Stripe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stripe Bundle

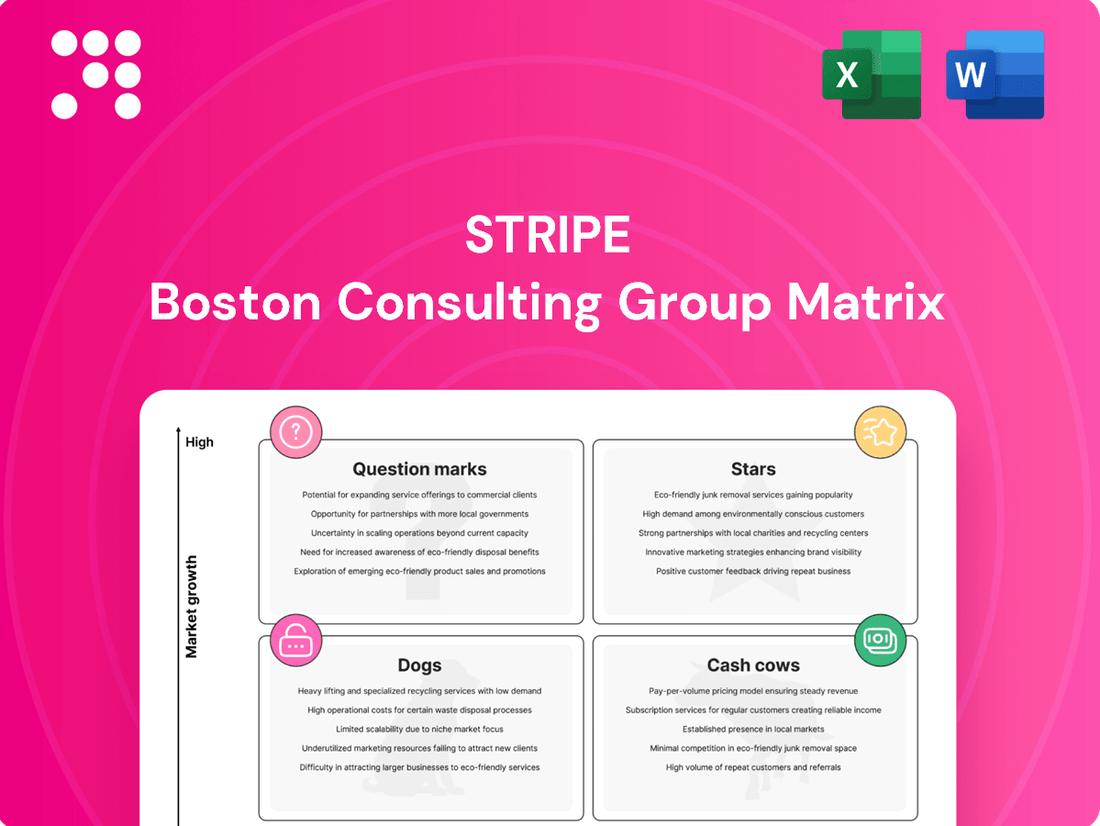

Curious about Stripe's strategic product positioning? Our BCG Matrix analysis offers a glimpse into where their offerings might fit as Stars, Cash Cows, Dogs, or Question Marks. Understand the core dynamics driving their portfolio.

Ready to move beyond speculation? Purchase the full BCG Matrix report for a comprehensive breakdown of Stripe's products, complete with data-backed insights and actionable strategies to optimize your own business approach.

Stars

Stripe's core payment processing services, handling both online and in-person transactions, firmly place it in the Star category of the BCG Matrix. In 2024, the company achieved a remarkable $1.4 trillion in total payment volume, marking a substantial 38% surge from the previous year. This volume represents roughly 1.3% of the global GDP, underscoring its dominant position and continued growth in the dynamic digital payments sector.

Stripe's substantial investments in AI and machine learning are a cornerstone of its strategy, focusing on optimizing payment flows and bolstering fraud prevention through tools like Stripe Radar. These advanced AI models have demonstrably boosted user revenue and performance. For instance, in 2024, Stripe helped businesses recover an impressive $6 billion that would have otherwise been lost to false declines.

The rapid uptake of Stripe by over 700 AI agent startups building on its platform highlights the company's strong growth trajectory and leadership in this burgeoning, innovative sector. This widespread adoption by AI-focused businesses validates Stripe's position as a critical infrastructure provider for the future of digital commerce and intelligent automation.

Stripe Connect is a shining Star in the BCG matrix for marketplaces. Its impressive adoption by a significant majority of top global marketplaces, reportedly 75%, highlights its dominant market share. This widespread use is driving substantial revenue growth for Stripe by enabling efficient onboarding of service providers and seamless payment management within these platforms.

The continued expansion of the platform and marketplace sector fuels Stripe Connect's high growth potential. As more businesses leverage online marketplaces to connect buyers and sellers, Stripe Connect is strategically positioned to capture a larger portion of this expanding market, solidifying its Star status.

Stripe Issuing

Stripe Issuing, the company's corporate card product, is a prime example of a Star within the Stripe BCG Matrix. Its performance in 2025 underscores this classification, demonstrating robust expansion and significant market penetration. The product is capitalizing on the burgeoning embedded finance sector.

In 2025, Stripe Issuing experienced an impressive growth rate of 58%. This strong upward trend is further evidenced by the substantial volume of transactions it facilitated, exceeding $13.4 billion for both virtual and physical card issuances. This financial data highlights its market leadership and rapid adoption.

- High Growth: Achieved 58% growth in 2025.

- High Market Share: Processed over $13.4 billion in transactions in 2025.

- Market Opportunity: Operates within the expanding embedded finance and corporate spending solutions market.

- Competitive Position: Stripe is rapidly increasing its traction in this dynamic sector.

Optimized Checkout Suite

The Optimized Checkout Suite is a prime example of a Star within Stripe's BCG Matrix. Its primary function is to boost conversion rates for businesses, which directly translates to increased revenue for both Stripe and its clients. This focus on revenue growth and attracting new users solidifies its Star status.

Data from 2025 shows businesses adopting the Optimized Checkout Suite experienced an average of a 14% uplift in their checkout conversion rates. This significant improvement highlights the suite's effectiveness and strong market demand in the competitive digital payments landscape.

- High Market Share: The suite is integral to Stripe's strategy for capturing and expanding market share in the fundamental area of payment processing.

- Strong Growth Potential: Its ability to directly impact client revenue ensures continued adoption and growth.

- Competitive Advantage: By improving conversion, it offers a tangible benefit that differentiates Stripe from competitors.

- Revenue Driver: Directly contributes to Stripe's top-line growth through increased transaction volumes.

Stripe's core payment processing, alongside its AI-driven fraud prevention tools like Stripe Radar, firmly establishes it as a Star. In 2024, Stripe processed $1.4 trillion in total payment volume, a 38% increase year-over-year, representing 1.3% of global GDP. Furthermore, Stripe Radar helped businesses recover $6 billion in 2024 that would have been lost to false declines, showcasing its significant value and high growth potential.

| Product/Service | BCG Category | Key Metrics (2024/2025) | Market Position |

| Core Payment Processing | Star | $1.4 trillion TPV (2024), 38% YoY growth | Dominant, high growth |

| Stripe Radar (Fraud Prevention) | Star | $6 billion recovered (2024) | High value, strong adoption |

| Stripe Connect (Marketplaces) | Star | 75% adoption by top marketplaces | Market leader, expanding |

| Stripe Issuing (Corporate Cards) | Star | 58% growth (2025), $13.4 billion transaction volume (2025) | Rapidly growing, embedded finance |

| Optimized Checkout Suite | Star | 14% average conversion uplift (2025) | High impact, competitive advantage |

What is included in the product

Strategic insights for Stripe's products, identifying Stars, Cash Cows, Question Marks, and Dogs.

Highlights which Stripe products to invest in, hold, or divest based on market share and growth.

Visualize your business units' positions on the Stripe BCG Matrix, instantly clarifying strategic priorities and resource allocation.

Cash Cows

Stripe's established standard payment processing is a clear Cash Cow within its BCG Matrix. This core service caters to a massive base of businesses, especially those with high and consistent transaction volumes, generating reliable revenue streams with minimal need for further investment. In 2024, Stripe continues to solidify its position as a dominant player in this segment, processing billions of dollars in transactions for businesses worldwide.

Stripe Billing, a cornerstone of its Revenue and Finance Automation Suite, is a clear Cash Cow. It has achieved a remarkable revenue run rate exceeding $500 million and currently oversees close to 200 million active subscriptions for more than 300,000 businesses.

This product commands a substantial market share within the recurring revenue management sector. Its established infrastructure allows for the generation of consistent and predictable cash flow, requiring minimal additional investment for continued growth.

Stripe Radar, the company's core fraud prevention system, functions as a Cash Cow within Stripe's business portfolio. Its automated detection of suspicious transactions significantly reduces losses for businesses, making it a high-value, essential service.

This robust offering underpins transaction trust and efficiency, generating consistent revenue through its integrated fee structure. Radar requires less aggressive investment for growth compared to emerging products, solidifying its position as a reliable income generator for Stripe.

Global Payment Infrastructure and Uptime

Stripe's robust global payment infrastructure, boasting an impressive 99.999% uptime in 2025, serves as a critical Cash Cow. This reliability underpins its ability to process a massive volume of transactions seamlessly.

The platform's extensive reach, supporting over 135 currencies and 100 payment methods across 46 countries, solidifies its position as a dependable, high-revenue generator for businesses worldwide. This core functionality requires continuous investment in maintenance and upgrades rather than aggressive expansion.

- Foundation of Trust: Consistent high uptime ensures businesses can rely on Stripe for uninterrupted payment processing, a non-negotiable for their operations.

- Global Reach: Support for 135+ currencies and 100+ payment methods across 46 countries makes it a versatile and indispensable tool for international commerce.

- Revenue Stability: This core service generates predictable, high-volume revenue, requiring operational excellence over aggressive market penetration efforts.

Large Enterprise Client Base

Stripe's extensive network of large enterprise clients, which includes a significant portion of major corporations, positions this segment as a clear Cash Cow within the BCG matrix. Half of the Fortune 100 companies and a remarkable 80% of the Forbes Cloud 100 rely on Stripe's services. This deep integration translates into massive, consistent payment volumes and predictable revenue streams.

These established relationships are characterized by substantial recurring revenue, underscoring their Cash Cow status. While growth in this segment might not be explosive, the sheer scale and unwavering dependence of these large businesses on Stripe's robust financial infrastructure ensure a stable and significant inflow of cash. This reliability is a hallmark of a mature, high-performing business unit.

The value derived from these enterprise clients is multifaceted:

- High Recurring Revenue: Large enterprises generate substantial and predictable payment processing volumes, creating a consistent revenue base for Stripe.

- Deep Integration: These clients often have complex, deeply embedded payment needs that Stripe's comprehensive suite of financial tools addresses, fostering long-term loyalty.

- Stability and Predictability: The sheer size and operational scale of Fortune 100 and Forbes Cloud 100 companies offer a high degree of stability and predictability in cash flow generation.

- Brand Validation: Partnerships with leading enterprises serve as powerful endorsements, enhancing Stripe's reputation and attracting further business.

Stripe's established standard payment processing is a clear Cash Cow within its BCG Matrix. This core service caters to a massive base of businesses, especially those with high and consistent transaction volumes, generating reliable revenue streams with minimal need for further investment. In 2024, Stripe continues to solidify its position as a dominant player in this segment, processing billions of dollars in transactions for businesses worldwide.

Stripe Billing, a cornerstone of its Revenue and Finance Automation Suite, is a clear Cash Cow. It has achieved a remarkable revenue run rate exceeding $500 million and currently oversees close to 200 million active subscriptions for more than 300,000 businesses.

Stripe Radar, the company's core fraud prevention system, functions as a Cash Cow within Stripe's business portfolio. Its automated detection of suspicious transactions significantly reduces losses for businesses, making it a high-value, essential service.

Stripe's extensive network of large enterprise clients, which includes a significant portion of major corporations, positions this segment as a clear Cash Cow within the BCG matrix. Half of the Fortune 100 companies and a remarkable 80% of the Forbes Cloud 100 rely on Stripe's services, translating into massive, consistent payment volumes and predictable revenue streams.

| Product/Service | BCG Category | Key Metrics (2024/2025) | Revenue Contribution | Investment Needs |

| Standard Payment Processing | Cash Cow | Billions in transactions processed; 99.999% uptime (2025) | High, stable | Maintenance & upgrades |

| Stripe Billing | Cash Cow | >$500M revenue run rate; ~200M active subscriptions | High, stable | Low |

| Stripe Radar | Cash Cow | Integral to transaction trust and efficiency | Consistent revenue | Low |

| Enterprise Client Segment | Cash Cow | 50% Fortune 100, 80% Forbes Cloud 100 reliance | Massive, consistent volumes | Low |

Delivered as Shown

Stripe BCG Matrix

The Stripe BCG Matrix preview you're examining is the identical, fully completed document you will receive immediately after your purchase. This means no hidden watermarks, no placeholder text, and no unfinished sections—just a professionally formatted, analysis-ready report designed to provide actionable strategic insights into Stripe's product portfolio.

Dogs

Undifferentiated, basic website plugins targeting very small businesses in commoditized e-commerce sectors are likely Dogs in the Stripe BCG Matrix. These plugins face fierce competition from a multitude of free or low-cost alternatives, limiting Stripe's market share and growth prospects in this saturated niche. While they might break even, their strategic contribution to overall growth is minimal.

Older, less strategic third-party integrations that don't align with Stripe's current focus areas like AI, stablecoins, or embedded finance could be categorized here. These might be integrations with low user adoption or those that demand ongoing maintenance without offering substantial growth potential or a competitive edge. For instance, a legacy integration with a niche e-commerce platform that Stripe has since deprioritized might fall into this category.

Niche regional payment methods with declining use, often found in mature markets, represent a segment of Stripe's portfolio that is experiencing a slowdown. These methods, while once important, are being overshadowed by more modern, streamlined digital payment solutions that cater to evolving consumer preferences.

For example, certain legacy bank transfer systems or specific country-specific card schemes with limited adoption beyond their initial region could be categorized here. While Stripe aims for comprehensive coverage, these payment methods might exhibit low transaction volumes and minimal growth prospects, indicating a low market share and limited future potential within Stripe’s overall payment processing ecosystem.

Low-Value, High-Maintenance Customer Segments

Customer segments that consistently generate very low transaction volumes but require disproportionately high customer support or specialized attention could represent a Dog in the Stripe BCG Matrix. These segments can become cash traps, consuming valuable resources without delivering significant returns or future growth potential.

For instance, a small business with infrequent, low-value transactions that requires constant technical assistance or personalized onboarding would fit this description. Stripe’s focus on scalable and efficient payment processing means such segments are often re-evaluated.

- Low Transaction Volume: These customers contribute minimally to overall revenue.

- High Support Costs: They consume a disproportionate amount of customer service resources.

- Resource Drain: They tie up operational capacity that could be used for more profitable segments.

- Strategic Review: Stripe would likely seek to minimize or divest such segments unless they offer a unique strategic advantage.

Services with Commoditized API Access

Services where the core API functionality has become a standard offering, with little differentiation from competitors, could be classified as Dogs within the Stripe BCG Matrix. If basic API access points are easily replicated and available at lower price points by numerous other payment processors, Stripe's position in these specific, undifferentiated segments might experience sluggish growth and a declining market share.

For instance, consider simple payment processing APIs that handle standard transactions. While Stripe's overall platform is robust, if these fundamental API features are widely available and indistinguishable from competitors, they represent a potential Dog. In 2024, the payment processing market continued to see intense competition, with many providers offering competitive rates for basic API integrations.

- Commoditized API Functions: Basic API endpoints for standard payment processing, such as authorization and capture, where competitive offerings are abundant and undifferentiated.

- Low Market Share/Growth: Segments where Stripe's market share is declining or stagnant due to intense price competition and lack of unique features in these specific API layers.

- Competitor Landscape: Numerous payment gateways and processors offer similar, low-cost API access, making it difficult for Stripe to command premium pricing or significant growth in these areas.

- Strategic Consideration: Stripe might need to focus on its value-added services and advanced features to offset the commoditization of its basic API offerings.

Dogs in the Stripe BCG Matrix represent offerings with low market share and low growth potential. These are typically older services or niche products that are no longer strategically aligned or face intense competition. For example, certain legacy payment integrations or features that have been superseded by more advanced solutions would fall into this category. In 2024, the continued evolution of digital payments meant that older, less adaptable payment methods or integrations often saw declining relevance and user adoption.

These segments can drain resources without contributing significantly to Stripe's overall growth or market leadership. Identifying and managing these "Dogs" is crucial for optimizing resource allocation and focusing on high-potential areas of the business.

Stripe's strategy often involves either divesting or minimizing support for these Dog products, freeing up capital and talent for more promising ventures.

| Product/Service Category | Market Share | Growth Rate | Strategic Fit | BCG Classification |

|---|---|---|---|---|

| Undifferentiated Website Plugins | Low | Low | Poor | Dog |

| Legacy Third-Party Integrations | Low | Low | Poor | Dog |

| Niche Regional Payment Methods (Declining) | Low | Low | Poor | Dog |

| Low-Volume, High-Support Customer Segments | Low | Low | Poor | Dog |

| Commoditized Basic API Functions | Low | Low | Poor | Dog |

Question Marks

Stripe's expansion into stablecoins and cryptocurrencies, notably through its acquisition of Bridge and support for USDC, places these services firmly in the Question Mark category of the BCG Matrix. The cryptocurrency market is experiencing rapid expansion; for instance, stablecoin transaction volumes saw a substantial increase, effectively doubling between the fourth quarter of 2023 and the fourth quarter of 2024.

While the market's growth trajectory is promising, Stripe is still in the process of establishing a significant market share and fully realizing the potential of its crypto offerings. These ventures require ongoing investment, consuming cash in the present but holding considerable promise for future returns, characteristic of a Question Mark.

Stripe Capital, as Stripe's business financing arm, fits the Question Mark quadrant of the BCG Matrix. It operates within the rapidly expanding fintech lending sector, a high-growth area. Early observations indicate that businesses utilizing Stripe Capital have seen notably accelerated revenue growth.

While Stripe Capital shows considerable promise in a dynamic market, it's a relatively new service compared to Stripe's established payment processing core. Its market share is still solidifying, and it requires ongoing investment to reach its full scaling potential.

Stripe's introduction of 'Pay by Bank' in markets like France and Germany by July 2025 represents a strategic move into burgeoning digital payment landscapes. These expansions are classic examples of potential Stars within the BCG matrix, characterized by high growth potential in these new geographic territories.

However, these initiatives necessitate considerable investment to capture market share against entrenched local payment providers. While the growth trajectory is promising, Stripe's current market share in these specific 'Pay by Bank' offerings is relatively low, reflecting their nascent stage.

Embedded Finance Solutions

Stripe's expansion into embedded finance, encompassing services like banking-as-a-service and corporate cards, positions these ventures as potential Stars in the BCG matrix. This strategic move diversifies Stripe's revenue streams beyond its core payment processing. The embedded finance market is experiencing robust growth, with projections indicating a substantial increase in value over the coming years, driven by the increasing demand for integrated financial solutions within non-financial platforms.

While Stripe is still in the early phases of fully integrating and scaling these complex embedded finance offerings, the market's trajectory is promising. These initiatives require significant investment, akin to the capital expenditure needed for developing new technologies or expanding into new geographic markets. However, successful scaling could transform these ventures into significant revenue drivers for Stripe in the future.

- Embedded Finance Market Growth: The global embedded finance market is expected to reach $7.2 trillion by 2030, growing at a CAGR of 28.3% from 2023 to 2030.

- Stripe's Diversification: Stripe's foray into banking-as-a-service and corporate cards aims to capture a larger share of the financial value chain.

- Investment and Scaling: These new offerings demand substantial upfront investment but offer high growth potential, characteristic of Stars.

AI-Driven Commerce for AI Agents

Stripe's strategic positioning for AI-driven commerce and its support for AI agent startups falls into the Question Mark category of the BCG Matrix. This is because while the broader AI market shows significant growth potential, the specific niche of AI agents actively participating in commerce is nascent and its future trajectory remains uncertain.

Stripe's substantial investments in developer tools for AI are a clear indicator of their ambition to lead in this emerging space. However, the actual market share and profitability Stripe will achieve from AI agents conducting transactions are yet to be definitively established. For instance, by early 2024, the global AI market was projected to reach hundreds of billions of dollars, yet the specific segment of AI agent-driven commerce was still in its infancy, making its long-term viability a key question.

- Emerging Market: The concept of AI agents autonomously executing commercial transactions is a new frontier, making its market size and growth rate difficult to predict accurately in 2024.

- High Investment, Uncertain Returns: Stripe is dedicating significant resources to facilitate AI commerce, but the ultimate return on this investment is still speculative.

- Platform Optimization: Stripe's focus is on building the infrastructure that enables these AI agents, aiming to become the foundational payment layer for this future commerce model.

- Competitive Landscape: While Stripe is investing, other payment processors and tech giants are also exploring opportunities in AI-powered commerce, creating a competitive environment where dominance is not guaranteed.

Stripe's ventures into stablecoins and AI agents represent significant Question Marks in their BCG Matrix. These areas are characterized by high growth potential but also considerable uncertainty regarding market share and profitability. For example, while the global AI market was projected to reach hundreds of billions of dollars by early 2024, the specific segment of AI agent-driven commerce was still nascent, making its long-term viability a key question.

Stripe Capital also fits the Question Mark quadrant. It operates in the rapidly expanding fintech lending sector, with early indications of accelerated revenue growth for businesses using the service. However, as a relatively new offering compared to Stripe's core payment processing, its market share is still solidifying and requires ongoing investment to reach its full scaling potential.

| Stripe Initiative | BCG Category | Rationale | Key Data Point (as of early 2024/projections) |

| Stablecoins & Crypto | Question Mark | High market growth, but Stripe's market share and profitability are still developing. | Stablecoin transaction volumes doubled between Q4 2023 and Q4 2024. |

| Stripe Capital | Question Mark | Operating in a high-growth fintech lending sector with unproven long-term market dominance. | Businesses using Stripe Capital show accelerated revenue growth. |

| AI-Driven Commerce & AI Agents | Question Mark | Nascent market with uncertain future trajectory and requires substantial investment. | Global AI market projected in hundreds of billions, but AI agent commerce segment is infancy. |

BCG Matrix Data Sources

Our Stripe BCG Matrix leverages a robust combination of internal financial data, extensive market research, and competitive intelligence to provide an accurate and actionable strategic overview.