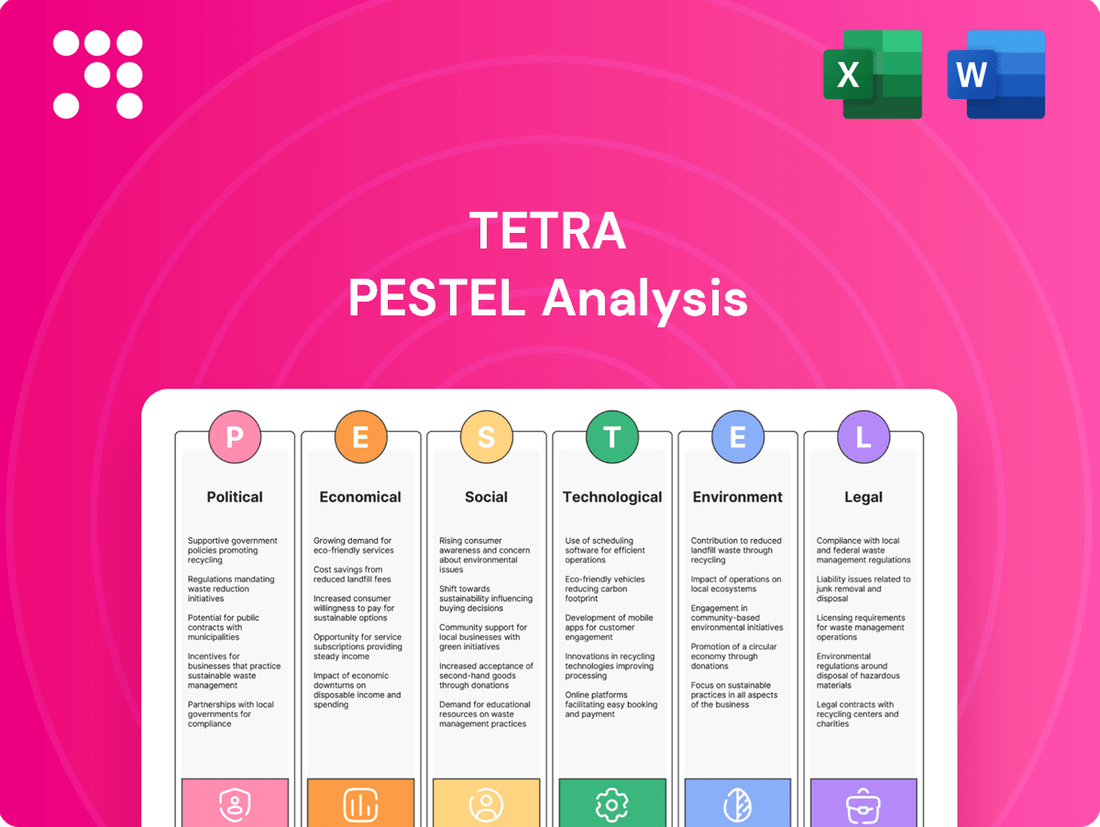

Tetra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tetra Bundle

Unlock the critical external factors shaping Tetra's market landscape with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges. Equip yourself with the strategic foresight needed to navigate these shifts and secure Tetra's future success. Download the full analysis now to gain actionable intelligence.

Political factors

Government energy policies are a major driver for the oil and gas sector. For example, the US, a significant energy producer and consumer, saw its crude oil production reach an average of approximately 12.9 million barrels per day in 2023, a figure that could be influenced by policy shifts following the 2024 elections.

In Europe, the EU's Renewable Energy Directive III targets a 42.5% share of renewables in its energy mix by 2030, a goal that may redirect capital away from fossil fuels and reshape investment strategies within the industry.

Ongoing geopolitical tensions, including the protracted Russia-Ukraine conflict and instability in the Middle East, continue to cast a long shadow over global energy markets, injecting significant uncertainty. These events directly impact oil and gas trade routes and supply chain reliability, leading to price volatility. For instance, the International Energy Agency (IEA) reported in early 2024 that while oil markets showed some resilience, ongoing regional conflicts posed a persistent risk to supply.

TETRA Technologies, as a key player in the energy services sector, must actively manage the ramifications of these global instabilities. Such geopolitical shifts directly influence exploration and production (E&P) activities, affecting demand for TETRA's services and the overall investment climate in the energy sector. The company's strategic planning must account for potential disruptions that could impact project timelines and profitability.

The regulatory environment for the oil and gas industry is in constant flux, with an increasing trend towards more rigorous rules. For instance, in March 2024, the U.S. Environmental Protection Agency (EPA) implemented sweeping methane emission standards for all oil and gas facilities, both new and existing, mandating the use of advanced leak detection and repair technologies.

These evolving regulations directly influence operational expenditures and compliance burdens for companies like TETRA Technologies, which offers critical services to this sector. The need for upgraded equipment and processes to meet these new environmental mandates presents both challenges and opportunities for service providers in the energy industry.

Permitting and Approval Processes

The Energy Permitting Reform Act, introduced in July 2024, signifies a political push to expedite the approval process for energy infrastructure projects. This legislation aims to cut down on lengthy bureaucratic hurdles, potentially speeding up the development of new oil and gas ventures. For TETRA Technologies, a more efficient permitting environment could translate into increased opportunities for its well completion and production services, as projects move from planning to execution faster.

Key provisions within the Energy Permitting Reform Act include measures for expedited judicial reviews and streamlined approvals specifically for projects situated on federal lands. This focus on federal lands is particularly relevant as a significant portion of oil and gas exploration and production occurs on these territories. By reducing the time it takes to gain necessary permits, the act could unlock new development potential, directly benefiting companies like TETRA that supply essential equipment and services to the upstream oil and gas sector.

The potential impact of these reforms on TETRA is substantial. Faster project approvals can lead to a quicker ramp-up in drilling and completion activities. For instance, if the act successfully reduces average permitting times by, say, 20% (a projection based on initial legislative goals), this could accelerate project timelines for TETRA's clients. This acceleration directly boosts demand for TETRA's specialized fluids, completion equipment, and water management solutions, thereby enhancing revenue streams.

- Legislative Action: The Energy Permitting Reform Act, introduced July 2024, targets bureaucratic delays in energy project approvals.

- Key Provisions: Includes faster judicial reviews and streamlined approvals for federal land projects.

- Potential Impact: Aims to accelerate new oil and gas developments, increasing demand for TETRA's services.

- Economic Indicator: A projected 20% reduction in permitting times could significantly boost project timelines and TETRA's revenue.

International Trade Relations

Global trade relations, including sanctions and agreements, profoundly impact energy markets. For instance, Russia successfully redirected a significant portion of its oil exports to countries like India and China following Western sanctions, showcasing the adaptability of trade flows. This re-routing directly influences investment decisions in exploration and production, as well as the demand for associated energy services worldwide.

These geopolitical shifts can lead to fluctuating global energy prices and create new opportunities for producers and service providers in emerging markets. The International Energy Agency (IEA) reported in its Oil Market Report (OMR) for May 2024 that while global oil demand growth is projected to slow to 1.1 million barrels per day (mb/d) in 2024, regional trade patterns are adapting to new realities.

- Sanctions Impact: Western sanctions on Russia have led to a significant redirection of its oil exports, with India and China becoming major buyers.

- Trade Flow Adaptation: This redirection demonstrates the resilience of global energy trade, with new supply routes and buyer relationships forming.

- Market Dynamics: Such shifts directly affect global demand for energy services and influence where exploration and production investments are most viable.

- Price Volatility: Geopolitical tensions and trade realignments contribute to price volatility in the international oil and gas markets.

Political stability and government policies are critical for the oil and gas industry. For example, the U.S. Energy Information Administration reported that U.S. crude oil production averaged 12.9 million barrels per day in 2023, a figure that could be influenced by policy decisions following the 2024 elections.

The European Union's commitment to renewable energy, targeting a 42.5% share by 2030, is reshaping investment landscapes and potentially diverting capital from traditional fossil fuel projects.

Geopolitical events, such as the ongoing conflict in Ukraine and Middle Eastern instability, continue to create significant uncertainty in global energy markets, impacting supply routes and price volatility. The International Energy Agency noted in early 2024 that while oil markets showed resilience, regional conflicts remained a persistent risk to supply.

Regulatory changes, like the U.S. EPA's March 2024 methane emission standards for all oil and gas facilities, necessitate advanced leak detection and repair technologies, increasing compliance costs for companies like TETRA Technologies.

What is included in the product

The Tetra PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Tetra's operating environment.

The Tetra PESTLE Analysis offers a structured framework that simplifies complex external factors, reducing the overwhelm of information and enabling clearer strategic decision-making.

Economic factors

The oil and gas sector remains susceptible to significant price fluctuations, a key economic factor. In 2024, Brent crude prices showed relative stability, trading between $74 and $90 per barrel, representing a calmer period compared to the previous 25 years.

However, the economic landscape shifted in Q2 2025, with Brent crude experiencing a wider range, fluctuating between $57 and $75 per barrel. This increased volatility introduces considerable uncertainty into the market.

Such price swings have a direct and substantial impact on investment decisions within the industry. Companies like TETRA, which provide services to the oil and gas sector, see their demand and profitability directly influenced by these price movements.

The global economic landscape in late 2024 and early 2025 is characterized by a delicate balance between easing monetary policies and persistent fears of a global slowdown. This dynamic directly influences energy markets, as interest rate cuts anticipated in 2025 could potentially reignite economic growth and, consequently, boost energy demand. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, with a slight uptick expected in 2025, signaling a cautious optimism that could support energy consumption.

A healthy global economy typically correlates with heightened industrial activity and increased energy usage. This trend is particularly beneficial for energy service providers, as greater demand often translates into more projects and higher revenues. For example, as economies recover and expand, the need for oil and gas exploration, production, and refining services tends to rise, directly impacting the performance of companies within this sector.

Capital expenditures in the oil and gas sector have surged, climbing 53% over the past four years. This significant investment reflects a robust financial outlook for the industry.

Accompanying this investment growth, net profits have seen a substantial increase of nearly 16% in the same period. This indicates strong operational efficiency and favorable market conditions.

The oilfield services sector, where TETRA operates, experienced its most successful year in 34 years during the 2023-2024 reporting period. This sustained profitability and increased capital spending underscore a healthy and expanding market for energy service providers.

Mergers and Acquisitions Trends

Mergers and acquisitions (M&A) in the oil and gas industry, especially within the Permian Basin, have been a major trend, with upstream deals totaling nearly $136 billion since 2023. This consolidation aims to create more robust entities. However, the first half of 2025 saw a significant 60% drop in US upstream M&A, largely driven by unstable oil prices and disagreements on company valuations between potential buyers and sellers.

This slowdown in M&A activity presents a mixed bag of implications. While the creation of larger, consolidated companies can lead to bigger client opportunities, a decrease in the number of deals might limit certain avenues for business growth and partnerships.

- Upstream M&A in Permian Basin: Approximately $136 billion in deals since 2023.

- US Upstream M&A Slowdown (H1 2025): A 60% decrease in deal volume.

- Key Drivers of Slowdown: Price volatility and buyer-seller valuation gaps.

- Impact on Business: Potential for larger clients versus reduced deal-driven opportunities.

Demand for Energy Services and Products

The energy sector's robust demand for oil and gas, fueled by continuous exploration and production, directly benefits companies like TETRA by increasing the need for specialized services and products. This ongoing activity is a primary driver for TETRA's core business segments, particularly those focused on drilling and completion fluids and water management.

The global market for drilling and completion fluids is a significant indicator of this demand. Projections show it reaching $15.3 billion by 2033, with a steady growth rate of 3.76% annually from an estimated $10.8 billion in 2024. This sustained market expansion underscores the consistent need for the essential fluids and services TETRA provides.

This sustained demand for energy services and products translates into a strong and stable foundation for TETRA's operations. Key aspects include:

- Growing Market Size: The drilling and completion fluids market is expected to expand from $10.8 billion in 2024 to $15.3 billion by 2033.

- Consistent Growth Rate: A projected compound annual growth rate (CAGR) of 3.76% indicates sustained demand.

- Exploration and Production Link: Increased upstream activities directly correlate with higher consumption of drilling fluids and related services.

- Water Management Importance: Efficient water management is crucial for these operations, creating demand for TETRA's expertise in this area.

Economic factors significantly shape the oil and gas sector. Despite a calmer period in 2024 with Brent crude prices between $74-$90, Q2 2025 saw increased volatility, with prices ranging from $57-$75 per barrel. This volatility directly impacts investment and demand for services like those provided by TETRA.

The global economy in late 2024 and early 2025 shows cautious optimism, with the IMF projecting 3.2% global growth in 2024, potentially boosting energy demand. Capital expenditures in the oil and gas sector have surged by 53% over four years, with net profits rising nearly 16%, indicating a strong market for energy service providers like TETRA.

The drilling and completion fluids market is projected to grow from $10.8 billion in 2024 to $15.3 billion by 2033, with a 3.76% CAGR. This sustained demand, driven by exploration and production, benefits TETRA's core business segments.

| Metric | 2024 (Est.) | 2025 (Est.) | Trend |

|---|---|---|---|

| Brent Crude Price Range | $74 - $90 | $57 - $75 | Increased Volatility |

| Global GDP Growth | 3.2% | Slightly Higher | Cautiously Optimistic |

| Oil & Gas CapEx Growth (4 Yrs) | N/A | +53% | Significant Increase |

| Oil & Gas Net Profit Growth (4 Yrs) | N/A | +16% | Strong Profitability |

| Drilling & Completion Fluids Market | $10.8 Billion | $11.2 Billion (Est.) | Steady Growth (3.76% CAGR) |

What You See Is What You Get

Tetra PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Tetra PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business. It provides actionable insights to inform your strategic decision-making and mitigate potential risks.

Sociological factors

The oil and gas industry, including companies like TETRA, faces mounting pressure to integrate Environmental, Social, and Governance (ESG) factors into their strategies. In 2024, global ESG investments are projected to reach over $3.7 trillion, highlighting investor demand for sustainable practices. This trend means TETRA must actively demonstrate environmental stewardship and social responsibility to maintain its appeal to a growing segment of capital markets.

A robust ESG performance is no longer just a reputational boost; it's becoming a prerequisite for attracting investment and securing long-term financing. For instance, many major oil and gas companies are setting ambitious emissions reduction targets, with some aiming for net-zero by 2050. TETRA's ability to align its operations with these evolving stakeholder expectations will be critical for its future financial health and market positioning.

Public perception of the oil and gas sector is increasingly shaped by environmental anxieties, especially concerning carbon emissions and pollution. For instance, a 2024 survey indicated that over 60% of global consumers believe companies should prioritize sustainability, impacting brand loyalty and investment decisions.

This heightened societal pressure compels energy companies to invest in technologies and practices that minimize their carbon footprint and champion sustainable resource management. This trend is reflected in the significant increase in ESG (Environmental, Social, and Governance) investments, which reached an estimated $3.9 trillion globally by the end of 2024.

TETRA Technologies' solutions, particularly in water management and the development of low-carbon technologies, are well-positioned to help clients navigate these public concerns. Their water recycling technologies, for example, can reduce freshwater consumption in hydraulic fracturing by up to 90%, directly addressing pollution and resource depletion worries prevalent in 2024.

The energy sector's shift towards renewables and digital solutions is reshaping job requirements. For instance, by 2025, the global demand for renewable energy skills is projected to grow significantly, with a particular emphasis on technicians and engineers proficient in areas like solar panel installation and wind turbine maintenance. TETRA needs to invest in upskilling its current workforce and attracting new talent with expertise in these evolving technological domains to remain competitive.

Community Engagement and Social License

Companies in the oil and gas industry, including TETRA Technologies, are prioritizing robust community engagement to secure their social license to operate. This involves substantial investments in local infrastructure, education, and healthcare initiatives. For instance, in 2024, many energy firms allocated significant portions of their community investment budgets towards projects aimed at improving local living standards, recognizing that tangible benefits foster goodwill and reduce operational risks.

TETRA's global footprint necessitates a tailored approach to community relations, acknowledging that each operational area has unique social dynamics and expectations. Successful community engagement not only builds trust but also acts as a crucial risk mitigation strategy, preventing project delays or opposition. This focus is becoming increasingly critical as public scrutiny of the energy sector intensifies.

- Community Investment: Many energy companies reported increasing their community investment by 5-10% in 2024 compared to the previous year, focusing on sustainable development projects.

- Social License: A strong social license is directly linked to reduced project approval times and fewer operational disruptions, saving companies millions in potential losses.

- Local Employment: Initiatives that prioritize local hiring and skill development within operating communities have shown a marked improvement in community sentiment towards energy projects.

Consumer Demand Shifts

Consumer demand is increasingly favoring sustainability, leading to a significant global shift away from traditional fossil fuels and towards cleaner energy alternatives, including electric vehicles (EVs). This trend directly impacts the energy sector, prompting companies to re-evaluate their long-term strategies.

Projections indicate a substantial rise in EV adoption, with some forecasts suggesting global EV sales could approach 10 billion by 2025. This surge in electric mobility is expected to curb oil demand, influencing the market dynamics for oil and gas companies.

- Growing EV Adoption: Global EV sales are anticipated to reach significant figures by 2025, impacting traditional fuel consumption.

- Shift to Renewables: Consumers are actively seeking greener energy solutions, driving investment in renewable energy sources.

- Industry Diversification: Oil and gas companies are exploring diversification into renewable energy and related services to adapt to changing demand.

- Strategic Imperative: Companies like TETRA must consider these evolving consumer preferences for future growth and market relevance.

Societal expectations are pushing the oil and gas industry towards greater transparency and accountability regarding its environmental and social impact. By 2025, the demand for skilled workers in renewable energy sectors is expected to see substantial growth, highlighting a need for workforce adaptation within traditional energy companies.

Public perception is increasingly influenced by a company's commitment to sustainability and community well-being. In 2024, many energy firms increased their community investment by 5-10%, focusing on local development to secure their social license to operate.

The rise of electric vehicles, with global sales projected to reach significant numbers by 2025, signals a long-term shift in energy consumption patterns. This necessitates that companies like TETRA consider diversification into cleaner energy solutions and related services to remain competitive.

Technological factors

The market for drilling and completion fluids is growing thanks to new technologies that improve how stable wells are and how much oil or gas can be produced. These advancements are key to making operations more efficient and cost-effective.

Innovations are focusing on fluids with less toxicity, including water-based and synthetic-based options, to lessen the environmental footprint of drilling operations. This shift towards greener solutions is a major trend shaping the industry.

TETRA, a company focused on completion fluids, is well-positioned to capitalize on this trend. Their expertise in providing efficient and environmentally sound fluid solutions directly addresses the industry's evolving demands.

The oil and gas sector is seeing a significant surge in digital transformation, with companies like TETRA increasingly integrating Artificial Intelligence (AI), Machine Learning (ML), and the Industrial Internet of Things (IIoT). These technologies are key to boosting operational efficiency and cutting expenses. For instance, AI and ML are vital for predicting equipment failures, assessing risks, and streamlining exploration and refining operations.

By embracing these advancements, TETRA can expect to see a tangible improvement in its service delivery and overall operational performance. The adoption of AI in predictive maintenance alone has shown significant cost savings in the industry; some reports suggest it can reduce maintenance costs by up to 30% and unplanned downtime by as much as 50%.

Technological advancements are significantly boosting the efficiency and affordability of water management in the oil and gas industry. Innovations range from smaller, more effective treatment systems to the integration of AI and data analytics for optimizing operations.

The industry is seeing a greater emphasis on reusing and recycling water, a trend that aligns with sustainability goals and cost reduction efforts. For instance, by 2024, the global produced water treatment market was projected to reach over $20 billion, with technological innovation being a key driver of growth.

TETRA Technologies' water management solutions are strategically positioned to capitalize on these trends, providing crucial support for well completion operations by enabling more efficient and environmentally sound water handling.

Development of Low-Carbon Technologies

The energy sector is witnessing a significant shift, with oil and gas giants channeling more capital into low-carbon technologies. This strategic pivot is driven by a desire to mitigate risks tied to volatile traditional markets and secure a foothold in the evolving energy future. For instance, major players are substantially increasing their stakes in projects focusing on carbon capture and storage (CCS) and the burgeoning hydrogen economy. This trend is particularly relevant in 2024 and 2025, as global energy policies increasingly favor decarbonization pathways.

These investments create a fertile ground for companies like TETRA, which possess the expertise and services necessary to support these emerging low-carbon ventures. The demand for specialized services in areas like hydrogen production infrastructure and CCS implementation is projected to grow considerably. For example, the global CCS market alone is anticipated to reach approximately $12.5 billion by 2027, indicating a substantial opportunity for service providers in this space.

- Increased Investment: Major oil and gas companies are allocating billions towards low-carbon technologies, aiming to diversify their portfolios and meet sustainability targets.

- Market Opportunities: The growth in CCS and hydrogen production presents new revenue streams for service providers like TETRA, who can offer specialized engineering, manufacturing, and operational support.

- Future Energy Landscape: These technological developments are reshaping the energy sector, signaling a long-term transition away from fossil fuels and towards cleaner alternatives.

- Decarbonization Drive: Investments align with global efforts to reduce greenhouse gas emissions, with many nations setting ambitious net-zero targets for 2050, influencing corporate strategies in 2024-2025.

Improved Oilfield Service Efficiency

The oilfield services sector is undergoing a significant shift, driven by a combination of technological advancements and a strong emphasis on cost efficiency. Companies are increasingly adopting digital tools to offer more profitable, environmentally friendly solutions. This focus on optimization means that operators can achieve their production goals with fewer drilling rigs, a trend that directly benefits energy services providers like TETRA.

For TETRA, this means an enhanced ability to capitalize on the industry's drive for operational excellence. The integration of advanced technologies is not only streamlining processes but also contributing to a more sustainable energy landscape. For instance, the adoption of digital twin technology in drilling operations can lead to predictive maintenance and optimized well performance, reducing downtime and operational costs.

Key benefits of improved oilfield service efficiency include:

- Reduced operational costs: Streamlined processes and fewer rig days translate to significant cost savings for operators.

- Enhanced production efficiency: Optimized drilling and completion techniques allow for faster achievement of production targets.

- Lower carbon footprint: More efficient operations often result in reduced energy consumption and emissions.

- Increased profitability for service providers: TETRA and similar companies can leverage these efficiencies to offer competitive, high-margin solutions.

Technological advancements are revolutionizing the oil and gas sector, with a strong push towards digital transformation. Companies are integrating AI, machine learning, and IoT to boost efficiency and cut costs, with predictive maintenance alone potentially slashing maintenance expenses by up to 30%.

Innovations in water management are also key, focusing on reuse and recycling, with the global produced water treatment market expected to exceed $20 billion by 2024. Furthermore, the energy sector is increasingly investing in low-carbon technologies like carbon capture and storage (CCS) and hydrogen, with the CCS market projected to reach approximately $12.5 billion by 2027.

| Technology Area | Impact | Example Data/Trend (2024-2025) |

|---|---|---|

| Digital Transformation (AI/ML/IIoT) | Improved operational efficiency, cost reduction, predictive maintenance | Predictive maintenance cost savings: up to 30%; unplanned downtime reduction: up to 50% |

| Water Management Innovation | Enhanced water reuse/recycling, cost-effective treatment | Global produced water treatment market: >$20 billion (2024 projection) |

| Low-Carbon Technologies (CCS/Hydrogen) | Diversification, risk mitigation, new revenue streams | Global CCS market: ~$12.5 billion (2027 projection) |

Legal factors

The U.S. EPA's March 2024 methane emission standards for oil and gas operations, impacting both new and existing facilities, introduce significant compliance obligations. These regulations require advanced leak detection and repair technologies, alongside more rigorous reporting, directly affecting TETRA's client base.

TETRA's clients will likely incur increased expenses for monitoring and adhering to these new standards, potentially boosting demand for services that facilitate compliance and emission reduction solutions. For instance, the cost of advanced methane detection equipment can range from thousands to tens of thousands of dollars per site.

Beyond federal oversight, individual states are increasingly shaping environmental policy. For instance, California's Senate Bill 1137, enacted in 2024, mandates a phase-out of oil and gas wells situated near sensitive zones. This type of legislation can impose substantial compliance costs or necessitate operational shifts for companies like TETRA, requiring them to navigate a complex patchwork of state-specific rules.

Legislation like the Energy Permitting Reform Act, introduced in July 2024, is designed to speed up the approval process for energy infrastructure. This act includes measures such as establishing timelines for court reviews and giving preference to projects on federal lands.

While these reforms are intended to accelerate project development, TETRA, like other companies, must still carefully manage and understand the intricacies of these updated permitting regulations. Navigating these changes effectively is crucial for timely project execution and compliance.

Climate-Related Disclosure Requirements

New regulations are increasingly requiring companies to be more open about their emissions and sustainability efforts. For instance, the EU's Green Deal and proposed rules from the U.S. SEC are pushing for greater climate risk disclosure. This means businesses, including TETRA and its clients, must prepare for more stringent reporting.

While a universal standard for environmental reporting is still taking shape, the pressure on companies to detail their climate impacts is growing. For example, a 2024 report indicated that over 90% of S&P 500 companies now report on climate-related issues, though the depth and standardization vary significantly. This trend underscores the need for robust data collection and transparent reporting practices.

- Evolving Disclosure Landscape: Companies must track and report greenhouse gas emissions (Scope 1, 2, and increasingly Scope 3) in line with emerging global standards.

- Regulatory Drivers: Key regulations like the EU's Corporate Sustainability Reporting Directive (CSRD) and the SEC's climate disclosure proposal (expected to be finalized in 2024/2025) are setting new benchmarks.

- Client Impact: TETRA's clients will need to provide accurate and auditable data on their environmental footprint to meet these new disclosure mandates.

- Data Verification: The increasing focus on disclosure means that the accuracy and reliability of reported environmental data will be subject to greater scrutiny and potential third-party assurance.

International Legal Frameworks

International legal frameworks significantly shape the energy sector. For instance, the European Union's Renewable Energy Directive III (RED III), adopted in 2023, mandates that at least 42.5% of the EU's energy consumption must come from renewable sources by 2030, with an ambition to reach 45%. This directive directly influences investment decisions and operational strategies for energy companies operating within or trading with the EU, encouraging a shift towards cleaner energy solutions and impacting global supply chains for renewable technologies.

These international agreements often set ambitious targets for renewable energy adoption and energy efficiency. For example, the Paris Agreement, ratified by over 190 countries, aims to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels. This global commitment drives national policy changes and fosters international cooperation, creating a complex web of regulations and incentives that affect energy markets worldwide.

- Global Climate Pledges: Over 190 countries are signatories to the Paris Agreement, driving national energy policies and international collaboration.

- EU Renewable Energy Directive III (RED III): Sets a binding target of 42.5% renewable energy by 2030 for the EU, with an aspirational goal of 45%.

- International Standards: Agreements like those from the International Energy Agency (IEA) influence technological adoption and market practices across borders.

- Cross-border Energy Trade: International legal frameworks govern the flow of energy and energy technologies between nations, impacting market access and pricing.

Legal factors significantly influence TETRA's operations and its clients, particularly through environmental regulations. The U.S. EPA's March 2024 methane emission standards for oil and gas facilities impose new compliance burdens, requiring advanced leak detection and repair technologies. Similarly, state-level legislation, like California's SB 1137 phasing out wells near sensitive areas, adds complexity and potential costs for companies. The Energy Permitting Reform Act, introduced in July 2024, aims to streamline approvals but still demands careful navigation of updated regulations.

The evolving disclosure landscape, driven by regulations like the EU's CSRD and anticipated SEC climate disclosure rules, mandates greater transparency on emissions. Companies must now provide auditable data on their environmental footprint, increasing scrutiny on reporting accuracy. International agreements, such as the EU's RED III targeting 42.5% renewable energy by 2030, and global commitments like the Paris Agreement, also shape energy sector strategies and investments.

| Regulation/Directive | Key Provisions | Effective/Expected | Impact on TETRA/Clients | Data Relevance |

|---|---|---|---|---|

| U.S. EPA Methane Standards | Stricter emission controls for oil & gas; leak detection & repair mandates | March 2024 | Increased compliance costs, demand for emission reduction services | Methane emission data, leak detection efficacy |

| California SB 1137 | Phase-out of oil & gas wells near sensitive zones | 2024 | Operational shifts, potential compliance costs | Well proximity data, operational permits |

| Energy Permitting Reform Act | Expedited review timelines for energy infrastructure | July 2024 | Need for efficient navigation of permitting processes | Project timelines, regulatory approval status |

| EU Corporate Sustainability Reporting Directive (CSRD) | Mandatory sustainability reporting for EU companies | Phased implementation from 2024 | Enhanced data collection & reporting requirements | Scope 1, 2, 3 emissions data, sustainability metrics |

| EU Renewable Energy Directive III (RED III) | Target of 42.5% renewable energy by 2030 for EU | Adopted 2023 | Drives investment in renewables, impacts energy mix | Renewable energy generation, energy efficiency data |

Environmental factors

The oil and gas industry faces increasing pressure to curb methane emissions, a powerful greenhouse gas. New Environmental Protection Agency (EPA) regulations, finalized in March 2024, require the implementation of advanced technologies for detecting and repairing methane leaks, alongside more rigorous reporting protocols. These rules aim to significantly cut emissions from existing and new oil and gas facilities.

TETRA Technologies' expertise, particularly in water management and its specialized product offerings, can directly support clients in adhering to these new, stricter environmental mandates. By providing solutions that help manage water produced during oil and gas operations, TETRA can indirectly assist in reducing the overall environmental footprint and meeting compliance needs related to emission reduction efforts.

Escalating water scarcity is a major environmental challenge, compelling the oil and gas sector to explore new water sources and improve efficiency. For instance, by 2025, global freshwater demand is projected to exceed available resources by 40%, according to UN Water reports, highlighting the urgency for change.

This situation is driving a significant shift towards reducing freshwater consumption, increasing the use of brackish water, and enhancing the recycling of produced water within operations. Companies are actively seeking ways to reuse water that has already been extracted during the oil and gas extraction process.

TETRA Technologies' water management solutions are strategically aligned to meet these evolving industry needs. Their offerings aim to help clients not only decrease their environmental impact but also achieve substantial reductions in operational expenses by optimizing water use and treatment.

Companies are increasingly prioritizing carbon neutrality, with many setting ambitious net-zero targets. This focus drives significant investment in carbon capture and storage (CCS) technologies to reduce CO2 emissions. For instance, by the end of 2024, global investment in CCS projects was projected to reach $200 billion, according to industry reports.

The global push for decarbonization is also accelerating investments in renewable energy and alternative fuels, particularly within the oil and gas sector. This shift is evident as major energy companies allocate substantial capital towards green energy portfolios, aiming to meet evolving market demands and regulatory pressures.

TETRA's strategic direction, which emphasizes low-carbon energy initiatives, directly aligns with these broader industry-wide decarbonization efforts. This strategic alignment positions TETRA to capitalize on the growing market for sustainable energy solutions and navigate the transition away from traditional fossil fuels.

Sustainable Practices and ESG Alignment

The oil and gas sector is increasingly focused on environmental, social, and governance (ESG) principles, driving a shift towards sustainability. Companies are actively reducing their environmental footprint, with initiatives like Zero Liquid Discharge (ZLD) systems gaining traction to minimize water waste. For instance, by 2024, many companies aim to significantly cut greenhouse gas emissions, with some targeting a 30% reduction from 2019 levels.

TETRA can solidify its market standing by actively supporting and showcasing these sustainable practices for its clients. This includes facilitating the adoption of technologies that enable remote operations, thereby reducing travel-related emissions, and promoting waste minimization strategies throughout the value chain.

- ESG Investment Growth: Global ESG assets were projected to reach $50 trillion by 2025, highlighting the financial imperative for sustainable operations.

- ZLD Adoption: The ZLD market is expanding, with projections indicating significant growth driven by water scarcity concerns and regulatory pressures in the energy sector.

- Remote Operations: Increased adoption of remote monitoring and control systems in 2024-2025 is expected to reduce operational carbon emissions by up to 15% in some offshore facilities.

- Waste Reduction Targets: Many upstream oil and gas companies have set ambitious targets for waste reduction, aiming for a 20% decrease in non-hazardous waste by 2025.

Investment in Renewable Energy and Diversification

The global shift towards sustainability is profoundly impacting the energy sector, with substantial investments flowing into renewable energy sources. In 2024, utility-scale solar and wind projects alone represented close to 90% of all new energy capacity additions. This trend is compelling traditional oil and gas companies to explore diversification strategies, venturing into renewable energy development to align with market demands and regulatory pressures.

TETRA is actively participating in this transition, strategically expanding its footprint in the low-carbon energy market. By leveraging its established core competencies, the company is adapting to the dynamic energy landscape, positioning itself for sustained growth amidst evolving environmental considerations and market opportunities. This strategic pivot reflects a broader industry movement towards cleaner energy solutions.

- Renewable Energy Dominance: Utility-scale solar and wind accounted for approximately 90% of new energy capacity additions in 2024.

- Industry Diversification: Oil and gas firms are increasingly investing in renewable energy projects to broaden their portfolios.

- TETRA's Strategic Expansion: TETRA is moving into the low-carbon energy sector, utilizing its existing expertise.

- Market Adaptation: The company's expansion signifies an adaptation to the evolving global energy framework and demand for sustainable solutions.

Environmental factors are increasingly shaping the oil and gas industry, with a strong emphasis on reducing greenhouse gas emissions and managing water resources more sustainably. Stricter regulations, like the EPA's March 2024 methane emission rules, are compelling companies to adopt advanced leak detection technologies and improve reporting. This regulatory push, coupled with escalating global water scarcity – projected to create a 40% deficit in freshwater resources by 2025 according to UN Water – necessitates innovative water management solutions and a greater focus on water recycling.

The drive towards carbon neutrality and net-zero targets is fueling significant investment in carbon capture and storage (CCS), with global CCS project investment estimated to reach $200 billion by the end of 2024. Simultaneously, the sector is accelerating investments in renewables and alternative fuels, with utility-scale solar and wind projects accounting for nearly 90% of new energy capacity additions in 2024. TETRA Technologies' focus on water management and low-carbon energy initiatives directly aligns with these critical environmental trends, positioning the company to support clients in achieving compliance and capitalizing on the shift towards sustainable energy.

| Environmental Factor | Industry Impact | TETRA's Alignment | Key Data Point (2024-2025) |

| Methane Emissions Reduction | Stricter EPA regulations finalized March 2024 | Water management solutions aid compliance | Focus on advanced leak detection technologies |

| Water Scarcity | 40% global freshwater deficit projected by 2025 (UN Water) | Water management and recycling solutions | Increased use of brackish and recycled produced water |

| Decarbonization & CCS | $200 billion projected global CCS investment by end of 2024 | Low-carbon energy initiatives | Growing investment in renewable energy portfolios |

| ESG & Sustainability | ESG assets projected to reach $50 trillion by 2025 | Support for ZLD systems and remote operations | Up to 15% emission reduction from remote operations |

PESTLE Analysis Data Sources

Our Tetra PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable academic research, and leading industry-specific reports. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental landscape.