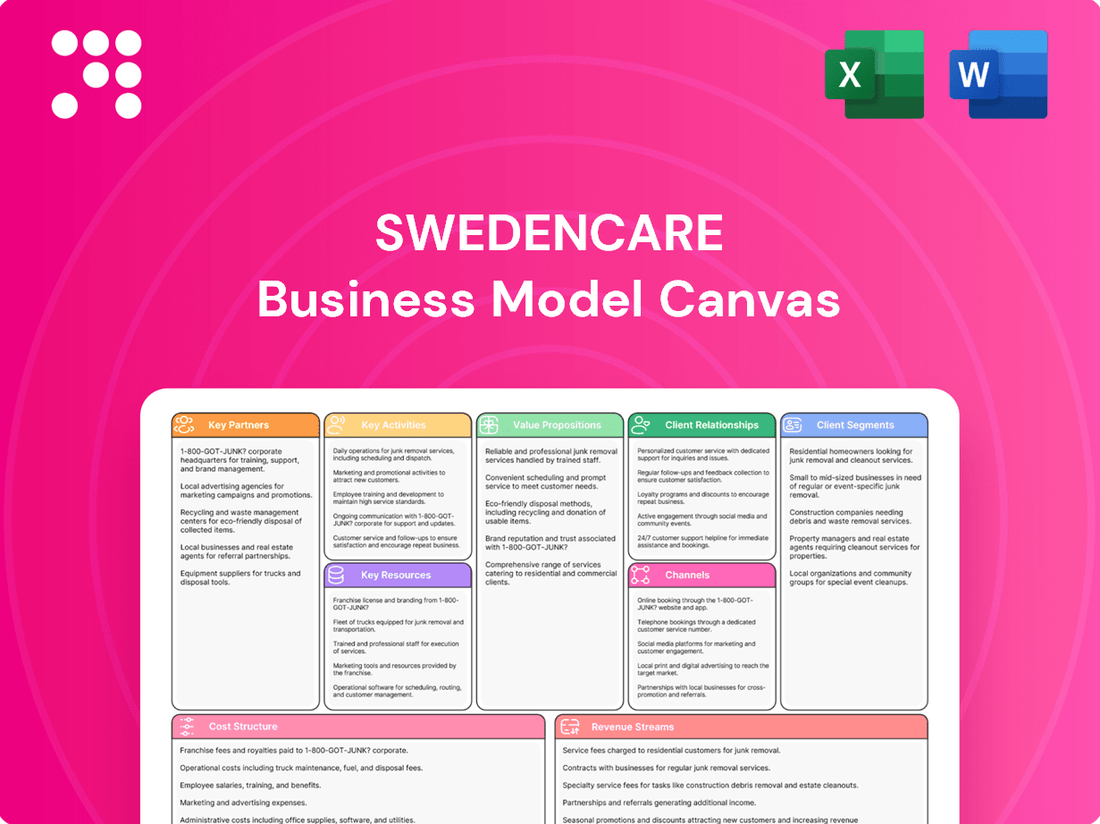

Swedencare Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

Discover the strategic framework behind Swedencare's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights into their market approach.

Unlock the full strategic blueprint behind Swedencare's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Swedencare's success is deeply intertwined with veterinary clinics and professionals, who act as crucial prescribers and direct sales points for their specialized animal healthcare products. These partnerships are vital for reaching pet owners through the trusted recommendations of veterinarians and the convenient sales channels within clinics.

Beyond sales, these collaborations extend to product development and clinical trials, ensuring Swedencare's offerings are both innovative and scientifically validated. For instance, Swedencare has actively engaged with veterinary partners to refine its probiotic and skin health formulations, leveraging their practical experience and scientific insights.

Swedencare's strategic alliances with major pet retail chains and prominent online marketplaces, such as Amazon, are fundamental to achieving extensive market penetration and ensuring product accessibility for consumers. These collaborations are vital for distributing Swedencare's comprehensive product range, which includes well-regarded brands like ProDen PlaqueOff®, to a significantly larger customer demographic.

The company's direct engagement in sales on platforms like Amazon, exemplified by their recent management of NaturVet's Amazon operations, underscores the importance of these digital channels in driving sales and expanding brand visibility. This direct approach allows for greater control over brand presentation and customer interaction, ultimately supporting revenue growth.

Swedencare's extensive reach across roughly 70 countries hinges on its international distributors and retailers. These crucial partners manage the complexities of local logistics, marketing efforts, and sales operations, ensuring Swedencare's products are accessible and effectively promoted in diverse regional markets.

In 2024, Swedencare continued to leverage these partnerships to navigate varied market demands and regulatory landscapes, a strategy that has historically driven its global sales growth. For instance, their presence in key European markets relies heavily on established distribution channels that understand local consumer preferences and compliance requirements.

Manufacturing and Production Partners

Swedencare's manufacturing and production partners are vital for its success. These collaborations, particularly with facilities specializing in soft chew production, ensure both the high quality of their products and the dependability of their supply chains. For instance, in 2024, Swedencare continued to leverage specialized manufacturers to maintain its premium product standards.

The company's strategic emphasis on local production and supply chains is a key risk mitigation strategy. By prioritizing proximity, Swedencare aims to buffer itself against potential disruptions caused by trade barriers and tariffs, which can significantly impact international business operations. This focus on localized manufacturing helps maintain cost stability and timely delivery.

- Specialized Manufacturing: Collaborations with facilities equipped for soft chew production are essential for product quality and innovation.

- Supply Chain Reliability: Partnerships ensure a consistent and dependable flow of goods to meet market demand.

- Risk Mitigation: A focus on local production and supply chains helps Swedencare navigate potential trade barriers and tariffs effectively.

- Quality Assurance: These partnerships are fundamental to upholding Swedencare's commitment to high-quality product development.

Acquired Companies and Their Networks

Swedencare's growth is significantly fueled by strategic acquisitions that integrate valuable networks. For instance, the acquisition of Summit Veterinary Pharmaceuticals Limited brought with it an established portfolio of veterinary products and a loyal customer base, enhancing Swedencare's market presence.

Similarly, the acquisition of Riley's Organics provided access to a distinct customer segment and a robust e-commerce distribution channel, further diversifying Swedencare's reach and revenue streams. These moves are key to expanding market share and product breadth.

- Acquired Companies: Summit Veterinary Pharmaceuticals Limited, Riley's Organics

- Benefits of Acquisitions: Established product lines, expanded customer bases, integrated distribution networks

- Strategic Impact: Increased market share, diversified product offerings, enhanced market penetration

- Financial Integration: Seamlessly incorporating acquired revenue streams and operational efficiencies into the Swedencare group

Swedencare's key partnerships are diverse, encompassing veterinary professionals, retail chains, online marketplaces, international distributors, and specialized manufacturers. These collaborations are critical for product development, sales, market penetration, and supply chain reliability. For instance, in 2024, Swedencare continued to rely on its network of approximately 70 country distributors to navigate local markets effectively.

| Partner Type | Key Role | Examples/Impact |

|---|---|---|

| Veterinary Clinics & Professionals | Prescribers, direct sales, product validation | Crucial for reaching pet owners; involved in product refinement. |

| Pet Retail Chains & Online Marketplaces | Market penetration, product accessibility | Ensures wide distribution of brands like ProDen PlaqueOff®; Amazon presence is key. |

| International Distributors | Logistics, local marketing, sales operations | Facilitates reach in ~70 countries, adapting to regional demands. |

| Specialized Manufacturers | Product quality, supply chain dependability | Essential for high-quality soft chews; crucial for risk mitigation against trade barriers. |

What is included in the product

This Swedencare Business Model Canvas provides a detailed framework of their strategy, focusing on their premium pet health products, direct-to-consumer channels, and commitment to quality ingredients.

It outlines key customer segments, revenue streams, and operational activities, offering a clear understanding of their market position and growth potential.

Swedencare's Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their strategy, allowing for quick identification of customer segments and value propositions to address unmet needs in the pet health market.

Activities

Swedencare’s key activities heavily revolve around the meticulous development and continuous innovation of animal healthcare products. A significant focus is placed on creating new offerings, particularly within the preventive care segment, targeting crucial areas such as dental health, joint support, and skin and coat vitality.

This involves extensive research, sophisticated formulation processes, and rigorous testing to guarantee both the effectiveness and safety of each product. For instance, Swedencare has been actively expanding its product lines, including the introduction of sterile eye fluids, demonstrating a commitment to addressing diverse animal health needs.

Swedencare’s production and manufacturing activities are central to delivering its wide array of pet health products. This involves meticulous oversight of both in-house operations and those managed by external manufacturing partners, ensuring consistent quality across their entire product range, including specialized items like soft chews.

Optimizing production processes is a continuous effort, aiming to enhance efficiency and scalability. For instance, in 2023, Swedencare reported a significant increase in production capacity to meet growing global demand, with a particular focus on expanding their soft chew manufacturing capabilities to support market expansion in regions like North America.

Swedencare focuses on implementing robust global marketing and sales strategies to elevate its diverse brand portfolio, which includes NaturVet®, Innovet, Pet MD®, Rx Vitamins®, nutravet®, Rileys®, and ProDen PlaqueOff®. These efforts are designed to reach pet owners and veterinary professionals across international markets.

The company leverages a blend of digital marketing, such as social media campaigns and online advertising, alongside traditional channels like print media and trade shows, to build brand awareness and drive sales. In 2023, Swedencare reported a significant increase in net sales, reaching SEK 1,570 million, reflecting the growing demand for its specialized pet health products.

Distribution and Logistics Management

Swedencare's key activity in distribution and logistics management focuses on efficiently moving its pet health products worldwide. This involves overseeing a complex network that reaches veterinarians, pet stores, and direct online consumers across numerous markets. The company's operations in 2024 highlight the importance of this function in ensuring product availability and customer satisfaction.

Managing this global reach requires meticulous attention to supply chain optimization and inventory control. Swedencare's presence in nine countries, coupled with its relationships with international retailers, underscores the scale of its logistical operations. This ensures that products are where they need to be, when they need to be there.

- Global Network Oversight: Directing distribution channels through nine subsidiaries and international retail partners to reach end-customers.

- Supply Chain Efficiency: Implementing strategies to streamline the movement of goods from production to market, minimizing transit times and costs.

- Inventory Optimization: Utilizing advanced inventory management techniques to balance product availability with holding costs, ensuring sufficient stock without oversupply.

- Channel Management: Catering to diverse sales channels, including veterinary clinics, specialized pet stores, and e-commerce platforms, each with unique logistical demands.

Mergers and Acquisitions (M&A) and Integration

Swedencare actively engages in mergers and acquisitions to bolster its product offerings, expand its geographical footprint, and enhance its operational strengths. This strategic pursuit is a core function, driving both organic and inorganic growth.

A significant aspect of this key activity involves the successful integration of acquired entities. For instance, the integration of Summit Veterinary Pharmaceuticals and NaturVet's Amazon business are prime examples of Swedencare's commitment to realizing synergistic benefits and unlocking new avenues for growth.

- Strategic Acquisitions: Swedencare consistently seeks out strategic acquisitions to broaden its product lines and market presence.

- Integration of Acquired Businesses: A critical activity is the seamless integration of companies like Summit Veterinary Pharmaceuticals and NaturVet's Amazon business.

- Synergy Realization: The primary goal of these integrations is to achieve operational efficiencies and capitalize on cross-selling opportunities.

- Growth Opportunities: M&A activities are designed to unlock significant growth potential by entering new markets and expanding existing ones.

Swedencare's key activities encompass product development, manufacturing, global marketing, distribution, and strategic acquisitions. These pillars drive the company's mission to enhance animal health and well-being through innovative and high-quality products.

The company's commitment to research and development is evident in its continuous efforts to create new formulations and expand its product portfolio, with a strong emphasis on preventive care. Manufacturing excellence, whether in-house or outsourced, ensures consistent quality across all offerings.

Effective global marketing and sales strategies are crucial for building brand awareness and driving demand for its diverse brands like ProDen PlaqueOff®. This is supported by efficient distribution and logistics, ensuring products reach consumers worldwide through various channels.

Strategic mergers and acquisitions play a vital role in Swedencare's growth, allowing for market expansion and the integration of complementary businesses to enhance its overall capabilities and product range.

| Key Activity | Description | Recent Data/Focus |

|---|---|---|

| Product Development & Innovation | Creating and improving animal healthcare products, focusing on preventive care. | Expansion of product lines, including sterile eye fluids. |

| Manufacturing & Production | Overseeing quality production, both in-house and outsourced. | Increased production capacity in 2023 to meet demand, especially for soft chews. |

| Marketing & Sales | Promoting a diverse brand portfolio globally through digital and traditional channels. | Net sales reached SEK 1,570 million in 2023. |

| Distribution & Logistics | Efficiently managing global supply chains to ensure product availability. | Operations in nine countries, serving veterinarians, pet stores, and e-commerce. |

| Mergers & Acquisitions | Acquiring and integrating businesses to expand offerings and market reach. | Integration of Summit Veterinary Pharmaceuticals and NaturVet's Amazon business. |

Preview Before You Purchase

Business Model Canvas

The Swedencare Business Model Canvas you're previewing is the actual document you will receive upon purchase, not a simplified sample. This comprehensive overview, detailing key aspects of Swedencare's operations, is exactly what you'll download and can immediately utilize for your strategic planning. Rest assured, the content and structure you see here are precisely what you'll gain full access to, ensuring a transparent and valuable transaction.

Resources

Swedencare's strength lies in its diverse and respected brand portfolio within the animal healthcare sector. Brands like ProDen PlaqueOff®, NaturVet®, Innovet, Pet MD®, Rx Vitamins®, nutravet®, and Rileys® are cornerstones of their business, each holding significant market recognition and representing valuable intellectual property.

This collection of well-established brands provides Swedencare with a distinct competitive advantage. For instance, ProDen PlaqueOff® has demonstrated consistent growth, contributing to Swedencare's reported net sales of SEK 365.5 million in the first quarter of 2024, a notable increase from the previous year.

Swedencare's extensive global distribution network is a cornerstone of its business model. This network includes wholly-owned subsidiaries strategically located in nine countries, providing a direct presence and local market expertise.

Further extending its reach, Swedencare partners with an international network of retailers, allowing access to approximately 70 countries. This broad reach is crucial for making their specialized health products accessible to a wide customer base across diverse geographical markets.

Swedencare's commitment to R&D is evident in its specialized preventive care portfolio. Their facilities and expert teams are geared towards creating novel formulations and product formats, such as the increasingly popular soft chews and sterile eye fluids, ensuring they stay at the forefront of pet health innovation.

In 2023, Swedencare reported that their investment in research and development, a key driver of their product pipeline, contributed to the launch of several new products. This focus on innovation is critical for expanding their market reach and meeting the evolving demands for specialized pet wellness solutions.

Skilled Workforce and Management Team

Swedencare's success hinges on its skilled workforce and experienced management team. This team possesses deep knowledge across critical areas like product development, manufacturing, marketing, sales, and overall executive leadership, ensuring smooth operations and effective strategy implementation. Their expertise is particularly crucial in specialized fields such as veterinary medicine and pet health, which are central to Swedencare's product offerings.

The company's commitment to a knowledgeable team is evident in its operational capabilities. For instance, Swedencare reported a robust sales growth of 15% in 2023, reaching SEK 1,150 million, a testament to the effectiveness of its sales and marketing teams. This growth is underpinned by a management structure that fosters innovation and market responsiveness.

Key personnel attributes include:

- Deep Industry Expertise: Management and staff with backgrounds in veterinary science and animal nutrition drive product innovation and quality assurance.

- Operational Excellence: A manufacturing team skilled in producing high-quality supplements ensures consistent product standards and efficient production cycles.

- Strategic Leadership: An executive team capable of navigating market dynamics, identifying growth opportunities, and managing international expansion.

- Specialized Talent: Personnel with specific knowledge in areas like regulatory affairs and international market penetration are vital for global reach.

Financial Capital and Profitability

Swedencare's access to robust financial capital, evidenced by its strong cash flow and consistent profitability, is a cornerstone of its business model. This financial strength allows the company to not only sustain its daily operations but also to invest strategically in research and development, driving innovation in its product lines. For instance, Swedencare reported a net profit of SEK 272 million for the first nine months of 2024, a significant increase that underscores its financial health and capacity for reinvestment.

This financial stability directly fuels Swedencare's growth ambitions, including its ability to pursue strategic acquisitions. The company's strong cash flow generation provides the necessary liquidity to fund these expansionary moves, thereby increasing market share and diversifying its offerings. The consistent profitability acts as a powerful enabler for both organic growth and inorganic expansion, ensuring Swedencare remains competitive and can capitalize on market opportunities.

Key financial resources supporting Swedencare's business model include:

- Consistent Profitability: Demonstrated by a net profit of SEK 272 million for the first nine months of 2024.

- Strong Cash Flow: Providing liquidity for operations and investments.

- Access to Capital: Enabling R&D initiatives and strategic acquisitions.

- Financial Stability: Underpinning ongoing growth and expansion strategies.

Swedencare's key resources are its strong portfolio of established brands like ProDen PlaqueOff® and NaturVet®, its extensive global distribution network reaching approximately 70 countries, and its dedicated R&D capabilities focused on specialized preventive care. The company's financial strength, demonstrated by a net profit of SEK 272 million for the first nine months of 2024, further supports its operations and growth initiatives.

| Key Resource | Description | Supporting Data (2024) |

| Brand Portfolio | Well-recognized brands in animal healthcare | ProDen PlaqueOff®, NaturVet®, Innovet, Pet MD®, Rx Vitamins®, nutravet®, Rileys® |

| Distribution Network | Global reach through subsidiaries and partners | Wholly-owned subsidiaries in 9 countries, access to ~70 countries |

| R&D Capabilities | Focus on specialized preventive care and innovation | New product launches, focus on soft chews and sterile eye fluids |

| Financial Strength | Profitability and cash flow for investment and growth | Net profit: SEK 272 million (first nine months of 2024) |

Value Propositions

Swedencare's value proposition centers on specialized preventive pet healthcare, offering a focused range of products designed to address critical health areas like dental hygiene, joint mobility, and skin and coat vitality. This targeted approach provides pet owners with effective solutions for common ailments, promoting long-term pet health and happiness.

By concentrating on these key preventive needs, Swedencare empowers pet owners to proactively manage their pets' well-being. For instance, their dental care products aim to reduce the incidence of costly dental procedures, a significant concern for many pet parents. In 2023, the global pet dental care market was valued at over $2.5 billion, highlighting the demand for such specialized solutions.

Swedencare's value proposition centers on offering trusted and scientifically backed products, a cornerstone for building confidence with both veterinary professionals and pet owners. This commitment is exemplified by products like ProDen PlaqueOff, which has earned the VOHC Seal, a recognized endorsement for efficacy in managing dental plaque and tartar in pets.

The emphasis on proven effectiveness, supported by scientific research, directly translates into a stronger brand reputation and fosters loyalty. For instance, Swedencare's investment in research and development aims to continuously validate the performance of their product lines, ensuring they deliver tangible health benefits for animals.

Swedencare's value proposition centers on a broad product portfolio anchored by strong, recognizable brands such as ProDen PlaqueOff®, NaturVet®, and Riley's®. This diverse offering addresses a wide spectrum of pet health requirements, from dental care to overall wellness. In 2023, Swedencare reported net sales of SEK 992 million, demonstrating significant market penetration with these established brands.

Global Accessibility and Availability

Swedencare's commitment to global accessibility is evident in its robust international distribution network, ensuring pet owners and professionals worldwide can easily obtain their specialized healthcare products. This widespread availability is crucial for consistent pet care.

The company's strong online presence further amplifies its reach, making its offerings accessible to a broader customer base across numerous countries. This digital strategy is key to their market penetration.

- Extensive Distribution Network: Swedencare products are available in over 30 countries, demonstrating significant global reach.

- Online Sales Growth: In 2023, Swedencare reported a substantial increase in online sales, highlighting the effectiveness of their digital accessibility strategy.

- Market Penetration: The company actively expands into new geographic markets, aiming to make its solutions available to a larger percentage of the global pet population.

Commitment to Pet Health and Well-being

Swedencare's core mission is dedicated to enhancing the health and well-being of pets, offering a sense of security to pet owners globally. This commitment is a cornerstone of their value proposition, directly addressing the growing concern pet parents have for their animals' quality of life.

This focus on pet health translates into tangible benefits for consumers. Pet parents are actively seeking products that are not only effective but also contribute positively to their pets' long-term health. Swedencare's approach provides this reassurance, aligning with a market trend where pet humanization continues to drive purchasing decisions.

- Mission Alignment: Swedencare's mission to improve pet health directly addresses a key concern for pet owners.

- Reassurance for Owners: The company provides peace of mind to pet parents by offering reliable health solutions.

- Market Resonance: This value proposition strongly appeals to the growing market of devoted pet owners seeking premium products.

- Product Trust: Swedencare aims to build trust by demonstrating a genuine commitment to animal welfare through its offerings.

Swedencare provides specialized, scientifically-backed preventive pet healthcare solutions, focusing on key areas like dental hygiene and joint health. Their product portfolio, featuring brands like ProDen PlaqueOff, offers tangible health benefits and builds trust with both pet owners and veterinary professionals.

The company's commitment to proven effectiveness, validated by research and endorsements like the VOHC Seal, ensures pet owners receive reliable products that contribute to their pets' long-term well-being. This focus addresses the increasing demand for premium, health-conscious pet care options.

Swedencare's value proposition is further strengthened by its broad brand recognition and extensive global distribution network, making its specialized products accessible to a wide international customer base. This accessibility, combined with a strong online presence, drives market penetration and sales growth.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Specialized Preventive Care | Targeted solutions for critical pet health needs. | Focus on dental hygiene, joint mobility, skin & coat. |

| Scientifically Backed & Trusted | Products with proven efficacy and professional endorsements. | ProDen PlaqueOff holds the VOHC Seal. |

| Brand Recognition & Portfolio | Strong brands addressing diverse pet health requirements. | Key brands include ProDen PlaqueOff®, NaturVet®, Riley's®. |

| Global Accessibility | Wide availability through extensive distribution and online presence. | Products available in over 30 countries; strong online sales growth in 2023. |

Customer Relationships

Swedencare cultivates direct engagement with veterinarians through dedicated sales teams. These teams build rapport and trust by providing ongoing support and educational resources, ensuring veterinary professionals are well-informed about Swedencare's product offerings and their benefits.

Educational initiatives, such as webinars and product training sessions, are key to empowering veterinarians. This direct interaction helps them understand how Swedencare products can improve pet health outcomes, making them more likely to recommend the brand to their clients.

In 2024, Swedencare continued to invest in its direct sales force, recognizing the critical role veterinarians play as trusted advisors. This strategy aims to solidify loyalty within the veterinary community, a vital channel for reaching pet owners seeking expert recommendations.

Swedencare cultivates strong partnerships with key pet retail chains and international distributors, recognizing them as vital channels for reaching consumers. These collaborations involve dedicated support, including product training for staff and joint marketing initiatives to enhance visibility and sales. For instance, in 2023, Swedencare reported that its international sales accounted for a significant portion of its revenue, underscoring the importance of these distribution networks in its global strategy.

Swedencare prioritizes accessible online customer service and support, crucial for its direct-to-consumer e-commerce strategy. This includes responsive assistance for inquiries and issue resolution, fostering trust and repeat business.

For consumers purchasing through platforms like Amazon, this online support is vital for a positive experience. In 2024, e-commerce sales continue to be a significant driver for many consumer goods companies, highlighting the importance of seamless digital customer interactions.

Brand Community Building

Swedencare actively cultivates brand communities by leveraging social media platforms and providing valuable educational content. This direct engagement with pet owners fosters a sense of belonging and transforms customers into loyal brand advocates.

These initiatives, including interactive Q&A sessions and sharing user-generated content, aim to build strong emotional connections. Such connections are crucial for driving repeat purchases and encouraging word-of-mouth marketing.

- Social Media Engagement: Swedencare utilizes platforms like Instagram and Facebook to share engaging content, run contests, and respond to customer inquiries, fostering a vibrant online community.

- Educational Content: They provide informative articles and guides on pet health and nutrition, positioning themselves as a trusted resource for pet owners.

- Brand Advocacy: By encouraging customers to share their experiences and success stories, Swedencare builds a network of passionate brand advocates.

- Repeat Purchases: The strong community bond and trust established through these efforts directly contribute to increased customer loyalty and repeat business.

Investor Relations and Transparency

Swedencare prioritizes investor relations and transparency by fostering open communication with shareholders and analysts. This commitment is demonstrated through regular financial reports, investor presentations, and dedicated calls. For instance, in the first quarter of 2024, Swedencare reported a net sales increase of 11% compared to the same period in 2023, reaching SEK 316 million, which was communicated through their quarterly report and subsequent investor webcast.

This consistent flow of information is crucial for building trust and providing the comprehensive financial data necessary for informed decision-making by stakeholders. The company actively engages with the investment community, aiming to ensure a clear understanding of their strategic direction and financial performance. In 2023, Swedencare hosted several investor events, including participation in key industry conferences, further enhancing their accessibility.

- Open Communication Channels: Regular financial reports, investor presentations, and calls keep shareholders informed.

- Data-Driven Insights: Providing comprehensive financial data enables informed decision-making by investors.

- Building Trust: Transparency in reporting fosters a strong and reliable relationship with the investment community.

- 2024 Performance Snapshot: Q1 2024 saw an 11% net sales increase to SEK 316 million, highlighting ongoing growth communicated through investor channels.

Swedencare's customer relationships are multifaceted, focusing on direct engagement with veterinarians through specialized sales teams who provide ongoing support and education. They also foster strong ties with retail partners and distributors, crucial for reaching consumers globally. Online, Swedencare prioritizes accessible customer service to support its e-commerce efforts and builds brand communities via social media, turning customers into advocates.

The company maintains open communication with investors, providing regular financial reports and engaging in investor events to ensure transparency and build trust. This approach, exemplified by their Q1 2024 net sales increase of 11% to SEK 316 million, underscores their commitment to keeping stakeholders well-informed about performance and strategy.

| Relationship Type | Key Activities | 2024 Focus/Data |

| Veterinarians | Direct sales, education, product training | Investment in sales force to solidify loyalty |

| Retailers & Distributors | Partnerships, staff training, joint marketing | Vital channels for global consumer reach |

| Pet Owners (Direct) | Online customer service, social media engagement, educational content | Building brand communities and loyalty via digital channels |

| Investors | Financial reports, investor calls, presentations | Q1 2024 net sales: SEK 316 million (+11% YoY) |

Channels

Veterinary clinics serve as a crucial channel for Swedencare, acting as a direct conduit for product recommendations and sales. Pet owners place significant trust in their veterinarians, making these professional endorsements highly influential for purchasing decisions, especially for specialized and preventive care items.

In 2024, the veterinary channel remains a cornerstone of Swedencare's strategy, with a focus on building strong relationships with clinics. This approach is supported by the fact that veterinary recommendations are a primary driver for pet owner purchases of health supplements and treatments, a trend expected to continue as pet humanization drives demand for advanced care solutions.

Swedencare utilizes specialty pet retail stores, encompassing both independent boutiques and larger chains, as a key distribution channel. This strategy provides direct access to pet owners who are actively seeking specialized products for their companions.

These retail environments are crucial for product visibility and allow Swedencare to connect with consumers who prioritize pet health and well-being. In 2024, the global pet care market, including retail sales, was projected to exceed $200 billion, highlighting the significant consumer spending in this sector.

The knowledgeable staff found in these stores act as valuable brand advocates, offering expert advice on product usage and benefits, which can significantly influence purchasing decisions for products like Swedencare's veterinary-approved supplements.

Swedencare actively utilizes major online retail platforms, such as Amazon, to reach consumers directly. This strategy is crucial for expanding their global footprint and driving sales growth.

The company's recent move to manage some of its brands' Amazon sales internally underscores the significant role this channel plays in their business model. This direct management allows for greater control over brand presentation and customer experience.

In 2023, Amazon's global net sales reached $574.8 billion, demonstrating the immense potential for brands like Swedencare to tap into a vast customer base through these platforms.

Pharmacies and Health Stores

Swedencare's strategy to broaden its reach through pharmacies and health stores is a key component of its distribution channels. This expansion is particularly effective for products that straddle the pet care and general wellness categories, making them more accessible to a wider consumer base.

This approach leverages the trust consumers place in these retail environments for health-related purchases. By being present where people are already seeking health solutions, Swedencare can capture a larger market share.

- Increased Accessibility: Pharmacies and health stores offer a familiar and convenient point of purchase for consumers looking for health and wellness products for themselves and their pets.

- Bridging Categories: Products that appeal to both human and pet health needs find a natural home in these outlets, expanding their potential customer base.

- Brand Credibility: Placement within established health retailers can enhance Swedencare's brand perception and trustworthiness.

- Market Penetration: In 2024, the global health and wellness market continued its upward trajectory, with retail pharmacies playing a crucial role in product distribution. For instance, the pharmacy retail sector in Europe saw steady growth, providing a fertile ground for new product introductions.

Company Subsidiaries and International Network

Swedencare leverages its own subsidiaries in nine countries, alongside a robust international network of retailers and distributors. This structure allows for efficient sales and logistics management across approximately 70 countries, ensuring broad market reach.

This multi-layered approach is crucial for Swedencare's global strategy. For instance, in 2023, the company reported that its international sales constituted a significant portion of its revenue, highlighting the effectiveness of its extensive network.

- Global Reach: Operations and sales managed in approximately 70 countries.

- Subsidiary Network: Direct presence through subsidiaries in nine key markets.

- Distribution Channels: Extensive network of retailers and distributors for market penetration.

- Logistics Management: Efficient handling of sales and product distribution worldwide.

Swedencare's distribution strategy is multifaceted, encompassing veterinary clinics, specialty pet retail, online platforms, pharmacies, and its own global network of subsidiaries and distributors. This comprehensive approach ensures broad market penetration and accessibility for its pet health products.

The company's direct management of some Amazon sales in 2024 highlights the growing importance of e-commerce, a channel that saw Amazon's net sales reach $574.8 billion in 2023. This strategic focus on online channels allows for greater brand control and direct customer engagement.

By leveraging its subsidiaries in nine countries and a distributor network reaching approximately 70 countries, Swedencare effectively manages sales and logistics globally. This extensive reach was critical in 2023, with international sales forming a substantial part of the company's overall revenue.

| Channel | Key Role | 2023/2024 Relevance |

|---|---|---|

| Veterinary Clinics | Professional recommendation and sales | Cornerstone; veterinary recommendations drive purchases. |

| Specialty Pet Retail | Product visibility and direct consumer access | Access to health-focused consumers; global pet care market >$200 billion (2024 projection). |

| Online Platforms (e.g., Amazon) | Global reach and sales growth | Significant sales driver; Amazon net sales $574.8 billion (2023). |

| Pharmacies & Health Stores | Accessibility and credibility for wellness products | Expanding reach into health-conscious consumers; steady growth in European pharmacy retail (2024). |

| Subsidiaries & Distributors | Global logistics and market penetration | Operations in ~70 countries; international sales a significant revenue driver (2023). |

Customer Segments

Pet owners who prioritize preventive care are a key demographic for Swedencare. These individuals actively seek out products that can help their pets avoid common ailments, such as dental disease, joint pain, and skin allergies. They view pet health as an investment in their animal's long-term well-being and quality of life.

This segment is often willing to spend more on premium, science-backed solutions. For instance, a significant portion of pet owners are concerned about dental health; in 2024, it's estimated that over 80% of dogs and 70% of cats over the age of three suffer from some form of dental disease, driving demand for preventative dental care products.

Veterinarians and veterinary clinics are key partners for Swedencare, acting as trusted advisors and resellers of specialized pet health products. These professionals, including animal healthcare practitioners, recommend and sell high-quality, effective, and reliable solutions directly to pet owners, ensuring optimal patient care.

Pet retailers, both online giants and local brick-and-mortar shops, represent a crucial customer segment for Swedencare. These businesses are actively seeking a broad selection of pet health products to meet diverse consumer needs. In 2024, the global pet care market continued its robust growth, with e-commerce sales in this sector alone reaching an estimated $35 billion, highlighting the significant reach of online retailers.

These retailers are particularly drawn to brands with strong recognition, as this translates to higher consumer trust and sales volume. They also prioritize products offering healthy profit margins, ensuring their own business sustainability. For instance, the premium pet food and health supplements segment, where Swedencare often operates, has seen average gross profit margins of 30-40% in recent years, making it an attractive category for stockists.

Pet Owners of Cats, Dogs, and Horses

Swedencare's core customer base consists of pet owners, specifically those who care for cats, dogs, and horses. This segment represents the primary end-users who directly benefit from the company's specialized health and wellness products.

The company's product development is strategically aligned with the health requirements of these popular companion animals. For instance, Swedencare's offerings often address common issues faced by cats and dogs, such as digestive health and joint support.

The horse owner segment is also a significant focus, with products designed to support equine well-being, particularly in areas like joint health and recovery. This targeted approach ensures that Swedencare's portfolio effectively meets the distinct needs of each animal type.

By concentrating on these specific pet owner groups, Swedencare can develop highly relevant and effective solutions. This focus is crucial for building brand loyalty and capturing market share within the growing pet care industry. For example, the global pet care market was valued at approximately USD 261 billion in 2023 and is projected to grow, highlighting the substantial opportunity within this customer segment.

- Primary End-Users: Cat, dog, and horse owners.

- Product Focus: Tailored health and wellness solutions for these animals.

- Market Relevance: Addressing common health concerns specific to cats, dogs, and horses.

Acquired Customer Bases

Swedencare benefits from acquired customer bases, particularly those loyal to brands like NaturVet and Riley's Organics. This provides an immediate, established market for Swedencare's products.

The strategy focuses on nurturing these existing relationships. By maintaining high product quality and thoughtfully expanding offerings, Swedencare aims to ensure continued customer satisfaction and loyalty.

- Customer Retention: Swedencare leverages the existing trust built by acquired brands, reducing the cost and effort associated with acquiring new customers.

- Brand Synergy: Integrating acquired brands allows Swedencare to cross-promote and offer a wider range of complementary products to these established customer groups.

- Market Expansion: Acquiring companies with strong customer loyalty, such as NaturVet, which reported significant growth in its pet supplement line prior to acquisition, directly expands Swedencare's market reach.

Swedencare's customer base is primarily composed of dedicated pet owners, with a strong emphasis on those who own cats, dogs, and horses. These individuals are characterized by their commitment to their pets' health and well-being, actively seeking out specialized products that address specific needs.

A significant segment of these owners prioritizes preventive care, viewing it as an investment in their pet's longevity and quality of life. This proactive approach fuels demand for science-backed solutions, particularly for common issues like dental disease, joint pain, and skin conditions, which affect a large percentage of pets.

Swedencare also strategically targets veterinarians and pet retailers, both online and physical, as crucial channels for product distribution and recommendation. These partners are vital for reaching end-consumers and are attracted to brands offering high-quality, effective products with healthy profit margins, such as those in the premium pet health supplement market.

| Customer Segment | Key Characteristics | 2024 Market Data/Insights |

|---|---|---|

| Pet Owners (Cats, Dogs, Horses) | Prioritize preventive care, seek science-backed solutions, invest in long-term well-being. | Global pet care market valued at over USD 261 billion in 2023; 80% of dogs and 70% of cats over three suffer from dental disease. |

| Veterinarians & Clinics | Trusted advisors, recommend and resell specialized pet health products. | Act as key gatekeepers for premium pet health solutions. |

| Pet Retailers (Online & Brick-and-Mortar) | Seek broad product selection, value brand recognition, prioritize profit margins. | Online pet product sales alone reached an estimated $35 billion in 2024; premium pet health supplements can offer 30-40% gross profit margins. |

| Acquired Customer Bases (e.g., NaturVet) | Loyal to existing brands, provide immediate market access. | Leveraged for brand synergy and cross-promotion opportunities. |

Cost Structure

Swedencare's production and manufacturing costs encompass the entire journey of their animal healthcare products, from initial development to the final packaged item. This includes the crucial expenses for raw materials, the skilled labor involved in production, and the ongoing costs of maintaining manufacturing facilities. For instance, in 2023, Swedencare reported that their cost of goods sold, which directly reflects these production expenses, amounted to SEK 385.6 million.

These costs are further influenced by whether production is handled internally or outsourced to external contract manufacturers. Managing these relationships and ensuring quality control across different production sites is a significant part of their operational expenditure. The company's commitment to quality ingredients, like those used in their ProDen PlaqueOff line, contributes to these material costs.

Swedencare allocates substantial resources to sales and marketing, recognizing its crucial role in global brand promotion. These investments encompass a wide array of activities, including extensive online marketing efforts, impactful advertising campaigns, and engaging in-store promotions. The company also actively participates in trade shows to reach a broader audience and build relationships within the industry.

These marketing initiatives are designed to drive brand awareness and customer acquisition across their diverse product portfolio. For instance, in 2023, Swedencare reported significant expenditures in this area, with sales and marketing costs amounting to approximately SEK 160 million, reflecting a strategic focus on expanding market reach and strengthening their competitive position.

Swedencare's distribution and logistics costs encompass warehousing, transportation, and the management of its worldwide supply chain. This includes expenses for freight, shipping, and maintaining optimal inventory levels across its global network. For instance, in 2024, Swedencare reported that its cost of goods sold, which includes these logistics, represented a significant portion of its revenue, highlighting the importance of efficient operations.

Managing these operational expenditures is paramount for Swedencare's profitability. The company actively seeks to streamline its logistics processes, from sourcing raw materials to delivering finished products to consumers. This focus on efficiency aims to mitigate the impact of fluctuating shipping rates and fuel costs, which can directly affect the bottom line.

Research and Development (R&D) Costs

Swedencare's commitment to innovation is reflected in its significant Research and Development (R&D) costs. These expenditures are crucial for developing new products, enhancing existing ones, and conducting vital clinical trials. This continuous investment ensures Swedencare remains at the forefront of the health and wellness industry, expanding its product portfolio and solidifying its competitive advantage.

The company's R&D efforts are strategically focused on creating scientifically-backed, high-quality health supplements. This dedication to innovation is a key driver for future growth and market leadership.

- Expenditures on Innovation: Swedencare invests heavily in exploring new ingredients and formulations.

- Product Development: This includes the rigorous process of bringing new health supplements from concept to market.

- Clinical Trials: Essential for validating product efficacy and safety, supporting marketing claims.

- Competitive Edge: R&D is fundamental to differentiating Swedencare's offerings in a crowded marketplace.

General and Administrative (G&A) Expenses

Swedencare's General and Administrative (G&A) expenses represent the crucial overhead that keeps the business running smoothly. These costs are not directly linked to creating products or making sales, but they are essential for overall operations. Think of things like the salaries for the people who manage the company's day-to-day affairs, the cost of running an office, and any legal or IT support needed.

These G&A costs also cover other vital operational expenses. This includes the financial outlays associated with integrating any acquired companies, which is a significant part of Swedencare's growth strategy. Furthermore, the meticulous process of financial reporting and compliance falls under this umbrella, ensuring transparency and adherence to regulations.

For instance, during 2023, Swedencare reported administrative costs amounting to SEK 105.7 million. This figure highlights the investment in the infrastructure and personnel necessary to support their expanding global presence and product development.

- Salaries for administrative staff: Covering management, HR, finance, and support personnel.

- Office expenses: Including rent, utilities, and supplies for corporate offices.

- Legal and compliance fees: Costs associated with legal counsel and regulatory adherence.

- IT infrastructure and support: Maintaining technology systems and providing IT assistance.

- Merger and acquisition (M&A) integration costs: Expenses related to combining newly acquired businesses.

- Financial reporting and audit fees: Costs for preparing financial statements and external audits.

Swedencare's cost structure is multifaceted, encompassing production, sales, R&D, and administration. Production costs, including raw materials and labor, were SEK 385.6 million in 2023. Sales and marketing expenses were approximately SEK 160 million in the same year, reflecting a strong push for global brand awareness.

Administrative costs, covering overhead and integration of acquisitions, stood at SEK 105.7 million in 2023. These figures underscore the significant investments made across various functions to support Swedencare's growth and market position.

| Cost Category | 2023 (SEK million) |

|---|---|

| Cost of Goods Sold (Production) | 385.6 |

| Sales and Marketing | 160.0 |

| General and Administrative | 105.7 |

Revenue Streams

Swedencare generates substantial revenue by selling its animal healthcare products to a network of pet retail stores. These retailers, encompassing both brick-and-mortar shops and e-commerce platforms, then offer these products to the ultimate consumers, the pet owners. This B2B sales channel represents a core component of Swedencare's revenue generation strategy.

In 2024, Swedencare continued to leverage this retail distribution model, which proved to be a significant driver of its overall sales performance. The company's ability to secure shelf space and online visibility with key pet retailers is crucial for reaching a broad customer base. This approach allows Swedencare to scale its operations efficiently by partnering with established distribution networks.

Swedencare generates revenue by selling its specialized pet health products directly to veterinary clinics. This channel allows for higher margins as veterinarians are key influencers and trusted sources for pet owners.

In 2023, Swedencare reported that its direct sales to veterinarians represented a significant portion of its overall revenue, particularly in its core markets. This direct engagement ensures product quality control and allows for targeted marketing efforts towards professionals.

Swedencare generates revenue directly from pet owners purchasing products via their e-commerce websites. This includes sales facilitated through their managed Amazon accounts, a significant and growing channel for the company.

In 2024, Swedencare continued to see robust expansion in its direct-to-consumer online sales. This channel is a key driver of revenue growth, reflecting the increasing preference of consumers for convenient online purchasing of pet health products.

Acquisition-driven Revenue

Acquisition-driven revenue represents a significant engine for Swedencare's growth, directly stemming from the integration of newly acquired companies and their product portfolios. This strategy fuels non-organic expansion, broadening the company's market presence and diversifying its revenue base.

This approach allows Swedencare to quickly enter new markets or strengthen its position in existing ones by leveraging the established customer bases and product offerings of acquired entities. In 2023, Swedencare continued to actively pursue strategic acquisitions, contributing to its overall revenue uplift.

- New Revenue Streams: Sales from acquired brands like Neutrosec and ProbiMage directly add to Swedencare's top line.

- Non-Organic Growth: Acquisitions are a key driver of growth that isn't solely dependent on internal product development.

- Market Share Expansion: By integrating acquired businesses, Swedencare increases its overall footprint and competitive standing.

- Synergistic Benefits: Acquired product lines often complement existing offerings, creating cross-selling opportunities and enhancing value.

International Sales and Exports

Swedencare generates significant revenue from its international sales and exports, reaching approximately 70 countries worldwide. This global reach is facilitated through a robust network of partners and subsidiaries that distribute its products.

Europe, the United Kingdom, and the Nordic region stand out as particularly strong growth drivers for Swedencare's international business. These markets demonstrate a consistent demand for the company's offerings, contributing substantially to its overall revenue.

- Global Distribution: Swedencare's products are available in roughly 70 countries via its international network.

- Key Growth Markets: Europe, the UK, and the Nordics are identified as primary drivers of international sales.

- Revenue Contribution: International sales and exports form a critical component of Swedencare's total revenue streams.

Swedencare's revenue is diversified across multiple channels, with a strong emphasis on business-to-business sales to pet retailers and direct sales to veterinary clinics. This dual approach ensures broad market penetration and leverages professional trust.

Online direct-to-consumer sales, including through platforms like Amazon, are a rapidly growing revenue stream, reflecting evolving consumer purchasing habits. Furthermore, strategic acquisitions significantly boost revenue by integrating new product lines and market access.

International sales and exports form a substantial portion of Swedencare's income, with Europe, the UK, and the Nordics being key contributors, underscoring the company's global market presence.

| Revenue Stream | Key Channels | 2023/2024 Data Highlight |

|---|---|---|

| Retail Sales | Pet Retail Stores (Brick-and-mortar & E-commerce) | Core driver of overall sales performance. |

| Veterinary Sales | Direct to Veterinary Clinics | Significant revenue portion, especially in core markets; higher margins. |

| Direct-to-Consumer (DTC) | E-commerce Websites, Amazon | Robust expansion in online sales; key driver of revenue growth. |

| Acquisition-Driven | Integrated acquired companies (e.g., Neutrosec, ProbiMage) | Fueling non-organic expansion and revenue uplift. |

| International Sales & Exports | Global network (approx. 70 countries) | Europe, UK, Nordics are strong growth drivers; contribute substantially. |

Business Model Canvas Data Sources

The Swedencare Business Model Canvas is informed by a combination of internal financial data, market research reports, and competitive analysis. These sources provide a comprehensive view of customer needs, market opportunities, and operational realities.