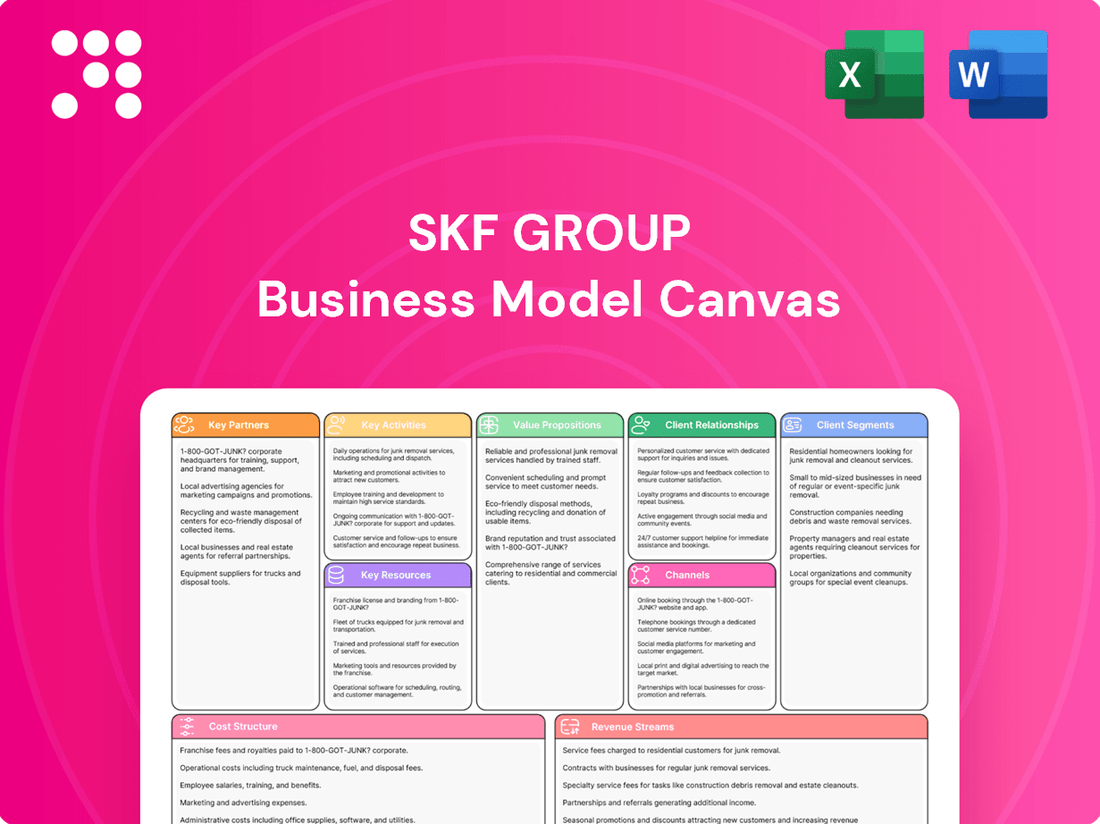

SKF Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SKF Group Bundle

Unlock the strategic blueprint behind SKF Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how SKF innovates, partners, and delivers value to its diverse customer base. Dive into the core elements that drive their market leadership.

Partnerships

SKF’s strategic suppliers are vital for securing high-quality raw materials and components, with a notable focus on sourcing green steel and sustainable lubricants. This commitment ensures manufacturing excellence and supports SKF's decarbonization goals throughout its value chain.

Collaborations with technology partners are instrumental in integrating advanced solutions such as AI and IoT into SKF's products and operations. These partnerships enhance product capabilities and drive significant improvements in operational efficiency, reflecting SKF's forward-looking approach to innovation.

SKF actively partners with industry associations and leading research institutions globally to remain at the cutting edge of bearing technology and related fields. These collaborations are crucial for driving innovation in areas like electrification and intelligent manufacturing, with SKF investing significantly in R&D, for example, their €1.1 billion R&D expenditure in 2023 underscores this commitment. By engaging with these bodies, SKF gains access to specialized expertise and contributes to the development of industry standards, helping to tackle complex engineering challenges in sectors such as renewable energy.

SKF's extensive global network, comprising over 17,000 distributors, is a cornerstone of its business model, ensuring efficient product delivery and localized customer support. This vast network allows SKF to penetrate diverse geographic markets and serve a wide array of industrial sectors effectively.

These channel partners are instrumental in extending SKF's market reach, providing essential access to its comprehensive range of bearings, seals, and lubrication solutions. Their local presence facilitates timely product availability and crucial technical assistance for end-users across the globe.

Customers for Co-creation and Solution Development

SKF actively collaborates with leading industrial and automotive clients to jointly develop bespoke solutions. These partnerships are designed to tackle unique operational hurdles and advance sustainability objectives.

This strategy ensures SKF's innovation pipeline is closely tied to actual market demands, resulting in the creation of products that offer significant value. For instance, in 2024, SKF launched a new generation of bearings with enhanced sealing technology, a direct result of feedback from key partners in the wind energy sector seeking improved longevity in harsh environments.

- Customer-Driven Innovation: SKF's co-creation model prioritizes customer input for product development.

- Tailored Solutions: Partnerships focus on customizing products for specific performance enhancements.

- Sustainability Focus: Collaborations often target improvements in energy efficiency and product lifespan.

- Market Alignment: This approach ensures SKF's offerings directly meet evolving industry needs.

Sustainability and Circular Economy Collaborators

SKF actively seeks partnerships focused on sustainability and the circular economy. For instance, SKF collaborates with companies to transform residual materials from bearing production into new special steel, demonstrating a commitment to resource efficiency. In 2023, SKF reported a 20% reduction in CO2 emissions from its own operations compared to 2022, highlighting the impact of such collaborations.

These collaborations are crucial for achieving SKF's ambitious decarbonization targets. By working with partners on initiatives like developing circular solutions for end-of-life bearings, SKF aims to minimize its environmental footprint across the entire product lifecycle. This strategic approach supports SKF's goal to achieve net-zero emissions by 2050.

- Circular Material Transformation: Partnerships focused on turning production by-products into valuable new materials.

- Environmental Impact Reduction: Collaborations aimed at lowering emissions and waste throughout the value chain.

- Resource Efficiency Promotion: Joint efforts to maximize the use of resources and promote recycling.

- Decarbonization Goal Support: Alliances contributing to SKF's science-based targets for emission reduction.

SKF's key partnerships are diverse, encompassing strategic suppliers for raw materials, technology collaborators for innovation, and an extensive distributor network for market reach. These alliances are crucial for product development, operational efficiency, and customer service, with a strong emphasis on sustainability and co-creation with major clients.

| Partner Type | Focus Area | Impact/Example | 2023/2024 Data Point |

|---|---|---|---|

| Strategic Suppliers | Green steel, sustainable lubricants | Ensures quality, supports decarbonization | SKF invested €1.1 billion in R&D in 2023 |

| Technology Partners | AI, IoT integration | Enhances product capabilities, operational efficiency | N/A (Ongoing integration) |

| Research Institutions & Industry Associations | Bearing technology, electrification | Drives innovation, sets industry standards | N/A (Continuous collaboration) |

| Distributors (17,000+) | Product delivery, customer support | Global market penetration, localized service | N/A (Network size) |

| Industrial & Automotive Clients | Bespoke solutions, sustainability | Co-creation of products meeting market demands | Launched new generation bearings in 2024 based on wind energy sector feedback |

| Sustainability Partners | Circular economy, material transformation | Reduces waste, promotes resource efficiency | 20% reduction in CO2 emissions from own operations in 2023 vs 2022 |

What is included in the product

A comprehensive, pre-written business model tailored to SKF's strategy, organized into 9 classic BMC blocks with full narrative and insights, reflecting their real-world operations and plans.

This model covers customer segments, channels, and value propositions in detail, designed to help entrepreneurs and analysts make informed decisions and supports validation of business ideas using real company data.

SKF's Business Model Canvas offers a structured approach to pinpointing and resolving operational inefficiencies, acting as a powerful pain point reliever by clarifying value propositions and customer relationships.

It provides a clear, visual framework to identify and address friction points within SKF's operations, enabling targeted solutions for improved performance.

Activities

SKF's commitment to Research and Development (R&D) is a cornerstone of its strategy, driving innovation in bearing, seal, mechatronics, and lubrication technologies. The company directs significant investment towards high-growth sectors and emerging trends, such as electrification and intelligent manufacturing, ensuring its offerings remain at the forefront of industry advancements.

In 2023, SKF continued its focus on innovation, introducing new solutions designed to boost customer reliability, energy efficiency, and overall performance. This dedication to continuous improvement is evident in their product pipeline and market reception.

A substantial part of SKF's R&D efforts in 2024 is channeled into integrating Internet of Things (IoT) and Artificial Intelligence (AI). This focus is primarily aimed at developing sophisticated predictive maintenance solutions, which promise to revolutionize how industries manage equipment health and operational uptime.

SKF's manufacturing and production activities are centered on producing a diverse portfolio including bearings, seals, lubrication systems, and mechatronics. A key focus is on continually refining these production processes for greater efficiency.

In 2024, SKF is actively strengthening its regional supply chains and making strategic investments in its manufacturing facilities. This initiative aims to boost competitiveness and significantly shorten delivery times for customers.

The company is also expanding its production capabilities for ceramic bearings. This expansion is driven by the increasing demand for these specialized components in applications requiring very high rotational speeds.

SKF's sales and marketing efforts are geared towards reaching a wide array of customers in industries like manufacturing, transportation, and aviation. This involves carefully managing their product offerings, setting competitive prices, and focusing on growing their business in the aftermarket where they service existing equipment.

In 2024, SKF continued to emphasize its global distribution network, a vital component for ensuring customers can get the parts they need, when they need them. This network is key to maintaining product availability and supporting SKF's commitment to timely delivery across its various markets.

Service Provision and Condition Monitoring

SKF's core activities revolve around providing comprehensive services that enhance machinery performance. This includes condition monitoring, which uses sensors and data analysis to detect potential issues before they cause failures. Predictive maintenance strategies are then employed to schedule repairs proactively, minimizing downtime and associated costs for clients.

Furthermore, SKF offers specialized lubrication management services. Proper lubrication is critical for reducing wear and tear on rotating equipment, and SKF's expertise ensures optimal lubrication practices are implemented. These services collectively aim to boost operational efficiency and extend the lifespan of customer assets.

- Condition Monitoring: SKF provides advanced sensor technology and data analytics to continuously monitor equipment health, enabling early detection of anomalies.

- Predictive Maintenance: Leveraging insights from condition monitoring, SKF develops and implements predictive maintenance schedules to prevent unexpected breakdowns.

- Lubrication Management: SKF offers expert guidance and solutions for optimizing lubrication processes, ensuring machinery operates smoothly and reliably.

- Digital Solutions: The company utilizes remote diagnostics centers and digital platforms to deliver proactive support and enhance equipment uptime for its global customer base.

Strategic Business Transformation and Optimization

SKF is actively pursuing strategic business transformation, notably by initiating the separation of its Automotive business into a standalone entity. This move is designed to foster more concentrated growth and strategic focus within that segment.

The company is also implementing rightsizing measures and diligently optimizing its cost structure. These initiatives are crucial for bolstering SKF's long-term competitiveness and improving overall profitability.

- Strategic Restructuring: SKF is creating an independent Automotive business to drive focused growth.

- Cost Optimization: Rightsizing and cost structure improvements are key to enhancing competitiveness.

- Agility Enhancement: These efforts aim to build a leaner and more adaptable organization.

- Financial Impact: While specific 2024 financial impacts are still unfolding, these transformations are expected to yield significant improvements in operational efficiency and market responsiveness.

SKF's key activities encompass robust research and development, focusing on advanced bearing, seal, and lubrication technologies, with a significant 2024 push into IoT and AI for predictive maintenance.

Manufacturing excellence is a core activity, producing a wide range of components while enhancing regional supply chains and expanding ceramic bearing production. Their sales and marketing efforts leverage a global distribution network to serve diverse industries, with a particular emphasis on aftermarket services.

Crucially, SKF provides value-added services like condition monitoring and lubrication management, aiming to boost customer reliability and asset lifespan. The company is also undergoing strategic transformation, including the separation of its Automotive business and ongoing cost optimization initiatives.

| Activity Area | Key Focus Areas | 2024 Initiatives/Data |

|---|---|---|

| Research & Development | Bearing, Seal, Mechatronics, Lubrication Tech | IoT & AI integration for predictive maintenance; focus on electrification. |

| Manufacturing & Production | Diverse component production, process efficiency | Strengthening regional supply chains; expanding ceramic bearing capacity. |

| Sales & Marketing | Global customer reach, aftermarket growth | Optimizing global distribution network for product availability. |

| Services | Condition monitoring, predictive maintenance, lubrication management | Enhancing operational efficiency and asset lifespan for customers. |

| Strategic Transformation | Business separation, cost optimization | Separating Automotive business; rightsizing and cost structure optimization. |

Full Document Unlocks After Purchase

Business Model Canvas

The SKF Group Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis you'll gain access to, allowing you to understand SKF's strategic framework with complete confidence.

Resources

SKF Group's intellectual property, including its vast patent portfolio and proprietary designs in bearings and seals, forms a cornerstone of its competitive edge. This deep well of advanced engineering knowledge fuels its ability to create groundbreaking solutions for various industries.

In 2023, SKF reported substantial investments in research and development, underscoring its commitment to innovation and the continuous expansion and protection of its technological leadership. This ongoing R&D effort ensures SKF remains at the forefront of its specialized fields.

SKF operates a global network of manufacturing facilities, providing substantial production capacity essential for serving diverse international markets. This extensive footprint allows for efficient global reach and localized support.

In 2023, SKF continued to invest in modernizing its manufacturing processes and enhancing productivity across its sites. Regionalization strategies are actively being implemented to bolster supply chain resilience and shorten delivery times, a critical factor in today's dynamic market.

SKF's commitment to innovation is evident in its ongoing investments in advanced manufacturing technologies. For instance, the company has been focusing on smart factory initiatives to improve operational efficiency and flexibility, ensuring it can adapt to evolving customer demands and market conditions.

SKF's business model hinges on its highly skilled workforce, comprising engineers, researchers, and technical specialists. These professionals are the driving force behind SKF's innovation, product development, and crucial customer support, ensuring the delivery of advanced engineering solutions.

The company actively invests in continuous employee development, with a strategic focus on upskilling in emerging fields like Artificial Intelligence. This commitment to human capital development is essential for SKF to maintain its technological leadership and competitive edge in the market.

In 2024, SKF continued its emphasis on talent, with a significant portion of its global workforce engaged in roles directly contributing to engineering and technical expertise. This human capital is the bedrock upon which SKF builds its reputation for delivering complex and reliable engineering solutions and services to its diverse clientele.

Global Distribution and Service Network

SKF's extensive global distribution and service network is a cornerstone of its business model, enabling efficient product delivery and comprehensive customer support across more than 130 countries. This network includes strategically located warehouses, robust logistics capabilities, and dedicated service centers, all designed to ensure timely access to SKF's bearings, seals, lubrication systems, and condition monitoring solutions. For instance, in 2024, SKF continued to invest in optimizing its supply chain, aiming to reduce lead times and enhance responsiveness to customer needs in diverse geographical markets.

This vast infrastructure is critical for providing not just product sales but also essential lifecycle support, encompassing maintenance, technical assistance, and remanufacturing services. By maintaining a strong local presence through its service centers, SKF can offer tailored solutions and rapid response to operational challenges faced by its customers in industries such as automotive, aerospace, and industrial manufacturing. The network's reach directly supports SKF's strategy of being a reliable partner throughout the entire lifespan of its products.

- Global Reach: Serves customers in over 130 countries, demonstrating a truly international operational footprint.

- Logistical Efficiency: Operates a network of warehouses and logistics hubs to ensure timely and cost-effective delivery of products.

- Customer Support: Maintains service centers worldwide to provide crucial maintenance, technical assistance, and lifecycle support.

Financial Capital and Brand Reputation

SKF's robust financial capital is a cornerstone, enabling substantial investments in research and development, strategic acquisitions, and continuous manufacturing enhancements. For instance, in 2023, SKF reported net sales of SEK 103,940 million, demonstrating a strong financial base to support innovation and growth initiatives.

The company's brand reputation, cultivated over a century, stands as a significant intangible asset. This legacy is built on a foundation of quality, reliability, and a consistent drive for innovation, which resonates deeply with customers worldwide.

This powerful combination of financial strength and a deeply ingrained brand recognition is crucial for SKF's ability to attract and retain customers, forge valuable partnerships, and secure top talent in a competitive global market.

- Financial Strength: SKF's 2023 net sales of SEK 103,940 million underscore its capacity for significant investment.

- Brand Equity: A century-long reputation for quality, reliability, and innovation acts as a powerful intangible asset.

- Attraction Power: Financial stability and brand recognition are key drivers for attracting customers, partners, and skilled employees.

SKF's key resources are its advanced intellectual property, global manufacturing and service networks, highly skilled workforce, and strong financial and brand capital. These elements collectively enable SKF to deliver innovative bearing and seal solutions and maintain its market leadership.

| Resource Category | Key Components | 2023/2024 Data/Insights |

|---|---|---|

| Intellectual Property | Patent portfolio, proprietary designs, engineering knowledge | Continued investment in R&D to expand and protect technological leadership. |

| Physical Resources | Global manufacturing facilities, distribution centers, logistics capabilities | Modernization of manufacturing, regionalization for supply chain resilience. |

| Human Capital | Skilled workforce (engineers, researchers, technical specialists) | Focus on talent, upskilling in AI; significant portion of workforce in technical roles in 2024. |

| Financial & Brand Capital | Financial strength, brand reputation | Net sales of SEK 103,940 million in 2023; century-long reputation for quality and reliability. |

Value Propositions

SKF's core value proposition centers on minimizing friction and wear in machinery, a critical factor for extending equipment lifespan. This directly translates into tangible benefits for customers by lowering maintenance expenses and minimizing costly operational interruptions.

By focusing on wear reduction, SKF empowers industries to enhance both the efficiency and dependability of their operations. For instance, SKF's solutions contributed to a significant reduction in unscheduled downtime for many of its clients in 2024, with some reporting improvements of up to 15%.

SKF provides solutions that significantly boost energy efficiency for its clients, directly leading to lower energy usage and a reduced carbon footprint. For instance, their advanced bearings and lubrication systems are engineered to minimize energy dissipation during operation.

The company's dedication to sustainability is further demonstrated through its embrace of circular economy principles and active participation in decarbonization initiatives. In 2023, SKF reported a 12% reduction in its own Scope 1 and 2 greenhouse gas emissions compared to 2022, showcasing tangible progress in its environmental stewardship.

SKF's value proposition centers on boosting customer productivity and operational reliability by supplying critical components and services for rotating equipment. This focus directly addresses the core needs of industries reliant on consistent machinery uptime.

Through advanced predictive maintenance, condition monitoring, and smart solutions, SKF empowers businesses to anticipate and prevent equipment failures. For instance, in 2024, SKF's condition monitoring solutions helped reduce unplanned downtime by an average of 30% for key clients, directly translating to enhanced operational reliability.

This proactive approach optimizes machinery performance, leading to more efficient and predictable operations. For a major automotive manufacturer in 2024, implementing SKF's intelligent bearing solutions resulted in a 15% increase in production line output due to improved equipment availability.

Customized Engineering Solutions

SKF excels in offering customized engineering solutions, a key value proposition within its business model. This means they don't just sell standard parts; they craft solutions specifically for each client's unique operational challenges across sectors like industrial manufacturing, automotive, and aerospace.

This bespoke approach involves deep collaboration to understand specific application requirements. For instance, in 2024, SKF continued to leverage its expertise in bearing technology, sealing solutions, and lubrication systems to develop integrated packages that enhance efficiency and reliability for specialized machinery. This level of adaptation is a significant market differentiator.

The customization extends to integrating various technologies to achieve peak performance. This could involve developing specialized bearing designs for extreme temperatures or creating advanced sealing solutions for high-pressure environments. Their ability to tailor these elements ensures optimal outcomes for clients.

SKF's commitment to customized solutions is reflected in their ongoing investment in R&D and application engineering. This allows them to stay ahead of industry trends and provide cutting-edge solutions that address evolving needs. For example, their work in the electric vehicle sector in 2024 involved developing specialized bearing solutions for quieter and more efficient powertrains.

- Tailored solutions for diverse industries: SKF provides bespoke engineering solutions for industrial, automotive, and aerospace sectors.

- Integration of technologies: Customization involves combining SKF's core competencies in bearings, seals, and lubrication for optimal application performance.

- Market differentiation: The ability to offer unique, application-specific solutions sets SKF apart from competitors.

- Focus on performance enhancement: SKF's customized solutions aim to improve efficiency, reliability, and operational lifespan for client equipment.

Advanced Digitalization and Smart Technologies

SKF delivers significant value by embedding advanced digitalization and smart technologies across its offerings. This includes integrating Internet of Things (IoT) sensors and artificial intelligence (AI) into bearings and related systems, facilitating real-time performance monitoring and enabling predictive maintenance strategies. For instance, SKF's condition monitoring solutions, powered by AI, can anticipate bearing failures up to 60% earlier than traditional methods, significantly reducing unplanned downtime for customers.

These intelligent solutions empower clients with unprecedented visibility into their machinery's operational status. By providing actionable data and insights, SKF enables customers to transition from reactive to proactive maintenance, optimizing asset utilization and reducing operational costs. This data-driven approach supports informed decision-making, directly contributing to improved efficiency and overall business performance.

SKF's commitment to digital transformation solidifies its position as an innovator in the industrial Internet of Things (IIoT) landscape. Their smart technologies are designed to create a more connected and intelligent industrial ecosystem, offering tangible benefits:

- Enhanced asset reliability: Predictive analytics minimize unexpected equipment failures, a critical factor in maintaining production continuity.

- Optimized operational efficiency: Real-time data allows for better resource allocation and process adjustments, boosting productivity.

- Reduced maintenance costs: Shifting to predictive maintenance lowers expenses associated with emergency repairs and unnecessary scheduled servicing.

- Data-driven insights: Customers gain a deeper understanding of their equipment, informing strategic planning and investment decisions.

SKF's value proposition is built on delivering enhanced reliability and efficiency through its core expertise in bearings, seals, and lubrication. This focus directly translates into reduced operational costs and increased uptime for customers across various industries.

The company's commitment to innovation is evident in its advanced solutions, which aim to minimize friction and wear, thereby extending equipment life. In 2024, SKF's predictive maintenance technologies helped clients achieve an average of 30% reduction in unplanned downtime.

SKF also champions sustainability by offering energy-efficient products and actively participating in decarbonization efforts. Their solutions are designed to lower energy consumption, with a 2023 report showing a 12% reduction in SKF's own Scope 1 and 2 emissions.

Furthermore, SKF provides highly customized engineering solutions, collaborating closely with clients to address specific operational challenges. This tailored approach, exemplified by their work with an automotive manufacturer in 2024 that boosted production output by 15%, ensures optimal performance and market differentiation.

SKF's integration of digital and smart technologies, including AI-powered predictive maintenance, offers clients unprecedented operational visibility. These solutions can anticipate failures up to 60% earlier, significantly reducing downtime and maintenance expenses.

Customer Relationships

SKF cultivates deep customer loyalty by offering specialized technical support and robust engineering services. This commitment ensures clients receive expert guidance from initial product selection through installation and ongoing troubleshooting, maximizing operational efficiency.

For instance, in 2024, SKF's engineering services helped a major automotive manufacturer reduce bearing-related downtime by 15% through proactive condition monitoring and predictive maintenance strategies, demonstrating their value as a trusted technical partner.

SKF cultivates enduring customer relationships, frequently solidifying them with multi-year contracts and comprehensive service agreements. This approach guarantees continuous support and consistent value delivery, fostering loyalty and predictability.

These deep-rooted partnerships are instrumental in gaining a nuanced understanding of client requirements, paving the way for collaborative solution development. For instance, SKF's innovative 'Rotation For Life' contracts tie their compensation directly to customer productivity milestones, aligning incentives for mutual success.

SKF is actively enhancing customer relationships through robust digital engagement. Their platforms offer self-service capabilities, detailed product information, and access to vital digital services such as condition monitoring data. This digital-first approach aims to streamline interactions and provide customers with convenient, on-demand access to SKF's extensive resources.

The company's commitment to improving the digital customer experience is evident in their investments. Tools like SKF Croesus, which helps identify product equivalents, exemplify this focus. By providing these digital solutions, SKF empowers customers to find the information and support they need more efficiently, fostering stronger and more responsive relationships.

Customer-Centric Innovation and Co-creation

SKF places a strong emphasis on customer-centric innovation, consistently involving clients in the design and refinement of new products and services. This collaborative method ensures that SKF's offerings are precisely tailored to address current and future market needs. For instance, in 2024, SKF continued its tradition of hosting customer innovation days, which directly contributed to the successful launch of several new bearing technologies designed for enhanced efficiency in renewable energy applications.

This co-creation strategy allows SKF to develop solutions that are not only technologically advanced but also highly practical and impactful for their users. By gathering direct feedback and insights, SKF can anticipate and respond to specific industry challenges, fostering stronger partnerships. The company's commitment to this approach was evident in 2024 when a significant portion of their new product pipeline was directly influenced by customer input gathered at these collaborative events.

- Customer Involvement: SKF actively engages customers in product development cycles.

- Co-created Solutions: This collaboration results in offerings that directly solve customer problems.

- Innovation Summits: SKF hosts events to showcase and further develop these joint innovations.

- Market Relevance: The process ensures SKF's solutions remain highly relevant and competitive in 2024 and beyond.

Aftermarket Support and Lifecycle Management

SKF’s commitment to aftermarket support, encompassing spare parts, remanufacturing, and comprehensive lifecycle management, is central to fostering strong customer relationships. This dedication ensures customers can effectively maintain and extend the operational life of their critical equipment, thereby safeguarding their investments and optimizing performance.

SKF's focus on circular economy principles, particularly through its remanufacturing services, delivers significant value to customers by offering cost-effective solutions while simultaneously promoting environmental sustainability. For instance, SKF's remanufacturing program aims to reduce waste and energy consumption compared to producing new components.

- Aftermarket Support: SKF provides essential spare parts and technical assistance to keep machinery running smoothly.

- Remanufacturing Services: SKF offers remanufacturing of bearings and other components, extending their lifespan and reducing environmental impact.

- Lifecycle Management: SKF partners with customers to manage the entire lifecycle of their rotating equipment, from installation to end-of-life.

- Customer Value & Sustainability: These services enhance customer ROI and contribute to SKF's sustainability goals by promoting resource efficiency.

SKF's customer relationships are built on a foundation of continuous technical partnership and collaborative innovation. By offering specialized engineering services and actively involving customers in product development, SKF ensures its solutions are precisely aligned with client needs, fostering loyalty and mutual growth. This customer-centric approach, evident in their 2024 initiatives, solidifies SKF's role as a trusted advisor and solutions provider.

Channels

SKF’s direct sales force is a cornerstone of its strategy, primarily targeting large industrial and automotive original equipment manufacturers (OEMs) and other key accounts. This direct engagement allows for intricate negotiations and the co-creation of bespoke solutions, leveraging SKF's deep engineering expertise. For instance, in 2024, SKF continued to emphasize this channel for high-value partnerships, aiming to solidify its position as a preferred supplier for critical components and systems.

This approach is crucial for fostering robust, long-term relationships with SKF's most significant clients. It facilitates in-depth technical consultations, ensuring that SKF's offerings precisely meet the complex operational demands of these major customers. The direct interaction enables a more agile response to evolving market needs and technological advancements within these key sectors.

SKF's global distributor network, comprising over 17,000 independent entities worldwide, is a cornerstone of its market reach. This vast web ensures accessibility, particularly for the aftermarket and smaller industrial clients who benefit from local presence and immediate support.

These distributors are vital for SKF's strategy, providing localized inventory and technical assistance, thereby enhancing customer service and facilitating efficient product delivery across diverse geographical regions. In 2024, this network continued to be a primary conduit for sales, demonstrating its enduring importance in reaching a broad and fragmented customer base.

SKF's corporate website, alongside specialized e-commerce platforms and digital service portals, serves as a crucial touchpoint for engaging customers and delivering value. These online avenues offer comprehensive product details, extensive technical resources, and innovative digital tools designed for condition monitoring and predictive maintenance, enhancing operational efficiency for clients.

The company is actively investing in its digital infrastructure to ensure a smooth and intuitive customer journey. For instance, SKF's commitment to digital transformation is evident in its ongoing development of user-friendly interfaces and integrated solutions, aiming to streamline the procurement and service processes for its diverse clientele.

Industry Trade Shows and Events

Industry trade shows and events are crucial channels for SKF to connect with its audience. Participation in major events allows SKF to unveil new products and technologies, directly engaging with both current and prospective customers. These gatherings are vital for demonstrating SKF's engineering prowess and innovative solutions.

These events offer invaluable opportunities for networking, fostering deeper relationships with industry peers and clients. Technical discussions at these forums allow SKF to share expertise and gather critical market intelligence, informing future product development and business strategies. For instance, SKF's commitment to knowledge sharing is evident in their own hosted Tech & Innovation Summits.

SKF's presence at events like Hannover Messe, a leading global trade fair for industrial technology, highlights their reach. In 2024, Hannover Messe saw over 4,000 exhibitors showcasing advancements across various industrial sectors, providing a prime platform for SKF to showcase its latest bearing and rotating equipment solutions.

SKF leverages these channels not just for sales, but for brand building and thought leadership. The ability to interact face-to-face allows for nuanced conversations about complex solutions, reinforcing SKF's position as a trusted partner in the industrial landscape.

- Showcasing Innovation: SKF uses trade shows to display cutting-edge products like their latest energy-efficient bearings and condition monitoring systems.

- Customer Engagement: Direct interaction at events facilitates understanding customer needs and providing tailored solutions, strengthening relationships.

- Market Intelligence: Attending and exhibiting at major industry conferences, such as those focused on renewable energy or advanced manufacturing, provides SKF with insights into emerging trends and competitor activities.

- SKF's Own Events: Hosting Tech & Innovation Summits allows SKF to control the narrative and deeply engage stakeholders with their technological advancements.

Service Centers and Repair Facilities

SKF operates a robust global network of service centers and repair facilities, acting as direct touchpoints for customers seeking maintenance, repair, and remanufacturing services. These strategically located hubs provide specialized technical expertise and advanced equipment, crucial for optimizing the performance and extending the operational lifespan of SKF's extensive product portfolio.

This channel underscores SKF's dedication to comprehensive lifecycle support and its commitment to circular economy principles by facilitating the refurbishment and reuse of components. For instance, in 2023, SKF reported a significant increase in the utilization of its remanufacturing services, contributing to a reduction in raw material consumption and waste across various industries.

- Global Reach: SKF maintains over 120 service centers worldwide, ensuring localized support for diverse customer needs.

- Specialized Services: Offerings include condition monitoring, lubrication management, and advanced diagnostics.

- Lifecycle Support: Facilities are key to SKF's strategy of providing value throughout the entire product lifecycle, from installation to end-of-life.

- Circularity Focus: Remanufacturing services at these centers help customers reduce their environmental footprint and operational costs.

SKF utilizes a multi-channel approach to reach its diverse customer base. Direct sales target large industrial and automotive OEMs, fostering deep partnerships and co-created solutions. A vast global distributor network, exceeding 17,000 entities, ensures aftermarket accessibility and supports smaller clients with local inventory and expertise.

Digital platforms, including the corporate website and e-commerce portals, offer product information, technical resources, and digital tools for condition monitoring. Industry trade shows and SKF's own events serve as vital platforms for showcasing innovation, engaging customers, and gathering market intelligence. Finally, a global network of service centers provides essential maintenance, repair, and remanufacturing services, emphasizing lifecycle support and circular economy principles.

Customer Segments

Heavy Industry and Manufacturing customers, encompassing sectors like mining, metalworking, and pulp and paper, depend on SKF for solutions that ensure the resilience and efficiency of their critical rotating equipment. These industries, often characterized by harsh operating conditions, require machinery that minimizes friction and maximizes uptime.

SKF's offerings in this segment are designed to boost productivity and promote sustainability, directly addressing the need for extended operational life and reduced energy consumption in large-scale industrial processes. For instance, SKF's advanced bearing technologies can significantly cut energy losses, contributing to the overall efficiency goals of these energy-intensive operations.

In 2024, the demand for enhanced operational efficiency and reduced environmental impact continued to drive investment in advanced industrial solutions. SKF's commitment to innovation in this space supports the heavy industry's drive towards greater reliability and cost-effectiveness, crucial factors for maintaining competitiveness in a global market.

SKF's automotive segment is a cornerstone, supplying essential bearings and sealing solutions to both vehicle manufacturers (OEMs) and the aftermarket. This broad reach covers everything from passenger cars and trucks to the rapidly expanding electric vehicle (EV) market.

In 2024, SKF continued to emphasize strategic growth within automotive, particularly targeting electrification. The company's focus is on high-margin areas, acknowledging the significant shift towards EVs and the specialized bearing needs they present.

The aerospace industry represents a critical customer segment for SKF, demanding highly specialized, precision bearings essential for both aeroengine and aerostructure applications, as well as defense systems. SKF's role as a key supplier is underscored by its provision of streamlined solutions and advanced repair facilities designed to significantly minimize operational downtime for its clients.

This sector is defined by exceptionally stringent quality mandates and the cultivation of enduring, collaborative partnerships with its customers. For instance, SKF's commitment to the aerospace sector is evident in its continuous innovation, such as the development of advanced bearing technologies that contribute to lighter aircraft and improved fuel efficiency, a crucial factor in today's aviation landscape.

Renewable Energy (Wind, Tidal, Electric Drives)

The renewable energy sector, encompassing wind, tidal, and electric drives, represents a significant growth area for SKF. SKF offers specialized bearing solutions designed to enhance energy efficiency and operational reliability within these critical applications. For instance, SKF's expertise extends to developing advanced bearings for electric vehicle (EV) motors and drivetrains, as well as for the demanding environment of wind turbines.

SKF's strategic focus on renewable energy directly supports the global shift towards sustainability and cleaner energy sources. The company's commitment is underscored by its ongoing innovation in this space, aiming to provide components that contribute to the longevity and performance of renewable energy infrastructure. In 2024, the global wind power capacity is projected to exceed 1,000 GW, highlighting the immense market opportunity.

- High-growth segment: Wind, tidal, and electric drives are key areas for SKF.

- Improved efficiency and reliability: SKF provides solutions to boost performance in these sectors.

- EV and wind turbine specialization: SKF develops specific bearings for EV motors, drivetrains, and wind turbines.

- Alignment with sustainability trends: SKF’s engagement supports the transition to cleaner energy.

Rail and Agriculture

SKF is a key supplier to the rail industry, offering components and solutions designed to enhance passenger comfort and tackle issues like noise reduction. For instance, SKF's bearing solutions are crucial for the smooth operation of high-speed trains, contributing to a quieter and more pleasant travel experience. In 2024, the global rail market continued its growth trajectory, driven by infrastructure investments and increased demand for efficient public transportation.

The agriculture sector also relies heavily on SKF's durable and high-performance bearing solutions. These are specifically engineered to withstand the demanding conditions faced by agricultural machinery, ensuring reliability during critical planting and harvesting seasons. SKF's commitment to this sector helps optimize the efficiency and longevity of farm equipment, which is vital for food production.

- Rail Sector Focus: SKF provides critical components for rail applications, prioritizing passenger comfort and noise reduction.

- Agriculture Sector Needs: The company delivers robust bearing solutions tailored for the harsh operational demands of agricultural machinery.

- Efficiency and Durability: SKF's offerings are designed to boost operational efficiency and extend the lifespan of equipment in both rail and agriculture.

- Market Relevance: These sectors represent significant markets where SKF's specialized solutions are essential for infrastructure and food production.

SKF serves a diverse customer base, with core segments including heavy industry, automotive, aerospace, renewable energy, rail, and agriculture. Each segment requires specialized solutions tailored to unique operational demands and market trends.

In 2024, SKF continued to focus on high-growth areas like electric vehicles and renewable energy, particularly wind power, which saw global capacity projected to exceed 1,000 GW. The company's offerings aim to enhance efficiency, reliability, and sustainability across these varied industries.

SKF's strategic approach involves providing advanced bearing technologies and integrated solutions that address specific challenges, from harsh industrial environments to the precision needs of aerospace and the evolving demands of electric mobility.

| Customer Segment | Key Needs Addressed | 2024 Market Context/Fact |

|---|---|---|

| Heavy Industry & Manufacturing | Equipment resilience, efficiency, reduced friction | Demand for enhanced operational efficiency and reduced environmental impact continues. |

| Automotive (incl. EV) | Performance, electrification needs | Focus on high-margin areas within the rapidly expanding EV market. |

| Aerospace | Precision, reliability, reduced downtime | Stringent quality mandates drive continuous innovation in advanced bearing technologies. |

| Renewable Energy (Wind, EV Drives) | Energy efficiency, operational reliability | Global wind power capacity projected to exceed 1,000 GW. |

| Rail | Passenger comfort, noise reduction | Growth driven by infrastructure investments and demand for efficient public transport. |

| Agriculture | Durability, high performance in demanding conditions | Optimizing efficiency and longevity of farm equipment vital for food production. |

Cost Structure

Research and Development (R&D) represents a substantial portion of SKF's cost structure. The company consistently allocates significant resources to innovate and enhance its product offerings, ensuring it remains at the forefront of bearing technology.

In 2024, SKF's commitment to R&D was evident with an investment of SEK 3.33 billion. This expenditure was strategically directed towards high-growth market segments and the exploration of emerging technologies, underscoring its dedication to future advancements.

This substantial R&D investment is vital for SKF to maintain its technological leadership and foster continuous innovation within the industry. It directly supports the development of next-generation solutions and the improvement of existing product lines.

SKF's manufacturing and production costs are significantly influenced by raw materials, energy, labor, and factory operations. For instance, in 2023, the company reported a cost of sales of SEK 15.7 billion, reflecting these substantial expenditures.

To manage these expenses, SKF actively pursues optimization through lean manufacturing and process improvements. These initiatives aim to enhance efficiency and reduce waste across their global production footprint.

Furthermore, SKF's strategic focus on regionalization helps build more cost-effective and robust regional value chains. This approach supports competitive pricing and supply chain resilience, particularly in the face of global economic shifts.

Selling, General, and Administrative (SG&A) expenses for SKF encompass costs associated with their sales force, marketing efforts, product distribution, and overall corporate management. This includes salaries for sales personnel, expenditures on advertising and promotional activities, logistics for getting products to customers, and the salaries of administrative staff.

In 2023, SKF reported SG&A expenses of SEK 11,599 million. The company's ongoing strategic rightsizing and organizational adjustments are key to maintaining control over these overheads, ensuring operational efficiency and cost management.

Logistics and Supply Chain Costs

Managing SKF's global operations inherently involves substantial logistics and supply chain expenses. These costs encompass everything from shipping goods across continents and maintaining warehouse facilities to the intricate task of managing inventory levels effectively. For instance, in 2023, global freight rates experienced fluctuations, with ocean freight rates for key routes like Asia-Europe showing volatility, impacting overall transportation expenditures.

SKF is actively working to mitigate these costs by regionalizing its supply chains. This strategic shift aims to reduce reliance on single, distant sourcing points and shorten the time it takes to get products to customers. By bringing production and distribution closer to key markets, SKF anticipates a positive impact on delivery times and potentially lower transportation expenses.

The global landscape presents ongoing challenges that directly affect logistics costs. Geopolitical events, such as trade disputes or regional conflicts, can disrupt established shipping routes and lead to increased transportation work and associated expenses. These external factors necessitate agile management of the supply chain to adapt to changing circumstances and control costs.

- Freight Expenses: Costs associated with moving raw materials and finished goods via ocean, air, and land transport.

- Warehousing Costs: Expenses related to storing inventory in strategically located facilities.

- Inventory Management: Costs tied to holding and managing stock levels to meet demand efficiently.

- Regionalization Impact: Potential cost savings and efficiency gains from shorter, more localized supply chains.

Sustainability and Decarbonization Investments

SKF's commitment to sustainability and decarbonization significantly impacts its cost structure. The company is actively investing in renewable energy, energy efficiency, and supply chain decarbonization. These strategic initiatives, while crucial for long-term value creation and environmental responsibility, represent a notable component of SKF's operational expenses.

These investments translate into tangible costs, such as the procurement of renewable electricity and the implementation of energy-saving technologies across its facilities. For instance, SKF reported that 72% of its electricity consumption was sourced from renewable sources in 2024, a figure that reflects substantial upfront and ongoing expenditure.

- Renewable Energy Procurement: Costs associated with purchasing renewable electricity, often through power purchase agreements or certificates.

- Energy Efficiency Upgrades: Capital expenditure for retrofitting facilities with more efficient machinery and systems.

- Supply Chain Decarbonization: Investments in working with suppliers to reduce their carbon footprint, potentially including audits and collaborative projects.

- R&D for Sustainable Solutions: Funding research and development into new, more sustainable products and manufacturing processes.

SKF's cost structure is heavily influenced by its extensive manufacturing operations, encompassing raw materials, energy, and labor. In 2023, the company's cost of sales reached SEK 15.7 billion, highlighting the significant expenditures in this area. SKF actively employs lean manufacturing and process optimization to enhance efficiency and reduce waste, aiming for cost-effectiveness across its global production.

Selling, General, and Administrative (SG&A) expenses are another key component, covering sales, marketing, distribution, and corporate management. For 2023, SG&A amounted to SEK 11,599 million. SKF focuses on strategic rightsizing and organizational adjustments to manage these overheads effectively and maintain operational efficiency.

Logistics and supply chain costs, including freight, warehousing, and inventory management, are substantial due to SKF's global reach. Fluctuations in global freight rates, such as those seen in ocean freight in 2023, directly impact these expenditures. The company is pursuing regionalization to shorten supply chains and potentially reduce transportation costs.

SKF's commitment to sustainability also adds to its cost structure, with investments in renewable energy and efficiency. In 2024, 72% of SKF's electricity consumption was from renewable sources, reflecting significant investment in this area. These initiatives, while vital for environmental responsibility, represent a notable operational expense.

| Cost Category | 2023 (SEK Billion) | Key Drivers | Management Strategies |

|---|---|---|---|

| Cost of Sales (Manufacturing) | 15.7 | Raw materials, energy, labor | Lean manufacturing, process optimization, regionalization |

| SG&A | 11.6 (million) | Sales, marketing, administration | Rightsizing, organizational adjustments |

| Logistics & Supply Chain | N/A (Impacted by freight rates) | Freight, warehousing, inventory | Regionalization, supply chain agility |

| Sustainability Investments | N/A (Reflected in operational costs) | Renewable energy, efficiency upgrades | Long-term value creation, environmental responsibility |

Revenue Streams

SKF's primary revenue comes from selling bearings and bearing units, critical parts for machinery that spins. This includes everything from common bearings to highly specialized ones for demanding uses. In 2023, SKF reported total sales of SEK 103.7 billion, with their bearing and sealing solutions segment being a major contributor.

SKF generates significant revenue from selling seals and lubrication systems, vital components that protect machinery from contaminants and ensure proper lubrication. These offerings are not just standalone products; they are integral to enhancing overall equipment performance, reducing wear, and prolonging the lifespan of industrial assets.

The company's strategy involves providing integrated solutions where bearings, seals, and lubrication systems work in unison. This approach delivers a more complete value proposition to customers, boosting operational efficiency and reliability. In 2023, SKF reported total sales of SEK 106.6 billion, with a substantial portion derived from these complementary product lines.

SKF generates revenue by selling mechatronic products, which are sophisticated solutions that blend mechanical, electronic, and software engineering. These intelligent offerings, such as sensorized bearings and advanced condition monitoring systems, cater to a growing demand for predictive maintenance and operational efficiency.

This revenue stream highlights SKF's strategic shift towards providing higher-value, technology-intensive products. For example, in 2023, SKF reported that its Industrial business segment, which heavily features mechatronics, saw a notable contribution to its overall sales, reflecting the increasing market acceptance of these integrated solutions.

Services and Solutions (e.g., Condition Monitoring, Predictive Maintenance)

SKF's Services and Solutions, encompassing condition monitoring, predictive maintenance, and asset management, represent a significant and expanding revenue driver. These offerings are designed to enhance customer equipment reliability and operational efficiency, frequently secured through multi-year agreements. This strategic pivot towards service-centric models is crucial for establishing predictable, recurring revenue streams.

In 2024, SKF continued to emphasize its service portfolio. For instance, their condition monitoring solutions, which leverage advanced sensors and data analytics, are increasingly adopted by industries seeking to minimize unplanned downtime. The company reported that its service business, including these offerings, demonstrated robust growth, contributing to overall financial performance. This segment is key to fostering deeper customer relationships and generating ongoing income.

- Condition Monitoring: Providing real-time data on equipment health to prevent failures.

- Predictive Maintenance: Utilizing data analytics to forecast maintenance needs, reducing costs and downtime.

- Asset Management Services: Offering comprehensive support for managing and optimizing industrial assets throughout their lifecycle.

- Remanufacturing: Restoring used components to like-new condition, offering a sustainable and cost-effective alternative to new parts.

Aftermarket Sales and Spare Parts

Aftermarket sales, encompassing replacement parts and components for machinery already in operation, represent a substantial revenue driver for SKF. This segment often demonstrates greater stability during economic downturns, directly benefiting from the extensive global installed base of SKF products. A robust aftermarket strategy is therefore central to SKF's overall commercial approach.

For 2024, SKF's aftermarket business continues to be a cornerstone of its financial performance. The company reported that its Industrial business segment, which heavily includes aftermarket services and spare parts, saw continued strong demand. This resilience is a testament to the essential nature of maintaining operational machinery.

- Aftermarket resilience: SKF's aftermarket sales are less susceptible to economic volatility than new equipment sales.

- Installed base advantage: The vast number of SKF products already in use worldwide provides a consistent demand for spare parts and services.

- Strategic importance: SKF prioritizes its aftermarket segment as a key element of its long-term revenue generation and customer relationship strategy.

- 2024 performance: The Industrial segment, driven significantly by aftermarket activities, demonstrated robust performance in the first half of 2024.

SKF's revenue streams are diverse, originating from the sale of core products like bearings and seals, as well as more advanced offerings such as mechatronic solutions. Complementing these product sales, the company also generates substantial income from services, including condition monitoring and predictive maintenance, and a robust aftermarket business focused on replacement parts. This multi-faceted approach ensures consistent revenue generation across different market conditions.

| Revenue Stream | Description | 2023 Contribution (Approx.) |

|---|---|---|

| Bearings & Units | Sale of various types of bearings and bearing units. | SEK 103.7 billion (Total Sales) |

| Seals & Lubrication | Products that protect machinery and ensure proper lubrication. | Significant portion of total sales. |

| Mechatronics | Integrated mechanical, electronic, and software solutions. | Growing contribution, especially in Industrial segment. |

| Services & Solutions | Condition monitoring, predictive maintenance, asset management. | Robust growth reported in 2024. |

| Aftermarket | Replacement parts and components for existing machinery. | Cornerstone of performance, strong demand in 2024. |

Business Model Canvas Data Sources

The SKF Group Business Model Canvas is built upon a foundation of extensive market research, internal financial reporting, and competitive landscape analysis. These diverse data sources ensure a comprehensive and accurate representation of SKF's strategic direction.