Tenet Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

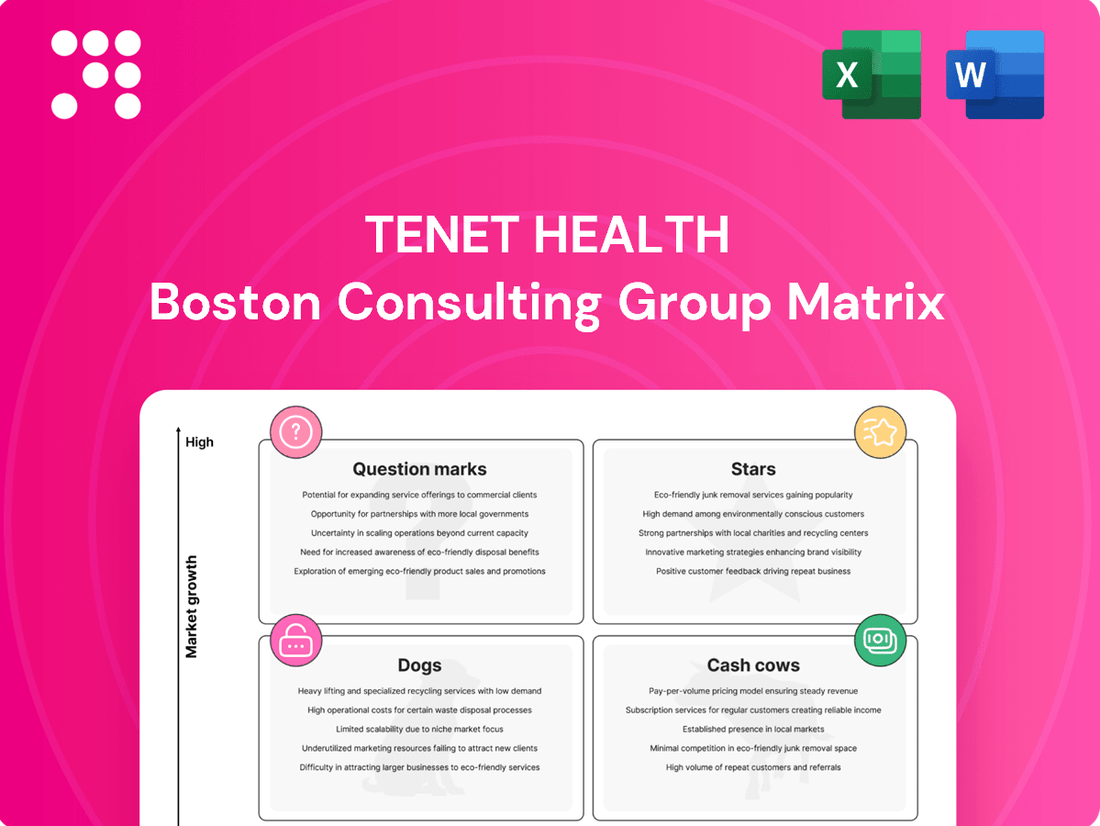

Curious about Tenet Health's strategic positioning? This glimpse into their BCG Matrix reveals how their various business units perform in terms of market share and growth potential. Understand which segments are driving growth and which might need a closer look.

Don't settle for a partial view. Purchase the full Tenet Health BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Unlock actionable insights and a clear roadmap for optimizing their portfolio and future investments.

Stars

Tenet's United Surgical Partners International (USPI) segment is a major driver of the company's growth, showcasing impressive financial results. In the first quarter of 2025, Ambulatory Care Adjusted EBITDA saw a significant increase of 15.7% compared to the previous year, highlighting the division's strong profitability.

Further demonstrating this upward trend, overall net operating revenues for the USPI segment grew by 11.3% year-over-year in the second quarter of 2025. This expansion is fueled by a multi-pronged strategy encompassing strategic acquisitions, the development of new facilities, and the broadening of its service offerings.

Tenet Health's United Surgical Partners International (USPI) is experiencing robust expansion in high-acuity procedures within its ambulatory surgery centers (ASCs). This strategic shift is evident in areas like total joint replacements and cardiovascular interventions, which are increasingly being performed in outpatient settings.

The trend is particularly strong for total joint replacements, which saw a notable increase of 12.6% in Q2 2025 compared to the same period in the previous year. This growth highlights the expanding capabilities of ASCs to handle more complex medical cases.

By concentrating on these sophisticated, higher-reimbursement procedures, Tenet Health is effectively boosting its profitability and solidifying its market position. This focus is crucial for capturing greater market share in the dynamic and expanding outpatient surgical sector.

Tenet Health is significantly growing its ambulatory surgery center (ASC) business, USPI, through a dual strategy of acquiring existing facilities and building new ones from scratch. This aggressive expansion is a key part of their growth plan.

In 2024 alone, Tenet added close to 70 ASCs to its USPI portfolio. Looking ahead to 2025, the company plans to open between 10 and 12 new de novo centers. This commitment is backed by an annual investment of around $250 million dedicated to mergers and acquisitions (M&A) within the ambulatory surgery sector.

High Adjusted EBITDA Margins in USPI

USPI demonstrates exceptional financial performance, evidenced by its Adjusted EBITDA margin reaching a notable 39.2% in the second quarter of 2025.

This robust profitability, combined with a healthy growth trajectory, firmly positions USPI as a Star within Tenet Health's portfolio. The segment's ability to generate significant returns is a direct result of its operational efficiency and a favorable mix of patient cases.

- High Profitability: USPI's Adjusted EBITDA margin was 39.2% in Q2 2025.

- Star Performer: Strong margins and growth classify it as a Star.

- Key Drivers: Efficient operations and favorable case mix contribute to success.

Consistent Same-Facility Revenue Growth

USPI, a key component of Tenet Healthcare, is showing strong performance in its existing locations. This consistent same-facility revenue growth highlights the underlying strength of its operations.

In the second quarter of 2025, USPI achieved a notable 7.7% increase in same-facility revenue. This demonstrates successful organic growth, meaning the company is generating more revenue from its current surgical centers without relying solely on opening new ones or acquiring others.

This upward trend in revenue from established facilities is a positive sign for Tenet Healthcare.

- Consistent Same-Facility Revenue Growth: USPI's performance indicates a healthy expansion of business within its existing infrastructure.

- Q2 2025 Performance: A 7.7% increase in same-facility revenue for Q2 2025 underscores this positive trend.

- Organic Growth Driver: This growth complements Tenet's strategy of expanding through acquisitions and new facility development.

- Market Demand: Sustained demand for ambulatory surgical services is a key factor contributing to this steady revenue increase.

Tenet's United Surgical Partners International (USPI) segment is a clear Star in its business portfolio. Its consistent growth, demonstrated by an 11.3% year-over-year net operating revenue increase in Q2 2025, coupled with a strong Adjusted EBITDA margin of 39.2% in the same quarter, highlights exceptional financial performance. This success is driven by strategic expansion, including the addition of nearly 70 ASCs in 2024 and plans for 10-12 new centers in 2025, alongside a focus on high-acuity procedures.

| Segment | Q2 2025 Revenue Growth (YoY) | Q2 2025 Adj. EBITDA Margin | Key Growth Drivers |

| USPI (Ambulatory Care) | 11.3% | 39.2% | Acquisitions, New Facilities, High-Acuity Procedures |

What is included in the product

The Tenet Health BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting units for growth, maintenance, or divestment.

A visual Tenet Health BCG Matrix report, easily shareable and printable, clarifies strategic resource allocation.

Cash Cows

Tenet Health's established general acute care hospitals, especially those operating in steady markets, are key cash cows. These facilities, despite portfolio adjustments, show consistent performance, generating reliable revenue. Their mature market standing and loyal patient bases contribute to this stability.

Within Tenet Health's hospital operations, mature service lines like general medical and surgical care represent their cash cows. These areas consistently see high patient volumes, generating a steady and reliable stream of revenue.

These established services, unlike newer, high-growth areas, demand less investment in innovation and expansion. This efficiency translates directly into strong profit margins, as Tenet can focus on optimizing existing processes and resource allocation for maximum return.

For instance, in 2024, Tenet Health reported that its hospital segment, which houses many of these mature service lines, continued to be a significant contributor to its overall financial performance, demonstrating the enduring strength of these consistent volume generators.

Conifer Health Solutions, a subsidiary of Tenet Health, is a significant player in the healthcare services sector, focusing on revenue cycle management and value-based care solutions. This segment is a prime example of a cash cow within Tenet's portfolio, generating consistent and predictable revenue streams.

The stable, recurring nature of its services, such as patient billing and claims processing, means Conifer contributes reliably to Tenet's overall cash flow. In 2023, Conifer's revenue was reported at approximately $1.3 billion, underscoring its substantial contribution and consistent performance.

Disciplined Cost Management in Hospital Operations

Tenet Health's disciplined cost management in hospital operations is a key driver for its Cash Cow segment. By focusing on efficiency, the company has seen improved Adjusted EBITDA margins. For instance, in the first quarter of 2024, Tenet reported an Adjusted EBITDA of $652 million, a 12.6% increase year-over-year, demonstrating the impact of these cost-saving measures.

These initiatives, which include strategic management of labor costs and supply chain expenses, are designed to extract maximum cash flow from their existing, well-established hospital assets. This operational discipline ensures profitability even in periods of slower top-line growth.

- Operational Efficiency: Tenet's focus on streamlining processes and optimizing resource allocation directly enhances profitability.

- Labor Cost Management: Strategic workforce planning and utilization contribute significantly to cost control.

- Supply Chain Optimization: Negotiating favorable terms and reducing waste in medical supplies bolsters margins.

- EBITDA Growth: The first quarter of 2024 saw a 12.6% year-over-year increase in Adjusted EBITDA, highlighting the success of these cost-saving efforts.

Favorable Payer Mix and Pricing Yield

Tenet Health's hospital segment demonstrates robust performance driven by a favorable payer mix and enhanced pricing. This strategic advantage, particularly from commercial payers and exchange admissions, directly boosts revenue per adjusted admission, a key metric for profitability.

The emphasis on higher acuity services further bolsters profit margins within this mature business line. For instance, in 2024, Tenet reported that its hospital segment generated substantial operating cash flow, a testament to the sustained benefits of its payer strategy and service mix.

- Favorable Payer Mix: Commercial and exchange admissions contribute disproportionately to revenue.

- Pricing Yield Improvement: Better negotiation and contracting lead to higher per-admission revenue.

- High-Margin Services: Focus on complex procedures and higher acuity care drives profitability.

- Consistent Cash Generation: These factors combine to create a stable and significant cash flow from the hospital operations.

Tenet Health's established general acute care hospitals, particularly those in stable markets, are prime examples of cash cows. These facilities consistently generate reliable revenue, benefiting from mature market positions and loyal patient bases.

Conifer Health Solutions, Tenet's revenue cycle management subsidiary, also functions as a cash cow. Its recurring services like patient billing and claims processing provide predictable cash flow, as evidenced by its $1.3 billion in revenue in 2023.

The hospital segment's strong performance is bolstered by operational efficiencies and disciplined cost management, leading to improved profitability. For example, Tenet reported a 12.6% year-over-year increase in Adjusted EBITDA to $652 million in Q1 2024, driven by labor and supply chain cost controls.

A favorable payer mix, with a higher contribution from commercial payers, and a focus on higher acuity services further enhance the profitability of these mature operations, ensuring consistent cash generation.

| Segment | Role in BCG Matrix | Key Characteristics | 2023 Revenue (Approx.) | 2024 Performance Highlight |

|---|---|---|---|---|

| General Acute Care Hospitals | Cash Cow | Mature markets, stable patient volume, consistent revenue | N/A (part of overall hospital segment) | Significant contributor to overall financial performance |

| Conifer Health Solutions | Cash Cow | Revenue cycle management, value-based care, recurring services | $1.3 Billion | Reliable contributor to cash flow |

Preview = Final Product

Tenet Health BCG Matrix

The Tenet Health BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, devoid of watermarks or demo content, is meticulously prepared for strategic clarity and professional application. You can confidently expect the exact same data and insights to be yours, ready for immediate use in your business planning and decision-making processes.

Dogs

Tenet Health's recently divested hospitals would likely be classified as Dogs in the BCG Matrix. In 2024, the company completed the sale of 14 hospitals, a move that generated significant gross proceeds and helped reduce its debt. This strategic divestment signals a focus on core, high-acuity care and ambulatory services, suggesting these sold hospitals had limited growth potential and market share.

Underperforming low-acuity service lines in Tenet Health's portfolio are those with declining market share or facing tough local competition, often failing to significantly boost profitability. These services might just cover their costs or even drain resources without promising future growth, making them prime candidates for either being phased out or significantly improved.

Tenet's strategic direction involves a deliberate move away from these less impactful service areas. For instance, in 2024, Tenet Health continued its focus on divesting or optimizing underperforming facilities and service lines, aligning with its broader strategy to concentrate on higher-margin and higher-growth opportunities.

Hospitals in declining or saturated markets, where Tenet Health has a weak competitive standing, are classified as Dogs in the BCG Matrix. These facilities typically face limited future growth prospects and can consume valuable resources.

In 2024, Tenet Health actively pursued a divestment strategy, targeting these underperforming assets. This move was designed to shed businesses that offered minimal strategic value and were not contributing effectively to the company's overall growth objectives.

Outdated Operational Models

Outdated operational models, or facilities that are inefficient, require disproportionate investment for maintenance, or struggle to adapt to modern healthcare demands, are considered Dogs within Tenet Health's portfolio. These are operations where continued investment would likely yield low returns, making them candidates for divestiture or significant restructuring.

Tenet's strategic shift, as evidenced by its portfolio transformation efforts, aims to move away from such capital-intensive and low-growth areas towards more predictable and capital-efficient business models. For instance, in 2023, Tenet announced the sale of its US হাসপাতাল operations, a move that aligns with shedding assets that no longer fit its strategic vision for efficiency and growth.

- Low Return on Investment: Operations requiring substantial capital for upkeep without commensurate revenue growth.

- Strategic Mismatch: Facilities unable to adapt to evolving healthcare delivery methods or patient needs.

- Capital Inefficiency: Operations that consume significant resources for maintenance and modernization, hindering capital allocation to higher-growth areas.

Persistent Negative Contribution Margins

Persistent Negative Contribution Margins in Tenet Health's BCG Matrix would represent business units or service lines with low market share that consistently struggle with profitability. These segments consume resources and management focus without delivering sufficient returns, hindering overall company performance. For instance, if a specific, less utilized hospital facility or a niche outpatient service line within Tenet consistently operated at a loss, even after cost adjustments, it would fall into this category.

Tenet's strategic emphasis on high-acuity care and the expansion of its ambulatory surgery centers (ASCs) indicates a deliberate shift away from such underperforming areas. This strategic realignment aims to reallocate capital and management bandwidth towards more promising and profitable ventures. For example, Tenet's 2023 financial reports highlighted significant growth in its Ambulatory Care segment, which typically offers higher margins and better scalability compared to some traditional hospital services.

- Low Market Share: Units in this category possess a small slice of their respective markets, making it difficult to achieve economies of scale.

- Negative Contribution Margins: These segments incur more variable costs than revenue generated, leading to a direct loss on each unit sold or service provided.

- Capital and Management Drain: Despite poor performance, these units require ongoing investment and attention, diverting resources from more strategic initiatives.

- Strategic Divestment or Restructuring: Companies often consider divesting or restructuring "Dog" units to improve overall portfolio health and financial efficiency.

Hospitals or service lines within Tenet Health that exhibit low market share and operate in slow-growing or declining markets are classified as Dogs. These segments often require significant investment to maintain but yield minimal returns, draining resources. For instance, Tenet's 2024 strategic divestments, including 14 hospitals, targeted such underperforming assets to improve overall portfolio efficiency.

These "Dog" units typically have outdated operational models or struggle to adapt to evolving healthcare demands, making them capital inefficient. Tenet's focus on divesting these areas, as seen in its continued portfolio optimization throughout 2024, aims to reallocate capital to higher-growth, more profitable ventures like its ambulatory surgery centers.

Tenet Health's strategic shift is designed to shed businesses with low strategic value and minimal contribution to overall growth objectives. This approach helps the company concentrate on core, high-acuity care and ambulatory services, which are positioned for better future performance.

The divestment of underperforming assets, a key strategy in 2024, allows Tenet to exit markets where its competitive standing is weak and future growth prospects are limited, thereby improving its financial efficiency.

| BCG Category | Characteristics | Tenet Health Example/Action (2024) |

| Dogs | Low market share, low growth industry, low profitability | Divested 14 hospitals; focus on shedding underperforming assets |

Question Marks

Tenet Health is strategically investing in expanding high-acuity service lines, like advanced cardiovascular and neurosciences, within its existing hospital network. This move targets growing patient demand for specialized care, aiming to bolster its market position in these critical areas.

While these specialized services represent a growth opportunity, Tenet's current market share in these specific advanced fields within its hospitals is likely still in its nascent stages of development. Significant capital outlay is therefore essential to build the necessary infrastructure and expertise to achieve market leadership and capitalize on the increasing demand.

For instance, Tenet's USPI segment, which focuses on ambulatory surgery centers, saw revenue grow 8.1% in 2023. This expansion into higher-acuity services within hospitals is a complementary strategy to leverage their existing footprint and drive similar revenue growth in inpatient settings.

When USPI, a subsidiary of Tenet Healthcare, enters new USPI geographic markets with de novo centers or smaller acquisitions, these initial ventures can be viewed as question marks in the BCG matrix. The ambulatory surgery market is indeed experiencing significant growth, with projections indicating continued expansion. For example, the global ambulatory surgery centers market was valued at approximately $40 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 6% through 2030.

Establishing a dominant market share in a new region requires substantial upfront investment and marketing efforts. USPI's success in these nascent markets hinges on rapid adoption by patients and physicians, as well as effective market penetration strategies. Without a proven track record or established brand recognition in these specific locales, these new centers face uncertainty regarding their future performance and market position.

Investments in emerging healthcare technologies like advanced robotics and new digital health platforms, including telehealth, represent Tenet Health's potential future growth drivers, often categorized as question marks in a BCG matrix. These areas exhibit high growth potential, but Tenet's current market share and the certainty of return on investment remain unclear, demanding substantial capital and strategic prioritization for successful scaling.

Strategic Partnerships in Nascent Care Models

Tenet Health might forge strategic partnerships or launch pilot programs for emerging value-based care models or niche clinics that haven't yet been widely implemented across its system. These initiatives are situated in rapidly expanding segments of healthcare innovation but currently possess uncertain market penetration and profit potential.

These nascent ventures, often characterized by their experimental nature, require rigorous assessment to ascertain the justification for substantial investment aimed at achieving future market leadership. For instance, Tenet's participation in Accountable Care Organizations (ACOs) represents an investment in value-based care, with the success of these models still under development.

- Nascent Care Models: These are innovative healthcare delivery systems, like specialized chronic disease management programs, that are still in early stages of development and adoption.

- Strategic Partnerships: Collaborations with technology providers, payers, or other healthcare entities to co-develop or pilot these new care models.

- Unproven Market Share and Profitability: While in high-growth areas, the long-term financial viability and competitive positioning of these models are not yet established.

- Evaluation for Investment: The critical need to analyze potential return on investment and scalability before committing significant capital for future growth.

Specialized Outpatient Diagnostic and Imaging Centers

Developing specialized outpatient diagnostic and imaging centers, especially those with advanced technology, positions Tenet Health's offerings as potential stars in the BCG Matrix. These centers cater to a market increasingly valuing convenience and affordability, crucial for growth.

However, Tenet's initial market share in these competitive segments might be modest, characteristic of a question mark. Achieving substantial patient volume and securing robust referral networks quickly will be paramount to their success and upward trajectory.

- Market Growth: The outpatient diagnostic imaging market is projected to continue its expansion, driven by an aging population and increased demand for early disease detection. For instance, the global medical imaging market was valued at approximately $37.5 billion in 2023 and is expected to grow.

- Competitive Landscape: While offering advanced technology can be a differentiator, Tenet faces established players and independent imaging centers, making market penetration a key challenge.

- Referral Dependence: Success hinges on building strong relationships with physicians to ensure a consistent flow of patient referrals, a critical factor for these specialized facilities.

Tenet's investments in new ambulatory surgery centers (ASCs) in de novo markets or through smaller acquisitions are prime examples of question marks. These ventures require significant upfront capital and marketing to establish market presence, much like Tenet's push into high-acuity services within its hospitals.

The ambulatory surgery market, valued at approximately $40 billion in 2023, is growing, but new centers face the challenge of building patient volume and physician referrals in unfamiliar territories. Tenet's success in these nascent markets depends on rapid adoption and effective penetration strategies.

Similarly, investments in emerging healthcare technologies and new care models, such as Accountable Care Organizations (ACOs), are also question marks. These areas offer high growth potential but have uncertain market share and profitability, necessitating careful evaluation before committing substantial capital.

Tenet's strategy involves exploring these question marks to identify future stars, balancing the risk of unproven ventures with the potential for significant returns in a dynamic healthcare landscape.

BCG Matrix Data Sources

Our BCG Matrix leverages Tenet Health's internal financial disclosures and operational performance data, augmented by external market research and competitor analysis.