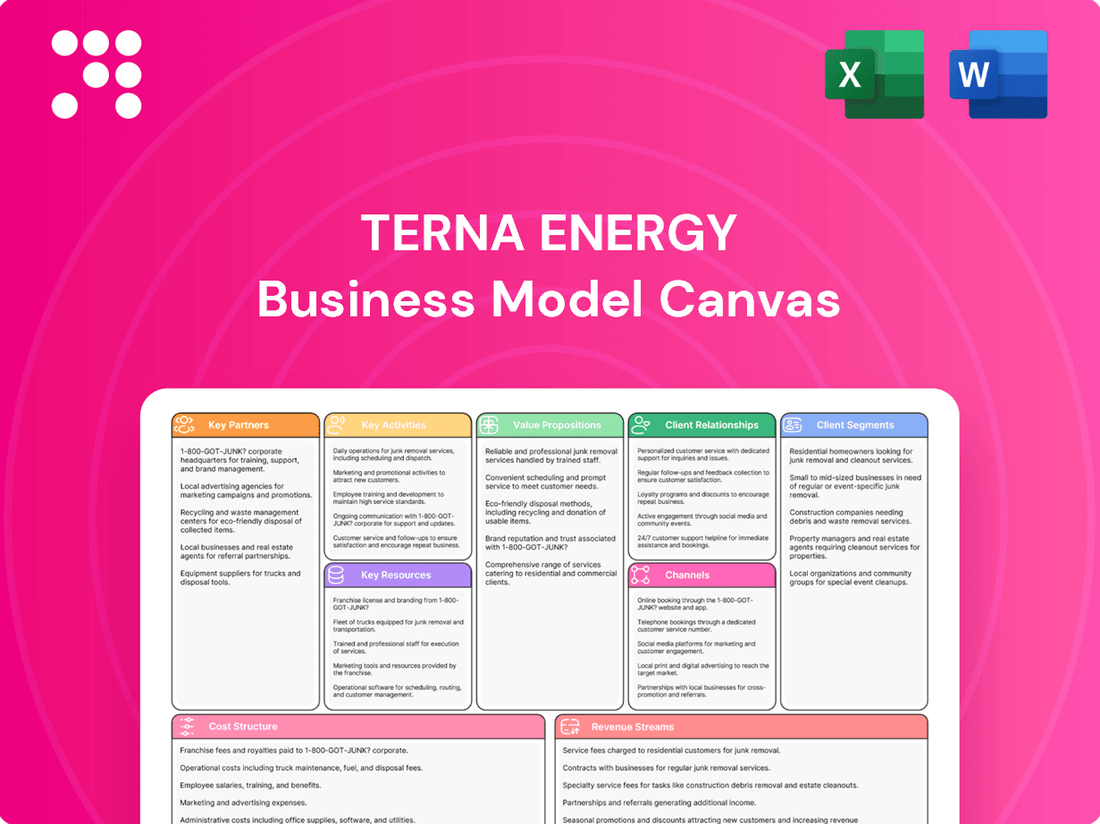

Terna Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Terna Energy Bundle

Unlock the strategic blueprint behind Terna Energy's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how Terna Energy effectively delivers value to its customers, manages key resources, and generates revenue in the dynamic energy sector. Discover the core components that drive their operations and market position.

Ready to gain a competitive edge? Download the full Terna Energy Business Model Canvas to explore their customer relationships, revenue streams, and cost structure in detail. This professionally crafted document is an invaluable resource for anyone looking to understand and replicate success in the renewable energy industry.

Partnerships

Terna Energy's key partnerships are significantly shaped by its recent acquisition by Masdar, an Abu Dhabi Future Energy Company. This strategic alliance, finalized in April 2025, sees Masdar taking full ownership of Terna Energy.

This €3.2 billion deal, one of Europe's largest renewable energy transactions in 2024, positions Masdar to bolster its European presence and significantly accelerate its renewable energy development initiatives across the continent.

Terna Energy actively collaborates with government and regulatory bodies, including the Greek Ministry of Energy and Infrastructure. This partnership is vital for obtaining essential environmental permits and project authorizations, ensuring Terna Energy’s renewable energy projects can move forward smoothly.

The company's adherence to EU Taxonomy provisions and alignment with national energy plans, such as Greece's National Energy and Climate Plan (NECP), underscores a robust working relationship with regulatory frameworks. For instance, Greece aims for renewable energy sources to cover at least 40% of its gross final energy consumption by 2030, a target Terna Energy directly contributes to.

These collaborations are fundamental for Terna Energy to maintain compliance with evolving sustainability standards and to facilitate the efficient development of its extensive portfolio. In 2023, Terna Energy reported significant progress in its renewable energy capacity, with over 2.7 GW operational, demonstrating the tangible results of these governmental partnerships.

Terna Energy relies heavily on financial institutions and lenders to fund its ambitious renewable energy projects. Securing substantial debt financing is crucial for the development of large-scale initiatives. For instance, the company's increased debt levels in recent periods directly support new investments in the sector.

The Amfilochia hydro-pump storage project exemplifies the significant capital requirements Terna Energy faces, underscoring the importance of these banking relationships. Furthermore, Terna Energy strategically employs green bond issuances, a testament to its partnerships with investors and financial markets committed to sustainable development, to bolster its funding for environmentally conscious projects.

Technology Providers and Equipment Manufacturers

Terna Energy relies heavily on technology providers and equipment manufacturers to build and run its state-of-the-art renewable energy installations. These partnerships are crucial for accessing the latest advancements and specialized knowledge.

For example, Terna Energy is incorporating monocrystalline bifacial panels from JinkoSolar Holding Co Ltd and power inverters from Huawei Technologies into its solar energy projects. These collaborations guarantee access to high-performance equipment and the technical support needed for optimal operation.

- JinkoSolar Holding Co Ltd: A leading global solar panel manufacturer, providing advanced bifacial solar technology.

- Huawei Technologies: A key supplier of intelligent power inverters, essential for efficient solar energy conversion.

- Technological Advancement: These partnerships ensure Terna Energy utilizes cutting-edge technology, enhancing the efficiency and output of its renewable energy assets.

Construction and Engineering Firms

While Terna Energy often handles construction internally, it collaborates with external construction and engineering firms for large-scale or highly specialized projects. These partnerships are crucial for ensuring the efficient and timely completion of complex renewable energy infrastructure, including wind farms, solar parks, and pumped-hydro storage systems.

In 2024, Terna Energy’s construction segment experienced robust revenue growth, underscoring its active engagement in project development and the strategic importance of these external collaborations.

- Specialized Expertise: External firms bring niche engineering skills and advanced construction techniques for unique project requirements.

- Capacity Augmentation: Partnerships allow Terna Energy to scale up construction efforts for multiple large projects simultaneously.

- Risk Mitigation: Collaborating with experienced engineering firms can help manage technical and execution risks in complex builds.

Terna Energy's key partnerships are now primarily defined by its acquisition by Masdar in April 2025, a €3.2 billion deal that significantly expands Masdar's European renewable energy footprint. The company also maintains crucial relationships with government bodies like the Greek Ministry of Energy and Infrastructure, vital for permits and alignment with national targets, such as Greece's goal for renewables to comprise at least 40% of its energy consumption by 2030.

Financial institutions and investors are essential partners, providing the substantial debt financing and green bond capital required for Terna Energy's large-scale projects, including its Amfilochia pumped-hydro storage facility. Furthermore, technology partnerships with firms like JinkoSolar for advanced solar panels and Huawei for inverters are critical for optimizing the performance of its renewable assets, which exceeded 2.7 GW of operational capacity in 2023.

What is included in the product

A comprehensive, pre-written business model tailored to Terna Energy's strategy of sustainable energy development, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans, ideal for presentations and funding discussions.

Terna Energy's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their renewable energy strategy, simplifying complex operations for stakeholders.

Activities

Renewable Energy Project Development is Terna Energy's core activity, encompassing site identification, feasibility studies, securing permits, and facility design for wind, solar, hydroelectric, and biomass projects. This crucial step underpins the company's expansion strategy.

In 2024, Terna Energy continued its robust development pipeline, with a significant focus on solar and wind energy in Greece and abroad. The company aims to add substantial new capacity, building on its existing portfolio which already represents a significant portion of Greece's renewable energy generation.

Terna Energy is deeply involved in building renewable energy infrastructure, covering everything from wind farms and solar parks to hydroelectric power stations. This hands-on approach ensures they manage the entire development process.

In 2024, Terna Energy's construction division experienced a significant revenue boost, demonstrating their commitment to expanding renewable energy capacity. This growth reflects their active participation in developing new energy projects across the board.

Key projects driving this expansion include major undertakings like the Amfilochia pumped-storage hydroelectric plant. This facility is a prime example of Terna Energy's capability in executing complex and vital energy infrastructure developments.

Operation and maintenance of assets is crucial for Terna Energy, ensuring their renewable energy infrastructure runs smoothly and reliably. This involves constant oversight and proactive upkeep to keep energy production high and interruptions low.

By the close of 2024, Terna Energy had a total installed capacity of 1,224 MW. A key focus is optimizing how efficiently these assets are utilized, aiming to boost load factors and overall energy output.

Energy Management and Optimization

Terna Energy's key activities in energy management and optimization focus on maximizing the value of renewable energy sources. This involves sophisticated forecasting of energy production, often leveraging advanced analytics and weather data, to ensure a steady supply. For instance, in 2023, Terna Energy reported a significant increase in its renewable energy production, highlighting the effectiveness of its management strategies.

The company provides comprehensive solutions for optimizing energy production, integrating the generated green energy seamlessly into the national grid. This ensures system stability and security, a crucial aspect given the intermittent nature of renewables. Their efforts contribute to efficient resource utilization and can involve participation in energy markets through trading activities.

- Forecasting Renewable Energy Production: Utilizing advanced analytics and meteorological data to predict output from wind and solar farms.

- Grid Integration: Ensuring smooth and stable integration of renewable energy into the electricity grid.

- Energy Trading: Actively participating in energy markets to optimize the sale of generated green energy.

- Efficiency Optimization: Implementing strategies to enhance the operational efficiency of renewable energy assets.

Financing and Investment Management

Financing and Investment Management is crucial for Terna Energy's growth, involving securing capital for new renewable energy projects and managing existing financial obligations. This includes optimizing the company's capital structure to support its expansion plans.

Terna Energy's strategy focuses on long-term, predictable revenue streams from its renewable energy assets. This approach helps in managing debt levels effectively while pursuing new investment opportunities.

- Securing Capital: Terna Energy actively seeks financing for its pipeline of new renewable energy projects, which is reflected in its debt management strategies.

- Debt Management: The company manages its existing debt to ensure financial stability and optimize its cost of capital.

- Investment Optimization: Terna Energy focuses on optimizing its financial structure to support investments in projects with predictable, long-term revenue streams.

- Financial Performance: For 2024, Terna Energy reported significant growth in revenues and profits, underscoring the effectiveness of its financing and investment management approach.

Terna Energy's key activities revolve around the comprehensive lifecycle of renewable energy projects. This includes the initial development and construction phases, followed by the crucial operation and maintenance of these assets to ensure optimal energy generation. Furthermore, the company actively engages in energy management and optimization, including forecasting production and participating in energy markets. Finally, securing financing and managing investments are paramount to fueling Terna Energy's continued growth and expansion in the renewable energy sector.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Project Development & Construction | Identifying, permitting, designing, and building renewable energy facilities. | Continued expansion of solar and wind capacity; significant revenue growth in construction division. |

| Operation & Maintenance | Ensuring reliable and efficient operation of existing renewable energy assets. | Total installed capacity reached 1,224 MW; focus on optimizing asset utilization and load factors. |

| Energy Management & Optimization | Forecasting production, grid integration, and market participation for generated energy. | Leveraging advanced analytics for production forecasting; reported increased renewable energy production in 2023. |

| Financing & Investment Management | Securing capital for new projects and managing financial structure. | Significant growth in revenues and profits; focus on long-term, predictable revenue streams to manage debt. |

Full Document Unlocks After Purchase

Business Model Canvas

The Terna Energy Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Terna Energy's strategic approach to renewable energy development, including key partners, activities, and value propositions. You'll gain immediate access to this complete, ready-to-use analysis, allowing you to understand and leverage Terna Energy's business framework without any surprises.

Resources

Terna Energy’s installed renewable energy capacity is its core physical asset, encompassing a diverse range of operational wind, solar, hydroelectric, and biomass power plants. This robust infrastructure is fundamental to its business model, directly fueling its energy production and revenue streams.

As of the close of 2024, Terna Energy boasted a total installed capacity of 1,224 MW. This significant figure represents substantial growth and underscores the company's commitment to expanding its renewable energy footprint and generation capabilities.

Terna Energy relies heavily on substantial financial capital to fund its extensive renewable energy projects, from initial development through construction and eventual acquisition. This necessitates robust access to funding mechanisms to support significant capital expenditures.

The company's financial structure, as evidenced by its net debt levels and associated financial expenses, directly reflects the ongoing need for project financing and the management of these large-scale investments. These figures underscore the capital-intensive nature of the renewable energy sector.

The recent acquisition of Terna Energy by Masdar, a global leader in clean energy, is a significant development that injects considerable capital investment into the company. This infusion of funds is expected to accelerate Terna Energy's growth and project pipeline, enhancing its financial capacity.

Terna Energy's technological prowess is central to its business, particularly in renewable energy. They possess deep expertise in developing, building, and managing sophisticated wind, solar, and pumped-storage hydroelectric power plants. This technical know-how allows them to efficiently integrate these diverse renewable sources into the grid.

Their intellectual property portfolio is bolstered by a continuous focus on innovation. This commitment translates into the development of new, cutting-edge renewable energy projects and the ongoing optimization of their operational assets. For instance, in 2023, Terna Energy reported a significant portion of its installed capacity was in wind power, showcasing their established technological strength in this area.

Human Capital and Skilled Workforce

Terna Energy's human capital is a cornerstone of its business model, encompassing a diverse team of engineers, project managers, financial specialists, and operational personnel. This highly skilled workforce is indispensable for navigating the complexities of renewable energy project lifecycles, from initial conception through to ongoing maintenance. As of the latest available data, Terna Energy employs approximately 293 individuals, underscoring the concentrated expertise within its operations.

The proficiency of Terna Energy's employees directly impacts the success and efficiency of its renewable energy ventures. Their collective knowledge is crucial for innovation, effective project execution, and maintaining operational excellence across all its assets. This specialized human capital is a key enabler for the company's strategic objectives in the dynamic energy sector.

- Skilled Workforce: Engineers, project managers, financial experts, and operational staff are vital for all project phases.

- Expertise: Crucial for development, construction, operation, and maintenance of renewable energy projects.

- Employee Count: Terna Energy has around 293 employees, representing concentrated expertise.

- Strategic Value: Human capital drives innovation, execution, and operational excellence.

Land and Site Access for Projects

Terna Energy's business model hinges on its ability to secure suitable land and site access for its renewable energy projects. This involves identifying locations with high potential for wind, solar, or hydroelectric power generation. The company's success in developing projects across diverse geographies underscores its capability in this crucial area.

Access to prime sites is paramount for Terna Energy's operations. The company actively pursues and obtains the necessary environmental permits, demonstrating a systematic approach to site acquisition and development. This ensures that their facilities are strategically located to maximize energy capture and operational efficiency.

- Access to Prime Renewable Energy Sites: Terna Energy prioritizes locations with strong wind speeds, high solar irradiance, or favorable water resources for hydroelectric power.

- Environmental Permitting Expertise: The company possesses the capability to navigate complex environmental regulations and secure necessary permits for project development.

- Geographic Diversification: Terna Energy's project portfolio spans various regions, highlighting its broad reach in identifying and accessing suitable development sites.

Terna Energy's key resources are its extensive portfolio of operational renewable energy plants, representing significant installed capacity. This physical infrastructure is complemented by substantial financial capital, essential for project development and expansion, as highlighted by their ongoing capital expenditures and net debt. The company also leverages strong technological expertise in wind, solar, and hydroelectric power, alongside a skilled workforce of approximately 293 employees. Finally, access to prime renewable energy sites and the ability to secure necessary environmental permits are critical for Terna Energy's continued growth and operational success.

Value Propositions

Terna Energy's primary value lies in its commitment to producing clean and sustainable energy. They harness a diverse portfolio of renewable sources, including wind, solar, hydroelectric, and biomass power.

In 2024, Terna Energy achieved a significant milestone, generating 3.2 terawatt-hours (TWh) of clean energy. This output is crucial for reducing reliance on fossil fuels.

This clean energy generation directly translates to substantial environmental benefits, preventing an estimated 1.3 million tonnes of CO2 equivalent emissions in 2024. This action actively supports global decarbonization goals and promotes environmental sustainability.

Terna Energy guarantees a dependable flow of electricity to the national grid by leveraging its diverse range of renewable energy assets. This commitment strengthens energy security and lessens dependence on traditional fossil fuels.

In 2024, Terna Energy's growing installed capacity, reaching over 2.3 GW of renewable energy, and optimized load factors significantly bolster its capability to provide consistent and reliable power generation.

Terna Energy actively contributes to national energy independence by developing and operating domestic renewable energy projects. For instance, in 2023, their Italian operations alone generated a significant portion of the country's renewable electricity, reducing the need for imported fossil fuels and bolstering national energy security.

By focusing on wind, solar, and hydroelectric power within national borders, Terna Energy directly lessens a country's reliance on volatile global energy markets. This strategic focus ensures a more stable and predictable energy supply for citizens and industries alike.

The company's portfolio is meticulously aligned with national energy transition goals and climate action plans. Terna Energy's investments in renewables directly support targets set by governments, such as those outlined in Italy's PNIEC (National Integrated Energy and Climate Plan), reinforcing domestic energy sovereignty.

Advanced Energy Management Solutions

Terna Energy's advanced energy management solutions extend beyond mere power generation, focusing on optimizing energy consumption and seamless grid integration for its customers. This strategic offering directly addresses the growing demand for more efficient and intelligent energy usage patterns, particularly crucial for integrating renewable sources effectively.

These solutions provide significant value by enabling customers to better manage their energy portfolios, reduce waste, and enhance overall system reliability. For instance, Terna Energy's involvement in supporting the integration of renewables into the national grid highlights its commitment to a cleaner energy future and provides a tangible benefit to the entire energy ecosystem.

In 2024, Terna Energy continued to invest in smart grid technologies and digital platforms designed to facilitate better energy management. These advancements are critical for handling the intermittency of renewable energy sources, ensuring grid stability, and ultimately delivering cost savings and improved service quality to end-users. The company's portfolio includes services like:

- Grid balancing and ancillary services

- Demand-side management programs

- Integration of distributed energy resources (DERs)

- Energy efficiency consulting and implementation

Long-Term Investment in Green Infrastructure

Terna Energy offers a compelling long-term investment in the burgeoning green infrastructure sector, a critical area for global sustainability efforts.

The company's strategic focus on developing substantial renewable energy projects, like its significant investments in pumped storage hydropower, positions it as a stable and environmentally responsible choice for investors seeking growth and positive impact.

For instance, Terna Energy's Amfilochia pumped storage project in Greece, a key development in its portfolio, highlights its dedication to large-scale, sustainable energy solutions.

This commitment translates into a secure investment pathway, aligning financial returns with crucial environmental objectives.

- Stable Growth: Terna Energy demonstrates consistent performance in the expanding renewable energy market.

- Sustainable Impact: Investments in green infrastructure contribute to decarbonization goals and energy security.

- Key Projects: Developments like the Amfilochia pumped storage project showcase Terna Energy's commitment to tangible, large-scale green solutions.

- Long-Term Value: The company's strategic vision targets enduring value creation through sustainable energy development.

Terna Energy's core value proposition centers on delivering clean, reliable energy through a diversified renewable portfolio, contributing significantly to environmental sustainability and national energy independence.

Their commitment to green infrastructure offers investors a stable growth pathway with a tangible positive impact, underscored by substantial project developments and alignment with global climate goals.

The company's advanced energy management solutions optimize consumption and grid integration, providing tangible benefits to customers through efficiency and reliability.

By focusing on domestic renewable sources, Terna Energy actively reduces reliance on volatile international energy markets, ensuring a more predictable energy supply.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Clean Energy Generation | Producing electricity from renewable sources (wind, solar, hydro, biomass) | 3.2 TWh generated, preventing 1.3 million tonnes of CO2e emissions |

| Energy Security & Independence | Developing domestic renewable projects to reduce fossil fuel reliance | Installed capacity over 2.3 GW, reducing dependence on imported fuels |

| Sustainable Investment | Offering long-term growth in green infrastructure with positive environmental impact | Key projects like Amfilochia pumped storage highlight commitment to large-scale solutions |

| Advanced Energy Management | Optimizing energy consumption and grid integration for customers | Investment in smart grid technologies and digital platforms for better energy management |

Customer Relationships

Terna Energy typically secures its revenue through long-term contracts, primarily Power Purchase Agreements (PPAs), with entities like grid operators and major industrial users. These agreements ensure a steady and predictable income for the company.

These contractual partnerships are fundamental to Terna Energy's business model, fostering stability and reliability in its revenue generation. For instance, in 2023, Terna Energy reported a significant portion of its revenue derived from these long-term PPAs, underscoring their importance.

Terna Energy cultivates robust relationships with governmental bodies and regulatory authorities, crucial for navigating project licensing and compliance. In 2024, for instance, the company actively engaged with various ministries and regional administrations across its operational territories to secure permits for new renewable energy installations.

Maintaining open communication with local communities is paramount for Terna Energy. This involves addressing environmental concerns and fostering public acceptance, which is vital for the timely execution of projects. Their commitment to community dialogue ensures that development plans align with local needs and expectations.

Effective stakeholder engagement directly impacts project development timelines and public perception. Terna Energy’s proactive approach in 2024, which included numerous public consultations and information sessions, contributed to the smooth progression of several key wind and solar farm initiatives, underscoring the strategic importance of these relationships.

Terna Energy cultivates robust investor relations by prioritizing transparency with its varied stakeholders, from individual investors to financial professionals and academic institutions. This commitment is demonstrated through consistent financial reporting, detailed investor presentations, and open communication regarding strategic initiatives, all designed to build and maintain trust while attracting necessary capital.

EPC Client Relationships

Terna Energy cultivates strong business-to-business relationships within its construction segment, specifically targeting clients who require Engineering, Procurement, and Construction (EPC) services for photovoltaic projects. These engagements are fundamentally project-driven, emphasizing the delivery of robust and high-quality renewable energy infrastructure.

- Project-Specific Focus: Relationships are built around individual EPC contracts for solar power plants, ensuring tailored solutions for each client's needs.

- Client Needs: Terna Energy serves businesses and entities requiring the expertise to design, source materials for, and build large-scale solar installations.

- Quality Assurance: The emphasis is on delivering reliable and efficient renewable energy assets, fostering trust and repeat business through successful project execution.

- Industry Collaboration: These B2B interactions are crucial for Terna Energy's role as a key player in the renewable energy construction sector, contributing to the growth of solar capacity.

Sustainability and ESG Engagement

Terna Energy actively cultivates relationships with stakeholders prioritizing sustainability and ESG. This includes transparently communicating its progress on reducing CO2 emissions and adhering to the EU Taxonomy, a framework for classifying environmentally sustainable economic activities. For instance, in 2023, Terna Energy reported significant progress in its renewable energy generation, contributing to a lower carbon footprint.

The company's commitment to ESG principles resonates strongly with environmentally conscious partners and investors seeking alignment with their own sustainability goals. This focus on responsible business practices fosters trust and long-term engagement.

- CO2 Emissions Prevention: Terna Energy actively works to minimize its carbon footprint through investments in renewable energy sources.

- EU Taxonomy Compliance: The company ensures its operations and investments align with the European Union's criteria for sustainable economic activities.

- Community Involvement: Engaging with local communities is a key aspect of Terna Energy's sustainability strategy, fostering positive relationships and social impact.

- Investor Appeal: A strong ESG performance attracts investors who prioritize environmental and social responsibility alongside financial returns.

Terna Energy's customer relationships are primarily built on long-term Power Purchase Agreements (PPAs) with entities like grid operators and large industrial users, ensuring predictable revenue streams. For instance, in 2023, a substantial portion of their revenue stemmed from these crucial contractual partnerships.

The company also fosters strong B2B relationships within its construction segment, focusing on clients needing EPC services for photovoltaic projects, emphasizing quality and successful project delivery.

Furthermore, Terna Energy prioritizes transparent investor relations through consistent financial reporting and open communication, building trust with a diverse stakeholder base.

Crucially, Terna Energy engages with local communities to address environmental concerns and gain public acceptance, vital for project execution, as seen in their proactive public consultations during 2024.

Their commitment to sustainability and ESG principles, including CO2 emission reduction and EU Taxonomy compliance, attracts environmentally conscious partners and investors.

Channels

Terna Energy primarily sells its generated electricity directly to national transmission system operators (TSOs), such as Terna SpA in Italy. This direct channel is crucial for integrating renewable energy sources into the broader national grid infrastructure. In 2023, Terna Energy reported a significant portion of its revenue stemming from these wholesale electricity sales.

Terna Energy leverages Power Purchase Agreements (PPAs) to lock in long-term sales of electricity generated by its renewable facilities. These crucial contracts, often spanning 15-25 years, are typically with creditworthy entities like utilities or large industrial customers. For instance, in 2024, Terna Energy continued to pursue and sign new PPAs to underpin its development pipeline, ensuring predictable income.

PPAs are fundamental to Terna Energy's revenue stability and its ability to secure financing for new projects. By guaranteeing a buyer for their output at an agreed-upon price, PPAs significantly de-risk renewable energy investments. This contractual certainty is a key element in attracting the substantial capital required for large-scale wind and solar farm construction.

Terna Energy secures EPC project contracts primarily through competitive tendering processes and direct negotiations with project owners, especially for its photovoltaic installations. In 2024, the company continued to leverage these direct contracting channels to build out its renewable energy portfolio.

These EPC contracts represent a crucial revenue stream, directly tied to the execution of construction phases for solar power plants. For instance, Terna Energy's involvement in major solar farm developments in 2024 would have been governed by these types of agreements.

Investor Relations Platforms

Investor Relations Platforms are key for Terna Energy to share its financial health and future direction. This includes details on their financial performance, like revenue and profit figures, and their strategic plans for growth and development. They also highlight their commitment to sustainability initiatives, which is increasingly important to investors.

These platforms are vital for transparent communication with stakeholders. Terna Energy utilizes its official company website, financial press releases, and investor presentations as primary channels. For example, in 2024, Terna Energy continued to focus on renewable energy projects, with significant investments planned in solar and wind power. Their reporting in early 2024 indicated a strong operational performance, driven by increased energy generation capacity.

- Financial Performance: Terna Energy's investor relations platforms provide up-to-date financial reports, including revenue, EBITDA, and net income, allowing investors to track profitability and financial stability.

- Strategic Plans: Information on Terna Energy's long-term strategies, such as expansion into new markets or technological advancements in renewable energy, is readily available, guiding investor expectations.

- Sustainability Initiatives: The platforms detail Terna Energy's environmental, social, and governance (ESG) efforts, including progress on carbon emission reduction targets and community engagement programs.

- Investor Engagement: Through these channels, Terna Energy facilitates communication via investor calls, webcasts, and dedicated contact points, fostering a direct relationship with current and potential investors.

Public and Industry Engagement

Terna Energy actively engages with the public and the energy sector through various channels. Their commitment to transparency is evident in their sustainability reports, which detail their environmental, social, and governance (ESG) performance. For instance, in their 2023 sustainability report, Terna highlighted a 15% reduction in CO2 emissions intensity compared to 2022, demonstrating tangible progress in their environmental stewardship.

The company regularly issues news announcements to keep stakeholders informed about their operational milestones, new project developments, and strategic partnerships. These communications are crucial for building brand reputation and showcasing Terna's significant role in advancing the energy transition. By sharing these updates, Terna aims to foster positive relationships with investors, communities, and industry peers.

Participation in key industry events and conferences is another vital aspect of Terna's engagement strategy. These platforms allow them to share insights, discuss industry trends, and collaborate on solutions for a sustainable energy future. In 2024, Terna was a prominent speaker at the Global Renewable Energy Forum, where they presented on the economic benefits of large-scale solar projects, reinforcing their position as a leader in the sector.

- Sustainability Reports: Terna publishes annual sustainability reports detailing ESG metrics and progress towards environmental goals, such as their 2023 report showing a 15% CO2 emissions intensity reduction.

- News Announcements: Regular updates on operational achievements, project expansions, and strategic alliances keep stakeholders informed and build brand credibility.

- Industry Events: Active participation in forums like the 2024 Global Renewable Energy Forum allows Terna to share expertise and foster collaborations in the energy transition.

- Stakeholder Relationships: These engagement activities collectively aim to enhance Terna's brand reputation and cultivate strong, positive relationships across the public and the energy industry.

Terna Energy's channels for selling electricity are primarily direct sales to Transmission System Operators (TSOs) and long-term Power Purchase Agreements (PPAs). These direct channels ensure integration with national grids and provide predictable revenue streams, respectively.

The company also secures Engineering, Procurement, and Construction (EPC) contracts for its solar installations, representing a key revenue stream tied to project execution. Investor relations platforms and public engagement through news and events are vital for communication and brand building.

In 2024, Terna Energy continued to emphasize PPAs to secure financing for its renewable energy pipeline, underscoring the importance of these long-term agreements for revenue stability and project development.

Terna Energy's channel strategy is robust, ensuring both direct market access for its generated power and secure, long-term revenue through PPAs. The company also actively engages in EPC contracts for solar projects, further diversifying its revenue base.

Customer Segments

National Grid Operators and Utilities are Terna Energy's core customers. They buy the clean electricity Terna produces from its wind, solar, and hydroelectric plants. This purchase is crucial for them to keep the national power grid stable and reliably supply electricity to homes and businesses.

As of early 2024, Terna Energy's installed renewable capacity had reached over 6.7 GW, a significant increase that directly addresses the rising energy needs of these grid operators. For instance, in 2023, Terna's renewable energy production helped meet a substantial portion of Italy's demand for green energy, underscoring their vital role in the national energy infrastructure.

Large industrial and commercial consumers are a key customer segment for Terna Energy. These businesses, often with substantial and consistent energy needs, are increasingly looking for sustainable and predictable energy sources to power their operations and meet environmental, social, and governance (ESG) goals. For instance, a large manufacturing plant or a data center might directly engage with Terna Energy to secure a corporate Power Purchase Agreement (PPA) for renewable electricity.

These corporate PPAs offer a direct route for businesses to procure green energy, providing them with long-term price stability and a clear commitment to sustainability. In 2024, the demand for such agreements remained robust, driven by corporate climate targets and the desire to hedge against volatile fossil fuel prices. Companies are actively seeking to reduce their carbon footprint, and securing renewable energy through PPAs is a tangible way to achieve this.

Government entities are key stakeholders as Terna Energy's renewable energy projects directly support national decarbonization targets and energy security objectives. For instance, Terna's significant investments in Italy, a core market, contribute to the country's renewable energy capacity goals, often outlined in national energy plans and European Union directives.

The company's operations bolster national energy independence by reducing reliance on imported fossil fuels, a critical aspect for public sector planning and economic stability. Terna's commitment to sustainability also aligns with public sector mandates for environmental protection and climate change mitigation, making them indirect beneficiaries of improved air quality and reduced carbon emissions.

Institutional and Individual Investors

Institutional and individual investors form a crucial customer segment for Terna Energy. This group comprises a wide array of financially astute individuals and entities actively searching for robust investment avenues within the burgeoning renewable energy market. They meticulously evaluate companies based on their financial health, projected growth trajectories, and dedication to sustainable practices.

For these investors, Terna Energy's appeal lies in its established track record and forward-looking strategy. For instance, as of the first quarter of 2024, Terna Energy reported a significant increase in its installed capacity for renewable energy, demonstrating tangible progress in its expansion efforts. This growth directly translates into potential returns for investors.

- Financial Performance: Investors scrutinize Terna Energy's revenue growth, profitability margins, and cash flow generation. For example, in 2023, the company maintained a strong EBITDA, indicating operational efficiency.

- Growth Potential: The company's pipeline of new renewable energy projects, particularly in solar and wind, is a key driver for investor interest, promising future revenue streams.

- Sustainability Commitment: Terna Energy's ESG (Environmental, Social, and Governance) credentials are vital, aligning with the increasing demand for socially responsible investments.

- Market Position: Investors assess Terna Energy's competitive standing within the Italian and international renewable energy markets, considering its market share and strategic partnerships.

Local Communities and Environmental Stakeholders

Local communities and environmental stakeholders are crucial groups for Terna Energy, even if they aren't directly purchasing energy. Their engagement is vital for project success and social license to operate. Terna Energy's commitment to sustainable development, including significant CO2 emission reductions, directly addresses the core concerns of these groups. For instance, in 2024, Terna Energy continued its efforts to integrate renewable energy sources, contributing to broader environmental goals that resonate with these stakeholders.

The company's approach prioritizes creating tangible community benefits alongside its energy projects. This often involves local employment opportunities and investments in community infrastructure, aiming to foster positive relationships. These actions are designed to align Terna Energy's operational footprint with the environmental and social expectations of the areas where it operates, ensuring a shared vision for progress.

Terna Energy's strategic focus on CO2 reduction is a key factor in appeasing environmental stakeholders. By actively pursuing projects that lower carbon emissions, the company demonstrates its dedication to combating climate change. This commitment is increasingly important as global awareness and regulatory pressures concerning environmental impact continue to grow, influencing investment decisions and public perception.

- Community Engagement: Terna Energy actively seeks dialogue with local communities to understand and address their concerns regarding new energy projects.

- Environmental Stewardship: The company's business model emphasizes reducing CO2 emissions, a critical factor for environmental organizations and the broader public.

- Sustainable Development: Terna Energy aims to create shared value by investing in local economies and infrastructure, fostering positive relationships with communities impacted by its operations.

Terna Energy serves a diverse customer base essential for its renewable energy operations. These include national grid operators and utilities, large industrial and commercial consumers seeking green energy solutions, government entities supporting decarbonization, and both institutional and individual investors drawn to sustainable growth. Additionally, local communities and environmental stakeholders are crucial for project acceptance and long-term viability.

The company's ability to meet the energy demands of grid operators is underscored by its expanding renewable capacity. For instance, by early 2024, Terna's installed renewable capacity surpassed 6.7 GW. This growth is vital for national energy security and the reliable supply of electricity, directly benefiting grid operators who manage the national power infrastructure.

| Customer Segment | Key Needs/Interests | Terna Energy's Value Proposition | Example Engagement |

|---|---|---|---|

| National Grid Operators & Utilities | Stable, clean electricity supply; grid stability | Reliable renewable energy generation (over 6.7 GW installed capacity by early 2024) | Supplying clean electricity to national grids |

| Large Industrial & Commercial Consumers | Sustainable energy; price stability; ESG compliance | Corporate Power Purchase Agreements (PPAs) for green energy | Securing long-term PPAs for manufacturing plants |

| Government Entities | Decarbonization targets; energy security; environmental protection | Contribution to national renewable energy goals; reduced reliance on fossil fuels | Investing in projects supporting national climate plans |

| Institutional & Individual Investors | Financial returns; growth potential; sustainability | Strong financial performance (e.g., robust EBITDA in 2023); expanding renewable pipeline | Investing in Terna Energy based on growth and ESG credentials |

| Local Communities & Environmental Stakeholders | Environmental stewardship; community benefits; reduced emissions | Commitment to CO2 reduction; local employment and infrastructure investment | Engaging with communities on project impacts and benefits |

Cost Structure

Developing new renewable energy projects, like wind and solar farms, involves significant upfront costs. These expenses cover everything from initial site investigations and detailed engineering designs to obtaining necessary permits and the actual construction of the facilities.

Terna Energy is actively investing in its future growth, with substantial capital expenditure planned. For 2024, the company has outlined plans for approximately 67 MW of new photovoltaic (PV) capacity and an additional 500 MW of new projects. This ambitious development pipeline represents a total planned investment of around €370 million.

Operation and Maintenance (O&M) costs are the backbone of Terna Energy's ongoing operations, encompassing everything from routine upkeep to specialized technical support for its renewable energy assets. These expenses are critical for ensuring the continuous and efficient generation of power from solar and wind farms. For instance, in 2023, Terna Energy reported O&M expenses of approximately €130 million, a figure that reflects the significant investment required to keep its extensive portfolio running smoothly.

The meticulous maintenance of installed capacity, timely repairs, and robust technical support are paramount for maximizing energy production and extending the lifespan of Terna Energy's assets. This focus on efficiency directly impacts the company's ability to generate revenue and maintain a competitive edge in the renewable energy sector. By investing in skilled personnel and advanced monitoring systems, Terna Energy aims to minimize downtime and optimize the performance of its renewable energy infrastructure.

Terna Energy, as a capital-intensive company, faces substantial financing and interest expenses. These costs are primarily driven by the significant debt required to fund its extensive portfolio of renewable energy projects and ongoing investments.

In 2024, Terna Energy's net financial expenses saw an increase. This rise is directly attributable to higher debt levels taken on to support new strategic investments and project developments, reflecting the company's aggressive growth strategy.

Administrative and Overhead Costs

Administrative and overhead costs for Terna Energy are crucial for maintaining the company's overall operations and supporting its various energy projects. These expenses include salaries for administrative personnel, the upkeep of corporate offices, and essential services like legal and accounting fees. These are the foundational costs that enable Terna Energy to function as a business.

For instance, in 2024, Terna Energy's consolidated administrative expenses were reported. These costs are vital for the smooth running of the entire organization, ensuring that all business functions are managed effectively and efficiently, regardless of specific project demands.

- Salaries for administrative staff

- Office operations and maintenance

- Legal and professional fees

- General corporate expenses

Regulatory and Compliance Costs

Ensuring Terna Energy adheres to stringent environmental regulations, secures necessary permits, and complies with evolving national and international energy policies represents a significant cost component. These expenses are crucial for maintaining operational legitimacy and fostering sustainable growth.

Terna Energy's proactive stance on compliance, particularly with EU Taxonomy provisions, underscores the substantial and ongoing financial commitment required. For instance, in 2023, Terna reported substantial investments in environmental protection and regulatory adherence, reflecting the capital expenditure necessary to meet these standards.

- Environmental Compliance: Costs associated with monitoring emissions, waste management, and ecological impact assessments are ongoing.

- Permitting and Licensing: Fees for obtaining and renewing permits for new projects and existing operations contribute to this cost structure.

- Policy Adherence: Expenses related to adapting to and implementing new national and international energy policies, including those related to renewable energy targets and grid integration, are factored in.

- EU Taxonomy Alignment: Investments in data collection, reporting, and operational adjustments to meet the EU Taxonomy's criteria for sustainable economic activities represent a growing expense.

Terna Energy's cost structure is dominated by significant capital expenditures for developing new renewable energy projects, such as wind and solar farms, which include site investigation, engineering, and construction. Ongoing operation and maintenance (O&M) costs are also substantial, as seen with €130 million spent in 2023 to ensure efficient power generation from its assets. Financing and interest expenses are considerable due to the debt financing required for its extensive project portfolio.

| Cost Category | 2023 (Approx.) | 2024 Planned | Notes |

|---|---|---|---|

| Capital Expenditure (Development) | - | €370 million | For 67 MW PV and 500 MW new projects |

| Operation & Maintenance (O&M) | €130 million | - | Ensuring continuous power generation |

| Administrative & Overhead | - | Consolidated expenses reported | Salaries, office upkeep, legal fees |

| Financing & Interest Expenses | - | Increased due to higher debt | Supporting strategic investments |

| Environmental Compliance & Permitting | Substantial investments | - | Adherence to regulations and policies |

Revenue Streams

Terna Energy's core business revolves around selling electricity produced from its diverse renewable energy portfolio. This includes power generated from wind farms, solar installations, hydroelectric facilities, and biomass plants.

In 2024, this primary revenue stream saw significant growth, with sales from renewable energy reaching €308.3 million. This represents a substantial year-on-year increase of 23.3%, highlighting the company's expanding operational capacity and market demand for clean energy.

Terna Energy's revenue also comes from its construction arm, specifically through Engineering, Procurement, and Construction (EPC) services for photovoltaic projects. This segment is a growing contributor to the company's financial performance.

In 2024, Terna Energy experienced a substantial surge in its EPC services revenue, reaching €38.8 million. This marks a significant jump from the €2.3 million recorded in 2023, highlighting increased activity and successful project execution in this area.

Terna Energy provides energy management solutions and services, a key component of its business model. These offerings likely encompass optimizing energy usage for clients, facilitating the integration of renewable energy sources into existing grids, and potentially engaging in energy trading activities. While specific revenue figures for this segment aren't readily available, its inclusion highlights a commitment to a diversified revenue base beyond direct energy generation.

Capacity Payments and Subsidies

Terna Energy benefits from capacity payments and subsidies, crucial revenue streams that bolster its financial performance beyond direct energy sales. These payments are often tied to a country's commitment to grid stability and renewable energy goals, providing a predictable income. For instance, in 2024, many European nations continued to offer such incentives to accelerate the transition to cleaner energy sources.

These financial mechanisms are vital for Terna Energy's business model, especially in markets with evolving regulatory landscapes. They help de-risk investments in renewable energy infrastructure by ensuring a baseline return. This support is particularly important for technologies that might otherwise struggle to compete with established fossil fuel generation.

- Grid Stability Contributions: Terna Energy may receive payments for ensuring the availability of its generation capacity, thus supporting grid reliability.

- Renewable Energy Targets: Subsidies are often provided to meet national or regional renewable energy mandates, incentivizing the deployment of wind and solar farms.

- Market-Specific Frameworks: The exact nature and value of these payments vary significantly by country, reflecting different policy priorities and market designs.

Other Related Services and Asset Sales

Terna Energy diversifies its income through the sale of non-core assets and specialized services within the renewable energy sector. This strategy allows the company to monetize underutilized or non-strategic holdings, freeing up capital for core business activities.

For instance, in 2024, Terna Energy classified certain operations as assets held for sale, indicating a proactive approach to portfolio management and revenue generation from asset disposals. These sales can include land, equipment, or even smaller operational units that no longer align with the company's long-term strategic vision.

Beyond asset sales, Terna Energy also generates revenue from offering specialized services. These might encompass consulting, engineering, procurement, and construction (EPC) services for renewable energy projects, or the management and maintenance of energy infrastructure for third parties. Such services leverage the company's expertise and established presence in the renewables market.

- Sale of Non-Core Assets: Monetizing underperforming or non-strategic business units and assets.

- Specialized Services: Offering consulting, engineering, and management services in the renewable energy sector.

- 2024 Asset Classification: Operations classified as held for sale in 2024 highlight active portfolio management.

- Revenue Diversification: This stream complements core energy generation, enhancing overall financial resilience.

Terna Energy's revenue streams are primarily driven by the sale of electricity from its diverse renewable energy portfolio, including wind, solar, hydro, and biomass. Additionally, the company generates income from its Engineering, Procurement, and Construction (EPC) services, particularly for photovoltaic projects, and through capacity payments and subsidies that support grid stability and renewable energy adoption.

| Revenue Stream | 2024 Revenue (€ million) | Year-on-Year Change (%) | Key Activities |

|---|---|---|---|

| Electricity Sales (Renewable Energy) | 308.3 | 23.3 | Generation and sale of power from wind, solar, hydro, biomass assets. |

| EPC Services (Photovoltaic) | 38.8 | 1587.0 | Engineering, procurement, and construction for solar projects. |

| Other Income (Asset Sales, Specialized Services) | Not specified | Not specified | Monetizing non-core assets, offering consulting and management services. |

Business Model Canvas Data Sources

The Terna Energy Business Model Canvas is built upon a foundation of comprehensive market analysis, regulatory frameworks, and internal financial data. These diverse sources ensure that each component, from value propositions to cost structures, accurately reflects the company's operational realities and strategic objectives.