Tenneco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenneco Bundle

Tenneco navigates a competitive landscape shaped by powerful buyer demands and the constant threat of new entrants. Understanding the intensity of these forces is crucial for any stakeholder looking to grasp Tenneco's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Tenneco’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for critical raw materials, such as specialized metals, advanced polymers, and electronic components, significantly impacts Tenneco. When only a few suppliers offer a niche or high-performance material, their bargaining power escalates, potentially driving up Tenneco's input costs. For instance, in 2024, the automotive industry faced continued supply chain challenges, with certain rare earth metals, crucial for advanced electronics in vehicles, experiencing price volatility due to limited global production centers.

Switching suppliers for Tenneco, a major player in the automotive industry, involves significant hurdles. These include the costs of re-tooling manufacturing lines, re-certifying new components with original equipment manufacturers (OEMs), and re-validating the performance and safety of parts from a new vendor. These substantial expenses create high switching costs.

When switching costs are high, existing suppliers gain considerable bargaining power. Tenneco would face considerable disruption and financial outlay to transition to a new supplier. For instance, in 2024, the automotive industry continued to navigate supply chain complexities, where established supplier relationships often meant avoiding costly and time-consuming qualification processes.

Suppliers offering highly specialized or proprietary components, like advanced catalytic converters or sophisticated damping valves essential for Tenneco's product performance, possess significant bargaining power. The critical nature of these inputs ties Tenneco's product quality and innovation directly to these specific suppliers, increasing Tenneco's dependence.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while generally low for raw material providers, becomes a more significant concern for suppliers of highly integrated sub-assemblies or advanced technologies. Such a supplier could potentially enter Tenneco's market directly, offering finished products and becoming a competitor. This possibility, even if not actively pursued, grants these suppliers leverage in pricing and contract negotiations.

For instance, a supplier specializing in a complex exhaust system component could, in theory, begin manufacturing and selling complete exhaust systems. This would directly challenge Tenneco's existing business model in that specific segment. While Tenneco's diversified product portfolio and established market presence mitigate this risk across the board, specific high-value component suppliers might possess the capabilities to pose such a threat.

- Supplier Capability Assessment: Tenneco continually assesses the technical and manufacturing capabilities of its key suppliers to identify any potential for forward integration.

- Contractual Safeguards: Long-term supply agreements often include clauses designed to prevent suppliers from directly competing with Tenneco.

- Market Dynamics: The automotive industry's capital intensity and established distribution channels act as significant barriers to entry for most suppliers considering forward integration.

- Strategic Partnerships: Maintaining strong, collaborative relationships with suppliers can reduce the incentive for them to pursue competitive strategies.

Impact of Raw Material Price Volatility

Raw material price volatility significantly impacts Tenneco. Suppliers often pass these fluctuations, driven by global commodity markets, directly to Tenneco. For instance, steel prices, a key component for Tenneco's exhaust systems, saw considerable upward movement in early 2024 due to supply chain constraints and increased demand from the automotive sector.

This volatility can amplify supplier bargaining power. When demand is high or supply chains face disruptions, such as those experienced in 2023-2024 affecting various industrial metals, suppliers are in a stronger position to dictate terms. Tenneco might then face the difficult choice of absorbing increased costs, impacting its profit margins, or attempting to pass these higher expenses onto its customers, potentially affecting sales volume.

- Steel Price Fluctuations: Average hot-rolled coil steel prices in North America experienced a notable increase of approximately 15-20% between Q4 2023 and Q1 2024.

- Supply Chain Disruptions: Geopolitical events and logistical challenges in 2024 continued to create unpredictable supply chain environments for key raw materials.

- Impact on Margins: For companies like Tenneco, a 5% increase in raw material costs could directly reduce gross profit margins by a similar percentage if not passed on.

Tenneco's suppliers possess significant bargaining power, particularly those providing specialized components or critical raw materials where few alternatives exist. High switching costs, stemming from re-tooling and re-certification processes, further solidify supplier leverage. This dynamic can lead to increased input costs for Tenneco, impacting profitability, especially when coupled with raw material price volatility, as seen with steel prices in early 2024.

| Factor | Impact on Tenneco | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | Limited suppliers for critical materials increase their power. | Continued supply chain challenges for rare earth metals in 2024. |

| Switching Costs | High costs to change suppliers limit Tenneco's flexibility. | Established supplier relationships in 2024 avoided costly qualification processes. |

| Product Differentiation | Suppliers of specialized components have leverage due to critical nature. | Advanced damping valves are essential for Tenneco's product performance. |

| Forward Integration Threat | Potential for suppliers to become competitors. | Suppliers of complex sub-assemblies could theoretically pose a threat. |

| Raw Material Volatility | Suppliers pass price fluctuations to Tenneco. | Steel prices increased 15-20% in North America between Q4 2023 and Q1 2024. |

What is included in the product

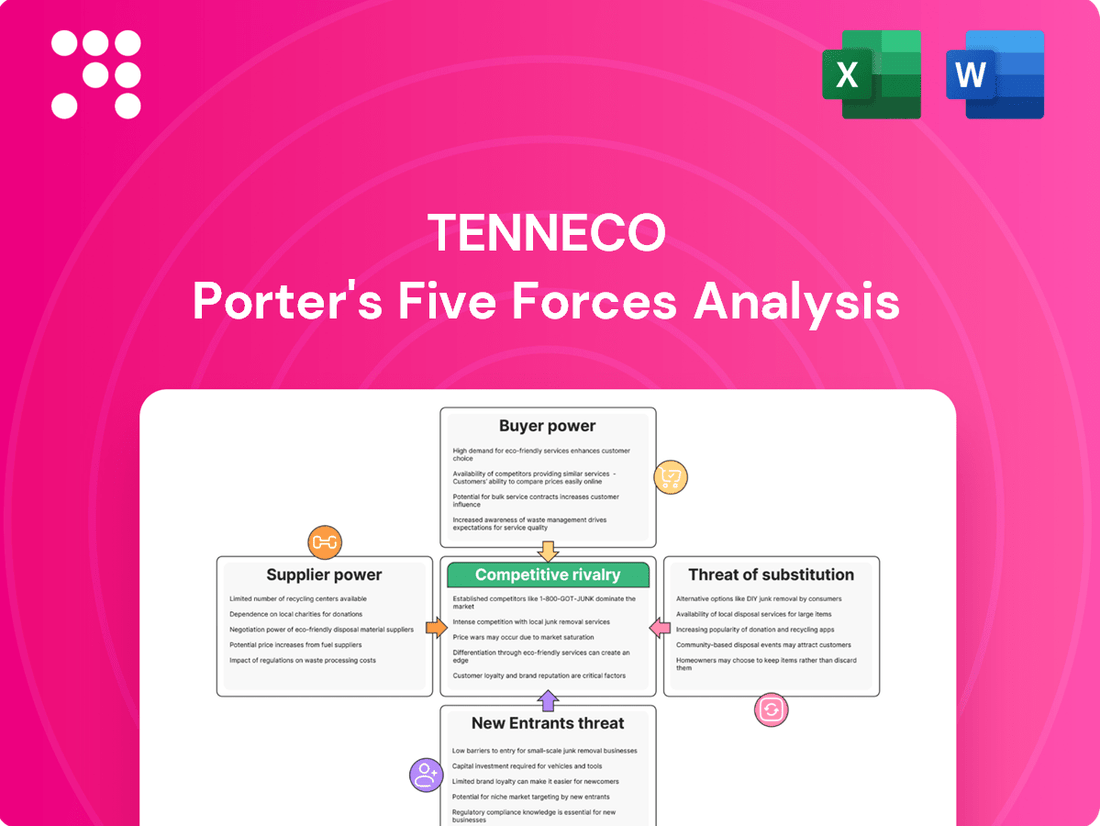

Analyzes the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes impacting Tenneco's automotive components business.

Visualize the competitive landscape with interactive charts, making Tenneco's strategic pressures immediately apparent for informed decision-making.

Customers Bargaining Power

Tenneco's customer base is dominated by a few large, global Original Equipment Manufacturers (OEMs). These major players, such as Ford, General Motors, and Stellantis, procure components in massive quantities. In 2024, it's estimated that these top OEMs represent a substantial portion of Tenneco's total sales, potentially exceeding 70% for certain product lines.

This concentration of powerful buyers grants them considerable bargaining power. Their ability to switch suppliers or negotiate aggressively on price, volume discounts, and contract terms directly impacts Tenneco's margins. For instance, a shift in an OEM's sourcing strategy or a prolonged negotiation could lead to a significant revenue shortfall for Tenneco.

Automotive Original Equipment Manufacturers (OEMs) operate in a fiercely competitive landscape, making them acutely sensitive to the cost of components. This intense focus on cost reduction directly translates into significant bargaining power for these customers when Tenneco is negotiating supply contracts.

For instance, in 2024, the automotive industry continued to grapple with supply chain challenges and fluctuating demand, further amplifying OEM pressure on suppliers like Tenneco to offer the most competitive pricing. This environment compels Tenneco to constantly enhance its operational efficiency and explore innovative cost-saving measures to secure and maintain its relationships with these major clients.

When automotive components become more standardized, original equipment manufacturers (OEMs) find it easier to switch between suppliers. This increased ease of sourcing from multiple vendors directly weakens Tenneco's ability to dictate prices for those particular parts. For instance, if a significant portion of Tenneco's product line consists of widely available, non-proprietary components, customers can readily compare prices and opt for the lowest bidder, thereby eroding Tenneco's pricing leverage.

Threat of Backward Integration by Customers

Large Original Equipment Manufacturers (OEMs), like major automotive brands, often have the substantial financial resources and engineering expertise to consider manufacturing certain components themselves. This is particularly true for less intricate parts where the value addition from specialized suppliers might be marginal. For instance, while a complex engine part is unlikely to be brought in-house, simpler metal stampings or plastic molded components could be candidates.

This potential for backward integration, even if it remains an unexercised threat, significantly influences negotiation dynamics. When customers can credibly threaten to produce parts internally, they gain considerable leverage in discussions about pricing, quality, and delivery terms with suppliers like Tenneco. This leverage can lead to more favorable contract terms for the OEM.

Consider the automotive sector in 2024: major automakers are constantly evaluating their supply chains for cost efficiencies and strategic control. While specific instances of full backward integration for complex automotive components are rare due to the high capital investment and specialized knowledge required, the *possibility* remains a constant factor. For example, a significant portion of the $1.7 trillion global automotive market in 2024 means that even a small percentage of component production brought in-house by a large OEM could represent a substantial volume for a supplier.

- OEMs possess financial clout: Major automotive manufacturers often report billions in annual revenue, providing the capital for potential in-house production investments.

- Technical capabilities are present: OEMs employ large engineering teams capable of designing and overseeing the production of various automotive parts.

- Threat influences pricing: The latent ability of customers to produce components internally acts as a powerful bargaining tool, potentially driving down supplier prices.

- Focus on less complex parts: The threat is more pronounced for components that do not require highly specialized manufacturing processes or proprietary technology.

Volume and Strategic Importance of Purchases

The substantial volume of components that major original equipment manufacturers (OEMs) purchase from Tenneco, combined with the critical role Tenneco's systems, such as braking and emissions control, play in vehicle performance and meeting regulatory standards, grants these customers significant leverage. This influence translates directly into their ability to dictate terms, demand high quality, and set strict delivery schedules.

For instance, in 2024, the automotive industry saw continued consolidation among major OEMs, further concentrating purchasing power. These large buyers, often representing a significant portion of Tenneco's revenue, can negotiate favorable pricing and contract terms due to their sheer scale and the essential nature of Tenneco's offerings for their final product.

- High Purchase Volumes: Major OEMs regularly procure vast quantities of components, making their business a substantial revenue driver for suppliers like Tenneco.

- Strategic System Importance: Tenneco's braking and emissions control systems are fundamental to vehicle safety, performance, and compliance, increasing customer dependence.

- Negotiating Power: The combination of volume and strategic importance allows large customers to exert considerable influence on pricing, quality standards, and delivery timelines.

- Market Concentration: A limited number of large OEMs in key markets amplifies their collective bargaining strength against component suppliers.

Tenneco's bargaining power with its customers is notably diminished due to the concentrated nature of its client base, primarily consisting of a few large Original Equipment Manufacturers (OEMs). These major automotive players, such as Ford and General Motors, wield significant influence due to their sheer purchasing volume and the critical nature of Tenneco's components, like braking and emissions systems, for vehicle functionality and regulatory compliance. In 2024, the automotive sector's ongoing cost pressures and market consolidation further amplified OEM leverage, compelling Tenneco to offer competitive pricing and stringent delivery terms.

| Customer Factor | Impact on Tenneco | 2024 Context |

| Customer Concentration | High bargaining power for few large OEMs | Top OEMs represent significant portion of sales |

| Purchase Volume | Leverage for price and terms negotiation | Large orders amplify customer influence |

| Component Importance | Customer dependence on critical systems | Braking/emissions systems are vital for vehicle performance |

| Switching Costs | Lower for standardized components | Ease of sourcing non-proprietary parts weakens Tenneco's position |

| Potential for Backward Integration | Threat of in-house production | OEMs possess financial and technical capacity for simpler parts |

Same Document Delivered

Tenneco Porter's Five Forces Analysis

This preview displays the complete Tenneco Porter's Five Forces Analysis, detailing the competitive landscape of the automotive parts industry. You're viewing the exact document you'll receive immediately after purchase, offering a comprehensive examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. This professionally formatted analysis is ready for your immediate use, providing actionable insights without any surprises.

Rivalry Among Competitors

Tenneco operates in an automotive components sector, especially ride control and emissions, brimming with many large, established global companies. This crowded field means intense competition as these sophisticated players battle for crucial original equipment manufacturer (OEM) contracts and aftermarket sales. For instance, in 2024, the global automotive aftermarket was valued at over $400 billion, a significant portion of which Tenneco targets, facing rivals like Bosch, ZF Friedrichshafen, and Magna International.

The automotive industry is experiencing a significant slowdown in traditional internal combustion engine (ICE) vehicle sales, with a clear long-term decline projected as electric vehicles (EVs) gain market share. This shift creates intense competitive rivalry for companies like Tenneco, especially those heavily reliant on ICE components, as the pool of available business shrinks.

In 2024, the pressure is palpable. While specific market share figures for ICE versus EV vary by region, the trend is undeniable. For instance, in the first half of 2024, EV sales continued their upward trajectory in major markets like Europe and China, directly impacting demand for ICE-specific parts. This forces suppliers to compete more aggressively for contracts within the shrinking ICE segment, driving down margins and increasing the need for strategic adaptation.

The automotive parts manufacturing sector, including companies like Tenneco, is characterized by substantial fixed costs. These stem from the need for large-scale production facilities, advanced machinery, and ongoing research and development, creating a high barrier to entry and exit. For instance, in 2024, the global automotive supplier market saw continued investment in advanced manufacturing technologies, pushing capital expenditure requirements higher.

These significant upfront investments mean that companies already in the industry face considerable challenges if they decide to leave. Consequently, businesses are incentivized to remain competitive and fight for market share, even during downturns, as the cost of exiting is simply too high. This dynamic intensifies competitive rivalry, as players are committed to staying and defending their positions.

Product Differentiation Challenges

Tenneco faces significant hurdles in differentiating its products within established component markets like braking and ride control. While the company invests in technological advancements, many competitors can closely match performance and quality benchmarks, diminishing the impact of innovation alone.

This parity often shifts the competitive battleground to price and existing customer relationships. Consequently, Tenneco finds itself in a landscape where direct competition is intense, with rivals frequently vying for market share based on cost-effectiveness and established supply chain connections.

- Product Parity: In mature segments like braking and ride control, achieving truly unique and defensible product differentiation is difficult.

- Price and Relationships: Competition often hinges on price competitiveness and the strength of long-standing customer ties.

- Intensified Rivalry: The challenge in differentiation directly fuels a more aggressive competitive environment, impacting Tenneco's market position.

Global Presence and Scale Requirements

Automotive suppliers like Tenneco must possess an extensive global manufacturing and logistics network to effectively serve Original Equipment Manufacturers (OEMs) worldwide. This necessity for a broad international footprint significantly heightens competition among the limited number of companies that can meet these stringent requirements.

These large-scale players vie directly for lucrative, multi-regional supply contracts, often leading to price pressures and demanding terms. For instance, in 2024, major automotive suppliers reported significant investments in expanding their production capabilities across North America, Europe, and Asia to secure these global OEM relationships.

- Global Footprint Necessity: Serving global OEMs demands a widespread international manufacturing and logistics infrastructure.

- Intensified Rivalry: The need for global scale concentrates competition among a select group of capable suppliers.

- Competition for Contracts: Players directly compete for multi-regional supply agreements, impacting pricing and terms.

- 2024 Investment Trends: Major suppliers continued to invest heavily in expanding their global production bases in 2024 to capture these contracts.

Competitive rivalry within the automotive components sector is fierce, driven by a mature industry with numerous established global players like Bosch, ZF Friedrichshafen, and Magna International. This intense competition is further amplified by the industry's substantial fixed costs, which create high barriers to exit, compelling companies to remain and fight for market share even during downturns.

Product parity in segments like ride control and braking means competition often centers on price and existing customer relationships, rather than unique technological advantages. The ongoing shift towards electric vehicles also intensifies rivalry for companies heavily invested in traditional internal combustion engine components, as the available market for these parts shrinks.

The necessity for a global manufacturing and logistics network to serve Original Equipment Manufacturers (OEMs) concentrates competition among a select group of capable suppliers, leading to direct competition for lucrative, multi-regional contracts and significant price pressures. In 2024, major suppliers continued to invest heavily in expanding their global production bases to secure these relationships.

| Key Competitors | Primary Product Segments | 2024 Market Focus |

| Bosch | Powertrain, Chassis, Safety Systems | Electrification, ADAS, Software Solutions |

| ZF Friedrichshafen | Drivetrain, Chassis Technology, Active Safety | EV Drivetrains, Autonomous Driving Systems |

| Magna International | Body & Chassis, Powertrain, Mirrors | EV Platforms, Lightweight Materials |

| Tenneco | Ride Control, Emissions Control | Aftermarket, OE for ICE and emerging EV components |

SSubstitutes Threaten

The accelerating global shift towards Electric Vehicles (EVs) poses a significant long-term threat to Tenneco, especially impacting its emission control technologies and traditional powertrain sealing systems. EVs, by their nature, do not require exhaust systems or many of the complex sealing components found in internal combustion engine (ICE) vehicles.

This transition directly reduces the addressable market for Tenneco's legacy products. By the end of 2023, EV sales represented approximately 14% of the global automotive market, a figure projected to climb substantially in the coming years, further eroding demand for ICE-specific components.

New technologies can create entirely new ways to solve the problems Tenneco's products address, acting as potent substitutes. For example, the rise of advanced vehicle architectures might diminish the demand for traditional suspension systems, while innovative braking technologies could reduce the market for conventional friction brakes.

The increasing prevalence of regenerative braking in electric vehicles (EVs) presents a significant threat to traditional friction brake component suppliers like Tenneco. As EVs become more common, the reliance on friction brakes for deceleration diminishes, as regenerative systems capture energy and slow the vehicle. This shift directly impacts the volume and wear rate of conventional brake pads and rotors.

By 2024, it's estimated that EVs will account for a substantial portion of new vehicle sales globally, with projections suggesting over 20% in major markets. This growing EV penetration means a shrinking addressable market for traditional friction brake parts, as regenerative braking handles a larger percentage of the braking duty cycle. While friction brakes remain essential for emergency stops and holding the vehicle, their lifespan and replacement frequency are significantly extended.

Integrated Vehicle Systems and Software Solutions

The increasing sophistication of integrated vehicle systems and software solutions presents a significant threat of substitution for traditional automotive components. As vehicles become more software-defined, functionalities previously reliant on distinct hardware components can be replicated or enhanced through advanced algorithms and digital platforms. For instance, sophisticated vehicle dynamics software could potentially optimize ride comfort and handling, thereby reducing the necessity for intricate, purely mechanical suspension systems. This shift means that companies focused on traditional hardware might find their products superseded by software-based alternatives that offer comparable or superior performance at a potentially lower cost or with greater adaptability.

This trend is particularly evident in areas like active safety and infotainment, where software updates can introduce new features or improve existing ones without requiring hardware changes. By 2024, the automotive industry saw a substantial increase in software-related investments, with many automakers dedicating billions to developing in-house software capabilities. For example, Stellantis announced plans to invest over €30 billion through 2025 in electrification and software development, highlighting the strategic pivot. This focus on software can lead to:

- Reduced demand for certain mechanical components: As software takes over control functions, the need for complex, specialized hardware may diminish.

- New competitive landscape: Technology companies and software developers are emerging as potential competitors or partners, introducing innovative solutions.

- Shifting value proposition: The value in vehicles is increasingly derived from software features and user experience rather than purely hardware specifications.

- Potential for obsolescence of existing hardware: Older hardware designs may become less desirable or functional as software capabilities advance.

New Materials and Manufacturing Processes

Innovations in materials science and manufacturing processes present a significant threat of substitution for Tenneco. For instance, the rise of advanced composites and additive manufacturing (3D printing) allows for the creation of components that can match or exceed the performance of traditional parts. These new materials and methods can result in products that are not only lighter and stronger but also more cost-effective to produce.

This technological advancement directly challenges Tenneco's existing product lines by offering functional alternatives. Companies can leverage these new capabilities to design and manufacture parts that serve the same purpose as Tenneco's offerings, potentially at a lower price point or with superior attributes. For example, the automotive industry is increasingly exploring lightweight composite materials to improve fuel efficiency, which could displace traditional metal components that Tenneco supplies.

- Advanced Composites: Offer weight reduction and enhanced durability, impacting traditional metal parts.

- Additive Manufacturing (3D Printing): Enables customization and on-demand production, potentially reducing reliance on mass-produced components.

- Cost-Effectiveness: New processes can lower manufacturing costs, making substitutes more competitive.

- Performance Enhancements: Lighter, stronger, or more durable substitutes can offer a competitive edge.

The increasing adoption of electric vehicles (EVs) significantly diminishes the need for traditional exhaust and emission control systems, a core area for Tenneco. By 2024, EV market share is projected to exceed 20% in major automotive markets, directly shrinking the addressable market for these components.

Furthermore, advancements in regenerative braking in EVs reduce reliance on conventional friction brakes, impacting Tenneco's offerings in this segment. The growing sophistication of vehicle software also presents a threat, as digital solutions can increasingly replicate or enhance functions previously handled by mechanical parts.

Innovations in materials science, such as advanced composites and additive manufacturing, offer lighter, stronger, and potentially more cost-effective alternatives to traditional components supplied by Tenneco.

| Threat of Substitutes | Impact on Tenneco | Key Drivers | 2024 Data/Projections | Mitigation/Opportunity |

| Electric Vehicles (EVs) | Reduced demand for emission control systems and traditional powertrain sealing. | Environmental regulations, declining battery costs, government incentives. | EVs projected to be over 20% of new vehicle sales in major markets by 2024. | Focus on EV-specific components, thermal management systems, battery sealing. |

| Regenerative Braking | Decreased wear and replacement cycles for friction brake components. | Energy recovery efficiency in EVs. | EVs utilize regenerative braking for a significant portion of deceleration. | Develop advanced friction materials with longer life, focus on integrated braking systems. |

| Advanced Materials & Manufacturing | Potential displacement of traditional metal components by lighter, stronger alternatives. | Weight reduction for fuel efficiency, customization capabilities. | Increased use of composites and 3D printing in automotive design. | Invest in R&D for new material applications, explore additive manufacturing partnerships. |

| Software-Defined Vehicles | Substitution of mechanical functions by advanced algorithms and digital platforms. | Enhanced vehicle performance, user experience, and feature integration. | Automakers investing billions in software development (e.g., Stellantis €30B+ through 2025). | Develop integrated hardware-software solutions, explore partnerships with tech companies. |

Entrants Threaten

Entering the automotive components manufacturing sector, where Tenneco operates, demands substantial upfront investment. This includes significant capital for research and development, acquiring specialized manufacturing equipment, and establishing global production and distribution networks. For instance, setting up a new advanced manufacturing facility for powertrain components can easily run into hundreds of millions of dollars.

Established players like Tenneco benefit from significant economies of scale, which directly impact their cost structure. New entrants would find it challenging to match these cost efficiencies, making it difficult to compete on price. In 2024, major automotive suppliers often operate with production volumes that allow them to negotiate better raw material prices and optimize labor costs per unit, creating a substantial barrier.

Securing contracts with major automotive Original Equipment Manufacturers (OEMs) presents a significant hurdle for new entrants. This process is lengthy and rigorous, requiring proven reliability, exceptional quality, and a robust global supply chain. For instance, in 2024, the average lead time for a new supplier to be fully integrated into an OEM's production line can extend beyond two years, a substantial commitment that deters many newcomers.

Incumbents like Tenneco benefit from decades of established relationships and deeply ingrained trust with OEMs. This history translates into preferential treatment and a smoother integration process, creating a formidable barrier to market entry for any company lacking such established connections. In 2023, approximately 85% of new vehicle platforms were supplied by existing, long-term partners of major automotive manufacturers, underscoring the difficulty for new players to break into the supply chain.

Tenneco’s substantial portfolio of patents and proprietary technologies in areas like emission control and ride dynamics creates a formidable hurdle for newcomers. This intellectual property makes it incredibly difficult for new companies to replicate Tenneco's core product offerings without significant investment in research and development, effectively deterring potential entrants.

Strict Regulatory and Safety Standards

The automotive industry is heavily regulated worldwide, especially concerning safety and emissions. For instance, the U.S. Environmental Protection Agency (EPA) sets strict emissions standards, and the National Highway Traffic Safety Administration (NHTSA) mandates rigorous safety testing. New companies entering this market must invest heavily in research, development, and compliance to meet these exacting requirements, which can take years and significant capital.

These complex compliance processes act as a substantial barrier to entry. Companies like Tenneco, which specialize in emission control and ride performance, must navigate a labyrinth of certifications and approvals. For example, achieving compliance with Euro 7 emissions standards, expected to be fully implemented in the coming years, will require substantial engineering and financial resources, deterring many potential new competitors.

- High R&D Investment: Meeting evolving emissions and safety regulations, such as those for electric vehicle components, demands significant upfront investment in research and development.

- Testing and Certification Costs: Extensive and costly testing and certification processes are required to validate compliance with global automotive standards.

- Industry Expertise: Deep technical knowledge and experience are essential to design and manufacture components that meet these stringent requirements.

Supply Chain Complexity and Global Footprint

Building a robust, globally integrated supply chain, essential for just-in-time delivery to original equipment manufacturers (OEMs) worldwide, represents a monumental challenge. This complexity and the sheer cost of establishing such a network create a formidable barrier for any new player attempting to enter the automotive parts manufacturing sector.

The logistical expertise and existing infrastructure required are substantial, making it difficult for newcomers to compete with established companies like Tenneco. For instance, in 2024, the automotive industry continued to grapple with supply chain disruptions, highlighting the critical need for resilient and sophisticated logistical capabilities that new entrants would struggle to replicate quickly.

- Global Supply Chain Investment: Companies like Tenneco invest billions annually to maintain and optimize their worldwide manufacturing and distribution networks.

- Logistical Expertise: The intricate management of global logistics, including customs, transportation, and inventory, requires years of experience and specialized knowledge.

- Just-In-Time (JIT) Delivery: Meeting the JIT demands of major automakers necessitates a highly synchronized and reliable supply chain, a feat difficult for new entrants to achieve.

The threat of new entrants in the automotive components sector, where Tenneco operates, is generally low due to significant barriers. High capital requirements for manufacturing facilities and R&D, coupled with the difficulty of securing OEM contracts, deter new players. Established relationships and intellectual property further solidify Tenneco's position, making market entry a formidable challenge for newcomers in 2024.

| Barrier | Description | 2024 Impact on New Entrants |

|---|---|---|

| Capital Investment | Establishing advanced manufacturing and R&D facilities requires hundreds of millions of dollars. | Prohibitive cost for most potential entrants. |

| OEM Contracts | Securing long-term supply agreements with automotive manufacturers is a lengthy, rigorous process. | Average integration time exceeds two years, a significant deterrent. |

| Economies of Scale | Existing players benefit from lower per-unit costs due to high production volumes. | New entrants struggle to compete on price against established cost structures. |

| Brand Loyalty & Relationships | Decades-old relationships with OEMs create preferential treatment and trust. | Approximately 85% of new vehicle platforms in 2023 were supplied by existing partners. |

| Intellectual Property | Patents and proprietary technologies in areas like emissions control create a competitive advantage. | Replication requires substantial R&D investment, increasing entry costs. |

| Regulatory Compliance | Meeting stringent global safety and emissions standards requires significant investment and expertise. | Navigating complex certifications like Euro 7 standards is a major hurdle. |

Porter's Five Forces Analysis Data Sources

Our Tenneco Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Tenneco's annual reports and SEC filings, industry-specific market research from firms like IHS Markit, and automotive sector trend reports.