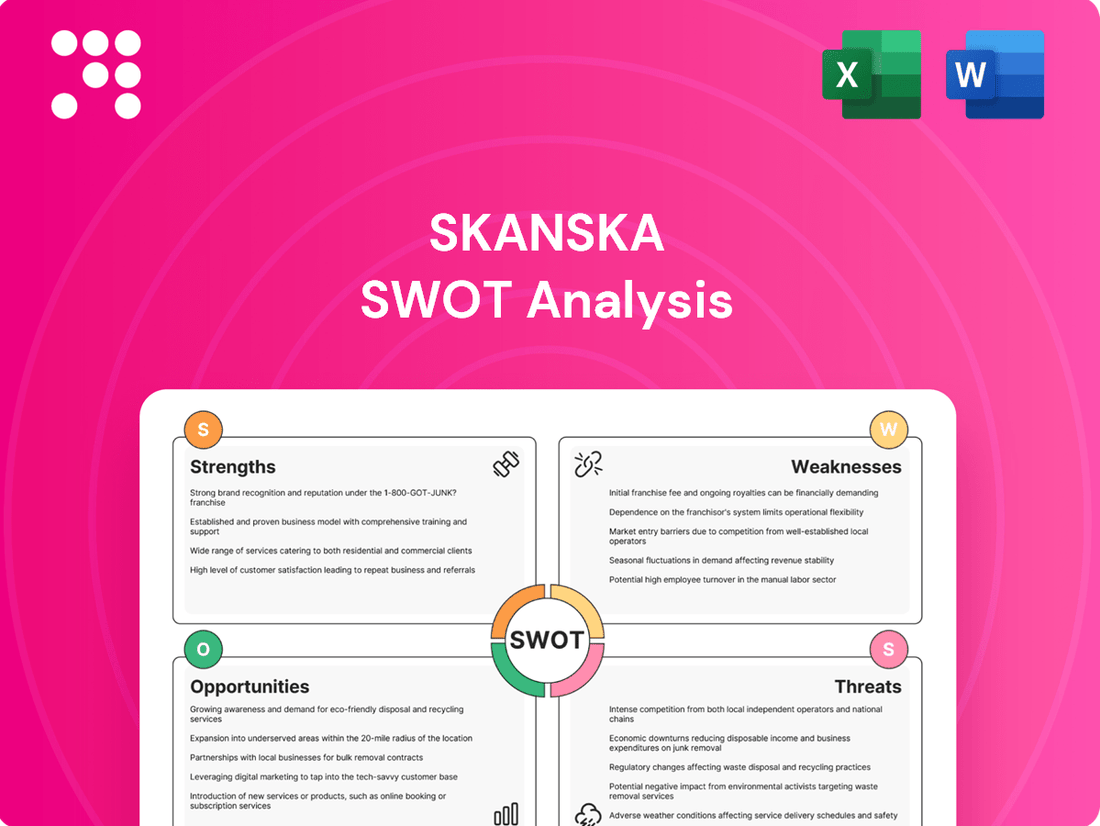

Skanska SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skanska Bundle

Skanska's strengths lie in its global reach and commitment to sustainability, but it faces challenges from market fluctuations and intense competition. Understanding these dynamics is crucial for anyone looking to invest or partner.

Want the full story behind Skanska's market position, potential pitfalls, and strategic advantages? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Skanska boasts a significant global footprint, operating in numerous countries across Europe and North America. This extensive reach across continents, combined with its involvement in diverse business areas like construction, commercial and residential property development, and infrastructure, significantly reduces its exposure to localized economic vulnerabilities. For instance, in 2024, Skanska reported strong performance in its Nordic markets despite some headwinds in other regions, showcasing the benefit of this diversification.

Skanska stands out with its deep commitment to sustainability, a key driver in today's construction market. They are recognized for leading green building certifications and designing energy-efficient structures, a significant draw for environmentally conscious clients. This focus directly addresses the growing global demand for responsible development, giving Skanska a distinct edge.

Innovation is another core strength, with Skanska actively exploring technologies like Building Information Modeling (BIM) and modular construction. These advancements are crucial for enhancing efficiency and streamlining project delivery, as evidenced by their continued investment in R&D, which reached SEK 1.2 billion in 2023, up from SEK 1.1 billion in 2022.

Skanska consistently showcases robust financial performance, a key strength. For instance, in the first quarter of 2024, the company reported a solid operating income of SEK 3.1 billion, demonstrating its ability to generate consistent profitability even amidst market fluctuations. This financial stability is underpinned by a strong balance sheet, enabling Skanska to undertake significant, capital-intensive projects.

The company's access to capital markets is another significant advantage. Skanska's status as a publicly traded entity with a long track record of financial prudence allows it to secure favorable financing for its extensive project pipeline. This financial muscle is crucial for bidding on and executing large infrastructure and construction contracts, which often require substantial upfront investment and long-term funding commitments.

This financial resilience translates into increased confidence from stakeholders. Clients, partners, and investors alike recognize Skanska's dependable financial health, which is vital for securing new business and fostering long-term relationships. This trust, built on a foundation of stable revenues and profitability, directly supports Skanska's strategic growth initiatives and its ability to navigate economic uncertainties.

Extensive Project Experience and Expertise

Skanska's extensive project experience and deep expertise are cornerstones of its strength. With decades in the construction and development sectors, the company has a proven ability to manage intricate projects, from iconic buildings to vital infrastructure. This robust track record, evidenced by successful delivery of large-scale developments, underscores their capability and reliability in the market.

This accumulated knowledge translates into a highly skilled workforce, a significant asset for securing new contracts and ensuring efficient project execution. For instance, in 2023, Skanska reported a strong order backlog of SEK 233 billion (approximately USD 22 billion), reflecting the continued demand for their expertise in complex projects.

Key aspects of this strength include:

- Decades of industry experience: Skanska has a long-standing presence and deep understanding of construction and development.

- Proven track record: The company has successfully delivered numerous complex and large-scale projects globally.

- Skilled workforce: Decades of operation have cultivated a highly experienced and capable team.

- Expertise in diverse sectors: Skanska demonstrates proficiency across various project types, including buildings and infrastructure.

Established Brand Reputation and Trust

Skanska's established brand reputation, built over decades of successful project delivery, fosters significant trust among clients and stakeholders worldwide. This strong global recognition is a key asset, enabling the company to secure new business more readily and attract top-tier talent. For instance, Skanska consistently ranks high in industry reputation surveys, a testament to their reliability and quality.

This deeply ingrained trust translates into tangible business advantages. It often positions Skanska as a preferred partner, increasing their win rate in competitive bidding processes. In 2023, Skanska reported a customer satisfaction score of 85%, highlighting the positive impact of their brand on client relationships.

- Global Recognition: Skanska's brand is recognized and respected across numerous international markets.

- Client Loyalty: A trusted reputation leads to repeat business and stronger, long-term client partnerships.

- Talent Acquisition: The company's strong brand image aids in attracting and retaining skilled professionals in a competitive industry.

- Competitive Edge: Brand trust provides a significant advantage when bidding for large-scale infrastructure and construction projects.

Skanska's extensive global presence across Europe and North America, coupled with its diversified business segments, significantly mitigates risks associated with localized economic downturns. This broad operational base, spanning construction, property development, and infrastructure, allows the company to leverage regional strengths and offset weaknesses in other markets. For example, Skanska's performance in 2024 demonstrated resilience in its Nordic operations despite challenges elsewhere, highlighting the benefit of this geographic and sectoral diversification.

A strong commitment to sustainability is a key differentiator for Skanska, aligning with the increasing global demand for environmentally responsible construction practices. The company's leadership in green building certifications and energy-efficient design appeals to a growing segment of clients prioritizing sustainability. This focus not only enhances Skanska's market appeal but also positions it favorably for future regulatory and market shifts towards greener development.

Skanska's dedication to innovation, particularly in areas like Building Information Modeling (BIM) and modular construction, drives operational efficiency and project delivery. Continued investment in research and development, which saw an increase from SEK 1.1 billion in 2022 to SEK 1.2 billion in 2023, underscores this commitment. These technological advancements are crucial for maintaining a competitive edge in the construction industry.

The company's robust financial performance, marked by a solid operating income of SEK 3.1 billion in Q1 2024, demonstrates its capacity for consistent profitability. This financial stability, supported by a strong balance sheet, enables Skanska to undertake large, capital-intensive projects and navigate market volatility effectively. Furthermore, its established access to capital markets, facilitated by its public listing and financial prudence, ensures favorable financing for its extensive project pipeline.

Skanska's deep-seated industry experience, built over decades, translates into a highly skilled workforce and a proven track record in managing complex projects. This expertise, evident in the successful execution of numerous large-scale developments globally, underpins its ability to secure new contracts and deliver projects efficiently. The company's order backlog of SEK 233 billion in 2023 reflects the sustained demand for its specialized capabilities.

Skanska's strong global brand reputation, cultivated through years of successful project delivery, fosters significant trust among clients and stakeholders. This recognition is a critical asset for securing new business and attracting top talent, as evidenced by its high rankings in industry reputation surveys. In 2023, Skanska achieved an 85% customer satisfaction score, underscoring the positive impact of its brand on client relationships and competitive positioning.

What is included in the product

Maps out Skanska’s market strengths, operational gaps, and risks by examining its internal capabilities and external market dynamics.

Offers a clear, actionable framework for identifying and addressing Skanska's strategic challenges.

Weaknesses

Skanska's business is deeply tied to the health of the economy. When interest rates rise or inflation spikes, as seen in the persistent inflation throughout 2023 and into early 2024, demand for new construction and property development often cools. This sensitivity means a slowdown in economic growth, a real concern in many global markets heading into 2025, can directly hit Skanska's project pipeline and profitability.

A weakening economy can also make financing more expensive and harder to secure, leading to project delays or even outright cancellations. For instance, during periods of economic uncertainty, developers may postpone large-scale projects, directly impacting a company like Skanska that relies on a steady stream of work. This cyclical nature is a fundamental challenge for the industry.

Skanska operates in sectors that demand substantial upfront capital for equipment, land acquisition, and project financing, making it a capital-intensive business. This inherent characteristic means significant financial resources are tied up before revenue generation even begins.

The company contends with high ongoing operational expenses, including labor, raw materials, and the maintenance of specialized machinery. For instance, in 2023, Skanska reported increased costs for materials and energy, impacting its project margins.

Effectively managing these substantial costs is crucial for profitability, especially when faced with volatile input prices or tight labor markets. The ability to control these expenditures directly influences Skanska's competitive pricing and overall financial health.

Skanska's global operations mean it must navigate a patchwork of building codes, environmental laws, and zoning regulations across many countries. These diverse and often changing rules can significantly impact project timelines and budgets, as seen in potential increases in compliance costs. For instance, stricter environmental standards introduced in 2024 in several European markets where Skanska is active could necessitate costly redesigns or material changes.

Intense Competition in Key Markets

Skanska operates in a construction and property development sector characterized by fierce rivalry. Many global giants and niche specialists compete for lucrative contracts, creating a challenging environment. This intense competition can compress profit margins, forcing Skanska to adopt aggressive pricing and focus on cost control. For instance, in 2023, the global construction market saw significant price volatility, impacting bidding strategies across the industry.

The need for continuous innovation and cost efficiency is paramount for Skanska to maintain its market position. Staying ahead requires substantial investment in new technologies and sustainable practices. Skanska's commitment to innovation is reflected in its increased R&D spending, which reached SEK 1.2 billion in 2024, aimed at developing more efficient construction methods and materials.

- High Rivalry: Numerous international and local firms compete for projects.

- Margin Pressure: Intense competition can lead to lower profit margins.

- Strategic Necessity: Continuous differentiation through innovation or cost reduction is vital.

Potential for Supply Chain Disruptions

Skanska's extensive reliance on a global network of suppliers for everything from raw materials to specialized services presents a significant vulnerability. Disruptions stemming from events like the ongoing geopolitical tensions impacting raw material costs or the lingering effects of global supply chain snarls experienced in 2023-2024 can directly translate into material shortages and inflated prices. This makes proactive risk management and the cultivation of resilient supply chains a constant and critical challenge for the company.

Skanska's significant capital intensity means large sums are tied up in projects before revenue is generated, impacting cash flow. High operational expenses, including labor and materials, were evident in 2023 with rising costs impacting margins, necessitating stringent cost control to maintain profitability. Navigating diverse and evolving international regulations adds complexity and potential budget overruns, as stricter environmental standards in Europe from 2024 illustrate.

Full Version Awaits

Skanska SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Skanska SWOT analysis, ensuring transparency and quality. Once purchased, the complete, detailed report will be yours to download.

Opportunities

The global push for greener construction and sustainable infrastructure presents a significant opportunity. Skanska, with its proven expertise in green building, is well-positioned to capture this growing market demand. This focus aligns with increasing client and regulatory preferences for projects that emphasize energy efficiency and reduced environmental impact.

Skanska's commitment to sustainability is a key differentiator. For instance, in 2023, Skanska reported that 90% of its building projects in the Nordics were certified green. This leadership allows them to secure projects that meet stringent environmental standards, a trend expected to accelerate through 2025 and beyond.

The global trend of increasing urbanization is a significant opportunity for Skanska. By 2050, it's projected that 68% of the world's population will live in urban areas, a substantial jump from today's figures. This demographic shift directly translates into a heightened demand for housing and essential infrastructure within cities.

Skanska is well-positioned to capitalize on this by leveraging its integrated business model, which spans residential and commercial property development, alongside construction and infrastructure services. For instance, in 2023, Skanska's residential development segment in Sweden saw continued strong demand, contributing positively to its overall performance. This expertise allows the company to address the growing need for urban living spaces and the necessary supporting services.

This sustained urbanization creates a predictable and robust pipeline of potential projects for Skanska. The company's ability to deliver comprehensive solutions, from building homes to constructing the roads and utilities that connect them, makes it a valuable partner in urban expansion efforts. This provides a consistent stream of revenue and growth opportunities in key urban markets.

Skanska has a significant opportunity to leverage advancements in construction technology like Building Information Modeling (BIM) and artificial intelligence (AI). These tools can dramatically improve project efficiency and reduce costs. For instance, BIM adoption in the construction industry is projected to grow, with the global BIM market expected to reach $17.15 billion by 2029, up from $7.4 billion in 2022, indicating a strong trend towards digital integration.

By investing more in AI, robotics, and prefabrication, Skanska can streamline project management, refine design processes, and optimize construction methods. This technological embrace can lead to a substantial competitive edge. Companies that effectively integrate AI into their operations have seen significant improvements; for example, a McKinsey report indicated that AI adoption can boost productivity by up to 15%.

Expansion into Emerging Markets

Skanska can leverage its expertise to tap into emerging markets with substantial infrastructure deficits. For instance, countries in Southeast Asia and parts of Africa are projected to see significant GDP growth in 2024-2025, driving demand for construction services. Skanska's experience in sustainable building and large-scale projects positions it well to capitalize on these opportunities.

These markets often present less saturated competitive landscapes, potentially leading to higher profit margins. However, careful due diligence is crucial to navigate the inherent geopolitical and economic volatilities. For example, while Vietnam's infrastructure spending is set to increase, understanding local regulatory frameworks is paramount.

- Targeted Expansion: Focus on emerging economies with clear infrastructure development plans and stable economic outlooks for 2024-2025.

- Risk Mitigation: Implement robust risk assessment and management strategies to address geopolitical and currency fluctuations in new markets.

- Strategic Alliances: Form partnerships with local entities to gain market access, navigate regulations, and share project risks.

Public-Private Partnership (PPP) Initiatives

Governments globally are increasingly turning to Public-Private Partnerships (PPPs) as a primary method for financing and executing major infrastructure developments. Skanska, with its proven track record in managing intricate infrastructure projects and its robust financial standing, is well-positioned to secure and excel in these collaborative ventures. These partnerships provide predictable, long-term revenue streams and allow Skanska to contribute to pivotal national development initiatives.

For instance, in 2023, the US government announced plans to invest over $1.2 trillion in infrastructure through various funding mechanisms, including a significant portion allocated for PPPs. Skanska's involvement in projects like the $3.3 billion Chicago Skyway concession in 2005 demonstrates its capacity to manage large-scale, long-term infrastructure assets. The company’s financial strength, evidenced by its 2023 reported revenue of SEK 177 billion (approximately $16.5 billion USD), further solidifies its ability to undertake substantial PPP commitments.

- Government reliance on PPPs for infrastructure: Many nations are prioritizing PPPs to bridge funding gaps for critical projects.

- Skanska's suitability for PPPs: Its extensive experience in complex infrastructure and strong financial health make it an ideal partner.

- Benefits of PPPs for Skanska: Access to stable, long-term revenue and involvement in large-scale national projects.

- Market trends: The global PPP market is projected to see continued growth, driven by infrastructure needs and government policies.

The global demand for sustainable and green construction is a major opportunity. Skanska's established expertise in this area, highlighted by 90% of its Nordic building projects being green certified in 2023, positions it to meet this growing market. This trend is further supported by increasing client and regulatory preferences for environmentally conscious projects.

Urbanization continues to drive demand for housing and infrastructure, with 68% of the world's population projected to live in urban areas by 2050. Skanska's integrated model, demonstrated by strong residential development performance in Sweden in 2023, allows it to effectively address these urban expansion needs.

Advancements in construction technology, such as BIM and AI, offer significant efficiency gains. The BIM market alone is expected to reach $17.15 billion by 2029, signaling a strong digital integration trend that Skanska can leverage for a competitive edge, potentially boosting productivity by up to 15% as seen with AI adoption.

Emerging markets with infrastructure deficits, particularly in Southeast Asia and Africa, present growth opportunities. Skanska's experience in large-scale, sustainable projects, coupled with a strong 2023 revenue of SEK 177 billion, enables it to capitalize on these expanding markets, potentially benefiting from less saturated competition.

Governments increasingly favor Public-Private Partnerships (PPPs) for infrastructure, a model Skanska is well-suited for given its project management experience and financial strength, evidenced by its substantial 2023 revenue. The US alone plans over $1.2 trillion in infrastructure investment, with a significant portion for PPPs, offering Skanska stable, long-term revenue streams.

Threats

Global economic slowdowns, a persistent concern heading into 2025, directly threaten construction demand. Reduced government infrastructure spending and cautious private sector investment can significantly dampen order intake for companies like Skanska. For instance, a projected slowdown in the Eurozone's GDP growth for 2025 could translate to fewer large-scale public works contracts.

Inflationary pressures remain a critical threat, particularly concerning material and labor costs. If Skanska cannot adequately pass these increased expenses onto clients, profit margins will inevitably shrink. The rising cost of key construction materials, such as steel and concrete, coupled with wage inflation in 2024 and projected into 2025, presents a direct challenge to maintaining profitability on existing and future projects.

Rising interest rates, a significant concern in 2024 and projected into 2025, directly increase the cost of capital for Skanska's development ventures and for its clients. This escalation in borrowing expenses can dampen enthusiasm for new projects and acquisitions.

Higher interest rates make real estate investments less appealing due to increased financing costs. This trend can lead to a slowdown in both commercial and residential property markets, directly affecting the demand for Skanska's construction and development services. For instance, the Federal Reserve's benchmark interest rate remained at 5.25%-5.50% through early 2024, a level that has already influenced project financing costs.

Geopolitical instability, including ongoing conflicts and rising trade tensions, presents a significant threat to Skanska's operations. For instance, the prolonged Russia-Ukraine conflict, which began in 2022, continues to impact global supply chains and energy prices, indirectly affecting construction material costs and project timelines worldwide. This instability, coupled with increasing protectionist policies in major markets, can disrupt material sourcing and raise operational expenses.

Trade wars and the implementation of tariffs, such as those seen between major economic blocs in recent years, directly increase the cost of imported materials and equipment essential for Skanska's large-scale projects. This can lead to project delays and budget overruns. Furthermore, the uncertainty generated by these trade disputes can chill investment climates, potentially leading to the cancellation or postponement of planned infrastructure and construction ventures in affected regions.

Skanska's extensive global presence, operating across Europe and North America, inherently exposes it to a wide array of geopolitical risks. For example, shifts in trade agreements or the imposition of new sanctions in any of its key operating regions can complicate cross-border logistics, increase the complexity of managing international projects, and create significant operational hurdles.

Skilled Labor Shortages

The construction sector, including major players like Skanska, continues to grapple with a significant deficit in skilled labor across developed economies. This scarcity extends to crucial roles such as project managers, engineers, and specialized craftspeople, impacting project timelines and overall quality.

This shortage directly translates into higher labor expenses and potential project delays, directly affecting Skanska’s operational efficiency and profitability. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for over 500,000 additional construction workers annually over the next decade to meet demand.

To counter this pervasive threat, Skanska's strategic imperative includes robust investment in:

- Apprenticeship and training programs: Developing internal talent pipelines to address specific skill gaps.

- Employee retention initiatives: Implementing competitive compensation, benefits, and career development opportunities to keep skilled workers engaged.

- Technology adoption: Exploring and integrating advanced construction technologies that can enhance productivity and potentially reduce reliance on certain manual labor roles.

Stringent Environmental Regulations and Climate Change Impacts

Skanska faces growing challenges from increasingly strict environmental regulations. For instance, the European Union's Green Deal, with its ambitious climate targets, necessitates substantial investments in sustainable construction practices and technologies. These regulations, covering areas like carbon emissions and waste management, directly impact compliance costs and operational procedures, potentially increasing project expenses and requiring adaptation of existing business models.

The physical manifestations of climate change also pose significant threats. Extreme weather events, such as increased frequency of heavy rainfall or heatwaves, can lead to project delays, damage to materials and infrastructure, and ultimately higher insurance premiums for Skanska's global operations. For example, the construction sector in many regions is already seeing increased costs associated with climate resilience measures and business interruption insurance due to severe weather patterns observed in 2024 and projected for 2025.

- Increased Compliance Costs: Stricter emissions standards and waste reduction mandates, like those being phased in across North America and Europe through 2025, require capital expenditure in greener technologies.

- Operational Disruptions: Climate change-induced extreme weather events can halt construction, leading to schedule overruns and increased labor costs.

- Higher Insurance Premiums: The escalating risk associated with climate events translates to more expensive insurance coverage for projects and assets.

- Supply Chain Vulnerability: Climate impacts can disrupt the availability and cost of raw materials, affecting project timelines and budgets.

Global economic headwinds, including potential slowdowns in key markets like the Eurozone heading into 2025, pose a direct threat to construction demand. Persistent inflation, particularly for materials and labor, continues to squeeze profit margins if costs cannot be passed on. Furthermore, elevated interest rates, remaining high in early 2024 and projected into 2025, increase capital costs for projects and dampen overall investment appetite.

| Threat Category | Specific Threat | Impact on Skanska | Data Point/Example (2024-2025 Projection) |

|---|---|---|---|

| Economic Factors | Global Economic Slowdown | Reduced construction demand, lower order intake | Projected Eurozone GDP slowdown impacting infrastructure spending |

| Economic Factors | Inflationary Pressures | Shrinking profit margins due to rising material and labor costs | Steel and concrete price increases, wage inflation |

| Economic Factors | Rising Interest Rates | Increased cost of capital, dampened project investment | Federal Reserve rate at 5.25%-5.50% influencing financing costs |

| Geopolitical Factors | Geopolitical Instability | Supply chain disruptions, increased operational expenses | Impact of Russia-Ukraine conflict on global supply chains and energy prices |

| Labor Market | Skilled Labor Shortage | Project delays, increased labor expenses, quality concerns | US BLS projection: need for 500,000+ additional construction workers annually |

| Regulatory & Environmental | Stricter Environmental Regulations | Increased compliance costs, need for investment in sustainable practices | EU Green Deal necessitating capital expenditure in greener technologies |

| Regulatory & Environmental | Climate Change Impacts | Project delays due to extreme weather, higher insurance premiums | Increased insurance costs for climate resilience measures observed in 2024 |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Skanska's official financial reports, comprehensive market research, and insights from industry experts and news outlets.