Tenneco Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenneco Bundle

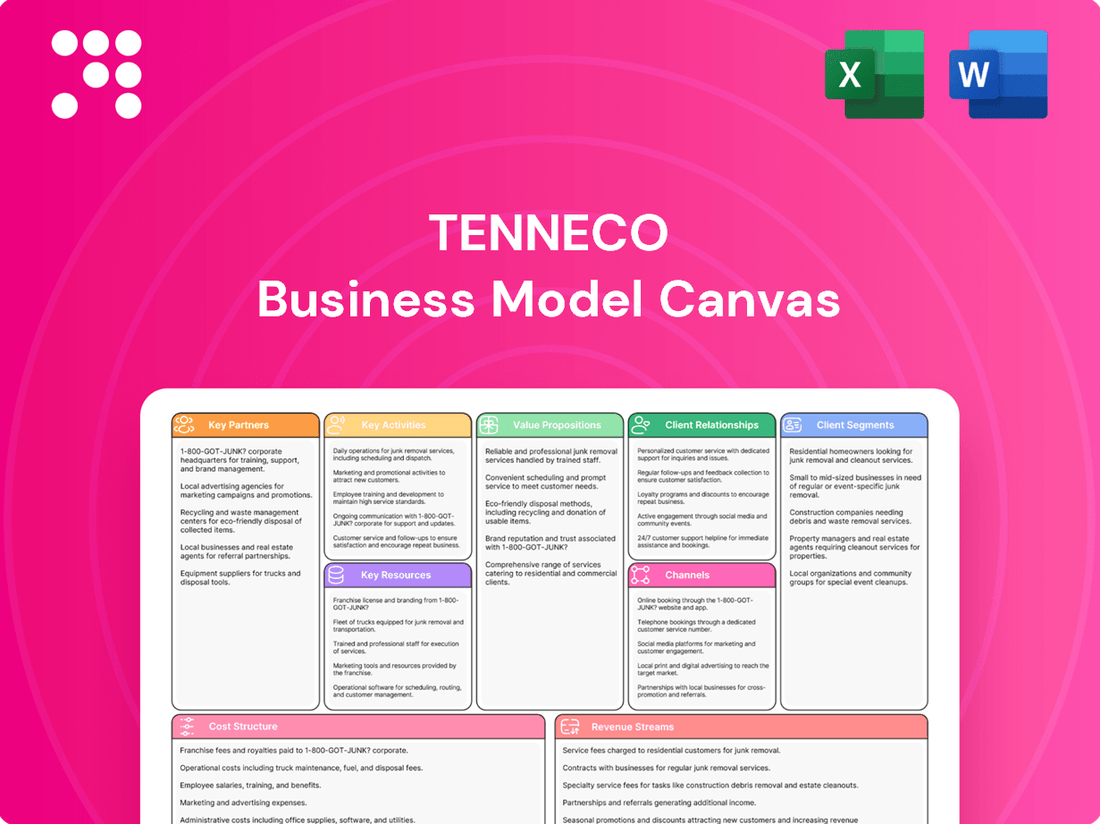

Unlock the strategic blueprint behind Tenneco's success with our comprehensive Business Model Canvas. Discover how they build value, engage customers, and manage resources in the automotive industry.

This detailed canvas offers a clear, actionable view of Tenneco's operations, from key partners to revenue streams. It’s an invaluable tool for anyone looking to understand market leaders.

Ready to gain deeper insights? Download the full Tenneco Business Model Canvas today and accelerate your own strategic planning and competitive analysis.

Partnerships

Tenneco deeply engages with Original Equipment Manufacturers (OEMs) across light vehicle, commercial truck, and off-highway sectors. These vital alliances ensure Tenneco's emission control, ride control, braking, and sealing systems are seamlessly integrated into new vehicle architectures from the outset.

These collaborations are instrumental in the co-development and rigorous testing required to meet stringent, evolving industry standards. For instance, Tenneco's work with OEMs is critical for navigating new emissions regulations like Euro 7 and China 7, ensuring vehicles are compliant upon market release.

Tenneco's DRiV business group relies heavily on its aftermarket distributors to ensure global product availability. These partners are crucial for reaching repair shops and consumers, solidifying Tenneco's position in the aftermarket sector.

In 2024, the automotive aftermarket continued its growth trajectory, with Tenneco's extensive distribution network playing a vital role in capturing this demand.

Tenneco actively partners with technology and innovation leaders to enhance its product portfolio, especially in cutting-edge suspension systems, emissions control, and powertrain advancements. These collaborations focus on novel materials, efficient manufacturing techniques, and digital solutions like AI and virtual simulation for accelerated product development.

By teaming up with these specialized firms, Tenneco aims to maintain its competitive edge and effectively address the evolving needs of the mobility sector, including the significant shift towards electric vehicles. For instance, in 2024, Tenneco continued its investment in research and development, with a significant portion allocated to these strategic technology partnerships, underscoring their importance in driving future growth and innovation.

Private Equity Firms (Apollo Funds, American Industrial Partners)

Tenneco's strategic alignment with private equity firms like Apollo Funds and American Industrial Partners (AIP) is a cornerstone of its operational and growth strategy. Following its acquisition by Apollo Funds in 2022, Tenneco has benefited from ongoing capital infusions aimed at fostering expansion. This partnership is further bolstered by AIP's significant investment alongside Apollo Fund X in Tenneco's Clean Air and Powertrain segments, bringing both financial resources and crucial industrial acumen.

These key partnerships are instrumental in Tenneco's capacity to pursue ambitious growth initiatives, refine its operational efficiencies, and channel investments into cutting-edge manufacturing technologies. The capital provided by these firms, particularly the substantial investment from AIP, directly supports Tenneco's strategic objectives.

- Apollo Funds: Acquired Tenneco in 2022, providing continued investment for growth.

- American Industrial Partners (AIP): Invested alongside Apollo Fund X in Clean Air and Powertrain businesses, offering capital and industrial expertise.

- Strategic Enhancement: These partnerships empower Tenneco to execute growth plans, optimize operations, and invest in advanced manufacturing.

Raw Material and Component Suppliers

Tenneco cultivates vital relationships with a broad spectrum of raw material and component suppliers to fuel its extensive manufacturing activities. These partnerships are crucial for maintaining a reliable and high-quality supply chain, essential for producing advanced emission control, ride control, and braking systems. For instance, Tenneco's commitment to innovation means actively engaging with suppliers for specialized materials, including those for advanced brake friction formulations and components incorporating sustainable and recycled content, a trend gaining significant traction in the automotive sector.

The company's supplier network is foundational to its operational efficiency and product quality. By fostering strong ties, Tenneco ensures access to critical inputs, from the chemical compounds in brake pads to the sophisticated electronic components in modern suspension systems. This strategic approach to procurement is particularly important as the automotive industry, and by extension Tenneco, increasingly emphasizes environmental responsibility and the integration of circular economy principles into its supply chain.

- Supplier Diversity: Tenneco sources a wide array of materials, including metals, polymers, chemicals, and specialized electronic parts from numerous global suppliers.

- Quality Assurance: Robust supplier vetting and ongoing performance monitoring are in place to guarantee the consistent quality of incoming materials and components.

- Sustainability Focus: There is an increasing emphasis on partnering with suppliers who offer sustainable and recycled material options, aligning with Tenneco's environmental goals.

- Strategic Sourcing: Key suppliers are often integrated into Tenneco's product development process, ensuring alignment on material innovation and cost-effectiveness.

Tenneco’s key partnerships are crucial for its OEM relationships, ensuring seamless integration of its systems into new vehicle designs and compliance with evolving regulations like Euro 7. These collaborations also extend to aftermarket distributors who are vital for global product availability, and technology innovators focused on advancements in suspension, emissions, and powertrain technologies, particularly for the growing EV market.

Financial backing from private equity firms like Apollo Funds and American Industrial Partners (AIP) is also a significant partnership, providing capital for expansion and operational improvements. Furthermore, Tenneco relies on a diverse network of raw material and component suppliers to maintain its supply chain integrity and product quality, with an increasing focus on sustainable sourcing.

| Partner Type | Key Partners | Role/Impact | 2024 Focus/Data |

|---|---|---|---|

| Original Equipment Manufacturers (OEMs) | Light Vehicle, Commercial Truck, Off-Highway Manufacturers | System integration, co-development, regulatory compliance | Navigating new emissions standards, EV platform integration |

| Aftermarket Distributors | Global network of aftermarket service providers | Product availability, market reach for repairs and consumers | Capturing growth in the expanding automotive aftermarket |

| Technology & Innovation Leaders | Specialized firms in advanced materials, AI, simulation | Product enhancement, R&D acceleration, future mobility solutions | Investment in EV components and digital manufacturing |

| Financial Partners | Apollo Funds, American Industrial Partners (AIP) | Capital infusion, operational expertise, growth funding | Support for expansion and investment in advanced manufacturing |

| Suppliers | Global network of raw material and component providers | Supply chain reliability, product quality, cost-effectiveness | Emphasis on sustainable materials and circular economy principles |

What is included in the product

A detailed blueprint of Tenneco's operations, outlining its key customer segments, value propositions, and revenue streams to deliver advanced emission control and ride control technologies.

This model highlights Tenneco's strategic partnerships, cost structure, and key resources, providing a clear framework for understanding its position in the global automotive supplier market.

The Tenneco Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, enabling quick identification of inefficiencies and areas for improvement.

It streamlines strategic planning and communication, transforming abstract concepts into actionable insights for teams and stakeholders.

Activities

Tenneco's commitment to innovation is evident in its substantial R&D investments, totaling $340 million in 2024. This funding fuels the development of cutting-edge automotive technologies aimed at enhancing clean air, performance, and suspension systems.

These research and development activities are strategically aligned with anticipating and addressing future market demands. Key areas of focus include developing solutions that meet increasingly stringent environmental regulations, such as the upcoming Euro 7 and China 7 emissions standards, and advancing the company's capabilities in sustainable mobility technologies.

Tenneco's core activities revolve around the global manufacturing and production of a wide array of automotive components. This includes essential systems like emission control, ride control, braking, and sealing technologies, catering to a diverse automotive market.

The company maintains a significant global footprint with manufacturing facilities strategically located throughout North America, Europe, Asia, and South America. This widespread presence allows Tenneco to effectively serve its international customer base and manage its complex supply chain.

A key focus for Tenneco is its dedication to sustainable manufacturing. In 2024, the company continued its efforts to minimize its environmental impact by targeting reductions in energy consumption, greenhouse gas emissions, and operational waste across its production sites.

Tenneco operates a sophisticated global distribution and logistics network, crucial for supplying its components to both original equipment manufacturers (OEMs) and the aftermarket. This intricate system ensures that parts reach vehicle assembly lines and aftermarket retailers promptly and efficiently across the globe.

The company's extensive global presence, boasting over 200 facilities strategically located in 28 countries, underpins its robust distribution capabilities. This widespread infrastructure is vital for managing the complexities of international shipping and local delivery demands, supporting Tenneco's expansive customer base.

Customer Relationship Management and Support

Tenneco's key activities heavily rely on building and nurturing robust relationships with its customer base, which includes major global original equipment manufacturers (OEMs) and aftermarket clients. This focus ensures a consistent demand for their advanced suspension and emissions control technologies.

Understanding specific customer needs and delivering tailored technical support are paramount. Tenneco strives to be more than a supplier, aiming to be a trusted partner by offering customized solutions that address unique challenges within the transportation sector. This commitment translates into a strong emphasis on customer satisfaction and proactive responsiveness.

For instance, in 2024, Tenneco continued to invest in digital platforms to enhance customer interaction and support, aiming to streamline communication and problem-solving. Their dedication to partnership is reflected in their collaborative approach to product development, ensuring their innovations align with evolving OEM requirements and aftermarket trends.

- Customer Needs Assessment: Continuously gathering feedback and data to understand evolving OEM and aftermarket requirements.

- Technical Support & Service: Providing expert technical assistance and after-sales service to ensure optimal product performance.

- Customized Solutions: Developing and offering tailored product designs and service packages to meet specific client needs.

- Relationship Management: Proactively engaging with clients to foster long-term partnerships and ensure high levels of satisfaction.

Strategic Planning and Portfolio Management

Tenneco's strategic planning and portfolio management are crucial following its acquisition by Apollo Funds. This involves a deliberate approach to optimizing its diverse business segments and pinpointing areas ripe for expansion. The company is focused on refining its growth strategies, allocating capital to promising new ventures, and exploring both internal development and external acquisitions.

A prime example of this strategic activity is the significant investment Tenneco received from Apollo Fund X and American Industrial Partners. This capital infusion specifically targets enhancements within its Clean Air and Powertrain divisions, underscoring a commitment to strengthening core areas and pursuing future growth.

Key activities in this area include:

- Strategic Alignment: Ensuring all business segments align with overarching growth objectives and market trends, particularly in the evolving automotive sector.

- Investment Prioritization: Directing capital towards high-potential areas like emission control technologies and advanced powertrain solutions.

- Synergy Realization: Leveraging the expertise and financial backing of Apollo Funds and American Industrial Partners to drive operational efficiencies and market penetration.

Tenneco's key activities center on research and development, manufacturing, and distribution of automotive components. The company invests heavily in R&D, with $340 million allocated in 2024 to develop advanced technologies for clean air, performance, and suspension systems, anticipating future market needs and regulatory changes.

Global manufacturing across over 200 facilities in 28 countries is a core function, producing emission control, ride control, braking, and sealing technologies. This is complemented by a sophisticated global logistics network ensuring timely delivery to OEMs and the aftermarket.

Building strong customer relationships through tailored technical support and customized solutions is paramount. Tenneco aims to be a collaborative partner, enhancing customer interaction via digital platforms and aligning product development with evolving OEM and aftermarket demands.

Strategic planning and portfolio management, particularly after the Apollo Funds acquisition, are critical. This involves optimizing business segments and allocating capital to high-potential areas like Clean Air and Powertrain divisions, supported by significant investment from Apollo Fund X and American Industrial Partners.

What You See Is What You Get

Business Model Canvas

The Tenneco Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup; it's a direct snapshot of the final, comprehensive deliverable. Upon completing your order, you will gain full access to this professionally structured and ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Tenneco operates an extensive global manufacturing footprint, boasting over 184 facilities strategically positioned across North America, Europe, Asia, and South America. This vast network includes not only production sites but also vital engineering centers.

These strategically placed manufacturing facilities are the backbone of Tenneco's operations, enabling the efficient production of its diverse range of automotive components. The company's global presence allows for optimized supply chains and localized manufacturing to effectively cater to specific regional market demands.

Tenneco's proprietary technologies and intellectual property are cornerstones of its business model, particularly in emission control and ride control systems. Innovations like their low emission brake technology and advanced suspension systems, such as the Continuously Variable Semi-Active suspension (CVSAe), represent significant competitive advantages. This commitment to R&D, evidenced by substantial patent portfolios, ensures a continuous stream of groundbreaking technologies.

Tenneco's highly skilled workforce, encompassing engineers, researchers, and manufacturing specialists, is a cornerstone of its success. This talent pool is directly responsible for driving innovation in automotive components and ensuring the superior quality of Tenneco's products across its global operations.

The company's operational philosophy, 'The Tenneco Way,' is deeply intertwined with its human capital, fostering a culture of accountability, speed, and disciplined execution. This approach effectively leverages the expertise of Tenneco's approximately 60,000 global team members to achieve strategic objectives.

Strong Brand Portfolio (e.g., DRiV, Monroe, Walker, Champion)

Tenneco's strong brand portfolio, notably within its DRiV aftermarket segment, acts as a cornerstone of its business model. This collection boasts over 30 established brands, including household names like Monroe, Walker, and Champion, which collectively contribute to significant brand equity and customer recognition across both original equipment manufacturer (OEM) and aftermarket channels. In 2024, the aftermarket segment continued to be a vital revenue driver, demonstrating the enduring strength of these brands.

These well-established brands foster deep customer loyalty and ensure a robust market presence, translating into consistent demand and pricing power. The company's commitment to integrity, cutting-edge engineering, and manufacturing excellence further bolsters its brand reputation, making them trusted choices for consumers and professionals alike.

- Brand Recognition: Over 30 aftermarket brands, including Monroe, Walker, and Champion, drive significant customer recall and preference.

- Market Penetration: Strong presence in both OEM and aftermarket segments, leveraging brand trust for sales.

- Customer Loyalty: Established brands cultivate repeat business and reduce customer acquisition costs.

- Competitive Edge: Brand equity provides a distinct advantage over competitors with less recognized portfolios.

Financial Capital and Investment Support

Tenneco's access to significant financial capital, notably from investors like Apollo Funds and American Industrial Partners, is a cornerstone of its business model. This financial strength is crucial for funding ambitious growth initiatives, enhancing its manufacturing infrastructure, and driving innovation through research and development.

This robust financial backing empowers Tenneco to pursue both internal expansion projects and to consider strategic acquisitions that could further solidify its market position. In 2024, such financial resources are particularly vital for navigating a dynamic automotive supply chain and investing in future technologies.

- Access to Capital: Significant funding from Apollo Funds and American Industrial Partners.

- Strategic Investment: Enables investment in growth, advanced manufacturing, and R&D.

- Expansion Support: Facilitates organic growth and potential strategic acquisitions.

Tenneco's key resources include its extensive global manufacturing and engineering network, proprietary technologies, a skilled workforce, and a strong portfolio of aftermarket brands. Financial capital from investors like Apollo Funds and American Industrial Partners is also critical for growth and innovation.

| Key Resource | Description | 2024 Relevance |

| Global Manufacturing Footprint | Over 184 facilities worldwide, including production and engineering centers. | Enables efficient production and localized market catering. |

| Proprietary Technologies | Innovations in emission control and ride control systems (e.g., CVSAe). | Drives competitive advantage and continuous R&D. |

| Skilled Workforce | Approximately 60,000 global employees, including engineers and specialists. | Drives innovation and ensures product quality under 'The Tenneco Way'. |

| Brand Portfolio | Over 30 aftermarket brands (Monroe, Walker, Champion) with strong equity. | Vital revenue driver in 2024, fostering customer loyalty and market presence. |

| Financial Capital | Funding from investors like Apollo Funds and American Industrial Partners. | Supports growth initiatives, infrastructure enhancement, and R&D investment. |

Value Propositions

Tenneco offers advanced emission control systems designed to help automotive manufacturers comply with evolving global environmental standards, such as the upcoming Euro 7 and China 7 regulations. These sophisticated technologies are crucial for reducing harmful exhaust emissions and enhancing fuel efficiency.

These solutions directly address the growing demand for cleaner transportation, contributing to improved air quality and the broader goal of sustainable mobility. For instance, Tenneco's innovations in catalytic converters and particulate filters are key to meeting these stringent targets.

In 2024, the automotive industry is facing significant pressure to reduce CO2 emissions by an average of 15% by 2025 for new cars sold in the EU, a target that Tenneco's advanced emission control systems directly support.

Tenneco's advanced suspension systems, such as its Continuously Variable Semi-Active (CVSAe) technology, significantly enhance vehicle handling and ride comfort. These systems adapt in real-time to road conditions, providing a smoother, more controlled driving experience.

The company's braking system innovations and NVH performance materials contribute directly to improved vehicle safety. By reducing noise and vibration, and ensuring reliable braking, Tenneco products help drivers maintain better control and reduce fatigue, especially during long journeys or challenging maneuvers.

Tenneco's commitment to quality and reliability is evident in its product engineering, meeting stringent automotive standards. This focus ensures that their components deliver optimal performance across a wide range of environments, from city driving to high-speed highway conditions, reinforcing their value proposition for enhanced vehicle performance and safety.

Tenneco's global aftermarket availability and support, powered by its extensive DRiV portfolio, ensures a vast selection of replacement parts and services are accessible worldwide. This broad reach directly contributes to vehicle longevity and consistent performance for a global customer base.

This robust aftermarket presence generates a predictable and stable revenue stream for Tenneco, solidifying its reputation as a dependable ally within the automotive and transportation sectors.

Sustainable and Eco-Friendly Manufacturing

Tenneco is dedicated to sustainable manufacturing, actively working to lessen its environmental impact. This includes a focus on reducing energy consumption and greenhouse gas emissions across its operations.

These efforts are not just about environmental responsibility; they also resonate with a growing segment of customers and stakeholders who prioritize eco-friendly products and practices. For instance, in 2023, Tenneco reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity.

- Reduced Environmental Footprint: Tenneco's initiatives aim to lower energy usage and decrease greenhouse gas emissions.

- Waste Recycling: The company is increasing its operational waste recycling rates.

- Customer Alignment: This commitment appeals to environmentally conscious consumers and partners.

- Stakeholder Value: Demonstrates corporate responsibility, enhancing brand reputation and investor appeal.

Trusted Partnership and Technical Expertise

Tenneco cultivates a trusted partnership with Original Equipment Manufacturers (OEMs) and aftermarket clients by leveraging its profound technical expertise. This collaboration is crucial for co-developing innovative solutions that meet evolving industry demands.

The company's extensive global network of engineers is a cornerstone of its value proposition. This team's dedication to customer satisfaction translates into highly customized solutions and unwavering support, directly assisting clients in achieving their performance benchmarks and regulatory compliance.

For instance, Tenneco's commitment to advanced engineering was highlighted in its 2024 product development initiatives, focusing on next-generation emissions control systems and suspension technologies designed to enhance vehicle efficiency and driver comfort. This technical prowess directly translates into tangible benefits for their partners.

- Customer-Centric Solutions: Tailored product development based on specific OEM and aftermarket needs.

- Technical Prowess: Deep engineering knowledge applied to emissions, suspension, and powertrain components.

- Global Support Network: Reliable assistance and collaboration across international markets.

- Performance Enhancement: Helping customers meet and exceed performance and regulatory standards.

Tenneco provides advanced emission control systems that help automakers meet stringent environmental regulations, such as Euro 7, and improve fuel efficiency. Their sophisticated technologies are vital for reducing harmful exhaust emissions and contribute to cleaner transportation goals.

The company's suspension and braking innovations enhance vehicle handling, ride comfort, and safety. By reducing noise, vibration, and ensuring reliable braking, Tenneco components help drivers maintain better control and reduce fatigue.

Tenneco's extensive global aftermarket presence ensures a wide range of replacement parts and services are accessible, supporting vehicle longevity and consistent performance worldwide. This robust network also provides a stable revenue stream.

Tenneco is committed to sustainable manufacturing, actively reducing its environmental impact through energy efficiency and greenhouse gas emission reduction. For example, in 2023, Tenneco reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity.

Tenneco cultivates strong partnerships with OEMs and aftermarket clients by leveraging its deep technical expertise and global engineering network. This allows for co-development of innovative solutions tailored to evolving industry demands and customer needs.

| Value Proposition | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Advanced Emission Control | Systems to meet global environmental standards (e.g., Euro 7) | Compliance, cleaner air, improved fuel efficiency | Supports automotive industry's push for lower CO2 emissions, targeting a 15% reduction by 2025 in the EU. |

| Enhanced Vehicle Performance & Safety | Innovative suspension (CVSAe) and braking systems, NVH materials | Superior handling, ride comfort, driver control, reduced fatigue | Directly addresses consumer demand for a smoother, safer driving experience. |

| Global Aftermarket Support | Extensive DRiV portfolio for replacement parts and services | Vehicle longevity, consistent performance, predictable revenue | Ensures continued vehicle operation and maintenance for a global customer base. |

| Sustainable Manufacturing | Focus on reducing energy consumption and greenhouse gas emissions | Environmental responsibility, appeal to eco-conscious consumers | Aligns with corporate social responsibility goals and growing market demand for green products. |

| Technical Expertise & Collaboration | Co-development with OEMs, global engineering support | Customer-centric solutions, meeting performance benchmarks | Facilitates the creation of next-generation vehicle technologies. |

Customer Relationships

Tenneco cultivates enduring partnerships with Original Equipment Manufacturers (OEMs) by assigning specialized account management teams. This approach ensures a deep understanding of each OEM's unique needs and production cycles, facilitating seamless integration of Tenneco's advanced ride control and emissions control technologies.

These dedicated teams engage in collaborative development, offering robust technical support and highly responsive service. For instance, in 2024, Tenneco's commitment to joint engineering efforts with major automotive OEMs led to the successful launch of several new vehicle platforms featuring Tenneco's innovative suspension systems, contributing to improved vehicle dynamics and driver comfort.

Tenneco cultivates strong aftermarket customer relationships through robust distributor programs. These programs offer essential training and marketing support, enabling distributors to effectively promote and service Tenneco's extensive line of replacement parts. This focus on equipping partners directly translates to enhanced customer loyalty and expanded market penetration.

Tenneco actively partners with Original Equipment Manufacturers (OEMs) for technical collaboration and co-development. This deep engagement allows them to tailor solutions to specific vehicle needs and anticipate future industry shifts. For instance, in 2024, Tenneco's advanced suspension systems were co-developed with leading automakers to enhance vehicle dynamics and ride comfort, reflecting a commitment to shared innovation.

Global Customer Service and Accessibility

Tenneco's commitment to global customer service ensures localized support across its numerous operating regions, enhancing accessibility and responsiveness to a diverse clientele. This approach is crucial for addressing varied regional needs and fostering strong relationships worldwide.

With operations spanning North America, South America, Europe, and Asia, Tenneco maintains a significant global presence. For instance, in 2024, the company continued to emphasize its extensive distribution network, which is key to providing timely support and service to its customers, whether they are in Detroit, Mexico City, or Shanghai.

- Global Reach: Tenneco operates in over 25 countries, facilitating localized customer service.

- Accessibility: The company provides support through various channels, including dedicated regional teams and digital platforms, ensuring customers can easily connect.

- Responsiveness: By understanding regional nuances, Tenneco aims for efficient problem-solving and issue resolution, a critical factor in maintaining customer satisfaction in competitive markets.

Sustainability Partnerships and Reporting

Tenneco actively partners with its customers on sustainability initiatives, fostering transparency through its comprehensive annual sustainability reports. This commitment to open communication builds significant trust, particularly with clients who increasingly prioritize environmental stewardship in their own operations.

Collaboration on eco-friendly solutions is a cornerstone of these relationships. For instance, in 2024, Tenneco highlighted its work with key automotive manufacturers to develop lighter, more fuel-efficient exhaust systems, contributing to reduced emissions. This focus on shared environmental goals strengthens customer loyalty and aligns Tenneco with a growing market segment.

- Customer Engagement: Direct collaboration on sustainability projects and transparent reporting.

- Trust Building: Annual sustainability reports provide data on Tenneco's environmental performance.

- Eco-Friendly Solutions: Joint development of products that reduce environmental impact.

- Market Alignment: Meeting the demand from customers who prioritize corporate social responsibility.

Tenneco fosters strong customer relationships through dedicated account management for OEMs, ensuring deep understanding and seamless integration of their technologies. Collaborative development and responsive technical support are key, as demonstrated by successful joint engineering efforts in 2024 with major automotive manufacturers for new vehicle platforms. Furthermore, robust distributor programs in the aftermarket provide essential training and marketing support, enhancing customer loyalty and market reach.

| Customer Segment | Relationship Approach | Key Activities | 2024 Focus/Data Point |

|---|---|---|---|

| Original Equipment Manufacturers (OEMs) | Strategic Partnerships & Co-Development | Dedicated Account Management, Joint Engineering, Technical Support | Successful launch of new vehicle platforms with advanced suspension systems. |

| Aftermarket Distributors | Empowerment & Support Programs | Training, Marketing Support, Responsive Service | Expansion of distribution network to enhance timely support globally. |

| End Consumers (Indirect) | Product Quality & Innovation | Delivering advanced ride control and emissions control technologies | Continued emphasis on developing lighter, more fuel-efficient exhaust systems. |

Channels

Tenneco's primary sales channel for its original equipment manufacturer (OEM) business is direct sales. This involves building close relationships with automotive manufacturers to supply critical components for new vehicle assembly lines. In 2024, Tenneco continued to leverage its engineering expertise and dedicated technical sales force to secure these high-volume contracts, a strategy that has historically driven significant revenue.

Tenneco leverages a comprehensive global aftermarket distribution network. This includes thousands of independent distributors, wholesalers, and retailers across the Americas, Europe, and Asia.

This expansive network ensures Tenneco's replacement parts and components are readily available to a wide array of customers, from independent repair shops to large service centers and individual consumers.

For instance, in 2023, Tenneco's aftermarket segment generated over $4 billion in revenue, underscoring the critical role of its widespread distribution channels in reaching global markets.

Tenneco actively utilizes online platforms to showcase its extensive product catalogs and disseminate critical information, particularly to its aftermarket customer base. This digital presence is crucial for reaching a broad audience and facilitating product discovery.

The company's corporate website and various digital channels serve as key avenues for promoting its advanced technologies and highlighting its commitment to sustainability initiatives. This digital engagement strategy aims to build brand awareness and communicate its value proposition effectively.

While specific e-commerce functionalities may vary, Tenneco's online strategy is designed to enhance customer interaction and provide accessible information, supporting sales and brand loyalty in a competitive automotive landscape.

Industry Trade Shows and Exhibitions

Tenneco leverages industry trade shows and exhibitions as a vital channel to connect with the automotive ecosystem. Participation in events like Auto Shanghai, a major global automotive exhibition, allows Tenneco to unveil its latest innovations in emissions control and ride performance technologies. These platforms are instrumental in nurturing relationships with both current and prospective clients, offering a tangible space to demonstrate product capabilities and discuss future collaborations.

These exhibitions are not just about showcasing products; they are strategic touchpoints for market intelligence. By attending, Tenneco gains firsthand exposure to emerging trends, competitor activities, and evolving customer demands. For instance, in 2023, Auto Shanghai saw a significant focus on electric vehicle (EV) technologies and sustainable mobility solutions, providing valuable insights for Tenneco's product development pipeline.

Key benefits Tenneco derives from these channels include:

- Brand Visibility: Enhanced presence among key industry players and media.

- Lead Generation: Direct engagement with potential customers, leading to new business opportunities.

- Market Insights: Real-time understanding of industry shifts and technological advancements.

- Partnership Development: Opportunities to forge new alliances and strengthen existing partnerships.

Strategic Partnerships and Joint Ventures

Strategic partnerships and joint ventures are crucial channels for Tenneco, enabling both capital infusion and expanded market reach. For instance, the company has historically engaged in such collaborations to bolster its financial standing and tap into new growth opportunities. These alliances can unlock new distribution networks and product development pathways, particularly in specialized segments or emerging markets.

Tenneco's strategic alliances, such as past collaborations with investment firms like Apollo Funds and American Industrial Partners, highlight the importance of these channels. These partnerships often provide significant capital injections, which can be vital for funding research and development, expanding manufacturing capabilities, or acquiring complementary businesses. They also offer access to new customer bases and geographical markets that might otherwise be challenging to penetrate independently.

- Capital Injection: Partnerships can bring in much-needed funds for operational expansion and strategic initiatives.

- Market Access: Joint ventures can open doors to new customer segments and geographic regions.

- Risk Sharing: Collaborations allow for the sharing of development costs and market risks.

- Synergies: Leveraging partner expertise can lead to enhanced product offerings and operational efficiencies.

Tenneco's channels are a mix of direct engagement for OEM clients and extensive distribution networks for the aftermarket. Online platforms and industry events serve as crucial touchpoints for brand building and market insight, while strategic partnerships provide capital and market access.

Customer Segments

Global Automotive Original Equipment Manufacturers (OEMs) producing light vehicles represent a core customer segment for Tenneco. These major manufacturers, such as Toyota, Volkswagen Group, and General Motors, rely on Tenneco for advanced emission control, ride control, and braking systems that are essential for their new vehicle platforms.

Tenneco's components are integrated directly into the manufacturing process, meaning Tenneco's success is tied to the production volumes and technological advancements of these OEMs. For instance, in 2024, the global light vehicle production was projected to reach over 90 million units, highlighting the immense scale of this market and the potential demand for Tenneco's offerings.

The primary driver for these OEM relationships is the need to meet increasingly rigorous global performance, safety, and emissions regulations. Tenneco's ability to innovate and deliver compliant, high-quality systems is paramount to securing and maintaining these critical partnerships. For example, upcoming Euro 7 emissions standards are pushing for even tighter controls on pollutants.

Global automotive original equipment manufacturers (OEMs) focusing on commercial trucks and off-highway vehicles represent a crucial customer segment for Tenneco. This includes makers of heavy-duty trucks, buses, and specialized equipment for construction and agriculture.

Tenneco supplies these OEMs with critical components like advanced emission control systems to meet stringent environmental regulations, robust ride control solutions for demanding operational conditions, and specialized powertrain parts designed for durability and performance in industrial settings. For instance, Tenneco’s solutions are integral to meeting Euro 7 emission standards, which are progressively being adopted globally, impacting the design and manufacturing processes of these vehicles.

Tenneco’s DRiV division caters to a diverse aftermarket customer base, encompassing independent workshops, auto parts retailers, and end-consumers. These customers rely on Tenneco for a comprehensive portfolio of well-known brands that facilitate vehicle maintenance and repair.

In 2024, the global automotive aftermarket was valued at over $450 billion, with a significant portion driven by replacement parts for passenger vehicles. Independent workshops and retailers are key channels, often prioritizing quality and brand recognition, areas where Tenneco's DRiV brands excel.

Motorsport and Performance Vehicle Enthusiasts

Tenneco's Performance Solutions group, alongside brands like Walker and DynoMax, directly targets motorsport and performance vehicle enthusiasts. This segment is driven by a desire for enhanced vehicle capabilities and a passion for automotive excellence.

These enthusiasts prioritize components that offer tangible improvements in speed, handling, and sound. They are often willing to invest in premium parts that deliver a competitive edge or a more exhilarating driving experience.

- Niche Market Focus: Targeting specific racing disciplines and high-performance street applications.

- Technology Driven: Enthusiasts seek advanced materials and engineering for optimal performance.

- Brand Loyalty: Strong recognition and trust in brands associated with racing success and quality.

- Aftermarket Demand: Significant demand for upgrades and replacement parts that exceed OEM specifications.

In 2024, the global automotive aftermarket, which includes performance parts, continued to show robust growth, with projections indicating a market size well into the hundreds of billions of dollars. Enthusiasts represent a key driver of this growth, particularly in segments focused on customization and performance enhancement.

Industrial and Other Specialized Vehicle Manufacturers

Tenneco's reach extends beyond passenger vehicles to include industrial and specialized vehicle manufacturers. This segment represents a crucial diversification of their customer base and revenue. For example, Tenneco supplies components for material handling equipment, like forklifts, and for various industrial machinery, showcasing the breadth of their application engineering.

This diversification is strategically important, reducing reliance on any single market. In 2024, the global industrial vehicle market saw continued demand, driven by infrastructure projects and e-commerce logistics. Tenneco's ability to provide robust and specialized solutions for these demanding environments positions them well within this sector.

- Diverse Applications: Components for forklifts, construction equipment, and agricultural machinery.

- Revenue Diversification: Reduces dependence on the automotive sector, providing stability.

- Market Growth: Benefits from global infrastructure spending and industrial expansion.

- Specialized Solutions: Offers tailored emission control and ride control technologies for heavy-duty applications.

Tenneco serves a broad spectrum of customers, from major global automotive manufacturers producing light and commercial vehicles to the diverse aftermarket segment. This includes independent repair shops and retailers, as well as a specialized niche of performance enthusiasts and industrial equipment makers.

Cost Structure

Raw material and component costs represent a substantial part of Tenneco's expenses. In 2024, the company's cost of revenue, which includes these direct material inputs, was a significant factor in its overall financial performance. For instance, fluctuating prices for steel, aluminum, and other essential metals directly influence Tenneco's procurement budget.

Manufacturing and operational expenses form a significant portion of Tenneco's cost structure, covering the day-to-day running of its global production sites. These include essential outlays for direct labor, the energy powering its machinery, routine maintenance to keep operations smooth, and broader facility overhead. For instance, in 2023, Tenneco reported Cost of Sales of $15.4 billion, a substantial figure reflecting these manufacturing realities.

Tenneco's commitment to eco-efficiency directly influences these costs, particularly through efforts to reduce energy intensity. Lower energy consumption translates to immediate savings on utility bills, a critical factor given the energy-intensive nature of automotive component manufacturing. This focus on sustainability not only benefits the environment but also enhances financial performance by trimming operational expenditures.

Tenneco dedicates significant resources to Research and Development (R&D) to drive innovation in its automotive components. These investments cover the creation of new technologies, the refinement of existing products, and the upkeep of advanced testing facilities, all vital for staying ahead in a dynamic automotive market. For instance, in 2023, Tenneco's R&D expenses were approximately $291 million, reflecting a commitment to future growth and technological leadership.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for Tenneco encompass the costs associated with running its sales and marketing operations, managing its administrative functions, and covering corporate overhead. These expenditures are crucial for driving revenue and maintaining the company's operational infrastructure.

In 2024, Tenneco's SG&A expenses reflect investments in expanding market reach and supporting its global business units. These costs are essential for brand building, customer relationship management, and ensuring efficient day-to-day operations across its diverse product lines.

- Sales and Marketing: Includes costs for advertising, promotions, sales force compensation, and market research to drive product demand and brand awareness.

- General and Administrative: Covers salaries for executive and administrative staff, legal fees, accounting services, and IT support, ensuring smooth business operations.

- Corporate Overhead: Encompasses expenses related to corporate headquarters, including rent, utilities, and other facility-related costs necessary for overall company management.

Logistics and Distribution Costs

Tenneco's expansive global footprint necessitates substantial investment in its logistics and distribution infrastructure. These costs encompass the warehousing of parts, the transportation of finished goods to various markets, and the intricate management of inventory to meet diverse customer demands efficiently.

In 2024, Tenneco's commitment to its vast distribution network translates into significant operational expenses. The company manages a complex web of facilities and transportation partners to ensure its automotive components reach assembly plants and aftermarket customers across continents.

- Warehousing: Maintaining a global network of warehouses to store a wide array of automotive parts.

- Transportation: Costs associated with shipping products via sea, air, and land freight.

- Inventory Management: Expenses related to tracking, optimizing, and holding inventory levels.

- Distribution Network Operations: Overhead for managing the entire supply chain and distribution channels.

Tenneco's cost structure is heavily influenced by its manufacturing and operational expenses, including direct labor and energy. In 2023, the company reported a Cost of Sales of $15.4 billion, underscoring the significant outlays in running its global production facilities. These costs are managed to optimize efficiency and reduce energy intensity, directly impacting financial performance.

Research and Development (R&D) is a key investment area, with approximately $291 million spent in 2023 to foster innovation in automotive components. Sales, General, and Administrative (SG&A) expenses, covering marketing, sales, and corporate overhead, are also substantial, with 2024 reflecting investments in market expansion and global business support.

| Cost Category | 2023 (Approx.) | Key Components |

|---|---|---|

| Cost of Sales | $15.4 billion | Raw materials, direct labor, manufacturing overhead |

| Research & Development | $291 million | New technology development, product refinement, testing facilities |

| SG&A | Varies (reflects marketing, admin, corporate costs) | Sales force, advertising, executive salaries, IT support |

Revenue Streams

Tenneco's Original Equipment (OE) sales to vehicle manufacturers represent a core revenue stream, involving the direct supply of emission control, ride control, braking, and sealing systems. These components are crucial for new vehicle production and are integrated by global automotive OEMs.

This segment often relies on long-term contractual agreements, directly tying revenue to the production volumes of specific vehicle models. In 2024, Tenneco continued to leverage its established relationships with major automakers to secure these vital OE contracts, contributing significantly to its overall financial performance.

Tenneco's DRiV business group generates significant revenue from aftermarket product sales, offering replacement parts and components. This stream is a crucial part of their business model, catering to the ongoing maintenance and repair needs of vehicles as they age.

Unlike original equipment (OE) sales, which can fluctuate with new vehicle production cycles, aftermarket sales typically exhibit greater stability. This resilience is driven by the consistent demand for parts as vehicles accumulate mileage and require servicing, providing a more predictable revenue base for Tenneco.

For instance, in 2023, Tenneco reported that its Aftermarket segment, a key component of DRiV, saw substantial contributions to its overall financial performance, underscoring the importance of this revenue stream in the company's diversified strategy.

Tenneco, a global leader in automotive parts, likely leverages its extensive patent portfolio by licensing proprietary technologies to other manufacturers. This could include advanced exhaust systems, emissions control solutions, or suspension components, generating revenue through upfront fees and ongoing royalty payments based on sales. For instance, in 2023, Tenneco reported significant investments in research and development, signaling a pipeline of innovative technologies ripe for licensing opportunities.

Sales of Specialized Products for Commercial and Off-Highway Vehicles

Tenneco generates significant revenue by selling specialized components tailored for commercial trucks, off-highway equipment, industrial machinery, and motorsport vehicles. This segment is crucial for diversifying its income streams beyond the more volatile light vehicle market.

This strategic focus allows Tenneco to tap into robust sectors like heavy-duty trucking and construction, which often exhibit different economic cycles than passenger cars. For instance, the commercial vehicle aftermarket, a key area for Tenneco's specialized products, is projected to see continued growth driven by fleet maintenance and upgrades.

- Specialized Components: Revenue derived from selling advanced emission control systems, suspension components, and other engineered parts for commercial and off-highway applications.

- Market Diversification: This revenue stream reduces reliance on the passenger car segment, providing stability through different industry demands.

- Growth Drivers: Expansion in infrastructure projects and increased global trade bolster demand for new and replacement parts in the commercial and off-highway sectors.

- 2024 Outlook: Tenneco anticipates continued strength in its commercial vehicle aftermarket business, contributing positively to overall revenue performance in 2024.

Strategic Investments and Capital Returns

As a privately held entity under Apollo Funds, Tenneco's strategic financial maneuvers are central to its revenue generation. These include potential divestitures of non-core assets or business units, which can unlock capital and streamline operations. For instance, Apollo's acquisition of Tenneco in 2023 for approximately $7.1 billion reshaped its financial landscape.

Future revenue streams are also shaped by strategic investments in growth areas and the possibility of public offerings for specific segments. A notable example is the planned initial public offering (IPO) for Tenneco's India unit, which could provide significant capital infusion and enhance shareholder value.

- Strategic Investments: Apollo's ownership allows for targeted capital allocation into areas promising high returns, potentially expanding Tenneco's market reach or technological capabilities.

- Divestitures: The potential sale of underperforming or non-strategic business units can generate immediate cash flow and allow management to focus on core competencies.

- Capital Returns: Beyond operational revenue, Tenneco's financial strategy includes optimizing capital structure and returning value to its owners through various financial instruments.

- Planned IPO for India Unit: This move in 2024 signals a strategy to leverage specific regional strengths and potentially unlock substantial value through public markets.

Tenneco's revenue is significantly driven by its Original Equipment (OE) sales, supplying essential components like emission control and ride control systems directly to vehicle manufacturers. This stream is directly tied to new vehicle production volumes, with long-term contracts forming the backbone of these relationships. In 2024, Tenneco continued to secure these vital OE contracts, bolstering its financial performance through consistent demand from global automotive OEMs.

The DRiV business group's aftermarket sales represent another substantial revenue stream, providing replacement parts for vehicle maintenance and repair. This segment offers greater stability compared to OE sales, as it's less susceptible to new vehicle production cycles and caters to the ongoing needs of aging vehicle fleets. In 2023, Tenneco highlighted the significant contribution of its Aftermarket segment to its overall financial results, underscoring its importance in the company's diversified strategy.

Tenneco also generates revenue from specialized components sold into commercial trucks, off-highway equipment, and motorsport vehicles, diversifying income beyond the light vehicle market. This focus taps into sectors like heavy-duty trucking and construction, which often have different economic cycles. The commercial vehicle aftermarket, a key area for Tenneco, is expected to see continued growth in 2024, driven by fleet maintenance and upgrades.

Furthermore, Tenneco's financial strategy under Apollo Funds involves revenue generation through strategic capital allocation, including potential divestitures of non-core assets and planned initial public offerings for specific segments, such as its India unit. These financial maneuvers, exemplified by Apollo's 2023 acquisition for approximately $7.1 billion, aim to unlock capital and streamline operations, enhancing overall shareholder value.

Business Model Canvas Data Sources

The Tenneco Business Model Canvas is informed by a blend of internal financial reports, customer feedback surveys, and competitive landscape analyses. These sources provide a comprehensive view of the company's operations and market position.