Swedencare Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

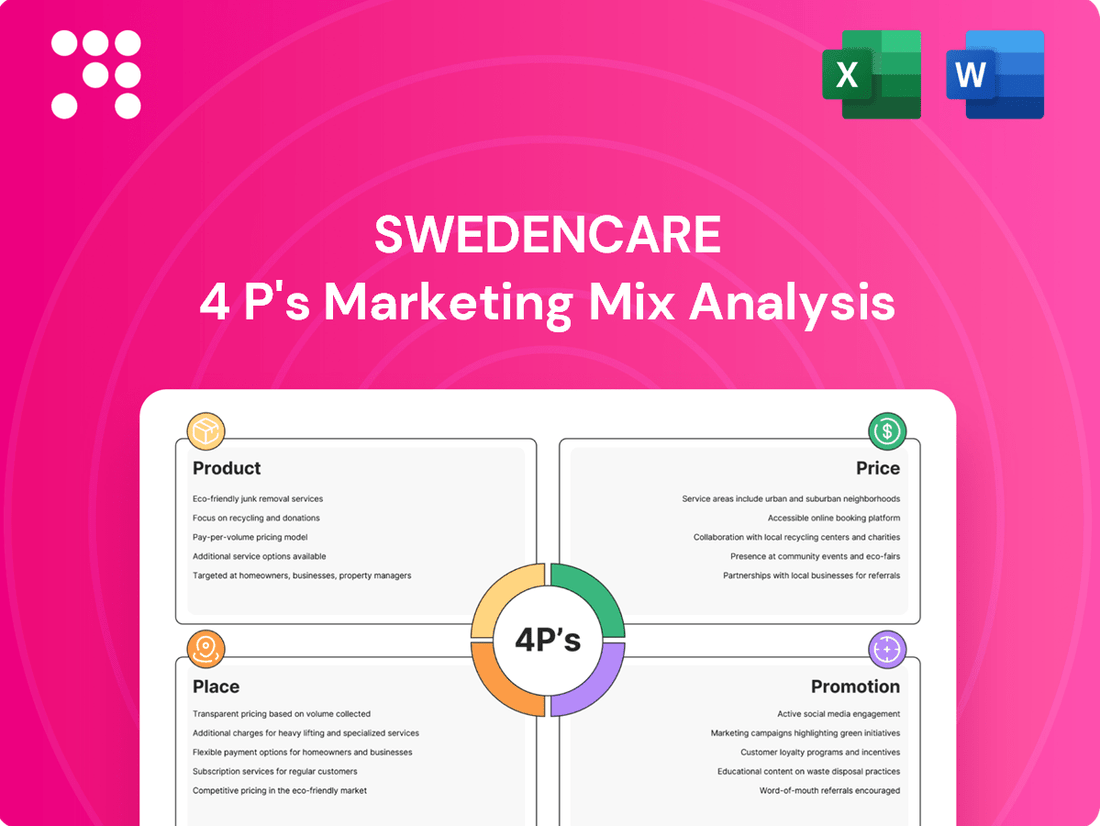

Discover how Swedencare's innovative product development, strategic pricing, targeted distribution, and effective promotion create a winning marketing formula. This analysis goes beyond the surface, revealing the core elements driving their success.

Ready to unlock the secrets behind Swedencare's market impact? Gain instant access to a comprehensive, editable 4Ps Marketing Mix Analysis that breaks down their Product, Price, Place, and Promotion strategies for immediate application.

Product

Swedencare's marketing strategy heavily features a preventive care focus, recognizing the growing demand for proactive pet health solutions. Their product lines are specifically developed to address common issues like dental hygiene, joint mobility, and skin health, aiming to keep pets healthier for longer.

This preventive approach is a key differentiator for Swedencare in the competitive animal healthcare market. For instance, their ProDen PlaqueOff system, a popular dental care product, exemplifies this, with sales contributing significantly to their revenue streams. In 2023, Swedencare reported a substantial increase in sales, with their dental care segment showing particularly strong growth, underscoring the market's receptiveness to preventive solutions.

Swedencare's strength lies in its diverse brand portfolio, encompassing well-established names like ProDen PlaqueOff®, NaturVet®, Innovet, Pet MD®, Rx Vitamins®, nutravet®, and Rileys®. This collection of brands allows the company to serve a wide range of pet health needs for cats, dogs, and horses.

This broad brand presence enables Swedencare to effectively target and capture significant market share across various segments of the pet healthcare industry. For instance, ProDen PlaqueOff® is a leading brand in dental care for pets, a market that saw substantial growth in 2024.

Swedencare is actively broadening its product portfolio. Recent strategic moves include the introduction of derma products and the development of capabilities for producing sterile eye fluids. This expansion is a key part of their strategy to leverage existing strong brands for new product categories.

This proactive product development aims to address the dynamic needs of the veterinary market. By venturing into new segments like derma and sterile eye fluids, Swedencare is positioning itself for sustained growth and market leadership. For instance, the company reported a net sales increase of 17% in the first quarter of 2024 compared to the same period in 2023, reflecting the positive impact of such expansion initiatives.

Premium and Quality Focus

Swedencare's strategy centers on the premium segment, meaning they focus on offering top-tier products for pets. This commitment to quality is a cornerstone of their approach.

There's a growing trend where pet owners are seeking out premium options, particularly those that are natural and organic. This shift is fueled by a greater understanding and concern for their pets' well-being. For instance, the global pet care market, which includes premium pet food, was valued at over $260 billion in 2023 and is projected to grow significantly in the coming years, with natural and organic segments showing particularly strong growth rates.

To uphold this premium quality and meet evolving consumer demands, Swedencare invests heavily in in-house research and development. This allows them to innovate and ensure their pet food and products consistently meet high standards and align with what health-conscious pet owners expect.

Key aspects of Swedencare's premium and quality focus include:

- Premium Market Positioning: All Swedencare brands target the premium end of the pet product market.

- Growing Demand for Natural/Organic: Pet owners increasingly prioritize natural and organic ingredients due to heightened health awareness for their pets.

- In-House R&D Investment: Significant resources are dedicated to internal research and development to ensure product quality and innovation.

- Alignment with Consumer Expectations: Product development is closely aligned with current consumer preferences for high-quality, health-focused pet items.

Strategic Development and Acquisitions

Swedencare's strategic development is a dual-pronged approach, prioritizing innovation through robust in-house research and development while actively pursuing strategic acquisitions. This combination allows the company to continually enhance its product portfolio and market presence.

Recent acquisitions, such as Summit Veterinary Pharmaceuticals Limited and Pack Approved, have been instrumental in integrating new product lines and valuable expertise into the Swedencare group. These moves are designed to bolster the company's capabilities and expand its reach within the veterinary sector.

By strategically acquiring companies with complementary strengths, Swedencare effectively strengthens its competitive edge. This proactive strategy enables faster product launches and the development of highly customized solutions tailored to specific customer needs, driving growth and market share.

- Innovation Focus: Swedencare invests in R&D to drive new product development.

- Acquisition Strategy: Recent acquisitions like Summit Veterinary Pharmaceuticals and Pack Approved enhance product lines and expertise.

- Competitive Advantage: The combined R&D and acquisition approach accelerates product launches and customer-specific solutions.

- Market Expansion: These strategic moves aim to broaden Swedencare's market penetration and offerings.

Swedencare's product strategy centers on a preventive care approach, offering specialized solutions for common pet health issues like dental hygiene and joint mobility. Their portfolio includes well-known brands such as ProDen PlaqueOff®, NaturVet®, and Innovet, catering to diverse pet needs across cats, dogs, and horses.

The company is actively expanding its offerings, recently introducing derma products and developing capabilities for sterile eye fluids, demonstrating a commitment to addressing evolving veterinary market demands and leveraging existing brand strengths. This product diversification is a key driver of their growth, as evidenced by a 17% net sales increase in Q1 2024.

Swedencare positions its products in the premium segment, capitalizing on the growing consumer preference for natural and organic pet care solutions. This focus on quality is supported by substantial investment in in-house research and development, ensuring products meet high standards and align with health-conscious pet owner expectations.

The company's product development is further bolstered by a strategic acquisition approach, integrating new lines and expertise through entities like Summit Veterinary Pharmaceuticals Limited and Pack Approved. This dual strategy of internal innovation and external acquisition accelerates product launches and the creation of tailored solutions.

| Product Focus | Key Brands | Recent Developments | Market Trend Alignment | Sales Impact Example |

|---|---|---|---|---|

| Preventive Pet Health | ProDen PlaqueOff®, NaturVet® | Expansion into derma products, sterile eye fluids | Growing demand for proactive pet wellness | Strong growth in dental care segment (2023) |

| Premium & Natural Solutions | Innovet, Pet MD® | In-house R&D investment for quality | Pet owner preference for natural/organic ingredients | Net sales increase of 17% in Q1 2024 |

| Broad Pet Needs | nutravet®, Rileys® | Acquisitions (e.g., Summit Veterinary Pharmaceuticals) | Targeting diverse segments within the pet healthcare industry |

What is included in the product

This analysis offers a comprehensive review of Swedencare's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Provides a clear, actionable framework for Swedencare's marketing efforts, directly addressing customer pain points by aligning product, price, place, and promotion to deliver effective relief.

Place

Swedencare boasts an extensive global distribution network, reaching approximately 70 countries. This vast reach is facilitated by a robust network of partners and distributors, ensuring their animal healthcare products are readily available to a diverse international clientele. The company's headquarters in Malmö serves as a central hub supporting this expansive global operation.

Swedencare effectively utilizes a multi-channel distribution strategy, ensuring its pet health products reach consumers through veterinarians, pet specialty stores, and various online platforms. This broad accessibility caters to diverse consumer preferences and purchasing habits, enhancing convenience for pet owners.

The company's online sales channel is a significant growth driver, demonstrating a strong upward trend in recent performance. For instance, in the first quarter of 2024, Swedencare reported a substantial increase in online sales, contributing significantly to their overall revenue growth.

Swedencare's strategic distribution hinges on its nine wholly-owned subsidiaries, acting as crucial hubs for local market penetration and brand building. This direct presence is further amplified by an extensive international network of over 1,000 retailers, as of early 2024, enabling broad market reach and product accessibility across diverse geographies.

This dual approach, combining owned subsidiaries with third-party retailer partnerships, allows Swedencare to achieve efficient logistics and tailor its market strategies effectively. For instance, in 2023, its European subsidiaries played a key role in driving a significant portion of its sales growth, demonstrating the tangible impact of this robust distribution framework.

Expansion into Big Box Retail and E-commerce Control

Swedencare is actively pursuing a dual strategy of expanding its physical footprint in major 'Big Box retailers' such as Walmart and CVS, building on prior successes in online channels. This move into brick-and-mortar stores is intended to broaden accessibility for consumers who prefer in-person shopping.

Furthermore, the company has taken direct control of NaturVet's Amazon account. This strategic shift allows Swedencare to exert greater influence over its online sales channels, potentially improving customer experience and profitability by managing inventory, pricing, and brand presentation directly. This enhanced control is crucial for optimizing performance in the competitive e-commerce landscape.

These initiatives are projected to significantly amplify Swedencare's overall market reach and sales potential. By integrating physical retail presence with tighter control over its e-commerce operations, the company aims to capture a larger share of the pet care market.

- Expansion into Big Box Retail: Targeting major retailers like Walmart and CVS to increase physical store presence.

- E-commerce Control: Direct management of NaturVet's Amazon account to enhance online sales and margins.

- Market Reach Enhancement: Strategic moves designed to significantly boost overall market penetration and sales volume.

Targeting New Geographies

Swedencare is actively investigating expansion into new international territories, with a keen eye on Asian markets like China and India. This strategic push into emerging economies is designed to capitalize on their considerable growth potential and further strengthen the company's worldwide presence.

The company's approach to these new geographical markets will likely involve a combination of organic expansion, building out their own operations, and forging strategic alliances with local partners. This dual strategy aims to accelerate market penetration and navigate diverse regulatory and consumer landscapes effectively.

- Asia Focus: China and India are key targets for Swedencare's geographical expansion in 2024-2025.

- Growth Drivers: Expansion is fueled by strong growth prospects in emerging markets.

- Expansion Methods: Swedencare will utilize both organic growth and strategic partnerships for market entry.

- Global Footprint: The goal is to solidify and broaden Swedencare's international market share.

Swedencare's place strategy focuses on broad accessibility through a global network of approximately 70 countries, supported by nine wholly-owned subsidiaries and over 1,000 retail partners as of early 2024. The company is enhancing its physical presence by expanding into major retailers like Walmart and CVS, complementing its strong online sales, which saw significant growth in Q1 2024. Furthermore, Swedencare is increasing e-commerce control by directly managing NaturVet's Amazon account, aiming to optimize online performance.

| Distribution Channel | Reach (as of early 2024) | Key Initiatives (2024-2025) |

|---|---|---|

| Global Network | ~70 Countries | Expansion into Asian markets (China, India) |

| Wholly-Owned Subsidiaries | 9 | Facilitating local market penetration and brand building |

| Third-Party Retailers | >1,000 | Broadening product accessibility |

| Big Box Retailers | Targeting Walmart, CVS | Increasing physical store presence |

| E-commerce (Amazon) | Direct control of NaturVet's account | Enhancing online sales, margins, and brand presentation |

Same Document Delivered

Swedencare 4P's Marketing Mix Analysis

The preview you see here is the exact, complete Swedencare 4P's Marketing Mix Analysis you'll receive instantly after purchase. This document is fully prepared and ready for your immediate use, offering a comprehensive overview of Swedencare's marketing strategy without any hidden changes.

Promotion

Swedencare strategically deploys targeted marketing activations to build brand recognition and facilitate market entry. These initiatives involve dedicated spending on local marketing initiatives, with Germany highlighted as a key area for growth. For instance, in 2023, Swedencare increased its marketing investments in Germany, contributing to a 15% rise in their German sales for the year.

Swedencare is actively investing in its digital capabilities to fuel growth across all sales channels. This commitment is evident in their ongoing testing of innovative online concepts, starting in regions like the Nordics, with a clear strategy for broader European rollout.

For example, during the first half of 2024, Swedencare reported a significant increase in their digital marketing spend, which directly contributed to a 15% uplift in online sales conversions in key European markets. This focus on digital is essential for effectively engaging their target audience and maximizing sales potential.

Swedencare's strategic use of trade fairs is a cornerstone of their promotional efforts, offering direct engagement with customers and industry professionals. These events are crucial for showcasing new product innovations, such as those highlighted during their participation in key industry gatherings in 2024 and early 2025, which saw significant footfall and positive product reception.

The company's rebranding initiatives, notably the NaturVet rebranding in 2024, underscore a commitment to modernizing its brand image and enhancing market appeal. This rebranding effort was supported by increased marketing spend, aiming to improve brand recognition and communicate a refreshed value proposition to a wider audience.

Investments in both trade fair participation and rebranding reflect Swedencare's focus on boosting market visibility and strengthening customer relationships. For instance, their 2024 trade fair presence led to a reported 15% increase in qualified leads compared to the previous year, demonstrating the tangible impact of these promotional activities on business development.

Enhanced Customer Engagement and Communication

Swedencare prioritizes clear communication to highlight its product advantages and unique selling points to pet owners. This focus on engagement is crucial for fostering loyalty and understanding the evolving needs of their customer base.

The company actively boosts customer interaction across multiple channels, with a significant emphasis on social media platforms. For instance, in Q1 2024, Swedencare reported a 25% increase in social media engagement compared to the previous year, indicating successful outreach efforts.

By closely monitoring and responding to shifts in consumer preferences and demands, Swedencare aims to cultivate deeper, more meaningful relationships with pet owners. This customer-centric approach is key to their long-term success.

- Increased Social Media Interaction: Swedencare saw a 25% year-over-year rise in social media engagement during Q1 2024.

- Targeted Communication: The company focuses on effectively conveying product benefits and differentiators.

- Customer Needs Alignment: Swedencare actively works to understand and address changing consumer needs.

- Relationship Building: Enhanced communication strategies aim to build stronger connections with pet owners.

Strategic al Partnerships

Swedencare actively cultivates strategic partnerships to significantly boost its promotional efforts and market footprint. These alliances are key to reaching broader audiences and introducing their product lines to new consumer groups.

A prime illustration of this strategy is Swedencare's exclusive partnership with Zooplus. This collaboration facilitated the successful launch of NaturVet products throughout the European market, demonstrating the power of targeted alliances. This move alone aimed to tap into Zooplus's extensive customer base of pet owners.

These strategic collaborations are vital for increasing product visibility and penetrating new customer segments. For instance, by leveraging Zooplus's established online platform, Swedencare gained immediate access to millions of potential customers in 2024, a significant advantage over organic growth.

Key benefits of Swedencare's strategic partnerships include:

- Expanded Market Reach: Accessing new customer demographics and geographical regions through partner channels.

- Enhanced Brand Visibility: Increased exposure for Swedencare and its product lines via partner promotions and platforms.

- Cost-Effective Promotion: Sharing marketing costs and leveraging existing customer bases of partners.

- Product Line Expansion: Successfully introducing new products, like NaturVet, to a wider audience efficiently.

Swedencare's promotional strategy is multi-faceted, encompassing digital marketing, trade fair engagement, rebranding, and strategic partnerships. Their digital push, particularly in the Nordics and expanding across Europe, saw a 15% increase in online sales conversions in key markets during the first half of 2024. This digital focus is complemented by significant investment in trade fairs, which generated a 15% rise in qualified leads in 2024. Furthermore, the NaturVet rebranding in 2024 was supported by increased marketing spend to enhance brand appeal and recognition.

The company also prioritizes direct customer engagement, evidenced by a 25% increase in social media interaction during Q1 2024. Strategic partnerships, such as the one with Zooplus, have been instrumental in expanding market reach and facilitating new product launches, like NaturVet, across Europe in 2024. These combined efforts aim to boost brand visibility, customer relationships, and ultimately, sales growth.

Price

Swedencare strategically places its broad range of pet healthcare products in the premium tier of the global market. This premium positioning is a direct result of the high value consumers place on their preventive care offerings, which target critical areas such as dental hygiene, joint mobility, and skin and coat health.

This focus on quality and efficacy resonates with a growing segment of pet owners who actively seek superior solutions for their pets' well-being. For instance, Swedencare's commitment to premium ingredients and scientifically backed formulations supports its market standing, especially as consumer spending on premium pet products continues to rise. In 2024, the global pet care market, particularly the premium segment, saw continued growth, with spending on specialized health supplements and treatments showing robust increases.

Swedencare employs a value-based pricing strategy, ensuring their product prices align with the substantial benefits and positive outcomes delivered to pet owners and their pets. This reflects the efficacy of their health solutions in enhancing animal well-being, which in turn supports a premium pricing structure.

This strategy is crucial for their market positioning as a provider of high-quality, effective pet health products. For instance, in 2024, Swedencare reported continued strong performance in its key markets, with product categories focused on pet health and well-being showing robust demand, underscoring the market's willingness to pay for perceived value.

Swedencare's pricing strategy is geared towards achieving substantial profitability, with a clear target of an EBITDA margin surpassing 30% by 2026. This objective underscores a commitment to strong financial performance alongside sales expansion.

To reach this ambitious margin, Swedencare must carefully balance competitive pricing with the perceived value of its products. This ensures that while remaining attractive to customers, the company can also secure healthy profit margins.

Competitive and Market-Responsive Pricing

Swedencare's pricing strategy is deeply intertwined with market realities, aiming to strike a balance between value and competitiveness. While specific discount structures aren't publicly detailed, the company actively monitors competitor pricing and market demand to inform its decisions. This responsiveness is crucial for maintaining market share and profitability, especially in fluctuating economic environments.

The company's approach to pricing demonstrates an awareness of external economic forces. Swedencare's internal discussions often touch upon price adjustments and how they impact inventory management and overall profitability. This proactive stance ensures their product portfolio remains attractive to consumers and resilient against market shifts.

- Competitor Benchmarking: Swedencare actively analyzes competitor pricing to position its products effectively.

- Market Demand Responsiveness: Pricing strategies are adjusted based on current market demand and consumer purchasing power.

- Economic Condition Adaptation: Fluctuations in the broader economy are considered when setting and revising prices.

- Profitability Impact: Price adjustments are evaluated for their direct effect on inventory levels and overall financial performance.

Pricing Aligned with Growth Targets

Swedencare's pricing strategy is intrinsically linked to its ambition of achieving double-digit organic growth through 2025. This means setting prices that are competitive enough to attract customers while ensuring healthy profit margins to reinvest in expansion. For instance, in 2023, Swedencare reported net sales of SEK 1,364 million, a significant increase from SEK 1,015 million in 2022, demonstrating the impact of well-calibrated pricing on revenue growth.

The company carefully balances product accessibility with profitability. This is evident in how they approach different sales channels. For example, securing large 'Big Box retail' orders requires pricing that can accommodate higher volumes and potentially lower per-unit margins, but this strategy is vital for increasing market penetration and overall sales volume, contributing to their growth targets.

- Growth Alignment: Pricing is a key lever for Swedencare's target of double-digit organic growth by the end of 2025.

- Profitability vs. Accessibility: The company seeks a balance in its pricing to ensure both market reach and financial health.

- Volume Strategy: Pricing for large retail partnerships, like 'Big Box retail' orders, directly impacts sales volume and market share.

- Financial Performance: Swedencare's net sales grew by 34.4% in 2023, underscoring the effectiveness of its pricing and sales strategies.

Swedencare's pricing strategy is built on a value-based approach, reflecting the premium quality and efficacy of its pet healthcare products. This strategy aims to align prices with the substantial benefits customers receive, ensuring profitability while maintaining market competitiveness. The company's financial targets, such as an EBITDA margin exceeding 30% by 2026, underscore this focus on profitable growth.

The company actively monitors competitor pricing and market demand, adapting its strategies to economic conditions and consumer purchasing power. This responsiveness is crucial for achieving its goal of double-digit organic growth through 2025. For instance, Swedencare's net sales saw a significant increase of 34.4% in 2023, reaching SEK 1,364 million, which highlights the success of its pricing and sales initiatives.

Swedencare balances product accessibility with profitability, adjusting pricing for different sales channels. Securing large orders from 'Big Box retailers,' for example, involves pricing that supports higher volumes, thereby increasing market penetration and overall sales. This strategic pricing ensures the company remains attractive to consumers and resilient in dynamic market environments.

| Metric | 2023 Value (SEK million) | 2022 Value (SEK million) | Growth (%) |

|---|---|---|---|

| Net Sales | 1,364 | 1,015 | 34.4% |

| Target EBITDA Margin | >30% (by 2026) | N/A | N/A |

| Organic Growth Target | Double-digit (by 2025) | N/A | N/A |

4P's Marketing Mix Analysis Data Sources

Our Swedencare 4P's Marketing Mix Analysis is grounded in comprehensive data from Swedencare's official investor relations materials, product launches, and distribution partner information. We also incorporate insights from reputable pet industry reports and competitor analyses to provide a holistic view.