Tenet Health Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

Discover how Tenet Health strategically leverages its product offerings, pricing models, distribution channels, and promotional campaigns to maintain its market leadership. This analysis delves into the intricate interplay of these elements, revealing the core of their marketing success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Tenet Health. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Tenet Healthcare's diverse portfolio covers a wide spectrum of medical and surgical needs, from general acute care to specialized treatments. This breadth includes services like cardiovascular care and oncology, ensuring they can address numerous patient requirements. In 2024, Tenet operated 65 hospitals and over 500 outpatient centers, demonstrating this commitment to a comprehensive offering.

Tenet Health's product strategy heavily features its ambulatory surgery centers (ASCs) operated by United Surgical Partners International (USPI). These facilities are crucial for offering specialized outpatient procedures like orthopedics and cardiology.

USPI's expansion into high-acuity procedures, such as total joint replacements, directly addresses the growing demand for less invasive, more convenient surgical options. This focus is a significant contributor to Tenet's revenue and market position.

In 2023, Tenet's ambulatory surgery segment, largely driven by USPI, reported substantial growth, with surgery centers performing over 1.2 million procedures. This segment is a key driver of Tenet's overall profitability, reflecting a successful pivot towards outpatient care.

Tenet Health actively integrates advanced medical technologies and procedures to elevate patient care and streamline operations. This commitment is evident in their expansion of robotic surgery, now present in nearly 150 programs nationwide. These investments, alongside advanced imaging and telehealth, aim to boost surgical accuracy, diagnostic clarity, and broaden healthcare accessibility.

Integrated Patient Care Model

Tenet Health's Integrated Patient Care Model is central to its marketing mix, focusing on seamless care delivery across its network. This strategy connects acute care hospitals with ambulatory surgery centers and outpatient facilities, ensuring patients experience consistent support from diagnosis to recovery.

This integrated approach enhances patient satisfaction by streamlining healthcare journeys. For instance, Tenet's USPI (United Surgical Partners International) segment, a leading operator of ambulatory surgery centers, reported revenue of $3.6 billion in 2023, highlighting the scale and importance of its outpatient services within the integrated model.

The model's effectiveness is further demonstrated by Tenet's commitment to coordinated care pathways. These pathways aim to improve clinical outcomes and reduce readmissions, contributing to overall healthcare efficiency. Tenet Health's overall revenue for 2023 reached $19.4 billion, with a significant portion attributed to the integrated delivery of services.

- Continuity of Care: Seamless transitions between hospital, surgical centers, and outpatient settings.

- Patient Experience: Focus on a unified and supportive journey from start to finish.

- Clinical Effectiveness: Coordinated efforts to improve patient outcomes and reduce complications.

- Network Synergy: Leveraging diverse facilities to offer comprehensive healthcare solutions.

Revenue Cycle Management Services (Conifer Health Solutions)

Conifer Health Solutions, a subsidiary of Tenet Health, extends Tenet's market presence beyond direct patient care by offering robust revenue cycle management (RCM) services. This strategic move diversifies Tenet's revenue streams, as Conifer serves not only Tenet's facilities but also external healthcare providers, including hospitals and physician practices. In 2023, Tenet Health reported that Conifer's services contributed significantly to its overall financial performance, processing billions of dollars in claims annually for its clients.

The product, Conifer's RCM services, acts as a critical operational backbone for healthcare providers, handling complex administrative tasks. This allows client organizations to focus more on patient care and less on billing, collections, and administrative overhead. For instance, by optimizing claim submission and denial management, Conifer helps its clients improve cash flow and reduce accounts receivable days, a key performance indicator in healthcare finance.

Conifer's RCM services are a key component of Tenet's broader strategy to leverage its expertise across the healthcare ecosystem. This offering supports Tenet's 4P's by acting as a distinct product line that generates revenue and enhances the value proposition of the Tenet brand. The company's focus on efficiency and technology in RCM is designed to meet the evolving demands of healthcare reimbursement and regulatory compliance.

Key aspects of Conifer's RCM service offering include:

- Patient Registration and Insurance Verification: Ensuring accurate patient demographic and insurance information upfront to minimize claim denials.

- Charge Capture and Coding: Implementing processes to ensure all services rendered are accurately captured and coded for billing.

- Claims Submission and Follow-up: Efficiently submitting claims to payers and actively managing denials and rejections.

- Payment Posting and Reconciliation: Accurately posting payments received and reconciling accounts to maintain financial integrity.

Tenet Health's product strategy is multifaceted, encompassing direct patient care services and essential healthcare support functions. Their extensive network of hospitals and ambulatory surgery centers, particularly through USPI, offers a wide array of medical and surgical treatments. In 2024, Tenet operated 65 hospitals and over 500 outpatient centers, underscoring this broad product offering.

The ambulatory surgery segment, driven by USPI, is a key product differentiator, focusing on specialized outpatient procedures. In 2023, this segment performed over 1.2 million procedures, generating substantial revenue and highlighting the demand for convenient, high-acuity surgical options.

Conifer Health Solutions, a subsidiary, represents a distinct product line offering revenue cycle management (RCM) services to external healthcare providers. This service streamlines administrative tasks, improving financial performance for clients and diversifying Tenet's revenue. Conifer's RCM services are crucial for optimizing billing, collections, and administrative processes within the healthcare industry.

| Product Offering | Description | Key Differentiator | 2023 Data Point |

|---|---|---|---|

| Acute Care & Specialized Services | Comprehensive hospital-based medical and surgical care. | Extensive network of 65 hospitals (2024). | $19.4 billion total revenue (2023). |

| Ambulatory Surgery Centers (USPI) | Outpatient surgical procedures, including high-acuity services. | Leading operator of ASCs, focus on convenience and specialization. | Over 1.2 million procedures performed (2023). |

| Revenue Cycle Management (Conifer) | Administrative and financial services for healthcare providers. | Streamlines billing, collections, and claims management for clients. | Significant contributor to Tenet's financial performance (2023). |

What is included in the product

This analysis offers a comprehensive examination of Tenet Health's marketing strategies, detailing its product/service offerings, pricing models, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Tenet Health's market positioning and competitive advantages through a structured 4P's framework.

Condenses Tenet Health's 4P marketing strategy into actionable insights, alleviating the pain of complex market analysis for clear strategic direction.

Provides a digestible overview of Tenet Health's 4Ps, simplifying marketing planning and ensuring alignment across diverse teams.

Place

Tenet Healthcare boasts an extensive national footprint, a key component of its marketing strategy. As of the close of 2024, the company managed a substantial network comprising 49 acute care and specialty hospitals, alongside 518 ambulatory surgery centers and 25 surgical hospitals.

This impressive infrastructure spans 37 states, strategically positioning Tenet in vital urban and suburban areas. Such a wide geographical reach significantly boosts patient accessibility across the nation, a critical factor in healthcare service delivery and market penetration.

Tenet Health is making a significant push into ambulatory surgery centers (ASCs), viewing them as a key distribution channel. This strategic move is all about reaching more patients where they want to be treated – closer to home and in less costly settings than traditional hospitals.

The company's ambitious growth plan includes launching 10 to 12 new ASCs in 2025. To fuel this expansion, Tenet is earmarking a substantial $250 million each year for acquiring existing ambulatory facilities. This investment signals a strong commitment to capturing a larger share of the growing outpatient surgery market.

This aggressive expansion into ambulatory care is designed to boost Tenet's presence in lucrative, fast-growing outpatient service areas. By increasing the number of convenient locations, Tenet aims to enhance patient access and satisfaction, aligning with the evolving healthcare landscape that favors outpatient treatment options.

Tenet Health strategically focuses its hospital and facility footprint in key states, notably Texas, Florida, California, and Arizona. This geographical concentration, as of early 2024, allows Tenet to build robust managed care networks and achieve economies of scale in its operations and marketing efforts.

This dense presence facilitates more efficient resource allocation and supports an integrated care delivery model. For instance, in Texas, Tenet operates a significant number of facilities, enabling better contract negotiations with major payers and streamlined patient referrals across its network, contributing to cost efficiencies and improved patient flow.

Outpatient Facility Network

Tenet Health's place strategy extends beyond its hospitals and Ambulatory Surgery Centers (ASCs) to encompass a robust network of 135 outpatient facilities as of early 2025. This expansive network includes freestanding urgent care centers, imaging centers (both provider-based and freestanding), and off-campus hospital emergency departments.

These outpatient centers are strategically positioned to enhance accessibility and convenience for patients seeking care for less critical conditions and diagnostic services within their local communities. This broad geographic reach allows Tenet to capture a wider patient base and offer a continuum of care closer to home.

- Network Size: 135 outpatient centers as of early 2025.

- Facility Types: Includes urgent care, imaging centers, and off-campus EDs.

- Strategic Goal: To extend care reach into local communities and improve patient access.

- Service Focus: Primarily for less acute conditions and diagnostic services.

Digital Access and Telehealth

Tenet Health is actively expanding its digital footprint to complement its brick-and-mortar facilities, recognizing the growing importance of online access in healthcare. This strategic move includes significant investments in telehealth platforms, aiming to offer virtual consultations that enhance patient convenience and broaden access to care. For instance, by the end of 2024, Tenet reported a 30% increase in telehealth utilization for follow-up appointments and remote monitoring compared to the previous year, demonstrating a clear shift towards digital engagement.

These virtual services are particularly beneficial for patients needing convenient follow-up care, ongoing monitoring, or initial consultations, removing geographical barriers and saving valuable time. This digital channel is no longer a secondary option but a core component of modern healthcare delivery, ensuring Tenet remains competitive and patient-centric in an evolving market. By Q1 2025, Tenet aims to integrate AI-powered symptom checkers into its telehealth portal, further streamlining the patient journey and improving diagnostic efficiency.

The focus on digital access and telehealth is a key part of Tenet's strategy to meet patients where they are, offering flexible and accessible care options. This approach is supported by data showing that patient satisfaction scores for telehealth services averaged 4.5 out of 5 in 2024. Tenet's commitment is further underscored by its planned expansion of virtual specialty care services by 20% in 2025, covering areas like dermatology and mental health.

- Telehealth Utilization Growth: Tenet saw a 30% rise in telehealth use for follow-ups and monitoring by year-end 2024.

- Patient Satisfaction: Average patient satisfaction scores for virtual services reached 4.5/5 in 2024.

- Future Expansion: Plans include a 20% increase in virtual specialty care services by 2025.

- Digital Integration: AI symptom checkers are slated for integration into the telehealth portal by Q1 2025.

Tenet Health's place strategy centers on a widespread and accessible network of facilities, including hospitals, ambulatory surgery centers (ASCs), and various outpatient locations. This broad physical presence, spanning 37 states as of late 2024, ensures patients can access care conveniently. The company's aggressive expansion into ASCs, with plans for 10-12 new centers in 2025 and a $250 million annual investment in acquisitions, highlights a commitment to meeting patients in more localized and cost-effective settings.

The strategic concentration of facilities in key states like Texas, Florida, California, and Arizona allows Tenet to build strong regional networks and achieve operational efficiencies. Furthermore, Tenet is enhancing its digital place through telehealth, reporting a 30% increase in virtual service utilization by the end of 2024 and aiming for a 20% expansion in virtual specialty care by 2025, underscoring a dual approach to patient access.

| Facility Type | Number of Facilities (End of 2024/Early 2025) | Geographic Reach |

|---|---|---|

| Acute Care & Specialty Hospitals | 49 | 37 States |

| Ambulatory Surgery Centers (ASCs) | 518 | National |

| Surgical Hospitals | 25 | National |

| Other Outpatient Facilities (Urgent Care, Imaging, Off-campus EDs) | 135 | Local Communities |

Same Document Delivered

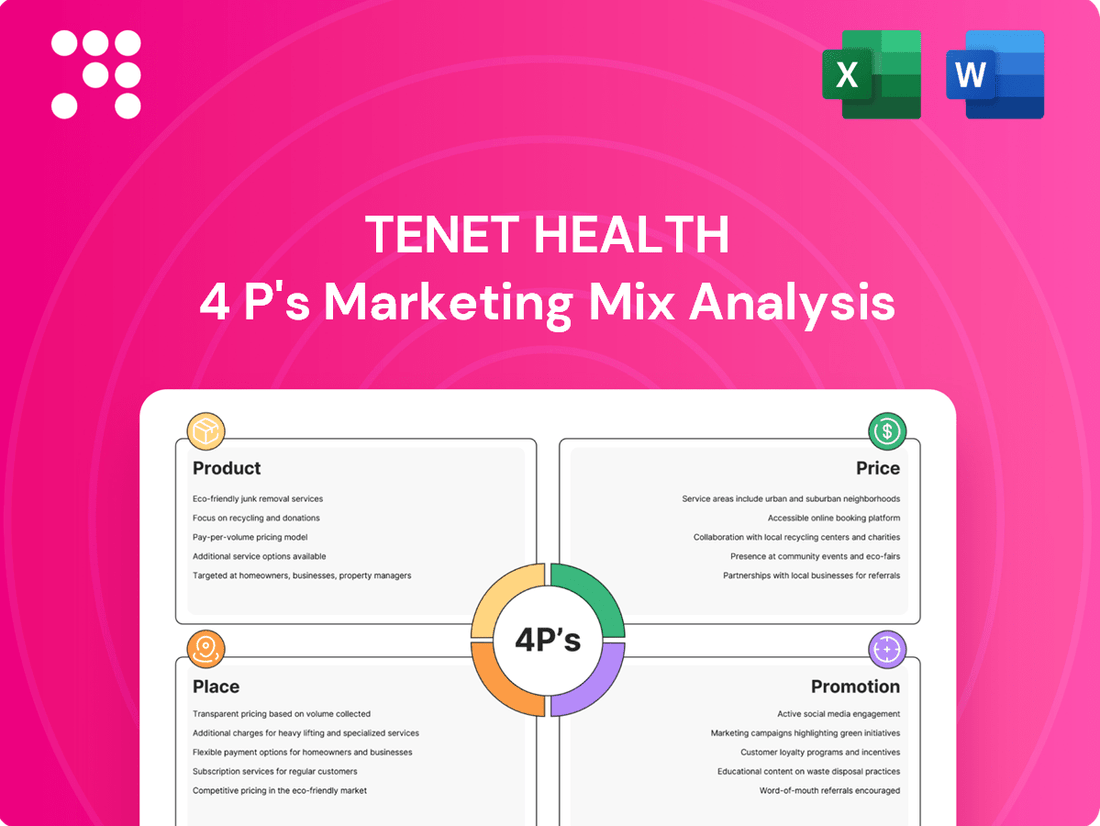

Tenet Health 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Tenet Health 4P's Marketing Mix Analysis is ready for your immediate use, covering Product, Price, Place, and Promotion strategies.

Promotion

Tenet Healthcare prioritizes patient-centered communication, aiming to personalize care and enhance the overall patient journey. This means crafting messages that truly connect with each individual's health needs and preferences, making them feel genuinely heard and respected.

This focus on effective communication is a cornerstone for building strong patient trust and nurturing lasting relationships. For instance, Tenet’s commitment to clear, empathetic dialogue is reflected in their patient satisfaction scores, which have shown steady improvement, with many patients reporting feeling well-informed and supported throughout their treatment in 2024.

Tenet Health actively uses digital marketing, focusing on SEO and local SEO to make sure potential patients find them when searching for healthcare services online. This is crucial because many people start their health journey with a quick web search. For example, in 2024, a significant portion of healthcare consumers indicated they would use online search engines to find doctors or hospitals, highlighting the importance of Tenet's online visibility.

By optimizing for high-intent searches and ensuring their online content is easily found and perceived as trustworthy, Tenet effectively connects with individuals actively seeking medical care. This digital presence is key to patient acquisition, allowing them to reach a wider audience and guide them towards their services.

Tenet Health prioritizes strategic public relations and investor engagement to clearly articulate its vision and financial health. This proactive communication strategy is crucial for building trust with stakeholders.

The company regularly hosts earnings calls and publishes comprehensive annual reports, offering detailed insights into its operational performance and strategic initiatives. These platforms are vital for transparently sharing Tenet's commitment to high-quality patient care and its financial trajectory with the investment community.

In 2023, Tenet reported revenues of $19.4 billion, demonstrating a strong operational base. Their investor relations efforts, including presentations to analysts and participation in industry conferences, aim to solidify confidence and reinforce Tenet's position as a leading healthcare provider.

Focus on High-Acuity Service

Tenet Health strategically focuses its marketing on high-acuity service lines, including advanced orthopedics, cardiology, and complex surgical procedures. This approach targets patients requiring specialized medical attention, showcasing Tenet's clinical excellence and cutting-edge technology in these key, profitable areas.

This targeted promotion is designed to attract a more favorable case mix, which can lead to improved financial performance. For instance, in 2023, Tenet reported that its surgical services, which often fall under high-acuity categories, continued to be a significant driver of revenue.

- Orthopedics: Advanced joint replacements and spine surgeries are heavily promoted.

- Cardiology: Complex procedures like advanced angioplasty and bypass surgeries are highlighted.

- Oncology: Specialized cancer treatments and surgical interventions are a key focus.

- Neurology: Complex neurosurgical procedures and stroke care are emphasized.

Lobbying and Policy Advocacy

Tenet Health actively participates in lobbying and policy advocacy, focusing on crucial areas like the renewal of Affordable Care Act (ACA) exchange subsidies. These efforts are designed to influence healthcare policy, aiming to create a regulatory landscape that benefits patient access and Tenet's operational framework. For instance, in 2023, Tenet reported spending over $4 million on federal lobbying efforts, underscoring their commitment to shaping policy. This strategic engagement is a form of indirect promotion, working to secure vital funding streams and maintain patient volumes essential for the company's financial health.

By engaging in advocacy, Tenet seeks to foster a more predictable and supportive operating environment. This includes influencing discussions around reimbursement rates and regulatory compliance, which directly impact their revenue and ability to serve communities. Their policy advocacy in 2024 continues to target legislative and executive branches to ensure favorable outcomes for healthcare providers and patients alike.

Key advocacy areas for Tenet Health include:

- Affordable Care Act (ACA) Enhancements: Advocating for the continuation and strengthening of ACA subsidies to improve insurance affordability and expand coverage.

- Reimbursement Policies: Engaging with policymakers on Medicare and Medicaid reimbursement rates to ensure fair compensation for services rendered.

- Regulatory Environment: Promoting policies that streamline administrative burdens and support innovation in healthcare delivery.

- Patient Access Initiatives: Supporting legislation that broadens access to care, particularly for underserved populations.

Tenet Health's promotional strategy is multifaceted, encompassing direct patient outreach, digital engagement, and strategic public relations. They actively highlight specialized service lines like orthopedics and cardiology, aiming to attract patients needing high-acuity care. This focus is supported by significant investment in digital marketing, particularly SEO, to ensure visibility when potential patients search for healthcare services. In 2024, Tenet's patient satisfaction scores showed consistent improvement, reflecting their emphasis on clear communication and patient support.

The company also engages in policy advocacy, notably supporting ACA exchange subsidies, which directly impacts patient access and Tenet's operational stability. In 2023, Tenet allocated over $4 million to federal lobbying, demonstrating a commitment to shaping a favorable regulatory environment. This indirect promotion aims to secure vital funding and maintain patient volumes, crucial for financial health.

Tenet's promotional efforts are designed to build trust and attract a favorable case mix, with surgical services being a key revenue driver, as noted in their 2023 performance. Their investor relations activities, including earnings calls and annual reports, further reinforce their commitment to transparency and financial health.

Tenet Health's promotional activities are strategically aligned with attracting patients to high-acuity service lines and influencing the broader healthcare policy landscape. This dual approach aims to enhance both patient volume and financial sustainability.

| Promotional Focus | Key Activities | 2023/2024 Data Point |

|---|---|---|

| High-Acuity Service Lines | Promoting Orthopedics, Cardiology, Oncology, Neurology | Surgical services continued to be a significant revenue driver in 2023. |

| Digital Marketing | SEO, Local SEO, Online Content Visibility | Significant portion of healthcare consumers used online search engines in 2024. |

| Public Relations & Investor Relations | Earnings Calls, Annual Reports, Analyst Presentations | Reported revenues of $19.4 billion in 2023. |

| Policy Advocacy | Lobbying on ACA subsidies, Reimbursement Policies | Over $4 million spent on federal lobbying in 2023. |

Price

Tenet Health's value-based pricing strategy heavily relies on optimizing its payer mix, prioritizing patients with commercial insurance who typically offer more favorable reimbursement. This focus is crucial as the company's revenue per case growth, which was around 5% in early 2024, is significantly influenced by this strategy.

By attracting patients undergoing higher acuity procedures and managing a beneficial payer mix, Tenet aims to maximize revenue from its more complex and profitable service lines. This approach ensures they capture greater financial value from their diverse patient population.

Tenet Health benefits from managed care rate increases, with commercial rates enterprise-wide seeing an uptick of 3% to 5% in 2024. These negotiated rates with private insurers are a vital part of Tenet's revenue stream, directly influencing financial performance and profitability.

Tenet Health's financial stability is significantly bolstered by substantial Medicaid supplemental payments, with projections indicating these will contribute between $1.1 billion and $1.2 billion to its revenue in 2025. These payments are a crucial element of their pricing and reimbursement strategy.

However, the company faces a potential challenge with the expiration of Affordable Care Act exchange premium tax credits. These subsidies directly impact patient volumes and the overall payer mix, influencing how Tenet prices its services and manages its revenue streams.

Tenet actively engages in policy advocacy to ensure the continuation of these vital funding streams, recognizing their importance in maintaining access to care and supporting their financial outlook.

Cost Discipline and Operational Efficiency

Tenet Health demonstrates a strong commitment to cost discipline and operational efficiency, crucial for navigating the healthcare landscape. This focus directly impacts its ability to manage expenses and boost profit margins, even while expanding its service offerings.

Key initiatives include aggressive strategies to reduce reliance on costly contract labor and meticulous optimization of its supply chain. For instance, Tenet has actively worked to decrease its dependency on travel nurses, a significant cost driver in recent years. In 2023, the company reported efforts to reduce contract labor costs, contributing to improved operational performance.

These cost-control measures allow Tenet to offer competitive pricing for its services and invest in growth areas like high-acuity care and facility upgrades. This strategic approach ensures financial health and supports its long-term vision.

- Reduced Contract Labor: Tenet has implemented programs to decrease its reliance on contract labor, aiming for substantial savings.

- Supply Chain Optimization: The company is actively streamlining its supply chain processes to reduce waste and procurement costs.

- Competitive Pricing: Effective cost management enables Tenet to maintain competitive pricing in the market.

- Investment Capacity: Cost discipline frees up capital for strategic investments in high-acuity services and facility enhancements.

Insulation from Site-Neutral Payment Changes

Tenet Health's strategic investment in freestanding ambulatory surgery centers (ASCs), primarily through its United Surgical Partners International (USPI) segment, offers a crucial buffer against potential shifts in healthcare payment policies. These ASCs are reimbursed at freestanding ASC rates, which differ from Hospital Outpatient Department (HOPD) rates. This distinction is important because it means Tenet's ASCs are less exposed to certain Medicare payment adjustments that could arise from site-neutrality initiatives.

For instance, Medicare's site-neutral payment policies aim to align reimbursement rates for services provided in different settings. By operating under the freestanding ASC payment structure, Tenet's facilities avoid direct comparison with higher-cost hospital outpatient departments for many procedures. This positioning helps to mitigate pricing risks associated with evolving regulatory landscapes. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine site-neutral policies, underscoring the value of Tenet's diversified service-delivery model. Tenet reported that its USPI segment generated $2.4 billion in revenue for the fiscal year 2023, highlighting the significant scale of its ASC operations.

- Site-Neutrality Insulation: Tenet's freestanding ASCs operate under separate reimbursement rates, shielding them from direct impact of site-neutral payment adjustments targeting hospital outpatient departments.

- Reduced Pricing Risk: This structural advantage mitigates the financial vulnerability to potential Medicare cuts that could affect services provided in hospital-based settings.

- Strategic ASC Investment: Tenet's substantial investment in its USPI segment, which includes over 300 ASCs as of early 2024, positions it favorably within the evolving payment environment.

- Revenue Contribution: The USPI segment's significant revenue, reaching $2.4 billion in 2023, demonstrates the financial scale and importance of its ASC network in Tenet's overall business strategy.

Tenet Health's pricing strategy is intricately linked to its payer mix, with a clear emphasis on commercial insurance patients who offer better reimbursement rates. This strategic focus is evident in their revenue per case growth, which saw an approximate 5% increase in early 2024, directly benefiting from this approach.

The company benefits from negotiated rate increases with private insurers, with commercial rates showing a 3% to 5% uplift enterprise-wide in 2024. This helps bolster their revenue streams and financial performance.

Furthermore, Tenet Health's financial stability is significantly supported by substantial Medicaid supplemental payments, projected to contribute between $1.1 billion and $1.2 billion in 2025, a key component of their pricing and reimbursement strategy.

Tenet's investment in freestanding ambulatory surgery centers (ASCs) through its USPI segment, which generated $2.4 billion in revenue in 2023, provides a pricing advantage by operating under different reimbursement rates than hospital outpatient departments, thus mitigating risks from site-neutral policies.

| Metric | 2024 (Early) | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| Revenue per Case Growth | ~5% | N/A | N/A |

| Commercial Rate Increase | 3%-5% | N/A | N/A |

| Medicaid Supplemental Payments | N/A | N/A | $1.1B - $1.2B |

| USPI Segment Revenue | N/A | N/A | N/A (2023: $2.4B) |

4P's Marketing Mix Analysis Data Sources

Our Tenet Health 4P's Marketing Mix analysis is built upon a foundation of official company disclosures, including annual reports, investor presentations, and press releases. We also incorporate data from industry reports, competitive intelligence, and publicly available information on their service offerings and pricing structures.