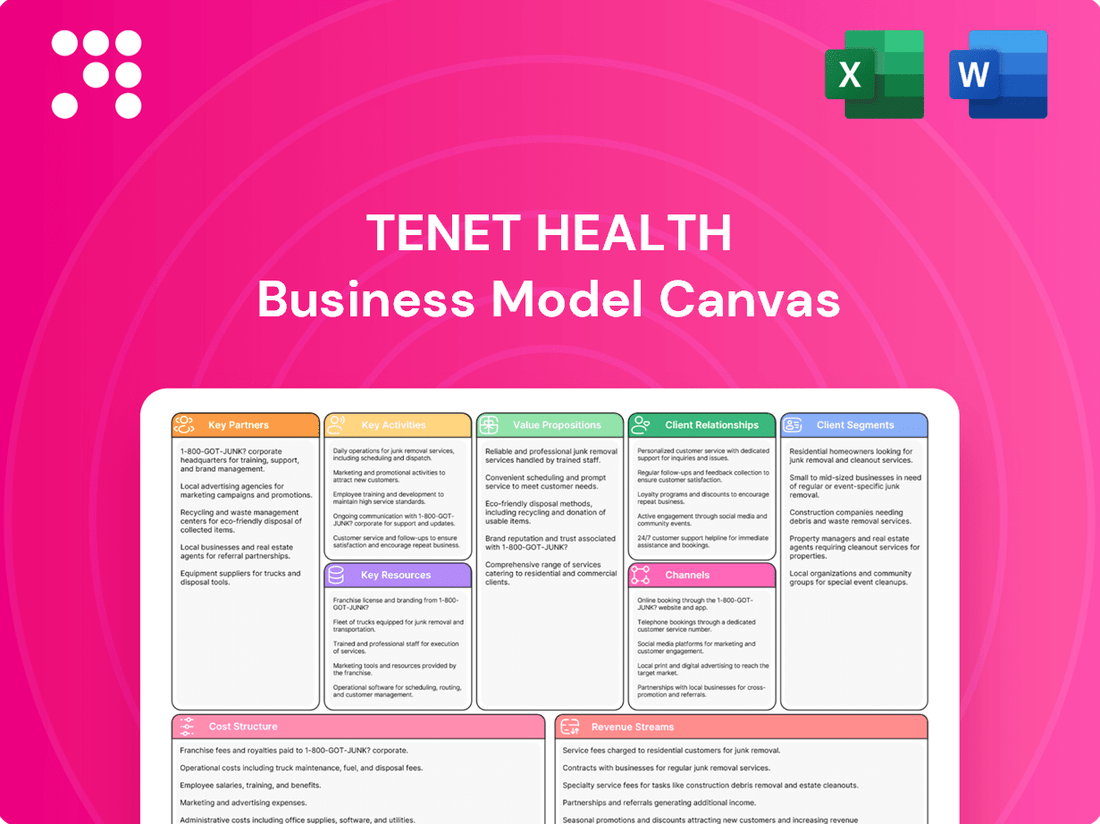

Tenet Health Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

Uncover the intricate workings of Tenet Health's strategic framework with our comprehensive Business Model Canvas. This detailed analysis breaks down how Tenet Health delivers value, manages resources, and builds crucial relationships to thrive in the healthcare sector. It's an essential resource for anyone seeking to understand market-leading healthcare operations.

Ready to gain a deeper understanding of Tenet Health's success? Our full Business Model Canvas provides a clear, actionable blueprint of their customer relationships, revenue streams, and cost structure. Download it now to unlock the strategic secrets that drive their business forward.

Partnerships

Tenet Healthcare actively collaborates with other hospital systems and medical groups to expand its network and service offerings. As of 2024, Tenet maintains strategic partnerships with 47 hospitals across various states, including integrated healthcare networks in California, regional collaboratives in Florida, and comprehensive care networks in Texas. These collaborations enable shared resources, extended geographic reach, and enhanced patient access to a wider array of services.

Tenet Healthcare's partnerships with insurance providers are fundamental to its business model, directly impacting patient access and revenue. These collaborations ensure that a broad base of patients can utilize Tenet's facilities and services, while also guaranteeing reimbursement for the care provided.

Tenet actively partners with major national insurance carriers, including UnitedHealthcare, Aetna, Cigna, and various Blue Cross Blue Shield plans. This extensive network coverage is critical, as it allows Tenet to serve a vast number of individuals covered by these plans, thereby driving patient volume and financial stability.

Tenet Health's ability to provide top-tier medical services hinges on its crucial partnerships with leading medical equipment and technology suppliers. These collaborations are vital for equipping its facilities with the latest advancements in healthcare, ensuring patient care remains at the forefront of innovation.

Strategic alliances with giants like Siemens Healthineers, GE Healthcare, and Philips Healthcare are paramount. For instance, Siemens Healthineers provides diagnostic imaging systems, a critical component for accurate patient diagnosis. In 2024, the global medical imaging market was valued at over $40 billion, underscoring the importance of these advanced technological inputs.

GE Healthcare contributes essential medical monitoring equipment, vital for tracking patient vital signs and ensuring timely interventions. Philips Healthcare, on the other hand, supplies cutting-edge surgical technologies, enabling Tenet's medical professionals to perform complex procedures with greater precision and safety. These partnerships ensure Tenet's access to innovation, directly impacting the quality and efficiency of care delivered.

Pharmaceutical Companies

Tenet Health collaborates with pharmaceutical companies to enhance its clinical services and drive research forward. These partnerships are crucial for advancing patient care and exploring new treatment avenues.

Specific collaborations highlight Tenet's commitment to innovation. For instance, partnerships with firms like Pfizer have facilitated clinical research, while collaborations with Johnson & Johnson have supported vital clinical trials. These efforts directly contribute to medical advancements.

- Pfizer Collaboration: Focused on clinical research to explore new therapeutic approaches.

- Johnson & Johnson Partnership: Engaged in clinical trials to test and validate innovative treatments.

- Impact on Patient Care: These alliances accelerate the availability of cutting-edge medical options for patients.

- Advancing Medical Knowledge: Contributions to research foster a deeper understanding of diseases and their management.

Physician Partners

Physician partnerships are a cornerstone of Tenet Health's strategy, particularly in its ambulatory surgery centers (ASCs). These collaborations are crucial for delivering specialized medical services and broadening Tenet's reach.

Tenet actively cultivates relationships with skilled physicians to improve patient access to advanced treatments. This focus is evident in its expansion of both employed physician networks and those affiliated with its United Surgical Partners International (USPI) segment.

- Physician Alignment: Tenet aims to align with physicians who prioritize quality outcomes and patient satisfaction, ensuring a high standard of care across its facilities.

- ASCs Growth: Physician partnerships are vital for the continued growth and success of Tenet's extensive network of ambulatory surgery centers.

- Network Expansion: By partnering with physicians, Tenet strengthens its overall healthcare network, increasing its capacity to serve diverse patient needs.

Tenet Health's key partnerships extend to academic institutions and research organizations, fostering innovation and clinical excellence. These collaborations are vital for advancing medical knowledge and integrating the latest research into patient care protocols.

For example, Tenet partners with universities for medical training programs and joint research initiatives. These academic alliances ensure a pipeline of skilled healthcare professionals and facilitate the translation of scientific discoveries into clinical practice. In 2024, Tenet's affiliated teaching hospitals reported over 15,000 resident physicians and fellows, highlighting the depth of these educational partnerships.

Furthermore, Tenet collaborates with healthcare technology companies to develop and implement innovative digital health solutions. These partnerships are crucial for improving operational efficiency, enhancing patient engagement, and expanding access to care through telehealth services.

Tenet Health also engages with government agencies and regulatory bodies to ensure compliance and shape healthcare policy. These relationships are essential for navigating the complex healthcare landscape and advocating for initiatives that benefit patients and providers.

| Partner Type | Examples | 2024 Impact/Focus |

|---|---|---|

| Academic Institutions | University Medical Schools | Medical training, joint research, talent pipeline |

| Research Organizations | Clinical research institutes | Advancing medical knowledge, developing new treatments |

| Technology Companies | Digital health solution providers | Operational efficiency, telehealth expansion |

| Government Agencies | CMS, HHS | Compliance, policy advocacy |

What is included in the product

A detailed Tenet Health Business Model Canvas outlining its core operations, focusing on patient care services as a key value proposition delivered through a network of hospitals and outpatient facilities.

This model emphasizes revenue streams from patient services and insurance reimbursements, supported by key partnerships with physicians and payers, all while managing cost structures related to healthcare delivery.

Tenet Health's Business Model Canvas offers a clear, structured approach to identifying and addressing operational inefficiencies, streamlining patient care pathways, and optimizing resource allocation.

It acts as a powerful tool for pinpointing and alleviating the strain of complex healthcare management, enabling a focused strategy for improved service delivery.

Activities

Tenet's primary activities revolve around the efficient operation and strategic management of its extensive healthcare network. This includes a diverse range of facilities, from large general acute care hospitals to specialized ambulatory surgery centers (ASCs) and other outpatient care sites.

As of the close of 2024, Tenet's operational footprint was significant, with its subsidiaries managing 49 acute care and specialty hospitals. Furthermore, the company held interests in a substantial 518 ASCs and 25 surgical hospitals, spread across 37 states, demonstrating a broad and diversified market presence.

These core activities necessitate meticulous oversight of daily operations, ensuring strict adherence to all healthcare regulations and maintaining consistently high standards for patient care and safety across all facilities.

Tenet Health's core operations revolve around delivering a broad spectrum of medical and surgical services. This encompasses everything from routine acute care to highly specialized treatments like cardiac procedures, cancer therapies, and women's health services. These offerings are supported by essential infrastructure including operating suites, radiology departments, and advanced clinical labs.

The company strategically emphasizes higher acuity procedures, especially within its Ambulatory Surgery Centers (ASCs). This focus on complex cases is a key driver for revenue expansion. For instance, in 2023, Tenet's ASCs generated approximately $2.4 billion in revenue, highlighting their significant contribution to the business.

Conifer Health Solutions, a key subsidiary, drives Tenet's revenue cycle management (RCM) and value-based care initiatives. This involves managing patient interactions and optimizing net patient revenue across Tenet's facilities and for external health systems.

In 2023, Conifer processed over $35 billion in net patient revenue for its clients, demonstrating its significant operational scale. This extensive RCM capability is crucial for Tenet's financial health and its ability to support diverse healthcare providers.

Strategic Acquisitions and De Novo Development

Tenet Health's growth engine heavily relies on strategic acquisitions and building new facilities from the ground up, especially within its USPI ambulatory surgery center business. This dual approach is key to expanding its market reach and modernizing its service offerings.

In 2024, Tenet significantly bolstered its ambulatory network by adding 69 new ambulatory surgery centers (ASCs). Looking ahead to 2025, the company has ambitious plans, targeting the development of 10 to 12 de novo centers. This aggressive expansion highlights a commitment to organic growth alongside inorganic opportunities.

- Strategic Acquisitions: Tenet actively seeks out and integrates new facilities to enhance its portfolio.

- De Novo Development: The company also focuses on building new facilities from scratch to meet market demand.

- USPI Focus: A significant portion of this expansion effort is concentrated within the United Surgical Partners International (USPI) segment.

- Investment: Tenet is allocating approximately $250 million annually towards mergers and acquisitions within the ambulatory sector.

Investing in Technology and Innovation

Tenet Health actively invests in cutting-edge technology and innovation to boost efficiency and elevate patient care. This commitment translates into significant capital allocation for upgrading essential medical equipment.

- Robotic Surgery Platforms: Enhancing precision and minimally invasive procedures.

- Advanced Imaging Systems: Improving diagnostic accuracy and speed.

- Digital Health Initiatives: Expanding access and convenience through telehealth and AI.

In 2024, Tenet continued its focus on digital transformation, with investments aimed at integrating AI for diagnostics and expanding its telehealth capabilities. These efforts are designed to streamline operations, reduce costs, and ultimately improve patient outcomes.

Tenet's key activities center on operating and managing its vast network of healthcare facilities, including acute care hospitals and ambulatory surgery centers (ASCs). This involves ensuring high standards of patient care and regulatory compliance across all locations. The company also focuses on revenue cycle management through its subsidiary, Conifer Health Solutions, and strategic growth via acquisitions and new facility development.

The company's expansion strategy is evident in its significant growth within the ambulatory surgery sector. In 2024, Tenet added 69 new ASCs to its portfolio, with plans to develop an additional 10 to 12 de novo centers in 2025. This focus on ambulatory care, particularly higher acuity procedures, is a key revenue driver, with ASCs generating approximately $2.4 billion in revenue in 2023.

| Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Network Operation | Managing acute care hospitals and ASCs | 49 acute care hospitals managed; 518 ASCs interests |

| Revenue Cycle Management | Optimizing revenue through Conifer Health Solutions | Conifer processed over $35 billion in net patient revenue in 2023 |

| Strategic Growth | Acquisitions and de novo development, especially in ASCs | Added 69 ASCs in 2024; plans for 10-12 de novo centers in 2025 |

| Investment in Technology | Upgrading medical equipment and digital health initiatives | Focus on AI for diagnostics and expanding telehealth capabilities in 2024 |

Full Version Awaits

Business Model Canvas

The Tenet Health Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a mockup or a sample; it is a direct snapshot from the complete, ready-to-use file. Upon completing your order, you will gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately leverage its insights for strategic planning.

Resources

Tenet's extensive network of physical facilities forms a crucial key resource. As of December 31, 2024, the company managed 49 acute care and specialty hospitals. This robust infrastructure is central to delivering a wide range of healthcare services.

Furthermore, Tenet holds significant interests in 518 ambulatory surgery centers (ASCs) and 25 surgical hospitals. This broad geographic footprint across multiple states enables access to a diverse patient population and facilitates the offering of varied medical treatments and procedures.

Tenet Health's business model hinges on its highly skilled workforce, encompassing physicians, nurses, and allied health professionals. This talent pool is fundamental to delivering quality patient care and maintaining operational efficiency.

The company actively invests in staff training and development. For instance, in 2023, Tenet reported significant investments in employee education and training programs, aiming to keep its professionals at the forefront of medical advancements and best practices. This commitment ensures proficiency in the latest treatments and technologies.

A key resource is Tenet's network of employed physicians. As of the first quarter of 2024, Tenet Health employed over 1,800 physicians across its various facilities, a strategic asset that enhances service integration and patient continuity of care.

Tenet Health's commitment to advanced medical technology and equipment is a cornerstone of its business model, directly impacting the quality of care provided. This includes significant investments in state-of-the-art diagnostic imaging systems, such as MRI and CT scanners, and sophisticated medical monitoring equipment crucial for patient safety and effective treatment. For instance, Tenet Health hospitals are equipped with advanced surgical technologies, including robotic surgery platforms, which enable minimally invasive procedures, leading to faster recovery times and improved patient outcomes.

Proprietary Revenue Cycle Management Systems (Conifer)

Conifer Health Solutions, a wholly owned subsidiary of Tenet Healthcare, operates proprietary technology-enabled revenue cycle management services. This robust system is a critical asset for Tenet, designed to streamline financial operations from patient registration through to final payment collection.

The proprietary nature of Conifer's systems allows for tailored solutions that optimize cash flow and enhance patient financial engagement. This focus on efficiency directly contributes to improved financial outcomes for both Tenet's hospitals and its external healthcare clients.

- Key Function: End-to-end revenue cycle management, covering patient access, billing, and collections.

- Value Proposition: Enhances cash flow, patient satisfaction, and financial performance for healthcare providers.

- Clientele: Serves Tenet's own facilities and external healthcare organizations seeking RCM expertise.

Strong Payer Relationships and Contracts

Tenet Health's robust payer relationships are foundational to its business model, ensuring consistent revenue streams and broad patient access. The company actively manages contracts with a diverse array of health insurance providers, a critical element for financial health.

These established agreements facilitate network participation and cultivate a favorable payer mix, directly impacting Tenet's revenue generation. For instance, in 2023, Tenet reported that its managed care and commercial revenue represented a significant portion of its overall income, underscoring the importance of these payer contracts.

- Extensive Network Participation: Tenet Health maintains contracts with a wide spectrum of health insurance companies, including major national and regional payers. This broad network allows patients to utilize Tenet's facilities and services with in-network coverage, driving patient volume.

- Favorable Payer Mix: By securing agreements with various insurers, Tenet can achieve a payer mix that optimizes reimbursement rates. This strategic approach is vital for managing operational costs and maximizing profitability.

- Revenue Stability: Strong payer relationships and well-negotiated contracts provide a predictable revenue flow, which is essential for financial planning and investment in facilities and technology.

- Patient Access Enhancement: These partnerships ensure that a larger patient population can access Tenet's healthcare services, thereby increasing market share and reinforcing its position within the healthcare ecosystem.

Tenet Health's intellectual property, particularly its proprietary technology and data analytics capabilities, represents a significant key resource. This intellectual capital drives operational efficiencies and supports strategic decision-making.

The company's brand reputation and established patient trust are invaluable intangible assets. A strong brand encourages patient loyalty and attracts top medical talent.

Tenet Health's financial resources, including access to capital markets and strong credit ratings, are critical for funding operations, acquisitions, and technological advancements. As of the first quarter of 2024, Tenet Health maintained a solid financial position, enabling continued investment in its infrastructure and services.

| Resource Category | Specific Resource | Impact on Business Model |

|---|---|---|

| Physical Facilities | 49 acute care and specialty hospitals (as of Dec 31, 2024) | Core service delivery infrastructure |

| Physical Facilities | 518 ambulatory surgery centers (ASCs) and 25 surgical hospitals | Broad geographic reach and service diversification |

| Human Capital | Over 1,800 employed physicians (Q1 2024) | Enhanced service integration and patient continuity |

| Technology | Conifer Health Solutions' proprietary RCM technology | Streamlined financial operations and improved cash flow |

| Financial Resources | Access to capital markets | Funding for growth, technology, and operations |

Value Propositions

Tenet Health provides a full spectrum of medical and surgical care, operating hospitals, outpatient clinics, and ambulatory surgery centers. This integrated network ensures patients receive seamless, coordinated care across different service points, enhancing accessibility and continuity from initial diagnosis through specialized treatment.

In 2024, Tenet Health continued to expand its service offerings, with its ambulatory surgery centers performing over 1.2 million procedures. The company's hospital segment saw a significant increase in patient admissions for complex procedures, reflecting the breadth and depth of its integrated healthcare model.

Tenet Health's core value proposition centers on providing high-quality, compassionate, and patient-centered care. This commitment translates into a focus on elevating the overall patient experience through tailored care plans and open communication channels.

The company actively invests in its facilities and adopts advanced technologies. For instance, in 2024, Tenet Health continued its strategic capital expenditures aimed at modernizing its hospitals and enhancing diagnostic and treatment capabilities, directly impacting patient outcomes and satisfaction scores.

Tenet Health's value proposition centers on providing patients with access to sophisticated medical technology and specialized care. This translates into benefits like utilizing advanced diagnostic imaging and robotic surgery, enhancing treatment precision and patient outcomes.

Patients gain access to high-acuity and specialty services, particularly in fields such as orthopedics, cardiology, and oncology. Tenet's strategic focus allows for the delivery of these advanced treatments, often within more cost-effective ambulatory settings, making specialized care more accessible.

In 2023, Tenet Health reported capital expenditures of $1.1 billion, a significant portion of which is directed towards technological advancements and facility upgrades that support these specialized services. This investment underscores their commitment to offering cutting-edge medical solutions.

Cost-Effective Outpatient Care (USPI)

Through United Surgical Partners International (USPI), Tenet Health offers significantly more affordable healthcare, especially for surgical procedures performed in an outpatient setting. This focus on ambulatory care allows for streamlined operations and reduced overhead compared to traditional hospital environments.

USPI's value proposition centers on providing high-quality care at a lower price point. On average, USPI services are 30% to 50% less expensive than comparable procedures at hospitals. This cost advantage makes essential surgical interventions more accessible to a wider patient population.

- Affordability: USPI's outpatient model typically results in 30% to 50% lower costs than inpatient hospital care for suitable procedures.

- Access to Care: Lower costs increase patient access to necessary surgical treatments.

- Efficiency: Streamlined outpatient processes contribute to cost savings and improved patient throughput.

Operational Efficiency and Financial Stability for Partners

For its physician partners and other healthcare providers, Tenet Health delivers enhanced operational efficiency and a strong foundation of financial stability. This is a core part of their value proposition, aiming to streamline operations and improve financial outcomes for those they collaborate with.

Through its United Surgical Partners International (USPI) segment, Tenet offers a distinct advantage by facilitating safer surgical procedures and enabling more favorable rate negotiations with payers. This focus on procedural excellence and improved reimbursement directly contributes to the financial health of its partners.

Further bolstering this offering, Conifer Health Solutions, a Tenet subsidiary, provides specialized revenue cycle management services. These services are designed to optimize cash flow and enhance the overall financial performance of partner organizations, addressing critical back-office functions.

- Operational Efficiency: Streamlined processes and support services through USPI and Conifer.

- Financial Stability: Improved rate negotiations and optimized cash flow via revenue cycle management.

- Safer Procedures: A focus on clinical quality and safety within USPI facilities.

- Enhanced Financial Performance: Direct impact on partner profitability through optimized revenue cycles.

Tenet Health's value proposition is built on providing integrated, high-quality healthcare with a focus on patient experience and access to advanced medical technology. This is achieved through a network of hospitals and ambulatory surgery centers, ensuring seamless care coordination and specialized treatment delivery.

The company's commitment to patient-centered care is evident in its investment in facility modernization and advanced technologies, aiming to improve outcomes and satisfaction. For instance, in 2024, Tenet Health continued significant capital expenditures to upgrade its facilities and enhance diagnostic and treatment capabilities.

Through its United Surgical Partners International (USPI) segment, Tenet Health offers a compelling value proposition of affordability and accessibility for surgical procedures. USPI's outpatient model provides care at 30% to 50% lower costs than traditional hospital settings, making essential surgeries more attainable for a broader patient base.

For its physician partners, Tenet Health delivers enhanced operational efficiency and financial stability through its integrated network and specialized support services like revenue cycle management. This focus on streamlined operations and optimized cash flow directly benefits partner profitability.

| Value Proposition Component | Description | Key Differentiator | 2024 Data/Impact |

|---|---|---|---|

| Integrated Care Network | Full spectrum of medical and surgical care across hospitals and outpatient facilities. | Seamless patient journey and continuity of care. | Over 1.2 million procedures performed at ambulatory surgery centers. |

| Patient-Centered Care | High-quality, compassionate care with a focus on patient experience. | Tailored care plans and open communication. | Continued investment in facility modernization and advanced technologies. |

| Affordability & Access (USPI) | Lower-cost surgical procedures in an outpatient setting. | 30-50% cost savings compared to hospital procedures. | Increased patient access to necessary surgical interventions. |

| Physician & Partner Support | Enhanced operational efficiency and financial stability for healthcare providers. | Streamlined operations and improved revenue cycle management. | Conifer Health Solutions optimizing cash flow for partner organizations. |

Customer Relationships

Tenet Health prioritizes building strong patient relationships through personalized care and active engagement. This means understanding each patient's unique needs and ensuring they receive compassionate treatment, with clear communication at every step of their healthcare experience.

A key focus is enhancing patient satisfaction, a critical metric for relationship strength. For instance, in 2023, Tenet Health reported improvements in patient experience scores across its facilities, reflecting a commitment to this personalized approach.

Tenet Health cultivates strong physician relationships by actively collaborating and offering comprehensive support, especially within its ambulatory surgery centers. This partnership model provides physicians with essential infrastructure, cutting-edge technology, and robust operational assistance, thereby enabling them to deliver superior patient care and expand their professional reach.

Tenet Health cultivates robust partnerships with managed care organizations (MCOs) and health insurance providers. These alliances are fundamental for securing network inclusion, negotiating competitive reimbursement rates, and facilitating patient access to Tenet's healthcare services. For instance, in 2023, Tenet reported that a significant portion of its revenue was derived from managed care contracts, highlighting their importance.

Community Engagement and Outreach

Tenet Health actively builds strong community ties through accessible, high-quality care and targeted outreach programs. This approach prioritizes understanding and addressing the unique health needs of the populations it serves, fostering a culture of well-being.

In 2024, Tenet continued its focus on community engagement, with initiatives aimed at improving health literacy and access to preventative services. For example, many Tenet facilities hosted free health screenings and educational workshops, directly impacting thousands of individuals.

- Community Health Initiatives: Tenet hospitals and clinics participated in over 500 community health fairs and events nationwide in 2024, offering vital health screenings and information.

- Partnerships for Impact: Collaborations with local non-profits and public health organizations allowed Tenet to extend its reach, addressing specific needs like chronic disease management and maternal health in underserved areas.

- Patient Education and Support: The organization provided extensive patient education materials and support groups, empowering individuals to take an active role in their health journey.

Technology-Enabled Patient Communication

Tenet Health is enhancing patient relationships by integrating technology into its communication strategies. This includes a significant expansion of telehealth services, offering virtual consultations that provide convenience and accessibility for patients. In 2024, Tenet reported a substantial increase in telehealth utilization, with virtual visits accounting for a growing percentage of outpatient encounters, demonstrating a clear preference among patients for these digital channels.

Furthermore, Tenet is deploying AI-driven workflows within its revenue cycle management. This technology streamlines administrative processes, leading to improved patient engagement by providing clearer billing information and more responsive support. By reducing administrative friction, Tenet aims to foster greater trust and satisfaction, directly strengthening the patient-provider relationship.

- Telehealth Expansion: Increased virtual consultation availability for greater patient access and convenience.

- AI in Revenue Cycle: Streamlining administrative tasks to improve patient financial experience and engagement.

- Enhanced Patient Support: Utilizing technology to provide more responsive and personalized communication.

- Data-Driven Engagement: Leveraging insights from technology platforms to better understand and meet patient needs.

Tenet Health is committed to fostering strong patient relationships through a multi-faceted approach that blends personalized care with technological innovation. This involves actively engaging with patients, understanding their individual needs, and ensuring compassionate communication throughout their healthcare journey. The organization also places significant emphasis on strengthening ties with physicians and managed care organizations, which are crucial for service delivery and accessibility.

In 2024, Tenet Health continued to expand its telehealth services, with virtual visits representing a growing portion of outpatient encounters, offering patients greater convenience and accessibility. Simultaneously, the integration of AI in revenue cycle management aims to streamline administrative processes, leading to a more transparent and responsive financial experience for patients. These efforts collectively support Tenet's goal of enhancing patient satisfaction and building lasting trust.

| Customer Relationship Aspect | 2023 Focus/Data | 2024 Initiatives/Data |

|---|---|---|

| Patient Engagement | Improvements in patient experience scores | Expansion of telehealth services; increased virtual visit utilization |

| Physician Collaboration | Infrastructure and technology support for physicians in ASCs | Continued focus on operational assistance and cutting-edge technology |

| Managed Care Partnerships | Significant revenue from managed care contracts | Negotiating competitive reimbursement rates and network inclusion |

| Community Outreach | Targeted outreach programs addressing local health needs | Health literacy and preventative service initiatives; free health screenings |

Channels

Tenet's owned and operated hospitals are the core of its service delivery, acting as the primary channel for patients seeking comprehensive medical care. These facilities offer everything from emergency services to specialized surgical procedures, forming the backbone of their healthcare network.

As of the first quarter of 2024, Tenet operated 58 general acute care hospitals and 12 specialty hospitals, demonstrating a significant physical presence in the healthcare market. This extensive network allows them to cater to a broad range of patient needs and conditions.

These hospitals are crucial for generating revenue through patient services, procedures, and treatments. In the first quarter of 2024, Tenet reported total operating revenues of $4.7 billion, with hospital operations being a significant contributor to this figure.

United Surgical Partners International (USPI) is a key channel for Tenet Health, focusing on outpatient surgical services. In 2024, USPI continued to be a major driver of growth, with Tenet reporting that its ambulatory surgery centers performed a significant volume of procedures, contributing substantially to revenue. This channel benefits from the increasing demand for less invasive and more convenient surgical options.

Tenet Health's business model extends beyond Ambulatory Surgery Centers (ASCs) to encompass a broad network of outpatient facilities. This includes diagnostic imaging centers, urgent care centers, and even off-campus hospital emergency departments. These facilities are crucial for providing accessible care for less severe medical needs and for offering specialized diagnostic services.

In 2024, Tenet continued to leverage these outpatient channels to broaden its reach and patient engagement. For instance, their urgent care centers offer convenient access for minor illnesses and injuries, diverting less critical cases from more resource-intensive hospital settings. Similarly, imaging centers provide essential diagnostic services, often with greater convenience and lower costs than hospital-based imaging.

Employed Physician Networks

Tenet Health leverages its network of employed physicians as a critical channel for delivering patient care. These physicians are integral to Tenet's strategy, practicing within its hospitals and outpatient centers to facilitate seamless, coordinated treatment pathways.

This physician employment model directly influences patient volume and service utilization within Tenet's facilities. For instance, Tenet's employed physician groups are key drivers for admissions and procedures across its extensive hospital network. By integrating physicians directly into its operational structure, Tenet ensures that a significant portion of patient referrals and treatments occur within its own system, fostering efficiency and revenue capture.

- Physician Network Strength: Tenet Health's employed physician base is a cornerstone of its patient access strategy.

- Integrated Care Delivery: Physicians practicing within Tenet's facilities ensure coordinated care and patient flow.

- Referral Stream: Employed physicians represent a significant source of patient referrals and revenue for Tenet's hospitals and outpatient services.

- Operational Efficiency: This model supports streamlined operations and enhanced management of care quality and costs.

Digital Platforms (Telehealth)

Digital platforms, especially telehealth, are a crucial channel for Tenet to broaden healthcare access. These virtual consultations and digital health programs enable patients to receive medical attention from anywhere, significantly boosting convenience and expanding the provider's reach.

In 2024, telehealth adoption continued its upward trajectory. For instance, a significant portion of patients, estimated to be around 40% by industry reports, expressed a preference for virtual visits for routine check-ups and follow-up appointments, highlighting the growing demand for these services.

- Expanded Reach: Telehealth allows Tenet to connect with patients in rural or underserved areas, overcoming geographical barriers.

- Patient Convenience: Virtual appointments reduce travel time and waiting room waits, offering a more flexible healthcare experience.

- Service Diversification: Digital platforms enable Tenet to offer a wider range of services, from primary care consultations to specialist follow-ups and mental health support.

- Operational Efficiency: By managing certain patient interactions virtually, Tenet can optimize the utilization of its physical facilities and clinical staff.

Tenet's owned hospitals, numbering 58 general acute care and 12 specialty hospitals as of Q1 2024, form the primary channel for comprehensive medical services. These facilities generated a substantial portion of Tenet's $4.7 billion in Q1 2024 revenue.

United Surgical Partners International (USPI) represents a critical channel for outpatient surgical care, with its ambulatory surgery centers performing a high volume of procedures in 2024, contributing significantly to revenue. This focus aligns with patient preference for less invasive options.

Tenet's broader outpatient network, including imaging and urgent care centers, serves as an accessible channel for less severe medical needs and diagnostics, enhancing patient engagement and service diversification.

The employed physician network acts as a vital channel, driving patient referrals and ensuring coordinated care within Tenet's hospitals and outpatient facilities, thereby enhancing operational efficiency and revenue capture.

Digital platforms, particularly telehealth, are increasingly important channels for Tenet, expanding healthcare access and patient convenience. In 2024, an estimated 40% of patients showed a preference for virtual visits for routine care.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Owned Hospitals | General acute care and specialty facilities | 58 general acute care, 12 specialty hospitals; significant revenue driver |

| USPI (Ambulatory Surgery Centers) | Outpatient surgical services | High procedure volume, key growth driver |

| Other Outpatient Facilities | Imaging centers, urgent care, off-campus EDs | Accessible care for minor needs, diagnostic services |

| Employed Physician Network | Physicians practicing within Tenet facilities | Drives referrals, ensures coordinated care |

| Digital Platforms (Telehealth) | Virtual consultations and digital health programs | Expanding access, patient convenience; ~40% preference for virtual visits |

Customer Segments

This segment encompasses individuals requiring immediate inpatient hospital care for serious medical conditions, surgical procedures, and advanced specialized treatments. Tenet's facilities are specifically designed to manage high-acuity cases, including those in cardiovascular, neurosciences, and oncology departments.

In 2024, Tenet Health's hospitals continued to be a critical provider for these complex patient needs. For instance, the company reported significant volumes in its specialty service lines, reflecting the demand for acute care. Their commitment to handling these challenging cases underscores their role in the healthcare ecosystem.

Tenet Health is increasingly serving patients who opt for outpatient surgical procedures, a segment growing due to the convenience and cost savings offered by Ambulatory Surgery Centers (ASCs). Specialties like orthopedics, gastroenterology, and pain management are particularly strong in this area.

In 2024, the demand for outpatient procedures continued its upward trajectory, with ASCs performing an estimated 25 million procedures nationwide. This trend is fueled by advancements in minimally invasive techniques and a preference for quicker recovery times outside traditional hospital settings.

Tenet Health actively serves patients with a diverse range of insurance coverage, encompassing both commercial plans and government programs like Medicare and Medicaid. This broad patient base is crucial for the company's operational stability and revenue generation.

A key financial strength for Tenet lies in its payer mix, which historically favors commercial insurance. In 2023, for instance, commercial payers represented a substantial portion of Tenet's revenue, often yielding higher reimbursement rates compared to government programs. This favorable mix directly bolsters the company's financial performance and profitability.

Physicians and Physician Groups

Physicians and physician groups represent a critical dual customer and partner segment for Tenet Health. Tenet actively collaborates with independent medical staffs and physician partners, particularly within its United Surgical Partners International (USPI) segment, fostering a symbiotic relationship that drives patient care and operational efficiency.

Furthermore, Tenet serves employed physician groups across its network, integrating their expertise and services directly into its healthcare delivery model. This dual approach allows Tenet to leverage a broad spectrum of medical talent and ensure comprehensive patient management.

- Partnership Model: Tenet collaborates with independent physicians and physician groups, particularly within its USPI ambulatory surgery center network.

- Employment Model: Tenet also employs physicians directly, integrating them into its hospital and clinic operations.

- Value Proposition: For physicians, Tenet offers access to advanced facilities, administrative support, and a broad patient base, enhancing their practice and patient outcomes.

- Market Reach: In 2024, Tenet Health continued to expand its physician alignment strategies, aiming to strengthen relationships with the approximately 100,000 physicians who admit or operate at its facilities.

Other Healthcare Providers and Health Systems

Tenet Health, through its Conifer Health Solutions segment, actively engages with a broad range of healthcare entities beyond its own facilities. This includes serving independent hospitals, larger health systems, and individual physician practices. Conifer provides essential services aimed at optimizing their financial operations and adapting to evolving payment models.

The core offerings to these external clients focus on revenue cycle management, ensuring efficient billing, collections, and claims processing. Furthermore, Conifer assists these partners in navigating and succeeding within value-based care arrangements, a critical shift in healthcare reimbursement. In 2024, Conifer's revenue cycle management services are particularly vital as providers face increasing complexity in payer contracts and patient billing.

- Conifer Health Solutions serves external hospitals and health systems.

- Services include revenue cycle management and value-based care support.

- Physician practices and self-insured organizations are also key clients.

- This segment diversifies Tenet's revenue streams and leverages its operational expertise.

Tenet Health's customer segments are diverse, catering to both individuals seeking acute care and those opting for outpatient services. The company also serves physicians and other healthcare entities through its various business units.

In 2024, Tenet Health continued to be a primary provider for patients requiring complex inpatient hospital care, including specialized treatments and surgical procedures. This segment is vital for managing high-acuity cases across departments like cardiology and oncology.

The demand for outpatient surgical procedures through Tenet's Ambulatory Surgery Centers (ASCs) also remained strong in 2024. Specialties such as orthopedics and gastroenterology drove significant patient volumes, reflecting a national trend towards less invasive and quicker recovery options.

Tenet Health's payer mix is a key financial driver, with a substantial portion of revenue historically coming from commercial insurance plans, which generally offer higher reimbursement rates than government programs like Medicare and Medicaid.

Beyond direct patient care, Tenet Health, via its Conifer Health Solutions, supports external hospitals, health systems, and physician practices with revenue cycle management and value-based care strategies, diversifying its revenue and leveraging its operational expertise.

Cost Structure

Salaries, wages, and benefits represent a substantial component of Tenet Health's cost structure, reflecting its extensive network of healthcare professionals and support staff. This category is a primary cost driver, essential for attracting and retaining skilled talent in the competitive healthcare industry.

In the second quarter of 2025, Tenet Health reported a slight year-over-year decrease in expenses related to salaries, wages, and benefits. This adjustment, while marginal, underscores the ongoing management of labor costs within the organization.

The cost of medical supplies, equipment, and pharmaceuticals represents a significant portion of Tenet Health's expenses. For instance, in 2023, Tenet reported that supply costs, including pharmaceuticals, were a major driver of operating expenses, often increasing with the complexity and acuity of patient care.

These expenditures are inherently variable, directly tied to the volume and nature of services provided. Procedures requiring specialized implants, advanced diagnostic imaging contrast agents, or high-cost drugs naturally incur higher supply costs. This fluctuation means Tenet must maintain robust inventory management and negotiate effectively with suppliers.

Operating and maintaining Tenet Health's extensive network of hospitals and outpatient facilities incurs substantial costs. These include utilities like electricity and water, rent or mortgage payments for properties, property taxes, and essential ongoing maintenance to ensure safe and functional environments. For instance, in 2023, Tenet Health reported that its facility-related expenses, encompassing these operational and maintenance costs, represented a significant portion of their overall operating expenditures, reflecting the capital-intensive nature of healthcare infrastructure.

Technology and IT Infrastructure Investments

Tenet Health's cost structure is significantly impacted by ongoing investments in technology and IT infrastructure. These crucial expenditures cover areas like electronic health records (EHRs), robust cybersecurity measures, and the adoption of new medical technologies. For instance, in 2023, Tenet Health reported capital expenditures totaling $1.2 billion, a portion of which was allocated to enhancing its technological capabilities to improve operational efficiency and deliver advanced patient care.

These technology investments are not just operational necessities but strategic drivers for Tenet Health. They enable better data management, streamline clinical workflows, and support the integration of innovative medical devices and treatment methodologies. The company's commitment to these areas is reflected in its financial reporting, underscoring the substantial costs associated with maintaining a cutting-edge healthcare IT environment.

- Electronic Health Records (EHRs): Upgrading and maintaining comprehensive EHR systems to ensure seamless patient data management and accessibility.

- Cybersecurity: Investing in advanced security protocols and infrastructure to protect sensitive patient information and prevent data breaches.

- New Medical Technologies: Acquiring and integrating emerging medical equipment and software to enhance diagnostic accuracy and treatment efficacy.

- IT Infrastructure: Continuous investment in network upgrades, cloud computing, and data analytics platforms to support evolving healthcare demands.

Acquisition and Development Costs

Tenet Health's growth hinges on acquiring and developing new facilities, especially Ambulatory Surgery Centers (ASCs). This strategy demands considerable investment. In 2023, Tenet Health, through its subsidiary USPI, continued its aggressive pursuit of ASC acquisitions and de novo development, underscoring the importance of this cost category.

The company dedicates a significant portion of its capital to M&A in the ambulatory sector. For instance, Tenet's 2024 capital expenditure guidance reflects ongoing investment in strategic growth initiatives, including ASC development and acquisitions, aiming to expand its footprint and service offerings.

- Acquisition Outlays: Tenet Health consistently allocates capital for acquiring existing ASCs and hospital-based outpatient departments, integrating them into its network.

- De Novo Development: Significant funds are earmarked for building new ASCs from the ground up, a key component of their expansion strategy.

- Capital Allocation for Growth: The company's financial reports detail substantial annual budgets for M&A and development projects, particularly within the ambulatory care segment.

Tenet Health's cost structure is heavily influenced by its significant investment in technology and IT infrastructure. These expenditures are crucial for maintaining electronic health records (EHRs), robust cybersecurity, and adopting new medical technologies. For instance, in 2023, Tenet Health reported capital expenditures of $1.2 billion, with a notable portion dedicated to enhancing its technological capabilities to improve efficiency and patient care.

The company’s strategic focus on acquiring and developing Ambulatory Surgery Centers (ASCs) represents another major cost driver. Tenet Health, through its subsidiary USPI, actively pursues ASC acquisitions and new developments. This commitment is evident in their capital allocation strategies, with 2024 guidance indicating continued investment in these growth initiatives to expand their market presence and service offerings.

These investments in ASCs are substantial, encompassing both the purchase of existing facilities and the construction of new ones. Tenet Health's financial reports consistently highlight significant annual budgets allocated to mergers, acquisitions, and development projects, particularly within the ambulatory care segment, underscoring this as a key area of expenditure.

| Cost Category | Description | 2023 Impact/Focus |

|---|---|---|

| Technology & IT Infrastructure | EHRs, cybersecurity, new medical tech | $1.2 billion capital expenditure (portion for tech) |

| Ambulatory Surgery Center (ASC) Growth | Acquisitions and de novo development | Aggressive pursuit of ASCs by USPI |

| Capital Allocation for Growth | M&A and development projects | Significant annual budgets for ambulatory care expansion |

Revenue Streams

Tenet's core revenue generation stems from the patient services offered across its network of acute care and specialty hospitals. This encompasses a broad range of medical treatments, from routine check-ups and emergency care to complex surgical procedures and extended inpatient stays. For instance, in the second quarter of 2025, Tenet's hospital operations reported net operating revenues of $4 billion, reflecting a modest 0.9% increase year-over-year.

Ambulatory care services, primarily through its United Surgical Partners International (USPI) subsidiary, represent a crucial revenue engine for Tenet Health. These facilities generate income from a wide array of outpatient surgical procedures and other medical services. USPI's performance is a strong indicator of this segment's health, with net operating revenues experiencing a notable 11.3% increase year-over-year in the second quarter of 2025.

Tenet Health's revenue is significantly shaped by payments from a mix of health insurance providers and government programs. Commercial payers, along with government-funded initiatives like Medicare and Medicaid, form the backbone of this income. A healthy balance among these payers, often referred to as a favorable payer mix, directly impacts the company's financial performance.

Furthermore, an increase in net revenue per case plays a crucial role in boosting this revenue stream. For instance, in the second quarter of 2025, Tenet Health experienced a positive pre-tax impact of $79 million. This boost was specifically attributed to additional supplemental revenues received from Medicaid programs, highlighting the importance of these government reimbursements.

Physician Services Revenue

Tenet Health generates revenue through its employed physician networks and partnerships, covering a range of medical services. This includes standard office visits, in-depth specialized consultations, and various procedures carried out by their medical staff.

For instance, in 2023, Tenet Health reported that its physician services segment played a significant role in its overall financial performance, contributing to the company's ability to offer comprehensive patient care.

- Office Visits: Revenue from routine patient consultations.

- Specialized Consultations: Income from expert medical advice and assessments.

- Procedures: Earnings from medical interventions and treatments performed by physicians.

Revenue Cycle Management Services (Conifer)

Conifer Health Solutions, a subsidiary of Tenet Healthcare, generates revenue by offering comprehensive revenue cycle management (RCM) services. These services are provided not only to Tenet's own hospitals and facilities but also to a broad base of external healthcare providers. This dual approach diversifies Conifer's income and leverages its expertise across the industry.

The core of Conifer's revenue stream lies in its ability to streamline and optimize the financial operations of healthcare organizations. This encompasses crucial functions such as patient registration, insurance verification, claims submission, payment posting, denial management, and patient billing. By efficiently managing these processes, Conifer helps clients accelerate cash flow and reduce administrative costs.

- Revenue Diversification: Conifer's RCM services cater to both internal Tenet facilities and external healthcare clients, creating multiple avenues for income generation.

- Service Scope: The revenue generated is tied to a wide array of services including claims processing, patient billing, and overall financial management for healthcare providers.

- Market Position: In 2024, the RCM market continued to grow, with companies like Conifer playing a vital role in helping healthcare systems navigate complex payment landscapes and improve financial performance.

Tenet's revenue is primarily driven by patient services across its hospital network, covering a wide spectrum of medical care. This includes everything from emergency services to complex surgeries. For example, in the second quarter of 2025, Tenet's hospital operations generated $4 billion in net operating revenues.

Outpatient surgical procedures and other medical services provided through its USPI subsidiary are a significant revenue contributor. USPI's performance highlights this segment's strength, with net operating revenues increasing by 11.3% year-over-year in Q2 2025.

Payments from commercial health insurers and government programs like Medicare and Medicaid form the core of Tenet's income. A favorable payer mix is essential for the company's financial health.

Additional supplemental revenues, such as those received from Medicaid programs, also boost overall revenue. In Q2 2025, Tenet Health saw a positive pre-tax impact of $79 million attributed to these reimbursements.

Tenet also generates revenue from its employed physician networks, which offer services ranging from routine office visits to specialized consultations and procedures. In 2023, physician services were a key component of Tenet's overall financial performance.

Business Model Canvas Data Sources

The Tenet Health Business Model Canvas is built upon a foundation of comprehensive financial statements, detailed patient demographic data, and extensive market research reports. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the healthcare industry.