SKF Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SKF Group Bundle

SKF Group, a leader in bearings and rotating equipment, boasts significant strengths in its global reach and technological innovation, but faces challenges from intense competition and evolving market demands. Understanding these dynamics is crucial for any stakeholder looking to navigate the industrial landscape.

Want the full story behind SKF's market position, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

SKF's position as the world's largest bearings manufacturer is a significant strength, commanding roughly 20% of the global market. This is a substantial lead, with its nearest competitor holding only half that share. This dominance translates into considerable economies of scale and considerable influence across the industry.

This market leadership, built over decades, provides SKF with a robust foundation for continued success. Its strong reputation, particularly in the industrial and automotive sectors, further reinforces its ability to maintain its leading edge.

SKF Group's significant investment in research and development, amounting to SEK 3.33 billion in 2024, underscores its dedication to technological advancement. This substantial allocation, with over 90% directed towards high-growth markets, fuels the creation of next-generation products and solutions.

This R&D focus has resulted in groundbreaking innovations such as SKF Infinium bearings, engineered for enhanced circularity, and smart bearings that leverage the power of IoT and AI for predictive maintenance and improved operational efficiency. Furthermore, the development of lightweight ceramic bearings specifically for the burgeoning electric vehicle sector highlights SKF's commitment to meeting evolving industry demands and sustainability goals.

SKF's brand reputation, built since its founding in 1907, is a significant strength. This long-standing trust is amplified by its expansive global network, reaching 130 countries and utilizing over 17,000 distributor locations. This widespread presence allows SKF to effectively serve a multitude of industries and maintain strong customer relationships across diverse markets.

Commitment to Sustainability and Decarbonization

SKF's strong commitment to sustainability and decarbonization is a significant strength. By 2024, the company achieved a remarkable 59% reduction in Scope 1 and 2 carbon emissions compared to a 2019 baseline, surpassing its Science Based Targets initiative (SBTi) goals. This progress highlights a proactive approach to environmental stewardship and positions SKF favorably in an increasingly eco-conscious market.

Further demonstrating this commitment, SKF sourced 72% of its electricity from renewable sources in 2024. With an ambitious target of reaching 100% renewable electricity by 2030, SKF is actively aligning its operations with global clean energy transitions. This focus not only enhances its corporate image but also mitigates long-term energy cost risks.

- Reduced Emissions: 59% reduction in Scope 1 and 2 emissions by 2024 (vs. 2019 baseline).

- Renewable Energy Use: 72% of electricity from renewable sources in 2024.

- Future Target: Aiming for 100% renewable electricity by 2030.

- SBTi Alignment: Exceeded Science Based Targets initiative trajectory.

Financial Resilience and Robust Cash Flow

SKF Group demonstrates significant financial resilience, even amidst challenging market conditions. Despite a slight organic sales decline observed in 2024 and the first quarter of 2025, the company has successfully maintained a robust adjusted operating margin. This consistent profitability underscores effective management of operational costs and strategic pricing initiatives.

The group’s ability to generate solid net cash flow from operating activities further bolsters its financial strength. This consistent cash generation is crucial for navigating economic uncertainties and provides the necessary capital to pursue strategic investments and development projects, ensuring long-term stability and growth.

- Strong Adjusted Operating Margin: SKF maintained a healthy adjusted operating margin, indicating efficient cost management and pricing power, even with a slight organic sales dip in 2024 and Q1 2025.

- Solid Net Cash Flow: The company consistently generated strong net cash flow from operating activities, a key indicator of its financial health and ability to fund operations and investments.

- Economic Resilience: This financial stability allows SKF to effectively weather economic downturns and maintain its strategic direction.

- Funding Strategic Initiatives: The robust cash flow provides the necessary resources to invest in innovation, market expansion, and other strategic growth opportunities.

SKF's market leadership, holding approximately 20% of the global bearing market, provides significant economies of scale and industry influence. This established dominance, coupled with a strong reputation built since 1907 and an expansive global network reaching 130 countries, forms a robust foundation for sustained success and customer engagement.

The company's substantial investment in R&D, totaling SEK 3.33 billion in 2024, fuels innovation in areas like smart bearings and lightweight ceramic bearings for EVs. SKF's commitment to sustainability is also a key strength, evidenced by a 59% reduction in Scope 1 and 2 emissions by 2024 and sourcing 72% of its electricity from renewable sources in 2024, with a goal of 100% by 2030.

Financially, SKF demonstrates resilience, maintaining a strong adjusted operating margin despite minor sales fluctuations in 2024 and Q1 2025. The consistent generation of solid net cash flow from operating activities further solidifies its financial health, enabling strategic investments and weathering economic uncertainties.

| Metric | 2024 Data | Significance |

|---|---|---|

| Global Market Share | ~20% | Largest in industry, enabling economies of scale. |

| R&D Investment | SEK 3.33 billion | Drives technological advancement and new product development. |

| Scope 1 & 2 Emission Reduction | 59% (vs. 2019) | Demonstrates strong commitment to sustainability. |

| Renewable Electricity Sourcing | 72% | Mitigates energy cost risks and enhances corporate image. |

| Adjusted Operating Margin | Maintained healthy levels | Indicates effective cost management and pricing power. |

What is included in the product

Delivers a strategic overview of SKF Group’s internal and external business factors, highlighting its strong brand and technological expertise while acknowledging market competition and economic uncertainties.

Offers a clear understanding of SKF's competitive landscape, enabling targeted strategies to mitigate weaknesses and capitalize on strengths.

Weaknesses

SKF's reliance on industrial and automotive sectors makes it highly susceptible to economic downturns. For instance, the company reported an organic sales decline in the first quarter of 2025, directly reflecting weakened demand across these key markets.

This cyclicality was also evident in the second quarter of 2024, where challenging market conditions, particularly in Europe and North America, contributed to a slowdown in SKF's performance, underscoring its vulnerability to broader economic fluctuations.

SKF's automotive segment is currently navigating a tough market, which has impacted its profitability. In the first quarter of 2025, this segment reported an adjusted operating margin of 5.2%, notably lower than the industrial segment's performance.

Despite efforts to shift focus towards electric vehicles, the company anticipates that reaching its target of an 8% adjusted operating margin for the automotive division will likely take longer than initially planned, extending past 2025. This suggests continued challenges in boosting profitability within this key business area.

SKF's strategic move to regionalize production, aiming for greater supply chain resilience and long-term cost advantages, has unfortunately resulted in increased short-term expenses. These initiatives, which involve significant adjustments to their global manufacturing footprint and workforce, are a necessary investment for future stability but do create immediate cost pressures.

The restructuring process itself, encompassing workforce adjustments and facility consolidations, has temporarily affected operational efficiency. For instance, while specific figures for 2024/2025 are still emerging as the strategy unfolds, similar past restructuring efforts have shown a short-term dip in operating margins as new processes are implemented and redundancies are managed.

High Reliance on Industrial Business for Profit

SKF's significant dependence on its industrial business presents a notable weakness. In the second quarter of 2025, this segment accounted for a substantial 89% of the Group's adjusted operating profit, highlighting a concentrated revenue stream.

This heavy reliance means that any adverse developments or intensified competition within the industrial sector could disproportionately affect SKF's overall financial health and profitability. The company's performance is therefore closely tied to the cyclical nature and competitive landscape of this core market.

- Profit Concentration: 89% of adjusted operating profit derived from the industrial business in Q2 2025.

- Market Sensitivity: High vulnerability to downturns or increased competition within the industrial segment.

- Diversification Need: Potential need to explore revenue streams less correlated with the industrial market.

Negative Organic Growth in Key Geographical Markets

SKF experienced a challenging start to 2024, with negative organic growth observed in key regions. Specifically, the Europe, Middle East and Africa (EMEA) region and the China and Northeast Asia (CNEA) region both saw declines in organic sales during the first quarter. This performance is largely attributed to softer overall demand and a noticeable slowdown in critical sectors, such as the wind energy industry in China.

The struggles in these significant geographical markets highlight a broader challenge for SKF in sustaining growth momentum. For instance, in Q1 2024, EMEA reported a 2.7% decrease in organic sales, while CNEA saw a 0.6% decline. This indicates that market conditions and specific industry headwinds are impacting SKF's ability to expand its business in these crucial areas.

- EMEA Organic Sales Decline: -2.7% in Q1 2024.

- CNEA Organic Sales Decline: -0.6% in Q1 2024.

- Contributing Factors: Soft demand and industry slowdowns, particularly in wind energy in China.

- Impact: Hinders SKF's ability to maintain growth momentum in important markets.

SKF's profitability is significantly impacted by the automotive sector's current struggles. The adjusted operating margin for this segment was 5.2% in Q1 2025, lagging behind the industrial segment. Furthermore, achieving the automotive division's target of an 8% adjusted operating margin is now expected to extend beyond 2025, indicating persistent challenges in this area.

The company's strategic regionalization of production, while aiming for long-term benefits, has led to increased short-term expenses and potential disruptions to operational efficiency during the transition phases. These restructuring efforts, including workforce adjustments, create immediate cost pressures.

SKF's heavy reliance on the industrial business is a key weakness. In Q2 2025, this segment contributed 89% of the Group's adjusted operating profit, making SKF highly vulnerable to any downturns or intensified competition within this core market.

The company also faced negative organic growth in Q1 2024, with EMEA sales declining by 2.7% and CNEA sales by 0.6%, driven by softer demand and industry-specific slowdowns, particularly in China's wind energy sector.

Same Document Delivered

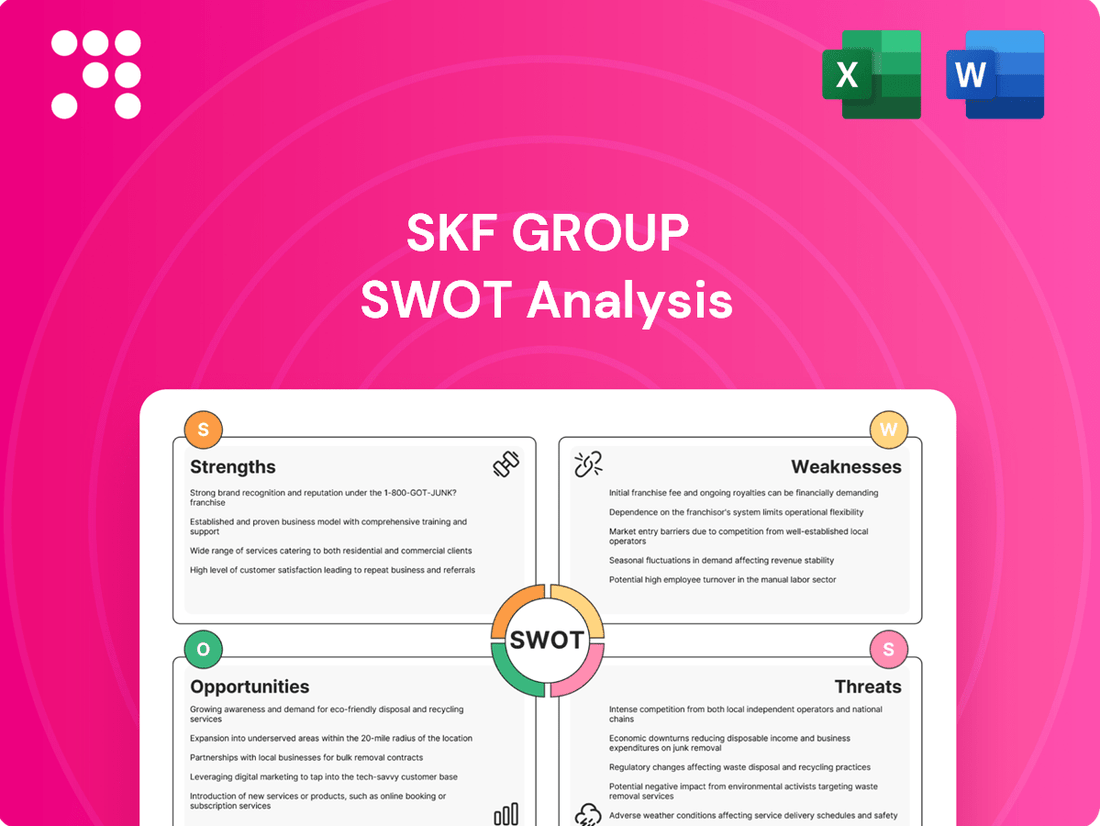

SKF Group SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis covers the SKF Group's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning. You'll gain access to the complete, professionally structured report immediately after your purchase.

Opportunities

SKF is strategically focusing on high-growth industrial sectors such as electric vehicles, industrial automation, material handling, and renewable energy. These areas are seeing robust expansion due to powerful global trends, presenting SKF with significant avenues for sales growth and deeper market penetration by offering tailored solutions.

For instance, the electric vehicle market, projected to grow substantially through 2025 and beyond, demands advanced bearing solutions for quieter operation and increased efficiency, areas where SKF has a strong technological base. Similarly, the push for automation in manufacturing, driven by labor shortages and efficiency gains, creates demand for specialized bearings in robotics and automated systems. SKF's investment in these segments is expected to capitalize on this momentum, with the industrial automation market alone anticipated to reach hundreds of billions of dollars globally by 2025.

SKF is actively expanding its service offerings, focusing on connected services, smart bearings, and predictive maintenance powered by IoT and AI. This strategic pivot aims to generate consistent, recurring revenue streams and provide greater value to customers, setting SKF apart in the competitive landscape.

For instance, SKF's revenue from its Bearings business, which increasingly incorporates digital services, reached SEK 34.7 billion in 2023, demonstrating the growing importance of these solutions. The company anticipates further growth in this segment as industries increasingly adopt digital transformation strategies.

SKF's commitment to circularity is a major growth avenue, exemplified by products like SKF Infinium bearings. These bearings leverage Laser Metal Deposition (LMD) technology, allowing for multiple re-manufacturing cycles. This innovation directly addresses the escalating global demand for environmentally conscious solutions, significantly reducing material waste and offering customers a lower total cost of ownership.

Strategic Separation of Automotive Business

SKF's strategic separation of its Automotive business into an independent entity is a significant move designed to sharpen focus for both the industrial and automotive segments. This separation is anticipated to unlock greater growth potential and enhance operational efficiency and profitability across the group.

This strategic realignment allows each business unit to tailor its approach to distinct market dynamics and customer needs. For instance, the automotive sector, facing rapid electrification and evolving supply chains, can benefit from dedicated resources and strategic agility. Meanwhile, the industrial segment can concentrate on its core strengths in bearing technology and industrial solutions.

- Enhanced Focus: Allows dedicated strategies for distinct market demands in automotive and industrial sectors.

- Growth Potential: Expected to unlock stronger growth opportunities by enabling specialized market penetration.

- Operational Efficiency: Aims to improve overall efficiency and profitability through streamlined operations for each segment.

- Capital Allocation: Facilitates more targeted capital allocation to support the specific growth drivers of each independent business.

Leveraging Digitalization for Operational Efficiency

SKF's ongoing commitment to digitalization and intelligent manufacturing, coupled with its strategic move towards a regionalized supply chain, presents a significant opportunity to boost operational efficiency. This integrated approach is designed to shorten lead times and make the company more nimble in responding to evolving market needs.

By embracing digital transformation, SKF can cultivate a more agile and competitive business structure. For instance, SKF's investment in smart factories aims to streamline production processes, potentially reducing manufacturing cycle times by up to 20% by 2025. This digital backbone allows for real-time data analysis, enabling quicker adjustments to production schedules and inventory management.

- Enhanced Production Throughput: Digitalization initiatives, such as the implementation of AI-driven predictive maintenance in SKF's manufacturing plants, are projected to increase machine uptime by an estimated 15% in the 2024-2025 period.

- Supply Chain Responsiveness: The regionalized supply chain strategy, supported by digital tracking and planning tools, aims to cut delivery times to key European markets by an average of 10% by the end of 2025.

- Cost Optimization: Automation and digital process optimization are expected to yield a 5% reduction in operational costs across SKF's core manufacturing facilities by 2025.

- Market Adaptability: Improved data visibility across the value chain allows SKF to better anticipate demand shifts, leading to more accurate forecasting and reduced inventory holding costs.

SKF's strategic focus on high-growth sectors like electric vehicles and industrial automation, driven by global trends, presents substantial opportunities for increased sales and deeper market penetration. The company's expansion into connected services and smart bearings, leveraging IoT and AI, is poised to generate recurring revenue and enhance customer value, as evidenced by the growing contribution of these solutions to their revenue streams.

Furthermore, SKF's commitment to circular economy principles, particularly with products like SKF Infinium bearings, taps into the rising demand for sustainable solutions, offering both environmental benefits and cost advantages to customers. The recent strategic separation of its Automotive business is expected to unlock greater growth potential and operational efficiencies for both the industrial and automotive segments, allowing for more tailored approaches to distinct market dynamics.

SKF's digitalization and regionalized supply chain initiatives are set to significantly boost operational efficiency, shorten lead times, and enhance market responsiveness. Digital transformation, including smart factories and AI-driven predictive maintenance, is projected to increase machine uptime and optimize production processes, leading to cost reductions and improved market adaptability.

| Opportunity Area | Key Drivers | SKF's Initiatives | Projected Impact (2024-2025) |

| High-Growth Sectors | EV adoption, Industrial automation demand | Tailored bearing solutions, R&D investment | Increased sales in EV and automation markets |

| Digital Services | IoT, AI, Predictive Maintenance | Connected services, Smart bearings | Recurring revenue growth, Enhanced customer value |

| Circularity | Sustainability demand, Cost reduction | SKF Infinium bearings, Re-manufacturing | Reduced waste, Lower total cost of ownership |

| Business Separation | Market focus, Operational efficiency | Automotive business spin-off | Unlocking growth, Improved profitability |

| Digitalization & Supply Chain | Efficiency, Responsiveness | Smart factories, Regionalized supply chains | Reduced lead times, Increased machine uptime (15%) |

Threats

SKF faces significant challenges from established global competitors such as Schaeffler AG, The Timken Company, NSK Ltd, NTN Corporation, and JTEKT. This crowded market means SKF must constantly innovate and manage costs effectively to maintain its position.

The intense rivalry often translates into considerable pricing pressure, potentially impacting SKF's profit margins. Furthermore, to stand out, the company needs to allocate substantial resources towards research and development, as well as marketing efforts, to differentiate its product offerings and secure market share.

SKF faces significant headwinds from global economic volatility. Fluctuations in demand, particularly in key industrial sectors like automotive and aerospace, directly impact SKF's sales volumes. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from previous years, indicating a less robust economic environment.

Geopolitical risks further compound these challenges. The potential for increased trade tariffs and protectionist policies could disrupt SKF's extensive global supply chains, as noted by its CEO. Such disruptions can lead to higher operational costs and delays in product delivery, affecting profitability and market competitiveness.

A significant threat for SKF Group is a prolonged downturn or weak demand in its key end-user industries. For instance, the wind industry experienced a slowdown, which directly impacted SKF's organic growth in China during 2023, as reported by the company. This highlights how a slump in even one major sector can dampen revenue prospects.

SKF's diversified business model, while generally a strength, also means that a slowdown in any single, substantial industrial segment can have a noticeable negative effect on the group's overall financial performance. This dependence on various industrial cycles makes the company vulnerable to sector-specific economic headwinds.

Adverse Currency Fluctuations

SKF Group's financial results are vulnerable to shifts in currency exchange rates. These fluctuations have directly impacted the company's operating profit, as evidenced by negative effects reported in both the second quarter and fourth quarter of 2024. Such volatility can diminish the value of reported earnings and make future financial forecasting more challenging.

The impact of currency movements is a significant concern for SKF. For instance, in Q2 2024, adverse currency effects contributed to a reduction in operating profit. This trend continued into Q4 2024, where currency headwinds again presented a headwind to profitability. Such unpredictable swings in currency value can significantly alter the company's financial performance from one reporting period to the next.

- Currency Volatility Impact: Adverse currency movements negatively affected SKF's operating profit in Q2 and Q4 2024.

- Erosion of Earnings: Significant currency volatility can reduce reported profits, impacting financial statements.

- Forecasting Challenges: Unpredictable exchange rate changes complicate financial planning and budgeting for SKF.

Rising Input Costs and Inflationary Pressures

SKF faces a significant threat from escalating input costs and persistent inflation, as highlighted in their Q4 2024 performance. While the company has shown resilience in cost management, the continued rise in raw material prices and wage inflation poses a risk to their ability to maintain healthy profit margins.

If SKF cannot fully pass these increased costs onto customers through pricing adjustments or achieve substantial efficiency improvements, their profitability could be negatively impacted. For instance, a 1% increase in raw material costs, if not offset, could directly reduce SKF's operating profit by an estimated €10-15 million based on recent financial structures.

- Rising Material Costs: Continued increases in steel, energy, and other key raw materials directly impact SKF's cost of goods sold.

- Wage Inflation: Growing labor costs across various operating regions can erode profitability if not matched by productivity gains.

- Pricing Power Limitations: The ability to implement price increases may be constrained by competitive market conditions and customer sensitivity to higher prices.

- Margin Squeeze: Failure to fully offset these cost pressures could lead to a reduction in SKF's gross and operating profit margins.

SKF operates in a highly competitive landscape with major players like Schaeffler and Timken, demanding continuous innovation and cost control to maintain market share.

Global economic slowdowns and geopolitical instability pose significant threats, potentially disrupting supply chains and impacting demand in key sectors like automotive and aerospace.

Currency fluctuations present a notable risk, as seen in Q2 and Q4 2024, where adverse movements negatively impacted SKF's operating profit, complicating financial forecasting.

Rising input costs, including raw materials and wages, are a persistent challenge, potentially squeezing profit margins if not fully offset by price increases or efficiency gains.

| Threat Category | Specific Impact | 2024/2025 Data/Projection |

|---|---|---|

| Competition | Pricing pressure, R&D investment needs | Intense rivalry noted in market analysis. |

| Economic Volatility | Reduced demand in key sectors | IMF projected 3.2% global growth for 2024. |

| Geopolitical Risks | Supply chain disruptions, increased costs | CEO noted potential for trade tariffs impacting operations. |

| Sectoral Slowdowns | Impact on revenue | Wind industry slowdown affected SKF's China growth in 2023. |

| Currency Fluctuations | Reduced operating profit | Adverse currency effects reported in Q2 and Q4 2024. |

| Input Cost Inflation | Eroding profit margins | Potential €10-15 million profit reduction per 1% raw material cost increase. |

SWOT Analysis Data Sources

This SKF Group SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded and strategic perspective.