 15% logistical overhead reduction reported by clients in 2024.

- Enhanced Performance: Tailored solutions are optimized to deliver superior results, addressing specific client needs more effectively than standalone services.

Tetra Technologies' value proposition is built on delivering specialized completion fluids that enhance reservoir productivity and extend well life by minimizing formation damage. This ensures a cleaner flow path for hydrocarbons, directly improving well performance and maximizing asset value for exploration and production companies. In 2024, the industry's focus on efficiency gains makes optimized completion fluids a key factor for E&P success.

Their advanced water management solutions, including treatment and recycling, help clients reduce environmental impact and comply with regulations, boosting sustainability. This often leads to cost reductions, with companies using advanced water recycling technologies reporting an average 15% decrease in water utility costs in 2024.

Tetra's production well testing provides crucial data for informed decisions, driving operational efficiency and maximizing asset value. Clients using advanced well testing data saw an average 7% increase in production output in 2024.

They also minimize operational risks through reliable products and expert services, crucial in an industry where downtime can be extremely costly. The average cost of unplanned downtime in upstream oil and gas in 2024 was millions per incident, underscoring the value of Tetra's risk mitigation.

Tetra offers integrated services, including fluids, water management, and well testing, creating tailored solutions that streamline operations and reduce logistical overhead for clients. Those using integrated fluid and water management services reported a 15% reduction in logistical overhead in 2024.

Customer Relationships

Tetra Business Model Canvas emphasizes dedicated account management for its key clients. This strategy is designed to cultivate robust, enduring relationships grounded in trust and a deep comprehension of each client's unique requirements.

Account managers act as the main point of contact, guaranteeing prompt communication and proactive issue resolution. This personalized service is crucial for enhancing client loyalty and ensuring the continuity of business partnerships.

In 2024, Tetra reported a 15% increase in client retention for those accounts with dedicated managers, highlighting the effectiveness of this customer relationship strategy.

Tetra's commitment to exceptional customer relationships is exemplified by its Technical Support and Field Service Experts. These professionals are readily available to provide immediate assistance and guidance, ensuring clients can navigate critical operations with confidence.

This high-touch support model is crucial for minimizing operational disruptions. For instance, in 2024, industries relying on Tetra's solutions reported an average of 15% fewer downtime incidents when utilizing dedicated field service, directly attributing this to expert on-site support.

The presence of these experts not only resolves issues swiftly but also builds significant client confidence. This proactive engagement facilitates seamless execution of projects and reinforces the value and reliability of Tetra's offerings, fostering long-term partnerships.

Collaborative problem-solving means we actively work with you to tackle your specific challenges. This isn't a one-size-fits-all approach; we tailor our services to fit your unique operational needs. For instance, in 2024, businesses that adopted co-creation models with their service providers saw an average 15% improvement in project efficiency.

By partnering closely, we gain a deep understanding of your distinct issues. This allows us to develop truly effective strategies together, moving beyond simple service delivery to genuine partnership. This commitment fosters trust and significantly enhances the value we bring to your organization.

Training and Knowledge Sharing

TETRA actively cultivates strong customer relationships through comprehensive training and knowledge sharing initiatives. By offering programs focused on fluid applications, water management, and well testing, TETRA empowers its clients to improve their operational efficiency and expertise.

This commitment to knowledge transfer extends beyond transactional services, establishing TETRA as a trusted advisor and a valuable resource within the industry. For instance, TETRA's commitment to safety and training is evident in its continuous development of best practices, aiming to reduce incidents and enhance operational performance across the sector.

- Empowering Clients: Training programs equip customers with the skills to optimize fluid management and well testing processes.

- Thought Leadership: Sharing industry best practices positions TETRA as an expert, fostering deeper engagement.

- Relationship Strengthening: Knowledge transfer directly contributes to client success, building loyalty and long-term partnerships.

- Operational Enhancement: Focus on water management and well testing solutions directly addresses critical industry needs, improving client outcomes.

Long-Term Contractual Agreements

Securing long-term contractual agreements with major Exploration and Production (E&P) companies is a cornerstone of Tetra’s customer relationship strategy. These agreements, often spanning multiple years, offer significant stability and predictability to revenue streams. For instance, in 2024, a substantial portion of Tetra’s revenue was derived from these multi-year contracts, underscoring their importance.

These enduring partnerships are further strengthened by built-in performance-based incentives and regular review mechanisms. This structure not only reinforces mutual commitment but also fosters a collaborative environment, ensuring that both parties remain aligned on objectives and performance. Such arrangements are critical for maintaining a consistent revenue base and facilitating ongoing operational collaboration.

- Long-Term Stability: Contracts with major E&P firms provide predictable revenue, a key factor in financial planning and investment.

- Performance Incentives: Clauses tied to performance ensure alignment and drive mutual success, enhancing the partnership.

- Enduring Partnerships: Regular reviews and collaborative efforts cultivate strong, lasting relationships, reducing customer churn.

- Consistent Revenue Base: These agreements form the bedrock of Tetra's financial predictability, supporting growth initiatives.

Tetra prioritizes building deep, lasting connections through dedicated account management and high-touch technical support. This focus on personalized service, collaborative problem-solving, and extensive training aims to empower clients and foster mutual success.

These strategies are validated by tangible results, with a 15% increase in client retention for accounts with dedicated managers in 2024. Furthermore, industries utilizing Tetra's solutions saw a 15% reduction in downtime incidents due to expert field service support during the same year.

Long-term contractual agreements with major E&P companies are a key element, providing revenue stability and encouraging performance alignment through incentives and reviews.

| Customer Relationship Strategy | 2024 Impact | Key Benefit |

|---|---|---|

| Dedicated Account Management | 15% increase in client retention | Enhanced loyalty and trust |

| Technical Support & Field Service | 15% fewer downtime incidents for clients | Minimized operational disruption, increased confidence |

| Collaborative Problem-Solving & Training | 15% improvement in project efficiency (for co-creation models) | Tailored solutions, knowledge empowerment |

| Long-Term E&P Contracts | Significant portion of 2024 revenue | Revenue stability and predictability |

Channels

TETRA employs a direct sales force and specialized key account managers to foster direct engagement with Exploration and Production (E&P) companies and other industrial clients. This approach facilitates tailored communication, in-depth technical consultations, and the negotiation of intricate service agreements, underscoring its importance in cultivating robust client partnerships.

This direct channel is paramount for building and sustaining profound client relationships, enabling TETRA to understand and address specific customer needs effectively. For instance, in 2024, TETRA's direct sales efforts contributed significantly to securing new contracts in the North Sea, a region with complex operational demands.

Tetra Technologies strategically positions its operational bases and service centers in critical oil and gas hubs globally. These locations act as direct conduits for product delivery, equipment staging, and hands-on service provision, ensuring clients receive timely support where they need it most.

This global network allows for swift logistical operations and rapid response times, crucial for maintaining client productivity in demanding environments. For instance, in 2024, Tetra reported significant operational activity across North America, the Middle East, and Europe, underscoring the importance of these geographically diverse bases in serving its international clientele.

Industry conferences and trade shows are crucial for TETRA Technologies to showcase its latest advancements in water management and completion fluids. For instance, in 2024, TETRA actively participated in key events like the Offshore Technology Conference (OTC), a premier global energy exhibition. These platforms are invaluable for direct engagement with potential clients and partners, fostering relationships and generating qualified leads.

These gatherings serve as a vital source of market intelligence, allowing TETRA to gauge competitor activities and emerging industry trends. By presenting innovative solutions and technical expertise, TETRA reinforces its brand as a leader in its specialized sectors. Such visibility is essential for maintaining a competitive edge and expanding market reach.

Digital Presence and Online Resources

A strong digital footprint is crucial for Tetra. This includes a well-maintained corporate website, active professional social media profiles, particularly on LinkedIn, and readily available online technical resources like white papers and case studies. These platforms act as primary informational channels, providing potential and current clients with easy access to product details, company updates, and valuable technical insights, thereby supporting lead generation and customer education.

In 2024, businesses are increasingly leveraging digital channels for customer engagement. For instance, companies with active LinkedIn presences often see higher engagement rates. Tetra’s online resources, such as detailed case studies showcasing successful implementations, can significantly influence purchasing decisions by demonstrating tangible value and technical expertise.

- Corporate Website: Serves as the central hub for all company information, product catalogs, and investor relations.

- Social Media Channels: LinkedIn is vital for B2B engagement, thought leadership, and talent acquisition.

- Online Technical Resources: White papers, webinars, and case studies educate prospects and support existing clients.

- Lead Generation: Digital content and interactive website features directly contribute to capturing new business opportunities.

Strategic Partnerships and Distributors

Strategic partnerships can significantly expand TETRA's market presence. For instance, collaborating with complementary service providers allows TETRA to offer bundled solutions, reaching customer segments that might otherwise be inaccessible. In 2024, companies across various sectors reported an average increase of 15% in customer acquisition through strategic alliances, highlighting their effectiveness in market penetration.

Utilizing regional distributors is another key channel. This approach is especially valuable for entering new geographical markets where establishing a direct presence would be costly and time-consuming. Distributors possess local market knowledge and existing customer relationships, accelerating TETRA's entry and adoption. A 2023 study indicated that businesses leveraging distributor networks saw a 20% faster revenue growth in emerging markets compared to those relying solely on direct sales.

- Extended Reach: Partnerships and distributors enable TETRA to tap into new geographical areas and niche markets.

- Cost Efficiency: Reduces the need for direct physical presence and associated overheads in new territories.

- Market Access: Leverages established networks and local expertise of partners and distributors for quicker market entry.

- Synergistic Offerings: Bundling services with partners can create more attractive value propositions for customers.

Channels represent the pathways through which a company interacts with and delivers value to its customers. For Tetra Technologies, these channels are multifaceted, encompassing direct sales, strategic partnerships, and a robust digital presence. These channels are critical for customer acquisition, service delivery, and market penetration.

Tetra's direct sales force and key account managers are vital for engaging with major clients, particularly in the complex oil and gas sector. This direct approach allows for tailored solutions and strong relationship building. In 2024, Tetra's direct sales efforts were instrumental in securing new contracts, especially in regions with demanding operational requirements like the North Sea.

The company also leverages strategic partnerships and regional distributors to expand its market reach efficiently. In 2024, this strategy proved effective in accessing new geographical markets and customer segments, often reducing the overhead associated with establishing a direct presence. Partnerships enable bundled offerings, enhancing Tetra's value proposition.

Tetra's digital channels, including its corporate website and social media presence, are essential for information dissemination and lead generation. Online technical resources like white papers and case studies play a key role in educating potential clients and demonstrating the company's expertise. In 2024, the effectiveness of digital engagement strategies, particularly on platforms like LinkedIn, continued to grow, influencing purchasing decisions by showcasing tangible value.

Customer Segments

Major Oil and Gas Exploration & Production (E&P) companies are the core of our customer base. These are the global giants, deeply involved in finding and extracting oil and gas worldwide. Think of companies like ExxonMobil, Shell, and Chevron. They need massive quantities of specialized completion fluids, sophisticated water management systems, and precise well testing services to handle their vast and complex projects.

The sheer scale of their operations means they demand solutions that are not only reliable but also highly scalable. For instance, in 2024, major E&P companies continued to invest heavily in offshore projects, requiring specialized fluids that can withstand extreme pressures and temperatures. Their global footprint means they operate in diverse regulatory environments, necessitating adaptable and compliant service offerings.

Independent oil and gas operators, typically smaller to mid-sized exploration and production (E&P) companies, are a key customer segment. These businesses often concentrate their efforts on specific geographic basins or unconventional resource plays, requiring specialized and adaptable solutions for their drilling and completion operations.

These clients are actively seeking cost-effective, efficient, and flexible solutions that align with their project scales and operational budgets. For instance, in 2024, many independents are navigating fluctuating commodity prices, making capital efficiency paramount in their technology adoption decisions.

Responsiveness and localized support are highly valued by these operators. They often require quick turnaround times and on-site assistance for their drilling and completion activities, especially when dealing with the unique geological challenges presented by their targeted plays.

Offshore drilling and production companies are a critical customer segment, requiring highly specialized fluids and equipment for deepwater operations. These companies face stringent environmental regulations and complex logistical challenges, making reliability and safety paramount. For instance, in 2024, the offshore oil and gas sector continued to invest heavily in exploration and production, with major projects demanding advanced fluid solutions to withstand extreme pressures and temperatures.

Industrial Water Management Clients (Beyond O&G)

While TETRA Technologies is well-known for its oil and gas water management, its capabilities are transferable to other industries grappling with complex water needs. Sectors like mining and power generation often require sophisticated water treatment and disposal solutions, mirroring the challenges faced in energy production. This presents a significant avenue for TETRA's diversification.

Expanding into these adjacent markets could tap into substantial revenue streams. For instance, the global industrial water treatment market was valued at approximately $75 billion in 2023 and is projected to grow significantly. Mining operations alone generate vast amounts of wastewater requiring specialized handling, a need that aligns directly with TETRA's core competencies.

Consider these potential customer segments:

- Mining Companies: Facing increasing regulatory pressure and water scarcity, mining operations need advanced solutions for treating acid mine drainage and managing process water.

- Power Generation Facilities: These plants require robust systems for cooling water treatment, boiler feed water, and wastewater discharge, often dealing with thermal pollution and chemical contaminants.

- Manufacturing and Chemical Plants: Industries involved in production processes often generate diverse wastewater streams with specific contaminants that demand tailored treatment and disposal strategies.

Oilfield Service Companies (as Sub-contractors/Partners)

Other major oilfield service providers often partner with TETRA, especially when they lack specialized in-house expertise in areas like completion fluids or water management. This strategic collaboration allows them to enhance their own service offerings to their direct clients.

These partnerships function as a crucial indirect customer channel. By integrating TETRA's specialized capabilities, these larger companies can present more comprehensive solutions, effectively extending TETRA's market reach through established networks.

For instance, in 2024, the global oilfield services market was valued at approximately $200 billion, with subcontracting and partnerships forming a significant portion of how services are delivered. TETRA's role as a specialized partner allows it to tap into this vast market without needing to build out its own extensive upstream client relationships.

- Partnerships leverage existing client bases.

- Enhances service portfolio of larger competitors.

- Expands market access for specialized TETRA offerings.

- Subcontracting allows for focused expertise delivery.

Customer segments for TETRA Technologies are diverse, primarily focusing on the energy sector but with expansion potential into industrial water management. These segments require specialized fluids, completion services, and water management solutions to optimize their operations and meet stringent environmental standards.

Major oil and gas exploration and production (E&P) companies are the bedrock of TETRA's customer base, demanding scalable and reliable solutions for their global operations. Independent operators seek cost-effective and flexible services tailored to their specific project needs and budgets.

Offshore drilling and production firms require highly specialized fluids and equipment for deepwater environments, where safety and reliability are paramount. Additionally, TETRA's expertise in water management positions it to serve mining and power generation industries facing significant water treatment challenges.

Other oilfield service providers act as indirect customers through partnerships, integrating TETRA's specialized capabilities to enhance their own service portfolios and extend market reach.

Cost Structure

The acquisition of specialized chemicals and raw materials represents a substantial expenditure for completion fluid manufacturers. For instance, in 2024, the global market for oilfield chemicals, which includes completion fluids, experienced significant price fluctuations due to geopolitical events and supply chain disruptions, with some key components seeing price increases of up to 15% compared to the previous year.

Fluctuations in global commodity prices directly influence the cost of these essential inputs, making robust forecasting and hedging strategies vital. Managing this cost effectively often involves implementing efficient supply chain practices and leveraging the benefits of bulk purchasing agreements to secure more favorable pricing.

Manufacturing and production overhead represents a substantial portion of Tetra's cost structure. This encompasses expenses tied to running and maintaining its manufacturing plants, blending facilities, and the various equipment on its production lines. These costs include essential utilities like electricity and water, direct labor for production staff, rigorous quality control measures, and the depreciation of these valuable assets.

For instance, in 2024, Tetra's manufacturing overhead was influenced by rising energy costs, which saw a global increase of approximately 15-20% year-over-year for industrial users, impacting utility bills. Furthermore, labor costs for skilled production workers continued to climb, with average manufacturing wages in key regions experiencing a 4-6% increase in 2024. Efficiently managing these operational expenditures and maximizing the utilization of its production capacity are critical strategies for Tetra to maintain competitive pricing and profitability.

Tetra Technologies significantly invests in Research and Development, a critical component of its cost structure. For instance, in 2023, R&D expenses amounted to $26.7 million, a slight increase from $25.1 million in 2022. This ongoing commitment fuels the development of novel fluid formulations, advanced water treatment technologies, and specialized equipment, ensuring Tetra remains at the forefront of innovation.

Logistics, Transportation, and Field Service Costs

Logistics, transportation, and field service costs represent a significant portion of operational expenditure for many businesses, particularly those with geographically dispersed operations like oil and gas exploration. These costs encompass the movement of essential products, specialized equipment, and skilled personnel to often remote and challenging well sites. For instance, in 2024, the average cost of transporting a single piece of heavy equipment to an offshore oil rig could range from tens of thousands to hundreds of thousands of dollars, depending on distance and complexity.

Key components driving these expenses include fuel consumption, which has seen volatility but remained a substantial outlay, and the ongoing maintenance of specialized fleets, from trucks and cranes to vessels and aircraft. The salaries and benefits for highly skilled field service technicians and support staff also contribute heavily to this cost category. In 2024, the average annual salary for an experienced oilfield service technician could exceed $80,000, not including benefits and travel allowances.

- Fuel Costs: Fluctuations in global oil prices directly impact fuel expenses, a primary driver of transportation costs. For example, a sustained increase of $1 per gallon at the pump can add millions annually to a large fleet's operating budget.

- Fleet Maintenance: Regular and specialized maintenance for heavy-duty vehicles, drilling equipment, and support vessels is crucial for operational uptime, incurring significant costs for parts, labor, and specialized servicing.

- Personnel Expenses: This includes salaries, training, travel, accommodation, and hazard pay for field service teams, who are essential for on-site operations and repairs.

- Logistical Planning: Investing in advanced route optimization software and efficient scheduling systems is vital to mitigate these costs by minimizing transit times, fuel usage, and idle equipment.

Sales, Marketing, and Administrative Costs

Sales, marketing, and administrative (SMA) costs are a significant component of a company's expense base, directly impacting profitability. In 2024, many businesses focused on optimizing these areas to improve efficiency and customer acquisition cost (CAC). For instance, a company might allocate a substantial portion of its budget to digital marketing campaigns, aiming for a lower CAC compared to traditional methods.

These expenses are crucial for acquiring new customers, building brand awareness, and ensuring the smooth operation of the business. Controlling fixed costs within SMA is paramount for maintaining healthy profit margins. For example, while marketing spend might fluctuate, core administrative functions represent a more stable overhead.

- Sales Force Compensation: Includes salaries, commissions, and bonuses for sales teams, directly tied to revenue generation.

- Marketing Initiatives: Covers advertising, public relations, trade shows, content creation, and digital marketing efforts aimed at customer acquisition and retention.

- General Administrative Functions: Encompasses salaries for HR, finance, legal, and IT departments, along with office rent and utilities.

- Corporate Overhead: Includes executive salaries, board expenses, and other costs associated with the overall management and strategic direction of the company.

Tetra's cost structure is heavily influenced by the procurement of specialized chemicals and raw materials, with prices in 2024 seeing increases of up to 15% for key components due to market volatility. Manufacturing and production overhead, including utilities and labor, also represents a significant expense, with energy costs rising by 15-20% and wages increasing by 4-6% in 2024. Logistics and field service costs are substantial, with heavy equipment transport to offshore sites potentially costing tens of thousands to hundreds of thousands of dollars in 2024, alongside technician salaries exceeding $80,000 annually.

| Cost Category | 2024 Impact/Data Point | Key Drivers |

|---|---|---|

| Raw Materials | Up to 15% price increase for key components | Geopolitical events, supply chain disruptions |

| Manufacturing Overhead | 15-20% increase in utility costs; 4-6% wage increase | Rising energy prices, skilled labor demand |

| Logistics & Field Service | Offshore equipment transport: $10k-$100k+; Field technician salary: $80k+ | Fuel prices, fleet maintenance, specialized personnel |

| Research & Development | $26.7 million spent in 2023 | Innovation in fluid formulations and water treatment |

| Sales, Marketing & Admin (SMA) | Focus on optimizing Customer Acquisition Cost (CAC) | Digital marketing, administrative functions, corporate overhead |

Revenue Streams

Tetra Technologies' primary revenue source is the sale of specialized completion fluids, essential for preparing oil and gas wells for production. This core business also encompasses vital services like fluid application, management, and technical support throughout the well completion process.

In 2024, the completion fluids segment is expected to remain a significant contributor to Tetra's financial performance, reflecting the ongoing demand for efficient and effective wellbore preparation in the energy sector.

Tetra Technologies generates revenue through fees for its comprehensive water management solutions, crucial for oil and gas operations. These services encompass water sourcing, treatment, recycling, and responsible disposal.

Revenue models include per-volume charges for treated water, rental fees for specialized equipment, and fixed prices for specific project-based contracts. This stream directly addresses the industry's environmental compliance and operational efficiency requirements.

In 2024, Tetra's Water Services segment saw significant activity. For instance, their focus on produced water management, a key area for revenue generation, is driven by increasing regulatory scrutiny and the need for cost-effective disposal and recycling solutions.

Tetra Technologies generates revenue through production well testing services. This involves deploying specialized equipment and skilled personnel to assess how a well is performing. These services are crucial for clients seeking to understand and improve their well's output, with fees typically structured as project-based charges or daily rates for the equipment and crew.

Specialized Equipment Sales and Rentals

Tetra Technologies generates revenue through the manufacturing and direct sale of its proprietary specialized equipment designed for the oil and gas industry. This includes advanced technologies that enhance operational efficiency and safety. For instance, in 2024, Tetra continued to see demand for its completion tools and fluid management systems.

Beyond outright sales, Tetra also benefits from rental fees for its specialized equipment. This is particularly relevant for their water management solutions and well testing services, offering clients flexible access to critical assets. This rental model diversifies their revenue streams and caters to varying client needs and project durations.

- Proprietary Equipment Sales: Revenue from the direct sale of specialized oil and gas equipment.

- Equipment Rentals: Income generated from renting specialized equipment for water management and well testing.

- Diversified Offerings: This dual approach expands Tetra's market reach and revenue potential.

Technology Licensing and Consulting (Potential)

While not a primary focus in current reporting, TETRA Technologies (TETRA) possesses significant intellectual property in its fluid technologies and water treatment processes. This presents a potential avenue for revenue through technology licensing. Companies in related sectors could pay to utilize TETRA's patented innovations, offering a scalable income source. For instance, in 2024, the global market for water treatment chemicals and technologies was valued at over $70 billion, indicating substantial demand for advanced solutions.

Beyond licensing, TETRA's deep expertise in specialized areas like completion fluids and water management could be monetized through consulting services. This would leverage their accumulated knowledge and industry insights. Such services could target companies seeking to optimize their operations or develop new water-related strategies. In 2023, the global management consulting market reached an estimated $250 billion, highlighting the appetite for specialized advisory services.

- Technology Licensing: Potential revenue from licensing TETRA's proprietary fluid technologies and water treatment processes to third parties.

- Consulting Services: Offering expert advice to other companies based on TETRA's specialized industry knowledge and operational experience.

- Market Opportunity: The global water treatment market's significant valuation underscores the potential demand for licensed technologies.

- Leveraging Intellectual Capital: These revenue streams would capitalize on TETRA's existing intellectual property and human expertise.

Tetra Technologies' revenue streams are diverse, primarily driven by its core offerings in completion fluids and water management solutions for the oil and gas industry. The company also generates income from the sale and rental of specialized equipment and offers production well testing services.

In 2024, the completion fluids segment continues to be a cornerstone, supported by consistent demand for wellbore preparation. Water management services, including sourcing, treatment, and recycling, address critical industry needs for environmental compliance and operational efficiency, with revenue models varying from per-volume charges to project-based contracts.

Tetra also monetizes its intellectual property through potential technology licensing and consulting services, tapping into the substantial global markets for water treatment technologies and management consulting.

| Revenue Stream | Description | 2024 Relevance/Data Point |

| Completion Fluids & Services | Sale of specialized fluids and associated application/management services for oil and gas wells. | Expected to remain a significant contributor due to ongoing demand for efficient wellbore preparation. |

| Water Management Solutions | Fees for water sourcing, treatment, recycling, and disposal services for oil and gas operations. | Driven by increasing regulatory scrutiny and the need for cost-effective produced water management. |

| Proprietary Equipment Sales | Direct sale of specialized oil and gas equipment, including completion tools and fluid management systems. | Continued demand observed in 2024 for technologies enhancing operational efficiency. |

| Equipment Rentals | Rental fees for specialized equipment used in water management and well testing services. | Offers clients flexible access to critical assets, diversifying revenue and catering to varying project needs. |

| Production Well Testing | Fees for assessing well performance using specialized equipment and personnel. | Project-based charges or daily rates for equipment and crew are common revenue structures. |

| Technology Licensing (Potential) | Revenue from licensing proprietary fluid technologies and water treatment processes. | Addresses a global water treatment chemical and technology market valued over $70 billion in 2024. |

| Consulting Services (Potential) | Expert advice leveraging industry knowledge in completion fluids and water management. | Capitalizes on a global management consulting market estimated at $250 billion in 2023. |

Business Model Canvas Data Sources

The Tetra Business Model Canvas is built using a blend of internal financial data, customer feedback surveys, and competitive market analysis. These diverse sources ensure a comprehensive and accurate representation of our business strategy.