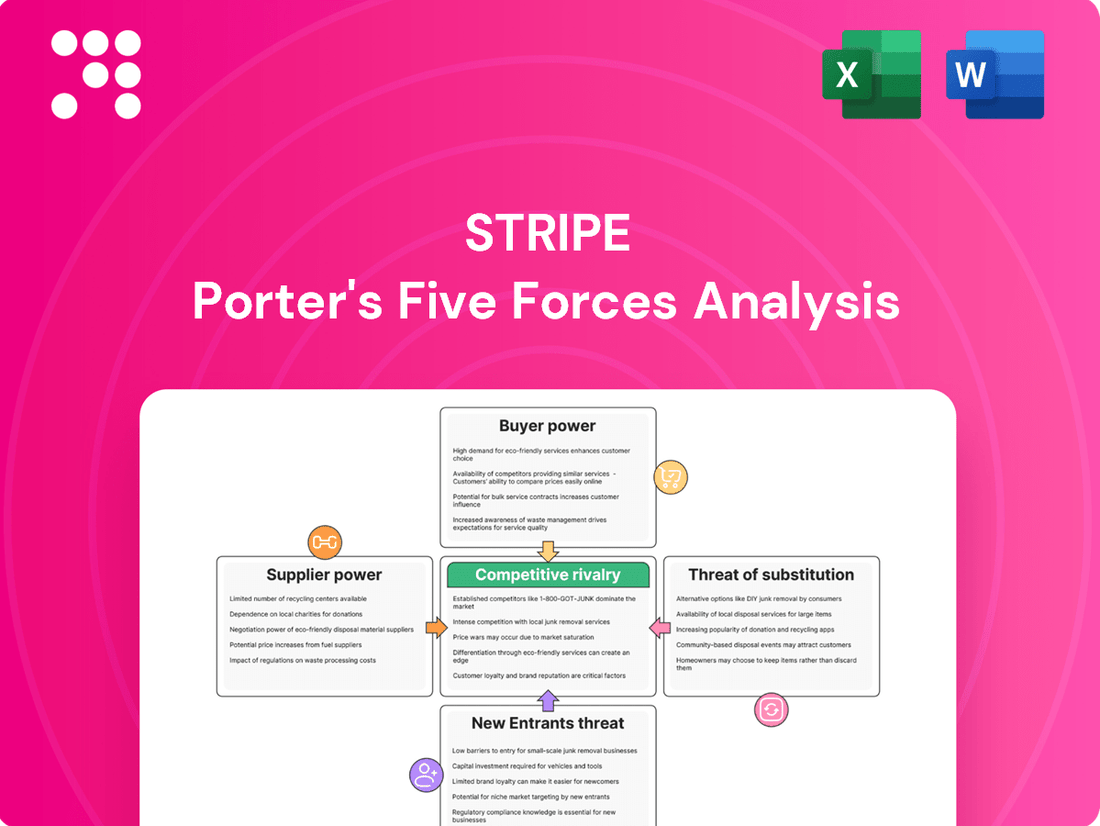

Stripe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stripe Bundle

Stripe operates in a dynamic fintech landscape, facing intense competition and evolving customer expectations. Understanding the underlying forces shaping this market is crucial for any stakeholder.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Stripe’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Stripe's reliance on financial institutions like banks and major payment networks such as Visa and Mastercard significantly impacts its bargaining power. These institutions dictate fees and contractual terms, giving them considerable leverage. In 2024, Visa and Mastercard's dominance in the U.S. credit card market, holding a substantial share, underscores their ability to set these terms.

Stripe's reliance on major cloud infrastructure providers like Amazon Web Services (AWS) and Google Cloud Platform grants these suppliers significant bargaining power. The critical nature of these services means Stripe cannot easily switch providers if terms become unfavorable. For instance, AWS reported over $62.5 billion in revenue for 2023, highlighting its substantial market presence and leverage.

However, Stripe actively manages this supplier power by diversifying its cloud infrastructure. By utilizing multiple providers, Stripe can negotiate more competitive pricing and service level agreements. This multi-cloud strategy reduces dependence on any single provider, thereby strengthening Stripe's position at the bargaining table and mitigating potential cost increases.

Stripe's reliance on specialized software and data for crucial functions like fraud detection and identity verification means these providers can hold considerable sway. If their solutions are truly one-of-a-kind or indispensable, they can command higher prices, directly impacting Stripe's operational expenses.

The bargaining power of these suppliers is further shaped by how easily Stripe can switch to alternatives and the associated costs of doing so. For instance, a significant shift in data providers could involve substantial integration and validation efforts, making such moves less appealing.

Labor Market and Talent Acquisition

The availability of skilled software engineers and fintech experts significantly impacts Stripe's operational costs and its capacity for innovation. A tight labor market, particularly for specialized roles in areas like AI and financial automation, can empower potential employees, driving up salary and benefit demands.

In 2024, the demand for top-tier software engineers remained exceptionally high, with average salaries for experienced engineers in major tech hubs often exceeding $150,000 annually. This competitive landscape directly influences Stripe's talent acquisition costs and its ability to retain crucial expertise.

- High Demand for Specialized Skills: The ongoing digital transformation across industries fuels a persistent need for engineers proficient in cloud computing, cybersecurity, and data analytics, all critical for Stripe's platform.

- Geographic Talent Concentration: While talent pools are global, significant concentrations of skilled professionals in areas like Silicon Valley and New York can create localized bidding wars for talent, impacting compensation benchmarks.

- Impact on Innovation: The ability to attract and retain top engineering talent is directly linked to Stripe's capacity to develop new features, improve existing services, and stay ahead in the rapidly evolving fintech sector.

Regulatory Bodies and Compliance Frameworks

Regulatory bodies, while not direct suppliers in the traditional sense, exert considerable influence over Stripe's operational expenses and strategic direction. Compliance with a complex web of global financial regulations, data privacy mandates like GDPR, and anti-money laundering (AML) protocols demands significant investment. These investments in legal, compliance, and technological infrastructure directly translate to increased operating costs, akin to a supplier's pricing power.

For instance, the Financial Crimes Enforcement Network (FinCEN) in the United States, along with similar bodies worldwide, imposes stringent AML and Know Your Customer (KYC) requirements. Stripe's 2023 annual report likely details substantial expenditures on compliance technology and personnel to navigate these evolving rules. Failure to comply can result in hefty fines, impacting profitability and market access.

- Increased operational costs due to compliance mandates.

- Significant investments in legal, compliance, and technology infrastructure.

- Potential for substantial fines and reputational damage from non-compliance.

Stripe's reliance on key financial institutions and payment networks like Visa and Mastercard significantly shapes supplier bargaining power. These entities, holding substantial market share in 2024, can dictate terms and fees, impacting Stripe's operational costs. Diversifying cloud infrastructure providers, such as AWS and Google Cloud, helps Stripe mitigate the leverage of these critical technology suppliers.

| Supplier Type | Key Players | Impact on Stripe | 2024 Context |

|---|---|---|---|

| Financial Institutions | Visa, Mastercard | Dictate fees, contractual terms | Dominant market share in credit card processing |

| Cloud Infrastructure | AWS, Google Cloud | Critical service reliance, switching costs | High revenue for providers indicates strong leverage |

| Specialized Software | Fraud detection, identity verification providers | Potential for higher prices if solutions are unique | Indispensable solutions command premium pricing |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Stripe's position as a leading online payment processor.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Small and medium-sized businesses (SMBs) represent a crucial segment for Stripe, and their sensitivity to transaction fees is a significant factor. The highly competitive landscape of payment processing means Stripe must consistently offer attractive pricing and be transparent about its costs to win and keep these businesses.

This price sensitivity directly influences Stripe's strategy. To remain competitive and retain its large SMB customer base, Stripe needs to balance its revenue goals with the need to offer cost-effective solutions. The sheer volume processed highlights this dynamic; in 2024, Stripe processed over $1 trillion in payments, demonstrating how critical it is to manage pricing effectively for such a large customer pool.

Large enterprises, crucial revenue drivers for payment processors like Stripe, increasingly demand sophisticated features and deep customization for their payment infrastructure. This trend intensified in 2024, as businesses sought to optimize checkout flows and integrate payments seamlessly with their unique operational software. For instance, many large e-commerce platforms require highly specific fraud detection rules and tailored subscription management capabilities that go beyond standard offerings.

The bargaining power of customers in the payment processing industry is significantly influenced by low switching costs. For businesses, moving from one payment gateway to another, like Stripe, often involves relatively straightforward integration processes. This ease of transition means that if a competitor emerges with more attractive pricing, superior features, or enhanced customer support, a business can make the switch with minimal operational disruption.

This dynamic directly empowers customers, compelling payment processors such as Stripe to remain highly competitive. For instance, in 2024, the market saw continued pressure on transaction fees as providers vied for market share. Stripe itself has historically focused on developer experience and robust APIs to retain clients, but the underlying low switching costs mean that price and feature parity remain critical battlegrounds, forcing continuous innovation and value proposition refinement.

Availability of Alternatives

The sheer number of payment processing alternatives available significantly boosts customer bargaining power. Companies like Square, PayPal, and Adyen, alongside many specialized providers, offer diverse options. This competitive landscape means businesses can easily switch providers if they aren't satisfied with Stripe's terms or features. For instance, in 2024, the global digital payments market was valued at over $1.8 trillion, highlighting the intense competition and the numerous players vying for market share. This abundance of choice empowers customers to demand better pricing, more integrated services, and superior customer support.

This availability forces Stripe to continually innovate and offer value beyond basic transaction processing. Customers can leverage the competitive environment to negotiate favorable rates and service level agreements.

- Increased competition from players like Square, PayPal, and Adyen provides businesses with ample choices for payment processing.

- The global digital payments market's substantial size, exceeding $1.8 trillion in 2024, underscores the intense competition.

- Customers can easily compare offerings, leading to pressure on Stripe to differentiate through pricing, features, and service quality.

Customer Knowledge and Information Availability

Customers, particularly larger enterprises, are becoming increasingly informed about the intricacies of payment processing. They actively seek out and compare pricing structures, feature sets, and service quality across various providers. This heightened awareness directly translates into greater bargaining power.

The readily available information regarding payment processing options empowers customers. They can leverage this knowledge to negotiate better terms and demand a higher level of service and value from providers like Stripe. For instance, by understanding the competitive landscape, a large e-commerce business might negotiate a lower per-transaction fee.

- Increased Information Access: Customers can easily compare pricing and features from multiple payment processors online.

- Negotiating Leverage: Greater knowledge allows customers to demand more favorable terms, such as lower fees or enhanced services.

- Focus on Value: Businesses are no longer just looking at cost but also at the overall value proposition, including reliability and integration capabilities.

- Data-Driven Decisions: Customer decisions are increasingly based on data and analytics, pushing providers to be more competitive and transparent.

The bargaining power of customers for payment processors like Stripe is substantial, driven by low switching costs and a highly competitive market. Businesses can easily move between providers, forcing Stripe to offer competitive pricing and superior features to retain them.

In 2024, the global digital payments market exceeded $1.8 trillion, with numerous players like Square, PayPal, and Adyen competing intensely. This abundance of choice empowers customers to demand better terms and services.

Customers are also more informed than ever, actively comparing pricing and features. This knowledge gives them significant leverage to negotiate favorable rates and enhanced value, pushing providers like Stripe towards continuous innovation and transparency.

| Factor | Impact on Stripe | Customer Action |

|---|---|---|

| Low Switching Costs | Pressure to maintain competitive pricing and services. | Easily move to alternative providers. |

| Numerous Alternatives | Need for differentiation beyond basic transaction processing. | Compare and select from a wide range of providers. |

| Increased Customer Information | Requirement for transparency in pricing and features. | Negotiate better terms based on market knowledge. |

Same Document Delivered

Stripe Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Stripe's competitive landscape through Porter's Five Forces, analyzing threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the payment processing industry. This comprehensive analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Stripe faces intense competition from established global payment processors such as PayPal, Square (now Block), and Adyen. PayPal, a dominant force, powers transactions for a substantially larger number of websites worldwide, indicating its extensive market reach.

Adyen and Square (Block) present formidable competition, mirroring Stripe's business model and actively vying for market share across various merchant segments. For instance, as of late 2023, Block reported a gross payment volume of $200 billion across its Seller ecosystem, showcasing its significant transaction processing capabilities.

While Stripe provides a broad suite of payment processing tools, its rivals often carve out distinct advantages by focusing on specific market segments or functionalities. For example, Square excels in omnichannel retail, seamlessly blending online and in-person transactions, a key differentiator for many small and medium-sized businesses.

Shopify Payments, naturally, offers deep integration for merchants already operating within the Shopify e-commerce ecosystem, providing a streamlined experience that reduces friction for their user base. This tight coupling is a significant competitive advantage for businesses built on that platform.

Furthermore, companies like PaymentCloud specialize in serving high-risk industries, a segment where Stripe and others may have more stringent underwriting or higher fees, demonstrating how niche specialization can effectively counter a more generalized offering.

Competitive rivalry in the payment processing space frequently centers on pricing and fee structures. For instance, some competitors, like Helcim, adopt an interchange-plus pricing model that includes volume discounts, directly challenging Stripe's established fee tiers.

Stripe's own pricing strategy is a significant consideration for businesses selecting a payment gateway. This intense competition can exert downward pressure on transaction fees, which in turn can affect the profitability of payment processors.

In 2024, the ongoing competition in the fintech sector means that businesses are increasingly scrutinizing these costs. For example, while Stripe's standard U.S. transaction fee is 2.9% + $0.30, the availability of alternative models with potentially lower overall costs for high-volume merchants remains a key competitive factor.

Innovation and Product Development

The fintech landscape thrives on relentless innovation, meaning competitors are constantly rolling out new capabilities. This includes sophisticated fraud detection, AI-driven tools, and integration with emerging payment technologies like stablecoins and open banking initiatives.

Stripe's commitment to research and development is paramount to staying ahead. In 2023, Stripe reported significant investments in its product suite, aiming to enhance developer experience and expand its global payment capabilities.

- Rapid Feature Rollouts: Competitors frequently introduce advanced fraud prevention and AI-powered analytics.

- Emerging Payment Support: Integration with stablecoins and open banking is a key battleground.

- R&D Investment: Stripe's sustained focus on innovation is vital for maintaining its market position.

- Developer Experience: Enhancing tools for developers is a critical differentiator in attracting and retaining users.

Geographic Expansion and Localized Solutions

Competitors are increasingly focused on global expansion, not just by entering new countries but by deeply understanding and adapting to local payment preferences and regulatory landscapes. This means supporting everything from specific regional bank transfers to complying with data privacy laws that vary significantly across jurisdictions.

Stripe itself is actively engaged in this geographic expansion strategy. For instance, the company is preparing for official launches in key Southeast Asian markets, Indonesia and the Philippines, slated for 2025. This move is a direct response to the growing digital economies in these regions and the demand for localized payment solutions.

The intense rivalry in this area is evident as companies strive to offer seamless, compliant payment processing worldwide. This often involves:

- Developing partnerships with local financial institutions to integrate regional payment methods.

- Investing in legal and compliance teams to navigate complex international regulations.

- Customizing product offerings to meet the unique needs of businesses operating in specific countries.

The payment processing industry is characterized by fierce competition, with players like PayPal, Square (Block), and Adyen posing significant challenges to Stripe. These rivals not only mirror Stripe's offerings but also actively target similar merchant segments, often with specialized solutions.

For example, Square's Seller ecosystem processed $200 billion in gross payment volume by late 2023, highlighting its substantial market presence. Competitors also differentiate through niche market focus, such as Square's strength in omnichannel retail, or by offering tailored pricing models like Helcim's interchange-plus with volume discounts.

This intense rivalry drives innovation and can lead to downward pressure on transaction fees, impacting profitability across the sector. In 2024, businesses are keenly evaluating these costs, with Stripe's standard U.S. fee of 2.9% + $0.30 being a point of comparison against competitors' potentially more advantageous structures for high-volume clients.

| Competitor | Key Strengths | 2023/2024 Data Points |

|---|---|---|

| PayPal | Extensive global reach, large user base | Powers transactions for a vast number of websites globally. |

| Square (Block) | Omnichannel retail, small-to-medium business focus | $200 billion gross payment volume (Seller ecosystem, late 2023). |

| Adyen | Global presence, enterprise solutions | Continues aggressive expansion into new markets. |

| Helcim | Interchange-plus pricing, volume discounts | Directly competes on pricing transparency and flexibility. |

SSubstitutes Threaten

Traditional bank transfers and ACH payments remain a significant threat to payment processors like Stripe, especially for high-value transactions and in markets with lower credit card adoption. These methods offer a direct route for funds, often with lower fees compared to card processing. For instance, in 2024, ACH network volume continued its steady growth, handling trillions of dollars annually, demonstrating its persistent relevance.

Stripe is actively mitigating this threat by enhancing its 'Pay by Bank' solutions, which leverage direct bank connections. This strategy aims to capture the cost-saving and security benefits of bank transfers, such as the absence of chargebacks, which are a common concern with card payments. This move is crucial as businesses increasingly seek cost-efficient payment rails.

Businesses can bypass aggregated platforms like Stripe by opting for direct payment gateways and dedicated merchant accounts. Providers such as Adyen offer these services, granting businesses greater autonomy over their payment infrastructure.

This direct approach can mitigate risks associated with platform dependency, like the potential for frozen funds, making it a compelling substitute for businesses seeking more control and stability in their payment processing.

The increasing popularity of digital wallets like Apple Pay and Google Pay, alongside Buy Now, Pay Later (BNPL) options and the growing interest in cryptocurrencies, offers alternatives to the traditional card payments that form a core part of Stripe's business. Stripe itself acknowledges this evolving landscape, having recently reintroduced crypto payments, specifically focusing on USDC, and now supporting over 100 different payment methods to remain competitive.

In-house Payment Processing Solutions

Large enterprises with substantial transaction volumes may opt to build and maintain their own internal payment processing systems, thereby circumventing third-party services like Stripe. This approach offers enhanced control and the potential for reduced long-term expenses, although it demands considerable initial capital outlay and specialized knowledge.

This internal development can be particularly appealing for companies operating in sectors with highly specific or complex payment requirements, such as financial services or large-scale e-commerce. For instance, a major online retailer processing billions of dollars annually might find it more cost-effective and secure to manage its payment infrastructure internally rather than relying on external providers. The ability to customize features, integrate seamlessly with existing enterprise resource planning (ERP) systems, and maintain direct oversight of data security are significant drivers.

- Cost Savings Potential: While upfront investment is high, companies like Amazon have historically built extensive in-house payment infrastructure, potentially realizing significant savings on transaction fees at scale.

- Control and Customization: In-house solutions offer unparalleled flexibility to tailor payment flows, fraud detection, and customer experience to specific business needs.

- Expertise Requirement: Developing and maintaining such systems necessitates a dedicated team of software engineers, security specialists, and compliance experts.

- Market Trends: While many businesses leverage third-party processors, the trend towards greater data control and specialized needs continues to make in-house solutions a viable, albeit complex, alternative for the largest players.

Cash and Offline Payment Methods

For businesses with a strong physical footprint, especially those serving less digitally-native customer bases, cash and other traditional offline payment methods continue to act as viable substitutes to digital payment platforms like Stripe. Even with Stripe's expansion into in-person payment solutions, the inherent presence of non-digital transaction options poses a competitive threat. For example, in 2024, the global cash usage, while declining, still represented a significant portion of transactions in many emerging markets, with some estimates suggesting it accounted for over 70% of consumer payments in certain regions.

This reliance on cash and offline methods is particularly pronounced in sectors such as small retail, informal markets, and certain service industries where digital adoption might be slower or less cost-effective for the merchant. While Stripe's value proposition is clear for online and increasingly for modern in-person retail, the persistence of these older payment forms means customers still have a readily available alternative if digital solutions are perceived as too complex, costly, or unavailable. In 2024, the World Bank reported that approximately 1.4 billion adults globally remained unbanked, highlighting a substantial segment for whom cash is the primary, if not only, payment method.

The threat of substitutes here isn't about direct competition on features but rather on accessibility and established habit. Businesses can still operate and thrive using only cash or checks, particularly if their customer demographic prefers these methods. This means Stripe faces a challenge in markets where the infrastructure and consumer behavior strongly favor non-digital transactions, requiring significant efforts to onboard both merchants and consumers to digital payment ecosystems.

The threat of substitutes for Stripe is multifaceted, encompassing traditional payment methods like bank transfers and cash, as well as emerging digital alternatives. These substitutes often offer lower costs or greater accessibility, particularly in specific markets or for certain transaction types. For instance, in 2024, ACH network volume continued its strong growth, handling trillions of dollars annually, demonstrating its persistent relevance as a lower-cost alternative to card processing.

Emerging digital wallets, Buy Now Pay Later (BNPL) services, and even cryptocurrencies represent significant substitutes, offering consumers and businesses different ways to transact. Stripe itself is adapting, reintroducing crypto payments and supporting over 100 payment methods to stay competitive. For large enterprises, building in-house payment systems is also a substitute, offering greater control and potential long-term cost savings, though requiring substantial investment and expertise.

Even in 2024, cash remains a considerable substitute, especially in emerging markets where unbanked populations are significant. The World Bank reported approximately 1.4 billion unbanked adults globally, highlighting the continued reliance on cash. This persistence of non-digital methods means Stripe must continuously work to onboard users to digital payment ecosystems, addressing both merchant and consumer preferences.

| Substitute Type | Key Advantages | Stripe's Counter-Strategy | Market Relevance (2024 Data) |

|---|---|---|---|

| Bank Transfers (ACH) | Lower fees, direct funds transfer | Enhanced 'Pay by Bank' solutions | Trillions in annual volume, steady growth |

| Digital Wallets / BNPL | Consumer convenience, deferred payment | Support for over 100 payment methods | Increasing consumer adoption |

| In-house Payment Systems | Control, customization, potential cost savings | Focus on developer tools and platform flexibility | Viable for large enterprises with high volume |

| Cash / Offline Methods | Accessibility, established habit | Expansion into in-person payments | Significant in emerging markets (e.g., ~70% of consumer payments in some regions) |

Entrants Threaten

The fintech landscape, especially in payment orchestration, is experiencing a surge of new companies. This is largely because it's become easier to start a business in this area. Cloud computing and open application programming interfaces (APIs) have significantly lowered the initial hurdles.

In 2024, the financial technology sector saw substantial investment, with global funding surpassing $100 billion. This influx of capital has empowered new entrants, enabling them to innovate rapidly and aggressively vie for market share.

New entrants can strategically focus on niche markets or underserved segments, developing specialized payment solutions that cater to specific industries, regions, or unique business models. This approach allows them to establish a beachhead, potentially before challenging larger players like Stripe in broader markets. For instance, a fintech startup could offer highly tailored payment processing for the burgeoning creator economy, a segment that might have evolving needs not fully addressed by generalist platforms.

Technological advancements, particularly in AI, blockchain, and open banking, present a significant threat of new entrants to the payment processing industry. These innovations allow startups to create highly efficient, secure, and cost-effective payment solutions, potentially unseating established players. For instance, AI can streamline fraud detection and customer onboarding, while blockchain offers enhanced transparency and reduced transaction fees. Open banking initiatives further lower barriers by enabling seamless data sharing between financial institutions and fintechs.

Regulatory Sandboxes and Supportive Ecosystems

Regulatory sandboxes, implemented in numerous jurisdictions, significantly reduce the barriers to entry for new fintech companies. These controlled environments allow startups to test novel financial services and products without facing the full weight of existing regulations. For instance, the UK's Financial Conduct Authority (FCA) sandbox has facilitated the testing of over 200 firms since its inception, many of which have gone on to launch commercially.

This easing of market access directly impacts established players like Stripe. A more permissive regulatory landscape can foster a surge of innovative startups, each potentially chipping away at market share or offering specialized services that compete with Stripe’s broader offerings. For example, by mid-2024, several countries in Southeast Asia had expanded their fintech sandbox programs, leading to an observable increase in new payment and lending platforms.

- Regulatory Sandboxes: Offer controlled testing grounds for new financial technologies.

- Reduced Barriers: Lower initial hurdles for fintech startups entering the market.

- Increased Competition: Intensify pressure on existing payment processors like Stripe.

- Emerging Markets: Jurisdictions like Singapore and the UAE are actively promoting these sandboxes, fostering innovation.

Venture Capital Funding and Investment

The fintech sector continues to attract substantial venture capital, with global fintech funding reaching approximately $40 billion in 2023. This influx of capital allows new entrants to aggressively invest in cutting-edge technology, extensive marketing campaigns, and rapid customer acquisition, even at the expense of short-term profitability. Such financial backing enables these startups to effectively challenge established players by offering competitive products and services.

This readily available funding acts as a significant barrier to entry for businesses lacking similar financial resources. Newcomers can sustain operations and growth for extended periods, absorbing initial losses to gain market share. For instance, in 2024, several neobanks and payment processing startups secured multi-million dollar funding rounds, enabling them to aggressively expand their user bases and product offerings, directly competing with traditional financial institutions.

- Venture Capital Investment: Global fintech funding in 2023 was around $40 billion.

- Impact on New Entrants: Capital enables heavy investment in product development and marketing.

- Competitive Advantage: Access to funding allows new players to operate at a loss initially and challenge incumbents.

- Sustained Growth: Startups can maintain operations and expand market share due to investor backing.

The threat of new entrants remains a significant factor for payment orchestration platforms. Lowered barriers to entry, fueled by technological advancements and supportive regulatory environments, mean more startups can emerge. These new players often leverage specialized solutions or target niche markets, creating competitive pressure. For example, the surge in digital payments and the rise of the creator economy have seen numerous specialized payment gateways appear, challenging established players.

In 2024, the fintech sector continued its robust growth, with significant venture capital flowing into new payment solutions. This readily available funding allows startups to invest heavily in technology and customer acquisition, even if it means operating at a loss initially. This financial backing is crucial for them to gain traction and compete effectively against incumbents.

Emerging markets and regulatory sandboxes further facilitate new entrants. Jurisdictions actively promoting fintech innovation provide controlled environments for testing new products, reducing the risk and time-to-market for startups. This trend is observable globally, with countries actively seeking to foster competitive fintech ecosystems.

| Factor | Description | Impact on Stripe | Example (2024) |

|---|---|---|---|

| Technological Advancements | AI, blockchain, and open banking enable efficient, secure, and cost-effective payment solutions. | New entrants can offer superior or specialized features. | AI-powered fraud detection startups gaining traction. |

| Reduced Barriers to Entry | Cloud computing and open APIs lower startup costs. | More companies can enter the market, increasing competition. | Ease of launching niche payment aggregators. |

| Regulatory Sandboxes | Controlled environments for testing new financial services. | Facilitates rapid innovation and market entry for startups. | UK FCA sandbox supporting over 200 firms by mid-2024. |

| Venture Capital Funding | Significant investment in fintech allows startups to scale rapidly. | New entrants can aggressively compete on price and features. | Several neobanks and payment startups securing multi-million dollar rounds. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Stripe is built upon a foundation of diverse data sources, including Stripe's own financial reports, investor presentations, and public statements. We also incorporate industry-specific market research, competitor analysis from financial data providers, and insights from regulatory bodies overseeing the payments industry.