Swedencare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

Swedencare operates in a dynamic pet health market, facing moderate threats from new entrants and the availability of substitutes. Understanding the intensity of buyer power and supplier bargaining is crucial for navigating this landscape.

The complete report reveals the real forces shaping Swedencare’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The pet healthcare product industry, especially for specialized preventive care, frequently depends on unique, high-quality, or patented ingredients. For instance, certain advanced probiotics or novel joint support compounds might only be available from a limited number of producers.

If a few specialized manufacturers control the supply of these critical components, they gain considerable bargaining power over companies like Swedencare. This concentration allows them to influence pricing and contract terms, potentially impacting Swedencare's cost of goods sold and profit margins.

Switching suppliers for crucial raw materials or active pharmaceutical ingredients presents significant hurdles for Swedencare. These challenges translate into substantial costs and operational complexities, impacting the company's agility in procurement.

The financial implications of changing suppliers are considerable. Costs can escalate rapidly due to the need for re-formulation of products, securing new regulatory re-approvals, conducting extensive re-testing, and adapting manufacturing processes to accommodate new inputs.

These elevated switching costs directly empower existing suppliers. They gain leverage, making it more difficult and costly for Swedencare to readily transition to alternative sources, thereby solidifying the supplier's position in the value chain.

When suppliers offer highly specialized or unique ingredients that are crucial for the effectiveness and premium image of Swedencare's products, their bargaining power increases significantly. Swedencare's commitment to high-quality, often proprietary formulations means they may depend on a limited number of suppliers for these key components.

For example, if a specific patented extract or a rare, sustainably sourced ingredient is vital to Swedencare's flagship Probiotic Plus range, the supplier of that ingredient holds considerable leverage. This reliance on differentiated inputs, which are difficult for competitors to replicate, strengthens the supplier's hand in price negotiations and supply terms.

Threat of Forward Integration by Suppliers

Suppliers of specialized ingredients, particularly those with unique formulations or patented compounds crucial for Swedencare's products, could pose a threat by integrating forward. This means they might start producing their own finished pet healthcare items, directly competing with Swedencare if they can leverage existing distribution channels or build brand recognition.

For instance, a supplier of a novel probiotic strain used in Swedencare's digestive supplements might decide to launch their own line of probiotic chews. This would transform a key partner into a direct rival, especially if the supplier has established relationships with retailers or a strong online presence, as seen in the broader pet supplement market where new brands emerge frequently.

The risk is amplified if these suppliers possess proprietary technology or exclusive access to raw materials, giving them a competitive edge in product development and manufacturing. This scenario could force Swedencare to either compete with its own suppliers or seek alternative, potentially less advantageous, sourcing options.

- Potential for Supplier Forward Integration: Suppliers of specialized ingredients could enter the finished pet healthcare product market, becoming direct competitors.

- Impact on Competition: This would intensify competition, especially if suppliers have established market access or brand recognition.

- Strategic Implications: Swedencare might face increased pressure on pricing and market share if key suppliers choose to compete directly.

Impact of Global Supply Chain Stability

The stability of global supply chains directly impacts the bargaining power of suppliers for companies like Swedencare. Recent years have seen significant disruptions, from the COVID-19 pandemic to geopolitical tensions, which have led to increased scarcity and higher costs for many raw materials and components. For instance, the global semiconductor shortage, which extended well into 2023 and early 2024, dramatically increased the leverage of chip manufacturers, forcing many industries to pay premium prices or face production delays.

In a volatile supply chain environment, suppliers can more easily command higher prices or dictate more favorable terms. This is because alternative sources may be scarce, unreliable, or prohibitively expensive. For Swedencare, this translates to potentially higher production costs for its pet health products, impacting profit margins and operational efficiency. The ability of suppliers to leverage these conditions is a key factor in assessing their bargaining power.

Several factors contribute to the increased bargaining power of suppliers in unstable supply chains:

- Limited Availability of Key Inputs: Disruptions can reduce the overall supply of essential raw materials or specialized components, making it harder for buyers like Swedencare to secure sufficient quantities.

- Increased Lead Times and Unpredictability: Longer and less predictable delivery times give suppliers more control over the timing and availability of goods.

- Higher Transportation and Logistics Costs: Volatility in shipping and freight markets, as seen with elevated container shipping rates in late 2023 and early 2024, can be passed on to buyers, strengthening the supplier's position.

- Concentration of Suppliers: If Swedencare relies on a few key suppliers for critical ingredients or packaging, these suppliers gain significant leverage, especially during times of scarcity.

Suppliers of specialized ingredients crucial for Swedencare's premium products hold significant bargaining power due to limited alternatives and high switching costs. These costs include re-formulation, regulatory re-approvals, and re-testing, which can be substantial. For instance, if a unique patented probiotic strain is vital for Swedencare's flagship products, its supplier can dictate terms, directly impacting Swedencare's profitability.

Global supply chain volatility, evidenced by extended lead times and increased logistics costs in late 2023 and early 2024, further amplifies supplier leverage. When essential inputs are scarce, suppliers can command higher prices, as seen with the general increase in raw material costs across industries. This situation forces buyers like Swedencare to accept less favorable terms or face production disruptions.

A key concern is the potential for supplier forward integration, where ingredient providers might launch their own competing pet healthcare products. This was observed in the broader pet supplement market in 2023-2024, with new brands frequently emerging. If a supplier of a critical ingredient for Swedencare enters the market directly, it transforms a partner into a competitor, potentially impacting Swedencare's market share and pricing strategies.

| Factor | Impact on Swedencare | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increased leverage for few suppliers | Reliance on specific patented ingredients |

| Switching Costs | High costs deter supplier changes | Re-formulation, regulatory approvals |

| Supply Chain Volatility | Higher input prices, reduced availability | Increased raw material costs in 2023-2024 |

| Forward Integration Risk | Potential for direct competition | New brands entering pet supplement market |

What is included in the product

This analysis unpacks the competitive intensity within Swedencare's pet health and nutrition market, examining supplier and buyer power, the threat of new entrants and substitutes, and the dynamics of rivalry.

Swedencare's Porter's Five Forces analysis offers a clear, one-sheet summary of all competitive pressures—perfect for quick, informed strategic decision-making.

Customers Bargaining Power

Swedencare's extensive global distribution network, reaching about 70 countries through veterinarians, pet stores, and online platforms, significantly weakens customer bargaining power. This broad reach means no single customer or channel holds substantial sway over Swedencare's pricing or terms. For instance, in 2024, Swedencare reported a strong presence in key markets, with sales growth driven by this diversified approach, indicating that individual customer demands are less likely to dictate business strategy.

Swedencare benefits from strong brand loyalty, particularly with its flagship product ProDen PlaqueOff®. This brand recognition, built on demonstrated benefits, significantly reduces customers' inclination to seek out cheaper alternatives. In 2023, ProDen PlaqueOff® was a key contributor to Swedencare's revenue growth, showcasing its market strength and customer trust.

The growing trend of pet humanization significantly boosts the bargaining power of customers, as owners increasingly view pets as family members and are willing to spend more on premium, specialized products. This elevated demand for high-quality pet healthcare, including preventive solutions, allows companies like Swedencare to command higher prices, thereby mitigating pressure from distributors to reduce costs. For instance, the global pet care market was valued at approximately $261 billion in 2023 and is projected to reach $350 billion by 2027, indicating a strong customer willingness to invest in their pets' well-being.

Influence of Large Retail Chains and Distributors

Swedencare's bargaining power of customers is significantly influenced by large retail chains and distributors. These entities, due to their substantial purchasing volume, can dictate terms regarding pricing, promotional support, and even product delivery schedules. For instance, Swedencare has experienced order delays from major clients, highlighting the leverage these large customers possess.

The concentration of purchasing power among a few key retailers means that Swedencare must carefully manage relationships to avoid adverse impacts on its sales and profitability. These large customers can demand lower prices, which can squeeze Swedencare's profit margins, especially if the company lacks alternative sales channels or has high fixed costs.

- Customer Concentration: A significant portion of Swedencare's revenue may be derived from a limited number of large retail partners, increasing their bargaining power.

- Price Sensitivity: Large retailers often operate on thin margins themselves, leading them to exert pressure on suppliers like Swedencare for competitive pricing.

- Operational Demands: These customers can impose strict requirements on inventory management, delivery windows, and product availability, adding operational complexity and cost for Swedencare.

Price Transparency in Online Channels

The surge in online sales, a key growth area for Swedencare, significantly amplifies price transparency for consumers. This ease of comparison across various brands and retailers empowers customers, particularly for products lacking strong differentiation, to exert greater bargaining power.

For instance, in 2024, the global e-commerce market continued its expansion, with consumers increasingly relying on online platforms for product research and price comparisons. This environment makes it simpler for buyers to identify the most competitive offers, potentially pressuring companies like Swedencare to maintain attractive pricing structures.

- Increased Online Penetration: By 2024, a substantial portion of consumer goods purchases, including health and wellness products, were facilitated through online channels, creating a more informed customer base.

- Price Comparison Tools: The proliferation of price comparison websites and apps in 2024 further democratized pricing information, allowing consumers to instantly gauge value across multiple vendors.

- Impact on Less Differentiated Products: For Swedencare's offerings that are perceived as commodities, this transparency can lead to greater price sensitivity among buyers, intensifying competitive pressures.

Swedencare's bargaining power of customers is a mixed bag, influenced by brand loyalty and the pet humanization trend, which generally strengthens customer position. However, their extensive global distribution and strong brand recognition for products like ProDen PlaqueOff® act as counterbalances. The increasing online presence and price transparency, while empowering consumers, also pressure Swedencare to remain competitive on pricing.

| Factor | Impact on Swedencare | 2024/2023 Data Point |

|---|---|---|

| Brand Loyalty & Pet Humanization | Increases customer bargaining power | Global pet care market valued at ~$261 billion in 2023 |

| Global Distribution & Brand Strength | Decreases customer bargaining power | ProDen PlaqueOff® a key revenue driver in 2023 |

| Online Sales & Price Transparency | Increases customer bargaining power | Continued expansion of global e-commerce in 2024 |

What You See Is What You Get

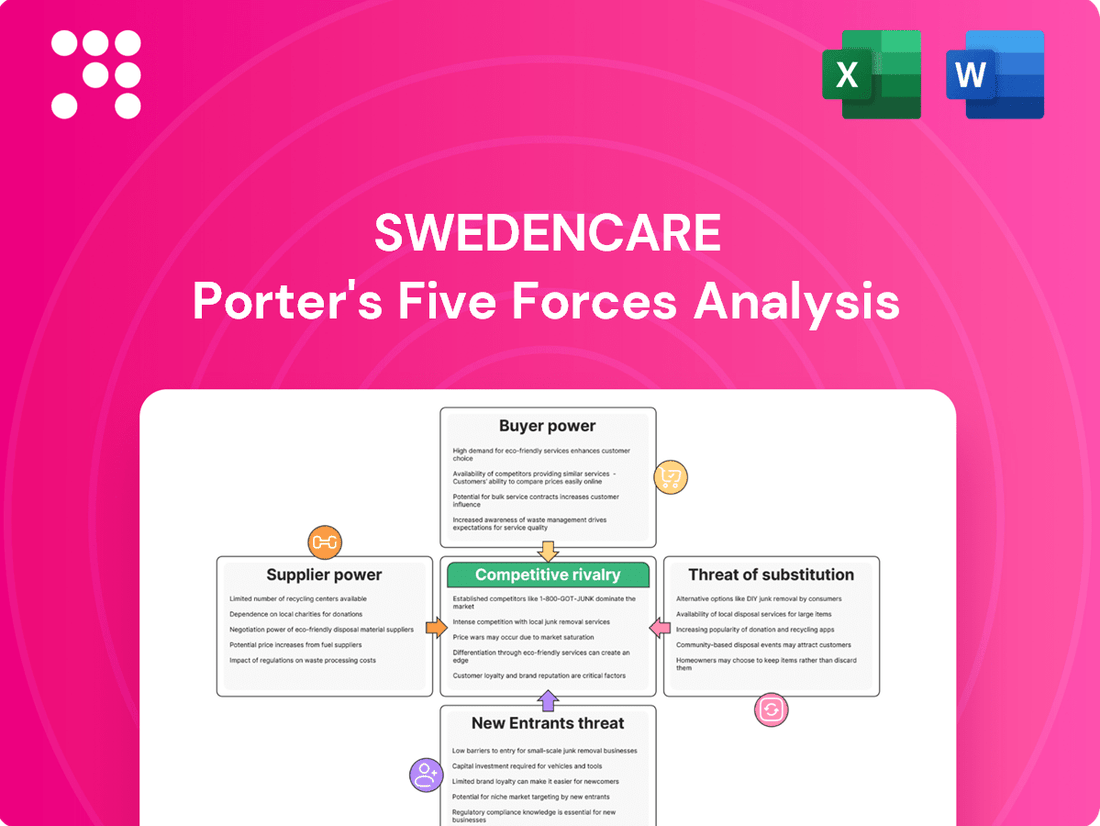

Swedencare Porter's Five Forces Analysis

This preview shows the exact Swedencare Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed analysis is ready for your strategic planning.

Rivalry Among Competitors

The pet healthcare market, encompassing areas like dental care, joint support, and skin and coat health, is showing robust and steady expansion. Projections frequently point to an annual growth rate of approximately 5% for the industry as a whole.

This consistent market growth, while beneficial for existing companies, also acts as a magnet, drawing in and supporting a wide array of competitors, from established corporations to nimble startups.

Swedencare benefits from an extensive product portfolio, featuring well-recognized brands like ProDen PlaqueOff®, a leader in its segment. This broad offering allows the company to cater to diverse customer needs and preferences, reducing the likelihood of direct price-based competition.

The strong brand equity associated with Swedencare’s products, particularly ProDen PlaqueOff®, acts as a significant barrier to entry for new competitors. This brand strength fosters customer loyalty, enabling Swedencare to command premium pricing and differentiate its offerings beyond mere product features.

Swedencare's competitive rivalry is intensified by its strategic acquisition of companies like Summit Veterinary Pharmaceuticals Limited. This move, aimed at broadening its product portfolio and extending its reach into new territories, directly challenges competitors by consolidating market share.

In 2023, Swedencare completed several acquisitions, demonstrating a proactive approach to inorganic growth. For instance, the acquisition of Summit Veterinary Pharmaceuticals Limited in the UK was a significant step in expanding its European presence and product lines within the veterinary sector.

These acquisitions are not merely about expansion; they represent a direct competitive maneuver to gain an advantage. By integrating new brands and capabilities, Swedencare strengthens its market position, forcing rivals to react and potentially engage in similar consolidation activities.

Moderated Organic Growth Rates

Competitive rivalry is a significant factor for Swedencare, particularly evident in the moderation of its organic growth rates. Despite a growing overall market, the company has experienced a slowdown in its own expansion. For instance, Swedencare's organic growth was 5% in the first quarter of 2025, a notable decrease from the 12% seen in the first quarter of 2024. Similarly, the full-year 2024 organic growth stood at 9%, down from 15% in 2023.

This trend suggests that competitive intensity is increasing, and certain markets where Swedencare operates may be becoming more saturated. Such conditions make it more challenging for companies to achieve substantial organic expansion through existing products and services alone. The need to differentiate and innovate becomes paramount in this environment.

- Moderated Organic Growth: Swedencare's Q1 2025 organic growth rate was 5%, down from 12% in Q1 2024.

- Full-Year Comparison: Full-year 2024 organic growth was 9%, compared to 15% in 2023.

- Market Saturation: The slowdown points to potentially higher market saturation in some operational areas.

- Increased Competition: This moderation indicates rising competitive pressures within the industry.

Global Presence and Regional Competitive Dynamics

Swedencare's operation in roughly 70 countries means it faces a diverse competitive environment. This includes battling against large global corporations as well as smaller, niche regional and local competitors. The intensity of this rivalry isn't uniform; it shifts considerably depending on the specific geographic market, necessitating adaptable and tailored strategies for each region.

For instance, in mature markets like the United States, competition might be dominated by established players with significant brand recognition and marketing budgets. Conversely, in emerging markets, the competitive landscape could be more fragmented, with local brands holding strong consumer loyalty. Swedencare's 2023 annual report indicated that while Europe remains its largest market, North America showed substantial growth, suggesting a need to navigate different competitive pressures in each region.

- Global Reach, Local Challenges: Operating in approximately 70 countries exposes Swedencare to a varied competitive landscape, ranging from large multinational corporations to specialized regional and local players.

- Varying Intensity: Competition intensity can differ significantly across geographies, requiring flexible and localized competitive strategies.

- Market-Specific Strategies: For example, in the US market, Swedencare might face intense competition from established brands like Nature's Bounty, while in other regions, smaller, locally focused companies could pose a greater threat.

Swedencare faces intense competition from both global giants and specialized local players across its approximately 70 operating countries. This rivalry is particularly evident in the moderation of its organic growth rates, with Q1 2025 organic growth at 5% compared to 12% in Q1 2024, and full-year 2024 growth at 9% versus 15% in 2023. This suggests increasing market saturation and pressure to differentiate.

The company's strategic acquisitions, such as Summit Veterinary Pharmaceuticals Limited in 2023, aim to consolidate market share and counter competitive pressures. However, the diverse nature of its global operations means that competitive intensity varies significantly by region, demanding tailored strategies to navigate established players in mature markets and fragmented landscapes in emerging ones.

| Metric | Q1 2024 | Q1 2025 | Full-Year 2023 | Full-Year 2024 |

|---|---|---|---|---|

| Organic Growth Rate | 12% | 5% | 15% | 9% |

SSubstitutes Threaten

For serious pet health issues, professional veterinary procedures like surgery for joint problems or thorough dental cleanings under anesthesia act as direct substitutes for preventive care products. These interventions offer more immediate and impactful solutions compared to daily supplements, presenting a significant threat to the market for such products.

The demand for veterinary services remains robust, with the global pet care market projected to reach USD 350 billion by 2027, indicating a strong reliance on professional medical interventions. In 2024, the veterinary services sector continued to see growth, driven by increased pet ownership and a willingness among owners to invest in advanced care for their animals, directly competing with the preventative solutions offered by companies like Swedencare.

The threat of substitutes for Swedencare's offerings is amplified by the expanding market for functional pet foods. These products are increasingly formulated to deliver health benefits, such as improved dental hygiene or enhanced joint mobility, directly through a pet's daily meals.

This trend means that specialized functional pet foods can effectively substitute for standalone dietary supplements, a category where Swedencare has a significant presence. For instance, the global pet food market was valued at approximately $130 billion in 2023 and is projected to grow, with a notable segment dedicated to health-focused and functional options.

Lower-cost generic and private label pet supplements, readily available in mass retail channels like supermarkets and drugstores, pose a significant threat. These products often mimic the functionality of Swedencare's premium offerings at a fraction of the price, appealing directly to budget-conscious consumers. For instance, in 2024, the private label segment of the pet care market continued its robust growth, capturing an increasing share of consumer spending, which directly impacts the potential market for specialized brands.

Emergence of Natural and DIY Remedies

The growing interest in natural pet care presents a significant threat of substitutes for companies like Swedencare. Pet owners increasingly explore home-based remedies or less regulated natural products as alternatives to commercially produced supplements. This shift is often driven by a desire for chemical-free solutions and a more hands-on approach to pet wellness, potentially diverting consumers away from established brands.

This trend is amplified by readily available information and recipes online, empowering owners to create their own pet care solutions. For instance, a 2024 survey indicated that over 35% of pet owners actively seek out DIY pet care solutions, with a notable portion citing cost savings and ingredient control as primary motivators. This DIY movement represents a direct substitution for purchased products.

- DIY Pet Care Trend: Over 35% of pet owners in 2024 reported seeking DIY pet care solutions.

- Motivations: Key drivers include cost savings and a desire for ingredient transparency.

- Information Accessibility: Online platforms provide extensive resources for homemade pet remedies, lowering the barrier to entry for DIY solutions.

- Impact on Commercial Products: This trend offers a viable substitute for consumers who prefer natural, owner-prepared options over commercial supplements.

Shift from Preventive to Curative Focus

The threat of substitutes for Swedencare's preventive pet care products arises when pet owners shift their focus from proactive health measures to reactive, curative treatments. If owners neglect preventive care, they might seek veterinary services and medications to address existing health problems, effectively substituting Swedencare's offerings with more interventionist solutions.

This shift can occur if pet owners perceive preventive products as unnecessary or too costly, especially if their pets appear healthy. For instance, a pet owner might delay purchasing Swedencare's joint supplements until their pet exhibits visible signs of arthritis, at which point they would opt for prescription pain relief or physical therapy from a veterinarian.

In 2023, the global veterinary pharmaceuticals market, which includes curative treatments, was valued at approximately $30 billion and is projected to grow. This substantial market size indicates a significant existing demand for curative pet care, representing a direct substitute if preventive measures are not adopted.

- Preventive vs. Curative Spending: While Swedencare thrives on preventive spending, a rise in veterinary visits for diagnosed illnesses signifies a substitution.

- Veterinary Pharmaceuticals as Substitutes: Prescription medications and treatments offered by veterinarians directly compete if preventive care is overlooked.

- Owner Perception and Cost: The perceived value and cost-effectiveness of preventive products influence the likelihood of substitution by curative approaches.

- Market Trends: The growing veterinary pharmaceuticals market highlights the substantial alternative of curative care available to pet owners.

The threat of substitutes for Swedencare's products is significant, stemming from both professional veterinary interventions and alternative consumer choices. Veterinary procedures, while more costly, offer immediate solutions for serious pet health issues, directly competing with preventive supplements. Furthermore, the rising popularity of functional pet foods and the availability of lower-cost private label options present substantial substitution risks, as consumers may opt for these integrated or more affordable alternatives.

| Substitute Category | Description | Market Context/Data | Impact on Swedencare |

| Veterinary Procedures | Surgical interventions, dental cleanings, prescription treatments for existing conditions. | Global pet care market projected to reach USD 350 billion by 2027; veterinary services sector saw continued growth in 2024. | Directly addresses severe issues, diverting funds from preventive care. |

| Functional Pet Foods | Pet foods formulated with added health benefits (e.g., joint support, dental care). | Global pet food market valued around $130 billion in 2023, with a growing segment for health-focused options. | Integrates health benefits into daily diet, potentially replacing standalone supplements. |

| Private Label/Generic Supplements | Lower-cost alternatives available in mass retail channels. | Private label segment in pet care continued robust growth in 2024, capturing increased consumer spending. | Appeals to budget-conscious consumers, offering similar functionality at lower prices. |

| DIY Pet Care | Home-prepared remedies and natural products. | Over 35% of pet owners in 2024 sought DIY pet care solutions, driven by cost and ingredient control. | Offers a perceived natural and cost-effective alternative, reducing demand for commercial products. |

Entrants Threaten

Entering the pet healthcare product market, particularly for specialized and premium items like those Swedencare offers, requires considerable financial outlay. This includes substantial investment in research and development to create effective formulations, setting up advanced manufacturing facilities, implementing rigorous quality assurance protocols, and executing comprehensive marketing campaigns. These considerable initial expenses act as a significant deterrent for potential new competitors.

Swedencare enjoys significant brand loyalty, particularly for its flagship product ProDen PlaqueOff®, which has cultivated a strong reputation among consumers. This established trust makes it difficult for new players to gain traction quickly. In 2023, Swedencare reported a net sales increase of 18% to SEK 1,163 million, demonstrating the strength of its existing market position.

The company's extensive global distribution network, reaching around 70 countries, presents a formidable barrier to entry. New entrants would need substantial capital and time to replicate this reach, facing challenges in securing shelf space and efficient logistics. This widespread presence ensures Swedencare's products are readily available, further solidifying its market dominance.

The animal healthcare industry is heavily regulated, with rules covering everything from how products are made and tested to how they’re labeled. These regulations aren't uniform, differing significantly from one country to another, creating a complex maze for new businesses to navigate. For instance, the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have distinct approval processes for veterinary drugs, each requiring substantial investment in research and documentation.

Complying with these varied and often rigorous requirements translates into significant costs for new entrants. These expenses include fees for product registration, extensive safety and efficacy testing, and maintaining quality control systems that meet global standards. In 2024, the cost of bringing a new veterinary pharmaceutical to market can easily run into tens of millions of dollars, a considerable barrier for startups lacking established financial backing.

Acquisition Strategy by Incumbent Players

Established players like Swedencare employ acquisition strategies to consolidate market share and capabilities, effectively raising the barrier to entry. For instance, Swedencare’s acquisition of Summit Veterinary Pharmaceuticals in 2022, a significant move in the pet health sector, demonstrates this approach. This not only expands Swedencare's product offerings but also absorbs potential competitors or innovative technologies before they can mature independently. Such M&A activity can make it more challenging for new entrants to gain traction, as the market becomes more concentrated and established players gain economies of scale and broader distribution networks.

The impact of these acquisitions on new entrants can be substantial:

- Reduced Pool of Targets: Acquisitions by incumbents diminish the number of smaller, innovative companies available for new entrants to partner with or acquire themselves.

- Increased Capital Requirements: A market dominated by large, consolidated players often necessitates greater initial capital investment for new entrants to compete effectively on price or scale.

- Enhanced Brand Loyalty and Distribution: Acquired companies often benefit from the established brand recognition and extensive distribution channels of the acquirer, making it harder for newcomers to reach customers.

Market Attractiveness and Growth Potential

The global pet healthcare market's consistent expansion, fueled by rising pet ownership and the humanization of pets, presents a significant draw for new companies. This growing demand makes the industry inherently attractive, encouraging fresh players to consider entering the space.

Despite existing barriers to entry, the sheer size and growth trajectory of the pet healthcare sector, which was valued at over $100 billion globally in 2023 and is projected to continue its upward trend, can still motivate new entrants. They might seek to carve out niche segments or introduce innovative products and services to capture a portion of this expanding market.

- Market Growth: The global pet care market is expected to reach approximately $350 billion by 2027, indicating strong ongoing demand.

- Humanization Trend: Consumers increasingly view pets as family members, leading to higher spending on premium healthcare and wellness products.

- Innovation Incentive: The potential for high returns in a growing market can spur new entrants to develop novel solutions, potentially disrupting established players.

The threat of new entrants for Swedencare is moderate. While high capital requirements, strong brand loyalty for products like ProDen PlaqueOff®, and extensive global distribution networks present significant hurdles, the growing and attractive pet healthcare market can still entice new players. Regulatory complexities and consolidation through acquisitions further elevate these barriers.

| Barrier | Impact on New Entrants | Swedencare's Position |

|---|---|---|

| Capital Requirements | High initial investment for R&D, manufacturing, and marketing. | Established financial resources and economies of scale. |

| Brand Loyalty | Difficult for new brands to gain consumer trust. | Strong reputation, particularly for ProDen PlaqueOff®. 2023 net sales: SEK 1,163 million. |

| Distribution Network | Reaching ~70 countries requires substantial logistics and capital. | Extensive global reach, securing shelf space and efficient logistics. |

| Regulatory Hurdles | Navigating varied international regulations (e.g., EMA, FDA) is costly. | Experience and resources to manage compliance. |

| Market Growth | Attractive sector (>$100 billion in 2023) can draw new competitors. | Leveraging growth through existing infrastructure and brand. |

Porter's Five Forces Analysis Data Sources

Our Swedencare Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Swedencare's annual reports, investor presentations, and official company statements. We supplement this with industry-specific market research reports and analyses from reputable financial data providers to ensure a comprehensive understanding of the competitive landscape.