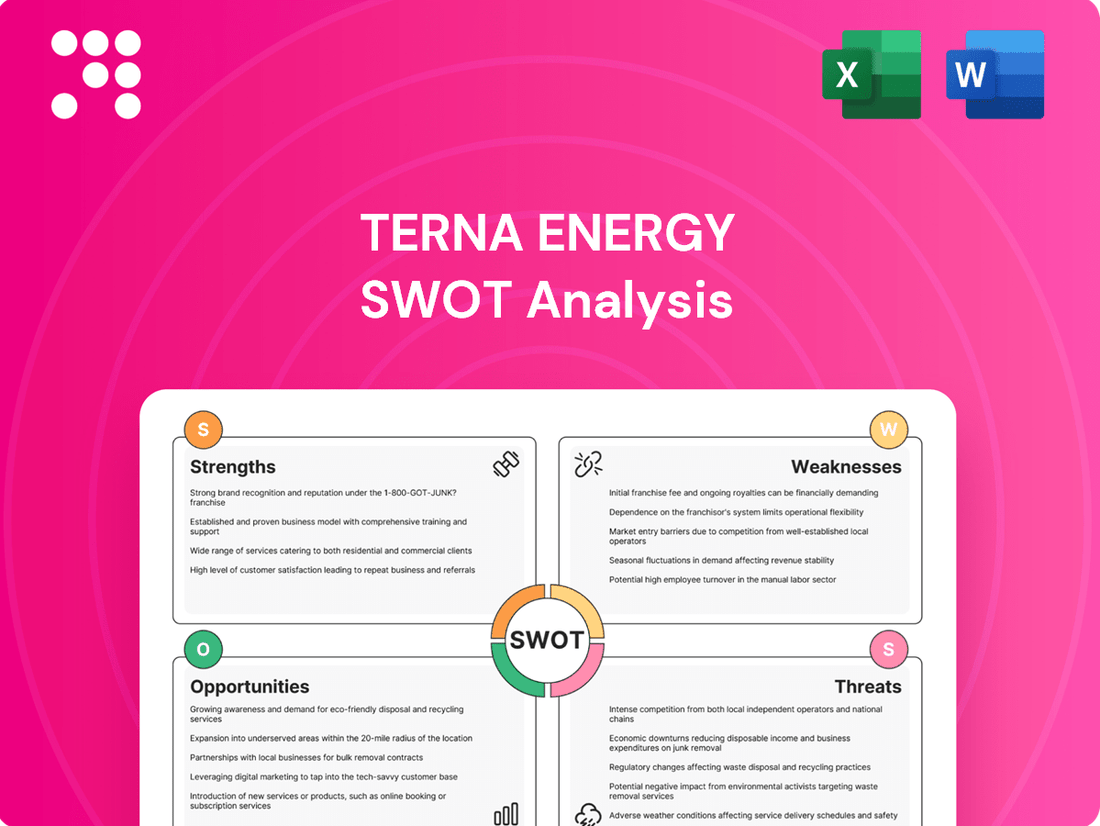

Terna Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Terna Energy Bundle

Terna Energy is a powerhouse in renewable energy, boasting significant strengths in its diversified portfolio and robust project pipeline. However, understanding the nuances of its operational efficiencies and potential market shifts is crucial for strategic advantage.

Want the full story behind Terna Energy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Terna Energy boasts a strong and varied renewable energy portfolio, encompassing wind, solar, hydroelectric, and biomass. This broad mix of green energy sources is a key strength, reducing the company's dependence on any single technology. Such diversification provides greater stability and resilience, especially when facing unpredictable weather patterns or shifts in regulations affecting a particular energy type.

By the close of 2024, Terna Energy had achieved a total installed capacity of 1,224 MW. A significant portion of this capacity comes from wind power, further bolstered by the recent commissioning of the Kafireas wind park, underscoring their ongoing commitment to expanding their renewable energy footprint.

Terna Energy has showcased impressive financial performance, with revenues from continuing operations climbing 37.6% year-on-year to €347.1 million in 2024. This growth was largely fueled by robust renewable energy sales. The company’s adjusted EBITDA also experienced a significant jump of 22.6%, reaching €212.6 million, underscoring its strong operational efficiency and profitability.

Terna Energy boasts a robust project pipeline, with 67 MW of solar projects currently under construction in Greece. This is complemented by an additional 500 MW of new photovoltaic, wind, and storage projects slated for construction worldwide, with an expected operational start by the close of 2025.

Further strengthening its growth outlook, the company is advancing the 670 MW Amfilochia pumped-storage hydroelectric project. These significant investments are strategically aimed at achieving a substantial installed capacity of 6.0 GW by the year 2030.

Commitment to Sustainability and EU Taxonomy Alignment

Terna Energy's robust commitment to sustainability is a significant strength, underscored by its generation of 3.2 TWh of clean energy in 2024, which effectively averted over 1.3 million tonnes of CO2 equivalent emissions. This dedication to environmental stewardship is further validated by its financial and operational alignment with EU Taxonomy provisions.

- EU Taxonomy Alignment: 88.8% of turnover, 84.9% of capital expenditures, and 99.5% of operational expenditures are aligned with EU Taxonomy standards.

- Environmental Impact: Generated 3.2 TWh of clean energy in 2024, preventing more than 1.3 million tonnes of CO2 equivalent emissions.

- Leadership in Sustainability: Demonstrates a leading position in environmental responsibility and adherence to stringent sustainability criteria.

Strategic Acquisition by Masdar

Masdar's complete acquisition of Terna Energy in April 2025 injects substantial capital, fueling Terna's ambitious European expansion plans. This strategic move aligns Terna with Masdar's goal of achieving 100 GW of global clean energy capacity by 2030.

The acquisition significantly bolsters Terna Energy's financial standing and market reach. It also grants access to Masdar's cutting-edge renewable energy technologies, positioning Terna for accelerated growth in key European markets.

- Capital Injection: Full acquisition by Masdar in April 2025 provides significant financial resources.

- European Expansion: Enables accelerated growth and investment in major European renewable energy projects.

- Synergistic Goals: Aligns Terna with Masdar's target of 100 GW global clean energy capacity by 2030.

- Technological Advancement: Facilitates access to Masdar's advanced clean energy technologies.

Terna Energy's diversified renewable energy portfolio, spanning wind, solar, hydro, and biomass, is a core strength, mitigating risks associated with single-source dependency and market volatility. The company's impressive financial performance, with revenues up 37.6% to €347.1 million in 2024 and adjusted EBITDA rising 22.6% to €212.6 million, highlights operational efficiency and strong market demand for its clean energy solutions. Furthermore, Terna Energy's robust project pipeline, including 67 MW of solar under construction and 500 MW of new projects globally by the end of 2025, coupled with the significant 670 MW Amfilochia pumped-storage project, positions it for substantial growth towards its 2030 target of 6.0 GW installed capacity.

| Metric | 2024 Data | Significance |

|---|---|---|

| Total Installed Capacity | 1,224 MW | Demonstrates significant operational scale. |

| Revenue Growth (YoY) | +37.6% | Indicates strong market demand and sales performance. |

| Adjusted EBITDA | €212.6 million | Shows robust operational profitability. |

| Clean Energy Generated | 3.2 TWh | Highlights environmental contribution and operational output. |

| CO2 Emissions Avoided | >1.3 million tonnes | Quantifies positive environmental impact. |

What is included in the product

Analyzes Terna Energy’s competitive position through key internal and external factors, highlighting its strengths in renewable energy development and opportunities for expansion while acknowledging weaknesses in market diversification and threats from regulatory changes.

Offers a clear, actionable SWOT analysis of Terna Energy to pinpoint and address strategic vulnerabilities, thereby alleviating concerns about market position and growth potential.

Weaknesses

Terna Energy's financial expenses related to debt have seen a notable increase. In 2024, net financial expenses from continuing operations rose to €62.9 million, a significant jump from €50.2 million reported in 2023. This upward trend is largely a consequence of the company taking on more debt to fund its ongoing investments and aggressive growth initiatives.

The higher debt burden directly translates to increased interest payments. Effectively managing these growing financial obligations will be a key challenge for Terna Energy as it continues to pursue its expansion strategies, ensuring the company's long-term financial stability.

Terna Energy's significant reliance on Greece for its revenue, with 91.2% of net sales originating from the country as of recent reports, presents a notable weakness. This substantial geographical concentration leaves the company particularly susceptible to the economic, regulatory, and political climate within Greece. Any adverse shifts in these local factors could disproportionately impact Terna Energy's financial performance and operational stability.

Terna Energy's reliance on renewable sources, especially wind, means its energy output is directly tied to weather patterns. While favorable winds boosted load factors in 2024, this also highlights the downside: unpredictable or unfavorable weather can significantly reduce energy generation.

This weather dependency creates a degree of revenue volatility for Terna Energy. For instance, a prolonged period of low wind speeds or extreme weather events could disrupt operations and impact financial performance, posing an ongoing operational challenge.

Integration Challenges Post-Acquisition

The 100% acquisition of Terna Energy by Masdar, while a significant strategic move, introduces inherent integration challenges. Merging diverse operational frameworks, distinct corporate cultures, and potentially conflicting strategic priorities between the two entities demands meticulous planning and execution to prevent operational friction.

These integration hurdles could impact Terna Energy's ongoing projects and day-to-day operations if not managed proactively. For instance, aligning IT systems and harmonizing employee benefits across both organizations are complex tasks that require substantial resources and time. Masdar's commitment to renewable energy, with significant investments in solar and wind power, will need to be carefully interwoven with Terna Energy's existing portfolio, which includes a substantial presence in electricity transmission and distribution.

Key integration challenges include:

- Cultural Harmonization: Bridging differences in organizational culture and management styles between Masdar and Terna Energy.

- Operational Synergies: Realizing expected operational efficiencies and cost savings through the integration of systems and processes.

- Strategic Alignment: Ensuring that the combined entity's strategic objectives are clearly defined and effectively communicated to all stakeholders.

- Regulatory Compliance: Navigating varying regulatory landscapes in different operational regions for both companies.

Dependence on Regulatory Frameworks and Incentives

Terna Energy's operations are significantly influenced by government policies and incentives within the renewable energy sector. Changes in these supportive measures, such as alterations to feed-in tariffs or tax credits, could directly affect project economics. For instance, a reduction in the Italian government's renewable energy incentives could decrease Terna's anticipated returns on new developments.

The company faces risks associated with evolving regulatory landscapes and potential shifts in energy policy. Stricter environmental regulations or changes in permitting processes could add costs or delays to Terna Energy's project pipeline. For example, if new regulations mandate more extensive environmental impact assessments, this could slow down the development cycle for wind or solar farms.

- Policy Sensitivity: Terna Energy's profitability is tied to government subsidies and tax incentives crucial for renewable energy projects.

- Regulatory Risk: Unfavorable policy shifts, like reduced feed-in tariffs or stricter environmental standards, pose a significant threat to project viability.

- Impact on Profitability: Changes in regulatory frameworks can directly impact the financial returns and long-term sustainability of Terna's investments.

- Market Uncertainty: Dependence on evolving energy policies creates uncertainty, potentially affecting Terna's strategic planning and investment decisions.

Terna Energy's significant debt burden, with net financial expenses rising to €62.9 million in 2024 from €50.2 million in 2023, indicates a growing financial commitment that could strain profitability. This increased reliance on debt to fuel expansion presents a key weakness, requiring careful management to maintain financial stability amidst ambitious growth plans.

Same Document Delivered

Terna Energy SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a comprehensive look at Terna Energy's Strengths, Weaknesses, Opportunities, and Threats, providing valuable insights for strategic planning. You're viewing a live preview of the actual SWOT analysis file; the complete version becomes available after checkout.

Opportunities

The global and European push for decarbonization is accelerating, creating a massive opportunity for renewable energy. Terna Energy is well-positioned to capitalize on this trend, with a strong focus on wind and solar power development.

Italy's commitment to renewable energy, outlined in its Integrated National Energy and Climate Plan (NECP), aims for a significant increase in installed capacity. For instance, the plan targets 55% of gross final energy consumption from renewable sources by 2030, a target that will drive demand for Terna Energy's expertise.

The EU's ambitious Fit-for-55 package further reinforces this shift, setting binding targets for emissions reductions and renewable energy deployment. This regulatory environment provides a clear and sustained market for Terna Energy's renewable energy projects and services throughout the 2024-2025 period and beyond.

The growing unpredictability of renewable energy sources, like solar and wind, makes energy storage absolutely crucial for a stable power grid. This is a massive opportunity for companies like Terna Energy.

Terna Energy is already making smart moves in this area. For instance, their Amfilochia pumped-storage hydro project is a significant development. They are also actively planning to integrate storage into their upcoming renewable energy installations, showing a clear strategy to capture market share in this vital and expanding sector.

Terna Energy is well-positioned to capitalize on the digital transformation sweeping the energy sector. Terna S.p.A., the Italian transmission system operator, has committed significant investment to digitalizing its operations, including AI-driven grid management and advanced data analytics. This strategic focus, evident in Terna S.p.A.’s reported €1.6 billion investment in its 2021-2030 Strategic Plan for grid modernization and digitalization, creates a fertile ground for Terna Energy to adopt similar technologies. By integrating these advanced platforms, Terna Energy can streamline project development, enhance asset performance, and improve overall operational efficiency.

Geographical Expansion and International Interconnections

Terna Energy's strategic partnership with Masdar significantly bolsters its capacity for geographical expansion, particularly within Europe. This alliance is key to Terna Energy's ambition to develop new green energy projects in countries like Bulgaria, diversifying its operational base and tapping into new markets for renewable energy generation.

Furthermore, Terna Energy is well-positioned to actively participate in crucial international interconnection projects. These projects are vital for enhancing the flow of renewable energy across borders, strengthening grid stability, and creating new revenue streams. For instance, Terna Energy's involvement in the Bulgarian market is part of a broader European strategy to build a more integrated and resilient green energy network.

- European Expansion: Masdar's backing provides Terna Energy with enhanced financial and strategic capabilities to pursue new projects across Europe, aiming to broaden its renewable energy portfolio.

- International Interconnections: Terna Energy is strategically targeting participation in cross-border energy projects to facilitate the transmission of green energy, thereby increasing its market reach and revenue potential.

- Bulgarian Market Entry: The company's development activities in Bulgaria exemplify its commitment to expanding its geographical footprint and capitalizing on growing demand for renewable energy in Eastern Europe.

Exploration of Secondary Market Acquisitions

Terna Energy is actively looking at buying existing renewable energy projects, often called secondary market acquisitions. This is a smart way for them to grow faster. Instead of building everything from scratch, which takes time, they can buy operational plants. This helps them get closer to their goal of having 6.0 GW of installed capacity by 2030.

This approach is particularly effective for accelerating market penetration. By acquiring established assets, Terna Energy can immediately add capacity to its portfolio and gain market share. For example, in 2023, the company was reportedly exploring several acquisition targets in the Italian solar market, aiming to leverage existing infrastructure and regulatory frameworks.

The benefits of this strategy include:

- Faster Capacity Growth: Acquiring operational assets provides immediate capacity, bypassing the lengthy development timelines of greenfield projects.

- Reduced Development Risk: Operational projects have already navigated permitting, construction, and interconnection challenges, lowering inherent risks.

- Market Entry and Expansion: Secondary market acquisitions offer a quicker route to entering new geographic regions or expanding presence in existing ones.

- Portfolio Diversification: This strategy can help diversify the company's asset base by acquiring projects with different technologies or operational histories.

The increasing global demand for decarbonization and Italy's ambitious renewable energy targets, such as reaching 55% renewable energy consumption by 2030, present a substantial opportunity for Terna Energy. The EU's Fit-for-55 package further solidifies this market by mandating emissions reductions and renewable energy deployment, creating a sustained demand for Terna Energy's expertise in wind and solar power. Additionally, the critical need for energy storage to stabilize grids powered by intermittent renewables offers a significant growth avenue, which Terna Energy is proactively addressing through projects like the Amfilochia pumped-storage hydro facility and integrating storage into new developments.

Terna Energy's strategic focus on secondary market acquisitions allows for faster capacity growth and reduced development risk, as seen in their exploration of Italian solar market targets in 2023, supporting their aim to reach 6.0 GW by 2030.

The company's partnership with Masdar enhances its European expansion capabilities, particularly in markets like Bulgaria, and positions Terna Energy to participate in crucial international interconnection projects that improve cross-border renewable energy flow and grid resilience.

Threats

The renewable energy sector is a crowded space, with many companies competing for the same development, financing, and operational contracts. This fierce rivalry can squeeze profit margins and drive up project expenses. For instance, in 2024, global renewable energy investment reached an estimated $600 billion, highlighting the significant capital flowing into the market and the intense bidding for profitable ventures.

Terna Energy faces significant risks from evolving government policies and energy market regulations, especially within Greece and the broader European Union. For instance, changes to renewable energy incentive schemes or carbon pricing mechanisms could directly affect Terna's profitability and the viability of its projects. The company's 2023 financial report highlights its reliance on stable regulatory environments for its substantial investments in renewables, making any adverse shifts a considerable threat.

Rising interest rates present a significant threat to Terna Energy. An increase in borrowing costs directly impacts the expense of financing new projects and managing existing debt. For instance, if Terna Energy's average cost of debt were to increase by 1%, its annual financing costs could rise substantially, potentially impacting profitability and cash flow available for reinvestment. This dynamic can slow down the pace of developing crucial renewable energy infrastructure.

Grid Congestion and Infrastructure Limitations

As the push for renewable energy accelerates, Terna Energy, like many in the sector, faces the growing threat of grid congestion. The existing electricity transmission infrastructure wasn't built for the distributed and often variable nature of renewable sources. This can lead to bottlenecks, preventing the full utilization of generated power from new solar and wind farms.

While Terna, as the Transmission System Operator (TSO), is making significant investments in grid modernization, these limitations remain a hurdle. For instance, Terna's 2024-2028 strategic plan outlines €10.5 billion in investments, with a substantial portion dedicated to grid upgrades and digitalization. However, the sheer pace of renewable project development might outstrip the pace of these infrastructure enhancements.

- Grid Congestion Impact: Delays in connecting new renewable capacity and reduced efficiency in transmitting power from operational assets.

- Infrastructure Investment: Terna's commitment to grid upgrades is substantial, aiming to bolster capacity and reliability.

- Pace of Development: The rapid expansion of renewable energy projects can strain even upgraded grid systems, posing an ongoing challenge.

Environmental Risks and Climate Change Impacts

Terna Energy, despite its commitment to renewable energy, faces inherent environmental risks. Extreme weather events, such as the severe storms and heatwaves experienced in 2024, can damage its wind turbines and solar farms, disrupting energy production and requiring costly repairs. For instance, the company reported minor impacts from adverse weather in its Q1 2024 earnings call, highlighting the ongoing vulnerability.

Furthermore, evolving environmental regulations and the potential for unforeseen ecological impacts pose significant threats. Increased compliance costs, such as those anticipated with stricter carbon emission reporting frameworks coming into effect in the EU in late 2024, could elevate operational expenses. Additionally, delays in project approvals due to environmental assessments or community concerns, as seen with some renewable projects globally in 2024, could hinder Terna Energy's expansion plans.

- Extreme Weather Vulnerability: Operations are susceptible to damage from events like hurricanes and prolonged droughts, impacting infrastructure and output.

- Regulatory Compliance Costs: Stricter environmental laws, including those related to emissions and land use, can increase operating expenses.

- Ecological Impact Uncertainty: Unforeseen environmental consequences of projects could lead to delays, fines, or reputational damage.

- Supply Chain Environmental Scrutiny: Growing pressure for sustainable supply chains can add complexity and cost to sourcing materials and components.

Intense competition within the renewable energy sector, evidenced by a global investment of approximately $600 billion in 2024, can compress Terna Energy's profit margins and escalate project costs. Changes in government policies and energy market regulations, particularly in Greece and the EU, pose a significant threat by potentially altering incentive schemes or carbon pricing, impacting project viability as noted in Terna's 2023 financial report. Rising interest rates directly increase financing costs for new projects and existing debt, potentially reducing funds available for reinvestment, as a 1% increase in the cost of debt could significantly impact annual financing expenses.

| Threat Category | Description | 2024/2025 Data/Impact |

| Competition | High rivalry for contracts and financing. | Global renewable investment reached ~$600 billion in 2024, indicating fierce competition for profitable ventures. |

| Regulatory Changes | Unfavorable shifts in energy policies and incentives. | EU carbon pricing mechanisms and renewable incentive schemes are subject to change, directly affecting profitability. |

| Rising Interest Rates | Increased cost of borrowing for projects and debt. | Higher interest rates directly impact financing expenses, potentially reducing cash flow for reinvestment. |

| Grid Congestion | Infrastructure limitations hindering renewable energy integration. | Despite €10.5 billion in grid upgrade investments planned by Terna (2024-2028), rapid renewable development may outpace infrastructure enhancements. |

| Environmental Risks | Damage from extreme weather and stricter regulations. | Severe weather events in 2024 caused minor operational impacts; stricter EU environmental reporting (late 2024) may increase compliance costs. |

SWOT Analysis Data Sources

This Terna Energy SWOT analysis is built upon a foundation of robust data, drawing from official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.