Terna Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Terna Energy Bundle

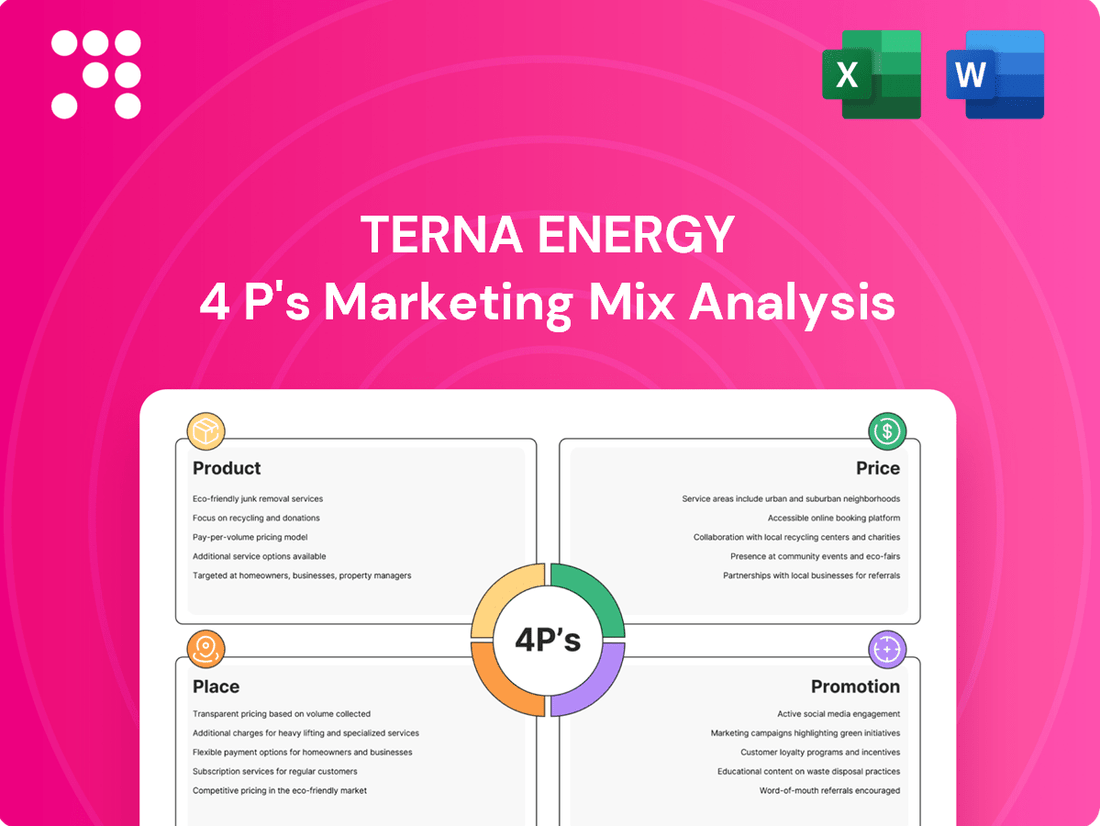

Uncover the strategic brilliance behind Terna Energy's market success with our comprehensive 4Ps Marketing Mix Analysis. Dive deep into their innovative product offerings, competitive pricing strategies, expansive distribution channels, and impactful promotional campaigns.

Gain an edge by understanding how Terna Energy effectively leverages each element of the marketing mix to connect with its audience and drive growth. This analysis provides actionable insights for anyone looking to master marketing strategy.

Ready to elevate your own marketing efforts? Access the full, detailed 4Ps Marketing Mix Analysis of Terna Energy, complete with expert commentary and ready-to-use frameworks. Save time and gain a competitive advantage today.

Product

Terna Energy's product, renewable energy project development, covers the entire journey from initial concept to operational asset. This involves meticulous site selection, comprehensive feasibility studies, and navigating the complex landscape of permits and licenses for wind, solar, hydro, and biomass projects. The company aims to bring sustainable energy generation assets to life, contributing significantly to the green energy transition.

Terna Energy's construction arm directly builds its green energy infrastructure, managing everything from engineering and procurement to the actual building of wind farms, solar parks, and other renewable facilities. This hands-on approach ensures control over project execution and quality.

The company's active development efforts are reflected in its financial performance. In 2024, the Construction segment saw a substantial revenue increase, indicating robust activity in developing new renewable energy capacity and a strong commitment to expanding its green energy portfolio.

Terna Energy is actively involved in financing its sustainable energy projects, securing capital through diverse financial instruments and managing its investment portfolios. This hands-on approach ensures a steady flow of funds for their green energy initiatives.

The company is currently progressing with new projects that represent approximately €370 million in total investment, with construction gradually commencing. This significant capital deployment underscores their commitment to expanding renewable energy capacity.

Strategic financial planning is a cornerstone of Terna Energy's operations, enabling the continuous growth and expansion of their green energy portfolio. This forward-thinking financial strategy is crucial for achieving their long-term sustainability goals.

Operation and Maintenance of Energy Facilities

Post-construction, Terna Energy actively manages the operation and maintenance of its renewable energy facilities. This commitment is crucial for ensuring these assets perform at their best, remain reliable, and have a long operational life, ultimately boosting energy production and reducing interruptions.

The company's focus on robust O&M directly contributes to maximizing the return on investment for its renewable energy portfolio. In 2024, Terna Energy saw a significant jump in renewable energy generation, with output rising by 24.7% year-on-year to 3.2 TWh, underscoring the effectiveness of their operational strategies.

- Optimized Performance: Continuous monitoring and proactive maintenance ensure peak energy output from all facilities.

- Asset Longevity: Regular upkeep extends the lifespan of renewable energy assets, safeguarding long-term value.

- Reliability Enhancement: Minimizing downtime through efficient maintenance practices guarantees consistent energy supply.

- Increased Generation: Terna Energy's O&M efforts supported a 24.7% year-on-year increase in renewable generation to 3.2 TWh in 2024.

Energy Management Solutions and Services

Terna Energy extends its offerings beyond mere energy generation, providing specialized energy management solutions and services. These are designed for clients focused on improving energy efficiency, seamlessly integrating with the grid, and optimizing their overall energy consumption. This commitment to comprehensive support for sustainable energy practices actively enhances the performance of energy systems.

In 2024, Terna Energy's focus on energy management is particularly relevant as global energy efficiency targets intensify. For instance, the International Energy Agency (IEA) reported in early 2025 that energy efficiency improvements are crucial for meeting climate goals, with a projected 3% annual improvement needed globally. Terna's services directly address this by offering:

- Energy Audits and Assessments: Identifying areas for improvement in consumption patterns.

- Smart Grid Solutions: Facilitating better integration and management of renewable energy sources.

- Demand-Side Management Programs: Helping clients reduce peak load and manage costs effectively.

- Energy Performance Contracting: Guaranteeing savings through implemented efficiency measures.

Terna Energy's product encompasses the full lifecycle of renewable energy projects, from initial development and construction to ongoing operation and maintenance, as well as specialized energy management services. This integrated approach ensures quality control and maximizes asset performance, contributing to a substantial 24.7% year-on-year increase in renewable energy generation to 3.2 TWh in 2024. The company is also actively progressing on new projects representing approximately €370 million in total investment, demonstrating a strong commitment to expanding its green energy portfolio.

| Product Segment | Key Activities | 2024 Impact/Data |

|---|---|---|

| Project Development | Site selection, feasibility studies, permitting | Progressing €370 million in new projects |

| Construction | Engineering, procurement, building facilities | Substantial revenue increase in Construction segment |

| Operation & Maintenance (O&M) | Monitoring, proactive maintenance, asset longevity | 24.7% YoY increase in renewable generation to 3.2 TWh |

| Energy Management Services | Energy efficiency, smart grid solutions, demand-side management | Addresses global energy efficiency targets |

What is included in the product

This analysis offers a comprehensive breakdown of Terna Energy's marketing mix, examining their product offerings, pricing strategies, distribution channels, and promotional activities.

It provides a strategic overview of Terna Energy's marketing positioning, ideal for professionals seeking to understand their approach to the market.

Simplifies complex marketing strategies by clearly defining Terna Energy's Product, Price, Place, and Promotion, alleviating the pain of understanding their market approach.

Provides a clear, actionable framework for Terna Energy's marketing efforts, resolving the pain of uncertainty in strategy execution and communication.

Place

For Terna Energy, 'Place' signifies the strategic geographical selection of renewable energy assets. This involves meticulous evaluation of wind speeds, solar irradiation, hydrological potential, and proximity to robust grid infrastructure. The company prioritizes locations with favorable regulatory environments and minimal environmental impact, ensuring long-term operational viability and efficient energy transmission.

In 2024, Terna Energy continued its focus on high-yield locations. For instance, their wind farm development in the Aegean Sea, leveraging consistent offshore winds, demonstrates a commitment to resource-rich areas. The company’s portfolio expansion in 2024, with a significant portion of new capacity coming online in Italy and Greece, reflects a strategic placement in regions with established renewable energy targets and supportive market conditions.

Terna Energy's power generation infrastructure is directly linked to national and regional electricity grids. This integration is crucial for efficiently delivering its renewable energy to consumers and businesses, enhancing convenience and logistical efficiency.

By year-end 2024, Terna Energy's total installed capacity reached 1,224 MW. This significant capacity allows for substantial green energy generation and reliable supply through the established grid networks.

Terna Energy's primary sales channel involves direct transactions of its electricity output to national utilities and substantial industrial clients. These arrangements are typically formalized through long-term Power Purchase Agreements (PPAs), which define the core 'place' where Terna Energy's energy is commercialized.

A notable instance of this strategy is the PPA Terna Energy secured in March 2024 with EYATH, a significant utility. This agreement underscores the company's focus on establishing stable, direct relationships for its energy sales, ensuring consistent revenue streams.

Presence in Key European and International Markets

Terna Energy’s operational footprint extends significantly beyond Greece, showcasing a strategic push into key European and international markets. This global presence is crucial for diversifying revenue streams and mitigating country-specific risks. For instance, a recent significant investment includes a 130 MW photovoltaic plant in Bulgaria, highlighting their commitment to expanding in Eastern Europe.

The company's expansion strategy is characterized by the development and operation of renewable energy projects across various geographies. This approach not only broadens their market exposure but also leverages different regulatory environments and energy demands. Terna Energy actively seeks opportunities to establish a robust international presence, aiming to become a leading player in the global renewable energy sector.

- Bulgaria: Operationalizing a 130 MW photovoltaic plant, demonstrating a tangible commitment to the Eastern European market.

- Geographic Diversification: Actively developing and operating projects in multiple countries to spread market risk and capture diverse growth opportunities.

- Market Exposure: Expanding into new territories to tap into varied energy demands and regulatory frameworks, enhancing overall business resilience.

- International Growth: A clear strategy to build a significant presence in European and other international markets, positioning Terna Energy as a global renewable energy developer.

Digital Platforms for Energy Management

While Terna Energy's core business is rooted in physical infrastructure, the 'place' in its marketing mix extends significantly to digital platforms for energy management. These online environments are crucial for delivering sophisticated energy optimization services to clients, enabling seamless data exchange and remote monitoring capabilities.

These digital platforms are the backbone for Terna Energy's value-added services, allowing for efficient and remote control of energy usage. For instance, in 2024, Terna Energy reported a significant increase in the adoption of its smart grid solutions, which rely heavily on such digital interfaces for real-time data analytics and client interaction. This digital presence ensures that clients can actively manage and improve their energy efficiency from anywhere.

- Data Exchange: Facilitates the secure and efficient transfer of energy consumption and production data.

- Monitoring: Provides clients with real-time visibility into their energy usage patterns and system performance.

- Control: Empowers clients to remotely adjust settings and optimize energy consumption based on live data and pre-set parameters.

- Remote Service Delivery: Enables Terna Energy to offer support, diagnostics, and updates without physical site visits, enhancing efficiency and client satisfaction.

Terna Energy strategically places its renewable energy assets in resource-rich locations with favorable regulatory frameworks, ensuring efficient transmission to national grids. By year-end 2024, their installed capacity reached 1,224 MW, with significant expansion in Italy and Greece. Their primary sales channel involves direct Power Purchase Agreements (PPAs) with utilities and industrial clients, exemplified by a March 2024 PPA with EYATH. Furthermore, Terna Energy is expanding its international footprint, with a 130 MW photovoltaic plant in Bulgaria as a key example of their global diversification strategy.

| Location | Capacity (MW) | Project Type | Status/Year | Key Metric |

|---|---|---|---|---|

| Aegean Sea | Undisclosed | Wind Farm | Ongoing Development | High Offshore Winds |

| Italy | Significant Portion of 2024 Additions | Various Renewables | Operational | Established Renewable Targets |

| Greece | Significant Portion of 2024 Additions | Various Renewables | Operational | Supportive Market Conditions |

| Bulgaria | 130 MW | Photovoltaic Plant | Operational | Eastern European Expansion |

| Total Installed Capacity | 1,224 MW | Various Renewables | End of 2024 | Reliable Green Energy Supply |

Same Document Delivered

Terna Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Terna Energy 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies in detail. You'll gain immediate access to actionable insights for Terna Energy's market positioning.

Promotion

Terna Energy prioritizes transparent investor relations and thorough financial reporting to showcase its value. This involves regularly releasing annual and semi-annual financial statements and press releases, like the FY 2024 results shared in March 2025.

This clear communication of financial performance and future growth opportunities is vital for building and maintaining market confidence. For instance, Terna Energy reported a significant increase in EBITDA for the first nine months of 2024, reaching €783.8 million, demonstrating strong operational performance.

Terna Energy actively showcases its expertise and ongoing projects by participating in key renewable energy industry conferences and forums. These gatherings are crucial for networking, highlighting their technological innovations, and fostering connections with potential partners, policymakers, and other industry leaders. In 2024, Terna Energy's presence at events like the European Utility Week and the Global Wind Summit reinforced its commitment to industry dialogue and advancement.

Terna Energy's commitment to Corporate Social Responsibility (CSR) and sustainability is a key component of their marketing strategy, particularly within the 'Promotion' aspect of the 4Ps. This involves actively communicating their dedication to environmental stewardship and social well-being.

The company's publication of detailed sustainability reports, such as their Sustainable Development Report 2023, serves as a crucial promotional tool. These reports provide transparent data on their Environmental, Social, and Governance (ESG) performance, showcasing tangible progress and commitment.

By highlighting their ESG achievements, Terna Energy reinforces its brand image as a forward-thinking leader in the green energy sector. This transparency builds trust and attracts environmentally conscious investors and consumers, directly impacting their market position and brand perception.

Targeted Business-to-Business (B2B) Communications

Terna Energy focuses its communication efforts on specific business clients, potential partners, and government bodies, reflecting its B2B model. This targeted approach involves direct engagement and customized proposals for energy solutions. For instance, Terna Energy's collaboration with EYATH on a green Public Private Agreement highlights this strategy. Building and maintaining robust professional relationships is crucial for securing new projects and contracts, as demonstrated by their ongoing efforts in the renewable energy sector.

Key aspects of Terna Energy's B2B communication strategy include:

- Direct Outreach: Proactive engagement with potential clients and stakeholders to present tailored energy solutions.

- Tailored Proposals: Development of customized project proposals that address the specific needs and objectives of each B2B client.

- Relationship Building: Emphasis on fostering strong, long-term professional relationships to facilitate business development and project acquisition.

- Strategic Partnerships: Collaboration with entities like EYATH underscores the importance of strategic alliances in securing significant projects, such as the green Public Private Agreement.

Digital Presence and Corporate Website

Terna Energy leverages its corporate website as a cornerstone of its digital presence, offering a comprehensive portal for stakeholders. This platform details the company's extensive renewable energy projects, innovative technologies, and crucial financial performance data, including its reported revenue of €2.5 billion for the fiscal year 2023.

The website serves as a vital channel for transparency and engagement, providing in-depth information on Terna Energy's sustainability commitments and its strategic vision. This digital hub ensures accessibility to key corporate information, reinforcing its mission and operational focus for investors, partners, and the public.

Furthermore, Terna Energy's active online visibility through its website significantly amplifies its overall communication strategy. It acts as a central repository for news, reports, and investor relations materials, facilitating informed decision-making and fostering trust.

Key aspects of Terna Energy's digital presence include:

- Comprehensive Project Portfolio: Detailed information on solar, wind, and other renewable energy developments.

- Financial Transparency: Access to annual reports, financial statements, and investor presentations.

- Sustainability Initiatives: Updates on environmental, social, and governance (ESG) performance and goals.

- Technological Innovation: Insights into the company's R&D and deployment of advanced energy solutions.

Terna Energy's promotion strategy centers on clear financial communication and active industry engagement. By releasing detailed financial reports, such as the FY 2024 results in March 2025, and participating in key conferences like the European Utility Week in 2024, the company builds market confidence and showcases its expertise.

Their commitment to sustainability is a core promotional element, highlighted through detailed reports like the Sustainable Development Report 2023, which emphasizes ESG performance. This transparency positions Terna Energy as a leader in the green energy sector, attracting environmentally conscious stakeholders.

The company also employs targeted B2B communication, focusing on direct outreach and tailored proposals for clients and partners, exemplified by their green Public Private Agreement with EYATH. Their corporate website serves as a central hub for information on projects, financials, and sustainability, reinforcing their brand and fostering trust.

Price

Terna Energy secures stable revenue through long-term Power Purchase Agreements (PPAs), which set electricity prices for extended periods. These agreements are crucial for managing price volatility in the renewable energy sector.

For instance, Terna Energy's PPA with EYATH established an average supply price under €80 per megawatt-hour. This strategy ensures predictable income and consistent pricing for Terna Energy's generated power.

Terna Energy actively engages in competitive bidding for new energy capacity, a crucial element in securing contracts and expanding its market presence. For instance, in the Italian electricity market, participation in capacity market auctions, like those held in 2024, is vital. These auctions determine remuneration for capacity providers, with Terna's success hinging on strategic pricing that balances market demand and competitor bids to ensure profitability and growth.

Terna Energy likely employs a cost-plus pricing strategy for external project development, ensuring profitability by covering all development, construction, and operational expenses. A typical profit margin added could range from 10% to 20% on top of these costs, reflecting the substantial capital investment and risk associated with renewable energy infrastructure.

Government Subsidies and Support Mechanisms

Government subsidies and support mechanisms are critical factors influencing the pricing and financial viability of Terna Energy's renewable energy projects. These incentives, such as feed-in tariffs or tax credits, directly impact project returns, making renewable energy sources more competitive. For instance, in Italy, Terna Energy has benefited from various support schemes designed to accelerate renewable energy deployment.

Terna Energy actively evaluates these governmental frameworks when developing its pricing strategies and assessing the economic feasibility of new ventures. The availability and structure of these support mechanisms can significantly alter the attractiveness of investments in wind, solar, and other renewable technologies.

- Feed-in Tariffs (FiTs): These guarantee a set price for renewable electricity fed into the grid, providing revenue certainty.

- Tax Credits and Incentives: Reductions in corporate taxes or investment tax credits lower the overall cost of capital for projects.

- Renewable Energy Certificates (RECs): Market-based incentives that reward the generation of renewable energy, adding another revenue stream.

- EU Green Deal Funding: Access to significant European Union funding programs can further bolster project economics and support Terna's expansion plans.

Value-Based Pricing for Energy Management Solutions

Terna Energy's approach to pricing its energy management solutions is rooted in value-based strategies. This means the price isn't just about covering costs; it's about reflecting the tangible benefits clients receive. Think of it as sharing the savings. For instance, if Terna's solutions help a business cut its energy bills by 15% in the first year, the pricing model would aim to capture a percentage of that saving, ensuring both parties benefit.

This strategy directly links the cost of Terna's services to the economic advantages clients gain. By focusing on cost savings and efficiency improvements, Terna positions its offerings as investments rather than mere expenses. This is particularly relevant in 2024 and 2025, as energy costs remain a significant concern for businesses aiming to improve their bottom line and sustainability metrics. For example, the International Energy Agency reported in early 2024 that industrial energy efficiency measures can deliver up to 30% cost reductions.

- Capturing Economic Benefits: Pricing reflects a share of the client's reduced energy expenditure.

- Client-Centric Approach: Focuses on the perceived value and ROI for the customer.

- Sustainability Alignment: Pricing encourages adoption of energy-saving technologies, aligning with environmental goals.

- Market Competitiveness: Offers a compelling value proposition in a market increasingly focused on energy efficiency.

Terna Energy's pricing strategy is multifaceted, balancing long-term contracts with market dynamics and client value. Their reliance on Power Purchase Agreements (PPAs) provides a stable revenue base, exemplified by a PPA with EYATH setting prices under €80 per megawatt-hour. This ensures predictable income streams amidst the renewable energy sector's inherent price volatility.

Furthermore, Terna Energy engages in competitive bidding for new energy capacity, crucial for market expansion. Success in these auctions, such as those in Italy during 2024, depends on strategic pricing that aligns with market demand and competitor bids. This approach aims to secure profitable contracts and ensure sustained growth.

For energy management solutions, Terna employs value-based pricing, directly linking service costs to client benefits. This means pricing reflects a share of the savings clients achieve, making Terna's offerings attractive investments. In 2024-2025, with energy costs a major concern, this strategy is particularly relevant, as demonstrated by the International Energy Agency's report that efficiency measures can yield up to 30% cost reductions.

| Pricing Strategy Element | Description | Example/Impact |

| Long-Term PPAs | Guaranteed prices for electricity over extended periods. | PPA with EYATH: Price under €80/MWh, ensuring revenue stability. |

| Competitive Bidding | Strategic pricing to win capacity market auctions. | Success in 2024 Italian auctions depends on balancing demand and competitor bids. |

| Value-Based Pricing (Energy Management) | Pricing reflects client's cost savings and economic benefits. | Capturing a percentage of client's reduced energy expenditure, encouraging adoption. |

| Cost-Plus (Project Development) | Adding a profit margin to development, construction, and operational costs. | Typical 10-20% margin on capital-intensive renewable projects. |

4P's Marketing Mix Analysis Data Sources

Our Terna Energy 4P analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market research. We meticulously examine their product portfolio, pricing strategies, distribution networks, and promotional activities to provide an accurate representation of their market approach.