Terna Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Terna Energy Bundle

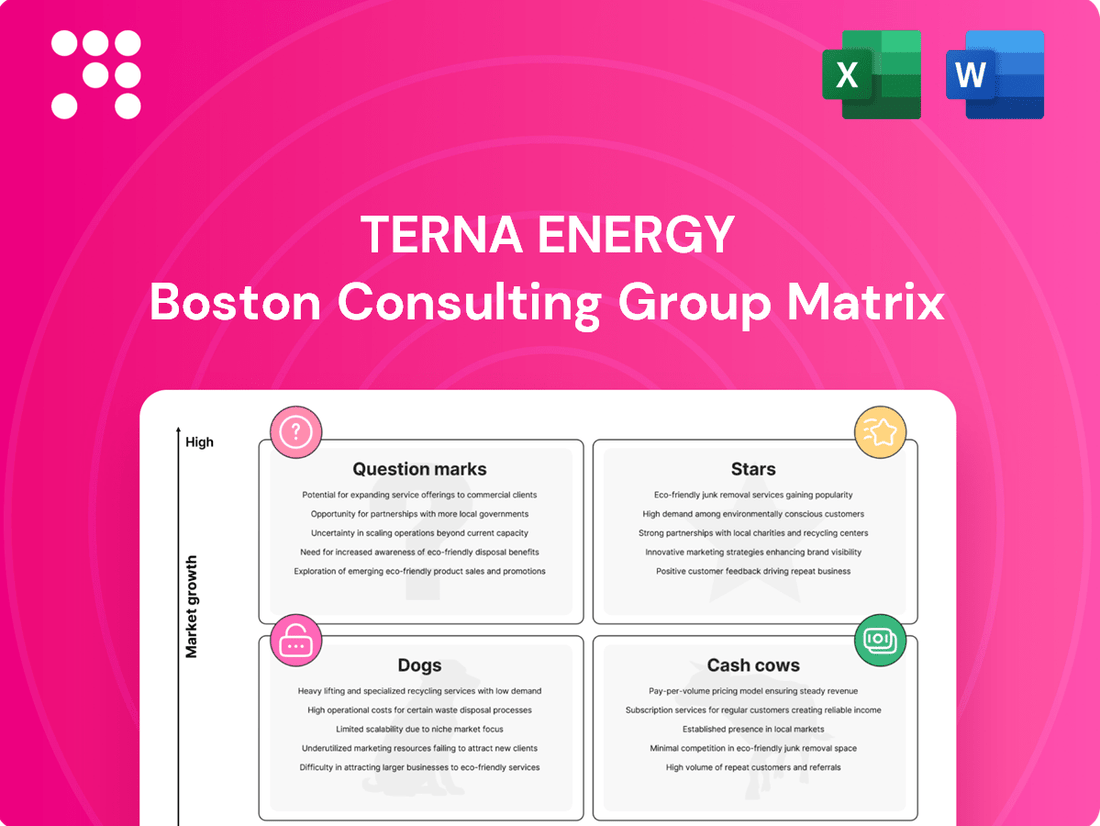

Curious about Terna Energy's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse energy solutions are performing in the market. Understand which segments are driving growth and which require careful consideration.

Unlock the full potential of Terna Energy's strategic blueprint by purchasing the complete BCG Matrix report. Gain in-depth analysis of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to guide your investment decisions.

Don't miss out on critical intelligence for navigating the energy sector. The full Terna Energy BCG Matrix offers a comprehensive, data-driven roadmap to optimize your portfolio and outmaneuver the competition.

Stars

Terna Energy's substantial installed wind capacity, exemplified by the 327 MW Kafireas wind park fully operational by late 2023, is a primary engine for its present expansion. This monumental project was instrumental in driving a 24.7% year-on-year surge in renewable energy generation during 2024, achieving a total of 3.2 TWh.

The impressive load factors observed at Kafireas are directly bolstering the overall performance of Terna Energy's renewable asset portfolio. These substantial, recently activated projects command a significant market share within the expanding renewable energy sector, clearly marking them as Stars in the BCG matrix.

Terna Energy is making significant strides in the solar photovoltaic (PV) sector. With 67 MW of projects already under construction in Greece and an additional 500 MW set to begin construction, the company is demonstrating substantial growth. This aggressive expansion underscores their commitment to becoming a leader in the rapidly expanding solar market.

Recent approvals for 260 MW of solar projects in Greece, alongside a 130 MW plant in Bulgaria, highlight the high growth potential Terna Energy is tapping into. These developments are strategically positioned within a booming global solar market, indicating strong future performance for these assets.

Terna Energy is making significant strides in energy storage, notably with its 670 MW Amfilochia pumped hydro storage project, which is on track. This initiative positions Terna Energy at the forefront of a critical, high-growth sector essential for grid reliability and incorporating more renewable energy sources.

The energy storage market, while demanding considerable upfront capital, offers Terna Energy a pathway to a dominant market share and robust future earnings as the sector matures. For instance, global investment in grid-scale battery storage systems is projected to reach hundreds of billions of dollars by the end of the decade, highlighting the immense potential.

Overall Renewable Energy Portfolio Expansion

Terna Energy is aggressively expanding its renewable energy portfolio, aiming for a total installed capacity of 6.0 GW by 2030. This represents a significant leap from its 1,224 MW capacity at the close of 2024.

- Strategic Capacity Growth: The company targets 6.0 GW installed capacity by 2030, a substantial increase from 1,224 MW in 2024.

- Strong Generation Performance: Terna Energy saw a 24.7% year-on-year increase in energy generation during 2024.

- Enhanced Financial Backing: The acquisition by Masdar bolsters Terna Energy's capital resources for future expansion.

Strategic Construction Segment for RES

Terna Energy's strategic construction segment, primarily focused on Engineering, Procurement, and Construction (EPC) for photovoltaic (PV) projects, is a clear Star in its BCG Matrix. This segment experienced a remarkable surge in revenue, reaching €38.8 million in 2024, a substantial leap from €2.3 million in 2023.

This robust performance directly fuels Terna Energy's expansion in high-growth renewable energy markets. The segment's ability to efficiently manage the deployment of these projects is crucial for maintaining the company's strong market position in renewable assets.

- Revenue Growth: Construction segment revenue grew from €2.3 million in 2023 to €38.8 million in 2024.

- Strategic Importance: Directly supports and enables the company's high-market-share renewable energy projects.

- Internal Expertise: Fosters and leverages internal capabilities in project execution.

- Star Classification: Its rapid growth and critical role in high-potential markets solidify its Star status.

Terna Energy's wind and solar projects, particularly those with high load factors like the 327 MW Kafireas wind park, are generating substantial revenue and driving significant growth. The company's renewable energy generation increased by 24.7% year-on-year in 2024, reaching 3.2 TWh, underscoring the strong performance of these assets. These projects, commanding significant market share in a booming sector, are clearly classified as Stars in the BCG matrix.

The company's strategic construction segment, focused on EPC for PV projects, also exhibits Star characteristics. Its revenue surged from €2.3 million in 2023 to €38.8 million in 2024, directly supporting the expansion of high-potential renewable energy assets and solidifying its Star classification.

Terna Energy's energy storage initiatives, like the 670 MW Amfilochia pumped hydro project, represent another promising Star. This segment is positioned to capture a dominant market share in a critical, high-growth sector essential for grid stability, with global investments in grid-scale battery storage projected to reach hundreds of billions of dollars by the end of the decade.

| BCG Category | Key Assets/Segments | 2024 Performance Indicators | Strategic Significance |

|---|---|---|---|

| Stars | Wind Power (e.g., Kafireas) | 3.2 TWh generation (24.7% YoY growth) | High market share, strong revenue driver |

| Stars | Solar PV Construction (EPC) | Revenue: €38.8 million (vs €2.3M in 2023) | Enables expansion in high-growth solar market |

| Stars | Energy Storage (e.g., Amfilochia) | On track for 670 MW | Critical for grid stability, high future earnings potential |

What is included in the product

This BCG Matrix overview for Terna Energy analyzes its portfolio, identifying which business units to invest in, hold, or divest.

A clear BCG matrix visualizes Terna Energy's portfolio, easing strategic decision-making by highlighting areas needing investment or divestment.

Cash Cows

Terna Energy's established wind farms, excluding the newly operational Kafireas project, are performing strongly. These fully operational assets are generating consistent and substantial revenue for the company.

These mature wind energy assets hold a significant market share within Greece, reliably contributing to Terna Energy's overall renewable energy sales. Their predictable cash flow and stable operations firmly place them as Cash Cows within the BCG matrix.

Terna Energy's mature hydroelectric power plants are classic cash cows within its portfolio. These long-life assets generate consistent and predictable energy, meaning they don't require significant new investment to maintain their output.

Operating in a well-established market, these facilities are highly profitable, contributing substantially to Terna Energy's strong cash flow generation. For instance, in 2023, Terna Energy reported a net profit of €150 million, with its hydroelectric segment playing a crucial role in this performance due to its low operational costs and high asset utilization rates.

Terna Energy’s operational solar parks are its established Cash Cows. These mature assets, having moved beyond the development phase, consistently generate significant cash flow with minimal reinvestment needs. Their low operational costs and strong market presence ensure they produce more earnings than required to maintain them.

Core Electricity Production Segment

Terna Energy's core electricity production segment is its primary Cash Cow, contributing a significant 76.2% to its net sales. This robust performance is fueled by a diversified portfolio of operational renewable energy assets, making it the main engine for both revenue and adjusted EBITDA generation.

As a market leader, this segment consistently generates surplus cash, which is then strategically reinvested into other growth areas within the company. In 2023, for instance, Terna Energy reported a substantial increase in its installed renewable capacity, underscoring the operational strength of this core business.

- Dominant Revenue Contributor: Accounts for 76.2% of Terna Energy's net sales.

- Strong EBITDA Generation: Drives the majority of the company's adjusted EBITDA.

- Market Leadership: Positioned as a leader in the electricity production market.

- Cash Flow Surplus: Generates more cash than it requires, funding strategic initiatives.

Energy Management Solutions

Terna Energy's energy management solutions are positioned as Cash Cows within its portfolio. These offerings likely generate consistent, predictable revenue from a well-established customer base in a mature market. The ongoing demand for optimizing energy consumption and operational efficiency ensures a stable income stream.

The operational costs associated with promoting and expanding these services are relatively low, especially once a strong client foundation is built. This allows Terna Energy to benefit from high profitability without significant new investment. These solutions are crucial for maintaining the company's overall financial health.

- Stable Recurring Revenue: Energy management services provide a predictable income, unlike more volatile growth areas.

- Low Investment Needs: Once established, these services require minimal capital for marketing and sales.

- Profitability Support: They contribute significantly to Terna Energy's bottom line, funding other ventures.

- Market Maturity: The mature market ensures consistent demand for efficiency solutions.

Terna Energy's established wind farms, excluding recent additions, are solid cash cows. These operational assets generate dependable revenue and hold a significant market share in Greece, contributing reliably to the company's renewable energy sales. Their predictable cash flow and stable operations solidify their position.

The company's mature hydroelectric power plants are also classic cash cows. These long-life assets provide consistent energy output with minimal need for new investment, ensuring high profitability and contributing substantially to Terna Energy's cash flow. For example, in 2023, hydroelectric power was a key driver of their €150 million net profit.

Terna Energy's operational solar parks are further examples of cash cows. These mature assets, past their development stage, consistently produce significant cash flow with minimal reinvestment. Their low operational costs and strong market presence mean they earn more than they cost to maintain.

The core electricity production segment, representing 76.2% of net sales in 2023, is Terna Energy's primary cash cow. This segment's robust performance, driven by a diversified portfolio of operational renewable assets, fuels both revenue and adjusted EBITDA, generating surplus cash for strategic reinvestment.

| Asset Type | BCG Classification | Key Characteristics | 2023 Contribution Example |

| Mature Wind Farms | Cash Cow | Consistent revenue, significant market share, stable operations | Reliable contributor to renewable sales |

| Hydroelectric Plants | Cash Cow | Predictable energy output, low investment needs, high profitability | Key to €150M net profit |

| Operational Solar Parks | Cash Cow | Significant cash flow, minimal reinvestment, low operational costs | Strong market presence |

| Core Electricity Production | Cash Cow | Dominant revenue contributor (76.2%), strong EBITDA, market leadership | Funds strategic initiatives |

Preview = Final Product

Terna Energy BCG Matrix

The Terna Energy BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately upon purchase. This strategic analysis, meticulously crafted by industry experts, provides a clear breakdown of Terna Energy's business units within the BCG framework, ready for your immediate use in decision-making and planning.

Dogs

Underperforming older assets within Terna Energy's portfolio, such as older wind farms or smaller solar installations, might be categorized as Dogs. These assets often struggle with lower capacity factors and higher maintenance costs compared to newer, more efficient technologies. For instance, if an older solar plant commissioned in the early 2010s is operating at a significantly lower efficiency rate than current industry standards, it could be a prime example.

These older assets may not be expanding their market share in their respective renewable energy sub-segments, especially if those segments are mature or experiencing slow growth. For Terna Energy, this could translate to a situation where a particular older hydroelectric plant, for example, has a limited geographical reach and faces competition from larger, more modern facilities. Such assets typically require a thorough internal review to assess their viability for continued operation versus divestiture.

Terna Energy's "other" segment, representing 4.1% of its net sales, likely encompasses legacy non-core operations. These segments typically exhibit low market share and limited growth potential, diverging from the company's primary focus on renewable energy.

These smaller, diversified activities may not align with Terna Energy's strategic direction, especially following its acquisition by Masdar. A thorough review is probable to identify and potentially divest these non-essential or underperforming units, streamlining the company's portfolio.

Outdated biomass facilities within Terna Energy's portfolio, particularly those that are smaller, less scalable, or burdened by rising operational costs without corresponding market expansion, would likely be classified as Dogs in a BCG Matrix analysis. These assets may not align with the company's broader, more aggressive renewable energy growth objectives.

If these specific biomass operations are yielding low returns and do not fit into Terna Energy's strategic vision for aggressive renewable expansion, they are prime candidates for the Dog quadrant. For instance, if a facility's operational expenditure in 2024 exceeded its revenue by a significant margin, and there's no clear path to profitability or integration into larger, more efficient energy systems, its classification as a Dog becomes more probable.

Geographically Isolated Small Projects

Geographically isolated small projects often represent Terna Energy's "Dogs" in the BCG matrix. These are typically smaller-scale operations located in regions where the company has minimal market presence and limited prospects for future growth. Think of a single solar farm in a remote rural area with little surrounding industrial or residential demand.

These projects can demand significant management resources, diverting attention from more promising ventures. Their low market share combined with a stagnant or declining growth outlook means they generate minimal returns, potentially becoming costly burdens rather than contributors to overall profitability. For instance, a project with a 2024 EBITDA margin of only 5% and a projected annual revenue growth rate of 1% would likely fall into this category.

- Low Market Share: These projects typically hold a very small percentage of their local market.

- Low Growth Potential: The regions they operate in offer little opportunity for expansion or increased demand.

- Resource Drain: They can consume management time and capital without delivering substantial returns.

- Potential Divestment Candidates: Often, these are considered for sale or closure to reallocate resources more effectively.

Initial Waste Management Facilities

Terna Energy's involvement in waste management facilities, contributing 5.5% to net sales in 2023, positions these operations within the context of a BCG Matrix. If these facilities operate in a market with limited growth potential and Terna Energy possesses a modest market share, they would likely be classified as Dogs.

This classification suggests that these waste management assets may not be significant revenue drivers or growth engines for the company. Consequently, Terna Energy might strategically reduce further investment in this segment to reallocate capital towards its more promising renewable energy ventures.

- Waste Management Facilities Contribution: 5.5% of Terna Energy's net sales in 2023.

- Potential BCG Classification: Dogs, if operating in a low-growth niche with low market share.

- Strategic Implication: Potential for minimized investment to focus on core renewable energy growth.

Older, less efficient renewable energy assets within Terna Energy's portfolio, such as older wind farms or smaller solar installations, are likely candidates for the "Dogs" category in a BCG Matrix. These assets often face challenges like lower capacity factors and higher maintenance costs compared to newer technologies. For example, an older solar plant commissioned in the early 2010s, operating at a significantly lower efficiency rate than current industry standards, would fit this description.

These "Dog" assets typically exhibit low market share in their respective sub-segments and have limited growth potential, especially in mature or slow-growing markets. An older hydroelectric plant with a limited geographical reach and facing competition from larger, modern facilities exemplifies this. Such units often require a critical internal review to determine their future viability, potentially leading to divestiture.

Terna Energy's legacy non-core operations, such as outdated biomass facilities or geographically isolated small projects, also fall into the Dog quadrant. These segments, which contributed 4.1% to net sales in 2023, may not align with the company's strategic focus on aggressive renewable expansion. For instance, a biomass facility with a 2024 EBITDA margin of only 5% and a projected annual revenue growth rate of 1% would likely be classified as a Dog, potentially leading to reduced investment or divestment.

| Asset Type Example | BCG Quadrant | Key Characteristics | 2024 Data Indication | Strategic Consideration |

|---|---|---|---|---|

| Older Solar Farm (Early 2010s) | Dogs | Low capacity factor, high maintenance costs, low market share | Efficiency rate significantly below current standards | Divestment or operational review |

| Older Hydroelectric Plant | Dogs | Limited geographical reach, competition from modern facilities, low growth potential | Low market share in its segment | Assess viability vs. divestiture |

| Outdated Biomass Facility | Dogs | Low scalability, rising operational costs, limited market expansion | EBITDA margin of 5%, 1% projected revenue growth | Reduced investment, potential divestment |

| Waste Management Facilities | Dogs (Potentially) | Low market share, limited growth potential in niche market | 5.5% of net sales in 2023 | Minimize investment, focus on core renewables |

Question Marks

Terna Energy is actively investigating opportunities in Greece's burgeoning offshore wind market. This sector is poised for significant expansion, yet Terna Energy's current presence is minimal, placing these ventures in the Question Marks category of the BCG matrix.

Developing these offshore wind farms demands substantial upfront capital for research, securing permits, and initial construction phases. For instance, the Greek government aims to have 1.5 GW of offshore wind capacity operational by 2030, indicating a strong policy push but also high initial investment hurdles for developers like Terna Energy.

While the long-term potential is considerable, the immediate success of these Greek offshore wind projects remains uncertain. If Terna Energy can navigate the regulatory landscape and secure necessary financing, these could evolve into high-growth Stars within their portfolio.

Terna Energy's expansion into new geographical markets, particularly beyond its core regions of Greece and Eastern Europe, positions them in high-growth but low-market-share territories. These new ventures are cash-intensive, reflecting the significant investment required for market entry and initial project development. An example of this strategy is their 130 MW solar plant in Bulgaria, representing an initial foray into a new region with a nascent market share.

Terna Energy is actively exploring early-stage innovative technologies, particularly in areas like green hydrogen and advanced smart grid applications. These nascent fields represent significant future growth potential, though Terna's current market penetration is minimal. For instance, the global green hydrogen market is projected to reach USD 50 billion by 2030, indicating a substantial opportunity for early movers.

These investments necessitate considerable research and development alongside significant capital outlay to establish feasibility and achieve scalability. Terna's strategic focus on these areas positions it to potentially capture future market share in a rapidly evolving energy landscape, aligning with global decarbonization efforts.

Large-Scale Pumped Hydro Storage (During Construction)

The Amfilochia hydro-pump storage project, with a planned capacity of 670 MW, currently falls into the Question Mark category for Terna Energy. This massive undertaking requires substantial capital expenditure, with €370 million allocated for 500 MW of new projects, including the Amfilochia facility.

During its construction phase, the project is a significant drain on resources, consuming capital without generating revenue. This aligns with the characteristics of a Question Mark, where high investment is needed to unlock future potential.

- Project Investment: €370 million allocated for 500 MW of new projects, including Amfilochia.

- Capacity: Amfilochia project is 670 MW.

- Current Status: Significant capital consumption during construction with no immediate returns.

- Future Potential: High growth potential upon completion, but balanced against current cash demands and project risks.

Unproven Hybrid Renewable Projects

Terna Energy's involvement in hybrid renewable projects, particularly those combining unproven technologies or in nascent development stages, would likely place them in the 'Question Marks' category of the BCG matrix. These ventures operate in a high-growth sector, aiming to integrate multiple renewable sources for enhanced efficiency and grid stability.

While the potential for market expansion is significant, these projects demand substantial capital for research, development, and initial deployment. Their success hinges on overcoming technological hurdles and achieving widespread market acceptance, which is currently uncertain. For instance, in 2024, the global investment in hybrid renewable energy systems saw a notable increase, reflecting investor interest in this evolving space, though specific adoption rates for novel combinations remain to be fully established.

- High Growth Potential: Hybrid projects tap into the expanding renewable energy market.

- Uncertain Market Share: New technology combinations lack proven market dominance.

- Significant Investment Needs: R&D and early-stage deployment require substantial capital.

- Risk of Low Profitability: Success depends on technological viability and market adoption.

Question Marks represent Terna Energy's ventures in high-growth markets where their current market share is low. These are often new technologies or geographical expansions that require significant investment but have uncertain future outcomes.

For example, Terna Energy's exploration of offshore wind in Greece fits this profile. The sector is growing, with Greece aiming for 1.5 GW of offshore wind by 2030, but Terna's current footprint is small, demanding substantial capital for development and regulatory navigation.

Similarly, investments in nascent areas like green hydrogen, with a global market projected to reach USD 50 billion by 2030, are also Question Marks. These require extensive R&D and capital outlay, with success dependent on technological advancements and market adoption.

The Amfilochia hydro-pump storage project, a 670 MW undertaking, also exemplifies a Question Mark. It consumes significant capital, such as the €370 million allocated for 500 MW of new projects including Amfilochia, without immediate returns, highlighting the high investment needed for future potential.

| Venture Area | Market Growth | Terna's Market Share | Investment Needs | Future Outlook |

|---|---|---|---|---|

| Greek Offshore Wind | High | Low | Substantial | Uncertain, high potential |

| Green Hydrogen | Very High | Negligible | High R&D and Capital | Emerging, significant opportunity |

| Amfilochia Pump Storage | Moderate (Infrastructure) | N/A (New Project) | High (e.g., €370M for 500MW) | High potential upon completion |

BCG Matrix Data Sources

Our Terna Energy BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.