Terna Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Terna Energy Bundle

Terna Energy operates within a dynamic energy sector, where the bargaining power of buyers and the intensity of rivalry significantly shape its strategic landscape. Understanding these forces is crucial for navigating the competitive environment effectively.

The complete report reveals the real forces shaping Terna Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Terna Energy is significantly shaped by the concentration of key equipment manufacturers. For specialized components like wind turbines, solar panels, and large-scale energy storage, a limited number of dominant suppliers can wield considerable pricing power. This concentration means Terna Energy may face higher project costs and potential delays if these suppliers dictate terms.

Switching costs for Terna Energy can be substantial, particularly for critical components in renewable energy infrastructure like specialized turbines or advanced grid management systems. If a supplier provides highly customized or proprietary technology, the expense and time required for Terna to integrate a new supplier's offering, including potential redesign and re-certification processes, can be significant. This technical lock-in can grant existing suppliers considerable leverage in negotiating pricing and contract terms.

Suppliers offering unique or highly differentiated technologies, intellectual property, or specialized construction services wield significant bargaining power. For Terna Energy, this is evident in their reliance on advanced renewable energy technologies and complex engineering solutions crucial for major undertakings like the Amfilochia pumped-storage hydroelectric plant, a project requiring specialized expertise and proprietary systems.

Threat of Forward Integration by Suppliers

Suppliers in the renewable energy sector, particularly those providing key components like solar panels or wind turbines, could potentially integrate forward into project development and operation. This would transform them from input providers into direct competitors for Terna Energy. Such a move could significantly disrupt Terna Energy's business model by limiting their access to critical technologies or by intensifying competition in the very markets Terna Energy serves.

For instance, a major wind turbine manufacturer might decide to develop and operate wind farms, leveraging their existing expertise and supply chain. This forward integration by suppliers directly impacts Terna Energy by potentially increasing the cost of obtaining essential equipment or by creating new, powerful rivals in the energy generation space. This dynamic underscores the importance of maintaining strong supplier relationships and exploring diversification strategies to mitigate such threats.

Consider the implications if a leading solar panel producer, having established robust manufacturing capabilities, were to enter the solar farm development market. This would mean Terna Energy could face competition from a company that not only supplies their panels but also develops and operates competing solar projects. In 2024, the global renewable energy market saw significant investment, with companies across the value chain exploring various strategic options, including vertical integration, to capture greater market share and control.

- Forward Integration Threat: Suppliers may enter Terna Energy's core business of renewable energy project development and operation.

- Competitive Impact: This integration can reduce Terna Energy's access to critical inputs or create new downstream competitors.

- Market Dynamics: Companies in the renewable energy supply chain are increasingly exploring integration strategies to enhance market position.

Importance of Terna Energy to Suppliers

Terna Energy's position as a customer significantly influences its suppliers' bargaining power. If Terna Energy constitutes a substantial portion of a supplier's sales, that supplier is likely to be more accommodating. For instance, in 2023, Terna Energy's renewable energy projects, particularly its wind farms, required substantial component and service providers.

The relative importance of Terna Energy as a customer to its suppliers also plays a role. If Terna Energy represents a significant portion of a supplier's revenue, the supplier's bargaining power might be mitigated, as they would be more incentivized to maintain a strong relationship and offer competitive terms. This dynamic is crucial in sectors like wind turbine manufacturing or solar panel supply, where Terna Energy is a key buyer.

- Customer Dependence: Suppliers heavily reliant on Terna Energy's orders are less likely to exert strong price demands.

- Revenue Contribution: For suppliers where Terna Energy is a major client, maintaining this relationship often means offering favorable pricing and terms.

- Supplier Landscape: The number and size of alternative buyers for a supplier's products or services also impact Terna Energy's leverage.

The bargaining power of suppliers for Terna Energy is influenced by the availability of substitute inputs and the differentiation of their offerings. While some components for renewable energy projects might have readily available alternatives, specialized technologies or proprietary systems can limit Terna's options, increasing supplier leverage. In 2024, the global supply chain for renewable energy components continued to see innovation, but critical elements like advanced battery storage solutions or highly efficient solar cells often remained concentrated among a few key manufacturers.

| Factor | Impact on Terna Energy | 2024 Context |

|---|---|---|

| Supplier Concentration | High concentration of key equipment manufacturers can lead to increased costs and potential delays. | Limited number of dominant suppliers for specialized wind turbines and solar panels. |

| Switching Costs | Substantial costs associated with integrating new suppliers for critical, customized components. | Technical lock-in for advanced grid management systems and proprietary energy storage solutions. |

| Supplier Differentiation | Unique technologies or specialized services grant suppliers significant leverage. | Reliance on advanced engineering for projects like pumped-storage hydroelectric plants. |

| Forward Integration Threat | Suppliers may enter Terna's core business, creating competition. | Renewable energy supply chain companies exploring integration strategies. |

| Customer Dependence | Terna's significance as a customer can mitigate supplier power. | Terna's substantial renewable energy projects in 2023 required many component providers. |

What is included in the product

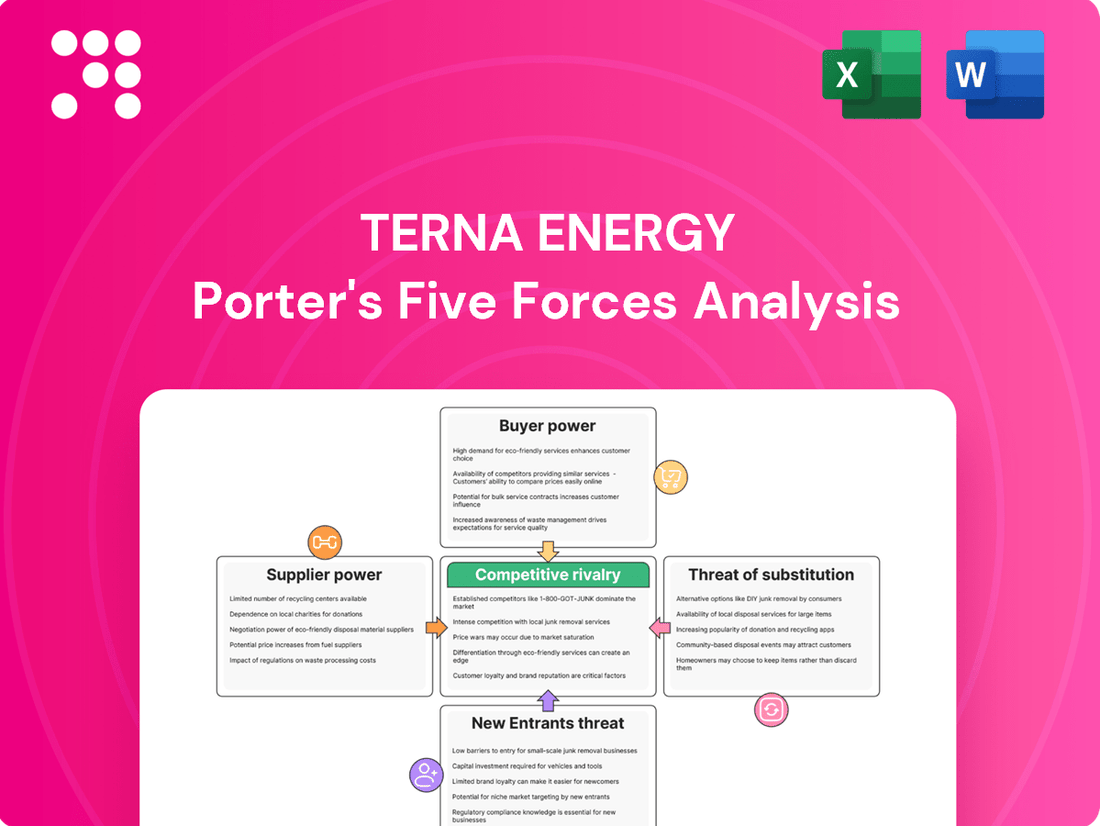

This analysis details the competitive forces impacting Terna Energy, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the energy sector.

Instantly visualize Terna Energy's competitive landscape with a clear, one-sheet summary of all five forces—perfect for quick strategic decision-making.

Customers Bargaining Power

Terna Energy's customer concentration significantly impacts its bargaining power. In Greece, a key market, the transition from auction-based systems to direct market competition and Power Purchase Agreements (PPAs) empowers fewer, larger energy off-takers. These major buyers can leverage their scale to negotiate lower prices and more favorable contract terms, directly affecting Terna Energy's revenue and profitability.

Customers who purchase substantial volumes of electricity from Terna Energy, like national grid operators or large industrial users, possess considerable bargaining power. Their significant demand gives them leverage to negotiate more favorable pricing and delivery terms for extended energy supply agreements.

The availability of substitute energy sources significantly empowers Terna Energy's customers. Customers can readily switch to power generated from fossil fuels or even from other renewable energy providers, directly impacting Terna's pricing flexibility. For instance, in 2024, the European Union continued to diversify its energy mix, with natural gas prices fluctuating, making it a viable alternative for some industrial users, thereby increasing their leverage against renewable energy providers like Terna.

Customer's Price Sensitivity

Customer price sensitivity is a significant factor in the energy sector, particularly for large industrial users or businesses in highly competitive markets. When energy costs represent a substantial portion of their operating expenses, customers actively seek ways to reduce these outlays.

The Greek electricity market has seen notable price volatility, with instances of zero or even negative wholesale prices occurring more frequently. This unpredictability directly impacts customer costs and encourages them to explore alternative, more stable, or lower-cost energy solutions, thereby amplifying their bargaining power.

- Increased Demand for Price Stability: Customers are actively seeking contracts that offer predictable energy pricing to mitigate the impact of market fluctuations.

- Shift Towards Hedging Strategies: Businesses are increasingly employing hedging techniques or engaging in long-term power purchase agreements to lock in favorable rates.

- Impact of Zero/Negative Prices: The occurrence of zero or negative wholesale prices in Greece incentivizes consumers to reduce consumption during these periods or seek out suppliers offering protection against such volatility.

Threat of Backward Integration by Customers

Customers can pose a threat of backward integration if they possess the financial clout and technical know-how to develop their own renewable energy facilities. This would directly diminish their need for external suppliers like Terna Energy.

For instance, large industrial consumers or even utility companies might consider building their own solar farms or wind turbines to secure a more stable and potentially cheaper energy supply. This is a significant consideration, especially as renewable technology costs continue to fall.

While direct backward integration by individual end-consumers is rare, large corporate buyers or energy-intensive industries could indeed explore this avenue. For example, a major manufacturing plant might invest in on-site solar generation, reducing its reliance on Terna Energy’s grid supply.

The bargaining power of customers is influenced by their ability to integrate backward. If customers can produce the energy themselves, they have more leverage in negotiations with Terna Energy, potentially driving down prices or demanding more favorable contract terms.

Terna Energy's customers, particularly large industrial users and national grid operators, wield significant bargaining power. Their substantial electricity consumption allows them to negotiate favorable pricing and contract terms, directly impacting Terna's revenue streams.

The increasing availability of alternative energy sources, including fluctuating natural gas prices in 2024, further empowers customers. They can switch to cheaper or more stable energy options, limiting Terna's pricing flexibility and increasing their negotiation leverage.

Customers' price sensitivity is heightened when energy costs form a large part of their operating expenses. This drives them to seek cost reductions, making them more inclined to negotiate aggressively with suppliers like Terna Energy.

| Factor | Impact on Terna Energy | Customer Leverage |

|---|---|---|

| Customer Concentration | Reduced pricing power | High for large off-takers |

| Availability of Substitutes | Pressure on pricing | High due to diverse energy options |

| Price Sensitivity | Vulnerability to price wars | High for cost-conscious buyers |

Preview the Actual Deliverable

Terna Energy Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Terna Energy, detailing the competitive landscape within the renewable energy sector. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and the availability of substitutes. Rest assured, there are no placeholders or generic content; this is the complete, ready-to-use analysis for your strategic planning.

Rivalry Among Competitors

The renewable energy sector in Greece is booming, driven by strong government support and substantial investment. This rapid expansion, with Greece aiming for significant renewable energy capacity by 2030, means there's ample room for multiple companies to thrive. However, this attractive growth also acts as a magnet for new competitors and spurs existing players, like Terna Energy, to ramp up their own capacity to capture market share.

The Greek renewable energy sector is experiencing significant fragmentation, with a growing influx of both domestic and international investors. This increasing diversity of players intensifies competitive pressures on established companies like Terna Energy.

Terna Energy encounters robust competition not only from other dedicated renewable energy firms but also from traditional energy giants like Hellenic Petroleum and Motor Oil, which are actively diversifying their portfolios into green energy. Furthermore, new, agile entrants are constantly emerging, adding another layer of competitive intensity.

In the renewable energy arena, electricity itself is often viewed as a commodity, which naturally makes it difficult for companies like Terna Energy to truly differentiate their core product. While Terna Energy diversifies across various renewable sources such as wind, solar, hydroelectric, and biomass, and also offers energy management solutions, the fundamental nature of electricity generation means that competitors offering similar capacities and services can easily enter the market.

This situation often leads to intense price competition. If rivals can match Terna's generation capabilities or service offerings, Terna Energy may find itself compelled to compete primarily on cost and operational efficiency to maintain market share. For instance, in 2024, the global renewable energy market experienced significant growth, with solar PV capacity additions alone reaching record levels, increasing the competitive intensity.

High Fixed Costs and Exit Barriers

The renewable energy sector, including companies like Terna Energy, faces intense competition due to substantial fixed costs. Developing wind farms or solar parks requires massive upfront investment in land, turbines, panels, and grid connections. For instance, a single offshore wind farm can cost billions of dollars to construct, creating a significant financial commitment.

These high capital expenditures translate into high exit barriers. Once a company invests heavily in renewable energy assets, it's difficult and costly to divest or repurpose them. This locks companies into the market, compelling them to continue operating and competing vigorously, even when market conditions are challenging, thereby intensifying rivalry among existing players.

- High Upfront Investment: Renewable energy projects require substantial initial capital, often in the billions for large-scale developments.

- Long-Term Asset Commitment: Assets like wind turbines and solar panels have long operational lifespans, creating a sticky investment.

- Intensified Rivalry: High exit barriers mean companies are less likely to leave the market, leading to sustained competition.

- Example: The cost of developing a single gigawatt of offshore wind capacity can exceed $3 billion, illustrating the scale of fixed costs.

Strategic Stakes and Acquisitions

The acquisition of Terna Energy by Masdar in early 2024 for approximately €3 billion underscores the intense strategic importance of the European renewable energy sector. This move by Masdar, a leading global clean energy entity, injects substantial capital and advanced technological capabilities into the market, directly impacting competitive dynamics.

Such significant consolidation events escalate rivalry by introducing aggressive expansion plans and innovative strategies from the acquiring entity. Other established and emerging players in the European renewables landscape are compelled to re-evaluate their own strategic positioning and investment priorities to remain competitive.

- Masdar's acquisition of Terna Energy in 2024 for roughly €3 billion highlights significant strategic investment in the European renewables market.

- This acquisition brings substantial capital and advanced technologies, intensifying competition.

- Competitors must adapt their strategies in response to Masdar's expanded presence and growth ambitions.

The competitive rivalry within Greece's renewable energy sector is exceptionally high, fueled by a growing number of domestic and international players. This intense competition is further amplified by the commodity-like nature of electricity, making differentiation challenging and often leading to price-based competition.

The significant upfront investments and long-term asset commitments in renewable energy create high exit barriers, ensuring that companies remain in the market and continue to compete vigorously. For instance, the substantial capital required for projects means that once invested, companies are locked in, intensifying ongoing rivalry.

The acquisition of Terna Energy by Masdar for approximately €3 billion in early 2024 is a prime example of how consolidation can escalate competition. This strategic move injects significant capital and technology, forcing other market participants to reassess their strategies and investment plans to stay competitive.

| Metric | 2023 (Approx.) | 2024 (Estimate/Activity) | Impact on Rivalry |

| Number of Active Renewable Energy Developers in Greece | ~30-40 | Increasing (due to new entrants and diversification) | Higher competition intensity |

| Terna Energy's Installed Capacity (GW) | ~2.0 GW (across various renewables) | Targeting expansion post-acquisition | Drives competitors to increase capacity |

| Average Price of Electricity from Renewables (EUR/MWh) | Fluctuating, but generally competitive | Potential for downward pressure due to increased supply | Intensifies price competition |

| Masdar's Investment in European Renewables (Post-Terna Acquisition) | N/A (pre-acquisition) | Significant capital infusion | Raises the bar for technological and financial capabilities |

SSubstitutes Threaten

The primary threat of substitutes for Terna Energy's renewable power generation stems from conventional fossil fuels, particularly natural gas. While Greece is actively moving away from lignite, the price-performance dynamic of natural gas remains a factor. During times of elevated demand or when renewable sources like wind and solar are less productive, natural gas can offer a more immediately available and cost-competitive alternative, even with a clear policy direction favoring renewables long-term.

Customer switching costs from renewable energy to conventional sources are generally low for grid operators and large industrial users, as existing infrastructure often allows for flexibility in energy sourcing. This means a company like Terna Energy faces a moderate threat from substitutes if the economics shift unfavorably for renewables.

However, government mandates and subsidies supporting renewable energy adoption, such as the Italian government's renewable energy targets for 2030 which aim for 65% of electricity from renewables, act as significant non-financial switching costs. Furthermore, corporate commitments to sustainability and ESG (Environmental, Social, and Governance) principles make it increasingly difficult for businesses to revert to fossil fuels, even if short-term cost savings were possible.

Customers' willingness to switch away from Terna Energy's services is influenced by concerns over energy security and the reliability of renewable sources. While renewables are improving, issues like grid stability and the inherent intermittency of sources like solar and wind can make dispatchable conventional power more appealing, especially during periods of high demand or when grid limitations are a factor.

Technological Advancements in Substitutes

Technological advancements are a significant threat to traditional energy providers like Terna Energy. Innovations in energy storage, such as advanced battery technologies and more efficient pumped hydro systems, are becoming increasingly viable. These advancements are critical for smoothing out the intermittent nature of renewable energy sources, making them more competitive with conventional power generation.

If these substitute technologies, like improved energy storage and sophisticated grid management solutions, don't mature rapidly or face adoption hurdles, the market might continue to rely on more flexible, albeit often less sustainable, traditional power sources. For instance, by mid-2025, global investment in battery storage is projected to reach hundreds of billions of dollars, indicating a rapid technological push that could displace existing energy infrastructure.

- Advancements in battery technology: Lower costs and higher energy density in lithium-ion and emerging solid-state batteries make them more attractive substitutes for grid-scale energy storage.

- Grid modernization: Smart grid technologies and AI-driven energy management systems improve the integration and reliability of distributed renewable energy sources, reducing the need for centralized, traditional power plants.

- Energy efficiency improvements: Innovations in building design, industrial processes, and consumer electronics reduce overall energy demand, directly impacting the market for energy generation services.

Regulatory and Environmental Pressures

Increasing regulatory and environmental pressures worldwide, particularly within the European Union, are making fossil fuel-based electricity generation a less attractive substitute for renewable sources like those Terna Energy focuses on. Governments are setting ambitious decarbonization targets, which directly impacts the viability and investment appeal of conventional power plants, even if they offer short-term operational benefits.

These pressures translate into tangible policy shifts. For instance, the EU's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. This legislative framework inherently disincentivizes fossil fuel use and promotes renewables, thereby strengthening the position of companies like Terna Energy against traditional energy providers.

- Global Decarbonization Push: Over 130 countries have pledged net-zero emissions, creating a strong tailwind for renewable energy adoption.

- EU Green Deal Impact: The EU's commitment to climate neutrality by 2050 significantly curtails the long-term prospects for fossil fuel infrastructure.

- Phasing Out Coal: Many European nations are actively phasing out coal power, removing a key substitute for renewable energy. For example, Germany aims to phase out coal by 2038, with potential acceleration.

The threat of substitutes for Terna Energy is primarily from conventional energy sources and emerging technologies. While natural gas offers a flexible alternative, its long-term viability is challenged by decarbonization policies. Advancements in energy storage, such as improved battery technology, are crucial for enhancing the competitiveness of renewables by addressing intermittency, with global battery storage investment projected to reach hundreds of billions by mid-2025.

| Substitute Type | Key Characteristics | Impact on Terna Energy | 2024 Data/Projections |

|---|---|---|---|

| Conventional Fuels (e.g., Natural Gas) | Dispatchable, price-sensitive, carbon-intensive | Moderate threat, especially during peak demand or low renewable output. Policy incentivizes shift away. | Natural gas prices in Europe remained volatile in early 2024, influenced by geopolitical factors, but the long-term trend favors renewables. |

| Energy Storage Technologies (Batteries, Pumped Hydro) | Addresses intermittency, cost reduction ongoing | High potential to enhance renewable competitiveness, reducing reliance on traditional backup. | Global investment in battery storage expected to exceed $100 billion annually by 2025. |

| Energy Efficiency | Reduces overall demand | Indirect threat by lowering the total market for energy generation. | EU targets aim for significant energy efficiency improvements across sectors by 2030. |

Entrants Threaten

The renewable energy sector, especially for large-scale projects like those Terna Energy focuses on, requires immense capital. Developing, building, and operating these facilities can easily run into hundreds of millions, if not billions, of euros. For instance, a single offshore wind farm can cost upwards of €1 billion. This significant financial hurdle acts as a powerful deterrent, making it tough for new companies with less access to substantial funding to enter the market and compete head-on with established entities.

The renewable energy sector in Greece is characterized by intricate and time-consuming authorization and permitting processes, often extending over several years for substantial projects. These regulatory complexities, while somewhat eased for smaller initiatives, present formidable entry barriers for newcomers lacking specialized knowledge and established networks.

New entrants into the energy sector, particularly those looking to develop renewable energy projects, face significant hurdles in accessing Greece's electricity grid infrastructure. Terna Energy, as an established player, benefits from existing grid connections and a deeper understanding of the complex regulatory landscape surrounding grid access.

Securing connection agreements for new projects can be a lengthy and costly process. For instance, in 2024, the average time for obtaining grid connection approvals for new renewable energy installations in Greece remained a concern, with some projects experiencing delays extending well over a year due to grid capacity limitations and the need for extensive studies.

The existing grid infrastructure in Greece, managed by entities like the Hellenic Electricity Distribution Network Operator (HEDNO), often operates at or near its capacity in certain regions. This congestion means that new entrants must not only secure a connection but may also be required to fund substantial upgrades to the grid to accommodate their generation capacity, a significant capital outlay that favors incumbents with established infrastructure.

Economies of Scale and Experience Curve

Established players like Terna Energy leverage significant economies of scale in their operations. This means they can develop, procure, and operate projects at a lower cost per unit of energy produced. For instance, in 2024, Terna Energy's large-scale solar and wind farms allow for bulk purchasing of equipment, reducing per-unit expenses. New companies entering the renewable energy sector face a substantial hurdle in matching these cost efficiencies. Without a similar scale of operations and accumulated experience, they find it difficult to compete on price with established entities.

The experience curve further solidifies this advantage for incumbent firms. As companies like Terna Energy undertake more projects, they refine their processes, learn from past challenges, and optimize their supply chains. This cumulative learning leads to ongoing cost reductions over time. New entrants, lacking this extensive history, are at a disadvantage as they are still in the process of building their operational expertise and establishing reliable supplier relationships. This learning curve can translate into higher initial costs, making it harder for them to undercut established players.

- Economies of Scale: Terna Energy benefits from bulk purchasing of solar panels and wind turbines, leading to lower per-unit costs in 2024.

- Experience Curve: Years of project development have allowed Terna Energy to optimize construction timelines and reduce operational overhead.

- Cost Disadvantage for New Entrants: Start-ups lack the purchasing power and operational efficiencies to match Terna Energy's cost structure.

- Barriers to Entry: The significant capital investment required for large-scale renewable projects, coupled with the need for established operational expertise, deters new competition.

Brand Loyalty and Reputation

While not as pronounced as in consumer goods, Terna Energy's strong reputation for reliability and successful project delivery can foster trust among off-takers and financing institutions. This established reputation acts as a barrier, making it harder for new, unproven entrants to gain traction. Terna Energy's extensive history and substantial portfolio further solidify this advantage.

For instance, Terna Energy's commitment to sustainability and its track record in developing large-scale renewable energy projects, such as its significant presence in wind power generation, contribute to its brand equity. By 2024, Terna Energy continued to expand its renewable energy capacity, reinforcing its image as a dependable partner in the sector.

- Established Reputation: Terna Energy's long-standing presence and consistent project execution build trust with customers and financiers.

- Project Delivery Success: A history of successfully completing complex energy projects deters new entrants who may lack this proven capability.

- Portfolio Scale: The sheer size and diversity of Terna Energy's operational portfolio offer economies of scale and operational expertise that new companies struggle to match.

The threat of new entrants for Terna Energy is moderate, primarily due to high capital requirements and regulatory complexities in Greece's renewable energy sector. Significant upfront investment, often exceeding hundreds of millions of euros for large projects, acts as a major deterrent. Furthermore, navigating the intricate permitting processes and securing grid access requires specialized knowledge and established networks, which new companies typically lack.

Established players like Terna Energy also possess substantial economies of scale and an experience curve advantage. This allows them to procure materials and operate projects at lower costs per unit of energy. For instance, in 2024, Terna Energy's bulk purchasing power for solar panels and wind turbines translates into significant cost efficiencies that new, smaller entrants cannot easily replicate.

The existing grid infrastructure presents another barrier, with congestion in certain regions requiring new entrants to potentially fund costly upgrades. Terna Energy's established grid connections and understanding of regulatory nuances provide a competitive edge. Their strong reputation for reliability further solidifies their position, making it challenging for unproven newcomers to attract off-takers and financing.

| Barrier Type | Impact on New Entrants | Terna Energy's Advantage |

| Capital Requirements | Very High | Established financing relationships and access to large-scale funding. |

| Regulatory Complexity & Permitting | High | In-depth knowledge of Greek regulations and existing relationships with authorities. |

| Grid Access & Infrastructure | High | Existing connections and understanding of grid upgrade requirements. |

| Economies of Scale & Experience Curve | High | Bulk purchasing power and optimized operational processes from years of experience. |

| Reputation & Brand Equity | Moderate | Proven track record of project delivery and reliability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Terna Energy is built upon a foundation of reliable data, including Terna's official annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable industry research firms and macroeconomic data providers to ensure a comprehensive understanding of the competitive landscape.