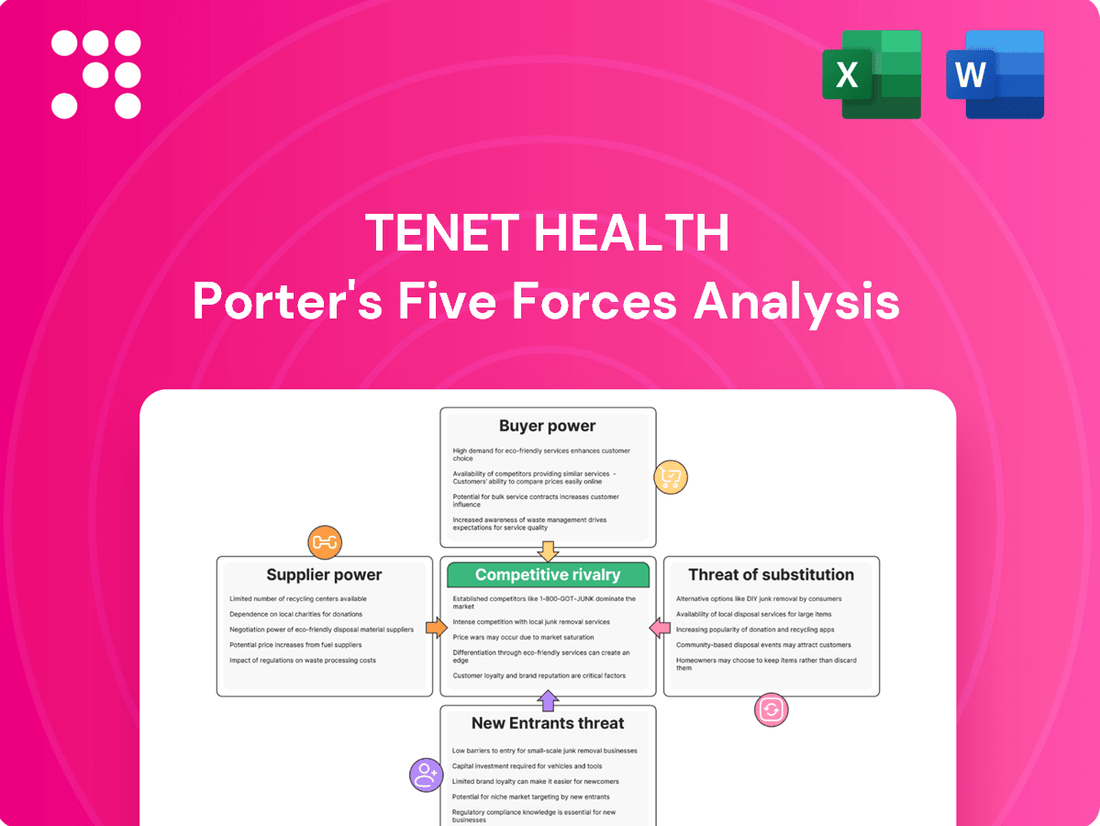

Tenet Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

Tenet Health operates in a dynamic healthcare landscape, facing significant pressure from powerful buyers and intense rivalry among established players. Understanding the bargaining power of its suppliers and the constant threat of new entrants is crucial for navigating this complex market.

The complete report reveals the real forces shaping Tenet Health’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability and cost of skilled healthcare professionals, such as nurses and physicians, directly affect Tenet's operating expenses. For instance, a 2024 agreement with SEIU-UHW involved significant wage hikes, highlighting the strong bargaining position of organized healthcare workers.

Tenet Health's ability to manage labor costs while maintaining sufficient staffing levels is a key operational challenge. The healthcare industry's ongoing demand for specialized talent means that labor availability and associated compensation will continue to be a significant factor in supplier bargaining power.

Tenet Health, a major healthcare provider, depends significantly on a wide array of medical supplies, equipment, and pharmaceuticals. Despite a 2.6% rise in supply costs during the second quarter of 2025, Tenet's substantial operational size and involvement in group purchasing organizations (GPOs) provide leverage. This allows them to negotiate more favorable terms, thereby somewhat counteracting the bargaining power of their suppliers.

Suppliers of highly specialized medical technology and innovative pharmaceuticals wield considerable bargaining power. This is often due to patent protections and the essential nature of their products for advanced patient care. For instance, a new, patented diagnostic imaging device crucial for Tenet's high-acuity services could command premium pricing.

Tenet Health's strategic emphasis on high-acuity services naturally increases its dependence on cutting-edge equipment. This reliance can concentrate purchasing power with a select group of specialized technology vendors, potentially leading to higher costs if Tenet cannot leverage its scale or find viable alternatives.

Physician Groups and Affiliations

Physicians, particularly those with specialized expertise or extensive patient bases, wield significant bargaining power. They can influence patient flow and negotiate favorable compensation terms, directly impacting Tenet's operational costs and revenue. For instance, in 2024, Tenet Health continued its focus on physician alignment, recognizing that strong relationships with high-demand specialists are crucial for maintaining market share and offering competitive services.

Tenet's strategic approach emphasizes partnerships with reputable physician groups to bolster its offerings in specialized medical fields. This strategy acknowledges that physician loyalty and collaboration are key drivers for attracting and retaining patients, especially in competitive markets. As of the first quarter of 2024, Tenet reported ongoing investments in physician recruitment and retention programs aimed at strengthening these vital affiliations.

- Physician Influence: Specialists can direct patient referrals, impacting Tenet's patient volume and service utilization.

- Compensation Negotiation: The ability of physicians to negotiate their fees directly affects Tenet's profitability.

- Strategic Partnerships: Tenet's focus on aligning with high-quality physicians enhances its access to specialized care and patient populations.

- 2024 Focus: Tenet's ongoing investments in physician recruitment and retention highlight the critical nature of these relationships in the current healthcare landscape.

Real Estate and Facilities Management

For Tenet Health, which operates a vast network of hospitals and surgery centers, real estate and facilities management are critical operational components. The specialized nature of healthcare construction and the long-term commitments typically involved in facility leases can grant significant bargaining power to landlords and specialized construction firms. This leverage stems from the high barriers to entry for developing and maintaining healthcare-specific properties.

The bargaining power of suppliers in this sector is influenced by several factors:

- Specialized Construction Needs: Healthcare facilities require unique infrastructure, such as advanced HVAC systems, specialized plumbing, and robust electrical grids, limiting the pool of qualified construction companies.

- Long-Term Lease Agreements: Many healthcare providers enter into long-term leases for their facilities, often 10-20 years or more. This commitment provides landlords with a stable, predictable revenue stream, enhancing their negotiating position.

- Location and Zoning: Prime locations with appropriate zoning for healthcare services are scarce, giving property owners in desirable areas considerable leverage.

- Limited Substitutes: For established, well-located facilities, there are few readily available substitutes for Tenet Health, further strengthening supplier power.

Suppliers of essential medical equipment and pharmaceuticals hold significant sway due to the critical nature of their products and, in some cases, patent protection. For instance, the cost of specialized medical technology, like advanced imaging machines, can be high, impacting Tenet's capital expenditure. Tenet's scale and participation in group purchasing organizations (GPOs) help mitigate this, as seen in their efforts to negotiate better terms for supplies, even with a noted 2.6% increase in supply costs in Q2 2025.

Skilled healthcare professionals, particularly physicians and nurses, represent a major supplier group with substantial bargaining power. Wage increases, like those agreed upon with SEIU-UHW in 2024, directly influence Tenet's operating expenses. The ongoing demand for specialized medical talent means labor costs will remain a key factor for Tenet, underscoring the importance of physician alignment strategies and recruitment investments, as highlighted in Q1 2024.

| Supplier Group | Bargaining Power Factors | Impact on Tenet Health | 2024/2025 Data Points |

|---|---|---|---|

| Medical Equipment & Pharma | Product essentiality, patent protection, limited substitutes | Higher product costs, capital expenditure impact | 2.6% rise in supply costs (Q2 2025) |

| Healthcare Professionals | High demand for specialized skills, unionization, patient referral influence | Increased labor costs, staffing challenges, revenue impact | SEIU-UHW wage hikes (2024), physician recruitment investments (Q1 2024) |

| Real Estate & Construction | Specialized facility needs, long-term leases, prime location scarcity | Higher facility costs, lease commitment leverage | N/A (General industry observation) |

What is included in the product

This analysis unpacks the competitive forces impacting Tenet Health, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the healthcare industry.

Instantly understand competitive pressures within the healthcare landscape, allowing Tenet Health to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Patients, as direct consumers of healthcare, are increasingly exercising their choice, driven by considerations of quality, cost, and convenience. This trend is amplified by Tenet Health's strategic expansion of its ambulatory surgery centers (ASCs). These ASCs offer more affordable alternatives for specific procedures, directly enhancing patient options and bargaining power.

Physicians wield considerable influence over patient choices for healthcare services, essentially acting as gatekeepers. This makes their referral patterns a critical factor for Tenet Health in attracting and retaining patients, directly impacting its market share and revenue streams.

Tenet Health's strategic focus on expanding its physician network and fostering strong partnerships highlights the recognition of this powerful dynamic. By aligning with physicians, Tenet aims to secure a steady flow of patient referrals, which is essential for its operational success and competitive positioning in the healthcare industry.

The bargaining power of customers, particularly insurance payers, significantly impacts Tenet Health. Large commercial insurers and government programs like Medicare and Medicaid dictate reimbursement rates, directly affecting Tenet's revenue. For instance, a favorable payer mix, with a higher proportion of patients covered by commercially insured plans offering better reimbursement, has historically been a crucial factor in Tenet's revenue expansion.

Government Reimbursement Policies

Government reimbursement policies significantly influence the bargaining power of customers in the healthcare sector. Programs like Medicare and Medicaid establish fixed reimbursement rates, effectively capping what healthcare providers can charge for services rendered to beneficiaries of these programs. Policy changes introduced by government bodies can also directly impact a provider's revenue streams, giving these government entities considerable leverage.

Tenet Health, for instance, anticipates receiving substantial supplemental payments from Medicaid in 2025. This expectation underscores the company's reliance on these government funding mechanisms, which in turn highlights the bargaining power these government programs wield over providers like Tenet.

- Government programs dictate reimbursement rates, limiting pricing power for healthcare providers.

- Policy shifts by government payers can directly affect provider revenue and operational flexibility.

- Tenet Health's reliance on anticipated 2025 Medicaid supplemental payments demonstrates the impact of government funding on its financial outlook.

Impact of Healthcare Exchange Subsidies

The bargaining power of customers in healthcare, particularly concerning Tenet Health, is significantly influenced by government subsidies. The potential expiration of Affordable Care Act (ACA) marketplace subsidies, which help a portion of patients afford care, directly impacts Tenet's patient volume and the mix of payers it serves. This uncertainty has been a point of concern for investors, who recognize the financial implications of shifts in patient affordability and reliance on government support.

These subsidies, a key component of healthcare access for many, can directly affect the number of patients seeking services at Tenet facilities. A reduction or elimination of these subsidies could lead to fewer insured patients or a greater proportion of patients with higher out-of-pocket costs, potentially altering Tenet's revenue streams and profitability.

- Subsidies underpin patient affordability: ACA marketplace subsidies make healthcare more accessible for millions, directly influencing patient volumes for providers like Tenet.

- Expiration creates revenue uncertainty: The potential lapse of these subsidies introduces a significant variable in Tenet's financial forecasting, impacting payer mix and collection rates.

- Investor concern highlights risk: Tenet's exposure to these expiring subsidies is a recognized risk factor for investors, reflecting the sensitivity of the business to healthcare policy changes.

The bargaining power of customers, particularly insurance payers, significantly impacts Tenet Health. Large commercial insurers and government programs like Medicare and Medicaid dictate reimbursement rates, directly affecting Tenet's revenue. In 2024, Tenet Health's payer mix continued to be a critical factor, with commercially insured patients generally yielding higher reimbursement rates compared to government programs.

Government reimbursement policies significantly influence customer bargaining power. For instance, Medicare and Medicaid establish fixed rates, capping provider charges. In 2024, Tenet Health's financial performance was closely tied to these government funding mechanisms, demonstrating the leverage these programs hold.

The potential expiration of Affordable Care Act (ACA) marketplace subsidies in 2025 presents a significant variable for Tenet Health. These subsidies impact patient affordability and payer mix, a concern for investors anticipating shifts in revenue streams and collection rates.

| Payer Type | Typical Reimbursement Impact | 2024 Relevance for Tenet |

|---|---|---|

| Commercial Insurance | Higher reimbursement rates | Crucial for revenue expansion; favorable payer mix is key |

| Medicare | Fixed, regulated rates | Significant revenue driver, subject to policy adjustments |

| Medicaid | Lower reimbursement rates, potential for supplemental payments | Reliance on government funding, including anticipated 2025 supplemental payments |

Same Document Delivered

Tenet Health Porter's Five Forces Analysis

This preview shows the exact Tenet Health Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare industry. This detailed document is fully formatted and ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

The U.S. healthcare landscape is fiercely competitive, with major hospital chains like HCA Healthcare and Universal Health Services posing significant rivalry to Tenet Health. These large, investor-owned operators, alongside many regional and local systems, vie for market share. Tenet, however, has solidified a substantial presence, especially within acute care hospitals and ambulatory surgery centers (ASCs).

Tenet Health's strategic focus on its United Surgical Partners International (USPI) segment significantly heightens competitive rivalry in the ambulatory care market. This intensified focus is backed by substantial investment, positioning USPI as a primary driver for Tenet's future growth.

USPI's expansion plans, including continued acquisitions throughout 2025, directly confront other providers of outpatient surgical services. This aggressive growth strategy means Tenet is actively competing for market share and physician partnerships in the increasingly lucrative ambulatory surgery center space.

Tenet Health's strategic emphasis on high-acuity services, including complex procedures like total joint replacements and cardiovascular interventions, places it in direct competition with other healthcare systems. This rivalry extends to attracting and retaining the specialized physicians essential for these lucrative, high-revenue cases.

In 2024, the demand for specialized medical services remains robust, intensifying the competition for market share in these profitable segments. Hospitals are increasingly differentiating themselves by investing in advanced technology and recruiting top surgical talent to capture these higher-margin procedures.

Cost Discipline and Operational Efficiency

Competitors in the healthcare sector intensely battle for market share by showcasing superior operational efficiency and rigorous cost management, directly influencing their profitability. This drive for efficiency is crucial for maintaining a competitive edge.

Tenet Health has demonstrated notable cost discipline, especially in its strategic management of contract labor expenses. This focus has been a significant contributor to its margin improvements, as seen in its financial performance.

- Tenet Health's Cost Management: In the first quarter of 2024, Tenet reported a significant reduction in its reliance on contract labor, which directly bolstered its operating margins.

- Impact on Profitability: Effective cost control, particularly in labor, allows Tenet to offer competitive pricing while maintaining healthy profit margins, a key differentiator.

- Industry Trend: The broader healthcare industry is also focusing on operational efficiencies to combat rising costs, making cost discipline a critical factor for survival and growth.

Portfolio Optimization and Divestitures

Tenet Health's competitive rivalry is intensified by its strategic portfolio optimization. In 2024 alone, the company divested 14 hospitals, a move designed to sharpen its focus on higher-margin service lines and core geographic areas. This rationalization aims to bolster its competitive standing by concentrating resources where they yield the greatest returns.

This divestiture strategy directly impacts competitive dynamics. By shedding underperforming or non-core assets, Tenet can allocate capital more effectively towards growth opportunities and strengthening its position in key markets. This allows for a more aggressive and targeted approach against rivals competing for market share in those focused segments.

- Divestiture Impact: Tenet's sale of 14 hospitals in 2024 is a clear signal of its strategy to streamline operations and enhance profitability.

- Resource Concentration: This action allows Tenet to concentrate its financial and managerial resources on its most promising and profitable business segments.

- Competitive Advantage: By focusing on core competencies, Tenet seeks to build a more sustainable competitive advantage in its chosen markets.

- Market Dynamics: Such portfolio adjustments can lead to shifts in market share and competitive intensity as rivals respond to Tenet's strategic repositioning.

Tenet Health faces intense competition from established players like HCA Healthcare and UHS, particularly in its core acute care and ambulatory surgery center (ASC) segments. The company's strategic focus on expanding its United Surgical Partners International (USPI) division, supported by significant investments and planned acquisitions throughout 2025, directly escalates rivalry in the outpatient surgical market. This heightened competition necessitates a strong emphasis on operational efficiency and cost management, areas where Tenet has shown progress, such as reducing contract labor expenses.

Tenet's 2024 divestiture of 14 hospitals underscores a strategic move to concentrate resources on higher-margin services and key markets, aiming to sharpen its competitive edge. This portfolio optimization directly influences market dynamics, compelling rivals to adapt as Tenet refines its focus on lucrative procedures and physician partnerships.

| Aspect | Description | Impact on Rivalry |

|---|---|---|

| Key Competitors | HCA Healthcare, Universal Health Services, regional hospital systems | High rivalry for market share in acute care and outpatient services. |

| USPI Focus | Aggressive expansion and investment in ASCs, including acquisitions through 2025. | Intensified competition in the lucrative ambulatory surgery market. |

| Strategic Divestitures | Sale of 14 hospitals in 2024. | Sharpened focus on core, high-margin services, leading to concentrated competitive efforts. |

| Cost Management | Reduction in contract labor expenses in Q1 2024. | Improved margins and competitive pricing capabilities. |

SSubstitutes Threaten

A significant threat to Tenet Health comes from the increasing shift of medical procedures from inpatient hospital settings to more affordable and convenient outpatient facilities, such as ambulatory surgery centers. This trend directly impacts traditional hospital revenue streams.

Tenet Health's strategic focus and substantial investments in its USPI segment, which operates ambulatory surgery centers, is a direct response to this substitution threat. By actively participating in and growing its outpatient services, Tenet aims to capture market share in this evolving healthcare landscape.

In 2023, Tenet's USPI segment continued its growth trajectory, demonstrating the company's commitment to this strategy. The increasing preference for outpatient care is a persistent challenge, but Tenet's expansion in this area positions it to mitigate this threat by becoming a provider within the substitute market itself.

The increasing adoption of telehealth and virtual care presents a significant threat of substitutes for traditional hospital services. These digital platforms offer convenient alternatives for routine consultations, follow-ups, and even certain diagnostic procedures, potentially diverting patients away from in-person visits. For instance, by mid-2024, a significant percentage of healthcare providers reported offering virtual visits, indicating a growing accessibility that directly impacts patient volume for hospitals like Tenet.

The rise of urgent care centers presents a significant threat of substitution for traditional hospital services. These centers offer a more convenient and often less expensive option for non-life-threatening ailments, directly competing for patient volume that would otherwise flow to Tenet Health's emergency departments and other acute care facilities. For instance, in 2024, the urgent care market continued its robust growth, with industry reports indicating a steady increase in patient visits for common illnesses and injuries, diverting revenue from higher-acuity hospital services.

Tenet Health itself is a participant in this market, operating its own urgent care centers. This diversification strategy, while potentially capturing new revenue streams, also highlights the competitive landscape and the blurring lines between different types of healthcare providers. The accessibility and cost-effectiveness of urgent care centers mean patients may bypass Tenet's more comprehensive, and typically more expensive, hospital-based care for services that can be adequately addressed in a lower-cost setting.

Home Healthcare Services

The threat of substitutes for Tenet Health's home healthcare services is significant, particularly for post-acute care, rehabilitation, and chronic disease management. As these services become more accessible and sophisticated, they offer a compelling alternative to traditional in-patient or skilled nursing facility care.

This shift can directly impact Tenet's revenue streams by shortening hospital stays and reducing the demand for its own facility-based post-acute services. For instance, the home healthcare market in the US was valued at approximately $130 billion in 2023 and is projected to grow steadily, indicating a strong and expanding substitute market.

- Growing preference for home-based care: Patients increasingly prefer to recover and manage conditions in the comfort of their own homes.

- Technological advancements: Telehealth, remote patient monitoring, and advanced medical equipment are making home healthcare more viable and effective.

- Cost-effectiveness: Home healthcare can often be more affordable than traditional facility-based care, making it an attractive substitute for payers and patients alike.

- Government policy and reimbursement: Favorable policies and reimbursement rates for home health services can further incentivize their use over facility care.

Preventive Care and Wellness Programs

The growing focus on preventive care and wellness programs by insurance providers and employers presents a significant threat of substitution for Tenet Health. These initiatives aim to keep individuals healthier, thereby reducing the need for traditional hospital services. For instance, in 2024, many health plans are expanding coverage for telehealth consultations and remote patient monitoring, directly competing with in-person visits for non-emergency conditions.

This shift towards proactive health management means fewer patients may require the acute, episodic care that forms a core part of Tenet Health's revenue. As individuals and organizations invest more in wellness, the demand for services like emergency room visits and inpatient stays could see a decline. This trend is further amplified by the increasing availability of digital health solutions and wearable technology, which empower consumers to manage their health more independently.

- Reduced Demand for Acute Care: As preventive measures become more prevalent, the need for hospitalizations and emergency services may decrease.

- Rise of Digital Health: Telehealth and remote monitoring offer convenient alternatives to traditional in-person care.

- Employer and Payer Initiatives: Health insurance companies and large employers are actively promoting wellness programs to lower overall healthcare costs.

- Consumer Empowerment: Wearable technology and health apps allow individuals to take a more active role in managing their well-being.

The increasing shift to outpatient settings, including ambulatory surgery centers and urgent care clinics, poses a significant threat of substitution for Tenet Health's core hospital services. These alternatives often provide more convenient and cost-effective care for many conditions, diverting patient volume and revenue. Tenet's own investment in its USPI segment, which operates ambulatory surgery centers, demonstrates its strategic response to this trend by participating in the substitute market itself.

Telehealth and virtual care also represent a growing substitute, offering accessible alternatives for routine consultations and follow-ups. By mid-2024, a substantial number of healthcare providers were offering virtual visits, highlighting the expanding reach of these digital platforms. Furthermore, the home healthcare market, valued at approximately $130 billion in 2023, is expanding, offering a viable substitute for post-acute and chronic care services traditionally provided by hospitals.

| Substitute Service | Impact on Tenet Health | 2023/2024 Data Point |

|---|---|---|

| Ambulatory Surgery Centers (ASCs) | Diverts inpatient procedures and revenue | Tenet's USPI segment showed continued growth in 2023. |

| Urgent Care Centers | Captures non-life-threatening ER visits and related revenue | Continued robust growth in patient visits for common ailments in 2024. |

| Telehealth/Virtual Care | Reduces need for in-person consultations and follow-ups | Significant percentage of providers offering virtual visits by mid-2024. |

| Home Healthcare | Reduces demand for skilled nursing and post-acute facility stays | US home healthcare market valued at ~$130 billion in 2023. |

Entrants Threaten

Establishing and operating general acute care hospitals and comprehensive healthcare systems, like those Tenet Health operates, requires a substantial capital investment. This includes the costs associated with building or acquiring facilities, purchasing advanced medical technology, and equipping specialized departments. For instance, the average cost to build a new hospital in the U.S. can range from $300 million to over $1 billion, depending on size and services offered. This high financial barrier significantly deters potential new entrants from entering the market, thereby reducing the threat of new competition.

The healthcare sector, including companies like Tenet Health, is burdened by significant regulatory barriers to entry. New entrants must navigate a complex web of licensing, certifications, and compliance standards, such as HIPAA for patient data privacy and various state-specific healthcare regulations. For instance, obtaining Medicare and Medicaid provider status, crucial for reimbursement, involves rigorous application processes and ongoing audits.

Newcomers face a substantial hurdle in replicating the established physician networks that are crucial for healthcare success. Tenet Health, for instance, benefits from long-standing relationships with a vast array of physicians, which are vital for patient referrals and service integration.

Developing these deep, trust-based relationships is a time-consuming and resource-intensive process, creating a significant barrier to entry. It's not just about having doctors; it's about having a cohesive system of care that patients and referring physicians trust, a network Tenet has spent years cultivating.

Brand Reputation and Patient Trust

In healthcare, patient trust and brand reputation are incredibly valuable, and they take a long time to build. Tenet Health, like other established providers, has cultivated this trust through years of delivering quality care and achieving positive patient outcomes. For instance, in 2023, Tenet Health reported a patient satisfaction score of 85% across its facilities, a testament to its long-standing commitment to care.

New competitors entering the market face a significant hurdle in replicating this established credibility. It’s not just about offering services; it’s about demonstrating a consistent track record of safety, effectiveness, and patient-centeredness. This deep-seated trust is a major barrier, making it difficult for newcomers to attract and retain patients who rely on proven quality.

The threat of new entrants is therefore somewhat mitigated by this intangible asset. Consider the high regulatory scrutiny and the need for extensive licensing and accreditation, which further complicate market entry. New facilities would need to invest heavily not only in infrastructure but also in building a reputation for clinical excellence, a process that can take a decade or more to mature.

- Patient Trust: A cornerstone of healthcare, built over years of consistent positive experiences and outcomes.

- Clinical Quality: New entrants must prove a high standard of medical care to gain patient confidence.

- Brand Reputation: Established providers like Tenet benefit from years of brand building and recognition.

- Barrier to Entry: Replicating the trust and reputation of incumbents is a significant challenge for new healthcare organizations.

Economies of Scale and Scope

Large, diversified healthcare providers like Tenet Health inherently possess significant advantages due to economies of scale. This means they can often negotiate better prices for supplies and equipment due to their sheer volume of purchases. For instance, in 2024, major hospital systems continued to leverage their size to secure favorable contracts for everything from pharmaceuticals to medical devices, a feat difficult for smaller, independent facilities to replicate.

Furthermore, these larger entities benefit from economies of scope, spreading the costs of administrative functions, IT infrastructure, and specialized services across a wider base. This allows them to offer a broader range of services more efficiently. A new entrant would struggle to match Tenet's ability to absorb overhead costs or invest in cutting-edge technology across multiple service lines without achieving a similar scale, making it a substantial barrier to entry.

- Economies of Scale: Tenet's size allows for bulk purchasing discounts on medical supplies and pharmaceuticals, a key cost advantage.

- Economies of Scope: Spreading administrative and IT costs across a larger network of facilities enhances efficiency and service breadth.

- Competitive Cost Structure: New entrants face difficulty matching the per-unit cost efficiency achieved by large, established players.

- Service Breadth: The ability to offer a comprehensive suite of services, from primary care to specialized treatments, is a significant differentiator that new, smaller entities would find hard to replicate initially.

The threat of new entrants for Tenet Health is significantly low due to several formidable barriers. High capital requirements, estimated at hundreds of millions to over a billion dollars for new hospital construction, alongside stringent regulatory hurdles like HIPAA compliance and Medicare/Medicaid certification, demand extensive resources and time.

Furthermore, Tenet's established physician networks, built on years of trust and collaboration, are difficult for newcomers to replicate. Patient trust and brand reputation, cultivated through consistent quality care and positive outcomes—evidenced by an 85% patient satisfaction score in 2023—also present a substantial challenge for new market players seeking to gain credibility.

Economies of scale and scope provide Tenet with a significant cost advantage, enabling better negotiation for supplies and efficient spreading of overhead costs. For example, in 2024, large healthcare systems continued to secure favorable contracts for pharmaceuticals and medical devices, a feat difficult for smaller entities to match.

| Barrier Type | Description | Impact on New Entrants | Example for Tenet Health (2023-2024) |

|---|---|---|---|

| Capital Requirements | High initial investment for facilities and technology. | Deters entry due to substantial financial risk. | New hospital construction costs: $300M - $1B+ (2024 estimates). |

| Regulatory Hurdles | Complex licensing, certifications, and compliance (e.g., HIPAA). | Requires extensive time, expertise, and ongoing adherence. | Medicare/Medicaid provider status involves rigorous application and audits. |

| Physician Networks | Established relationships with medical professionals. | Crucial for referrals and integrated care; time-consuming to build. | Tenet's long-standing partnerships facilitate patient flow and service coordination. |

| Brand Reputation & Trust | Years of delivering quality care and positive patient outcomes. | Difficult for new entrants to replicate, impacting patient acquisition. | 85% patient satisfaction score (2023) reflects established trust. |

| Economies of Scale/Scope | Cost advantages from large-scale operations and diversified services. | Enables better pricing and efficient overhead absorption. | Bulk purchasing discounts on supplies and pharmaceuticals (2024). |

Porter's Five Forces Analysis Data Sources

Our Tenet Health Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Tenet's annual reports, industry-specific market research from firms like IBISWorld, and regulatory filings from government bodies. This blend ensures a robust understanding of the competitive landscape.