SKF Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SKF Group Bundle

Curious about SKF Group's strategic positioning? This glimpse into their BCG Matrix reveals how their product portfolio stacks up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture and actionable insights.

Unlock the complete SKF Group BCG Matrix to understand their market dominance and potential growth areas. Purchase the full report for a detailed breakdown and strategic recommendations to optimize your investment decisions.

Stars

SKF is heavily investing in its smart bearings and condition monitoring segment, a key area for growth. These advanced bearings incorporate IoT and AI to allow for remote monitoring and predictive maintenance. This technology helps customers significantly cut down on maintenance expenses and boost their operational efficiency.

The demand for these smart solutions is soaring, fueled by the widespread adoption of Industry 4.0 principles across various sectors. SKF's commitment to innovation in this space firmly establishes it as a frontrunner in providing cutting-edge industrial solutions. For instance, SKF's condition monitoring systems are projected to see a compound annual growth rate (CAGR) of over 10% in the coming years, reflecting strong market demand.

SKF's bearings for electric vehicles (EVs) are positioned as a strong contender in the growing EV market. Their development of lightweight ceramic bearings and specialized hub bearing units directly addresses key performance demands in this sector, offering enhanced durability and improved battery efficiency through reduced friction.

The global EV market is experiencing robust growth, with projections indicating continued expansion. For instance, the International Energy Agency (IEA) reported that EV sales reached 14 million in 2023, a significant increase from previous years, highlighting the substantial market opportunity for SKF's innovative bearing solutions.

SKF is actively involved in pioneering renewable energy technologies. Their collaboration with Proteus Marine Renewables on tidal stream energy highlights a strategic push into high-growth sustainable sectors. This partnership aims to harness the predictable power of ocean tides, a significant advancement in renewable energy capture.

SKF's expertise in developing advanced bearings is crucial for the efficiency and longevity of wind turbines. The global wind power market is experiencing robust growth, with installations projected to reach new heights. For instance, in 2023, global offshore wind capacity additions were significant, and this trend is expected to continue, driven by decarbonization efforts and technological improvements.

High-Performance Railway Bearings

SKF's development of advanced gearbox bearings for high-speed and freight trains represents a significant move into a high-growth market. These bearings are designed to minimize friction, leading to improved energy efficiency and reduced operational costs for rail operators. This focus on sustainability and performance aligns perfectly with global trends in transportation infrastructure development.

This innovation is crucial for SKF's competitive positioning. The rail sector demands highly specialized and reliable components, and these new bearings offer a distinct advantage. The market for railway components is substantial, with global railway infrastructure spending projected to reach hundreds of billions of dollars annually in the coming years, driven by electrification and modernization efforts.

- Market Growth: The global railway bearing market is experiencing robust growth, fueled by increased demand for high-speed rail and freight transport.

- Efficiency Gains: SKF's new bearings offer up to 10% reduction in friction, translating to significant fuel savings for train operators.

- Sustainability Focus: The emphasis on reduced energy consumption and extended service life of these bearings supports the industry's sustainability goals.

- Competitive Advantage: This technological advancement positions SKF as a leader in providing advanced solutions for the demanding railway sector.

Integrated Circularity and Reliability Services

SKF is actively growing its service portfolio, emphasizing remanufacturing of used bearings and advanced reliability solutions. These offerings leverage AI-driven condition monitoring to enhance operational efficiency and sustainability.

These integrated services are designed to significantly extend the operational life of industrial assets and shorten crucial lead times for replacement parts. This strategic direction strongly aligns with the growing global emphasis on circular economy principles within the industrial sector.

SKF's focus on remanufacturing and AI-powered reliability services positions them for substantial growth. For instance, the remanufacturing of bearings can reduce the need for new raw materials by up to 80% and cut energy consumption by 70% compared to producing new bearings. This aligns with SKF’s 2024 sustainability goals, aiming for a 30% reduction in Scope 3 emissions by 2025, with services playing a key role.

- Extended Asset Lifecycles: Remanufacturing processes restore bearings to original specifications, prolonging their useful life.

- Reduced Lead Times: Remanufactured parts are often available much faster than new ones, minimizing equipment downtime.

- Circular Economy Alignment: These services reduce waste and conserve resources, embodying sustainable business practices.

- AI-Driven Reliability: Condition monitoring powered by AI predicts potential failures, enabling proactive maintenance and preventing costly breakdowns.

SKF's smart bearings and condition monitoring represent a significant growth area, leveraging IoT and AI for predictive maintenance. This innovation is crucial for the company's future, with the condition monitoring segment expected to grow at a CAGR exceeding 10% in the coming years.

The company's strategic focus on electric vehicle bearings and renewable energy technologies, like tidal stream energy, positions it to capitalize on major market shifts. SKF's advanced gearbox bearings for rail transport also highlight its commitment to efficiency and sustainability in a sector with substantial infrastructure investment projected.

SKF's expanding service portfolio, including remanufacturing and AI-driven reliability solutions, is a key driver of its circular economy strategy. Remanufacturing can reduce raw material needs by up to 80% and energy consumption by 70%, directly supporting SKF's 2024 sustainability goals.

SKF's Stars in the BCG matrix are its smart bearings and condition monitoring, EV bearings, renewable energy solutions, and advanced rail bearings. These are high-growth, high-market share areas where SKF is investing heavily and demonstrating strong technological leadership.

What is included in the product

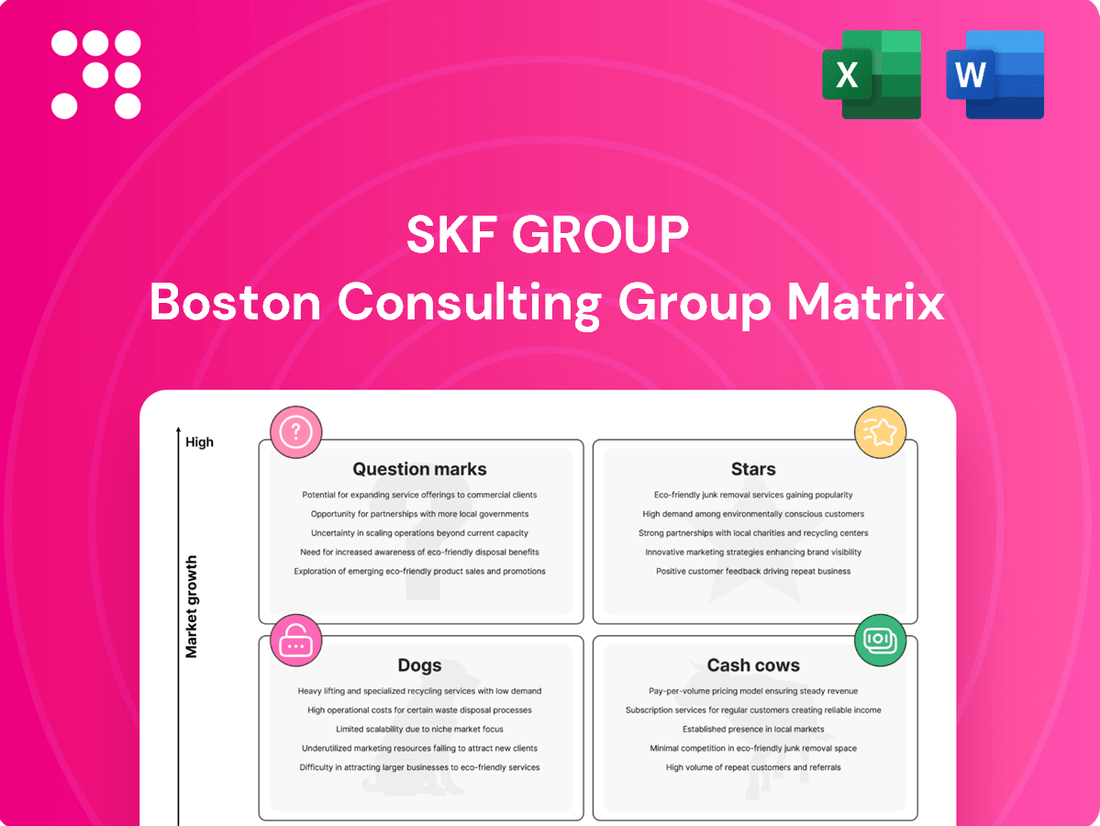

The SKF Group BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic resource allocation.

SKF Group BCG Matrix provides a clear, strategic overview, alleviating the pain of scattered business unit performance data.

A clean, export-ready BCG Matrix design for SKF Group eliminates the hassle of manual PowerPoint creation.

Cash Cows

SKF, the world's largest bearings manufacturer with about 20% of the global market share, relies heavily on its industrial bearings segment. This core business, a cornerstone of SKF's operations, consistently generates substantial cash flow from a mature yet indispensable market.

In 2024, the industrial bearings sector continues to be a stable revenue driver for SKF, reflecting the ongoing demand across various industries. The company's deep expertise and extensive product range in this area solidify its position as a market leader, ensuring sustained profitability.

SKF's Seals and Lubrication Systems represent a cornerstone of their business, acting as reliable cash cows. These established product lines consistently generate substantial revenue due to their critical role across numerous industrial sectors, from automotive to aerospace.

The enduring demand for high-quality seals and effective lubrication solutions ensures a stable and predictable income for SKF. This consistent market presence, coupled with SKF's strong brand reputation, translates into healthy profit margins and robust cash flow generation for the group.

For instance, in 2023, SKF reported that their Seals business generated approximately SEK 15.6 billion in sales, highlighting the significant contribution of these mature offerings to the company's overall financial performance.

SKF's extensive aftermarket sales and distribution network, comprising over 17,000 global distributors, acts as a significant cash cow. This robust network ensures consistent demand for replacement parts and services, a segment characterized by low growth but high profitability due to established product lines and strong customer loyalty. In 2023, SKF reported that its Aftermarket business segment generated approximately €2.3 billion in sales, demonstrating its stable revenue-generating power.

Bearings for Traditional Industrial Machinery

Bearings for traditional industrial machinery represent a significant cash cow for SKF. The ongoing demand from established sectors such as manufacturing, mining, and construction, where SKF holds a strong market position, provides a consistent revenue stream.

These mature markets necessitate regular maintenance and part replacements, which translates into predictable and stable sales for SKF's bearing products.

- Dominant Market Share: SKF maintains a leading position in the traditional industrial machinery bearing market.

- Steady Demand: Sectors like manufacturing, mining, and construction ensure continuous need for bearing replacements and maintenance.

- Mature Market Stability: The predictable nature of these established industries fuels reliable, ongoing sales.

- Revenue Generation: This segment consistently contributes to SKF's overall profitability, acting as a core revenue generator.

Automotive Bearings (Internal Combustion Engine & Commercial Vehicles)

SKF's automotive bearings, specifically those for internal combustion engine (ICE) vehicles and commercial vehicles, currently function as a Cash Cow within its business portfolio. Despite SKF's strategic pivot towards electric vehicles (EVs), this segment maintains a substantial market share in a mature, low-growth industry. This enduring strength allows it to consistently generate significant cash flow for the group.

The company's long-standing expertise and established supply chains in traditional automotive components provide a stable revenue stream. For instance, in 2023, SKF reported total sales of SEK 103.9 billion (approximately $9.8 billion USD), with the automotive segment contributing a significant portion, underscoring the continued relevance of its ICE and commercial vehicle offerings.

- High Market Share: SKF holds a dominant position in the ICE and commercial vehicle bearing market.

- Mature Segment: While growth is limited, the demand for these bearings remains consistent.

- Cash Generation: This segment is a reliable source of substantial cash flow for SKF.

- Strategic Importance: The cash generated supports investments in growth areas like EV technology.

SKF's Seals and Lubrication Systems are prime examples of Cash Cows. These segments consistently deliver strong, stable cash flow due to their critical, ongoing demand across a broad industrial base. Their mature market status means predictable sales and high profitability, reinforcing their role as reliable income generators for SKF.

SKF's extensive aftermarket sales and distribution network also functions as a significant Cash Cow. This established network ensures a steady demand for replacement parts and services, characterized by low growth but high profitability due to brand loyalty and established product lines. In 2023, SKF's Aftermarket business generated approximately €2.3 billion in sales, showcasing its consistent revenue-generating power.

Bearings for traditional industrial machinery are another key Cash Cow for SKF. Established sectors like manufacturing and mining ensure a continuous need for these essential components, leading to predictable and stable sales. This segment's strong market position fuels reliable, ongoing revenue, contributing significantly to SKF's overall profitability.

SKF's automotive bearings for internal combustion engine (ICE) and commercial vehicles are also Cash Cows. Despite the industry's shift, these segments maintain substantial market share in a mature, low-growth market, consistently generating significant cash flow. This enduring strength, backed by long-standing expertise, supports investments in newer technologies.

| Business Segment | Role in BCG Matrix | 2023 Sales (Approx.) | Key Characteristics |

| Industrial Bearings | Cash Cow | Large portion of SEK 103.9 billion total sales | Mature market, stable demand, dominant market share |

| Seals | Cash Cow | SEK 15.6 billion | Critical industrial need, high profitability, consistent revenue |

| Aftermarket Sales & Distribution | Cash Cow | €2.3 billion | Established network, brand loyalty, predictable sales |

| Automotive Bearings (ICE/Commercial) | Cash Cow | Significant portion of total sales | Mature segment, high market share, stable cash generation |

Preview = Final Product

SKF Group BCG Matrix

The preview you are seeing is the identical SKF Group BCG Matrix report you will receive upon purchase. This comprehensive document is fully formatted and ready for immediate strategic application, offering a clear visual representation of SKF's product portfolio's market share and growth potential. You can confidently expect the same level of detail and professional design in the downloadable version, enabling you to conduct in-depth analysis and make informed business decisions.

Dogs

SKF Group has been strategically divesting certain non-core aerospace operations. For instance, the divestment of its ring and seal operation located in Hanover, Pennsylvania, exemplifies this approach. This move is driven by the recognition that these specific operations may not hold a significant market share within SKF's overarching business.

The primary objective behind these divestments is to enhance SKF's overall efficiency and to sharpen its focus on business segments that demonstrate higher profitability and strategic alignment. This streamlining allows SKF to allocate resources more effectively towards its core competencies and growth areas.

SKF's legacy product lines, particularly those featuring older, less efficient bearing designs, are increasingly categorized as dogs within the BCG matrix. These products often face declining demand due to technological obsolescence, such as the phasing out of certain taper roller bearings used in older automotive models. For instance, SKF's sales in the automotive segment, while still significant, have seen shifts towards electric vehicle-specific solutions, impacting demand for traditional components.

SKF's bearing business, particularly in certain aftermarket segments and standard industrial bearings, often encounters intense price competition. Low-cost manufacturers, especially from Asia, frequently enter these markets with highly commoditized products, putting pressure on SKF's pricing power. For instance, in 2024, the global industrial bearing market saw an influx of lower-priced alternatives, impacting margins for established players in less specialized categories.

Underperforming Regional Operations or Factories

Underperforming regional operations or specific manufacturing facilities within SKF Group, if consistently failing to achieve profitability and market share targets despite optimization attempts, would be classified as Dogs in the BCG Matrix. SKF's strategic focus on regionalization, aimed at enhancing operational efficiency, naturally identifies these underperforming sites as prime candidates for either significant turnaround initiatives or eventual divestment.

For instance, if a particular European manufacturing plant, despite receiving investment in new machinery in 2023, continued to report a negative operating margin in the first half of 2024, it would likely fall into this category. Such a site might be struggling with high labor costs, outdated production processes, or declining local demand for its specific product lines.

- Low Profitability: A factory reporting a consistent operating loss, for example, a 5% operating loss in Q1 2024, would indicate underperformance.

- Declining Market Share: A regional sales office seeing its market share in its territory shrink from 15% in 2023 to 12% by mid-2024 would be a concern.

- High Operational Costs: Units with production costs exceeding industry benchmarks by more than 10% are candidates for scrutiny.

- Lack of Strategic Fit: Facilities producing legacy products with diminishing demand, contributing less than 2% to SKF's overall revenue in 2024, may be considered dogs.

Products with High Maintenance Costs and Low Customer Value

Products that are costly to maintain and offer little perceived value to customers often fall into the 'Dogs' category within the SKF Group BCG Matrix. These might include certain legacy bearing types or specialized components that require frequent servicing or have high warranty claim rates. For instance, if a particular industrial bearing line consistently incurs significant warranty expenses due to premature failure, and customers are not seeing a commensurate benefit in terms of extended operational life or efficiency gains, it would be a prime candidate for a 'Dog'. This situation can lead to customer dissatisfaction, reduced repeat business, and a negative impact on SKF's overall brand reputation and resource allocation.

These 'Dog' products often consume a disproportionate amount of SKF's resources in terms of research and development, manufacturing support, and customer service, without generating a proportional return. The drain on these resources could be better utilized in supporting SKF's 'Stars' or 'Cash Cows'. For example, if a product line has declining sales and a low market share, coupled with high support costs, it exemplifies the 'Dog' profile. SKF's focus in 2024 has been on optimizing its portfolio, which would involve identifying and addressing such underperforming product segments.

The characteristics of these 'Dog' products for SKF could include:

- High Warranty Costs: Products with a consistently high rate of warranty claims, indicating potential quality issues or design flaws that increase service expenses.

- Low Customer Perceived Value: Customers do not see a significant advantage or return on investment from using these products compared to alternatives, leading to weak demand.

- Resource Drain: Significant investment in technical support, spare parts inventory, and specialized maintenance without substantial contribution to revenue or market share growth.

- Negative Word-of-Mouth: Customer dissatisfaction due to performance issues or high maintenance requirements can damage SKF's reputation.

SKF's 'Dogs' represent business units or product lines with low market share and low growth potential. These often include legacy products facing technological obsolescence or intense competition from lower-cost alternatives. For instance, certain older bearing types used in declining industrial sectors might fall into this category. SKF's strategy typically involves either divesting these units or implementing significant turnaround efforts to improve their performance.

In 2024, SKF continued its portfolio optimization, which includes identifying and addressing these 'Dog' segments. For example, a regional operation with a market share below 5% and a negative sales growth trend would be a prime candidate for such a review. The focus is on reallocating resources from these underperforming areas to more promising growth opportunities within the group.

The financial implications of 'Dogs' for SKF include consuming resources without generating substantial returns, potentially impacting overall profitability. For example, a product line with declining sales and high operational costs, such as a specific industrial seal manufactured in a low-demand region, would represent a 'Dog'. Such segments might require significant investment to remain competitive or are candidates for divestment.

SKF's approach to 'Dogs' involves rigorous analysis to determine the best course of action, whether it's a strategic exit or a focused revitalization plan. This ensures that capital and management attention are directed towards areas with higher potential for growth and profitability, aligning with SKF's long-term strategic objectives.

Question Marks

SKF's strategic focus on magnetic bearings and high-speed electric motor components positions them in a high-growth sector fueled by the global electrification trend. The company is actively expanding its manufacturing capabilities, exemplified by its new factory in Morocco, to meet anticipated demand in these advanced areas.

While these segments represent promising future revenue streams, SKF's market share is still in its formative stages. Significant ongoing investment is necessary to solidify their leadership position and capitalize on the burgeoning market for these specialized components.

SKF's advanced digital services, moving beyond traditional condition monitoring, are emerging as potential stars in the BCG matrix. These offerings, which utilize AI and sophisticated data analytics for holistic machine performance optimization, represent a significant growth area. For instance, SKF's cloud-based condition monitoring platform, launched in recent years, aims to provide deeper insights into asset health and operational efficiency, reflecting a strategic push into these more complex digital solutions.

Capturing market share in these advanced digital service areas requires considerable investment in research and development, as well as dedicated efforts to drive customer adoption and integration. The company's 2024 strategy includes continued investment in these digital capabilities, aiming to differentiate its value proposition and secure a leading position in the evolving industrial services landscape. This focus on innovation is crucial for transitioning from established services to higher-value, data-driven solutions.

SKF is strategically positioning itself in emerging sectors like hydrogen processing and carbon capture, leveraging its established bearing and sealing technologies. These industries represent significant growth potential, with the global green hydrogen market projected to reach $17.05 billion by 2030, growing at a CAGR of 49.4%. Similarly, the carbon capture market is anticipated to expand substantially, driven by climate initiatives and regulatory pressures.

While these sectors offer promising future revenue streams, SKF's current market penetration and profitability within these nascent applications are likely modest. The company's focus is on adapting its core competencies to meet the unique demands of these new environments, such as the high-pressure and corrosive conditions prevalent in hydrogen production and carbon capture facilities.

Advanced Sealing Solutions for Complex Applications

SKF's advanced sealing solutions are designed to tackle demanding industrial challenges, aiming to significantly reduce operational downtime and maintenance expenses. This strategic focus on specialized, complex applications positions these products within high-growth market segments, reflecting an investment in future potential.

These innovative sealing technologies are currently in their market adoption phase. SKF's success hinges on expanding their reach and increasing market penetration to transition these offerings from question marks to stars in their portfolio.

- Focus on High-Growth Niches: SKF's development of advanced sealing for complex applications targets specialized industrial sectors with significant growth potential.

- Downtime Reduction: These solutions are engineered to minimize equipment downtime, a critical factor for operational efficiency and cost savings in heavy industry.

- Market Penetration Strategy: The current stage requires SKF to actively drive adoption and market share for these new technologies.

- Potential for Star Status: Successful market penetration could elevate these advanced sealing solutions into high-growth, high-market-share stars within SKF's product portfolio.

New Product Platforms like Extreme Super Precision Bearings

New product platforms like SKF Extreme Super Precision Bearings, introduced to meet demands in high-performance sectors, currently reside in the Question Mark quadrant of the BCG Matrix. These specialized bearings are engineered for applications requiring exceptional accuracy and reliability, such as advanced semiconductor manufacturing equipment and high-speed aerospace systems. SKF's investment in these niche, technologically advanced product lines reflects a strategic move to capture emerging market opportunities.

For these platforms to transition from Question Marks to Stars, they must achieve substantial market share growth. For instance, the global market for precision bearings was projected to reach over $10 billion by 2024, with a compound annual growth rate of approximately 5%. SKF's Extreme Super Precision Bearings aim to carve out a significant portion of this expanding market, particularly in segments demanding ultra-low friction and extreme temperature resistance.

- Market Penetration: SKF needs to aggressively market the unique capabilities of its Extreme Super Precision Bearings to key players in high-growth industries.

- Technological Leadership: Continued investment in R&D is crucial to maintain a competitive edge and justify premium pricing for these specialized products.

- Customer Adoption: Securing early adoption and positive case studies from influential clients will be vital for building credibility and driving broader market acceptance.

- Competitive Landscape: SKF faces competition from other bearing manufacturers also developing advanced solutions, necessitating a clear value proposition.

SKF's advanced sealing solutions for demanding applications are positioned as Question Marks due to their current market penetration stage. These products aim to reduce operational downtime and maintenance costs in high-growth industrial segments.

The success of these innovative seals depends on SKF's ability to expand their market reach and gain significant market share. This transition is crucial for them to evolve from potential future revenue sources into established, high-performing offerings within the company's portfolio.

SKF's Extreme Super Precision Bearings also fall into the Question Mark category, targeting niche, high-performance sectors. Achieving substantial market share growth is essential for these specialized bearings to become Stars, requiring continued R&D and customer adoption.

SKF's strategic investments in magnetic bearings and high-speed electric motor components place them in a high-growth area driven by electrification. While market share is still developing, SKF is expanding manufacturing to meet future demand, with significant investment needed to solidify leadership in these advanced components.

| SKF Group BCG Matrix - Question Marks | Description | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| Advanced Sealing Solutions | Designed for complex industrial challenges, reducing downtime. | High (targeting specialized sectors) | Low (in market adoption phase) | Increase market penetration and adoption. |

| Extreme Super Precision Bearings | Engineered for high-accuracy applications in semiconductor and aerospace. | High (e.g., precision bearing market projected over $10 billion by 2024) | Low (emerging product platforms) | Drive customer adoption, maintain technological leadership. |

| Magnetic Bearings & High-Speed Electric Motor Components | Leveraging electrification trend for advanced components. | High (driven by global electrification) | Low (formative stages) | Expand manufacturing, invest in R&D to solidify leadership. |

BCG Matrix Data Sources

Our SKF Group BCG Matrix leverages SKF's financial reports, industry growth data, and market share analysis to accurately position each business unit.