Tenneco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenneco Bundle

Tenneco's market position is shaped by its strong brand recognition and extensive distribution network, but it faces challenges from intense competition and evolving automotive technologies. Understanding these dynamics is crucial for anyone looking to invest or strategize within the automotive aftermarket sector.

Want the full story behind Tenneco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research for your business.

Strengths

Tenneco’s global market presence is a significant strength, with operations spanning North America, Europe, Asia, and South America. This extensive network of manufacturing facilities and engineering centers allows them to effectively serve key automotive markets worldwide and foster strong relationships with global original equipment manufacturers (OEMs).

The company’s broad product portfolio, encompassing ride performance, clean air, and powertrain systems, further solidifies its market position. This diversity enables Tenneco to offer comprehensive solutions across various automotive segments, catering to a wide array of customer needs and industry trends.

Tenneco's aftermarket business is a significant strength, offering a reliable revenue stream that helps buffer against the inherent volatility of the original equipment manufacturer (OEM) market. This segment provides a crucial layer of stability for the company.

The company has actively pursued growth in its aftermarket operations, evidenced by securing new contracts and launching innovative product lines. For instance, in 2023, Tenneco reported a substantial increase in aftermarket sales, contributing significantly to its overall financial performance.

This strategic emphasis on aftermarket expansion not only diversifies Tenneco's revenue sources but also effectively mitigates the risks associated with the cyclical downturns often experienced in the OEM sector, demonstrating a robust business strategy.

Tenneco's dedication to innovation is evident in its substantial R&D investments, reaching $340 million in 2024. This financial commitment fuels the creation of cutting-edge technologies across its clean air, performance, and advanced suspension systems.

The company is strategically positioning itself for the future of mobility by actively developing solutions for electric vehicles (EVs). This includes pioneering adaptive vibration absorbers specifically engineered for the unique demands of EV powertrains.

Operational Transformation and Financial Performance under Apollo Funds

Since its acquisition by Apollo Funds in late 2022, Tenneco has been actively engaged in an operational transformation. This strategic shift has focused on optimizing its business structure and enhancing overall financial performance. The company has achieved best-in-class business performance, evidenced by its attainment of top-quartile EBITDA margins.

A significant development in 2025 is the strategic investment from Apollo Fund X. This infusion of capital is designed to bolster Tenneco's capacity for both organic and inorganic growth initiatives, positioning it for continued expansion and market leadership.

- Operational Optimization: Tenneco's post-acquisition restructuring has streamlined operations, contributing to improved efficiency.

- Financial Performance: The company has achieved top-quartile EBITDA margins, reflecting enhanced profitability.

- Strategic Investment: Apollo Fund X's 2025 investment provides capital to fuel future growth.

- Growth Potential: The combined efforts are geared towards driving both organic expansion and strategic acquisitions.

Strong Sustainability Initiatives and ESG Performance

Tenneco demonstrates a robust commitment to sustainability and strong Environmental, Social, and Governance (ESG) performance, as detailed in its 2024 Sustainability Report. The company is actively working towards its 2030 sustainability goals, showing tangible reductions in key areas like energy consumption and greenhouse gas emissions. This dedication is further validated by its impressive achievement of a top 3% ranking within its sector by EcoVadis, securing a Silver Medal score of 72, which underscores its significant progress in responsible business practices.

Tenneco's global reach and diverse product lines are key strengths, allowing it to serve major automotive markets effectively. The company's aftermarket business provides a stable revenue stream, buffering against OEM market volatility. Significant R&D investment, including $340 million in 2024, drives innovation, particularly in EV technologies. Post-acquisition operational optimization and a strategic 2025 investment from Apollo Fund X are enhancing financial performance and growth potential, with the company achieving top-quartile EBITDA margins.

What is included in the product

Delivers a strategic overview of Tenneco’s internal and external business factors, highlighting its strengths in product innovation and market position, while also addressing weaknesses in supply chain efficiency and opportunities in emerging markets, alongside threats from intense competition and regulatory changes.

Offers a clear, actionable framework to identify and address Tenneco's strategic challenges and leverage its competitive advantages.

Weaknesses

Tenneco's historical strength in emission control and powertrain systems for internal combustion engine (ICE) vehicles now presents a significant weakness. As the automotive sector pivots sharply towards electrification, the company's substantial reliance on ICE components faces diminishing demand. This dependency could hinder its growth trajectory in a rapidly evolving market.

Tenneco's acquisition by Apollo Funds in 2022 was a leveraged buyout, meaning it took on significant debt to complete the deal. While the company has been working to pay down these obligations, the remaining debt load is substantial. For instance, as of the first quarter of 2024, Tenneco reported total debt of approximately $4.5 billion. This high level of debt can limit financial flexibility and increase the risk of financial distress if operating performance falters.

Tenneco faces formidable competition in the automotive components market from giants like Robert Bosch GmbH, Denso Corporation, and ZF Group. These rivals often boast superior research and development resources and long-standing partnerships with original equipment manufacturers (OEMs), creating significant hurdles for Tenneco.

The sheer number of established players, including Marelli, Valeo, and BorgWarner, intensifies this rivalry. This crowded landscape can lead to price wars and make it challenging for Tenneco to capture and maintain market share, directly impacting its profitability.

Vulnerability to Global Supply Chain Disruptions

Tenneco's extensive global manufacturing footprint makes it inherently vulnerable to disruptions within worldwide supply chains. Geopolitical tensions, severe weather events, and economic downturns can all create significant bottlenecks, causing production delays and driving up operational expenses. For instance, the semiconductor shortages experienced globally through 2021-2023 significantly impacted the automotive industry, a key market for Tenneco, leading to production cuts for many of its customers.

These supply chain vulnerabilities can directly affect Tenneco's ability to fulfill customer orders promptly and efficiently. Increased lead times and higher raw material costs, exacerbated by these disruptions, can erode profit margins and hinder the company's competitive positioning. In 2024, many manufacturers continued to grapple with elevated shipping costs and component availability issues, a trend that directly impacts companies like Tenneco operating in a globalized production environment.

- Geopolitical Instability: Events like the ongoing conflict in Eastern Europe have continued to impact energy prices and the availability of certain raw materials crucial for manufacturing.

- Natural Disasters: Extreme weather events, such as floods or earthquakes in key manufacturing regions, can halt production and disrupt transportation networks.

- Economic Pressures: Inflationary trends and currency fluctuations can increase the cost of imported components and impact demand from key markets, further straining supply chains.

- Logistical Challenges: Port congestion and a shortage of shipping containers, issues that persisted into early 2024, can lead to significant delays and increased freight expenses for global manufacturers.

Exposure to Cyclical Nature of the OEM Sector

Tenneco's significant reliance on the Original Equipment Manufacturer (OEM) sector exposes it to the inherent cyclicality of the automotive industry. This means revenue and profitability can swing considerably based on new vehicle production, which is sensitive to economic downturns and shifts in consumer demand. For instance, a slowdown in new car sales, as seen during periods of economic uncertainty, directly translates to fewer parts needed from Tenneco for new vehicles.

While Tenneco's aftermarket business offers a degree of resilience, the OEM segment's volatility remains a key weakness. This cyclicality can lead to unpredictable revenue streams.

- OEM Dependence: Tenneco's revenue is heavily tied to new vehicle production, making it vulnerable to industry cycles.

- Economic Sensitivity: Fluctuations in the broader economy directly impact new vehicle sales and, consequently, Tenneco's OEM business.

- Demand Volatility: Changes in consumer preferences and economic conditions can cause sharp swings in demand for new vehicles, affecting Tenneco's order volumes.

Tenneco's substantial debt load, a consequence of its 2022 leveraged buyout, limits financial flexibility. As of Q1 2024, the company carried approximately $4.5 billion in total debt, increasing its vulnerability to operational downturns and potentially hindering future investments.

The company's historical focus on internal combustion engine (ICE) components is a growing weakness as the automotive industry electrifies. This reliance on a declining technology segment could impede its adaptation and growth in a rapidly changing market.

Intense competition from established players like Bosch and Denso, who possess greater R&D resources and OEM relationships, creates significant market challenges for Tenneco. This crowded field can lead to price pressures and difficulties in maintaining market share.

Tenneco's global supply chain is susceptible to disruptions from geopolitical events, natural disasters, and logistical bottlenecks, as seen with the semiconductor shortages impacting the industry through 2021-2023. These issues can cause production delays and inflate operational costs, affecting profitability and customer fulfillment.

Same Document Delivered

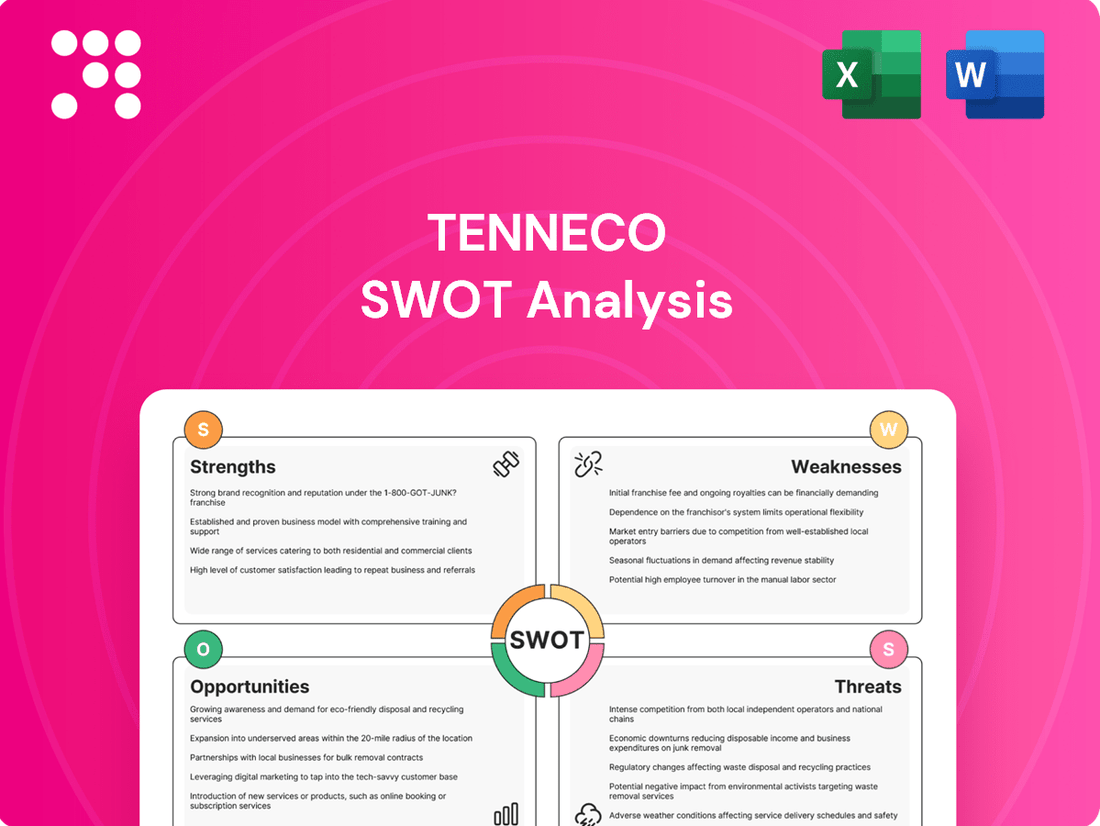

Tenneco SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Tenneco's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Tenneco's market position and future growth potential.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Tenneco SWOT analysis, empowering you with actionable intelligence.

Opportunities

The global automotive industry's accelerating pivot to electric vehicles (EVs) offers Tenneco a prime avenue for expansion. With EV sales projected to reach 30% of the global market by 2030, Tenneco's established prowess in ride performance and noise, vibration, and harshness (NVH) solutions is highly relevant.

Tenneco can strategically adapt its existing suspension and exhaust system technologies for the unique demands of EVs, such as lighter architectures and different powertrain configurations. For instance, developing specialized NVH solutions to mitigate the distinct sound profiles of electric motors presents a clear opportunity for differentiation.

Significant investment in research and development focused on next-generation EV components, including advanced battery thermal management systems and lightweight structural elements, will be vital. This proactive approach will solidify Tenneco's position as a key supplier in the rapidly growing electric mobility sector.

The automotive aftermarket, encompassing both traditional internal combustion engine (ICE) and emerging electric vehicle (EV) segments, presents a robust and expanding opportunity. In 2024, the global automotive aftermarket was valued at over $450 billion, with projections indicating continued growth driven by an aging vehicle parc and increasing complexity of vehicle systems. Tenneco is well-positioned to leverage this trend by broadening its product portfolio to cater to the specific needs of EV maintenance and repair, alongside its established ICE offerings.

Securing new business wins with both original equipment manufacturers (OEMs) and independent aftermarket channels will be crucial for Tenneco's expansion. Strengthening relationships with existing distributors and forging new partnerships will enhance market penetration and ensure wider product availability. This dual approach, serving both established and evolving vehicle technologies, offers a pathway to stable revenue and significant growth potential for Tenneco in the coming years.

Tenneco is actively pursuing strategic partnerships and acquisitions to bolster its market standing and broaden its product offerings, especially within the burgeoning electric vehicle (EV) sector. These collaborations are anticipated to speed up innovation and extend Tenneco's market penetration.

By teaming up with other industry players, Tenneco can gain access to new technologies and markets, enabling it to effectively leverage emerging trends and diversify its customer base. For instance, in early 2024, Tenneco announced a new partnership with a leading battery technology firm to co-develop advanced thermal management systems for EVs, aiming to capture a significant share of this rapidly growing segment.

Digital Transformation and Operational Optimization

Tenneco's commitment to digital transformation presents a significant opportunity. By further investing in advanced technology and data analytics, the company can fine-tune its operations, boosting efficiency and elevating customer interactions. This strategic focus on digital tools allows for smoother workflows, more effective inventory control, and a quicker adaptation to evolving market needs. For instance, in 2024, Tenneco continued to implement AI-driven forecasting for its supply chain, aiming to reduce lead times by an estimated 15% by the end of the year.

Leveraging digital platforms can unlock substantial gains in operational excellence. Streamlined processes, enhanced inventory management, and improved responsiveness are direct benefits. Tenneco's ongoing digital initiatives, including the rollout of a new enterprise resource planning (ERP) system in late 2024, are designed to integrate data across departments, providing real-time insights for better decision-making. This move is expected to contribute to a projected 5-7% increase in operational efficiency by 2025.

- Enhanced Efficiency: Digital tools can automate routine tasks, freeing up resources and reducing manual errors.

- Improved Inventory Management: Real-time data analytics allow for better stock level monitoring, minimizing overstocking and stockouts.

- Customer Experience: Digital platforms can offer personalized services, faster response times, and more transparent communication.

- Data-Driven Decisions: Investing in analytics provides actionable insights into market trends and operational performance.

Global Market Expansion, especially in High-Growth Regions

Tenneco is strategically positioning itself for significant global market expansion, particularly targeting regions with burgeoning electric vehicle (EV) adoption rates. This includes a strong focus on markets like China and Europe, where the shift towards cleaner transportation is accelerating rapidly. By establishing a more robust presence in these high-growth areas, Tenneco aims to tap into new customer segments and increase its overall revenue streams.

The company's expansion strategy is designed to diversify its customer base, which in turn helps to mitigate potential risks associated with over-reliance on specific markets or customer groups. Tenneco plans to leverage its existing global distribution networks and established partnerships to facilitate this entry into new territories, ensuring a more efficient and cost-effective rollout.

For instance, China's automotive market, a significant portion of which is now comprised of New Energy Vehicles (NEVs), saw sales of NEVs reach approximately 9.5 million units in 2023, a substantial increase from previous years. Similarly, Europe is a key market for EV growth, with many countries setting ambitious targets for phasing out internal combustion engine vehicles. Tenneco's expansion into these dynamic markets is a crucial element of its long-term growth and risk management strategy.

Key aspects of this opportunity include:

- Targeting high-growth EV markets: Focusing on regions like China and Europe with strong EV adoption trends.

- Diversifying customer base: Reducing reliance on existing markets by acquiring new clients globally.

- Leveraging existing infrastructure: Utilizing established distribution networks and partnerships for efficient market entry.

- Mitigating risk and driving revenue: Achieving sustainable growth and resilience through geographic diversification.

Tenneco's expertise in noise, vibration, and harshness (NVH) solutions is a significant asset in the evolving automotive landscape, particularly with the rise of electric vehicles (EVs) which present a unique NVH challenge. The company is well-positioned to develop specialized solutions for EV powertrains, which have different acoustic profiles compared to internal combustion engines. This focus on adapting and innovating existing capabilities for new vehicle architectures directly addresses a growing market need.

The automotive aftermarket represents a substantial and resilient revenue stream, with the global market exceeding $450 billion in 2024. Tenneco can capitalize on this by expanding its product offerings to cater to both traditional vehicles and the increasing number of EVs requiring maintenance and repair. This dual approach ensures continued relevance and revenue generation across diverse vehicle segments.

Strategic partnerships and potential acquisitions, especially within the EV component sector, offer a pathway for accelerated growth and technological advancement. By collaborating with firms specializing in areas like battery thermal management, Tenneco can enhance its product portfolio and secure a stronger foothold in the rapidly expanding electric mobility market. For instance, a partnership announced in early 2024 with a battery technology firm aims to co-develop advanced thermal management systems for EVs.

Tenneco's ongoing digital transformation, including the implementation of AI-driven supply chain forecasting and new ERP systems in 2024, promises significant operational efficiencies. These digital initiatives are projected to improve lead times and boost overall operational efficiency by 5-7% by 2025, enhancing competitiveness and responsiveness.

Geographic expansion into high-growth EV markets, such as China and Europe, presents a key opportunity for Tenneco. With China's NEV sales reaching approximately 9.5 million units in 2023, and Europe's ambitious EV targets, these regions offer substantial potential for increasing market share and diversifying revenue streams, thereby mitigating risks associated with market concentration.

Threats

The accelerating global shift towards electric vehicles (EVs) presents a substantial threat to Tenneco's established business, especially its reliance on components for internal combustion engine (ICE) vehicles. As more consumers and regulators embrace EVs, demand for traditional exhaust systems and powertrain parts is expected to decline. For instance, in 2024, projections indicated that EV sales could reach over 15% of the global automotive market, a significant jump from previous years, directly impacting Tenneco's core product lines.

The automotive industry's shift towards electric vehicles (EVs) is fueling fierce competition. Established players and nimble newcomers are aggressively developing and marketing EV-specific components, putting pressure on companies like Tenneco to adapt quickly.

This intensifying competition, particularly from suppliers solely focused on EV technology, poses a significant threat to Tenneco's market share. If Tenneco cannot accelerate its innovation and production of advanced EV solutions, it risks falling behind in a rapidly evolving market. For instance, by the end of 2024, it's projected that EV sales will continue their upward trajectory, demanding suppliers to demonstrate robust EV portfolios.

Ongoing global supply chain disruptions, fueled by geopolitical instability and trade tensions, continue to pose a significant threat. For instance, the lingering effects of the semiconductor shortage in 2023 and early 2024 impacted automotive production worldwide, directly affecting demand for components like those Tenneco supplies.

Geopolitical events, such as regional conflicts or new trade tariffs, can further exacerbate these issues, leading to increased raw material costs and unpredictable lead times. This volatility makes it challenging for Tenneco to maintain consistent production schedules and manage inventory effectively, potentially impacting profitability and market share.

Economic Downturns and Market Volatility

Macroeconomic headwinds, including persistent inflation and fluctuating interest rates, present a significant threat to Tenneco. These conditions can dampen consumer spending on new vehicles and aftermarket parts, directly impacting the company's revenue streams. For instance, rising inflation in 2023 and early 2024 has put pressure on household budgets, potentially delaying vehicle purchases and maintenance.

Market volatility, characterized by unpredictable swings in stock prices and commodity costs, adds another layer of risk. This instability can make financial planning more challenging and affect the cost of raw materials essential for Tenneco's manufacturing processes. The automotive sector, in particular, is sensitive to economic cycles, meaning a broader downturn could significantly curtail vehicle production and, by extension, demand for Tenneco's components.

Changes in international trade relations, such as tariffs or shifts in global supply chains, can also disrupt Tenneco's operations and profitability. These factors can increase the cost of imported components or create logistical hurdles. The ongoing evolution of global trade policies in 2024 necessitates careful monitoring and strategic adaptation to mitigate potential negative impacts on Tenneco's global sales and supply chain efficiency.

- Inflationary Pressures: Persistent inflation can erode consumer purchasing power, leading to reduced demand for new vehicles and aftermarket services.

- Market Volatility: Unpredictable market swings impact investment decisions and can increase the cost of doing business through fluctuating commodity prices.

- Trade Relations: Evolving international trade policies and potential protectionist measures pose risks to global supply chains and market access for Tenneco.

- Economic Slowdowns: A general economic downturn typically results in lower vehicle production volumes and decreased aftermarket spending, directly affecting Tenneco's sales performance.

Technological Disruption and Need for Continuous R&D Investment

The automotive sector is experiencing a seismic shift, driven by innovations like autonomous driving and the increasing prevalence of connected vehicles. Tenneco faces the significant challenge of keeping pace with these rapid technological advancements. This necessitates substantial and ongoing investment in research and development to create competitive solutions for these new frontiers.

Failing to innovate effectively in these areas poses a direct threat to Tenneco's market position. The company's ability to successfully translate R&D expenditure into commercially viable products is crucial, as misallocated resources or unsuccessful product launches represent a considerable financial risk. For instance, the global automotive R&D spending reached an estimated $200 billion in 2023, highlighting the competitive landscape Tenneco operates within.

- Technological Obsolescence: Rapid advancements in areas like electric vehicle powertrains and advanced driver-assistance systems (ADAS) could render current Tenneco product lines less relevant if R&D efforts lag.

- High R&D Costs: Developing cutting-edge automotive technologies requires significant capital outlay, potentially straining financial resources and impacting profitability if returns are not realized.

- Competition from Tech Giants: Non-traditional automotive players and technology companies are entering the space, bringing substantial R&D capabilities and potentially disrupting established supply chains.

- Uncertainty of New Technologies: Predicting which emerging technologies will gain widespread market adoption is challenging, making R&D investment inherently risky.

The rapid global shift towards electric vehicles (EVs) presents a significant threat to Tenneco, as its core business is heavily reliant on components for internal combustion engine (ICE) vehicles. Projections for 2024 indicated that EV sales could capture over 15% of the global automotive market, a trend that directly challenges Tenneco's established product lines.

Intensifying competition, particularly from suppliers exclusively focused on EV technology, threatens Tenneco's market share. If the company doesn't accelerate its innovation in EV solutions, it risks falling behind, especially as EV sales are expected to continue their upward trajectory through 2024, demanding robust EV portfolios from suppliers.

Macroeconomic headwinds like persistent inflation and fluctuating interest rates can dampen consumer spending on vehicles and aftermarket parts, impacting Tenneco's revenue. For example, rising inflation in 2023 and early 2024 strained household budgets, potentially delaying vehicle purchases and maintenance.

The automotive sector's rapid technological evolution, including autonomous driving and connected vehicles, requires substantial R&D investment from Tenneco. Failing to innovate effectively in these areas, especially given that global automotive R&D spending reached an estimated $200 billion in 2023, poses a direct threat to its market position.

| Threat Category | Specific Threat | Impact on Tenneco | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|---|

| Market Shift | Accelerating EV adoption | Reduced demand for ICE components | EV sales projected to exceed 15% of global market in 2024. |

| Competition | Emergence of EV-focused suppliers | Loss of market share if EV offerings lag | Intensifying competition from companies specializing in EV powertrains. |

| Economic Factors | Inflationary pressures & market volatility | Decreased consumer spending on vehicles, increased raw material costs | Inflation impacting household budgets; commodity price fluctuations affecting production costs. |

| Technological Disruption | Rapid advancements in automotive tech (ADAS, autonomy) | Risk of product obsolescence, high R&D costs | Global automotive R&D spending estimated at $200 billion in 2023; need for continuous innovation. |

SWOT Analysis Data Sources

This Tenneco SWOT analysis is built upon a foundation of verified financial filings, comprehensive market intelligence reports, and expert industry evaluations. These sources provide the critical data needed for an accurate and actionable strategic assessment.