Tenet Health SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

Tenet Health's strategic position is shaped by its significant market presence and network of facilities, yet it faces challenges in adapting to evolving healthcare regulations and competitive pressures. Understanding these internal strengths and external threats is crucial for any stakeholder looking to navigate the complex healthcare landscape.

Want the full story behind Tenet Health's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Tenet's United Surgical Partners International (USPI) division is a powerhouse, consistently showing strong results. This is largely due to its focus on more complex procedures, such as joint replacements and heart surgeries, which are increasingly being done on an outpatient basis. This strategic focus is paying off, with USPI seeing solid revenue increases and healthy profit margins in the first half of 2025.

USPI's growth trajectory is set to continue. Tenet plans to expand this segment further, both by acquiring existing surgical centers and by opening new ones. This expansion strategy capitalizes on a major trend: patients and payers alike prefer the convenience and cost-effectiveness of outpatient care over traditional hospital stays, making USPI a highly profitable and growing part of Tenet's business.

Tenet Health boasts a robust and geographically diverse network, encompassing 49 acute care and specialty hospitals and more than 500 ambulatory surgery centers as of December 2024. This extensive footprint allows for a broad spectrum of medical and surgical services, strengthening its market presence and creating multiple avenues for revenue generation.

The company's diversified service offerings are a key strength, catering to a wide range of patient needs and market demands. This comprehensive approach not only enhances patient accessibility but also provides Tenet with varied revenue streams, mitigating risks associated with over-reliance on a single service line.

In 2024, Tenet strategically divested certain underperforming hospitals, a move aimed at optimizing its portfolio for improved profitability and reduced debt. This focus on high-acuity care and efficient operations further solidifies its diversified healthcare services and extensive network as a significant competitive advantage.

Tenet Health has shown impressive financial gains, consistently surpassing earnings forecasts and boosting its 2025 projections. For instance, Q1 and Q2 2025 saw substantial jumps in net income and adjusted diluted earnings per share.

The company's balance sheet is also looking much healthier. By June 2025, Tenet had significantly reduced its debt, bringing the net debt to Adjusted EBITDA ratio down to a strong 2.45x.

This financial strength is further evidenced by robust free cash flow generation, which has allowed Tenet to expand its share repurchase program, returning more value to shareholders.

Effective Cost Management and Operational Efficiency

Tenet Health has demonstrated a notable strength in managing its operational costs, a key factor in its financial performance. The company has been particularly adept at controlling contract labor expenses, a significant cost center in the healthcare industry, which directly bolsters its profit margins.

Through a dedicated focus on efficiency initiatives, Tenet has embraced lean management principles and optimized its supply chain. These efforts have yielded substantial cost savings, allowing for reinvestment in patient care and fueling strategic growth opportunities. This commitment to cost discipline is a cornerstone of its consistent operational results and ongoing margin improvement.

- Contract Labor Savings: Tenet has actively worked to reduce reliance on and costs associated with contract labor. For instance, in the first quarter of 2024, the company reported a significant reduction in these expenses compared to prior periods, contributing positively to its bottom line.

- Efficiency Gains: The implementation of lean management and supply chain optimization strategies has led to tangible savings. While specific figures vary, these initiatives are designed to streamline processes and reduce waste across its hospital network, enhancing overall profitability.

- Margin Expansion: The disciplined approach to cost control has directly supported Tenet's ability to expand its operating margins. This financial prudence allows for greater flexibility in capital allocation and strengthens its competitive position in the market.

Strategic Investments in Technology and Quality Care

Tenet Health is making significant strides by investing in advanced technology and digital health solutions. This includes expanding telehealth capabilities, implementing AI for diagnostics, and adopting robotic surgery. These strategic moves are designed to broaden patient access, streamline operations, and ultimately improve the standard of care provided.

The company's commitment to clinical excellence is reflected in its rising patient satisfaction scores and ongoing capital investments in facilities and technology. For instance, in 2023, Tenet reported capital expenditures of $1.7 billion, a substantial portion of which was directed towards technology and facility upgrades to support these strategic initiatives.

- Technological Advancement: Tenet's focus on telehealth, AI diagnostics, and robotic surgery enhances patient reach and treatment precision.

- Operational Efficiency: Digital health initiatives aim to streamline workflows and reduce administrative burdens, improving overall efficiency.

- Quality of Care: Investments in cutting-edge technology directly contribute to elevating the quality and outcomes of patient care.

- Market Position: These forward-thinking investments solidify Tenet's standing as an innovator in the healthcare sector.

Tenet's USPI division is a significant strength, driven by its focus on high-margin outpatient procedures like joint replacements and cardiac surgeries. This segment saw robust revenue and profit growth in the first half of 2025, and Tenet plans further expansion through acquisitions and new center openings, capitalizing on the demand for cost-effective outpatient care.

The company's extensive network, comprising 49 acute care hospitals and over 500 ambulatory surgery centers as of December 2024, provides a broad service offering and strong market presence. This diversification across various medical services mitigates risk and creates multiple revenue streams.

Tenet demonstrated strong financial performance in 2024 and the first half of 2025, exceeding earnings expectations and reducing its net debt to Adjusted EBITDA ratio to a healthy 2.45x by June 2025. This financial discipline supports share repurchases and strategic investments.

Operational efficiency is another key strength, with Tenet successfully reducing contract labor costs and implementing lean management principles and supply chain optimization. These initiatives improved profit margins and allowed for reinvestment in patient care and growth.

Tenet's commitment to technological advancement, including telehealth, AI diagnostics, and robotic surgery, enhances patient access and care quality. Capital expenditures of $1.7 billion in 2023 were significantly directed towards these upgrades, positioning Tenet as an innovator.

| Metric | Value (as of H1 2025/End 2024) | Significance |

|---|---|---|

| USPI Revenue Growth | Strong double-digit increase | Driven by outpatient surgical demand |

| Hospital & ASC Network | 49 hospitals, 500+ ASCs (Dec 2024) | Broad geographic reach and service diversification |

| Net Debt to Adjusted EBITDA | 2.45x (June 2025) | Indicates improved financial leverage |

| Capital Expenditures | $1.7 billion (2023) | Investment in technology and facilities |

What is included in the product

Analyzes Tenet Health’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis of Tenet Health, simplifying complex strategic challenges for focused problem-solving.

Weaknesses

A significant portion of Tenet Healthcare's revenue, historically around 30-40%, is tied to government reimbursement programs like Medicare and Medicaid. This reliance creates a substantial vulnerability, as shifts in government policy, adjustments to reimbursement rates, or funding reductions can directly and materially impact the company's financial health. For instance, proposed cuts to Medicare reimbursement rates in recent years have highlighted the sensitivity of Tenet's earnings to these legislative decisions.

Despite overall revenue growth, Tenet's hospital segment has experienced some softening in volume indicators. In Q2 2025, outpatient visits, emergency room visits, and hospital surgeries all declined year-over-year, and the company lowered its 2025 projection for hospital adjusted admissions.

This trend suggests potential challenges in attracting and retaining certain patient volumes within its traditional hospital settings, which could impact future revenue streams if not addressed.

While Tenet Health has worked to reduce its debt, the company still operates in a capital-intensive industry and maintains a substantial debt load. Despite improvements in its net debt to Adjusted EBITDA ratio, this high leverage can restrict financial maneuverability, particularly when economic conditions worsen or interest rates rise. This necessitates ongoing efforts to manage and decrease its outstanding obligations.

Exposure to Expiring ACA Subsidies

The potential expiration of Affordable Care Act (ACA) marketplace subsidies at the end of 2025 presents a significant vulnerability for Tenet Health. A failure to renew these subsidies could result in fewer individuals having insurance coverage.

This scenario directly threatens Tenet's financial performance by potentially decreasing hospital revenues and increasing bad debt expenses. Given that exchange volumes constitute a notable portion of Tenet's patient admissions, the impact on payer mix could be substantial.

- Reduced Patient Volumes: A decline in insured individuals may lead to fewer hospital admissions.

- Increased Bad Debt: More uninsured patients could translate to higher uncollectible accounts.

- Unfavorable Payer Mix: A shift towards more self-pay patients would negatively affect revenue per patient.

- Uncertainty in Revenue Streams: The reliance on ACA subsidies creates revenue stream volatility.

Intense Competition in Healthcare Markets

Tenet Health operates within a fiercely competitive healthcare sector. It contends with established hospital networks, numerous independent ambulatory surgery centers, and rapidly growing telehealth providers. This crowded market puts pressure on Tenet to maintain its market share, potentially impacting its pricing power and necessitating higher expenditures on marketing and operational improvements to draw in and keep both patients and skilled medical professionals.

The competitive intensity is evident in the market dynamics. For instance, in 2024, the outpatient surgical market saw continued expansion of ASCs, with many systems like HCA Healthcare actively growing their footprint. Tenet's US Surgical segment, which includes its ASCs, faces direct competition from these expanding players. This rivalry can lead to challenges in patient acquisition and retention, as seen in the ongoing efforts by healthcare providers to differentiate their service offerings and manage costs effectively to remain competitive.

- Market Share Pressure: Intense competition from other large hospital systems and ASCs can dilute Tenet's market share.

- Pricing Challenges: Rivals can exert downward pressure on pricing for services, impacting Tenet's revenue.

- Increased Operational Costs: To attract and retain patients and staff, Tenet may need to invest more in marketing, technology, and employee compensation.

- Emerging Threats: The rise of telehealth platforms introduces new competitive avenues that Tenet must address.

Tenet's significant reliance on government reimbursements, historically making up 30-40% of revenue, exposes it to policy shifts and rate adjustments, as seen with past proposed Medicare cuts. Furthermore, softening patient volumes in its hospital segment, with declines in outpatient visits and surgeries in Q2 2025, indicates challenges in patient acquisition. The company's substantial debt load, while improving, still presents financial constraints, especially with potential rising interest rates.

The potential expiration of ACA marketplace subsidies by the end of 2025 poses a direct threat, risking reduced patient volumes and increased bad debt due to fewer insured individuals. This uncertainty in revenue streams, particularly for exchange-volume patients, could significantly impact Tenet's financial performance and payer mix.

Intense competition from other hospital networks, ambulatory surgery centers (ASCs), and telehealth providers pressures Tenet's market share and pricing power. For example, the continued expansion of ASCs by competitors like HCA Healthcare in 2024 directly challenges Tenet's US Surgical segment, potentially increasing operational costs for differentiation and patient retention.

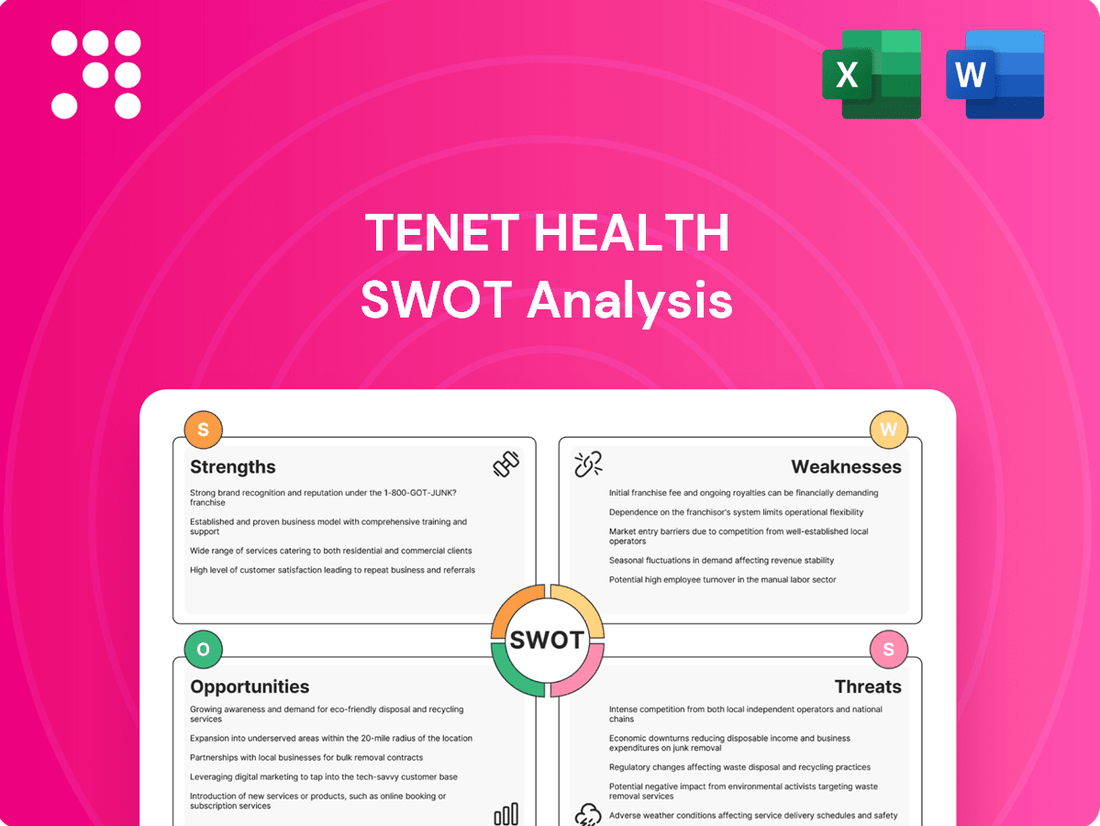

What You See Is What You Get

Tenet Health SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It showcases the comprehensive Strengths, Weaknesses, Opportunities, and Threats impacting Tenet Health, offering a clear strategic roadmap. The full, detailed analysis is unlocked immediately upon purchase.

Opportunities

Tenet's United Surgical Partners International (USPI) segment is a significant growth driver, with a robust strategy for both acquiring existing ambulatory surgery centers (ASCs) and developing new ones. The company is targeting the addition of 10 to 12 new centers in 2025, and they are exceeding their planned spending on mergers and acquisitions.

This expansion is fueled by a clear market trend: the ongoing migration of medical procedures from traditional hospital settings to outpatient facilities. Notably, even more complex, higher-acuity cases are moving to ASCs. This shift presents a substantial opportunity for Tenet to increase both its revenue and profit margins within its ambulatory care division.

Tenet Health is strategically concentrating on high-acuity services, like total joint replacements and cardiovascular interventions, across its hospital and ambulatory care segments. This focus is designed to boost revenue per case and enhance its payer mix, attracting more profitable procedures.

By prioritizing these specialized services, Tenet aims to capitalize on its advanced capabilities, which directly contributes to improved financial performance and margin expansion. This approach is a key element of their strategy to drive profitability in a competitive healthcare landscape.

Tenet Health can seize opportunities by further investing in digital health technologies like telehealth and AI-powered diagnostics. This move is projected to boost efficiency and patient care quality. For example, the telehealth market is expected to reach $250 billion by 2026, indicating significant growth potential.

Robotic surgery advancements also present a chance to improve patient outcomes and expand service offerings. Hospitals adopting robotic surgery have seen reduced recovery times and fewer complications. This technological integration can solidify Tenet’s competitive edge in the rapidly changing healthcare landscape.

Strategic Acquisitions and Partnerships

Tenet Health has a history of successfully integrating acquired assets, notably its expansion in the ambulatory surgery center (ASC) sector, which has been a significant driver of its financial performance. For instance, by the end of 2023, Tenet operated over 600 ASCs, contributing substantially to its revenue streams and market reach.

The company's robust financial health, evidenced by its strong free cash flow generation, provides a solid foundation for pursuing further mergers, acquisitions, and strategic alliances. This financial flexibility allows Tenet to strategically bolster its market share, diversify its service offerings, and penetrate new geographical markets effectively.

Opportunities for Tenet include:

- Acquiring smaller ASC chains or individual facilities to consolidate market presence and achieve economies of scale.

- Forming partnerships with physician groups to expand service lines and enhance patient care integration.

- Exploring joint ventures for developing new healthcare facilities or expanding into underserved regions.

- Leveraging its strong balance sheet to finance these strategic moves, potentially acquiring distressed assets or complementary businesses.

Share Repurchase Program and Shareholder Value Creation

Tenet Health's (THC) strong free cash flow generation, evidenced by its performance in 2024, supports an aggressive share repurchase program. This initiative directly aims to return capital to shareholders and bolster shareholder value.

The company's commitment to buybacks can significantly enhance earnings per share (EPS), making the stock more appealing. For instance, a substantial repurchase can reduce the number of outstanding shares, thereby increasing the EPS even if net income remains flat.

This strategy also serves as a powerful signal of management's confidence in Tenet's future growth and financial stability. Such confidence can attract investors looking for financially sound opportunities.

- Robust Free Cash Flow: Tenet Health has consistently demonstrated strong free cash flow generation, providing the financial capacity for significant capital returns.

- Share Repurchase Program Expansion: The company has actively expanded its share repurchase program, indicating a clear strategy to reduce outstanding shares.

- EPS Enhancement: By reducing the share count, the buyback program is designed to boost earnings per share, a key metric for investors.

- Management Confidence Signal: The aggressive repurchase activity signals management's positive outlook on the company's intrinsic value and future prospects.

Tenet's strategic focus on expanding its ambulatory surgery center (ASC) footprint, particularly in high-acuity services like joint replacements, positions it to capitalize on the growing trend of outpatient care. The company's acquisition strategy is robust, with plans to add 10-12 new centers in 2025, exceeding their initial spending targets. This expansion, coupled with investments in digital health technologies like telehealth, which is projected to reach $250 billion by 2026, and advancements in robotic surgery, offers significant avenues for revenue growth and margin improvement.

Tenet Health's strong free cash flow generation, a key financial strength, enables aggressive share repurchases, which can enhance earnings per share and signal management's confidence. The company's ability to integrate acquisitions, as seen with its over 600 ASCs by the end of 2023, provides a solid base for further consolidation and strategic alliances, potentially acquiring distressed assets or complementary businesses.

| Opportunity Area | Key Strategy | Projected Impact | Supporting Data/Trend |

|---|---|---|---|

| Ambulatory Surgery Center (ASC) Expansion | Acquisition and development of new ASCs, focusing on high-acuity procedures. | Increased revenue and profit margins through outpatient migration. | Targeting 10-12 new centers in 2025; exceeding M&A spending. |

| Digital Health Integration | Investment in telehealth and AI-powered diagnostics. | Enhanced efficiency and patient care quality. | Telehealth market projected to reach $250 billion by 2026. |

| Strategic Partnerships & Acquisitions | Consolidating market presence through ASC chain acquisitions and forming physician group partnerships. | Economies of scale and expanded service lines. | Operated over 600 ASCs by end of 2023. |

| Capital Return & Shareholder Value | Aggressive share repurchase program funded by strong free cash flow. | Boosted EPS and signaled management confidence. | Consistent strong free cash flow generation. |

Threats

Changes in healthcare regulations represent a significant risk for Tenet Health. For instance, potential shifts in Medicare and Medicaid reimbursement policies, alongside adjustments to Affordable Care Act subsidies, could directly affect the company's revenue streams. A hypothetical scenario, such as proposed Medicaid cuts under a 'One Big Beautiful Bill' framework, could lead to substantial financial instability, particularly impacting operations beyond 2025.

Tenet Health, like many healthcare providers, grapples with escalating labor expenses and a shortage of qualified staff. This trend, evident across the industry, directly impacts operational budgets. For instance, the U.S. Bureau of Labor Statistics projected a 2.7% increase in wages for healthcare practitioners and technical occupations in the year leading up to May 2024, a rate that often outpaces general inflation.

These rising costs can strain Tenet's profitability, potentially forcing a greater reliance on costly temporary or contract labor to fill critical roles. Such a shift not only inflates expenses but can also affect the consistency and quality of patient care, posing a significant operational threat.

Macroeconomic headwinds like persistent inflation and the specter of economic downturns pose significant threats to Tenet Health. These pressures directly impact consumer spending on healthcare services and increase Tenet's operational expenses, particularly for supplies and labor. For instance, the US inflation rate averaged 4.1% in 2023, impacting input costs across the healthcare sector.

Rising supply costs, a direct consequence of inflation, can erode Tenet's profit margins even with diligent cost management strategies. This squeeze on profitability could potentially affect the company's financial stability and its capacity for future investments or expansion. For example, the producer price index for medical supplies saw notable increases throughout 2023 and into early 2024.

Cybersecurity Risks and Data Breaches

Tenet Health, like all healthcare providers, is a prime target for cyberattacks due to the sensitive patient data it manages. A significant data breach could result in substantial financial penalties, with HIPAA fines alone reaching up to $1.5 million per violation category per year. For instance, the healthcare sector saw a 26% increase in reported breaches in 2023 compared to the previous year, highlighting the escalating threat landscape.

Such security failures not only lead to regulatory scrutiny but also severely damage Tenet's reputation and erode patient trust, potentially impacting patient volumes and revenue. The cost of recovering from a data breach in healthcare averaged $10.10 million in 2023, a figure that underscores the financial imperative for robust cybersecurity measures.

- High Likelihood of Cyberattacks: Handling vast amounts of Protected Health Information (PHI) makes Tenet an attractive target for malicious actors.

- Significant Financial Repercussions: Data breaches can incur millions in fines, legal costs, and remediation expenses.

- Reputational Damage and Loss of Trust: Patient confidence is critical; a breach can lead to a significant exodus of patients and difficulty attracting new ones.

- Operational Disruption: Ransomware attacks or system compromises can halt critical healthcare services, impacting patient care and revenue generation.

Payer Contracting and Reimbursement Challenges

Tenet Health faces significant hurdles in managing payer contracts and obtaining favorable reimbursement. Securing competitive rates from commercial insurers is a constant battle, and increased insurer scrutiny can directly reduce net revenue per case, impacting overall profitability. For instance, in 2023, Tenet reported that reimbursement from managed care and Medicare Advantage plans represented a substantial portion of their revenue, highlighting the direct impact of payer negotiations on their financial performance.

The sustainability of recent margin improvements, particularly those linked to temporary or one-time payment adjustments from payers, also poses a threat. Without ongoing favorable contract terms, these gains may not be repeatable, creating uncertainty in future earnings. Furthermore, the complexity of denial management, a crucial process for revenue realization, requires significant administrative resources and can lead to delayed or uncollected payments if not handled efficiently.

Changes in healthcare regulations, particularly around reimbursement policies for Medicare and Medicaid, present a persistent threat to Tenet Health's revenue stability. For example, shifts in Affordable Care Act subsidies could alter patient volumes and the ability to collect payments, impacting earnings beyond 2025.

Escalating labor costs and ongoing shortages of qualified healthcare professionals continue to strain Tenet's operational budgets. The U.S. Bureau of Labor Statistics projected a 2.7% wage increase for healthcare practitioners and technical occupations in the year ending May 2024, a trend that directly inflates expenses and can necessitate costly temporary staffing solutions.

Macroeconomic factors, including sustained inflation and the potential for economic slowdowns, pose significant risks by increasing operational expenses and potentially reducing consumer spending on healthcare services. With US inflation averaging 4.1% in 2023, rising costs for supplies and labor directly impact Tenet's profit margins.

Tenet Health remains a prime target for cyberattacks due to the sensitive patient data it handles, with the healthcare sector experiencing a 26% rise in reported breaches in 2023. A significant data breach could result in substantial financial penalties, with HIPAA fines reaching up to $1.5 million per violation category annually, alongside severe reputational damage.

The company also faces challenges in securing favorable payer contracts, as increased insurer scrutiny can reduce net revenue per case. Tenet's reliance on managed care and Medicare Advantage plans, which formed a substantial portion of its 2023 revenue, underscores the direct impact of payer negotiations on its financial performance.

| Threat Category | Specific Risk | Potential Impact | Example Data/Fact |

|---|---|---|---|

| Regulatory Changes | Shifts in Medicare/Medicaid Reimbursement | Reduced revenue, financial instability | Potential cuts to Medicaid funding could significantly impact operations beyond 2025. |

| Operational Costs | Rising Labor Expenses & Staff Shortages | Increased operational budgets, reliance on costly temporary staff | Healthcare practitioner wages rose 2.7% (May 2023-May 2024). |

| Economic Headwinds | Inflation & Potential Downturns | Higher operational expenses, reduced consumer spending on healthcare | US inflation averaged 4.1% in 2023, impacting supply costs. |

| Cybersecurity | Data Breaches & System Compromises | Financial penalties, reputational damage, operational disruption | Healthcare breaches increased 26% in 2023; HIPAA fines up to $1.5M/category/year. |

| Payer Contracts | Unfavorable Reimbursement Rates | Reduced net revenue per case, decreased profitability | Managed care and Medicare Advantage plans are a substantial revenue source for Tenet. |

SWOT Analysis Data Sources

This Tenet Health SWOT analysis is built upon a foundation of comprehensive data, including publicly available financial statements, detailed market research reports, and insights from industry experts. These sources provide a robust understanding of the competitive landscape and internal operations.