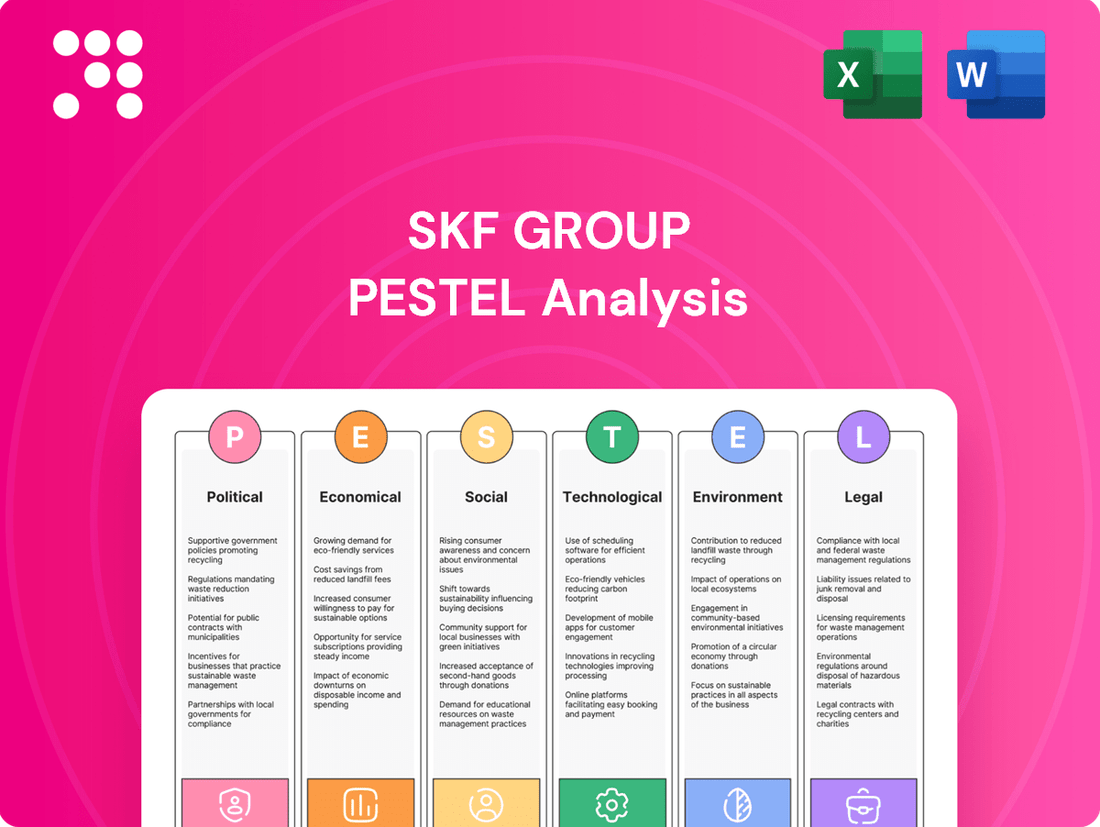

SKF Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SKF Group Bundle

Navigate the complex external forces shaping SKF Group's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and societal shifts are impacting SKF's operations and market position. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for an in-depth understanding.

Political factors

SKF, with its extensive global operations, is particularly sensitive to geopolitical shifts and evolving trade policies, including the imposition of tariffs. For instance, in 2024, ongoing trade tensions between major economic blocs continue to create uncertainty around the cost and availability of raw materials and finished goods, impacting SKF's international supply chain dynamics.

To counter these risks, SKF is actively enhancing the flexibility and redundancy within its supply chains. This strategic move aims to buffer against disruptions caused by unpredictable international relations and fluctuating trade agreements, ensuring operational resilience across its various markets. By mid-2025, the company plans to have diversified its key supplier base by an additional 15% to further mitigate single-source dependencies.

SKF is strategically shifting towards regionalizing its supply chains to enhance resilience and minimize reliance on geographically distant networks. This move is a direct response to the volatile global political and economic landscape, aiming to create more robust and adaptable operational models.

In 2024, SKF saw notable increases in its regionalization rates across both Asia and the Americas. This strategic pivot is designed to significantly shorten delivery lead times and reduce overall logistics expenses, making the company more agile in navigating international trade dynamics and geopolitical uncertainties.

Governments globally are intensifying efforts to foster sustainability, with a notable surge in policies and regulations targeting decarbonization. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving significant investment in green technologies and practices across member states. This governmental push directly influences companies like SKF, encouraging greater investment in research and development for energy-efficient bearings and sustainable manufacturing processes to align with these evolving environmental mandates and capture market opportunities in the burgeoning green economy.

Political Stability in Key Markets

SKF Group's extensive global footprint, spanning 130 countries, makes political stability a paramount concern. Unforeseen geopolitical shifts or instability in key operational regions can significantly disrupt supply chains and impact market demand. For instance, in 2024, evolving political landscapes in Europe and China presented distinct challenges and opportunities that directly influenced SKF's sales performance and overall profitability.

The company's reliance on stable governance and predictable regulatory environments across its diverse markets is crucial for maintaining operational efficiency and forecasting future growth. Political tensions or trade disputes can lead to increased costs, hinder market access, and create uncertainty, thereby affecting SKF's ability to execute its business strategies effectively.

- Geopolitical Risk: Political instability in regions like Eastern Europe and parts of Asia can disrupt SKF's manufacturing and distribution networks.

- Trade Policies: Fluctuations in international trade agreements and tariffs, particularly impacting major markets like China and the EU in 2024, directly influence SKF's cost of goods sold and market competitiveness.

- Regulatory Environment: Changes in national regulations concerning manufacturing standards, environmental compliance, and labor laws across SKF's operating countries necessitate continuous adaptation and can impact operational costs.

Regulatory Frameworks and Compliance

SKF operates within a dynamic global regulatory environment, necessitating constant adaptation to evolving standards. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in 2024, mandates extensive disclosure on environmental, social, and governance (ESG) matters. Compliance with such directives is crucial for SKF to maintain its operating licenses and bolster its reputation among stakeholders, particularly as investors increasingly prioritize transparent and sustainable business practices.

The company must also navigate specific regulations related to its industry, such as those concerning product safety, emissions, and fair competition. For example, stricter emissions standards for industrial equipment, which are being progressively implemented across major markets in 2024 and 2025, require SKF to invest in cleaner manufacturing processes and more energy-efficient product designs. Furthermore, the development of frameworks for green ledger capabilities, which are gaining traction for carbon accounting, presents both compliance challenges and opportunities for SKF to demonstrate its commitment to environmental stewardship.

- Increased scrutiny on ESG reporting: The CSRD, fully applicable from 2024, requires detailed sustainability disclosures.

- Evolving emissions standards: Stricter regulations for industrial equipment in 2024-2025 necessitate investment in greener technologies.

- Emergence of green ledger technology: SKF must consider compliance and integration of these new carbon accounting tools.

SKF's global operations mean political stability is key, as shifts in regions like Europe and China in 2024 directly impacted sales and profitability. Trade policy changes, such as tariffs, also create uncertainty for raw material costs and supply chains. The company is actively regionalizing its supply chains to mitigate these geopolitical risks and improve delivery times, with a 15% diversification target for key suppliers by mid-2025.

Governments worldwide are pushing for sustainability, influencing SKF to invest in energy-efficient products and greener manufacturing. New regulations like the EU's CSRD, effective in 2024, demand detailed ESG reporting, which SKF must adhere to for operational licenses and stakeholder trust. Stricter emissions standards for industrial equipment in 2024-2025 also require investment in cleaner technologies and product designs.

| Political Factor | Impact on SKF | 2024/2025 Relevance |

|---|---|---|

| Geopolitical Instability | Disrupts manufacturing and distribution | Eastern Europe, Asia |

| Trade Policies & Tariffs | Affects raw material costs and market competitiveness | EU-China trade tensions |

| Regulatory Compliance (ESG) | Requires investment in reporting and sustainable practices | CSRD, emissions standards |

| Supply Chain Regionalization | Enhances resilience and reduces logistics costs | 15% supplier diversification by mid-2025 |

What is included in the product

This PESTLE analysis of the SKF Group examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic direction.

It provides a comprehensive overview of the external landscape, highlighting key trends and their implications for SKF's global business environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick understanding of the external forces impacting SKF Group.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key Political, Economic, Social, Technological, Legal, and Environmental factors relevant to SKF.

Economic factors

SKF's financial performance is closely tied to the broader economic climate. In 2024, global macroeconomic headwinds, including slower industrial production in key regions, led to a modest dip in SKF's net revenue.

Despite softer market demand, especially noticeable in Europe and China during 2024, SKF managed to preserve a robust adjusted operating margin. This resilience was largely due to proactive cost control measures and agile pricing strategies implemented across its operations.

Global supply chain disruptions continue to shape SKF's strategic decisions. The company's proactive approach involves accelerating regionalization, a move that saw its localized supply chain ratio reach nearly 70% in 2024. This significant shift is designed to bolster resilience against unforeseen events, shorten delivery times, and manage logistics expenses more effectively, all crucial for maintaining operational efficiency and profitability.

SKF's commitment to innovation is evident in its substantial investment in Research & Development. In 2024, the company allocated SEK 3.33 billion to R&D, with a clear focus on future growth drivers.

Over 90% of this investment is directed towards high-potential sectors such as electric vehicles and railways. This strategic focus aims to develop cutting-edge solutions and expand SKF's product offerings in these dynamic markets, ensuring a strong competitive position.

Energy Costs and Efficiency Initiatives

Energy costs are a major economic factor for SKF, as a significant amount of global energy is used to combat friction, a core area of SKF's business. This direct link means fluctuating energy prices heavily influence the operational costs of the industries SKF serves.

SKF is actively addressing this by focusing on renewable energy and efficiency. In 2024, the company achieved 72% renewable electricity usage, demonstrating a strong commitment to reducing its reliance on fossil fuels and mitigating the impact of volatile energy prices.

These initiatives are crucial for both cost management and strengthening SKF's appeal to environmentally conscious customers and investors. Improving energy efficiency across its own operations directly translates to lower operating expenses.

- Energy Consumption: A substantial portion of global energy is spent overcoming friction, directly affecting SKF's customer industries.

- Renewable Energy Adoption: SKF reached 72% renewable electricity usage in 2024.

- Efficiency Focus: Improving energy efficiency across operations is a key strategy for cost reduction.

- Sustainability Impact: Enhanced energy efficiency and renewable adoption bolster SKF's sustainability credentials.

Strategic Portfolio Restructuring

SKF Group's strategic portfolio restructuring, particularly the planned separation of its Automotive business with a target listing by the first half of 2026, is a significant economic factor. This move is designed to unlock shareholder value and foster accelerated, profitable growth for both the spun-off automotive entity and the remaining industrial business. By allowing each segment to concentrate on its unique market dynamics and capital allocation needs, SKF anticipates improved operational efficiency and market responsiveness.

This strategic realignment comes as the automotive sector faces substantial shifts, including the transition to electric vehicles and evolving supply chain landscapes. In 2023, SKF's Automotive business generated approximately SEK 25 billion (around $2.4 billion USD) in sales, highlighting its scale. The separation is expected to provide greater financial flexibility and strategic focus for both businesses to navigate these industry-wide transformations and capitalize on emerging opportunities.

- Value Unlocking: The separation aims to create distinct investment profiles, potentially leading to higher valuations for both the industrial and automotive businesses.

- Focused Growth: Each entity can pursue tailored growth strategies and capital investments aligned with their respective market conditions and technological advancements.

- Resource Optimization: Improved allocation of capital and management attention to specialized business needs can drive greater efficiency and profitability.

- Market Adaptability: The restructuring allows each business to respond more nimbly to the specific economic and technological trends impacting their sectors.

SKF's financial health is intrinsically linked to global economic performance. In 2024, the company experienced a slight decline in net revenue, largely attributed to slower industrial output in key markets and softer demand, particularly in Europe and China. Despite these challenges, SKF maintained a strong adjusted operating margin through effective cost management and strategic pricing. The company's commitment to innovation is underscored by its 2024 R&D investment of SEK 3.33 billion, with over 90% directed towards high-growth areas like electric vehicles and railways.

Energy costs remain a significant economic consideration for SKF, given the substantial energy expenditure required to overcome friction, a core aspect of its business. To mitigate this, SKF is prioritizing renewable energy and operational efficiency, achieving 72% renewable electricity usage in 2024. This focus not only reduces operational costs but also enhances the company's sustainability profile, appealing to environmentally conscious stakeholders.

SKF is strategically restructuring its portfolio, planning to separate its Automotive business by the first half of 2026 to unlock shareholder value and foster growth in both the industrial and automotive segments. This move aims to improve operational efficiency and market responsiveness, especially as the automotive sector navigates significant shifts like the EV transition. In 2023, SKF's Automotive division generated approximately SEK 25 billion in sales, indicating the scale and importance of this strategic realignment.

| Key Economic Factors Affecting SKF Group | 2023 Data | 2024 Data/Outlook | Impact on SKF |

| Global Industrial Production | Moderate growth | Slower growth in key regions | Modest dip in net revenue |

| Energy Costs | Volatile | Continued volatility | Influences operational costs for customers and SKF |

| R&D Investment | SEK 3.2 billion (2023) | SEK 3.33 billion (2024) | Focus on future growth drivers, EV, and railways |

| Renewable Electricity Usage | 68% (2023) | 72% (2024) | Mitigates energy cost impact, enhances sustainability |

| Automotive Business Sales | ~SEK 25 billion | N/A (Pre-separation) | Strategic separation planned for value unlocking and focused growth |

Preview Before You Purchase

SKF Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the SKF Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping SKF's industry landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into potential opportunities and threats for SKF, crucial for competitive advantage.

Sociological factors

Societal awareness regarding environmental impact is a significant driver, with consumers increasingly favoring companies committed to sustainability. This trend directly influences SKF's product development, pushing for solutions that minimize ecological footprints.

SKF is responding by innovating in areas like decarbonization and energy efficiency. For instance, their focus on extending bearing life and reducing friction contributes to lower energy consumption in machinery, a key aspect of the circular economy. In 2023, SKF reported that its solutions contributed to customers saving approximately 1.7 million tons of CO2, highlighting the tangible impact of their sustainable offerings.

The accelerating integration of artificial intelligence and digitalization demands constant upskilling within SKF's workforce. SKF is actively investing in training initiatives to equip employees with the necessary skills for modern manufacturing and service operations.

In 2024, SKF continued its focus on digital transformation, with a significant portion of its training budget allocated to areas like data analytics and automation, reflecting the critical need for adaptability in the face of technological advancements.

The global push towards electrification, particularly in the automotive sector with the rapid growth of electric vehicles (EVs), is reshaping demand for specialized components. SKF is proactively adjusting its product lines and business strategy to benefit from this major trend, focusing on developing advanced bearings tailored for EV powertrains and associated systems.

By 2024, EV sales are projected to exceed 15 million units globally, a substantial increase that directly drives the need for high-performance, low-friction bearings. SKF's investment in EV-specific bearing technology, such as their integrated electric motor bearings, positions them to capture a significant share of this expanding market. This strategic pivot reflects a keen understanding of evolving consumer preferences and regulatory landscapes favoring sustainable transportation solutions.

Focus on Industrial Safety and Reliability

SKF's commitment to industrial safety and reliability directly addresses societal expectations for secure and efficient workplaces. By providing advanced condition monitoring and predictive maintenance solutions, SKF helps prevent catastrophic equipment failures. For instance, in 2024, industries globally are increasingly prioritizing worker safety, with regulations and public scrutiny demanding lower accident rates.

SKF's technologies contribute to this by minimizing unexpected machinery breakdowns, which are a significant cause of industrial accidents. This focus on operational uptime and safety aligns with a growing societal demand for responsible industrial practices. The company's solutions are vital in sectors like manufacturing and energy, where equipment failure can have severe consequences for both personnel and the environment.

- Societal Demand for Safety: Growing public and regulatory pressure for safer industrial operations.

- Reduced Downtime: SKF's predictive maintenance helps prevent unexpected stops, enhancing overall operational safety.

- Risk Mitigation: Solutions are designed to identify potential failures before they occur, safeguarding workers and assets.

Corporate Social Responsibility and Ethical Standards

SKF's dedication to corporate social responsibility is deeply ingrained, with its Code of Conduct serving as the bedrock for ethical operations across its global network. This framework dictates expected behaviors for employees, suppliers, and distributors, ensuring a consistent approach to responsible business practices. This aligns with increasing societal demands for companies to act as responsible corporate citizens and contribute meaningfully to the well-being of communities where they operate. In 2023, SKF reported a 10% increase in employee participation in sustainability initiatives, demonstrating a tangible commitment to these principles.

The company's ethical standards extend to its supply chain, with rigorous vetting processes designed to uphold human rights and environmental protection. SKF's 2024 sustainability report highlights that 95% of its key suppliers have undergone ethical audits, a significant rise from 80% in 2022. This focus on ethical sourcing is crucial for maintaining brand reputation and mitigating risks associated with non-compliance in an increasingly scrutinized global market.

SKF's commitment to ethical standards is not merely a compliance exercise but a strategic imperative that influences brand perception and stakeholder trust. This commitment is further evidenced by their investment in community development programs, which in 2024 totaled over $5 million globally, focusing on education and environmental conservation. Such actions reinforce SKF's standing as a responsible entity, fostering stronger relationships with customers, employees, and the wider public.

Societal expectations for corporate responsibility are increasingly shaping business practices, with a strong emphasis on ethical conduct and community engagement. SKF's proactive approach, demonstrated by its robust Code of Conduct and significant investment in community development programs totaling over $5 million globally in 2024, directly addresses these demands. This commitment fosters trust and enhances brand reputation among stakeholders.

SKF's dedication to ethical sourcing is evident in its supply chain, with 95% of key suppliers undergoing audits in 2024, up from 80% in 2022. This focus on responsible procurement mitigates risks and aligns with growing consumer and regulatory scrutiny of business operations.

The company's commitment to sustainability, including solutions that helped customers save an estimated 1.7 million tons of CO2 in 2023, resonates with a society increasingly concerned about environmental impact. This focus on eco-friendly innovation is becoming a key differentiator in the market.

SKF's investments in upskilling its workforce, particularly in AI and data analytics in 2024, reflect the societal shift towards digitalization and the need for adaptable skills in the modern economy. This ensures the company remains competitive and responsive to evolving industry demands.

The accelerating adoption of electric vehicles (EVs) presents a significant societal trend, with global EV sales projected to exceed 15 million units by 2024. SKF's strategic focus on developing specialized bearings for EVs positions them to capitalize on this transition towards sustainable transportation.

| Sociological Factor | SKF's Response | Impact/Data Point |

|---|---|---|

| Environmental Awareness | Developing sustainable solutions, extending bearing life, reducing friction | Contributed to customer CO2 savings of ~1.7 million tons in 2023 |

| Digitalization & AI | Investing in workforce upskilling (data analytics, automation) | Significant portion of 2024 training budget allocated to digital skills |

| Electrification (EVs) | Developing advanced bearings for EV powertrains | Projected global EV sales exceeding 15 million units by 2024 |

| Industrial Safety & Reliability | Providing condition monitoring and predictive maintenance | Minimizing unexpected machinery breakdowns, enhancing worker safety |

| Corporate Social Responsibility | Adhering to Code of Conduct, ethical supply chain audits, community investment | 95% of key suppliers audited in 2024; $5M+ invested in community programs in 2024 |

Technological factors

SKF is heavily investing in digitalization across its operations, integrating Industry 4.0 concepts like the Industrial Internet of Things (IIoT) to streamline its entire value chain. This strategic focus is key to optimizing production, boosting efficiency, and creating smarter manufacturing processes.

By leveraging IIoT, SKF aims to enhance predictive maintenance and real-time data analysis, leading to improved asset performance and reduced downtime. For instance, SKF's condition monitoring solutions, powered by IIoT, provide crucial insights for proactive maintenance, a significant driver of operational excellence.

SKF is heavily investing in AI and Machine Learning, aiming to embed these technologies into its core offerings. This is clearly demonstrated by their focus on smart bearings equipped with IoT capabilities for real-time remote monitoring and advanced predictive maintenance. For instance, SKF's ongoing development in this area is expected to significantly enhance asset lifespan and operational efficiency for their clients.

To bolster its AI capabilities, SKF is proactively developing internal expertise through dedicated training initiatives. Furthermore, the company is forging strategic partnerships with external entities to accelerate AI adoption and innovation. This dual approach ensures SKF remains at the forefront of technological advancements, driving value through intelligent solutions.

SKF's commitment to innovation in materials and engineering is a cornerstone of its leadership in bearing technology. The company is actively investing in advanced materials, such as ceramics, to enhance the performance of bearings, particularly for applications in electrification and high-speed rotational machinery. This strategic focus ensures SKF remains at the forefront of technological advancements in the sector.

A prime example of this innovation is SKF's development of high-performance railway bearings. These bearings are engineered to significantly reduce friction and energy consumption, contributing to greater efficiency and sustainability in the rail industry. By pushing the boundaries of material science and engineering, SKF is delivering solutions that meet the evolving demands of critical industrial applications.

Development of Energy-Efficient Solutions

SKF's technological drive centers on creating solutions that minimize friction and boost energy efficiency, directly impacting operational costs and environmental footprints for their clients.

This focus is evident in their product pipeline, with recent advancements like energy-efficient deep groove ball bearings and sealed spherical roller bearings. These innovations are designed not only to reduce CO2 emissions but also to extend the service life of components, offering tangible economic benefits.

For instance, SKF's commitment to sustainability is reflected in their 2023 report, which highlighted a 10% reduction in their own Scope 1 and 2 greenhouse gas emissions compared to 2022, partly driven by the adoption of more energy-efficient technologies and processes across their operations. This internal progress often translates into the efficiency gains offered by their external product development.

- Energy Efficiency Focus: SKF prioritizes developing products that reduce friction and energy consumption.

- CO2 Emission Reduction: Innovations aim to lower CO2 emissions for customers and in SKF's own operations.

- Product Lifespan Extension: New bearing designs contribute to longer operational life, reducing waste and replacement frequency.

- 2023 Performance: SKF reported a 10% decrease in Scope 1 and 2 emissions, showcasing the impact of efficiency measures.

Data Management and Quality

SKF Group is heavily investing in data management and quality as digitalization accelerates. The company understands that reliable, real-time data is crucial for its smart manufacturing initiatives and for providing enhanced digital customer experiences. This focus on data quality is a key driver for SKF's growth and innovation in its service portfolio.

SKF's commitment to data excellence is reflected in its ongoing efforts to refine data governance and analytics capabilities. For instance, SKF reported that its digital services contributed approximately 10% of total sales in 2023, a figure expected to grow as data-driven offerings expand. The company aims to leverage data to predict equipment failures, optimize maintenance schedules, and offer more personalized solutions to its clients.

Key aspects of SKF's technological approach to data management include:

- Enhanced Data Integration: Implementing systems to consolidate data from various sources, including sensors, production lines, and customer interactions, to create a unified view.

- Advanced Analytics: Utilizing AI and machine learning to derive actionable insights from data, enabling predictive maintenance and performance optimization.

- Cybersecurity Measures: Ensuring the integrity and security of vast amounts of sensitive data collected and processed.

- Data Quality Frameworks: Establishing strict protocols for data validation, cleansing, and enrichment to maintain high standards.

SKF is deeply integrating Industry 4.0, especially the Industrial Internet of Things (IIoT), to optimize its operations and create smarter manufacturing. This digitalization drive is central to enhancing predictive maintenance and real-time data analysis, directly improving asset performance and minimizing downtime.

AI and machine learning are being embedded into SKF's core offerings, exemplified by smart bearings with IoT for remote monitoring and predictive maintenance, aiming to extend asset lifespan and boost client efficiency. In 2023, SKF's digital services accounted for approximately 10% of its total sales, a segment poised for significant growth.

SKF's technological focus also emphasizes material innovation, investing in advanced materials like ceramics for enhanced bearing performance in demanding applications such as electrification. This commitment is evident in products designed for reduced friction and energy consumption, contributing to sustainability goals.

SKF reported a 10% reduction in its own Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022, a testament to its efficiency-focused technological advancements. The company is also prioritizing data management and quality to fuel its smart manufacturing initiatives and digital customer experiences.

Legal factors

SKF Group navigates a complex web of environmental regulations, impacting everything from emissions control to waste management and resource efficiency. These legal frameworks are a significant driver behind SKF's commitment to decarbonization and its ambitious renewable energy targets, ensuring adherence to increasingly stringent global and national standards.

For instance, the European Union's Green Deal, with its aim for climate neutrality by 2050, sets a precedent for many of SKF's operational adjustments. Compliance often necessitates significant investment in cleaner technologies and sustainable practices, influencing capital expenditure and operational costs.

SKF's position as a key supplier in demanding sectors like automotive and aerospace means it must adhere to stringent product liability laws. Failure to meet these standards, particularly for critical components like bearings and seals, can result in significant legal repercussions and damage to its reputation. For instance, in 2024, the automotive industry saw increased scrutiny on component safety, leading to more recalls and higher potential liabilities for manufacturers.

SKF's global operations, spanning 130 countries, necessitate careful navigation of diverse international trade laws and fluctuating tariff structures. These regulations directly impact the cost of goods and the ease of cross-border commerce, a critical factor for a company with extensive supply chains. For instance, changes in tariffs between major trading blocs can significantly alter the landed cost of SKF's bearings and related products in different markets.

The company's strategic move towards regionalization is a direct response to the complexities and potential disruptions arising from international trade. By strengthening regional manufacturing and supply capabilities, SKF aims to reduce its exposure to volatile trade disputes and the economic consequences of protectionist policies enacted by various governments. This approach allows for greater agility in adapting to evolving trade landscapes, ensuring business continuity and mitigating risks associated with geopolitical tensions impacting global trade flows.

Data Privacy and Cybersecurity Legislation

SKF's extensive digitalization, incorporating IoT and AI, places it under the purview of numerous data privacy and cybersecurity laws. Regulations like the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, mandate strict handling of personal data. Fines for non-compliance can be substantial, reaching up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust data protection measures to ensure legal adherence and mitigate cyber risks.

The evolving landscape of cyber threats demands continuous investment in cybersecurity infrastructure. In 2023, the average cost of a data breach globally reached $4.45 million, according to IBM's Cost of a Data Breach Report 2023. For a company like SKF, which handles sensitive operational and customer data, maintaining compliance with cybersecurity legislation is paramount to prevent financial penalties and reputational damage. Proactive security strategies are therefore a critical legal and operational imperative.

- GDPR Compliance: SKF must adhere to GDPR's principles for processing personal data, including consent, data minimization, and security.

- Cybersecurity Laws: Compliance with national and international cybersecurity frameworks is essential to protect against evolving threats.

- Data Breach Penalties: Significant financial penalties can be incurred for failing to protect sensitive data, impacting profitability and market standing.

- IoT and AI Regulations: Emerging regulations surrounding the use of IoT and AI technologies require careful consideration for data handling and security.

Corporate Governance and Reporting Requirements

SKF Group operates under rigorous corporate governance and financial reporting mandates. This includes the mandatory, regular release of detailed annual reports and sustainability reports, ensuring stakeholders are kept informed. For instance, SKF's 2023 Annual Report, published in early 2024, provided comprehensive financial performance data and strategic outlooks.

Compliance with legislation like the Securities Markets Act is paramount, fostering transparency and accountability towards shareholders and various regulatory authorities. This adherence is critical for maintaining investor confidence and smooth market operations.

SKF's commitment to these legal frameworks is demonstrated through:

- Adherence to IFRS Standards: SKF consistently reports its financial results in accordance with International Financial Reporting Standards, ensuring comparability and reliability of its financial statements. In 2023, the group reported net sales of SEK 103.9 billion.

- Corporate Governance Codes: The company follows established corporate governance codes, such as the Swedish Corporate Governance Code, to guide its board and management practices.

- Sustainability Reporting: SKF publishes detailed sustainability reports, aligning with global standards like the Global Reporting Initiative (GRI), to communicate its environmental, social, and governance performance.

- Regulatory Filings: Timely submission of all required filings to stock exchanges and financial regulatory bodies is a core legal obligation.

SKF must navigate a complex legal landscape, from environmental mandates like the EU's Green Deal to product liability in sectors like automotive. Global operations also require adherence to diverse trade laws and fluctuating tariffs, influencing supply chain costs. Furthermore, digitalization necessitates strict compliance with data privacy and cybersecurity regulations, with significant penalties for breaches.

The company's financial reporting is governed by stringent corporate governance and mandates, including adherence to IFRS standards and timely regulatory filings. For instance, SKF reported net sales of SEK 103.9 billion in 2023, underscoring the scale of its financial reporting obligations.

SKF's legal obligations extend to robust data protection measures, particularly concerning IoT and AI. Failure to comply with regulations like GDPR can result in substantial fines, as seen with the average data breach cost reaching $4.45 million in 2023. This highlights the critical need for proactive cybersecurity strategies to avoid financial and reputational damage.

Environmental factors

SKF is aggressively pursuing decarbonization, with a goal to cut Scope 1 and 2 greenhouse gas emissions by 95% by 2030, using 2019 as a baseline. The company also aims for net-zero emissions across its entire value chain by 2050.

These ambitious targets are being met with significant progress. As of 2024, SKF has already achieved a 59% reduction in its Scope 1 and 2 emissions, putting it well ahead of the schedule set by the Science Based Targets initiative (SBTi).

SKF is actively transitioning to renewable energy sources, a critical environmental factor influencing its operations and strategy. The company has committed to sourcing 100% of its electricity from renewables by 2030, aligning with the RE100 initiative. This commitment reflects a broader global trend towards decarbonization.

Significant strides have been made in this transition. In 2024, SKF achieved 72% of its electricity usage from renewable sources, a notable increase from 64% in 2023. This progress demonstrates a tangible movement towards their ambitious environmental goals.

SKF is deeply committed to circular economy principles, evident in their drive to slash waste and boost recycling. For example, they're enhancing recycling rates for by-products like grinding swarf, a key step in minimizing material loss. This focus on resource efficiency is central to their sustainability strategy, aiming to reduce the environmental footprint of their operations.

The company is also pioneering circular solutions, notably through the remanufacturing of used bearings. This process extends product life and reduces the need for new raw materials. SKF's efforts in this area underscore a broader commitment to resource conservation and a more sustainable industrial model, aligning with global environmental goals.

Sustainable Product Innovation

SKF Group is actively pursuing sustainable product innovation, focusing on developing solutions that boost energy efficiency and prolong machinery lifespan for their clients. This commitment directly translates to a reduced environmental impact for their customers. For instance, SKF has introduced advanced energy-efficient bearings specifically engineered to cut down CO2 emissions and elevate motor performance. In 2023, SKF reported that 90% of its product portfolio contributed to sustainability outcomes, with a significant portion directly linked to energy efficiency improvements for customers.

SKF's strategic direction emphasizes creating products that not only perform well but also contribute positively to environmental goals. This includes innovations aimed at reducing waste and optimizing resource utilization throughout the product lifecycle. The company's ongoing research and development efforts in 2024 and into 2025 are heavily geared towards these sustainable advancements.

- Energy Efficiency: SKF's new bearing designs can reduce friction by up to 20%, leading to substantial energy savings for industrial applications.

- Extended Lifespan: Innovations in materials and lubrication contribute to bearings lasting up to 30% longer, minimizing replacement needs and waste.

- CO2 Reduction: By improving motor efficiency, SKF's products help customers lower their operational carbon footprint.

- Circular Economy: SKF is exploring and implementing solutions for remanufacturing and recycling of components, aligning with circular economy principles.

Supply Chain Environmental Stewardship

SKF Group actively integrates environmental stewardship throughout its supply chain. A key initiative requires major energy-intensive raw material suppliers to achieve ISO 50001 certification by 2025, demonstrating a commitment to energy management systems.

The company is also focused on minimizing CO2 emissions stemming from the transportation of goods. This includes exploring more sustainable logistics solutions and optimizing shipping routes to reduce the carbon footprint associated with moving materials and finished products.

SKF encourages its suppliers to set and pursue more ambitious greenhouse gas reduction targets. This collaborative approach aims to drive broader environmental improvements across the entire value chain, fostering a shared responsibility for climate action.

- ISO 50001 Target: 2025 for major energy-intensive raw material suppliers.

- Focus Areas: CO2 emission reduction in goods transportation and encouraging supplier GHG targets.

- Strategic Goal: Extend environmental responsibility beyond direct operations into the supply chain.

SKF is making significant strides in environmental responsibility, aiming for net-zero emissions across its value chain by 2050 and a 95% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline. By 2024, the company had already achieved a 59% reduction in these emissions, exceeding SBTi targets.

The company is actively transitioning to renewable energy, with a goal of sourcing 100% of its electricity from renewables by 2030. In 2024, SKF reached 72% renewable electricity usage, up from 64% in 2023, demonstrating a strong commitment to decarbonization.

SKF is championing circular economy principles by enhancing recycling rates for by-products and remanufacturing used bearings to extend product life and reduce raw material consumption. Their product innovation focuses on energy efficiency and extended lifespan, with 90% of their portfolio contributing to sustainability outcomes in 2023, particularly through improved customer energy efficiency.

Environmental stewardship extends to SKF's supply chain, with a mandate for major energy-intensive raw material suppliers to achieve ISO 50001 certification by 2025. The group is also focused on reducing transportation emissions and encouraging suppliers to set ambitious greenhouse gas reduction targets.

| Environmental Factor | SKF's Target/Initiative | Progress/Data (as of 2024/2025) |

|---|---|---|

| Decarbonization | 95% reduction in Scope 1 & 2 emissions by 2030 (vs 2019) | 59% reduction achieved by 2024 |

| Renewable Energy | 100% renewable electricity by 2030 | 72% renewable electricity usage in 2024 (up from 64% in 2023) |

| Circular Economy | Enhanced recycling, remanufacturing of bearings | Focus on grinding swarf recycling, extending product life |

| Sustainable Products | Energy efficiency, extended lifespan | 90% of portfolio contributed to sustainability outcomes in 2023 |

| Supply Chain Management | ISO 50001 for suppliers, reduced transport emissions | Target for suppliers by 2025, ongoing logistics optimization |

PESTLE Analysis Data Sources

Our SKF Group PESTLE Analysis is built on a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, environmental, and legal factors are grounded in current and reliable information.