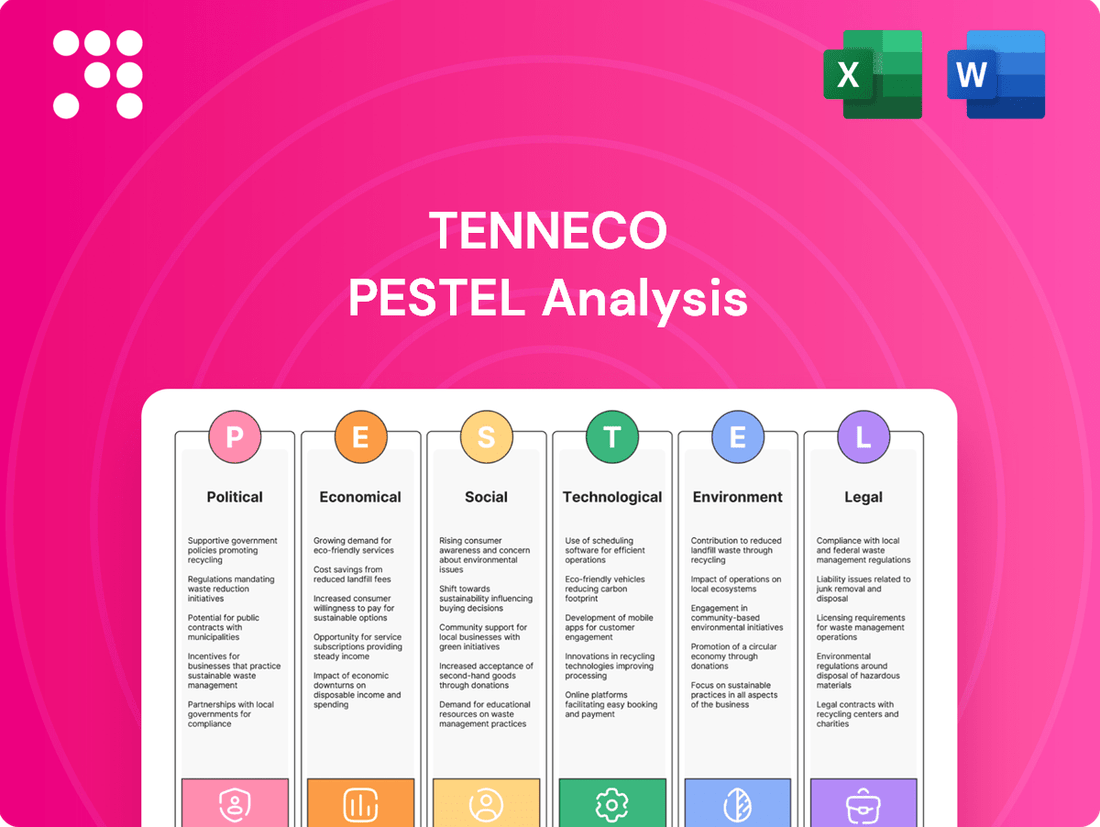

Tenneco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenneco Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental forces shaping Tenneco's strategic landscape. Our expert-crafted PESTLE analysis provides actionable insights to navigate market volatility and identify future growth opportunities. Download the full version now to gain a competitive edge and inform your investment decisions.

Political factors

Global trade policies, particularly tariffs on automotive parts and finished vehicles, directly affect Tenneco's cost of goods sold and its ability to compete internationally. For instance, the ongoing trade tensions between major economies can lead to unpredictable cost increases for components sourced from overseas, impacting Tenneco's profit margins.

Recent discussions around potential tariff hikes on electric vehicles (EVs) and their components from specific countries, such as the proposed 100% tariff on Chinese EVs by the US in 2024, highlight the vulnerability of the automotive supply chain. Such measures could significantly alter production strategies and market access for Tenneco's products, especially as the industry pivots towards electrification.

Governments globally are tightening environmental rules, with many nations, including those in the European Union and the United States, pushing for lower CO2 emissions and better fuel economy. For instance, the EU's CO2 emission performance standards for new cars and vans aim for an average of 95 g CO2/km for 2020, with even stricter targets for 2025 and beyond, impacting the design and sales of emission control systems.

These evolving mandates directly influence Tenneco's product development, particularly in its Clean Air segment, as manufacturers adapt to meet these stringent requirements. Stricter emissions standards often necessitate more complex and advanced exhaust aftertreatment systems, which Tenneco is well-positioned to supply.

Furthermore, safety regulations are also a significant driver. For example, advancements in active safety systems, like electronic stability control and advanced driver-assistance systems (ADAS), often integrate with braking and suspension components. The increasing adoption of these technologies, spurred by mandates in regions like North America and Europe, creates opportunities for Tenneco's Ride Performance division to innovate and supply these sophisticated systems.

Geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to create significant headwinds for global supply chains. These instabilities directly impact Tenneco by causing unpredictable fluctuations in the cost and availability of essential raw materials, including steel and aluminum, which are critical components for their automotive parts manufacturing.

In 2024, the automotive industry, including suppliers like Tenneco, faced persistent challenges related to these geopolitical events. For instance, disruptions in shipping routes and increased energy costs, directly linked to geopolitical instability, contributed to higher operational expenses for manufacturers. Tenneco's ability to secure consistent and affordable inputs is therefore paramount to maintaining production schedules and meeting customer demand for their emission control and ride control technologies.

Government Incentives and Subsidies for EVs

Government policies, such as tax credits and subsidies for electric vehicles (EVs), are significantly shaping the automotive landscape. For instance, the Inflation Reduction Act in the United States offers substantial credits for EV purchases, driving consumer adoption. These shifts directly affect Tenneco, influencing demand for its traditional exhaust and emissions control systems while opening avenues for new technologies like battery thermal management and advanced powertrain components.

The global push for electrification, supported by these governmental incentives, is a critical political factor for Tenneco. Many nations have set ambitious targets for EV sales and internal combustion engine (ICE) phase-outs. For example, the European Union aims for all new cars and vans sold to be zero-emission by 2035. This regulatory environment necessitates strategic adaptation by companies like Tenneco to align their product development and manufacturing capabilities with the evolving market demands.

- Government Support for EVs: Many governments offer direct financial incentives, such as purchase subsidies and tax credits, to encourage EV adoption. The U.S. federal tax credit for new EVs can be up to $7,500.

- Emission Standards: Increasingly stringent emission regulations globally are pushing automakers towards electrification, impacting the demand for traditional powertrain components.

- Infrastructure Investment: Government investment in EV charging infrastructure, like the Bipartisan Infrastructure Law’s $7.5 billion allocated for EV charging, further supports the transition.

- ICE Phase-Out Targets: Several countries and regions have announced target dates for phasing out the sale of new internal combustion engine vehicles, creating a clear timeline for market transformation.

Political Stability in Key Markets

The political stability of key automotive markets like China, North America, and Europe significantly influences consumer confidence and manufacturing activity for companies such as Tenneco. Political uncertainty, including trade disputes or shifts in regulatory environments, can dampen consumer spending on vehicles and disrupt supply chains. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe continued to create headwinds for European automotive production and sales, impacting companies with significant operations there.

Political stability directly impacts Tenneco's operational efficiency and market access. Regions experiencing political unrest or unpredictable policy changes may see reduced investment and slower economic growth, which translates to lower demand for automotive components. In 2025, the automotive industry will continue to monitor the outcomes of national elections in several major economies, as these can signal potential shifts in trade policies and environmental regulations that affect vehicle production and emissions standards.

Tenneco's strategic planning must account for varying levels of political stability across its global footprint. Factors such as government incentives for electric vehicles, changes in import/export tariffs, and labor laws can all create both opportunities and challenges. For example, government support for EV adoption in North America and Europe in 2024-2025 is a critical factor for Tenneco as it expands its offerings in advanced suspension and emissions control systems for these evolving vehicle types.

- China's Automotive Market: While generally stable, policy shifts regarding foreign investment and domestic production targets are closely watched.

- North America: Political stability is generally high, but trade agreements and environmental regulations remain key areas of focus for the automotive sector.

- Europe: Political stability varies by country, with a strong emphasis on emissions standards and the transition to electric mobility influencing market dynamics.

Government policies significantly shape the automotive industry, influencing Tenneco's operations through incentives for electric vehicles (EVs) and stringent emission standards. For instance, the U.S. Inflation Reduction Act provides substantial EV tax credits, while the EU targets zero-emission vehicle sales by 2035. These regulations drive Tenneco's innovation in emissions control and new technologies.

Geopolitical instability, such as conflicts in Eastern Europe, directly impacts Tenneco by disrupting supply chains for critical materials like steel and aluminum, leading to cost volatility. In 2024, shipping route disruptions and increased energy costs due to these tensions heightened operational expenses for manufacturers. Tenneco's ability to secure consistent material supply is crucial for maintaining production.

Political stability in key markets like China, North America, and Europe is vital for consumer confidence and manufacturing. Political uncertainty or shifts in trade policies and environmental regulations can dampen vehicle demand and disrupt operations. For example, in 2024, European automotive production faced challenges due to ongoing geopolitical tensions.

Government support for EVs, including purchase subsidies and charging infrastructure investment, is accelerating the transition to electric mobility. The U.S. Bipartisan Infrastructure Law allocated $7.5 billion for EV charging. These political drivers necessitate strategic adaptation by Tenneco to align its product portfolio with evolving market demands, particularly for advanced suspension and emissions control systems.

What is included in the product

This PESTLE analysis of Tenneco examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

Provides a clear, actionable overview of Tenneco's external environment, enabling strategic adjustments to mitigate potential risks and capitalize on opportunities.

Economic factors

The global economic outlook for 2024 and into 2025 suggests a moderate but uneven recovery. While some regions are experiencing robust growth, others face headwinds. This directly impacts consumer spending power, a critical driver for the automotive sector.

Consumer spending, particularly on discretionary items like new vehicles and vehicle maintenance, is closely tied to economic confidence and disposable income. For instance, a slowdown in consumer spending, as seen in certain developed markets during late 2023 due to persistent inflation, can translate into reduced demand for automotive parts and services.

Conversely, periods of economic stability and rising consumer confidence, projected for some emerging markets in 2025, could bolster sales of new vehicles and increase demand for aftermarket components and repairs, benefiting companies like Tenneco.

Inflationary pressures continue to impact Tenneco's operational costs, with rising raw material prices directly affecting manufacturing expenses. For instance, the Producer Price Index for manufactured goods saw a notable increase throughout 2023 and into early 2024, reflecting broader economic trends. This upward cost trajectory directly squeezes profit margins for companies like Tenneco.

The automotive supply chain remains a critical area of concern, with ongoing challenges in securing essential components and managing their fluctuating costs. The semiconductor shortage, while easing, still contributes to supply chain volatility, and the prices of metals like steel and aluminum, key inputs for Tenneco's products, have experienced significant swings. These supply chain disruptions and cost escalations directly impact Tenneco's ability to maintain competitive pricing and consistent production.

Elevated interest rates, such as the Federal Reserve's benchmark rate hovering around 5.25%-5.50% in early 2024, significantly increase the cost of financing new and used vehicles. This directly impacts consumer purchasing power, potentially dampening demand for automobiles.

A slowdown in vehicle sales, driven by higher borrowing costs, translates to reduced demand for original equipment (OE) and aftermarket automotive components. For companies like Tenneco, this means fewer new vehicles being produced and a potential decrease in the need for replacement parts.

For instance, if the average car loan rate rises from 5% to 7%, monthly payments on a $30,000 loan over five years increase by approximately $100. This added expense can deter buyers, leading to a ripple effect throughout the automotive supply chain, including component manufacturers.

Supply Chain Disruptions and Component Shortages

Ongoing supply chain disruptions, especially the persistent shortage of semiconductor chips and critical metals like rare earths, continue to impact automotive production. These issues directly affect manufacturers such as Tenneco, leading to production slowdowns and elevated component costs.

The scarcity of essential components, including advanced microcontrollers and specialized alloys, has forced many automakers to adjust production schedules throughout 2024 and into early 2025. This bottleneck directly translates to higher input prices for Tenneco, potentially squeezing profit margins.

- Semiconductor Shortage Impact: Reports from the automotive industry in late 2024 indicated that the chip shortage, while easing, still caused an estimated production loss of over 1 million vehicles globally in the first half of the year.

- Specialized Metal Scarcity: Prices for key metals used in automotive components, such as neodymium and dysprosium (essential for electric vehicle motors), saw a significant increase of 15-20% in 2024 due to geopolitical factors and increased demand.

- Production Delays: Tenneco, like its peers, faced extended lead times for critical inputs, sometimes extending by 30-50% compared to pre-pandemic levels, impacting their ability to meet OEM demand promptly.

Aftermarket Growth and Vehicle Lifespan

The automotive aftermarket is a robust sector for Tenneco, fueled by the growing average age of vehicles on the road. As cars get older, the need for replacement parts and maintenance services naturally increases, creating a consistent demand for Tenneco's core product lines like braking, ride control, and sealing systems. This trend offers a degree of market stability.

Several factors contribute to this aftermarket strength:

- Increasing Vehicle Age: The average age of vehicles in operation in the US reached a new record of 12.6 years in 2023, up from 12.1 years in 2020, according to S&P Global Mobility. This aging fleet directly translates to higher demand for parts.

- Aftermarket Sales Growth: The global automotive aftermarket was valued at approximately $450 billion in 2023 and is projected to grow, with estimates suggesting it could reach over $600 billion by 2030, according to various market research reports.

- Demand for Specific Systems: Tenneco's focus on braking, ride control, and sealing systems places it at the heart of essential vehicle maintenance and repair, sectors that are less susceptible to economic downturns compared to new vehicle sales.

- DIY vs. Professional Repair: While professional repair shops are a major channel, a significant portion of the aftermarket also caters to do-it-yourself (DIY) consumers, further broadening the market reach for replacement parts.

The global economic landscape in 2024 and early 2025 presents a mixed picture, with moderate growth anticipated in some regions while others grapple with economic slowdowns. This directly influences consumer purchasing power, a key determinant for the automotive sector. Inflationary pressures continue to affect operational costs for companies like Tenneco, with rising raw material prices impacting manufacturing expenses. Elevated interest rates, such as the Federal Reserve's benchmark rate holding steady around 5.25%-5.50% in early 2024, increase the cost of financing vehicles, potentially dampening demand.

Supply chain disruptions remain a significant challenge, with ongoing issues in securing essential components and managing fluctuating costs. The semiconductor shortage, though easing, still contributes to volatility, and prices for metals like steel and aluminum have seen considerable swings. These factors impact Tenneco's ability to maintain competitive pricing and consistent production, with extended lead times for critical inputs sometimes increasing by 30-50% compared to pre-pandemic levels.

Despite new vehicle sales challenges, the automotive aftermarket offers a stable revenue stream for Tenneco. The increasing average age of vehicles on the road, reaching a record 12.6 years in the US in 2023, drives demand for replacement parts and maintenance. The global automotive aftermarket was valued around $450 billion in 2023 and is projected for robust growth, further benefiting Tenneco's focus on braking, ride control, and sealing systems.

| Economic Factor | 2023/2024 Trend | Impact on Tenneco | Supporting Data/Example |

| Global Economic Growth | Moderate, uneven recovery | Influences consumer spending on vehicles and parts | Projected GDP growth varies by region for 2024-2025 |

| Inflation | Persistent pressure on costs | Increases manufacturing expenses, squeezes profit margins | Producer Price Index for manufactured goods saw increases in 2023-early 2024 |

| Interest Rates | Elevated (e.g., Fed rate 5.25%-5.50% in early 2024) | Increases vehicle financing costs, potentially reduces demand | A rise from 5% to 7% on a $30,000 car loan adds ~$100/month |

| Supply Chain Volatility | Ongoing shortages (semiconductors, metals) | Production delays, elevated component costs, extended lead times | Chip shortage caused estimated >1 million vehicle production loss globally (H1 2024); Metal prices increased 15-20% in 2024; Lead times up 30-50% |

| Automotive Aftermarket | Robust growth, driven by aging vehicles | Consistent demand for replacement parts and services | Average US vehicle age hit 12.6 years in 2023; Market projected to exceed $600 billion by 2030 |

Preview the Actual Deliverable

Tenneco PESTLE Analysis

The Tenneco PESTLE analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Tenneco.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Consumer preferences are rapidly shifting, with a growing demand for hybrid and electric vehicles. For instance, in 2024, the global electric vehicle market is projected to reach over $700 billion, with hybrid vehicles holding a significant share. This evolution directly impacts Tenneco's product development, requiring them to innovate and adapt their offerings to meet the increasing consumer interest in sustainable and technologically advanced automotive solutions.

The increasing adoption of Mobility-as-a-Service (MaaS) platforms, especially by Gen Z and Millennials, is reshaping how people access transportation. For instance, a 2024 report indicated that over 40% of urban dwellers in major European cities now utilize ride-sharing or subscription-based mobility services more frequently than owning a personal vehicle.

This shift away from traditional car ownership directly influences the automotive aftermarket, potentially reducing the demand for certain replacement parts as vehicle utilization patterns change. Tenneco must therefore explore how its product portfolio can adapt to support these evolving mobility ecosystems, perhaps by focusing on components for shared fleets or electric vehicle maintenance.

Growing consumer and societal awareness of environmental sustainability is significantly influencing the automotive sector, pushing for greener vehicles and manufacturing. This trend directly impacts Tenneco, prompting increased investment in eco-friendly materials and production methods for its emission control and ride control components. For instance, by late 2024, major automotive markets saw a notable surge in demand for vehicles meeting stricter emission standards, with some regions reporting over 20% year-over-year growth in EV and hybrid sales, directly correlating with the need for advanced sustainable componentry.

Aging Vehicle Fleet and Maintenance Needs

The world's vehicle fleet is getting older, and this trend is a significant boon for companies like Tenneco. As cars and trucks age, they naturally require more maintenance and replacement parts. This creates a consistent and reliable demand for Tenneco's core product categories, which include emission control systems, ride control components, braking parts, and sealing solutions. This demographic shift in vehicle ownership is a key driver for Tenneco's aftermarket business segment.

Consider these points:

- Aging Fleet Growth: The average age of vehicles on the road globally has been steadily increasing. For instance, in the United States, the average age of light-duty vehicles reached a record high of around 12.5 years in 2023, a figure expected to continue its upward trajectory into 2024 and beyond.

- Increased Aftermarket Demand: Older vehicles are more prone to wear and tear, necessitating more frequent repairs and part replacements. This directly translates to a stronger market for aftermarket suppliers.

- Tenneco's Position: Tenneco is well-positioned to capitalize on this trend, offering a broad portfolio of replacement parts that address the maintenance needs of this aging global fleet.

Impact of Urbanization on Vehicle Demand

The ongoing shift of populations to cities, a trend expected to see over 65% of the global population residing in urban areas by 2050, directly fuels the need for more vehicles. This isn't just about more cars; it's about a change in the *kind* of vehicles demanded. As urban spaces become more congested, there's a noticeable preference for smaller, more fuel-efficient, and often electric vehicles (EVs) to navigate city streets and comply with emissions regulations. This evolving urban mobility landscape directly influences Tenneco's product development and sales strategies.

This urbanization trend can significantly impact Tenneco's product mix. For instance, the growing demand for compact and electric vehicles means a potential increase in the need for specialized suspension components, exhaust systems designed for smaller engines or EV powertrains, and potentially lighter-weight materials. Data from 2024 indicates a continued surge in EV sales, with projections suggesting they will constitute a substantial portion of new vehicle registrations in major metropolitan areas within the next few years, directly affecting the types of aftermarket and OE parts Tenneco will supply.

- Urban Population Growth: Global urban population projected to reach 68% by 2050, driving increased transportation needs.

- Shift to Smaller Vehicles: Urban dwellers often favor compact and fuel-efficient cars due to parking and traffic constraints.

- EV Adoption in Cities: Major cities are leading the charge in electric vehicle adoption, influencing Tenneco's product focus.

- Demand for Efficient Powertrains: Urbanization correlates with a higher demand for emissions-compliant and fuel-saving vehicle technologies.

Societal expectations are increasingly prioritizing sustainability and ethical business practices, influencing consumer purchasing decisions and investor sentiment. This means companies like Tenneco must demonstrate a commitment to environmental responsibility and corporate social governance. For example, a 2024 survey revealed that over 70% of consumers consider a company's environmental impact when making purchasing choices, directly pressuring automotive suppliers to adopt greener manufacturing processes and materials.

The growing emphasis on vehicle safety and advanced driver-assistance systems (ADAS) is another key sociological factor. Consumers are demanding vehicles equipped with the latest safety technologies, which in turn drives demand for specialized components. By 2025, it's projected that over 80% of new vehicles sold in developed markets will feature some form of ADAS, creating opportunities for Tenneco to supply related components such as advanced braking systems and sensor-integrated suspension parts.

The global workforce demographic is also evolving, with a greater demand for skilled labor in areas like advanced manufacturing and software development for automotive technologies. Tenneco needs to attract and retain talent capable of innovating in areas like electric vehicle components and smart suspension systems. The 2024 automotive labor market report highlighted a significant skills gap in specialized automotive engineering roles, underscoring the importance of talent acquisition and development for companies like Tenneco.

Consumer expectations for personalized and connected vehicle experiences are on the rise. This includes demands for customizable ride comfort, integrated infotainment systems, and seamless connectivity. Tenneco's ability to develop adaptable ride control systems and components that integrate with vehicle electronics will be crucial. By 2025, the connected car market is expected to exceed $200 billion globally, indicating a strong consumer appetite for technology-driven automotive solutions.

Technological factors

Rapid advancements in electric vehicle (EV) technology, particularly in battery energy density and charging speeds, are reshaping the automotive landscape. For instance, by 2025, battery costs are projected to fall below $100 per kilowatt-hour, making EVs more competitive. This shift directly impacts Tenneco, as its traditional exhaust and emissions control systems are less relevant for EVs, necessitating a pivot towards components supporting EV platforms, such as thermal management systems and specialized suspension components for lighter vehicle architectures.

The increasing sophistication of Advanced Driver-Assistance Systems (ADAS), moving towards higher levels of automation, directly impacts Tenneco's product roadmap. As features like adaptive cruise control and lane-keeping assist become standard, even at Level 2, the demand for advanced braking and suspension systems that can seamlessly integrate and enhance these functionalities grows. For instance, by mid-2024, over 50% of new vehicles sold in the US were equipped with at least one Level 2 ADAS feature, highlighting this trend.

Tenneco's commitment to innovation in ride control and braking technologies is crucial to meet the evolving safety and performance expectations driven by autonomous driving. The company must ensure its offerings can support the precise control and rapid response times required for advanced ADAS, and ultimately, fully autonomous vehicles. This necessitates ongoing investment in research and development to stay ahead of the curve in this rapidly advancing technological landscape.

Tenneco's manufacturing operations are increasingly benefiting from the integration of smart factory principles and Industry 4.0 technologies. The company is leveraging artificial intelligence and digitalization to streamline its production lines, leading to enhanced efficiency and greater output capacity. For instance, by implementing AI-driven predictive maintenance in its plants, Tenneco can reduce unplanned downtime, a significant factor in maintaining production schedules and controlling costs.

Innovation in Materials Science for Lightweighting

Ongoing advancements in materials science, particularly in lightweight alloys and composites, are fundamentally reshaping the automotive industry. These innovations are directly linked to improving fuel efficiency and reducing overall vehicle weight, critical factors for meeting evolving environmental regulations and consumer demands. For instance, the adoption of aluminum alloys in vehicle frames can reduce weight by up to 30% compared to traditional steel, directly impacting fuel economy.

Tenneco's product development and engineering teams must actively integrate these cutting-edge materials into their designs. This strategic incorporation allows for the creation of lighter, more efficient suspension and exhaust systems. The global market for advanced lightweight materials in automotive is projected to reach over $50 billion by 2025, highlighting the significant opportunities and necessity for Tenneco to stay at the forefront of this trend.

- Advancements in aluminum alloys and carbon fiber composites are key drivers for vehicle lightweighting.

- Lighter vehicles directly translate to improved fuel efficiency and reduced emissions.

- Tenneco's engineering must prioritize the integration of these advanced materials for competitive advantage.

- The automotive lightweight materials market is experiencing substantial growth, indicating a strong industry trend.

Digitalization and Connectivity in Vehicles

The automotive industry's rapid digitalization and increasing connectivity are fundamentally reshaping vehicle design and functionality. The integration of technologies like 5G, advanced driver-assistance systems (ADAS), and sophisticated infotainment platforms means components must be more integrated and intelligent. This shift directly impacts how Tenneco's emission control and ride control systems are designed and implemented within the overall vehicle architecture, requiring greater adaptability and electronic integration.

By 2025, it's projected that over 90% of new vehicles sold globally will feature some form of advanced connectivity, including over-the-air updates and real-time diagnostics. This pervasive connectivity necessitates that automotive suppliers like Tenneco develop solutions that are not only mechanically robust but also seamlessly communicate with the vehicle's digital ecosystem. The demand for enhanced user experiences and data-driven services is pushing component manufacturers to innovate beyond traditional hardware.

- 5G Integration: Enabling faster data transfer for vehicle-to-everything (V2X) communication and real-time diagnostics.

- Advanced Infotainment: Driving demand for components that support richer multimedia experiences and personalized settings.

- Software-Defined Vehicles: Shifting focus from hardware to software updates for vehicle features, impacting component lifecycles and upgrade paths.

- Data Analytics: Increasing the importance of sensors and control units that can collect and transmit valuable performance and diagnostic data.

The automotive industry's embrace of electric vehicles (EVs) significantly alters demand for traditional components like exhaust systems, pushing Tenneco towards EV-specific technologies such as thermal management. By 2025, EV sales are expected to represent a substantial portion of the global market, driving this strategic shift. Furthermore, the proliferation of advanced driver-assistance systems (ADAS) necessitates more sophisticated braking and suspension solutions to ensure safety and performance, with over half of new vehicles in the US already featuring Level 2 ADAS by mid-2024.

Tenneco's manufacturing efficiency is being boosted by Industry 4.0 technologies, including AI for predictive maintenance, which minimizes downtime. Simultaneously, advancements in lightweight materials like aluminum alloys are critical for improving fuel efficiency, a trend supported by a global automotive lightweight materials market projected to exceed $50 billion by 2025. The increasing digitalization and connectivity of vehicles, with over 90% of new cars expected to be connected by 2025, also demand greater integration of Tenneco's components with the vehicle's digital ecosystem.

Legal factors

Global and regional emission standards, like the European Union's CO2 targets and various clean air acts, are pushing for advanced emission control technologies. Tenneco is directly impacted, needing to ensure its product lines, such as exhaust systems and catalytic converters, consistently meet these evolving and stricter requirements.

For instance, the EU's proposed CO2 emission standards for new cars and vans for 2030 aim for a 55% reduction compared to 1990 levels, with a full phase-out of internal combustion engine vehicles by 2035. This necessitates Tenneco's continuous innovation in emission reduction solutions to remain compliant and competitive in these key markets.

Tenneco must navigate increasingly stringent product liability laws and evolving safety standards for its automotive components, including braking and ride control systems. Failure to meet these rigorous requirements, such as updated crashworthiness regulations or emissions control standards, could lead to costly recalls and significant legal penalties. For instance, in 2024, the automotive industry faced increased scrutiny regarding advanced driver-assistance systems (ADAS) safety, impacting component suppliers like Tenneco.

Shifting international trade laws, particularly those concerning tariffs on automotive parts and finished goods, directly influence Tenneco's operational expenses and the cost-effectiveness of its global supply chain. For instance, the United States imposed tariffs on steel and aluminum in 2018, which increased raw material costs for manufacturers like Tenneco.

Navigating these complex import/export regulations is paramount for maintaining seamless international operations and avoiding costly disruptions. In 2024, ongoing trade discussions and potential adjustments to agreements like the USMCA continue to create uncertainty for companies with significant cross-border manufacturing and sales activities.

Data Privacy and Cybersecurity Regulations

The automotive sector's increasing reliance on connected vehicles and the vast amounts of data they generate mean that data privacy and cybersecurity regulations are gaining significant traction. While Tenneco's core business in emissions control and ride performance might not be directly impacted by these laws today, future product development, especially in areas like advanced driver-assistance systems (ADAS) or connected vehicle components, will necessitate strict adherence. For instance, the European Union's General Data Protection Regulation (GDPR) sets a high bar for data handling, and similar frameworks are emerging globally, impacting how vehicle data is collected, stored, and utilized.

As vehicle connectivity expands, Tenneco, like other automotive suppliers, must consider the implications of these evolving legal landscapes. The potential for data breaches and the need to protect sensitive customer information are paramount. Companies are increasingly investing in robust cybersecurity measures, and regulatory bodies are scrutinizing compliance. For example, the Cybersecurity Act of 2015 in the United States, and similar initiatives in other regions, are shaping the cybersecurity requirements for connected technologies, which could indirectly influence component design and manufacturing processes for suppliers.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is crucial for any connected vehicle data processed by Tenneco's future offerings.

- Cybersecurity Standards: Meeting evolving cybersecurity mandates for automotive components will be essential for market access and consumer trust.

- Supply Chain Security: Ensuring the cybersecurity of Tenneco's own supply chain and manufacturing processes is also a growing legal consideration.

- Cross-Border Data Flows: Navigating differing data privacy laws across various international markets presents a complex legal challenge for global suppliers.

Intellectual Property Protection

Protecting intellectual property (IP) is crucial for Tenneco's innovative automotive technologies, forming a cornerstone of its competitive edge. This involves safeguarding patents for novel suspension systems, emissions control technologies, and advanced manufacturing processes. In 2024, the automotive industry continued to see significant investment in R&D, with companies like Tenneco heavily reliant on IP to differentiate their offerings and secure market share.

Tenneco must implement comprehensive strategies to defend its designs and proprietary manufacturing techniques from infringement. This proactive approach ensures that the substantial investments made in developing cutting-edge automotive components translate into sustained financial returns. The company's ability to secure and enforce patents directly impacts its valuation and its capacity to command premium pricing for its technological advancements.

- Patent Portfolio Strength: Tenneco's patent portfolio is a key asset, protecting its innovations in areas like adaptive suspension and exhaust aftertreatment systems.

- Litigation and Enforcement: The company actively monitors the market for potential IP infringements and engages in legal action when necessary to protect its rights.

- Trade Secret Protection: Beyond patents, Tenneco safeguards critical manufacturing processes and proprietary know-how through robust trade secret policies.

- Licensing Opportunities: A strong IP position can also open doors for strategic licensing agreements, creating additional revenue streams.

Tenneco operates within a dynamic legal framework that significantly shapes its business strategy and operational compliance. Evolving global emission standards, such as the EU's stringent CO2 targets for 2030 and 2035, necessitate continuous innovation in Tenneco's emission control technologies to ensure product competitiveness and adherence to regulations. Furthermore, increasing product liability and safety standards, particularly concerning advanced driver-assistance systems (ADAS) and component integrity, require rigorous quality control and potential legal defense against claims.

International trade laws, including tariffs on raw materials like steel and aluminum, directly impact Tenneco's supply chain costs and global operational efficiency, with ongoing trade discussions in 2024 adding a layer of uncertainty. The growing importance of data privacy and cybersecurity regulations, driven by connected vehicle technology, means Tenneco must prioritize robust data protection measures and compliance with frameworks like GDPR for any future connected components or data handling. Finally, the protection of intellectual property, including patents for innovative suspension and emissions systems, is paramount for maintaining Tenneco's competitive advantage and securing its substantial R&D investments.

Environmental factors

The intensifying global focus on carbon neutrality and increasingly stringent emission reduction mandates within the automotive sector are reshaping Tenneco's business. These environmental pressures directly influence the company's product development, particularly its advanced emission control systems, as manufacturers seek solutions to meet evolving regulatory standards like Euro 7.

This shift fuels a greater demand for Tenneco's technologies designed for enhanced fuel efficiency and reduced pollutant output. For instance, by 2030, the European Union aims to cut CO2 emissions from cars by 55% compared to 1990 levels, a target that necessitates significant innovation in exhaust aftertreatment and powertrain components.

The automotive industry is increasingly prioritizing sustainable materials, with a growing demand for recycled and bio-based components. This shift is pushing manufacturers towards circular economy principles, aiming to minimize waste and maximize resource efficiency. For Tenneco, this means adapting its material sourcing and production processes to incorporate these environmentally friendly alternatives, which could involve exploring partnerships with suppliers specializing in recycled plastics or developing new manufacturing techniques for bio-composites.

Stricter regulations around waste disposal and recycling in the automotive sector, a key market for Tenneco, directly influence its operational costs and strategic planning. For instance, the EU's End-of-Life Vehicles Directive mandates higher recycling rates, pushing manufacturers like Tenneco to design components with recyclability in mind. This focus on circular economy principles is becoming increasingly important for maintaining market access and brand reputation.

Impact of Electric Vehicle Adoption on Environmental Footprint

The accelerating shift towards electric vehicles (EVs) is reshaping the automotive industry's environmental impact. While EVs eliminate tailpipe emissions, a significant portion of their environmental footprint is now concentrated in battery manufacturing, the sourcing of critical raw materials like lithium and cobalt, and the complex processes for battery recycling and disposal. For Tenneco, a key supplier to this evolving sector, these upstream and downstream environmental considerations translate into supply chain risks and opportunities.

The global EV market is projected for substantial growth. By 2023, EV sales surpassed 10 million units globally, representing a significant increase from previous years. Projections for 2024 and 2025 indicate continued strong expansion, with some forecasts suggesting EVs could account for over 20% of new car sales worldwide by 2025. This trend directly influences demand for automotive components, including those Tenneco supplies, and necessitates adaptation to new material requirements and manufacturing standards.

Tenneco's indirect exposure to these environmental factors means the company must navigate:

- Supply Chain Scrutiny: Increasing pressure on automakers to ensure ethical and sustainable sourcing of battery materials will cascade down to their suppliers, including Tenneco, demanding greater transparency and compliance.

- Circular Economy Integration: The development of robust battery recycling infrastructure and the adoption of circular economy principles will become crucial for managing end-of-life components and potentially creating new revenue streams.

- Technological Evolution: The ongoing innovation in battery technology, including solid-state batteries and alternative chemistries, will require Tenneco to adapt its product offerings and manufacturing processes to remain competitive.

- Regulatory Landscape: Evolving environmental regulations related to battery production, carbon footprints, and waste management will shape the operational and strategic decisions for companies like Tenneco within the automotive supply chain.

Water Usage and Pollution Control in Manufacturing

Environmental concerns surrounding water usage and pollution control in manufacturing are increasingly critical. Tenneco's operations, like many in the automotive supply chain, face growing pressure to manage water resources responsibly and minimize effluent discharge. This includes adhering to evolving regulations and public expectations for sustainable practices.

Tenneco's manufacturing facilities must comply with strict water management protocols and pollution prevention standards. These requirements often involve monitoring water intake, optimizing water recycling within processes, and treating wastewater to meet discharge limits. Failure to comply can result in significant fines and reputational damage.

- Water Scarcity: Regions where Tenneco operates may face water stress, necessitating efficient water use and conservation efforts.

- Wastewater Treatment: Manufacturing processes can generate wastewater containing various pollutants, requiring advanced treatment technologies to meet regulatory standards.

- Regulatory Compliance: Environmental agencies worldwide are implementing stricter regulations on water discharge quality and water usage intensity for industrial facilities.

The automotive industry's rapid shift towards electric vehicles (EVs) presents both challenges and opportunities for Tenneco, impacting its product demand and supply chain. With global EV sales projected to exceed 14 million units in 2024 and potentially reach 17 million in 2025, Tenneco must adapt to evolving material needs and manufacturing standards.

Stricter emissions regulations, such as the Euro 7 standards, are driving demand for Tenneco's advanced emission control technologies, encouraging innovation in fuel efficiency and pollutant reduction. Furthermore, a growing emphasis on sustainable materials and circular economy principles necessitates changes in Tenneco's sourcing and production, with a focus on recycled and bio-based components to meet environmental targets.

Water management and pollution control are also critical environmental factors for Tenneco, requiring adherence to increasingly stringent regulations on water usage and wastewater discharge. This includes implementing efficient water conservation measures and advanced treatment technologies to minimize environmental impact and ensure compliance.

| Environmental Factor | Impact on Tenneco | Data/Trend |

|---|---|---|

| EV Transition | Shift in component demand, new material requirements | Global EV sales projected to exceed 14 million in 2024, 17 million in 2025. |

| Emissions Regulations | Increased demand for emission control technologies | EU aims for 55% CO2 reduction from cars by 2030 (vs. 1990). |

| Sustainable Materials | Adaptation in sourcing and production | Growing demand for recycled and bio-based automotive components. |

| Water Management | Operational cost and compliance focus | Stricter regulations on water discharge and usage intensity. |

PESTLE Analysis Data Sources

Our Tenneco PESTLE Analysis is constructed using a comprehensive blend of publicly available data from governmental bodies, reputable financial institutions, and leading industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors impacting Tenneco are grounded in current and credible information.