Swedencare SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

Swedencare's strong brand reputation and innovative product pipeline are key strengths, but understanding potential market saturation and evolving regulatory landscapes is crucial for sustained growth.

Want the full story behind Swedencare's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Swedencare boasts an impressive global market presence, reaching approximately 70 countries through its extensive distribution network. This expansive reach is further bolstered by its nine international subsidiaries and a robust network of retailers.

This significant global footprint allows Swedencare to effectively tap into varied pet healthcare markets around the world, diversifying its revenue streams and mitigating risks associated with reliance on a single region.

Swedencare's strength lies in its diverse and premium product portfolio, featuring highly recognized brands like ProDen PlaqueOff®, NaturVet®, and Innovet. This extensive range covers critical areas such as dental, joint, and skin/coat health for a variety of pets, solidifying its leadership in specialized animal healthcare.

Swedencare's strategic acquisitions are a significant strength, evidenced by the successful integration of companies like Summit Veterinary Pharmaceuticals Limited and MedVant Inc. These moves have demonstrably broadened their product portfolio and strengthened their market presence. The full acquisition of Riley's Organics further underscores this capability, directly contributing to both organic and inorganic growth as part of their expansion strategy.

Consistent Revenue Growth

Swedencare has shown a steady upward trend in its earnings. For instance, net revenue saw a 7% jump in the first quarter of 2025 when compared to the same period in 2024. This momentum continued into the second quarter of 2025, with a 3% increase over the previous year's second quarter.

This consistent revenue growth highlights a robust demand for Swedencare's offerings and points to efficient management of its business activities. Such performance is a key indicator of market acceptance and operational success.

- Consistent Revenue Growth: Net revenue increased by 7% in Q1 2025 vs. Q1 2024.

- Sustained Sales: Q2 2025 net revenue grew 3% compared to Q2 2024.

- Market Demand: The increases reflect strong customer interest in their product lines.

- Operational Efficiency: Sustained growth suggests effective business strategies and execution.

Strong Cash Flow and Financial Position

Swedencare consistently demonstrates robust cash flow from its operating activities, a key strength that underpins its ability to fund ongoing operations and pursue strategic growth opportunities. This strong cash generation is particularly vital in the dynamic pet health market, allowing for reinvestment in product development and market expansion.

The company's financial position remains solid, characterized by healthy liquidity and manageable debt levels. This financial stability provides a crucial buffer against market volatility and enables Swedencare to navigate economic uncertainties effectively, ensuring continued operational resilience.

Key financial highlights supporting this strength include:

- Strong Operating Cash Flow: For the first quarter of 2024, Swedencare reported an operating cash flow of SEK 105 million, a significant increase compared to the previous year, indicating efficient cash generation from core business activities.

- Healthy Liquidity: As of March 31, 2024, the company maintained a solid cash and cash equivalents balance of SEK 386 million, providing ample financial flexibility.

- Positive Free Cash Flow: Swedencare's ability to generate positive free cash flow allows for debt reduction, dividend payments, and strategic investments without compromising financial health.

Swedencare's strengths are evident in its consistent financial performance and robust operational cash flow.

The company achieved a 7% increase in net revenue in Q1 2025 compared to Q1 2024, followed by a 3% growth in Q2 2025 over the prior year's second quarter. This sustained revenue growth indicates strong market demand and effective business execution.

Furthermore, Swedencare demonstrates strong operating cash flow, with SEK 105 million reported in Q1 2024, and maintains healthy liquidity with SEK 386 million in cash and cash equivalents as of March 31, 2024.

These financial indicators underscore the company's stability and capacity for strategic investment and expansion.

| Financial Metric | Q1 2024 | Q1 2025 | Q2 2024 | Q2 2025 |

|---|---|---|---|---|

| Net Revenue Growth | 7% | 3% | ||

| Operating Cash Flow | SEK 105 million | |||

| Cash & Equivalents (as of Mar 31) | SEK 386 million |

What is included in the product

Delivers a strategic overview of Swedencare’s internal and external business factors, highlighting its strengths in product innovation and market expansion, while addressing weaknesses in brand recognition and opportunities in emerging markets, and potential threats from competition and regulatory changes.

Provides a clear, actionable framework for identifying and addressing key challenges in the pet health market.

Weaknesses

Swedencare has experienced a noticeable dip in its operational profitability margins. For instance, operational EBITDA margins saw a 10% year-over-year decrease in the first quarter of 2025, followed by a 13% decline in the second quarter of 2025.

This trend suggests that the company might be facing challenges in managing its operating expenses effectively or that cost increases are outpacing revenue generation. Such a decline can signal underlying issues with operational efficiency or pricing power.

Swedencare's organic growth has fallen short of its ambitious double-digit target. In the first quarter of 2025, organic, currency-adjusted growth stood at 5%, followed by 7% in the second quarter. This performance indicates potential headwinds in driving internal expansion without a significant reliance on acquisitions to meet growth objectives.

The NaturVet brand, a cornerstone of Swedencare's offerings, saw a concerning decline of -21% in sales during the fourth quarter of 2024. This significant underperformance in a key segment poses a risk to the company's overall growth trajectory.

While other divisions within Swedencare demonstrated positive momentum, the substantial negative growth of NaturVet cannot be overlooked. Such a dip can affect investor confidence and potentially signal broader market challenges impacting specific product lines.

Decreased Profit After Tax

Swedencare experienced a notable decline in its profit after tax during the first half of 2025. Specifically, profit after tax in Q1 2025 fell to 23.9 MSEK, a decrease from 30.1 MSEK in the corresponding period of the previous year. The situation worsened in Q2 2025, where the company reported a net loss of -6.9 MSEK.

This contraction in net income has direct implications for the company's ability to reward shareholders and fund future growth initiatives. The reduced profitability can diminish investor confidence and limit the capital available for research and development or strategic acquisitions.

- Q1 2025 Profit After Tax: 23.9 MSEK (down from 30.1 MSEK in Q1 2024)

- Q2 2025 Profit After Tax: -6.9 MSEK (a net loss)

- Impact: Reduced shareholder value and constrained reinvestment capacity

Operational Cost Increases

Swedencare faced rising operational costs in early 2025, notably from significant investments in trade fairs and a comprehensive rebranding initiative. These strategic expenditures, alongside increased personnel expenses in the first quarter of 2025, can exert short-term pressure on the company's profit margins if not carefully controlled.

- Increased External Costs: Investments in trade fairs and rebranding efforts contributed to higher operational expenditures.

- Personnel Cost Rises: Q1 2025 saw an uptick in personnel-related expenses.

- Profitability Pressure: While strategic, these cost increases require effective management to avoid impacting profitability.

- Strategic Investment Impact: The company is balancing growth investments with the need for cost efficiency.

Swedencare's profitability has been impacted by declining operational margins, with EBITDA margins falling 10% year-over-year in Q1 2025 and 13% in Q2 2025, indicating potential issues with expense management or pricing. Furthermore, the company's organic growth has fallen short of its double-digit targets, achieving only 5% and 7% in Q1 and Q2 2025 respectively, suggesting challenges in internal expansion. The NaturVet brand experienced a significant sales decline of -21% in Q4 2024, posing a risk to overall growth, and the company reported a net loss of -6.9 MSEK in Q2 2025, down from a profit of 23.9 MSEK in Q1 2025.

| Metric | Q1 2024 | Q1 2025 | Q2 2024 | Q2 2025 |

|---|---|---|---|---|

| Operational EBITDA Margin | (Not specified) | -10% YoY decrease | (Not specified) | -13% YoY decrease |

| Organic Growth | (Not specified) | 5% | (Not specified) | 7% |

| NaturVet Sales Growth | (Not specified) | (Not specified) | (Not specified) | -21% (Q4 2024) |

| Profit After Tax | 30.1 MSEK | 23.9 MSEK | (Not specified) | -6.9 MSEK (Net Loss) |

Preview the Actual Deliverable

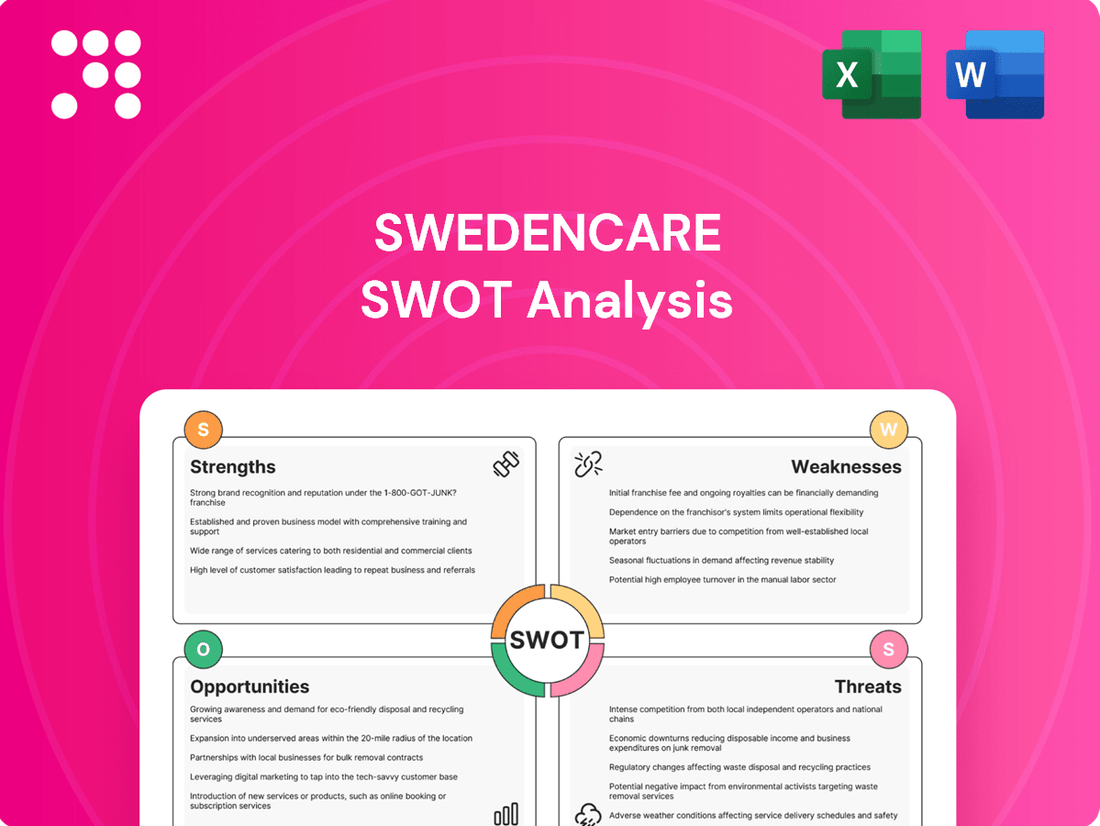

Swedencare SWOT Analysis

This is the actual Swedencare SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's current strategic position.

The preview below is taken directly from the full Swedencare SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for your business strategy.

This preview reflects the real Swedencare SWOT analysis document you'll receive—professional, structured, and ready to use. Gain a clear understanding of their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global pet healthcare market is a significant opportunity, forecast to grow from $253.75 billion in 2024 to $269.63 billion in 2025, reflecting a 6.3% compound annual growth rate. This upward trend is expected to continue, reaching $385.45 billion by 2029 with a 9.3% CAGR. Such strong market expansion offers a favorable environment for Swedencare to leverage its products and services, capitalizing on increasing consumer spending on pet well-being.

The increasing trend of pet humanization, where owners increasingly view their pets as integral family members, is a significant tailwind for Swedencare. This shift directly translates into higher consumer spending on premium pet healthcare, specialized treatments, and crucially, preventive care products. For instance, the global pet care market was valued at approximately $261 billion in 2023 and is projected to reach $350 billion by 2027, with a substantial portion driven by health and wellness segments.

Swedencare's strategic focus on preventive products, such as supplements and specialized nutrition, aligns perfectly with this evolving consumer behavior. This alignment presents a substantial growth opportunity as pet owners are more willing than ever to invest in proactive health measures to ensure their beloved companions live longer, healthier lives. The company's product portfolio is well-positioned to capitalize on this growing demand for proactive pet wellness solutions.

Swedencare is strategically targeting expansion into big box retailers, a move poised to unlock significant growth. The company plans to initially introduce its NaturVet products into the online inventories of major retail chains, with a subsequent rollout into physical store locations.

This new distribution channel offers a substantial opportunity to tap into a much wider consumer demographic, potentially driving considerable sales increases. For instance, in 2024, online sales for pet products in the US alone were projected to exceed $20 billion, highlighting the immense reach of e-commerce platforms associated with these large retailers.

Growth in E-commerce and Digital Platforms

The pet healthcare market is experiencing a substantial surge in e-commerce and digital health solutions. Swedencare's strategic focus on managing its Amazon sales independently and prioritizing online channels positions it well to leverage this growing trend. This approach allows for greater control over its digital presence and can lead to improved sales efficiency and expanded customer reach.

This digital shift presents a significant opportunity for Swedencare to enhance its market penetration. By optimizing its e-commerce operations, the company can tap into a wider customer base actively seeking convenient online purchasing options for pet health products.

Key opportunities include:

- Expanding direct-to-consumer (DTC) sales channels through its own website and third-party platforms like Amazon.

- Leveraging data analytics from online sales to better understand customer preferences and tailor product offerings.

- Developing or integrating digital health tools, such as online consultations or personalized health plans, to complement its product portfolio.

- Capitalizing on the increasing consumer comfort with purchasing pet medications and supplements online, a trend that accelerated significantly in recent years.

Strategic Geographic Expansion

Strategic geographic expansion presents a significant opportunity for Swedencare. While North America currently dominates as the largest market for pet healthcare products, the Asia-Pacific region is poised for the most rapid growth. Projections indicate the global pet care market will reach approximately $270 billion by 2025, with Asia-Pacific showing particularly strong upward trends.

Swedencare's established global distribution network and its history of successful strategic acquisitions provide a solid foundation for capitalizing on these international growth prospects. The company is well-positioned to deepen its penetration in emerging high-growth markets, leveraging its existing infrastructure and M&A capabilities.

- Asia-Pacific's projected rapid growth in the pet healthcare market.

- Swedencare's existing global distribution network as an enabler.

- Leveraging strategic acquisitions for market entry and expansion.

Swedencare can capitalize on the expanding global pet healthcare market, which is projected to reach $269.63 billion by 2025, showing a 6.3% CAGR. The increasing trend of pet humanization further drives spending on premium pet health and preventive care. The company's focus on supplements and specialized nutrition aligns perfectly with this consumer behavior, offering a strong opportunity for growth.

Expanding into big box retailers, starting with NaturVet products online and then in-store, presents a chance to reach a broader customer base. The US pet product e-commerce market alone was expected to exceed $20 billion in 2024, illustrating the potential of these channels. Furthermore, Swedencare's independent management of Amazon sales and prioritization of online channels positions it to benefit from the growing e-commerce trend in pet health solutions.

Geographic expansion, particularly into the rapidly growing Asia-Pacific region, offers significant potential. Swedencare's existing global distribution network and its proven ability to execute strategic acquisitions provide a strong platform to enter and grow in these emerging markets.

| Key Opportunity | Market Size/Growth | Supporting Data |

| Global Pet Healthcare Market Growth | Projected to reach $269.63 billion by 2025 (6.3% CAGR) | Global pet healthcare market forecast |

| Pet Humanization Trend | Increased spending on premium pet health and preventive care | Global pet care market valued at ~$261 billion in 2023, projected to reach $350 billion by 2027 |

| E-commerce & Digital Channels | US pet product e-commerce sales projected over $20 billion in 2024 | Growth in online sales for pet products |

| Geographic Expansion (Asia-Pacific) | Asia-Pacific region shows rapid growth trends | Emerging markets offer significant upside |

Threats

Economic uncertainty and market volatility present a significant threat to Swedencare. Global economic slowdowns and disruptions to world trade can directly impact consumer purchasing power, potentially leading to reduced spending on premium pet products. For instance, if inflation remains elevated or interest rates continue to climb through 2024 and into 2025, discretionary spending on items like specialized pet supplements could be curtailed by consumers facing tighter household budgets.

The pet healthcare sector is fiercely competitive, with many players actively seeking to capture market share. This crowded landscape can force companies like Swedencare to lower prices to remain competitive, potentially impacting profit margins. For instance, the global pet care market, which includes healthcare, was projected to reach USD 296.5 billion in 2024, indicating significant competition for consumer spending.

Increased marketing and promotional activities are often necessary to stand out, leading to higher operational costs for Swedencare. Such pressures can make it difficult to maintain a strong market position and consistent profitability in the face of aggressive strategies from rivals in the rapidly growing, yet highly contested, pet wellness industry.

As a global player, Swedencare's international sales expose it to the inherent risks of currency fluctuations. For instance, if the Swedish Krona strengthens significantly against currencies where Swedencare generates substantial revenue, such as the US Dollar or Euro, the reported value of those foreign earnings will decrease when translated back to SEK, potentially impacting profitability. This exposure is a constant consideration for companies operating across multiple economic landscapes.

Rising Costs of Advanced Treatments

The escalating expense of sophisticated veterinary treatments and products presents a significant hurdle. This trend could potentially slow down market expansion, particularly if it renders advanced pet healthcare unaffordable for a portion of pet owners, prompting a shift towards more basic or infrequent care.

For instance, the average cost of specialized veterinary procedures, such as advanced diagnostics or surgical interventions, has seen a notable increase. In 2024, estimates suggest these costs could be 5-10% higher than in the previous year, driven by inflation, technological advancements, and the specialized expertise required.

- Increased R&D Investment: The development of cutting-edge veterinary pharmaceuticals and therapies often involves substantial research and development costs, which are then passed on to consumers.

- Technological Advancements: Sophisticated diagnostic equipment and treatment modalities, while improving outcomes, contribute to higher overall healthcare expenses.

- Specialized Personnel: The need for highly trained veterinarians and technicians to administer advanced treatments adds to the labor costs, impacting the final price of services.

Supply Chain Disruptions and Logistics Challenges

Global supply chain vulnerabilities, a persistent issue throughout 2024 and projected into 2025, pose a significant threat to Swedencare's operations. These disruptions can directly impact the production and timely distribution of their health and wellness products. For instance, geopolitical tensions and shipping bottlenecks, which saw container shipping costs surge by over 100% in early 2024 compared to the previous year, can lead to increased operational expenses and lead times for Swedencare.

The inability to secure raw materials or transport finished goods efficiently can result in product shortages. This directly affects Swedencare's capacity to meet consumer demand, potentially leading to lost sales and a decline in customer loyalty. The company's reliance on international suppliers for key ingredients, such as certain vitamins and minerals, makes it particularly susceptible to these global logistics challenges.

- Increased operational costs due to higher shipping rates and potential need for expedited freight.

- Delays in product availability, impacting sales cycles and market responsiveness.

- Risk of inability to meet customer demand, leading to lost revenue and reputational damage.

- Potential need to absorb higher input costs, squeezing profit margins.

Intensifying competition within the pet healthcare market presents a significant threat, as a crowded landscape can drive down prices and squeeze profit margins for Swedencare. The global pet care market, valued at an estimated USD 296.5 billion in 2024, underscores the fierce battle for consumer spending. Companies must constantly invest in marketing and promotions to stand out, increasing operational costs and challenging sustained profitability.

Economic headwinds, including persistent inflation and rising interest rates through 2024 and into 2025, threaten to reduce consumer discretionary spending on premium pet products. This economic uncertainty directly impacts purchasing power, potentially leading to lower demand for specialized supplements. Furthermore, currency fluctuations pose a risk; a strengthening Swedish Krona could diminish the reported value of international earnings, impacting overall profitability.

Supply chain vulnerabilities remain a critical threat, with geopolitical tensions and shipping bottlenecks driving up costs. For instance, container shipping rates saw over a 100% surge in early 2024, leading to increased operational expenses and potential product shortages for Swedencare. This disruption can hinder the timely distribution of products, impacting sales and customer loyalty.

The rising cost of advanced veterinary treatments and products poses a barrier to market expansion. As specialized procedures become more expensive, potentially increasing by 5-10% in 2024 due to inflation and technological advancements, some pet owners may opt for less frequent or basic care, affecting demand for premium solutions.

SWOT Analysis Data Sources

This Swedencare SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-informed strategic overview.