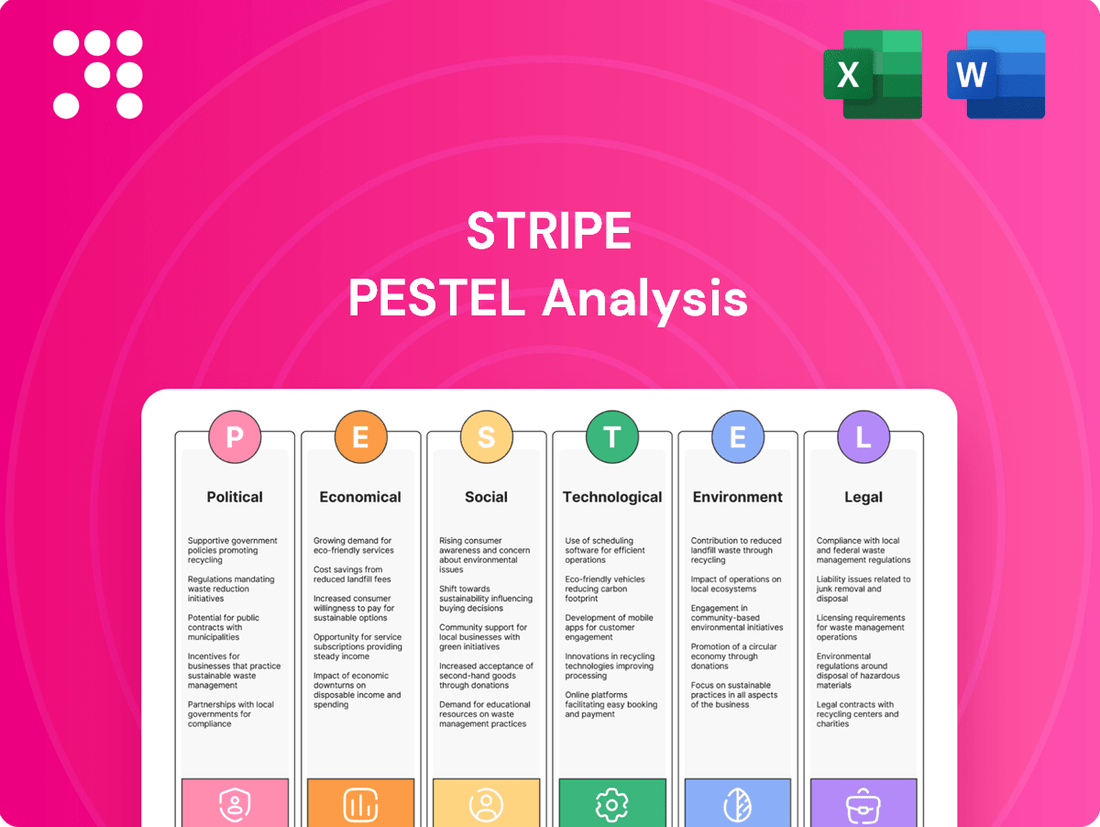

Stripe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stripe Bundle

Stripe operates in a dynamic global market, where political stability, economic fluctuations, and evolving social attitudes significantly shape its trajectory. Understanding these external forces is crucial for anticipating challenges and capitalizing on opportunities. Our comprehensive PESTEL analysis delves deep into these factors, offering actionable intelligence for strategic decision-making.

Gain a competitive edge by leveraging our expertly crafted PESTEL analysis for Stripe. This detailed report illuminates the political, economic, social, technological, legal, and environmental landscapes impacting the company. Equip yourself with the insights needed to navigate market complexities and drive informed business strategies. Download the full version now for immediate access to critical market intelligence.

Political factors

Governments globally are intensifying their focus on the fintech industry, and payment processors like Stripe are at the forefront of this scrutiny. This regulatory push centers on safeguarding consumers, preventing illicit financial activities through robust anti-money laundering (AML) protocols, and ensuring thorough customer identification via know-your-customer (KYC) mandates.

Stripe's operational footprint in over 50 countries necessitates a deep understanding and adherence to a patchwork of distinct legal frameworks. Navigating these varied regulatory environments is critical for maintaining compliance and sidestepping potential legal repercussions and financial penalties.

The political landscape directly shapes cross-border payment policies, impacting areas like capital flow restrictions and mandates for storing data within national borders. For a global player like Stripe, navigating these diverse regulations is crucial for facilitating smooth international transactions and supporting emerging payment methods such as stablecoins.

In 2024, the G20 continued its focus on improving cross-border payments, aiming to reduce costs and increase speed, a key area where Stripe's infrastructure plays a vital role. However, differing national approaches to data privacy and security, exemplified by regulations like the EU's GDPR, necessitate continuous adaptation by Stripe to maintain compliance across its global operations.

Stripe's operations are significantly shaped by data privacy and sovereignty laws. Regulations like the EU's General Data Protection Regulation (GDPR) mandate strict protocols for how Stripe handles customer information, impacting everything from data collection to storage and consent management. For instance, GDPR fines can reach up to €20 million or 4% of global annual turnover, a substantial risk for a company like Stripe processing vast amounts of financial data.

Political stances on data sovereignty, dictating where data must physically reside, also present challenges. These laws require Stripe to invest in localized data infrastructure and ensure compliance with varying international regulations regarding cross-border data transfers. Failure to comply can lead to significant operational disruptions and reputational damage.

Geopolitical Stability and Trade Relations

Geopolitical tensions, such as ongoing conflicts and trade disputes, can significantly impact Stripe's international operations and payment processing. For instance, the global supply chain disruptions witnessed in 2023, partly fueled by geopolitical instability, directly affected businesses relying on cross-border e-commerce, a core user base for Stripe. Stripe's expansion strategy, aiming for broader market penetration, is inherently tied to the stability of political landscapes and the existence of trade agreements that simplify international digital commerce. The World Bank's Ease of Doing Business report, while discontinued in its previous format, historically highlighted how regulatory environments and trade facilitation measures influence digital payment providers.

Shifting trade relations, including the rise of protectionist policies or new trade blocs, can create both challenges and opportunities for Stripe. For example, the European Union's continued efforts to harmonize digital markets and payment regulations, such as PSD2, create a more predictable environment for Stripe's services within the bloc. Conversely, sudden imposition of tariffs or sanctions can complicate cross-border transactions and increase operational costs for businesses using Stripe. In 2024, many governments are re-evaluating their trade partnerships, which could lead to altered market access for digital payment platforms.

Stripe's reliance on a global network of financial institutions and its role in facilitating international payments mean that geopolitical stability is paramount. Instability can lead to increased transaction costs, delays, and even the suspension of services in affected regions. As of early 2025, the ongoing geopolitical realignments continue to shape global trade flows, underscoring the need for Stripe to maintain robust risk management strategies and adaptable operational frameworks to navigate these complexities.

- Geopolitical Risk Impact: Disruptions from conflicts or sanctions can affect Stripe’s ability to process cross-border payments, impacting its revenue streams.

- Trade Agreement Importance: Favorable trade agreements reduce friction for international e-commerce, directly benefiting Stripe’s merchant clients and its own growth.

- Regulatory Harmonization: Efforts like the EU's digital market initiatives can streamline operations for Stripe, but geopolitical shifts can also lead to regulatory fragmentation.

Government Support for Digital Economies

Governments worldwide are actively fostering digital economies, which directly bolsters Stripe's growth. Initiatives aimed at digital transformation and e-commerce expansion, such as grants and tax breaks for businesses embracing online operations, create a more fertile ground for payment processors. For instance, many nations are prioritizing digital infrastructure development and offering incentives for SMBs to adopt modern payment solutions, thereby increasing the pool of potential Stripe users.

These policies translate into a larger addressable market for Stripe. As more businesses move online and adopt digital payment methods, the demand for robust and user-friendly payment infrastructure, like that provided by Stripe, naturally increases. This trend is particularly strong in emerging markets where governments are keen to leapfrog traditional financial systems and build digital-first economies.

- Government investment in digital infrastructure: Many countries are allocating significant funds to broadband expansion and cybersecurity, essential for digital commerce. For example, the US Bipartisan Infrastructure Law includes provisions for expanding broadband access, benefiting online businesses.

- Incentives for SMB digital adoption: Programs offering subsidies or tax credits for small businesses to implement e-commerce platforms and online payment gateways directly boost Stripe's customer acquisition.

- Regulatory support for fintech innovation: Favorable regulatory environments, including sandboxes for testing new financial technologies, encourage companies like Stripe to innovate and expand their service offerings.

Political factors significantly influence Stripe's operational landscape, particularly concerning global regulatory frameworks and government initiatives supporting digital economies. Stripe must navigate a complex web of international laws, including those related to anti-money laundering (AML) and know-your-customer (KYC) protocols, which are being strengthened globally to protect consumers and combat illicit finance.

Data privacy and sovereignty laws, such as the EU's GDPR, impose strict requirements on how Stripe handles customer data, with potential fines reaching up to 4% of global annual turnover. Geopolitical tensions and shifting trade relations also impact cross-border transactions, affecting Stripe's ability to facilitate international e-commerce. For instance, the G20's continued focus on improving cross-border payments in 2024 highlights a key area where Stripe's infrastructure is vital, but differing national data privacy approaches, like GDPR, demand constant adaptation.

Governments worldwide are actively promoting digital transformation, which directly benefits Stripe by expanding the market for online payments. Initiatives like government investments in digital infrastructure and incentives for small and medium-sized businesses (SMBs) to adopt e-commerce solutions create a more favorable environment for payment processors. As of early 2025, these trends are expected to continue, with many nations prioritizing digital economy growth.

| Factor | Impact on Stripe | Example/Data (2024-2025) |

| Regulatory Scrutiny (AML/KYC) | Increased compliance costs and operational complexity. | Governments globally intensifying focus on fintech; G20 continuing efforts on cross-border payment improvements. |

| Data Privacy Laws (e.g., GDPR) | Significant risk of fines and need for robust data management. | Fines up to €20 million or 4% of global annual turnover for GDPR violations. |

| Geopolitical Stability & Trade Relations | Affects cross-border transaction flow and operational costs. | Ongoing geopolitical realignments shaping global trade flows as of early 2025. |

| Government Support for Digital Economy | Expansion of addressable market and increased demand for payment services. | US Bipartisan Infrastructure Law supporting broadband expansion; incentives for SMB digital adoption. |

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental forces impacting Stripe, covering political, economic, social, technological, environmental, and legal factors. It offers a comprehensive understanding of the landscape to inform strategic decision-making.

A Stripe PESTLE Analysis offers a clear, summarized version of external factors, alleviating the pain of sifting through vast amounts of data for strategic decision-making.

Economic factors

Stripe's performance is intrinsically linked to the global economic climate and the booming e-commerce sector. As businesses increasingly move online, Stripe's payment processing volume directly reflects this trend.

In 2024, Stripe facilitated a staggering $1.4 trillion in payments, a figure that represented roughly 1.3% of the world's Gross Domestic Product. This substantial volume underscores Stripe's critical role in facilitating transactions within the digital marketplace.

Inflationary pressures in 2024 and early 2025 are a significant concern, potentially dampening consumer spending and increasing operational costs for businesses relying on Stripe. For instance, if inflation remains elevated, consumers might reduce discretionary spending, directly impacting the transaction volumes processed by Stripe.

Interest rate fluctuations also play a crucial role. As of mid-2025, central banks globally are navigating a complex interest rate environment. Higher rates can increase the cost of capital for businesses using Stripe's financial products, like corporate cards or business financing, potentially making these services less attractive or impacting repayment capabilities.

Stripe faces intense competition from established players like PayPal, which reported over $1.5 trillion in total payment volume in 2023, and Square (now Block), which processed $200 billion in payment volume in the same year. Newer entrants and specialized providers also contribute to a dynamic and crowded market.

To thrive, Stripe must consistently innovate its product suite, offering advanced features for fraud prevention and global payments, while maintaining competitive transaction fees. The breadth of its services, from payment processing to issuing and banking solutions, is crucial for attracting and retaining a diverse business clientele.

Companies like Adyen, known for its unified commerce platform, and emerging players focusing on specific niches, such as embedded finance or cryptocurrency payments, further intensify the competitive pressure. Stripe's success hinges on its ability to differentiate through superior technology, developer-friendly APIs, and a strong ecosystem of partners.

Currency Volatility and Stablecoin Adoption

Currency volatility significantly impacts businesses involved in international trade, creating uncertainty in revenue and costs. Stripe's move to offer stablecoin-based financial accounts in 101 countries directly addresses this by allowing companies to hold and transact in stablecoins like USDC and USDB. This innovation aims to reduce exposure to foreign exchange fluctuations and streamline cross-border transactions for a global user base.

The adoption of stablecoins by platforms like Stripe reflects a growing trend in digital finance, especially in regions experiencing high inflation or currency instability. For instance, in countries with rapidly devaluing currencies, businesses can use stablecoins to preserve capital and facilitate smoother international commerce. This strategy helps mitigate the financial risks associated with unpredictable exchange rates.

- Stripe's global reach: Offering stablecoin accounts in 101 countries provides a broad solution for international businesses.

- Mitigating FX risk: Stablecoins like USDC and USDB offer a hedge against volatile fiat currencies.

- Facilitating cross-border payments: This feature simplifies and potentially lowers the cost of international transactions.

- Digital asset integration: Stripe's expansion into stablecoins signals a broader embrace of digital assets in financial services.

Access to Capital and Business Financing Needs

The economic climate directly impacts a business's ability to secure funding and its overall need for financial tools. For instance, during periods of economic expansion, businesses are more likely to seek capital for growth, while downturns might increase the demand for working capital solutions. Stripe's expansion into business financing and corporate cards addresses this by offering a more integrated financial infrastructure that supports businesses throughout various economic cycles.

Stripe's financial products are designed to meet these evolving business financing needs. Their offerings go beyond traditional payment processing, providing solutions like Stripe Capital, which has provided over $1 billion in financing to businesses as of early 2024. This demonstrates a direct response to the market's demand for accessible and flexible business financing.

- Capital Availability: Economic conditions dictate the availability and cost of capital for businesses.

- Financing Demand: Growth phases often increase demand for loans and credit lines, while challenging times boost the need for working capital.

- Stripe's Role: Stripe's financial services, including business financing and corporate cards, directly address these fluctuating demands.

- Market Impact: By offering these solutions, Stripe supports business resilience and growth across diverse economic landscapes.

Stripe's significant role in global commerce is evident, processing $1.4 trillion in payments in 2024, representing 1.3% of global GDP. Economic factors like inflation and interest rate shifts directly influence consumer spending and business operational costs, impacting transaction volumes. Currency volatility is also a key concern, which Stripe is addressing through stablecoin financial accounts in 101 countries to mitigate foreign exchange risks.

Preview Before You Purchase

Stripe PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Stripe PESTLE analysis provides a comprehensive overview of the external factors impacting the company's operations and strategic decisions. It covers Political, Economic, Social, Technological, Legal, and Environmental influences, offering valuable insights for market understanding and business planning.

Sociological factors

Societal trust in digital transactions is a cornerstone for payment processors like Stripe. As more people embrace online shopping and mobile transactions, the demand for secure and efficient digital payment infrastructure grows. For instance, in 2024, global e-commerce sales were projected to exceed $6.3 trillion, showcasing a massive reliance on digital payment systems.

The growing preference for convenience fuels the adoption of digital payment methods. Consumers increasingly value quick, contactless, and integrated payment experiences, which directly benefits platforms offering seamless checkout solutions. By 2025, it's estimated that over 80% of global internet users will be making online purchases, highlighting this sociological shift.

The surge in e-commerce, with global online retail sales projected to reach $7.4 trillion by 2025, directly benefits Stripe by increasing transaction volumes. This trend is further amplified by the growing popularity of subscription models, which saw a 40% increase in consumer adoption between 2020 and 2023, creating a consistent revenue stream for businesses using Stripe's recurring payment solutions.

Consumers increasingly value the convenience and personalization offered by online shopping and subscription services. This shift in behavior, driven by ease of access and curated experiences, directly translates to higher demand for robust payment infrastructure like Stripe's, which simplifies the management of recurring transactions and customer accounts.

Consumer trust in the safety of online payments is a huge deal for companies like Stripe. When people feel their financial information is protected, they're much more likely to shop online. This trust is the bedrock of the digital economy.

Stripe actively builds this trust by focusing on strong security measures. They invest heavily in fraud prevention technology and use advanced encryption to keep data safe. Their commitment to PCI DSS compliance also shows they take protecting sensitive cardholder data very seriously, directly addressing public fears about data theft and financial scams.

In 2024, the global e-commerce market is projected to reach over $6.3 trillion, highlighting the massive reliance on secure online transactions. Stripe's ability to maintain high levels of security directly impacts its growth and reputation in this expanding digital marketplace.

Global Internet Penetration and Digital Inclusion

The increasing global internet penetration, projected to reach 75% of the world's population by the end of 2025, significantly expands Stripe's addressable market. This growth is particularly pronounced in emerging economies, where digital inclusion initiatives are actively bringing more individuals and businesses online. This trend directly translates to a larger pool of potential customers for Stripe's payment processing services.

Digital inclusion efforts, such as expanding affordable internet access and promoting digital literacy, are crucial. For instance, by 2024, an estimated 1.2 billion people were still offline, highlighting the ongoing opportunity for growth. As more of these individuals gain access, they become potential users of e-commerce and digital financial services, areas where Stripe excels.

- Growing Online Population: By 2025, over 5.5 billion people are expected to be internet users globally, a substantial increase from previous years.

- Emerging Market Focus: Regions like Southeast Asia and Africa are experiencing rapid internet adoption, presenting significant new markets for digital payment solutions.

- Digital Literacy Impact: Programs aimed at improving digital skills empower more people to engage with online businesses and financial platforms.

Impact of Gig Economy and Freelance Work

The burgeoning gig economy and the surge in freelance professionals directly fuel the demand for streamlined and reliable payment solutions. As more individuals opt for flexible work arrangements, the need for platforms that can efficiently manage diverse payout structures becomes paramount. Stripe's capabilities in facilitating easy and timely payouts are crucial for supporting this expanding segment of the global workforce.

This trend is substantial; by the end of 2024, it's projected that over 35% of the US workforce will participate in some form of gig work. Freelancers often require flexible payment options, including instant payouts and support for multiple currencies, areas where Stripe excels. This growing demographic represents a significant user base for payment processors adept at handling the complexities of independent contractor payments.

- Gig Economy Growth: Projections indicate continued expansion of the gig economy, with a significant portion of the workforce engaging in freelance or contract roles.

- Payout Needs: Freelancers and gig workers require efficient, flexible, and often immediate payout solutions to manage their income effectively.

- Stripe's Role: Stripe's platform is well-positioned to cater to these specific financial needs, offering tools that simplify payment processing for individuals and businesses engaging with freelancers.

Societal trust in digital transactions is paramount for Stripe's success, as consumers increasingly rely on secure online platforms. The projected growth in global e-commerce, reaching an estimated $6.3 trillion in 2024, underscores this dependency. Stripe's commitment to robust security measures, including advanced encryption and PCI DSS compliance, directly addresses consumer concerns about data protection and financial fraud.

The growing preference for convenience in payments significantly boosts demand for services like Stripe's. With over 80% of global internet users expected to make online purchases by 2025, seamless and integrated payment experiences are highly valued. This trend is further supported by the increasing adoption of subscription models, which saw a 40% rise in consumer uptake between 2020 and 2023, creating consistent revenue streams for businesses relying on recurring payment solutions.

The expansion of the gig economy, with over 35% of the US workforce projected to participate in freelance work by the end of 2024, creates a strong need for efficient payment processing. Freelancers require flexible and timely payout solutions, including multi-currency support and instant transfers, which Stripe is well-equipped to provide. This growing segment of independent workers represents a significant opportunity for payment platforms adept at managing complex contractor payments.

Technological factors

Stripe's commitment to technological advancement is evident in its deep integration of artificial intelligence and machine learning. These technologies are pivotal in refining its core offerings, especially in areas like fraud prevention and the efficiency of payment processing.

The company's proprietary AI foundation model, which has been trained on a massive dataset of billions of transactions, has demonstrably boosted its fraud detection capabilities. By analyzing vast amounts of data, Stripe achieved a 64% improvement in fraud detection rates. Furthermore, this sophisticated AI has been instrumental in recovering an impressive $6 billion in revenue that would have been lost due to false declines in 2024 alone.

Stripe's commitment to innovation in payment processing infrastructure is a key technological driver. They consistently enhance their developer-friendly APIs and tools, making it easier for businesses to integrate payment solutions. This focus allows companies to create tailored payment experiences and scale their operations seamlessly.

For instance, in 2024, Stripe continued to roll out advanced features like enhanced fraud detection and new payment methods, directly impacting transaction success rates and customer trust. Their investment in infrastructure directly supports the growing demand for seamless digital transactions, a trend projected to see global digital payment transaction values exceed $16 trillion by 2025.

Stripe is actively embracing blockchain and stablecoin technologies, signaling a significant strategic shift. The company has launched financial accounts powered by stablecoins and is exploring the issuance of corporate cards backed by these digital assets. This proactive integration places Stripe at the cutting edge of digital currency adoption in financial services.

Cloud Computing and Scalability

Stripe's heavy reliance on cloud computing, particularly providers like Amazon Web Services (AWS), is a significant technological factor. This infrastructure enables Stripe to deliver highly scalable and reliable payment processing, crucial for businesses experiencing rapid growth. For instance, AWS reported over $90 billion in annual revenue in 2023, underscoring the robust capabilities available to companies like Stripe.

The inherent scalability of cloud platforms allows Stripe to seamlessly manage fluctuating transaction volumes. This means a small startup can process a few payments today and scale to millions tomorrow without significant infrastructure overhauls, ensuring minimal downtime. This flexibility is a key differentiator in the competitive fintech landscape.

- Scalability: Cloud infrastructure allows Stripe to grow with its clients, handling massive transaction spikes.

- Reliability: Leveraging major cloud providers ensures high uptime and consistent service availability.

- Cost-Efficiency: Pay-as-you-go cloud models help manage operational costs effectively.

- Innovation: Access to advanced cloud services facilitates faster deployment of new features and security updates.

Real-Time Payments and Open Banking Initiatives

The rise of real-time payments and open banking is fundamentally reshaping how businesses and consumers transact. These advancements offer faster settlement times and greater data access, creating new avenues for innovation in financial services. For instance, by 2024, the global real-time payments market was projected to reach $32.5 billion, highlighting its rapid growth and adoption.

Stripe is actively capitalizing on these trends. The company is expanding its 'Pay by Bank' service across Europe, allowing for direct bank account payments. Furthermore, Stripe's acquisition of Orum in late 2023, a company specializing in real-time payment infrastructure, signals a strategic move to enhance its capabilities in this burgeoning sector. These initiatives position Stripe to leverage the increasing demand for instant, seamless payment experiences.

- Real-time Payment Growth: The global real-time payments market is experiencing significant expansion, with projections indicating continued strong growth through 2025.

- Open Banking Impact: Open banking initiatives are fostering greater competition and innovation by enabling third-party providers to access financial data with customer consent.

- Stripe's Strategic Moves: Stripe's investment in its 'Pay by Bank' offering and the acquisition of Orum demonstrate a clear focus on real-time payment infrastructure.

- Customer Preference Shift: Consumers and businesses are increasingly favoring payment methods that offer speed, convenience, and security, aligning with the benefits of real-time and open banking solutions.

Stripe's technological prowess is a cornerstone of its competitive advantage, particularly its deep integration of AI and machine learning. These technologies are crucial for enhancing fraud detection, processing payments efficiently, and improving overall service reliability. The company's proprietary AI model, trained on billions of transactions, achieved a 64% improvement in fraud detection and helped recover $6 billion in revenue from false declines in 2024.

The company's commitment extends to modernizing payment infrastructure through developer-friendly APIs and tools, enabling businesses to create tailored payment experiences and scale effectively. Stripe's continued rollout of advanced features, like enhanced fraud detection and new payment methods in 2024, directly boosts transaction success rates and customer trust, supporting the projected growth of global digital payment transaction values to over $16 trillion by 2025.

Stripe is also strategically embracing blockchain and stablecoin technologies, evidenced by its launch of stablecoin-powered financial accounts and exploration of corporate cards backed by digital assets. This forward-thinking approach positions Stripe at the forefront of digital currency integration within financial services.

Leveraging cloud computing, particularly AWS, provides Stripe with the scalability and reliability needed for its payment processing services. This infrastructure allows for seamless management of fluctuating transaction volumes, critical for businesses of all sizes, and supports Stripe's ability to innovate and deploy new features rapidly.

| Technology Area | Stripe's Application | Impact/Data Point |

|---|---|---|

| Artificial Intelligence & Machine Learning | Fraud detection, payment processing efficiency, revenue recovery | 64% improvement in fraud detection; $6 billion revenue recovered (2024) |

| APIs & Developer Tools | Seamless integration, tailored payment experiences, scalability | Facilitates easier business integration and growth |

| Blockchain & Stablecoins | Financial accounts, corporate cards | Positions Stripe at the cutting edge of digital currency adoption |

| Cloud Computing (AWS) | Scalability, reliability, cost-efficiency, innovation | Supports massive transaction volumes and rapid feature deployment |

Legal factors

Stripe operates within a complex web of payment services regulations globally. In Europe, for instance, directives like PSD2 and the requirement for Strong Customer Authentication (SCA) are paramount. These aim to bolster online payment security and significantly curb fraudulent transactions.

To navigate these requirements, Stripe has proactively adapted its offerings. For example, the company has invested in and implemented solutions to ensure its products meet the stringent demands of SCA, which mandates multi-factor authentication for most online card payments. This commitment to compliance is crucial for maintaining trust and operational integrity within the digital payment ecosystem.

Stripe's operations are heavily influenced by anti-money laundering (AML) and know your customer (KYC) regulations. Compliance with these global laws is paramount to preventing illicit financial activities and maintaining trust within the financial ecosystem. In 2023, financial institutions worldwide reported a significant increase in AML-related investigations, underscoring the critical nature of these compliance measures.

To meet these stringent requirements, Stripe meticulously collects and verifies customer information from diverse sources. This data verification process is essential for identifying and mitigating risks associated with fraudulent transactions and money laundering. The global cost of financial crime compliance, including AML/KYC efforts, reached an estimated $15.6 billion in 2024, highlighting the substantial investment required.

Stripe navigates a complex web of data protection and privacy laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations dictate how Stripe handles sensitive customer information, from collection to storage, ensuring robust security and user consent. Stripe's commitment to these standards is highlighted in its privacy policy, which was updated in January 2025, reinforcing its dedication to data transparency and upholding user rights concerning their personal data.

Tax Compliance and Reporting Requirements

As tax laws for digital goods and services continue to evolve globally, Stripe must offer comprehensive solutions to ensure its users remain compliant. This dynamic landscape requires constant adaptation to varying international tax regulations.

Stripe's commitment to simplifying these complexities is evident in Stripe Tax, which now supports businesses in 102 countries. This service is designed to help merchants manage intricate tax obligations and adhere to real-time compliance requirements, a critical factor for businesses operating across borders.

- Global Tax Law Evolution: Digital transaction tax rules are constantly changing in numerous countries.

- Stripe Tax Reach: The service is now active in 102 countries, aiding businesses with international tax complexities.

- Real-time Compliance: Stripe Tax assists businesses in meeting ongoing and immediate tax reporting demands.

Prohibited Business Categories and Regulatory Risk

Stripe maintains a strict policy on prohibited business categories, actively monitoring accounts to safeguard its payment network. This proactive approach is crucial for compliance and risk management, ensuring that only legitimate and low-risk transactions are processed. For instance, in 2024, Stripe's risk and fraud prevention systems processed billions of dollars in transactions, flagging and blocking a significant portion associated with high-risk industries or illicit activities.

Certain sectors, even if legally operating, face restrictions due to evolving regulatory landscapes or the risk appetites of financial partners. These restrictions can impact businesses in areas like adult content, gambling, or the sale of certain regulated goods, requiring them to seek alternative payment solutions. The financial industry's increasing scrutiny on compliance, particularly concerning anti-money laundering (AML) and know your customer (KYC) regulations, directly influences which business models Stripe can support.

- Stripe's Prohibited Business List: Continuously updated to reflect regulatory changes and emerging risks.

- Risk Monitoring: Advanced algorithms analyze transaction patterns to detect and prevent fraudulent activity.

- Industry Restrictions: Businesses in sectors like gambling or cryptocurrency may face heightened scrutiny or outright prohibition.

- Financial Partner Policies: Stripe's ability to serve certain industries is dictated by the terms set by its banking and card network partners.

Stripe operates under a dynamic global regulatory framework, necessitating constant adaptation to evolving laws concerning data privacy, financial crime, and consumer protection. The company's proactive approach to compliance, particularly with directives like PSD2 and SCA in Europe, ensures secure online transactions. Furthermore, stringent AML and KYC regulations are critical, with global financial crime compliance costs estimated at $15.6 billion in 2024, underscoring the significant investment required.

Stripe's commitment to data privacy is demonstrated through its adherence to regulations like GDPR and CCPA, ensuring robust security and user consent for data handling, as reflected in its January 2025 privacy policy update. The company also actively manages evolving tax laws for digital goods and services, with Stripe Tax supporting businesses in 102 countries to navigate complex international tax obligations and real-time compliance demands.

Stripe maintains a strict policy on prohibited business categories, utilizing advanced algorithms to monitor transactions and prevent fraud, a critical aspect given the billions of dollars processed and flagged in 2024. Certain industries, such as gambling or cryptocurrency, face heightened scrutiny or outright prohibition due to regulatory landscapes and financial partner risk appetites, impacting which business models Stripe can support.

| Regulatory Area | Key Regulations/Aspects | Stripe's Response/Impact | Relevant Data/Statistics |

|---|---|---|---|

| Payment Security | PSD2, Strong Customer Authentication (SCA) | Proactive implementation of SCA-compliant solutions | SCA mandates multi-factor authentication for most online card payments |

| Financial Crime Prevention | Anti-Money Laundering (AML), Know Your Customer (KYC) | Meticulous customer data verification and risk mitigation | Global financial crime compliance costs estimated at $15.6 billion in 2024 |

| Data Privacy | GDPR, CCPA | Adherence to data handling, security, and user consent standards | Stripe's privacy policy updated January 2025 |

| Taxation | Evolving digital transaction tax rules | Stripe Tax supports businesses in 102 countries | Assists with international tax complexities and real-time compliance |

| Business Restrictions | Prohibited business categories, industry risk appetites | Active monitoring and flagging of high-risk transactions | Billions processed and flagged for illicit activities in 2024 |

Environmental factors

Stripe's significant reliance on digital infrastructure means its environmental impact is closely tied to the energy consumption of its data centers. As of 2023, the global data center industry accounted for approximately 1% of worldwide electricity consumption, a figure that continues to grow with increasing digital demand.

Stripe has proactively addressed this by achieving 100% carbon-free computing across its data centers. This commitment, a key part of their environmental strategy, means that the electricity powering their operations is sourced from renewable energy, effectively mitigating the direct carbon emissions from their computing activities.

Stripe is deeply invested in corporate sustainability, particularly through its Stripe Climate program. This initiative empowers businesses to allocate a portion of their revenue towards funding cutting-edge carbon removal technologies.

A key aspect of Stripe Climate is its commitment to transparency and impact, with 100% of all donations directly supporting these vital carbon removal projects. As of early 2024, Stripe Climate has facilitated significant contributions, with businesses cumulatively pledging millions of dollars to advance these environmental solutions.

Stripe's significant commitment to carbon removal, exemplified by its co-founding role in Frontier, signals a strong belief in the environmental necessity and economic potential of these technologies. Frontier aims to purchase over $1 billion of permanent carbon removal by 2030, a substantial market signal designed to accelerate innovation and deployment.

This investment directly addresses the environmental imperative to mitigate climate change by supporting solutions that actively remove CO2 from the atmosphere. By backing these nascent technologies, Stripe is not only contributing to environmental goals but also positioning itself to benefit from the growth of a critical future industry.

Pressure for ESG Reporting and Transparency

There's a growing demand from investors, customers, and governments for companies to be open about their Environmental, Social, and Governance (ESG) performance. This push for transparency means businesses like Stripe are increasingly expected to detail their environmental footprint and sustainability strategies.

Stripe's own initiatives, such as Stripe Climate which aims to remove carbon dioxide from the atmosphere, directly address this pressure. By actively participating in carbon removal, Stripe demonstrates a commitment to environmental responsibility and provides tangible evidence of its efforts.

- Growing ESG Scrutiny: By 2024, over 90% of S&P 500 companies were reporting on ESG metrics, highlighting the widespread adoption of such disclosures.

- Stripe Climate's Impact: As of early 2025, Stripe Climate has committed significant funding to carbon removal technologies, showcasing a proactive approach to environmental stewardship.

- Regulatory Tailwinds: The EU's Corporate Sustainability Reporting Directive (CSRD) mandates extensive ESG reporting for many companies operating within or selling to the EU, further intensifying the need for transparent data.

Climate Change Impact on Global Commerce

Climate change presents a complex web of indirect challenges for global commerce, impacting businesses that rely on seamless transactions. For instance, extreme weather events, which are becoming more frequent and intense, can disrupt supply chains, leading to delays and increased costs for merchants. This, in turn, can affect the volume and flow of online payments that Stripe processes. By mid-2024, reports indicated a significant rise in climate-related supply chain disruptions, with some sectors experiencing an average of 15% more delays compared to previous years.

Shifts in consumer behavior are also a critical factor. As awareness of climate change grows, consumers are increasingly favoring businesses with strong environmental, social, and governance (ESG) credentials. This trend could influence the growth trajectory of e-commerce platforms and the payment solutions they utilize. A 2024 survey found that over 60% of consumers are more likely to purchase from brands demonstrating a commitment to sustainability.

Stripe's proactive engagement in carbon removal initiatives, such as its investment in direct air capture technologies, directly addresses these long-term risks. By supporting the development of solutions to mitigate climate change, Stripe aims to foster a more stable and predictable environment for global digital commerce. As of early 2025, Stripe has committed to funding projects that aim to remove millions of tons of carbon dioxide from the atmosphere annually.

The financial implications of these environmental factors are substantial:

- Supply Chain Resilience: Increased frequency of climate-related disruptions could lead to an estimated 5-10% increase in operational costs for businesses by 2026 due to rerouting and inventory management.

- Consumer Spending Shifts: The market for sustainable goods and services is projected to grow by 15-20% annually through 2027, impacting the types of businesses that thrive and utilize payment infrastructure.

- Carbon Pricing Mechanisms: The potential implementation of broader carbon pricing globally could add a direct cost to emissions-intensive businesses, influencing their profitability and transaction volumes.

- Investment in Green Technologies: Increased investment in climate-friendly technologies and infrastructure could create new markets and payment flows for innovative businesses.

Stripe's environmental strategy is deeply integrated with its core business, focusing on carbon neutrality and actively supporting carbon removal technologies. The company has achieved 100% carbon-free computing, meaning the energy powering its data centers comes from renewable sources, a significant step given the data center industry's growing energy demands, which accounted for about 1% of global electricity in 2023.

Through its Stripe Climate program, launched in 2020, businesses can automatically allocate a percentage of their revenue to carbon removal projects. By early 2024, this initiative had facilitated millions of dollars in contributions, directly funding vital climate solutions.

Stripe's co-founding of Frontier, a leading carbon removal marketplace, underscores its commitment to scaling these technologies, with a goal to purchase over $1 billion in permanent carbon removal by 2030. This proactive stance not only addresses environmental concerns but also anticipates shifts in consumer and investor preferences, as demonstrated by over 60% of consumers favoring sustainable brands in 2024.

The increasing frequency of climate-related disruptions, which caused an estimated 15% rise in supply chain delays for some sectors by mid-2024, highlights the indirect financial risks Stripe and its merchants face. By investing in climate solutions, Stripe aims to foster greater economic stability for the digital commerce ecosystem.

| Environmental Factor | Stripe's Action/Impact | Data/Trend (2023-2025) |

|---|---|---|

| Data Center Energy Consumption | 100% Carbon-Free Computing | Global data centers used ~1% of global electricity in 2023. |

| Carbon Removal Investment | Stripe Climate & Frontier | Frontier aims to purchase >$1B in carbon removal by 2030; Stripe Climate facilitated millions in contributions by early 2024. |

| Consumer Demand for Sustainability | Supporting eco-conscious businesses | 60%+ consumers favor sustainable brands (2024 survey). |

| Climate-Related Disruptions | Mitigation through stable commerce | ~15% increase in supply chain delays in some sectors by mid-2024. |

PESTLE Analysis Data Sources

Our Stripe PESTLE analysis is meticulously crafted using data from reputable financial institutions, government publications, and leading market research firms. We integrate economic indicators, regulatory changes, and technological advancements to provide a comprehensive overview.