Tenneco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenneco Bundle

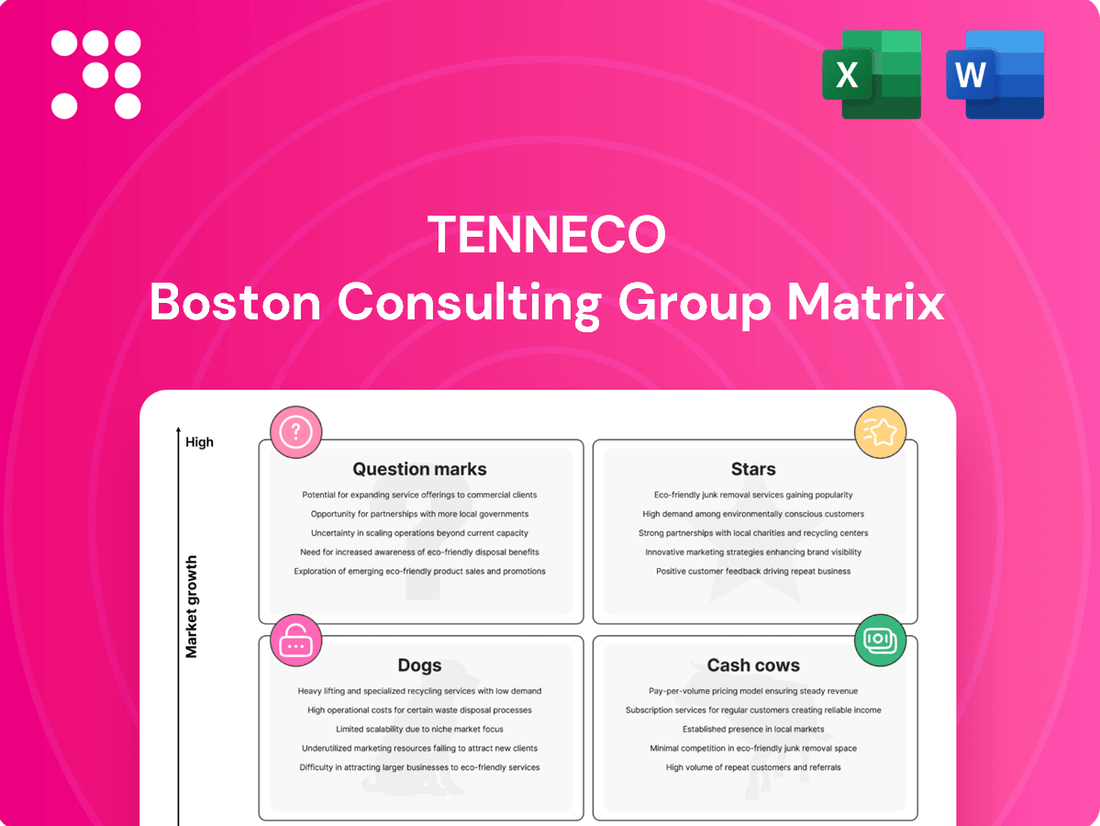

Curious about Tenneco's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full strategic picture; purchase the complete BCG Matrix for actionable insights to optimize your investment and product development strategies.

Stars

Tenneco's advanced braking systems are designed for the growing EV and ADAS markets, positioning them as Stars in the BCG matrix. The automotive brake systems market is booming, with an expected 6.2% compound annual growth rate from 2024 to 2025, and a further acceleration to 8.1% through 2029. This growth is fueled by stricter safety mandates and the increasing popularity of electric and hybrid vehicles.

Through its DRiV group, featuring brands like Wagner Brake, Tenneco is actively participating in these innovations. This strategic focus on high-growth segments like EV and ADAS braking systems suggests a strong competitive advantage and the potential for significant market share capture. The integration of braking technology with these advanced vehicle systems is crucial for future automotive safety and performance.

Next-generation emission control technologies are a clear Star for Tenneco, driven by intensifying global environmental regulations. The company's focus on advanced solutions for both current and future vehicle designs positions it strongly in a growing market.

The global automotive emission control market is expanding significantly, expected to reach USD 70.86 billion by 2033 from USD 50.61 billion in 2024, with a compound annual growth rate of 3.8%. This growth is directly linked to increasing environmental awareness and stricter rules.

Tenneco's Clean Air division, bolstered by a recent strategic investment from Apollo Funds, is well-equipped to capitalize on these trends and accelerate its progress in this dynamic sector.

Tenneco's high-performance and adaptive suspension systems, especially those tailored for electric vehicles and the luxury market, are positioned as Stars in the BCG Matrix. The global automotive suspension systems market is projected to grow at a compound annual growth rate of 4.2% through 2025, and then 5% through 2029, fueled by consumer desires for enhanced comfort, safety, and seamless integration with emerging vehicle technologies.

The selection of Tenneco's Monroe Intelligent Suspension by McLaren Automotive in late 2023 highlights the company's robust market standing and its innovative solutions within this dynamic and expanding sector. This partnership underscores the demand for advanced suspension technology in high-performance vehicles.

Integrated Powertrain Solutions for Evolving Mobility

Tenneco's powertrain segment is positioned as a Star within the BCG matrix due to its strategic focus on adapting to evolving mobility trends, including electrification. Significant investments are being directed here to foster accelerated growth in areas beyond traditional internal combustion engines. This proactive approach allows Tenneco to capture opportunities in a dynamic and expanding segment of the automotive components market.

The company's commitment to this sector is evident in its ongoing development of components compatible with electrified powertrains. While precise product launch figures for 2024 are still materializing, the strategic investments underscore a high-growth expectation. For instance, Tenneco announced in early 2024 its plans to invest heavily in advanced manufacturing for EV components, aiming to double its EV-related revenue by 2027.

- Market Adaptation: Tenneco's powertrain solutions are evolving to meet the demands of electric and hybrid vehicles, a rapidly growing market segment.

- Strategic Investment: Significant capital is being allocated to R&D and manufacturing capabilities for next-generation powertrain components.

- Growth Trajectory: The focus on electrification positions Tenneco for substantial growth as the automotive industry transitions away from solely internal combustion engines.

- Market Position: By investing in these future-oriented technologies, Tenneco aims to maintain and strengthen its competitive standing in a transforming industry.

Aftermarket Innovations for Modern Vehicles

Tenneco's DRiV aftermarket business is actively expanding its new product coverage for modern vehicles and emerging technologies, positioning these offerings as Stars within the BCG matrix. This strategic move capitalizes on the dynamic automotive aftermarket sector.

The automotive aftermarket is experiencing significant expansion, with a projected compound annual growth rate (CAGR) of 15.0% anticipated from 2024 to 2025. This growth is fueled by increasing global vehicle ownership and a robust demand for replacement parts.

DRiV's commitment to market leadership is evident in its introduction of new part numbers for prominent brands such as Monroe and MOOG. These new parts are designed to cover millions of vehicles, demonstrating DRiV's strong presence in a rapidly expanding market segment.

- Expanding Product Lines: DRiV is increasing its range of parts for newer vehicle models and advanced technologies.

- Market Growth: The automotive aftermarket is projected to grow at a 15.0% CAGR between 2024 and 2025.

- Brand Strength: New part introductions for Monroe and MOOG cover millions of vehicles, reinforcing brand leadership.

- Strategic Positioning: These efforts place DRiV's aftermarket innovations firmly in the Star category of the BCG matrix.

Tenneco's advanced braking systems, particularly those for EVs and ADAS, are Stars due to the booming automotive brake systems market, projected to grow at 6.2% CAGR from 2024-2025 and 8.1% through 2029. This growth is driven by safety regulations and EV adoption.

Next-generation emission control technologies are also Stars, benefiting from a global market expected to reach USD 70.86 billion by 2033, with a 3.8% CAGR from 2024. Stricter environmental rules are the primary catalyst.

High-performance and adaptive suspension systems, especially for EVs and the luxury market, are Stars. The global suspension market is expected to grow at a 4.2% CAGR through 2025, then 5% through 2029, driven by demand for comfort and integration with new vehicle tech.

Tenneco's powertrain segment, focusing on electrification, is a Star. The company plans to double its EV-related revenue by 2027 through significant investments in advanced manufacturing for EV components.

The DRiV aftermarket business is expanding product coverage for modern vehicles and emerging technologies, positioning it as a Star. The automotive aftermarket is projected for a robust 15.0% CAGR from 2024 to 2025.

| Tenneco Business Unit | BCG Category | Key Growth Drivers | Market Growth (CAGR) | Notable 2024/2025 Data Points |

|---|---|---|---|---|

| Advanced Braking Systems (EV/ADAS) | Star | EV adoption, ADAS integration, safety mandates | 6.2% (2024-2025), 8.1% (through 2029) | Focus on high-growth segments |

| Next-Gen Emission Control | Star | Environmental regulations, emissions standards | 3.8% (2024-2033) | Market size projected to reach USD 70.86 billion by 2033 |

| High-Performance/Adaptive Suspension | Star | EVs, luxury market, demand for comfort/safety | 4.2% (through 2025), 5% (through 2029) | McLaren Automotive partnership |

| Powertrain (Electrification Focus) | Star | Automotive electrification transition | N/A (specific segment growth) | Plans to double EV revenue by 2027 |

| DRiV Aftermarket | Star | Vehicle ownership, demand for replacement parts | 15.0% (2024-2025) | Expansion of new product coverage |

What is included in the product

The Tenneco BCG Matrix analyzes its business units based on market growth and share to guide investment decisions.

The Tenneco BCG Matrix provides a clear, actionable framework to identify and address underperforming business units, relieving the pain of resource misallocation.

Cash Cows

Tenneco's established aftermarket replacement parts, encompassing shocks, struts, and steering/suspension components for older vehicles, represent a classic Cash Cow. This segment benefits from the automotive aftermarket's substantial size, projected to reach USD 468.91 billion in 2024, ensuring a consistent and reliable revenue stream from ongoing maintenance and repair needs.

With well-established brands like Monroe Shocks and Struts and MOOG Steering and Suspension, Tenneco commands a significant market share in this mature, low-growth but highly profitable sector. These trusted brands generate substantial and stable cash flow, which can then be reinvested in other areas of the business.

Despite the automotive industry's pivot to electric vehicles, Tenneco's traditional emission control components for internal combustion engine (ICE) vehicles continue to be a robust Cash Cow. This segment benefits from a substantial existing fleet requiring replacement parts and ongoing compliance with emissions regulations for older vehicles.

In 2024, the aftermarket for emission control systems, including catalytic converters and mufflers, remained strong, driven by the sheer volume of ICE vehicles on the road globally. Tenneco's established market position and efficient manufacturing processes ensure consistent revenue streams and healthy profit margins from this mature business.

Tenneco's established business in conventional braking system components is a prime example of a Cash Cow within its portfolio. This segment caters to a vast and enduring market of existing passenger and commercial vehicles. The demand is consistent, fueled by routine wear and tear and essential safety regulations requiring component replacements.

The company's strong brand recognition, particularly with names like Wagner Brake, solidifies its market position. This allows Tenneco to generate substantial and predictable cash flow from this mature segment. Investment needs are relatively low, primarily focused on maintaining production efficiency rather than aggressive market expansion or promotion, given the inherent and steady demand.

Sealing Systems for Existing Powertrains

Tenneco's traditional sealing systems for existing internal combustion engine powertrains are likely considered Cash Cows. These products are fundamental to keeping vehicles running smoothly and ensuring their durability in a mature market.

While the growth for these established sealing systems might be modest, their significant market share and dependable demand from both new vehicle production (OEMs) and the repair sector (aftermarket) provide a steady revenue stream. For instance, the global automotive aftermarket was valued at approximately $450 billion in 2023 and is projected to grow at a CAGR of around 3.5% through 2030, indicating continued demand for essential components like seals.

- Established Market Dominance: Tenneco holds a strong position in the market for seals used in current internal combustion engine vehicles.

- Consistent Demand: These products are vital for both the initial manufacturing of vehicles and for ongoing maintenance and repair needs.

- Mature Industry Growth: While the overall market for new ICE vehicles may be slowing, the aftermarket for parts remains robust, ensuring sustained sales.

- Profitability Driver: The combination of high market share and consistent demand makes these sealing systems a significant contributor to Tenneco's profitability.

Legacy Ride Performance Products

Legacy Ride Performance Products, representing mature segments of Tenneco's offerings like standard shock absorbers and suspension components for older vehicle models, function as cash cows within the company's BCG matrix. These foundational products continue to deliver consistent revenue streams, bolstered by Tenneco's strong market position and established customer base in this segment. Despite the automotive industry's shift towards advanced suspension technologies, these essential parts maintain steady demand.

The enduring demand for these legacy products underscores their role as reliable revenue generators for Tenneco. In 2024, Tenneco continued to leverage its extensive distribution network to serve the aftermarket and original equipment manufacturers requiring these established suspension solutions. This segment benefits from predictable sales volumes, contributing significantly to the company's overall financial stability.

- Cash Cow Status: Mature ride performance products are cash cows, generating consistent profits with low reinvestment needs.

- Market Position: Tenneco's established presence and market share in legacy suspension components ensure reliable revenue.

- Demand Stability: Despite market evolution, foundational products for older vehicles maintain steady demand.

- Financial Contribution: These segments provide a stable financial base, supporting investment in growth areas.

Tenneco's established emission control systems for internal combustion engine (ICE) vehicles remain a significant Cash Cow. This segment benefits from a large global fleet of existing ICE vehicles requiring replacement parts, ensuring a steady revenue stream. The aftermarket for emission control components, including catalytic converters and mufflers, was robust in 2024, driven by ongoing vehicle maintenance needs and emissions compliance for older vehicles.

The company's strong market position and efficient manufacturing processes in this mature sector contribute to consistent revenue and healthy profit margins. Tenneco's legacy brands and extensive distribution network further solidify its ability to capitalize on the enduring demand for these essential components, which require minimal reinvestment for growth.

| Category | Tenneco Product Segment | BCG Matrix Classification | Key Characteristics | 2024 Market Context |

| Aftermarket Replacement Parts | Shocks, Struts, Steering/Suspension Components | Cash Cow | Mature market, high brand recognition (Monroe, MOOG), stable demand from existing vehicle fleet, low growth but high profitability. | Automotive aftermarket projected to reach USD 468.91 billion in 2024. |

| Emission Control Systems | Catalytic Converters, Mufflers | Cash Cow | Established market, essential for ICE vehicles, consistent revenue from replacement and compliance, efficient production. | Continued strong demand driven by large global ICE vehicle population. |

| Braking Systems | Brake Pads, Rotors | Cash Cow | Vast and enduring market for passenger and commercial vehicles, consistent demand due to wear and tear and safety regulations, strong brand (Wagner Brake). | Steady demand from existing vehicle population requiring routine maintenance. |

Preview = Final Product

Tenneco BCG Matrix

The Tenneco BCG Matrix preview you're seeing is the definitive document you'll receive upon purchase, offering a clear and actionable framework for strategic business unit analysis. This comprehensive report, meticulously crafted, will be delivered to you without any watermarks or demo content, ensuring immediate professional utility. You can confidently expect the exact same fully formatted, analysis-ready BCG Matrix report that is designed to guide your strategic decision-making. Once purchased, this valuable resource is instantly downloadable, ready to be integrated into your business planning and presentations.

Dogs

Tenneco's portfolio includes highly specialized mechanical components for older vehicle platforms, often characterized by declining demand. These niche products operate in low-growth markets, typically holding minimal market share and generating little to no profit for the company.

The accelerating shift towards vehicle electrification and evolving architectures poses a significant risk of obsolescence for many traditional mechanical parts. For instance, components like specialized exhaust systems for classic internal combustion engine vehicles could see demand plummet as newer, cleaner technologies dominate.

In 2024, Tenneco's focus on advanced emission control systems and suspension technologies for modern vehicles highlights the strategic de-emphasis on these legacy mechanical components. This strategic pivot is crucial for resource allocation and future profitability.

Products highly susceptible to raw material volatility, often found in the Dogs quadrant of the BCG Matrix, are those with minimal differentiation. These offerings are particularly vulnerable when they cannot easily pass on rising input costs to consumers. For instance, basic automotive components like stamped metal parts or simple plastic moldings often fall into this category.

In the current automotive landscape, marked by supply chain disruptions and escalating commodity prices, these products face significant profitability challenges. For example, the price of steel, a key input for many such components, saw significant increases throughout 2023 and into early 2024, impacting manufacturers unable to absorb or pass on these costs.

These types of products typically exhibit both low market share and limited growth potential. Their commoditized nature means competition is fierce, often based solely on price, making it difficult to command premium pricing even when raw material costs surge. Companies with these offerings often struggle to innovate or invest in differentiation, further entrenching them in the Dogs quadrant.

Within Tenneco's extensive product lines, certain legacy brands or specific product segments have demonstrated persistent underperformance. These are often found in mature or declining market segments where they have lost significant market share. For instance, historical data leading up to 2024 indicated that some of their older exhaust system components for older vehicle models, while still in production, were not keeping pace with evolving emissions standards or consumer demand for more advanced aftermarket solutions.

These underperforming legacy brands can be viewed as Tenneco's Dogs in the BCG Matrix. They consume valuable resources, including capital for manufacturing and inventory, without generating substantial returns or contributing meaningfully to the company's strategic growth objectives. The financial burden of maintaining these product lines, especially in light of their declining market relevance, presents a clear case for divestiture to improve overall operational efficiency and resource allocation.

Components for Heavily Declining Vehicle Segments

These components cater to vehicle segments experiencing significant decline. For instance, parts for older, less fuel-efficient heavy-duty trucks or specialized agricultural machinery with low current production volumes fall into this category. The market for these components is shrinking, making it difficult to maintain market share or achieve profitability.

Investing in these areas is generally not advisable for growth. Tenneco’s focus would likely be on managing existing inventory and potentially phasing out production lines rather than seeking expansion. For example, the market for certain diesel particulate filters designed for older engine standards, which are being replaced by newer, more stringent emissions controls, represents a declining segment.

The outlook for these components is dim, with low projected demand and a shrinking customer base. Companies relying heavily on these legacy parts may face challenges in sourcing them reliably and affordably.

- Declining Demand: Segments like older generation heavy-duty trucks see reduced new vehicle sales, impacting demand for related parts.

- Low Market Share: Companies in this space often struggle to maintain significant market share due to the overall contraction of their target markets.

- Limited Investment Returns: Investments in research and development or production capacity for these components are unlikely to yield substantial returns.

- Regulatory Impact: Stricter emissions standards and evolving vehicle technologies further accelerate the decline of older vehicle segments.

Products with High Maintenance or Warranty Costs

Products categorized under high maintenance or warranty costs, even within a stable market, can become significant drains on resources. These items, often found in the Dogs quadrant of the BCG matrix, tie up capital due to persistent repair needs or extensive warranty claims. For instance, a manufacturer of industrial machinery might find certain models, despite steady demand, are consistently flagged for costly component failures. This erodes profit margins and can deter future sales.

These products effectively act as cash traps, consuming funds that could be better allocated to growth areas. The high total cost of ownership, stemming from frequent servicing or part replacements, makes them less attractive to customers. By 2024, some automotive component suppliers experienced this challenge with older, less reliable electronic control units, where warranty claims represented a substantial percentage of the product's initial sale price, impacting overall profitability.

Key characteristics of these "Dogs" include:

- High warranty claims: Products with a history of frequent breakdowns leading to significant payouts under warranty.

- Elevated maintenance costs: Items requiring regular, expensive servicing to remain operational.

- Eroded profitability: The combination of high costs and stable, but not growing, revenue leads to low or negative returns.

- Struggling market share: Customers may opt for competitors offering more dependable or cost-effective alternatives over the product's lifecycle.

Tenneco's "Dogs" represent legacy product lines, often specialized mechanical components for older vehicle platforms, operating in declining markets with minimal market share. These products, such as certain exhaust systems for classic internal combustion engine vehicles, face obsolescence due to the accelerating shift towards electrification and evolving automotive architectures. By 2024, Tenneco's strategic focus on advanced emission control systems for modern vehicles underscores the de-emphasis on these underperforming legacy segments, which consume resources without substantial returns.

Question Marks

Tenneco's specialized EV components, like advanced braking systems designed for regenerative braking and suspension tuned for heavier battery weights, represent emerging product lines. These innovations address the unique demands of the rapidly expanding electric vehicle market.

While the EV sector is booming, Tenneco's market share in these specific, newer product categories is still in its formative stages. Significant capital allocation is necessary to solidify its position and transform these nascent offerings into future market leaders.

Sophisticated sensors for suspension or braking systems are key components that facilitate and integrate with Advanced Driver-Assistance Systems (ADAS). These sensors provide critical data for functions like adaptive cruise control and automatic emergency braking. The global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, highlighting its significant growth potential.

Tenneco's strategic investment in these ADAS-enabling technologies positions it within a high-growth sector. While Tenneco is expanding its capabilities, its current market share in these highly specialized and competitive ADAS component areas is likely still developing. The increasing adoption of safety regulations and the push towards autonomous driving are major drivers for this market expansion.

Tenneco's foray into digital and software-defined vehicle solutions positions it within a rapidly evolving automotive landscape. The industry's pivot towards software, AI, and enhanced connectivity signifies a significant growth trajectory, with the global automotive software market projected to reach over $100 billion by 2027.

While this represents a high-potential area, Tenneco's existing market share and established expertise in these nascent, software-intensive segments are likely to be limited. Significant investment will be necessary for Tenneco to build a robust presence and compete effectively in this technologically advanced space, which is crucial for future vehicle development and functionality.

Hydrogen Fuel Cell Vehicle Components

Components for hydrogen fuel cell electric vehicles (FCEVs) would fall under the question mark category in the Tenneco BCG Matrix. This is because FCEVs represent a high-growth, yet still relatively niche, segment within the broader alternative propulsion market. Tenneco's investment in research and development for these components signifies a strategic move to capture future market share in this developing technology.

The global FCEV market is projected for significant expansion. For instance, the market was valued at approximately USD 2.0 billion in 2023 and is anticipated to reach over USD 20 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 39%. This rapid growth, coupled with the early stage of widespread adoption, places FCEV components squarely in the question mark quadrant.

- High Growth Potential: The FCEV market is experiencing accelerated growth, driven by government incentives and increasing environmental concerns.

- Niche Market Share: Despite growth, FCEVs currently hold a small percentage of the overall automotive market compared to battery electric vehicles (BEVs).

- Significant R&D Investment: Companies like Tenneco are investing heavily in developing and refining fuel cell technology and its associated components, such as fuel cell stacks, hydrogen storage systems, and balance-of-plant components.

- Uncertain Future Dominance: While promising, the long-term dominance of FCEVs over other alternative powertrains remains a subject of ongoing market development and technological advancement.

New Market Entries in Rapidly Developing Regions

Tenneco's strategic initiatives to enter or expand in rapidly developing automotive markets, characterized by surging vehicle production and demand but currently low market share for Tenneco, would position these ventures as Question Marks in the BCG Matrix. These markets often present high growth potential but require significant investment to build brand recognition and distribution networks.

- High Growth Potential: Emerging markets in Southeast Asia and Africa are projected to see substantial growth in vehicle production. For instance, the Association of Southeast Asian Nations (ASEAN) automotive market is expected to grow at a compound annual growth rate (CAGR) of over 5% through 2030, driven by increasing disposable incomes and urbanization.

- Low Market Share: Tenneco's current presence in many of these regions is nascent, meaning their market share is minimal compared to established global and local competitors. This necessitates aggressive market penetration strategies to gain traction.

- Investment Requirements: Entering these markets demands considerable upfront investment in manufacturing facilities, supply chain development, and marketing efforts to establish a competitive foothold. For example, establishing a new manufacturing plant can cost hundreds of millions of dollars.

- Risk and Uncertainty: The success of these new market entries is not guaranteed. Factors such as regulatory changes, political instability, and evolving consumer preferences introduce a degree of uncertainty, making them classic Question Marks requiring careful management and strategic decision-making.

Tenneco's investments in burgeoning electric vehicle (EV) components, such as advanced braking systems optimized for regenerative braking, represent classic Question Marks. These are high-growth areas, with the global EV market projected to surpass 30 million units sold annually by 2025, yet Tenneco's market share in these specific, newer technologies is still developing.

Similarly, Tenneco's focus on sophisticated sensors for Advanced Driver-Assistance Systems (ADAS) fits the Question Mark profile. The ADAS market is expanding rapidly, expected to reach over $100 billion by 2030, but Tenneco's current penetration in these specialized components is likely nascent, demanding significant investment to capture future growth.

Components for hydrogen fuel cell electric vehicles (FCEVs) are also Question Marks. While the FCEV market is projected for substantial growth, reaching over $20 billion by 2030, it remains a niche segment where Tenneco's market share is still forming, requiring considerable R&D investment.

The company's strategic entries into rapidly developing emerging automotive markets, like Southeast Asia, also fall into the Question Mark category. These regions show strong vehicle production growth, with the ASEAN market projected to grow over 5% annually through 2030, but Tenneco's current market share is minimal, necessitating substantial investment for market penetration.

| Category | Market Growth | Tenneco Market Share | Investment Need | Example |

| EV Components | High | Low | High | Advanced Braking Systems for EVs |

| ADAS Sensors | High | Low | High | Sensors for Autonomous Driving |

| FCEV Components | High | Low | High | Fuel Cell Stack Components |

| Emerging Markets | High | Low | High | Automotive Parts in Southeast Asia |

BCG Matrix Data Sources

Our Tenneco BCG Matrix leverages comprehensive data from financial filings, internal sales figures, and market research reports to accurately assess product performance and market share.