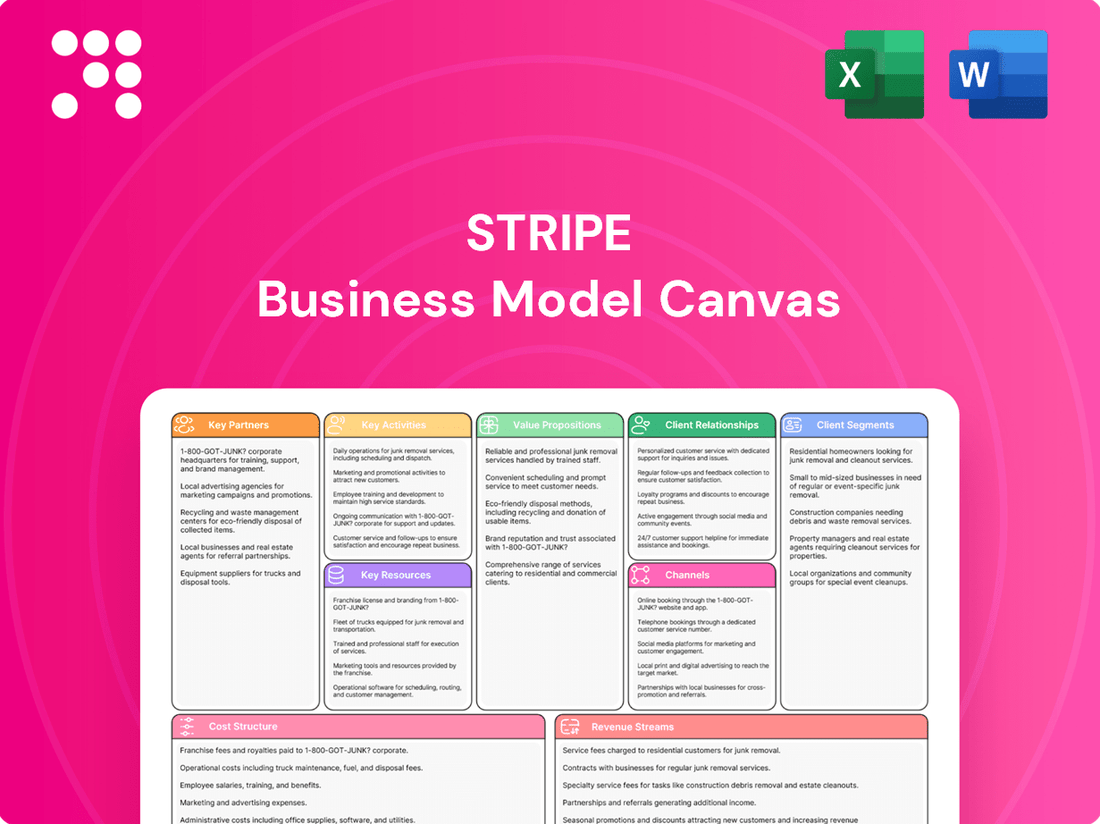

Stripe Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stripe Bundle

Curious about the engines driving Stripe's phenomenal growth? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their success.

Unlock the full strategic blueprint behind Stripe's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Stripe's collaboration with financial institutions and banks worldwide is foundational to its payment processing capabilities. These partnerships enable Stripe to handle transactions, issue cards, and offer embedded finance solutions, such as Stripe Treasury. For instance, in July 2024, Stripe expanded its partner bank network for Stripe Treasury by adding Fifth Third Bank.

Stripe's key partnerships with e-commerce platforms like Shopify and Adobe Commerce are crucial. These integrations allow millions of online businesses to easily accept payments through Stripe, significantly expanding Stripe's user base and revenue streams.

In 2024, Shopify reported over 4.4 million merchants, many of whom rely on integrated payment solutions like Stripe. This vast network provides Stripe with unparalleled access to a diverse range of businesses, from small startups to large enterprises.

These collaborations are mutually beneficial, as e-commerce platforms enhance their offerings with robust payment processing, while Stripe gains a substantial distribution channel, simplifying payment acceptance and management for their shared merchants.

Stripe actively partners with key technology and software providers, including giants like Salesforce and Oracle, to embed its payment solutions directly into business workflows. These collaborations with CRM, ERP, and accounting software vendors are crucial. For example, integrating with NetSuite allows businesses to manage payments alongside inventory and customer data, streamlining financial operations.

Fraud Prevention and Security Services

Stripe partners with leading fraud prevention and security service providers to bolster its platform's integrity. These collaborations are crucial for safeguarding transactions and protecting businesses from financial losses. For instance, Stripe has worked with entities like Capital One and Adyen to enhance its fraud reduction tools, ensuring a more secure environment for all users.

These strategic alliances are vital for maintaining trust and reliability within the payment ecosystem. By integrating advanced security measures and leveraging the expertise of specialized partners, Stripe aims to minimize the risk of fraudulent activities. This proactive approach helps businesses mitigate financial risks associated with online transactions.

Key aspects of these partnerships include:

- Enhanced Fraud Detection: Collaborations focus on developing and implementing sophisticated algorithms and machine learning models to identify and prevent fraudulent transactions in real-time.

- Data Security and Compliance: Partners assist Stripe in adhering to stringent data security standards and regulatory compliance requirements, ensuring the protection of sensitive customer information.

- Risk Management Tools: Joint efforts provide businesses with robust tools and insights to manage their own risk exposure, offering features like chargeback representment and identity verification.

Developer Communities and Integrators

Stripe actively cultivates relationships with developer communities and independent software vendors (ISVs). These partners are crucial as they build innovative applications and integrations on top of Stripe's APIs, extending its reach and utility. For instance, many SaaS companies and e-commerce platforms rely on these integrations to offer seamless payment experiences to their users.

This collaborative approach significantly broadens Stripe's ecosystem. By empowering developers, Stripe ensures its platform remains adaptable and feature-rich across a multitude of business needs and industries. This developer-first strategy has been a cornerstone of Stripe's growth, fostering a vibrant network that continuously innovates.

- Developer Engagement: Stripe hosts extensive documentation, SDKs, and developer tools, making it easier for programmers to integrate its services.

- ISV Partnerships: Collaborations with ISVs allow Stripe's payment solutions to be embedded within popular business software, reaching a wider customer base.

- Ecosystem Growth: The active developer community contributes to the creation of plugins, extensions, and custom solutions that enhance Stripe's value proposition.

- Market Expansion: By enabling third-party development, Stripe effectively expands its market presence into niche sectors and specialized business workflows.

Stripe's strategic alliances with financial institutions are fundamental, enabling robust payment processing and innovative financial products like Stripe Treasury. In 2024, the expansion of its partner bank network, including additions like Fifth Third Bank, underscores this commitment to broadening financial service capabilities.

What is included in the product

The Stripe Business Model Canvas outlines how the company creates, delivers, and captures value by focusing on developers as a key customer segment and offering a robust suite of payment processing tools.

It details Stripe's value proposition of simplifying online payments, its channels for reaching businesses, and its revenue streams derived from transaction fees and premium services.

The Stripe Business Model Canvas offers a structured framework to pinpoint and alleviate the complexities of payment processing, transforming operational headaches into streamlined solutions.

Activities

Stripe's primary focus is building and managing the sophisticated systems that enable seamless and secure payment processing, both online and in physical locations. This core activity is critical for its users to accept payments from customers worldwide.

The company handles an immense volume of transactions, demonstrating the scale and reliability of its infrastructure. In 2024 alone, Stripe processed an astounding $1.4 trillion in payments, highlighting its pivotal role in the global digital economy.

Stripe's core activity revolves around the continuous development and enhancement of its powerful APIs and developer tools. This commitment ensures a seamless and intuitive experience for businesses integrating payment processing. In 2024 alone, Stripe launched significant new features such as the Entitlements API and the Vault and Forward API, demonstrating a clear focus on expanding its platform's capabilities.

Further investment in AI-powered tools underscores Stripe's dedication to innovation and providing cutting-edge solutions. This ongoing development directly supports its mission to increase the GDP of the internet by making online commerce more accessible and efficient for businesses worldwide.

Stripe's core operations heavily rely on robust risk management and fraud prevention. A primary activity involves implementing and continuously refining sophisticated fraud detection systems like Stripe Radar. This protects both merchants and their customers from financial losses due to fraudulent transactions.

Stripe Radar's capabilities have been significantly enhanced, now extending to cover ACH and SEPA payments. This expansion utilizes advanced AI models, which have demonstrably reduced fraud rates for businesses utilizing these payment methods. For instance, in 2023, Stripe reported that Radar for Fraud Teams helped block over $20 billion in fraudulent transactions globally.

Customer Support and Relationship Management

Stripe's customer support is a cornerstone of its business, ensuring businesses of all sizes can leverage its payment infrastructure. This includes providing extensive documentation, developer resources, and responsive assistance to help users navigate the platform and resolve any issues. In 2024, Stripe continued to invest in its support channels, aiming to reduce response times and improve the overall customer experience.

Effective relationship management is key to retaining and growing Stripe's user base. By offering tailored solutions and proactive engagement, Stripe fosters loyalty among its diverse clientele. This focus on customer success is crucial for a platform that powers businesses ranging from nascent startups to established global enterprises.

- Extensive Documentation: Stripe offers a vast library of guides, API references, and tutorials, crucial for developers integrating payment solutions.

- Developer Support: Dedicated developer resources and forums help users troubleshoot technical challenges efficiently.

- Account Management: For larger clients, dedicated account managers provide personalized support and strategic guidance.

- Self-Service Options: A robust knowledge base and FAQ section empower users to find answers independently, streamlining support efforts.

Global Expansion and Regulatory Compliance

Stripe's key activity involves meticulously navigating the complex landscape of global expansion and regulatory compliance. This means continuously adapting its payment processing infrastructure to meet the unique financial regulations of each new country it enters.

This dedication to compliance is what allows businesses to seamlessly accept payments from customers in over 50 countries and process transactions in more than 135 currencies, a significant feat in the globalized digital economy.

- Global Reach: Stripe's platform supports payment acceptance in over 50 countries, facilitating international commerce for businesses.

- Currency Support: The company enables transactions in more than 135 currencies, broadening market access for its clients.

- Regulatory Adherence: Continuous efforts are made to comply with diverse and evolving local financial regulations across its operational territories.

Stripe's key activities are centered around building and maintaining its robust payment processing infrastructure, continuously enhancing its developer tools and APIs, and implementing sophisticated risk management systems. These efforts are crucial for enabling businesses to accept payments globally and securely.

The company's commitment to innovation is evident in its ongoing development of AI-powered tools and new API features, aiming to increase the GDP of the internet. Furthermore, Stripe prioritizes customer support and relationship management, ensuring businesses of all sizes can effectively utilize its platform.

Navigating global expansion and regulatory compliance is another vital activity, allowing Stripe to offer its services in numerous countries and currencies. This comprehensive approach underpins its value proposition to a diverse range of clients.

| Key Activity | Description | Impact/Data Point |

| Payment Processing Infrastructure | Building and managing secure systems for online and in-person payments. | Processed $1.4 trillion in payments in 2024. |

| API and Developer Tools | Developing and enhancing APIs and tools for seamless integration. | Launched Entitlements API and Vault and Forward API in 2024. |

| Risk Management & Fraud Prevention | Implementing and refining AI-powered fraud detection systems. | Stripe Radar helped block over $20 billion in fraudulent transactions globally in 2023. |

| Customer Support & Relationship Management | Providing extensive documentation, developer resources, and personalized assistance. | Focus on reducing response times and improving customer experience in 2024. |

| Global Expansion & Compliance | Navigating regulations for international payment processing. | Supports payment acceptance in over 50 countries and 135+ currencies. |

Preview Before You Purchase

Business Model Canvas

The Stripe Business Model Canvas you're previewing is the identical document you'll receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, professionally structured file. Once your order is processed, you'll gain full access to this exact canvas, ready for your strategic analysis and business planning.

Resources

Stripe's proprietary technology, particularly its developer-friendly APIs, is a cornerstone of its business model, allowing for incredibly flexible and seamless payment integrations. This advanced tech stack is constantly evolving, with recent developments like the Accounts V2 API beta highlighting their commitment to innovation. This technological prowess is a key resource that attracts and retains businesses looking for robust payment solutions.

Stripe's global payment network, built on relationships with thousands of financial institutions and payment processors worldwide, is a cornerstone of its business. This extensive infrastructure enables seamless processing of transactions across borders and supports a vast array of local payment methods, from credit cards to digital wallets.

In 2024, Stripe continued to expand its reach, facilitating payments in over 100 countries and supporting more than 135 currencies. This deep integration into local financial systems allows businesses using Stripe to access new markets efficiently, offering customers familiar and trusted payment options.

The reliability and breadth of this network are crucial for Stripe's value proposition, enabling businesses to accept payments from virtually anyone, anywhere. This robust infrastructure underpins Stripe's ability to handle complex payment flows and provide a consistent experience for merchants and their customers.

Stripe's business model heavily relies on its skilled engineering and product teams, a critical resource for its innovation. These teams, particularly those focused on software engineering, product development, and machine learning, are the engine behind Stripe's ability to offer cutting-edge payment solutions and maintain operational excellence.

In 2024, Stripe continued to invest significantly in its talent pool, recognizing that a highly capable workforce is essential for developing advanced features. This includes the ongoing integration of AI-powered solutions into its platform, which requires specialized expertise in machine learning and data science to enhance fraud detection, risk management, and user experience.

Brand Reputation and Trust

Stripe's brand reputation is a cornerstone of its business model, built on a foundation of reliability, security, and forward-thinking innovation in fintech. This strong reputation directly translates into customer trust, a critical factor for businesses entrusting their financial operations to a third party.

This trust is evident in Stripe's widespread adoption. As of early 2024, the company serves a significant portion of the world's leading businesses, including half of the Fortune 100 companies. This widespread acceptance underscores the confidence that major enterprises place in Stripe's ability to handle complex financial transactions securely and efficiently.

The key resources stemming from this brand reputation and trust include:

- Customer Loyalty and Retention: A trusted brand fosters long-term relationships, reducing churn and increasing the lifetime value of customers.

- Attraction of New Customers: Positive brand perception acts as a powerful marketing tool, drawing in new businesses seeking dependable financial solutions.

- Partnership Opportunities: A strong reputation makes Stripe an attractive partner for other technology companies and financial institutions looking to integrate payment solutions.

- Premium Pricing Power: Trust can allow Stripe to command higher prices for its services compared to less established competitors.

Customer Data and Analytics

Stripe leverages the immense volume of transaction data it processes to gain critical insights. This data is instrumental in refining its existing services, bolstering fraud prevention capabilities, and spearheading the development of innovative new products. For instance, this rich dataset is used to continuously retrain machine learning models, thereby optimizing transaction flows and improving success rates for merchants.

The insights derived from this customer data are foundational to Stripe's operational excellence and strategic growth. By analyzing patterns and trends, Stripe can proactively identify potential risks and opportunities, ensuring a more secure and efficient payment ecosystem for its users.

- Transaction Volume: In 2023, Stripe processed trillions of dollars in payments, providing an unparalleled dataset for analysis.

- Fraud Detection: Machine learning models trained on this data have demonstrably reduced fraudulent transactions for businesses using Stripe.

- Product Development: Insights into user behavior inform the creation of new features like Stripe Sigma for data analysis and Stripe Billing for recurring payments.

- Operational Efficiency: Continuous data analysis helps optimize payment routing and processing speeds, benefiting both merchants and consumers.

Stripe's extensive global payment network, built on partnerships with thousands of financial institutions, is a critical resource enabling seamless cross-border transactions and diverse local payment methods. This infrastructure, supporting over 135 currencies in 2024, allows businesses to easily access international markets.

The company's proprietary technology, especially its developer-friendly APIs, is another vital asset. This tech stack, continuously updated with features like the Accounts V2 API beta, ensures flexible and efficient payment integrations for businesses. Stripe's highly skilled engineering and product teams are the driving force behind this innovation, with significant 2024 investments in talent to enhance AI-powered solutions.

Stripe's strong brand reputation for reliability and security is a key resource, fostering customer trust and leading to widespread adoption, including by half of the Fortune 100 companies by early 2024. This trust translates into customer loyalty, new customer acquisition, and attractive partnership opportunities.

Finally, the vast transaction data processed by Stripe is a significant resource. In 2023 alone, Stripe processed trillions of dollars, providing invaluable data for refining services, improving fraud detection through machine learning, and informing new product development, ultimately enhancing operational efficiency.

| Key Resource | Description | 2024 Impact/Data Point |

|---|---|---|

| Proprietary Technology | Developer-friendly APIs and evolving tech stack | Facilitates seamless payment integrations; Accounts V2 API beta released. |

| Global Payment Network | Relationships with financial institutions worldwide | Supports transactions in over 100 countries and 135+ currencies. |

| Skilled Talent Pool | Engineering, product, and machine learning expertise | Drives innovation and AI integration for advanced features. |

| Brand Reputation & Trust | Reliability, security, and innovation in fintech | Underpins customer loyalty and adoption by major enterprises (e.g., 50% of Fortune 100 in early 2024). |

| Transaction Data | Insights from high transaction volumes | Enhances fraud detection and informs new product development (trillions processed in 2023). |

Value Propositions

Stripe's core value proposition is its simplified payment processing, enabling businesses to seamlessly accept online and in-person transactions. This means companies can get up and running with payments quickly, without needing deep technical expertise, which is crucial for rapid growth. For instance, in 2023, Stripe reported processing trillions of dollars in payment volume, highlighting the scale of its simplified infrastructure for businesses worldwide.

Stripe's global reach allows businesses to tap into international markets effortlessly. As of 2025, Stripe operates in 140 countries, enabling companies to accept payments from customers worldwide.

This extensive network supports transactions in over 135 currencies, breaking down geographical barriers for commerce. Businesses can expand their customer base and revenue streams by offering localized payment options.

Stripe offers developers powerful APIs and adaptable UI components, allowing them to craft unique payment experiences and construct intricate financial tools. This flexibility is key for businesses needing to integrate payments seamlessly into their existing systems or build entirely new financial products.

Features like the Payment Element simplify the integration of Stripe's checkout flow, while custom workflows enable businesses to manage complex payment scenarios, such as subscriptions or recurring billing, with precision. In 2023, developer adoption of Stripe's tools remained exceptionally high, with millions of API calls processed daily, highlighting the platform's essential role in modern digital commerce.

Advanced Fraud Prevention and Security

Stripe provides advanced fraud prevention and security through tools like Stripe Radar. This system uses machine learning to analyze transactions in real-time, identifying and blocking suspicious activity before it impacts a business. By minimizing fraud, Stripe helps businesses increase their approval rates for legitimate transactions and significantly reduce financial losses.

In 2023, Stripe Radar was credited with saving businesses over $1 billion in fraud losses. The platform continuously learns from a vast network of transactions, adapting to new fraud patterns. This proactive approach is crucial for maintaining customer trust and ensuring smooth payment processing.

- Machine Learning Powered: Stripe Radar leverages AI to detect and prevent fraudulent transactions.

- Reduced Financial Losses: Businesses experience fewer chargebacks and direct losses due to fraud.

- Increased Authorization Rates: By distinguishing legitimate from fraudulent payments, more valid transactions are approved.

- Real-time Protection: Fraud detection happens instantaneously, safeguarding businesses as transactions occur.

Comprehensive Financial Infrastructure

Stripe’s value proposition extends far beyond simple payment processing, offering a robust financial infrastructure that supports a wide array of business needs. This comprehensive suite simplifies complex financial operations, allowing businesses to focus on growth and innovation.

Businesses gain access to integrated financial services that streamline everything from recurring revenue to managing expenses and accessing capital. This holistic approach is crucial for modern businesses operating in a fast-paced digital economy.

- Integrated Services: Stripe provides solutions like Stripe Billing for recurring payments, Stripe Corporate Card for expense management, and Stripe Capital for business financing, all within a single platform.

- Operational Efficiency: By consolidating these financial tools, Stripe significantly reduces the complexity and administrative burden associated with managing multiple financial vendors.

- Scalability: The infrastructure is designed to scale with businesses, supporting everything from startups to large enterprises with evolving financial requirements.

Stripe's value proposition centers on providing a developer-friendly, all-in-one platform for online payment processing and financial services. This simplifies complex financial operations, allowing businesses to focus on core activities and growth.

The platform empowers businesses with robust tools for accepting payments globally, managing subscriptions, preventing fraud, and even accessing capital, all within a unified ecosystem. This comprehensive approach enhances operational efficiency and scalability.

For instance, in 2024, Stripe continued to expand its offerings, with a significant portion of its growth attributed to its expanding suite of financial services beyond basic payment processing.

The platform's commitment to innovation is evident in its continuous updates to APIs and features, ensuring businesses can adapt to evolving market demands and customer expectations.

Customer Relationships

Stripe's customer relationships heavily lean on a robust self-service model, primarily driven by its comprehensive developer documentation and powerful APIs. This allows businesses, from startups to enterprises, to integrate payment processing seamlessly and manage their operations with significant autonomy.

By offering well-structured guides and flexible APIs, Stripe empowers developers to build custom payment experiences, reducing the need for direct support. For instance, in 2023, Stripe reported that over 75% of its customer interactions were handled through self-service channels, highlighting the effectiveness of its documentation and API-first approach.

Stripe enhances customer relationships through automated and AI-powered support, offering businesses immediate assistance. Features like AI-powered anomaly alerts proactively identify potential issues, while tools such as Sigma Assistant enable quick data analysis and problem-solving.

This approach allows businesses to resolve queries and extract valuable insights without the need for extensive manual intervention, streamlining operations. For instance, Stripe's Sigma product, which leverages AI for data analysis, saw significant adoption by businesses seeking to understand their transaction patterns more efficiently in 2024.

Stripe deeply cultivates its developer community, fostering an environment where knowledge exchange and collaborative problem-solving thrive. This engagement is crucial for platform innovation and user support.

The company actively supports an ecosystem of partners and integrators, extending Stripe's functionality and reach. This network is key to providing comprehensive payment solutions.

By encouraging the development of third-party applications, Stripe enhances its platform's value proposition. For instance, many businesses in 2024 rely on specialized integrations built by this partner network to streamline operations.

Dedicated Account Management for Enterprises

For its enterprise clients, Stripe offers dedicated account management, a crucial element in fostering strong customer relationships. This personalized approach ensures that larger businesses receive specialized support tailored to their unique operational demands and growth trajectories.

This dedicated service includes custom pricing structures, allowing enterprises to negotiate terms that align with their high transaction volumes and specific business needs. In 2024, Stripe continued to enhance these enterprise offerings, recognizing the significant revenue contribution from this segment.

- Dedicated Account Managers: Provide direct points of contact for strategic guidance and issue resolution.

- Custom Pricing: Negotiated rates reflecting high transaction volumes and specific service requirements.

- Tailored Solutions: Development of bespoke integrations and features to meet complex enterprise needs.

- Proactive Support: Anticipating and addressing potential challenges before they impact operations.

Educational Content and Resources

Stripe provides extensive educational materials, including detailed guides and live webinars, designed to help businesses master their payment processing. This focus on customer education fosters greater platform adoption and empowers users to leverage Stripe’s full capabilities.

By offering these resources, Stripe actively supports its customers’ success, encouraging them to explore and integrate more of Stripe’s diverse financial services. This commitment to knowledge sharing builds stronger customer relationships and drives platform loyalty.

- Educational Resources: Stripe offers a comprehensive library of guides, tutorials, and API documentation.

- Webinars and Training: Regular webinars and training sessions cover topics from basic setup to advanced features.

- Customer Success: This educational approach directly contributes to customer success and platform optimization.

- Engagement: It encourages deeper engagement with Stripe’s expanding suite of financial tools.

Stripe's customer relationships are built on a foundation of self-service, developer-centric tools, and personalized support for larger clients. Its extensive API documentation and robust self-service portal empower businesses to manage payments independently, a model that saw over 75% of customer interactions handled via self-service in 2023.

Automated and AI-driven support, including anomaly alerts and tools like Sigma Assistant, provide immediate problem-solving and data analysis capabilities, enhancing user autonomy. The company also cultivates a strong developer community and partner ecosystem, fostering innovation and extending platform utility, with many businesses in 2024 relying on these third-party integrations.

For enterprise clients, dedicated account management and custom pricing structures are key, ensuring tailored support for high transaction volumes and unique business needs. This segment's importance is underscored by Stripe's continued enhancements to these offerings in 2024.

Stripe also prioritizes customer education through comprehensive guides and webinars, aiming to maximize platform adoption and user success. This commitment to knowledge sharing strengthens relationships and encourages deeper engagement with Stripe's expanding financial services.

| Relationship Aspect | Description | Key Data/Example (2023-2024) |

|---|---|---|

| Self-Service | Developer documentation, APIs, and knowledge base for independent management. | Over 75% of customer interactions handled via self-service channels in 2023. |

| Automated/AI Support | Proactive issue identification and AI-powered tools for quick problem-solving. | Significant adoption of Sigma product for AI-driven data analysis by businesses in 2024. |

| Community & Partners | Fostering developer engagement and supporting a network of integrators. | Many businesses in 2024 leverage third-party integrations built by the partner network. |

| Enterprise Support | Dedicated account managers, custom pricing, and tailored solutions. | Continued enhancements to enterprise offerings in 2024, reflecting revenue importance. |

| Customer Education | Extensive guides, tutorials, and webinars to maximize platform use. | Focus on knowledge sharing to drive platform adoption and user success. |

Channels

Stripe's primary channel for customer acquisition is its user-friendly online platform, enabling businesses to seamlessly sign up and integrate payment processing. This direct, low-friction approach is central to their rapid growth, making it easy for even small businesses to start accepting payments quickly.

In 2023, Stripe continued to see significant adoption through its online channels, reflecting the ongoing digital transformation of businesses globally. The ease of integration, often requiring just a few lines of code, significantly lowers the barrier to entry for merchants.

Stripe deeply engages developers by offering exceptional API documentation and hosting developer-focused events like DevCon. This commitment fosters a loyal technical community, making Stripe the go-to platform for building innovative digital products and services.

Stripe's strategic alliances with major e-commerce platforms like Shopify and BigCommerce are crucial. These collaborations allow businesses using these platforms to seamlessly integrate Stripe's payment processing, significantly expanding Stripe's customer base. For instance, Shopify reported over 2.1 million merchants in 2024, all potential Stripe users.

Collaborations with software providers, such as accounting or CRM systems, also act as key channels. By integrating with these essential business tools, Stripe becomes an embedded solution, simplifying financial operations for a wider range of businesses. This integration strategy is vital for capturing market share in the B2B payments space.

Furthermore, partnerships with system integrators who help businesses implement and manage their technology stacks are vital. These integrators often recommend and deploy payment solutions, making Stripe a preferred choice for businesses undergoing digital transformation. This reach through trusted advisors amplifies Stripe's market penetration.

Content Marketing and Thought Leadership

Stripe actively cultivates its brand through content marketing and thought leadership. Its blog, annual letters from CEO Patrick Collison, and a dedicated newsroom serve as primary channels for sharing insights. These platforms detail product advancements, analyze emerging industry trends, and highlight customer success stories. This consistent output positions Stripe as a knowledgeable authority within the fintech landscape, effectively attracting and educating prospective customers.

By providing valuable, accessible information, Stripe not only informs its audience but also builds trust and credibility. This strategy is crucial for attracting and retaining businesses that rely on their payment infrastructure. In 2024, content marketing remains a cornerstone of their customer acquisition and retention efforts, demonstrating a commitment to empowering the broader developer and business community with knowledge.

- Content Hubs: Stripe leverages its blog, annual letters, and newsroom to disseminate information.

- Key Topics: Product updates, industry trends, and customer success stories are frequently covered.

- Objective: To establish Stripe as a thought leader and attract/educate potential users.

- Impact: Builds credibility and trust within the fintech ecosystem.

Referral Programs and Word-of-Mouth

Stripe benefits significantly from its customers becoming advocates. Positive experiences with Stripe's reliable platform and user-friendly interface frequently translate into organic referrals. This word-of-mouth marketing is a powerful, cost-effective growth driver.

Satisfied businesses often share their successes with peers, directly leading to new customer acquisition for Stripe. This organic adoption within professional networks is a testament to the value Stripe delivers.

- Customer Advocacy: Happy users act as informal sales agents, recommending Stripe to others.

- Trust and Reputation: Stripe's established reliability builds trust, encouraging new businesses to try it.

- Network Effects: As more businesses use Stripe, its value proposition strengthens for everyone.

- Cost-Effective Growth: Word-of-mouth referrals significantly reduce customer acquisition costs compared to traditional advertising.

Stripe's channels are multifaceted, encompassing direct online engagement, strategic partnerships, and developer-centric outreach. Its online platform serves as the primary acquisition point, while collaborations with e-commerce giants like Shopify and software providers embed Stripe into existing business workflows. Developer communities are cultivated through exceptional documentation and events, fostering loyalty and innovation.

Customer Segments

Stripe serves a massive base of small and medium-sized businesses (SMBs), from burgeoning e-commerce ventures to innovative startups. These businesses rely on Stripe for payment processing that is both easy to adopt and capable of growing with them. In 2024, Stripe continued to be a go-to for new companies, with a significant portion of its user base being businesses less than five years old, highlighting its appeal to nascent enterprises.

Stripe is a crucial partner for businesses built on recurring revenue, especially Software as a Service (SaaS) providers. These companies rely heavily on Stripe Billing to handle the complexities of subscription management, from initial sign-ups to ongoing payment collection and dunning.

The scale of Stripe's impact is significant; the platform currently manages nearly 200 million active subscriptions globally. This demonstrates the trust and reliance SaaS and subscription-based businesses place on Stripe's infrastructure to ensure smooth, consistent revenue streams.

Online marketplaces and platforms are a key customer segment for Stripe Connect. These businesses, ranging from crowdfunding sites to gig economy platforms, require robust solutions for managing complex, multi-party payment flows and timely payouts to sellers or contributors. For instance, in 2024, the global marketplace sector continued its strong growth trajectory, with many platforms leveraging specialized payment infrastructure to scale their operations.

Large Enterprises and Global Corporations

Stripe's appeal extends to large enterprises and global corporations seeking robust, tailored financial solutions. These organizations often have intricate payment flows and require highly scalable infrastructure to manage their vast transaction volumes. Stripe provides these capabilities, ensuring seamless integration and compliance with global regulations.

The adoption by major players underscores Stripe's capacity to handle complex enterprise-level demands. Notably, half of the Fortune 100 companies now leverage Stripe's platform. This statistic highlights Stripe's evolution from a startup-focused provider to a critical partner for the world's largest businesses.

- Enterprise-grade solutions: Stripe offers customized payment gateways, fraud prevention tools, and financial reporting designed for the scale and complexity of large organizations.

- Scalability: The platform is built to handle massive transaction volumes, supporting the global operations of Fortune 100 companies.

- Strategic partnerships: Stripe's engagement with these enterprises often involves deep integration and co-development of financial products.

- Market penetration: The fact that 50% of the Fortune 100 use Stripe demonstrates significant trust and reliance on its services.

Developers and Tech Startups

Developers and technology startups form a crucial customer segment for Stripe. They are drawn to Stripe's powerful APIs, extensive documentation, and adaptable tools, which are essential for creating and scaling new online ventures. This segment leverages Stripe to integrate payment processing seamlessly into their products and services.

The reliance of innovative companies on Stripe is substantial. For instance, a significant majority of businesses recognized on the Forbes AI 50 list, specifically 78%, have chosen to build their platforms using Stripe's infrastructure. This highlights Stripe's role as a foundational technology provider for cutting-edge tech businesses.

- Developer-Centric Tools: Stripe provides APIs and SDKs that are highly regarded for their ease of use and comprehensive nature, enabling rapid integration.

- Startup Growth: Many startups utilize Stripe from their inception to manage payments, allowing them to focus on product development and market expansion.

- Innovation Hub: The platform is a preferred choice for companies at the forefront of technology, such as those in the AI space, underscoring its reliability and advanced capabilities.

Stripe's customer base is incredibly diverse, encompassing everyone from small e-commerce shops to global enterprises. The platform's ease of use and scalability make it a popular choice for businesses of all sizes looking to manage online payments effectively.

In 2024, Stripe continued to be a vital partner for subscription-based businesses, particularly SaaS companies. Its robust billing solutions are essential for managing recurring revenue streams, supporting nearly 200 million active subscriptions globally.

Online marketplaces and platforms also heavily rely on Stripe Connect for managing complex payment flows and payouts. The growth in the marketplace sector in 2024 further cemented Stripe's position as a key enabler for these businesses.

Large enterprises and Fortune 100 companies are increasingly adopting Stripe for its sophisticated, scalable financial infrastructure. In fact, half of the Fortune 100 now utilize Stripe, demonstrating its capacity to handle enterprise-level demands.

Developers and tech startups are a core segment, drawn to Stripe's powerful APIs and developer-friendly tools. Notably, 78% of companies on the Forbes AI 50 list in 2024 built their platforms using Stripe, highlighting its appeal to innovative ventures.

Cost Structure

Payment network fees and bank charges represent a substantial cost for Stripe, directly tied to the volume of transactions processed. These fees, paid to entities like Visa and Mastercard, are a fundamental component of the payment infrastructure that Stripe leverages.

Stripe typically passes these costs through to its merchants as part of its transparent, per-transaction pricing model. For instance, in 2024, interchange fees, a major part of these charges, can range from around 0.05% to 3.5% or more depending on the card type and transaction specifics.

Stripe's technology infrastructure and cloud services represent a significant cost. Maintaining a global, highly available, and secure payment processing system demands massive investment in cloud computing, servers, and data centers to handle billions of daily API requests.

Stripe dedicates substantial resources to Research and Development, a key cost in its business model. This investment fuels the creation of new payment solutions, improvements to existing services, and exploration of cutting-edge technologies. For instance, in 2023, Stripe continued to heavily invest in areas like AI-powered fraud detection and expanding its global infrastructure.

Sales, Marketing, and Customer Support

Stripe incurs significant costs in its Sales, Marketing, and Customer Support functions. These expenses are crucial for acquiring new businesses and retaining existing ones. For instance, in 2023, Stripe invested heavily in expanding its sales force and global marketing initiatives to reach a wider customer base.

These costs encompass a variety of activities, from digital advertising and content marketing to direct sales efforts and partnership development. The aim is to educate potential users about Stripe's payment processing solutions and to demonstrate their value proposition.

- Customer Acquisition Costs: Expenses related to advertising, lead generation, and sales commissions for bringing new merchants onto the platform.

- Marketing Campaigns: Investment in brand building, digital advertising, and content creation to attract and engage businesses.

- Sales Team Operations: Salaries, commissions, and overhead for the sales personnel responsible for closing deals.

- Customer Support Infrastructure: Costs for maintaining support teams, help desks, and self-service resources to assist users.

Compliance and Regulatory Costs

Stripe's commitment to operating globally means substantial expenditure on legal and compliance teams. These experts are crucial for navigating the intricate web of financial regulations across diverse jurisdictions, ensuring Stripe remains compliant with local laws and maintains its operational licenses. This investment is fundamental to building and preserving customer trust, a cornerstone of their business.

The cost of compliance is not static; it evolves with regulatory changes and expanding market presence. For instance, as of early 2024, the increasing focus on data privacy regulations like GDPR and CCPA, coupled with evolving Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, directly impacts operational expenditures. Companies like Stripe must continuously adapt their compliance frameworks.

- Global Regulatory Navigation: Costs associated with legal counsel and compliance officers to understand and adhere to financial regulations in over 100 countries where Stripe operates.

- Licensing and Permits: Fees for obtaining and maintaining necessary financial licenses and operating permits in various markets, which can be substantial and recurring.

- Data Security and Privacy Compliance: Investments in technology and processes to meet stringent data protection standards, such as those mandated by GDPR and CCPA, to safeguard user data.

- Anti-Money Laundering (AML) and KYC: Ongoing expenses for implementing and maintaining robust AML and KYC procedures to prevent financial crime and ensure regulatory adherence.

Stripe's cost structure is heavily influenced by transaction-based fees, technology infrastructure, and significant investments in research and development. These core expenses are fundamental to operating a global payment processing platform.

Beyond direct transaction costs, Stripe allocates substantial resources to sales, marketing, and customer support to acquire and retain its merchant base. Legal and compliance expenditures are also critical, given the complex regulatory landscape Stripe navigates globally.

| Cost Category | Description | Example Impact (2024 Data/Trends) |

|---|---|---|

| Payment Network Fees | Fees paid to card networks (Visa, Mastercard) for transaction processing. | Interchange fees can range from 0.05% to 3.5%+, varying by card type and transaction details. |

| Technology Infrastructure | Costs for cloud services, servers, and data centers supporting global operations. | Essential for handling billions of daily API requests and maintaining high availability. |

| Research & Development | Investment in new payment solutions, fraud detection (AI), and infrastructure upgrades. | Continued focus on enhancing security and expanding service offerings. |

| Sales & Marketing | Customer acquisition through advertising, sales commissions, and brand building. | Significant investment in global sales force expansion and digital marketing campaigns. |

| Legal & Compliance | Costs for navigating global financial regulations and data privacy laws. | Adapting to evolving GDPR, CCPA, AML, and KYC requirements across 100+ operating countries. |

Revenue Streams

Stripe's core revenue engine is built on transaction fees, taking a small percentage of each payment processed. For instance, a common rate for online card transactions is 2.9% plus a fixed fee of $0.30. This pay-as-you-go structure makes it accessible for businesses of all sizes.

Stripe generates significant revenue through subscription fees for its premium offerings. For instance, Stripe Billing, which facilitates recurring payments, charges either 0.7% of the recurring billing volume or a fixed monthly plan, providing a predictable income stream.

Beyond basic payment processing, Stripe monetizes value-added services that enhance merchant operations. Fees are collected for features like Stripe Radar, its sophisticated fraud prevention tool, and for expedited services such as instant payouts, which offer businesses immediate access to their funds.

Stripe earns revenue through its growing financial services offerings, such as its corporate card program and business financing solutions. These services cater to businesses looking for integrated financial tools.

The Stripe Issuing platform, which enables businesses to create and manage their own branded cards, saw significant transaction volume. In 2025, Stripe Issuing processed over $13.4 billion in transactions, demonstrating strong adoption and revenue generation from interchange fees and platform charges.

Stripe Connect and Platform Fees

Stripe Connect is a key revenue driver, allowing platforms and marketplaces to integrate payment processing seamlessly for their own users. This product is crucial for businesses that need to facilitate transactions between buyers and sellers on their sites.

In 2025, Stripe Connect demonstrated significant growth, contributing $340 million in new revenue. This highlights the increasing reliance of digital platforms on specialized payment solutions.

- Stripe Connect facilitates payments for platforms and marketplaces.

- It enables embedded payment functionalities for end-users.

- In 2025, Connect generated $340 million in new revenue.

Cross-Border and Currency Conversion Fees

Stripe captures revenue through cross-border and currency conversion fees, a vital component of its global payment processing services. These fees are applied when transactions involve different countries or currencies.

For international payments, Stripe charges a 1.5% fee on transactions originating from international cards. This is in addition to the standard transaction fee. This revenue stream is particularly significant given the increasing volume of global e-commerce.

Furthermore, Stripe levies a 1% currency conversion fee whenever a transaction requires converting one currency to another. This fee ensures Stripe covers the costs and risks associated with currency exchange fluctuations, contributing substantially to its overall income.

- International Card Fees: A 1.5% charge on transactions processed using international cards.

- Currency Conversion Fees: A 1% fee applied when converting currencies during a transaction.

- Global Revenue Contribution: These fees are a significant driver of Stripe's revenue from its international payment processing.

Stripe's revenue streams are diverse, primarily driven by transaction fees, premium service subscriptions, and value-added financial tools. The company leverages its platform to offer a comprehensive suite of payment and financial management solutions, each contributing to its overall income.

| Revenue Stream | Description | Example Fee/Contribution (2025 Data) |

|---|---|---|

| Transaction Fees | Percentage and fixed fee on each payment processed. | 2.9% + $0.30 per online card transaction. |

| Subscription Fees | Recurring charges for premium services like Stripe Billing. | 0.7% of recurring billing volume or fixed monthly plans. |

| Value-Added Services | Fees for features like fraud prevention (Radar) and expedited payouts. | Varies by service usage. |

| Financial Services | Revenue from corporate cards and business financing. | Generated from card usage and financing interest. |

| Stripe Issuing | Transaction volume from custom branded cards. | Processed over $13.4 billion in transactions. |

| Stripe Connect | Facilitating payments for platforms and marketplaces. | Generated $340 million in new revenue. |

| Cross-Border/Currency Fees | Charges for international transactions and currency conversions. | 1.5% for international cards, 1% for currency conversion. |

Business Model Canvas Data Sources

The Stripe Business Model Canvas is informed by a blend of internal financial data, customer feedback, and market intelligence. This multi-faceted approach ensures each component accurately reflects Stripe's operational reality and strategic direction.