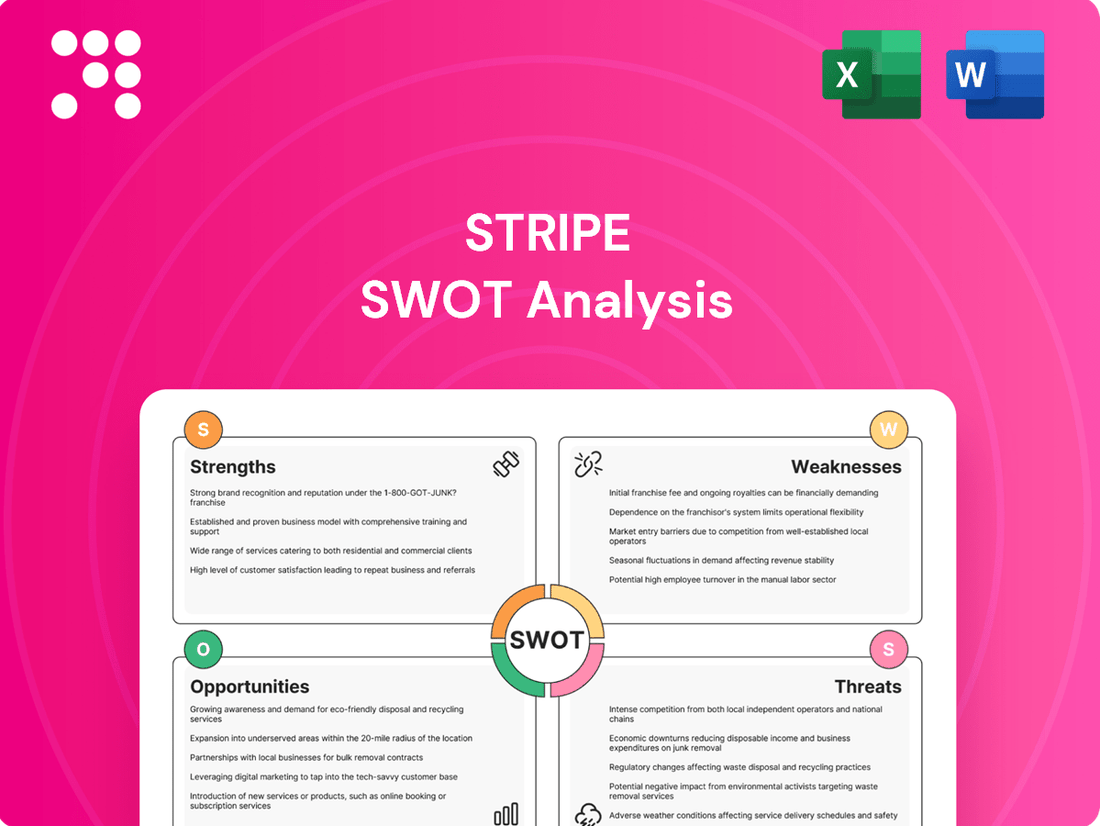

Stripe SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stripe Bundle

Stripe's robust platform and strong brand recognition are key strengths, but its reliance on a rapidly evolving fintech landscape presents significant opportunities alongside potential threats. Understanding these dynamics is crucial for any player in the digital payments arena.

Want the full story behind Stripe's competitive advantages, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Stripe's strength lies in its extensive financial infrastructure, offering businesses far more than just payment processing. Its suite includes robust tools for subscription management, advanced fraud prevention, business financing solutions, and corporate cards, creating a truly integrated financial ecosystem.

This all-encompassing approach acts as a significant draw for businesses seeking to streamline their financial operations. For instance, Stripe Capital has provided over $10 billion in financing to businesses as of early 2024, showcasing the practical application of its broader financial services and solidifying its position as a comprehensive financial partner.

Stripe has demonstrated exceptional growth, processing a staggering $1.4 trillion in total payment volume in 2024. This represents a substantial 38% year-over-year increase, highlighting its expanding reach and the increasing reliance on its services for global transactions. This volume is equivalent to about 1.3% of the world's Gross Domestic Product, underscoring Stripe's significant role in the digital economy.

The company enjoys widespread adoption among leading businesses, serving half of the Fortune 100 companies. Furthermore, its platform is utilized by a vast majority of top tech innovators, including 80% of the Forbes Cloud 100 and 78% of the Forbes AI 50. This deep penetration into key industry sectors signifies strong market trust and validation of Stripe's capabilities.

Stripe's significant investment in advanced AI and machine learning is a major strength, directly translating into tangible business benefits. These capabilities are not just theoretical; they are actively driving revenue growth for both existing and new clients.

The company's AI models are meticulously designed to optimize transaction flows, a critical factor in payment processing. This optimization has led to demonstrable improvements, such as a 4% increase in authorization rates for companies like Hertz, and a notable 23% revenue boost for publications like Forbes, showcasing the direct financial impact.

Furthermore, Stripe's AI-powered fraud prevention suite offers real-time threat detection. This not only helps businesses mitigate losses by reducing false declines but also enhances the overall accuracy of their transaction security, a key concern for any online business.

Developer-Friendly Platform and Innovation

Stripe's commitment to developers is a significant strength, evident in its exceptionally clear documentation and straightforward integration process. This developer-centric design, coupled with a robust suite of tools and APIs, significantly lowers the barrier to entry for businesses wanting to implement sophisticated payment solutions.

The company consistently pushes the envelope with product innovation. Recent advancements like Adaptive Pricing, which allows businesses to dynamically adjust pricing based on various factors, and expanded support for a wider array of global payment methods, further solidify its competitive edge and attract a broad user base. For instance, Stripe reported a 25% increase in developer adoption of its new APIs in the first half of 2024 compared to the previous year.

- Developer-First Approach: Streamlined integration, comprehensive APIs, and clear documentation.

- Product Innovation: Features like Adaptive Pricing and expanded payment method support drive adoption.

- Ecosystem Growth: A rich environment of tools and third-party integrations enhances platform utility.

- Rapid Adoption: Businesses benefit from Stripe's ease of use and continuous feature development.

Profitability and Strategic Reinvestment

Stripe's profitability, achieved in 2024 and projected to continue through 2025, marks a crucial turning point. This financial health allows for strategic maneuvering in a competitive market.

Instead of returning capital to shareholders via dividends, Stripe is channeling its profits into aggressive reinvestment. This focus on future growth areas is a key strength.

Key investment areas include:

- Stablecoins: Exploring blockchain technology for more efficient transactions.

- Artificial Intelligence (AI): Integrating AI for enhanced fraud detection and customer service.

- Financial Automation: Developing tools to streamline payment processing and financial management for businesses.

This strategic reinvestment in R&D, particularly in cutting-edge technologies, positions Stripe for leadership in rapidly evolving digital finance sectors.

Stripe's comprehensive financial infrastructure, extending beyond basic payment processing to include subscription management, fraud prevention, and business financing, creates a powerful, integrated ecosystem for businesses.

This all-in-one approach is a significant draw, as evidenced by Stripe Capital providing over $10 billion in financing to businesses by early 2024, demonstrating its value as a holistic financial partner.

The company's impressive growth trajectory is highlighted by processing $1.4 trillion in total payment volume in 2024, a 38% year-over-year increase, signifying its expanding global reach and importance in the digital economy, representing about 1.3% of global GDP.

Stripe's platform is widely adopted by leading businesses, including half of the Fortune 100 and a majority of top tech innovators, such as 80% of the Forbes Cloud 100, underscoring strong market trust and validation.

| Strength | Description | Supporting Data/Impact |

| Integrated Financial Infrastructure | Offers a broad suite of financial tools beyond payments. | Includes subscription management, fraud prevention, financing, and corporate cards. |

| Significant Business Financing | Provides capital to businesses through Stripe Capital. | Over $10 billion in financing provided by early 2024. |

| Exceptional Growth & Scale | Processes massive transaction volumes globally. | $1.4 trillion in total payment volume in 2024 (38% YoY increase); 1.3% of global GDP. |

| Widespread Industry Adoption | Trusted by major corporations and tech leaders. | Serves 50% of Fortune 100; 80% of Forbes Cloud 100; 78% of Forbes AI 50. |

| AI & Machine Learning Leadership | Leverages advanced AI for business benefits. | Improves authorization rates (e.g., +4% for Hertz) and revenue growth (e.g., +23% for Forbes). |

| Developer-Centric Design | Focuses on ease of use for developers. | Clear documentation, robust APIs, and streamlined integration; 25% developer adoption increase for new APIs in H1 2024. |

| Product Innovation | Continuously introduces new features. | Adaptive Pricing, expanded global payment methods. |

| Profitability and Reinvestment | Achieved profitability in 2024 and reinvests in growth. | Focus on stablecoins, AI, and financial automation R&D. |

What is included in the product

Delivers a strategic overview of Stripe’s internal and external business factors, highlighting its strong brand and developer focus while acknowledging competitive pressures and regulatory challenges.

Offers a clear, actionable SWOT analysis of Stripe, identifying key areas for growth and potential challenges to inform strategic decisions.

Weaknesses

Stripe's deep integration with online and physical commerce channels, while a core strength, also exposes it to significant risks. A substantial slowdown in global e-commerce, which saw robust growth during the pandemic, could directly curtail Stripe's transaction volumes and, consequently, its revenue streams. For instance, if consumer spending shifts away from online purchases due to economic pressures, Stripe's growth trajectory would be directly impacted.

Stripe's standard transaction fee of 2.9% plus $0.30 per successful card charge, while industry-standard for many, can represent a significant overhead for small businesses with lower average transaction values. For instance, a business processing $10 transactions would incur a fee of $0.59, equating to a 5.9% cost per transaction, which is considerably higher than the advertised rate. This can make alternative payment processors with tiered or flat-rate fees more appealing for micro-businesses or those in niche markets where ticket sizes are inherently small.

While Stripe offers robust self-service resources, some users have noted limitations in their customer support, particularly a lack of readily available phone support. This can be a significant drawback for businesses experiencing urgent payment processing issues, such as unexpected account holds or frozen funds, where immediate human interaction is often crucial for swift resolution.

Regulatory Complexity and Compliance Costs

Stripe’s global operations mean it must navigate a patchwork of varying and constantly changing financial regulations worldwide. This complexity directly translates into higher compliance costs and can create significant operational hurdles. For example, industry-wide fintech compliance spending saw a notable 15% increase in 2024, a trend that undoubtedly impacts Stripe. The company's strategic decision to implement an invite-only system in India in late 2024 further underscores the intricate challenges of adhering to specific national regulatory frameworks.

- Navigating diverse global regulations

- Increased compliance expenditures

- Operational challenges due to regulatory shifts

- Impact of regional compliance on market entry strategies

Market Share Against Established Players

Despite its impressive growth, Stripe faces a significant challenge in its market share against established payment giants. In late 2024, Stripe held a 17% share of the global payment acceptance technology market. This contrasts sharply with PayPal, which commanded 45% of the market during the same period.

While Stripe has carved out a strong niche in e-commerce, its overall global footprint remains smaller than some of its more seasoned rivals. This disparity highlights the ongoing effort required to expand beyond its core strengths and capture a more substantial portion of the broader payment processing landscape.

- Market Share Disparity: Stripe's 17% global market share in payment acceptance technology as of late 2024 lags behind PayPal's 45%.

- E-commerce Strength: Stripe excels in e-commerce but needs to broaden its reach to compete more effectively globally.

- Established Competition: Long-standing competitors have a significant advantage in overall market penetration.

Stripe's reliance on transaction fees, while standard, can be a deterrent for very small businesses due to the effective percentage cost on low-value transactions. For instance, a $10 transaction incurs a fee of $0.59, representing a 5.9% cost, making it less competitive for micro-merchants compared to alternative providers with more flexible fee structures.

The absence of easily accessible phone support can be a critical weakness for businesses facing urgent payment processing issues. This lack of immediate human intervention can prolong downtime and negatively impact customer trust, especially when dealing with account freezes or payment holds.

Stripe's global operations necessitate navigating a complex and ever-changing landscape of financial regulations. This increases compliance costs, estimated to have risen by 15% industry-wide in 2024, and can create significant operational challenges, as seen with their invite-only system in India in late 2024.

Stripe's market share, while growing, still trails behind established players. As of late 2024, Stripe held 17% of the global payment acceptance technology market, significantly less than PayPal's 45%. This indicates a need for further expansion beyond its e-commerce stronghold to achieve broader global penetration.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Transaction Fee Structure | Standard fees can be disproportionately high for low-value transactions. | Discourages micro-businesses, potentially leading them to seek alternative processors. | A $10 transaction incurs a 5.9% fee ($0.59). |

| Customer Support Limitations | Lack of readily available phone support for urgent issues. | Can lead to extended downtime and customer dissatisfaction during critical payment problems. | Users report difficulty reaching support for account holds or frozen funds. |

| Regulatory Complexity | Navigating diverse global financial regulations. | Increases compliance costs and creates operational hurdles. | Industry-wide fintech compliance spending rose 15% in 2024; India market entry was invite-only in late 2024. |

| Market Share Disparity | Lagging behind established competitors in overall market penetration. | Limits global reach and competitive positioning against larger rivals. | Stripe holds 17% of the global payment acceptance technology market (late 2024), compared to PayPal's 45%. |

Same Document Delivered

Stripe SWOT Analysis

This is the actual Stripe SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full Stripe SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of Stripe's market position and strategic outlook.

You’re viewing a live preview of the actual Stripe SWOT analysis file. The complete version becomes available after checkout, providing actionable insights for your business strategy.

Opportunities

Stripe has a substantial opportunity to grow by entering markets that are currently underserved by robust digital payment infrastructure. The Asia-Pacific region, for instance, is a prime target, with e-commerce expected to reach $250 billion by 2025, presenting a massive potential customer base.

By tailoring its services to include popular local payment methods in key countries, such as Indonesia, Stripe can significantly boost its adoption rates and capture a larger share of these burgeoning markets.

The embedded finance sector is poised for remarkable expansion, with projections indicating it will reach $384.8 billion by 2029. This trend offers a significant avenue for growth as more businesses seek to integrate financial services directly into their customer experiences.

Stripe's Banking-as-a-Service (BaaS) offerings are perfectly positioned to capitalize on this trend. By enabling non-fintech applications to seamlessly offer financial services, Stripe can embed its infrastructure into a vast array of platforms, thereby broadening its ecosystem and customer reach.

Stripe's ongoing commitment to artificial intelligence, including its own AI research and development, is a significant opportunity. For instance, Stripe's AI-powered fraud detection tools have been shown to reduce false positives by up to 40%, a crucial benefit for merchants.

The company's strategic focus on stablecoins, particularly through its partnerships and infrastructure development, presents another avenue for growth. The global stablecoin market is projected to reach trillions of dollars in transaction volume by 2025, offering Stripe a chance to facilitate more efficient and cost-effective cross-border payments.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions are crucial for Stripe to expand its service portfolio and penetrate new geographical markets. The company's proactive stance in acquiring complementary businesses, like Orum in early 2024 for its real-time payment and bank account verification technology, highlights its commitment to strengthening its financial infrastructure and service breadth.

These moves allow Stripe to integrate advanced functionalities directly, thereby offering a more comprehensive suite of tools to its existing and potential clients. This strategy is vital for staying competitive in the rapidly evolving fintech landscape.

- Orum Acquisition: Strengthened real-time payment and bank verification capabilities.

- Market Expansion: Partnerships and acquisitions are key to reaching new customer segments and geographies.

- Service Enhancement: Integrating new technologies broadens Stripe's financial infrastructure offerings.

Diversification Beyond Core Payment Processing

Stripe's core strength lies in payment processing, but significant opportunities exist to expand into adjacent financial services. The company's Revenue and Finance Automation suite, which includes Stripe Billing, is a prime example, already generating close to a $500 million annual run rate as of early 2024. This strategic move beyond simple transactions allows Stripe to capture more of its clients' financial operations.

By offering solutions that manage recurring billing, subscriptions, and even treasury functions, Stripe can deepen its integration with businesses. This broader suite of tools not only diversifies revenue but also increases customer stickiness, making it harder for clients to switch to competitors who offer a more siloed approach to financial management.

This diversification strategy taps into a growing market for integrated financial technology, enabling Stripe to address more complex business needs and solidify its position as a comprehensive financial infrastructure provider.

- Revenue and Finance Automation Suite: Expanding beyond core payments to offer integrated financial tools.

- Stripe Billing's Growth: Approaching a $500 million annual run rate (early 2024), demonstrating market traction.

- Increased Customer Lock-in: Deeper integration into financial operations enhances client retention.

- Addressing Complex Business Needs: Moving from transaction processing to holistic financial management.

Stripe is well-positioned to capitalize on the expanding embedded finance market, projected to reach $384.8 billion by 2029. Its Banking-as-a-Service offerings allow businesses to integrate financial services directly into their platforms, broadening Stripe's ecosystem. The company's investment in AI, particularly in fraud detection, offers a competitive edge, reducing false positives by up to 40%.

Stripe's expansion into new markets, especially the Asia-Pacific region where e-commerce is expected to hit $250 billion by 2025, presents a significant growth opportunity. By integrating local payment methods, Stripe can enhance adoption and market share. Furthermore, strategic acquisitions, like Orum in early 2024, bolster its real-time payment and verification capabilities, strengthening its financial infrastructure.

The company's Revenue and Finance Automation suite, with Stripe Billing nearing a $500 million annual run rate as of early 2024, demonstrates a successful move beyond basic payment processing. This diversification into recurring billing and subscription management deepens client relationships and increases revenue streams.

| Opportunity Area | Projected Market Size/Growth | Stripe's Advantage/Action |

|---|---|---|

| Embedded Finance | $384.8 billion by 2029 | BaaS offerings for seamless integration |

| Asia-Pacific E-commerce | $250 billion by 2025 | Tailored local payment solutions |

| AI in Fraud Detection | Reduced false positives by up to 40% | Enhanced security and merchant trust |

| Revenue & Finance Automation | ~$500 million annual run rate (early 2024) for Stripe Billing | Diversified revenue and increased customer stickiness |

Threats

Stripe operates within a fiercely competitive fintech sector, contending with established players such as PayPal and Square, alongside newer entrants like Adyen and a multitude of agile startups. This crowded market environment puts pressure on pricing, demanding constant technological advancement and potentially impacting Stripe's market share. For instance, in early 2024, the global fintech market was valued at over $11 trillion, highlighting the sheer scale and intensity of the competition.

As a leading payment processor, Stripe faces significant cybersecurity risks and fraud attempts. The global cost of cybercrime is projected to hit $10.5 trillion annually by 2025, a stark reminder of the constant threat landscape.

Stripe must continually invest in sophisticated security measures and fraud detection technologies to safeguard its platform and user data. A major security breach could irreparably harm its reputation and erode the trust of its vast customer base.

Economic downturns pose a significant threat to Stripe. Rising inflation and the potential for recessions in major markets, like the US and Europe, could lead to reduced consumer spending and business investment. This directly impacts transaction volumes, which are the lifeblood of Stripe's revenue. For instance, if a recession hits and businesses see a sharp decline in sales, Stripe's processing fees will naturally decrease.

Market volatility, characterized by unpredictable swings in asset values and investor sentiment, can also dampen investment in technology companies, including payment processors. This could affect Stripe's ability to raise capital for expansion or new product development. With global economic uncertainty persisting into 2024 and projections for 2025 indicating continued headwinds, Stripe's growth trajectory could be significantly challenged by these macroeconomic factors.

Evolving Regulatory Landscape and Compliance Burden

The financial technology sector is subject to a dynamic global regulatory environment, which escalates compliance expenses and operational intricacy for companies like Stripe. Navigating these varied requirements, as exemplified by past challenges in markets like India, presents a persistent hurdle that can impede growth or necessitate significant alterations to existing business models.

Stripe's operations are impacted by differing financial regulations across jurisdictions, demanding continuous adaptation and investment in compliance infrastructure. For instance, in 2024, the European Union's continued implementation of PSD3 and the Digital Operational Resilience Act (DORA) impose new data handling and security protocols. Similarly, evolving data privacy laws in various regions require constant vigilance and system updates, adding to the operational burden.

- Increased Compliance Costs: Adhering to diverse and changing financial regulations globally, including data protection and anti-money laundering (AML) rules, leads to higher operational expenses for Stripe.

- Market Access Restrictions: Non-compliance or the inability to adapt to specific national regulations can limit Stripe's ability to enter or operate in key international markets, hindering expansion efforts.

- Operational Complexity: Managing a patchwork of regulatory requirements across different countries adds significant complexity to Stripe's technology stack and operational processes, requiring substantial resources for oversight and adaptation.

Dependency on Third-Party Infrastructures

Stripe's reliance on third-party infrastructures, such as global banking networks and cloud service providers like AWS, presents a significant threat. Disruptions to these essential services, whether due to technical failures, cyberattacks, or policy changes from partners, could directly impede Stripe's ability to process transactions and maintain service uptime for its millions of merchants.

For instance, a widespread outage in a major payment network or a critical cloud provider could halt transaction processing for businesses globally, impacting Stripe's revenue and reputation. The company's operational continuity is therefore intrinsically linked to the stability and security of these external systems, a dependency that cannot be entirely eliminated.

Key dependencies include:

- Banking and Financial Networks: Stripe must interface with traditional financial institutions for fund settlement, which can be subject to their operational issues or regulatory changes.

- Cloud Infrastructure Providers: Major cloud services are vital for hosting Stripe's platform; any downtime or security breach at these providers directly affects Stripe's availability.

- Internet Service Providers and Network Operators: The seamless flow of data relies on the robust performance of global internet infrastructure.

Stripe faces intense competition from established players and emerging fintechs, pressuring its pricing and market share. The global fintech market, valued at over $11 trillion in early 2024, illustrates this fierce landscape. Cybersecurity threats are also a major concern, with global cybercrime costs projected to reach $10.5 trillion annually by 2025, necessitating continuous investment in security measures to protect user data and maintain trust.

Macroeconomic instability, including inflation and potential recessions in key markets, directly impacts Stripe's revenue by reducing consumer spending and business investment, thereby lowering transaction volumes. Market volatility can also hinder capital raising for expansion. Furthermore, the dynamic and complex global regulatory environment, exemplified by evolving data privacy laws and new protocols like the EU's DORA in 2024, increases compliance costs and operational complexity, potentially restricting market access.

Stripe's reliance on third-party infrastructures, such as banking networks and cloud providers like AWS, presents a significant risk. Disruptions to these essential services, whether from technical failures or cyberattacks, could halt transaction processing, impacting revenue and reputation. The company's operational continuity is therefore closely tied to the stability of these external systems.

| Threat Category | Specific Threat | Impact on Stripe | Example/Data Point |

|---|---|---|---|

| Competition | Intense competition from PayPal, Square, Adyen, and startups | Pricing pressure, potential market share erosion | Global fintech market valued over $11 trillion (early 2024) |

| Cybersecurity | Cyberattacks and fraud attempts | Reputational damage, loss of customer trust, financial losses | Global cybercrime costs projected to reach $10.5 trillion annually by 2025 |

| Economic Factors | Economic downturns, inflation, recessions | Reduced transaction volumes, lower revenue | Impact on consumer spending and business investment |

| Regulatory Landscape | Evolving global financial regulations, data privacy laws | Increased compliance costs, operational complexity, market access restrictions | EU's DORA implementation (2024) |

| Third-Party Dependencies | Disruptions to banking networks, cloud providers (e.g., AWS) | Service outages, inability to process transactions, reputational damage | Reliance on critical external infrastructure for operations |

SWOT Analysis Data Sources

This Stripe SWOT analysis is built upon a foundation of robust data, drawing from Stripe's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded perspective.