Swedencare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

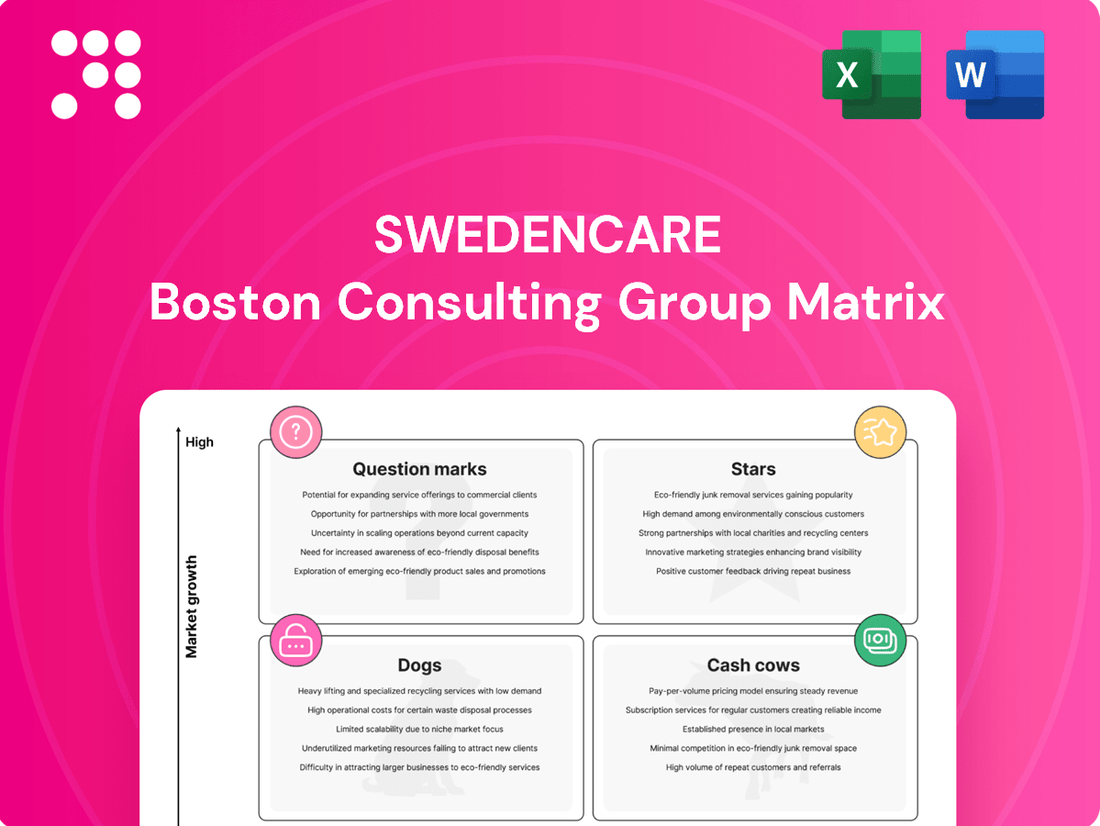

Curious about Swedencare's product portfolio performance? This glimpse into their BCG Matrix reveals where their offerings might be positioned as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their strategic landscape and unlock actionable insights for growth and resource allocation, dive into the full BCG Matrix.

Unlock the complete Swedencare BCG Matrix and gain a comprehensive understanding of each product's market share and growth potential. This detailed analysis provides the strategic clarity needed to make informed decisions about investment, divestment, and product development. Purchase the full report for a data-driven roadmap to optimizing Swedencare's market position.

Stars

ProDen PlaqueOff® Dental Products represent a significant star within Swedencare's business portfolio. This segment has experienced remarkable growth, with its dental product group alone achieving a 51% increase in Q1 2025.

Recognized as Swedencare's fastest-growing brand globally, ProDen PlaqueOff® benefits from strong clinical proof and veterinarian recommendations for pet oral health. Its expanding market presence, bolstered by innovations like new soft chew formulations, firmly establishes it as a leading force in the expanding pet dental care market.

The Pharma segment, significantly boosted by the April 2025 acquisition of Summit Veterinary Pharmaceuticals Limited, demonstrated robust growth, achieving a 39% increase in Q2 2025.

Summit's acquisition positions Swedencare within the UK's dynamic Animal Health Specials Market, a sector known for its high profitability and specialized veterinary pharmaceutical offerings.

This strategic move into a high-growth, high-margin market segment is expected to drive substantial future revenue, solidifying the Pharma segment's status as a key Star within Swedencare's business portfolio.

The Treats product group, bolstered by the acquisition of Riley's® Organics in January 2024, has demonstrated exceptional performance. In Q2 2025, this segment saw a remarkable 56% growth, highlighting its strong market penetration.

This expansion into the rapidly growing North American organic pet treat sector, fueled by strategic new product introductions under the Riley's® Organics brand, signifies a significant achievement. The robust growth trajectory suggests a strong competitive position within an expanding niche.

European Segment's Overall Performance

Swedencare's European segment is a powerhouse, driving significant growth and market presence. This region is characterized by robust performance and strategic expansion efforts.

The segment saw a notable 14% increase in the first quarter of 2025, underscoring its vital role in the company's overall success. Key markets such as the UK, the Nordics, and Italy are particularly strong contributors, demonstrating the segment's broad appeal and market penetration.

- European Segment Growth: Achieved a 14% increase in Q1 2025.

- Key Market Contributions: Strong performance from the UK, Nordics, and Italy.

- Strategic Positioning: Active market development solidifies Europe as a high-growth, high-market-share area.

Soft Chews Product Line

The soft chews product line, notably the ProDen PlaqueOff® Soft Chews introduced in Europe during the first quarter of 2024, is showing remarkable growth. This segment has seen its sales increase by over 50%, with units sold nearly doubling year-over-year. This performance highlights the strong market demand and acceptance of these innovative products within both the dental and nutraceutical sectors.

The rapid expansion of the soft chews into additional markets further solidifies their position as a key growth driver for the company.

- ProDen PlaqueOff® Soft Chews launched in Europe in Q1 2024.

- Sales for the soft chews product line increased by over 50%.

- Units sold in the soft chews category nearly doubled year-over-year.

- The product line is recognized as a significant growth driver due to high demand and market acceptance.

The ProDen PlaqueOff® dental product line is a clear Star for Swedencare. Its Q1 2025 performance saw a 51% revenue increase, driven by strong global brand recognition and veterinarian endorsements. Innovations, like new soft chew formulations, are capturing the expanding pet oral care market.

| Product Segment | Growth (Q1/Q2 2025) | Key Drivers |

|---|---|---|

| ProDen PlaqueOff® Dental | 51% (Q1 2025) | Global brand strength, vet recommendations, new soft chews |

| Treats (Riley's® Organics) | 56% (Q2 2025) | Acquisition, North American organic market, new product introductions |

| Pharma (Summit Vet Pharma) | 39% (Q2 2025) | Strategic acquisition, UK Animal Health Specials Market |

What is included in the product

The Swedencare BCG Matrix categorizes its product portfolio into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It provides strategic guidance on resource allocation, highlighting which products to invest in, hold, or divest.

The Swedencare BCG Matrix provides a clear, visual overview of product performance, simplifying strategic decisions and reducing the pain of complex portfolio analysis.

Cash Cows

The Nutraceuticals product category is Swedencare's largest, bringing in 49% of the group's net revenue in Q1 2025. This substantial revenue stream, even with a modest 3% growth rate in Q1 2025, highlights its strong market share in a mature and stable sector.

This segment's significant revenue contribution and established market position indicate it functions as a cash cow for Swedencare. It likely generates substantial cash flow, supporting investments in other, faster-growing business areas.

NaturVet, Swedencare's largest subsidiary, is a significant driver of sales, especially in North America. While Q4 2024 saw some negative growth due to specific adjustments, its established market presence and customer loyalty mean it typically produces substantial cash flow. Current transformation initiatives are focused on maintaining its strong contribution to overall profitability.

The Topicals/Dermatology product group is a solid performer for Swedencare, consistently contributing about 22-23% to net sales as of Q1 2025. This steady revenue stream, even with moderate growth, highlights its established presence in the market.

This segment is likely a cash cow due to its dependable sales and, typically, lower reinvestment requirements. Its strong market position suggests it generates significant profits without demanding substantial capital outlay, a hallmark of mature, successful products.

ProDen PlaqueOff® Powder

The original ProDen PlaqueOff® Powder stands as a cornerstone for Swedencare, representing a mature product with consistent demand. Its enduring market presence has solidified its position as a reliable revenue generator, contributing significantly to the company's financial stability. This product exemplifies a classic cash cow within the Swedencare portfolio.

With an impressive gross margin of 85%, ProDen PlaqueOff® Powder consistently delivers high profitability. This robust margin underscores its efficiency and strong market positioning, allowing Swedencare to leverage its established customer base for steady income. The product's consistent performance provides crucial financial resources for investment in other areas of the business.

- Historical Significance: ProDen PlaqueOff® Powder was instrumental in Swedencare's early growth, forming a substantial part of initial sales.

- Profitability: It boasts an exceptional gross margin of 85%, highlighting its strong financial performance.

- Market Stability: Its long-standing market presence and proven efficacy ensure a steady and predictable revenue stream.

- Cash Generation: The product acts as a primary cash generator, supporting Swedencare's overall financial health and investment capacity.

Strong Operating Cash Flow

Swedencare's operating cash flow is a testament to its strength as a cash cow. In the first quarter of 2025, the company generated a substantial 96.7 MSEK from its operations, followed by an even stronger 129.6 MSEK in the first half of 2025. This consistent and significant cash generation is a key indicator of a mature, profitable business.

The company's impressive operational gross margins, reaching 58.1% in Q1 2025, directly contribute to this robust cash flow. This healthy margin means that a large portion of revenue is converted into cash, fueling further growth and stability.

- Strong Operating Cash Flow: Swedencare reported 96.7 MSEK in Q1 2025 and 129.6 MSEK in H1 2025 from operating activities.

- High Gross Margins: Operational gross margins stood at 58.1% in Q1 2025, supporting cash generation.

- Financial Flexibility: This strong cash flow provides capital for strategic investments, potential acquisitions, and debt reduction.

The Nutraceuticals category, particularly driven by NaturVet, and the Topicals/Dermatology segment represent Swedencare's cash cows. These areas exhibit stable market positions and consistent revenue generation, as seen with Nutraceuticals contributing 49% of net revenue in Q1 2025 and Topicals accounting for 22-23%. The original ProDen PlaqueOff® Powder is a prime example, boasting an 85% gross margin and acting as a significant cash generator.

| Product Category | Q1 2025 Revenue Contribution | Key Product Example | Gross Margin (Example) | Cash Flow Indicator |

|---|---|---|---|---|

| Nutraceuticals | 49% | ProDen PlaqueOff® Powder | 85% | Strong Operating Cash Flow (96.7 MSEK Q1 2025) |

| Topicals/Dermatology | 22-23% | N/A | N/A | Consistent Revenue Stream |

What You See Is What You Get

Swedencare BCG Matrix

The Swedencare BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks, no altered content, and no surprises – just a ready-to-use strategic analysis tool. You can confidently use this preview to assess the quality and comprehensiveness of the Swedencare BCG Matrix, knowing the final version will be exactly the same. Upon completion of your purchase, this professionally designed document will be immediately available for your strategic decision-making.

Dogs

NaturVet, Swedencare's largest segment, faced a substantial downturn in Q4 2024, with a reported negative growth of -21%. This decline is largely concentrated within its private label sales division.

The private label segment within NaturVet is characterized by low market growth and a potentially shrinking share, signaling a challenging environment for these products. This underperformance suggests that resources invested here are not yielding adequate returns.

Given these factors, NaturVet's private label sales exhibit the classic traits of a 'Dog' in the BCG matrix. This classification indicates a need for strategic review, potentially leading to a decision about divestment or significant restructuring to improve performance.

Within Swedencare's product lineup, some older offerings might be experiencing stagnating growth, fitting the description of Dogs in the BCG matrix. These products, while perhaps historically important, may now have limited market share and minimal growth potential, demanding resources without significant returns.

The UK veterinary sector experienced a noticeable slowdown in growth during 2024, a trend that analysts anticipate will reverse by 2025. This temporary weakness in a key market can impact Swedencare’s products if they have significant reliance on UK distribution channels with low current market penetration or declining sales within that specific region.

Products Affected by Customer Inventory Adjustments

Swedencare's NaturVet product line experienced customer inventory adjustments around the 2023/2024 transition. These adjustments involved changes in order volumes and pricing, which consequently pushed some orders into 2025. If these inventory shifts signal a broader trend of declining demand and market share for specific NaturVet products, they could be classified as cash cows or question marks within the BCG matrix, indicating low growth and potential cash traps.

The impact of these adjustments on NaturVet's performance is crucial for strategic evaluation. For instance, if a particular NaturVet supplement saw a significant drop in orders due to overstocking by retailers, and this trend persists, it might indicate a shift from a star to a question mark if market growth slows, or even a cash cow if it still generates consistent, albeit reduced, revenue.

- NaturVet's Order Volume Fluctuations: Customer inventory adjustments at the 2023/2024 cusp impacted order volumes for certain NaturVet products.

- Delayed Shipments: These adjustments led to order fulfillment delays, with some orders now scheduled for shipment in 2025.

- Potential Cash Cow/Question Mark Classification: Sustained low demand and reduced market share for affected products could place them in the cash cow or question mark categories of the BCG matrix.

- Strategic Implications: Such a classification highlights potential cash trap scenarios and necessitates a review of product line strategy.

Non-Strategic or Unintegrated Smaller Acquisitions

Smaller acquisitions that haven't integrated well or shown growth could be considered Dogs in Swedencare's BCG Matrix. These might include ventures that haven't achieved their projected market penetration, potentially draining resources without substantial returns. For example, if a smaller acquired company in a niche market, say a pet supplement brand bought in 2023 for $5 million, failed to gain traction and only contributed 0.5% to Swedencare's overall revenue growth in 2024, it could be categorized as such.

Such entities might consume management attention and capital without contributing meaningfully to Swedencare's strategic objectives or overall market share. If turnaround efforts, such as new marketing strategies or product line extensions, do not yield significant improvements by late 2025, these acquisitions could be candidates for divestiture.

- Potential resource drain: Acquisitions failing to integrate or grow may consume valuable capital and management focus.

- Low market penetration: Companies that haven't achieved significant market share post-acquisition are at risk.

- Divestiture consideration: Ineffective turnaround plans may lead to the sale or closure of these units.

- Impact on overall performance: Unproductive acquisitions can negatively affect Swedencare's consolidated financial results.

Products in Swedencare's portfolio that have low market share and are operating in slow-growing or declining markets are classified as Dogs. These products typically generate low returns and may even consume more resources than they generate in profit. For example, if a particular pet supplement line, launched in 2022, only captured 0.1% of its target market by the end of 2024 and market growth for that category was only 2% annually, it would fit the Dog profile.

These underperforming assets require careful consideration. Swedencare might need to implement cost-cutting measures, re-evaluate marketing spend, or even consider divesting these products to free up capital for more promising ventures. The goal is to avoid having too many Dogs in the portfolio, as they can drag down overall profitability.

The financial performance of these Dog products in 2024 would likely show minimal revenue contribution and potentially negative operating margins. For instance, a specific product line might have generated €500,000 in revenue in 2024 but incurred €600,000 in associated costs, resulting in a €100,000 loss.

The strategic decision for Dogs often involves either a significant turnaround effort or an exit strategy. Without substantial improvements in market share or growth by mid-2025, divestment becomes a more probable outcome to improve Swedencare's overall BCG matrix positioning.

Question Marks

Swedencare's upcoming innovative cat product, slated for launch in the latter half of 2025, is positioned as a potential 'Question Mark' in their BCG Matrix. This new offering targets the burgeoning pet healthcare market, a sector that saw global revenues exceed $260 billion in 2023, with the cat segment showing robust growth. The company anticipates significant investment will be needed to gain traction and market share.

The strategy for this cat product line involves substantial marketing and consumer education to drive adoption. Without successful market penetration, it risks becoming a 'Dog' if it fails to capture market share. The company's success hinges on converting this high-potential, low-share product into a 'Star' through strategic execution and market response.

NaturVet's expansion into 'Big Box' retailers is a strategic move by Swedencare to tap into a high-growth channel, aiming to significantly broaden its consumer reach. This initiative is classified as a 'Question Mark' within the BCG Matrix due to its substantial potential for market share growth coupled with considerable inherent uncertainty.

The challenge lies in the current low market share within this specific retail segment. Swedencare must commit significant investment to navigate lengthy sales cycles, forge new partnerships, and execute impactful marketing campaigns to gain traction. For context, the pet supplies market in the US alone was valued at over $140 billion in 2023, with 'Big Box' retailers capturing a significant portion of this, highlighting the opportunity but also the competitive landscape.

Swedencare is strategically eyeing Asia for future expansion, recognizing its substantial growth potential. This move aligns with the company's ambition to broaden its global footprint in the pet health sector.

Entering Asian markets, however, presents a classic "question mark" scenario. While the growth prospects are high, Swedencare will likely begin with a low market share, necessitating significant upfront investment to build distribution channels and establish brand recognition. For example, in 2024, many companies entering emerging Asian markets like Vietnam or Indonesia faced initial setup costs averaging 15-20% of projected first-year revenue to secure shelf space and build consumer awareness.

Developing New Soft Chews with Summit Ingredients

Developing new soft chews with Summit's active ingredients is a strategic move into a burgeoning market. This initiative targets a high-growth product category with an anticipated launch early next year. The soft chew segment is experiencing significant expansion, making this a promising venture.

These new formulations are currently in their development phase. While they currently hold a low market share, their potential is considerable. This necessitates ongoing investment in research and development, alongside market entry strategies, to foster their growth into a 'Star' product.

- Market Growth: The global pet treats market, which includes soft chews, was valued at approximately USD 11.6 billion in 2023 and is projected to grow at a CAGR of over 7% from 2024 to 2030, according to market research reports from 2024.

- Investment Needs: Continued R&D and marketing expenditures are crucial for these nascent products to gain traction and market share.

- Potential Classification: Positioned as 'Stars' in the BCG matrix, these products require significant investment to maintain their growth trajectory in a competitive landscape.

Recently Acquired MedVant Inc.

The acquisition of MedVant Inc. in August 2024 marks Swedencare's strategic entry into the Canadian veterinary market. While MedVant demonstrated promising sales and a healthy EBITDA margin prior to the acquisition, its immediate impact on Swedencare's total net revenue is relatively modest. The purchase price was 34.8 MSEK, and MedVant reported sales of 2.5 MCAD in 2023.

Within the Swedencare BCG Matrix framework, MedVant Inc. is classified as a 'Question Mark'. This classification stems from Swedencare's strategic objective to utilize this acquisition as a platform for expanding its diverse product portfolio into a new and expanding market. Significant investment will be necessary to establish a substantial market share in Canada.

- Strategic Entry: MedVant acquisition provides Swedencare access to the Canadian vet market.

- Financial Snapshot: Purchase price of 34.8 MSEK, with 2023 sales of 2.5 MCAD for MedVant.

- BCG Classification: MedVant is a 'Question Mark' due to its potential and investment needs.

- Growth Objective: Swedencare aims to leverage MedVant for product expansion in a new market.

Question Marks represent new ventures or products with high growth potential but currently low market share. Swedencare's upcoming cat product, the NaturVet 'Big Box' retail expansion, and the MedVant acquisition in Canada all fit this description. These initiatives require substantial investment to gain market traction and establish a stronger competitive position.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | BCG Classification |

|---|---|---|---|---|

| Upcoming Cat Product | High (Global pet healthcare > $260B in 2023) | Low | Significant marketing & consumer education | Question Mark |

| NaturVet 'Big Box' Expansion | High (US pet supplies > $140B in 2023) | Low (in this channel) | Navigate sales cycles, partnerships, marketing | Question Mark |

| MedVant Inc. Acquisition (Canada) | High (Expanding Canadian vet market) | Low (for Swedencare's portfolio) | Establish substantial market share | Question Mark |

BCG Matrix Data Sources

Our Swedencare BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to accurately position each product.