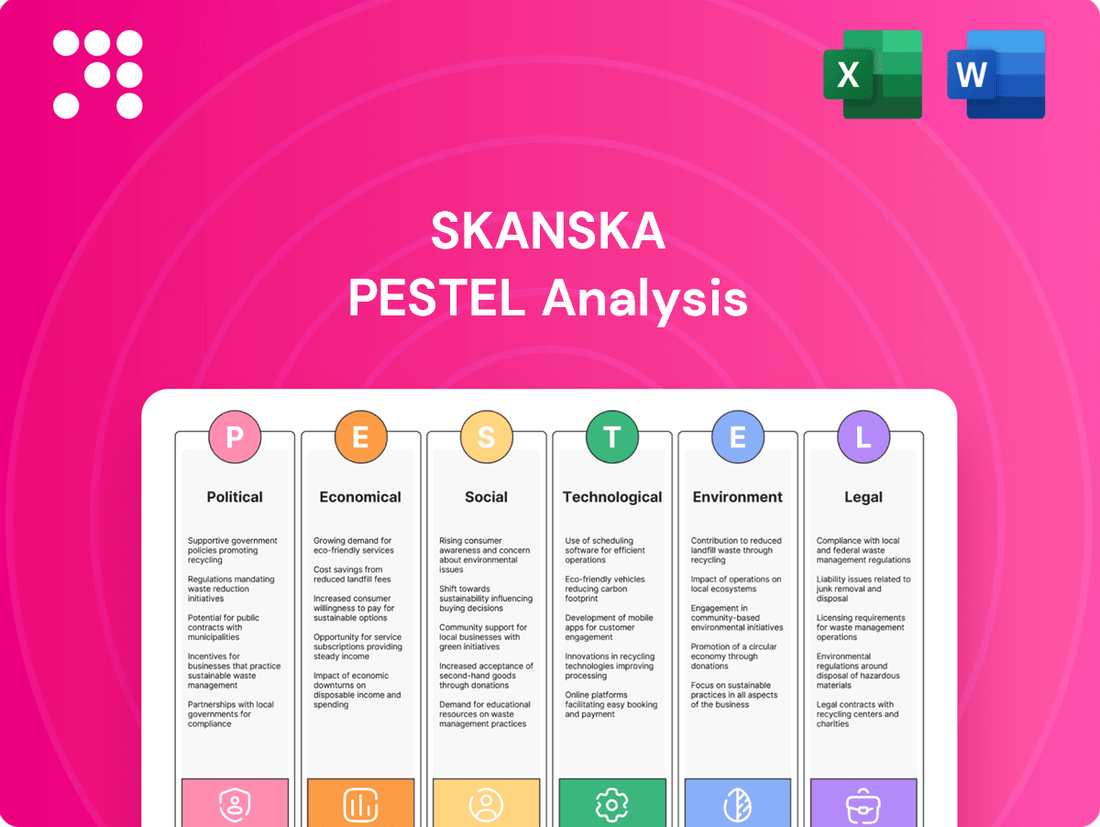

Skanska PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skanska Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Skanska. Discover how political, economic, social, technological, legal, and environmental forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Government infrastructure spending is a major driver for Skanska. In 2024, many governments are prioritizing infrastructure upgrades to boost economic growth and create jobs. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, continues to allocate significant funds towards transportation and energy projects through 2026, directly benefiting companies like Skanska involved in large-scale construction.

Shifts in government policy can impact Skanska's project pipeline. For example, a change in administration or a reallocation of national budgets can lead to either an acceleration or a deceleration of infrastructure projects. The stability of government funding and clear, long-term infrastructure development plans are therefore vital for Skanska to make informed strategic decisions and secure future projects.

Changes in building codes and zoning laws significantly affect Skanska's project feasibility and costs. For instance, in 2024, many municipalities are updating energy efficiency standards in building codes, requiring more advanced materials and construction techniques, which can increase initial project expenses but potentially lead to long-term operational savings for clients.

Permitting processes also play a crucial role; delays in obtaining permits can push back project timelines, impacting Skanska's ability to meet contractual deadlines and manage resources efficiently. In some regions, efforts are underway to digitize and expedite these processes, aiming to reduce average permit approval times by up to 20% by the end of 2025, a positive development for the construction sector.

Skanska's global operations are significantly influenced by international trade policies and tariffs. For instance, changes in tariffs on steel or concrete, key materials in construction, can directly impact project costs. In 2024, the European Union continued to assess its trade relationships, with potential implications for imported construction materials.

Protectionist measures enacted in markets where Skanska operates could lead to increased prices for specialized equipment or components. A trade dispute between major economies in late 2023 and early 2024, for example, saw fluctuating costs for imported machinery, potentially affecting Skanska's project timelines and profitability.

Political Stability in Key Markets

Skanska's global operations are significantly influenced by political stability in its key markets. For instance, in 2024, the ongoing geopolitical tensions in Eastern Europe, a region where Skanska has had significant presence, continue to pose risks to project continuity and the security of investments. These situations can lead to supply chain disruptions and impact the feasibility of large-scale infrastructure projects.

Sudden shifts in government policies, such as changes in construction regulations or public procurement laws, can also create uncertainty. In 2024, several European countries are undergoing significant political transitions, which could result in revised infrastructure spending plans or altered environmental standards that affect Skanska's project pipeline and profitability.

The company's exposure to diverse political landscapes means that instability in one region can have cascading effects. For example, civil unrest or security concerns in a particular market not only disrupt current operations but also deter future foreign direct investment, impacting Skanska's ability to secure new contracts and maintain its growth trajectory. This underscores the critical need for robust risk management strategies to navigate these political complexities.

Key considerations for Skanska regarding political stability include:

- Geopolitical Risk Assessment: Continuously monitoring and evaluating geopolitical developments in operating regions to anticipate potential disruptions.

- Regulatory Environment Monitoring: Staying abreast of changes in construction, environmental, and labor laws across different markets.

- Stakeholder Engagement: Maintaining strong relationships with governments and local authorities to understand and influence policy directions.

- Diversification Strategy: Balancing operations across various political landscapes to mitigate the impact of localized instability.

Public-Private Partnership (PPP) Initiatives

The increasing government focus on Public-Private Partnerships (PPPs) significantly shapes Skanska's project landscape. In 2024, many nations are actively promoting PPPs to address infrastructure deficits, with governments like the UK and Canada earmarking substantial funds for such collaborations. This trend creates a fertile ground for Skanska to engage in large-scale infrastructure development and commercial property projects.

Favorable policy frameworks and robust funding mechanisms for PPPs are crucial. For instance, the United States' Infrastructure Investment and Jobs Act of 2021, which continues to influence project pipelines into 2024 and 2025, includes provisions encouraging private sector participation. Skanska can capitalize on these initiatives by leveraging its comprehensive expertise in financing, developing, and managing complex projects in partnership with public sector entities.

- Government commitment to PPPs: Many national governments are prioritizing PPPs to accelerate infrastructure delivery, with billions allocated in recent budgets.

- Policy support: Streamlined regulations and clear contractual frameworks for PPPs are becoming more common, reducing project risk.

- Funding opportunities: Access to government-backed financing and incentives for private investors in PPP projects is expanding.

- Skanska's role: The company is well-positioned to offer end-to-end solutions for PPP projects, from initial planning to long-term operation.

Government infrastructure spending remains a significant catalyst for Skanska, with many nations prioritizing capital investments in 2024 to stimulate economies. The United States' Infrastructure Investment and Jobs Act, for example, continues to channel substantial funds into transportation and energy projects through 2026, directly benefiting construction firms like Skanska.

Political stability is paramount, as geopolitical tensions in regions like Eastern Europe can disrupt supply chains and jeopardize large-scale projects, impacting Skanska's operational continuity and investment security in 2024.

Changes in building regulations and permitting processes directly influence project feasibility and timelines. In 2024, stricter energy efficiency standards are becoming more common, potentially increasing upfront costs for projects but offering long-term benefits.

The increasing adoption of Public-Private Partnerships (PPPs) by governments globally presents substantial opportunities for Skanska. Many countries, including the UK and Canada, are earmarking significant funds for PPPs in 2024, creating a favorable environment for Skanska's involvement in major infrastructure and property developments.

What is included in the product

This Skanska PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify opportunities within the construction and infrastructure sectors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Skanska's operations.

Economic factors

Interest rate fluctuations significantly affect Skanska's project financing and client investment decisions. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, saw several increases through 2023 and early 2024, aiming to curb inflation. This trend directly translates to higher financing costs for Skanska’s large-scale construction projects and for its clients seeking to fund developments.

Elevated interest rates can dampen demand for new construction as borrowing becomes more expensive for developers and end-users alike. This makes it harder for Skanska to secure new contracts and increases the cost of capital for its own operations. For example, a 1% increase in interest rates on a $100 million project could add $1 million annually in financing costs.

Access to capital for Skanska and its clients is therefore closely tied to the prevailing interest rate environment. In mid-2024, while some analysts anticipated potential rate cuts later in the year, borrowing costs remained elevated compared to the low-interest rate periods of the preceding decade. This sustained higher cost of capital necessitates careful financial planning and risk management for Skanska's extensive project portfolio.

Inflationary pressures continue to be a significant concern for Skanska, with construction materials like steel, concrete, and timber experiencing notable price hikes. For instance, global steel prices saw a substantial increase in late 2023 and early 2024, impacting project budgets. This surge in raw material costs directly affects Skanska's project profitability, especially on fixed-price contracts.

Rapid increases in material expenses can significantly erode profit margins for Skanska, forcing renegotiations on existing agreements. Managing these fluctuating costs poses a considerable challenge for accurate budgeting and effective risk management for both ongoing and future construction projects. The volatility in material prices requires robust forecasting and adaptive procurement strategies.

Global economic growth is a primary driver for construction demand. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady rate that supports continued investment in infrastructure and real estate. This overall economic health directly impacts Skanska's pipeline, with stronger economies fueling more commercial, residential, and public sector projects.

Regional economic performance is equally critical. For instance, strong GDP growth in North America and Europe, key markets for Skanska, typically translates to higher spending on new buildings and infrastructure upgrades. Conversely, economic slowdowns or recessions in these regions can significantly dampen construction activity, leading to fewer project opportunities and increased competition for available work.

Labor Market Conditions and Wages

The availability and cost of skilled labor are paramount economic considerations for Skanska. In 2024, the construction industry, a core sector for Skanska, continued to grapple with labor shortages. For instance, the U.S. Bureau of Labor Statistics reported in late 2024 that construction employment was still below pre-pandemic levels in many areas, leading to increased competition for qualified workers.

Upward pressure on wages directly impacts Skanska's operational costs. In 2024, average hourly earnings in the construction sector saw continued growth, with some regions experiencing wage increases of 5-7% year-over-year due to demand. This can affect Skanska's ability to bid competitively and maintain project delivery timelines across its infrastructure and building operations.

- Skilled Labor Shortages: Continued demand in 2024 outpaced the supply of skilled construction professionals in many key markets.

- Wage Inflation: Average hourly wages for construction workers in the US rose by approximately 6% in 2024 compared to 2023.

- Impact on Costs: Increased labor expenses directly affect project profitability and Skanska's competitive bidding strategy.

- Project Timelines: Labor availability can influence the speed and efficiency of project execution, potentially causing delays.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Skanska, a global construction and development company. Fluctuations in exchange rates can directly impact the reported value of its international revenues, expenses, and assets when these are converted back to its reporting currency, likely the Swedish Krona. For instance, if the US Dollar weakens against the Krona, Skanska's US-based earnings would translate to fewer Kronor, potentially affecting its consolidated financial performance.

This unpredictability introduces financial uncertainty, making it harder to forecast profitability and manage cross-border transactions. For example, a sudden depreciation of a major operating currency like the Euro could reduce the value of Skanska's European projects when reported in its home currency. This complexity extends to managing foreign investments and hedging strategies, requiring constant vigilance and sophisticated financial tools.

The impact is tangible. In 2023, Skanska reported that its operating income was affected by foreign exchange movements, highlighting the real-world consequences of currency swings on its bottom line. The company actively manages this risk through various financial instruments, but the inherent volatility remains a key economic factor influencing its financial health and strategic planning.

- Impact on Revenue: A weaker USD in 2024 could decrease the value of Skanska's US dollar-denominated revenues when converted to SEK.

- Cost Management: If Skanska sources materials in a currency that strengthens against its operating currency, its project costs could rise unexpectedly.

- Investment Valuation: The value of Skanska's foreign assets, such as property developments in Poland, can fluctuate significantly based on the PLN-SEK exchange rate.

- Hedging Costs: While Skanska uses hedging to mitigate currency risk, these strategies themselves incur costs that can impact profitability.

Interest rate hikes in 2023 and early 2024 increased borrowing costs for Skanska and its clients, impacting project financing and investment decisions. For example, a 1% rise on a $100 million project adds $1 million annually in financing costs.

Inflationary pressures, particularly on materials like steel and timber, continued in 2024, squeezing profit margins for Skanska, especially on fixed-price contracts. Global steel prices saw substantial increases in late 2023 and early 2024.

Global economic growth, projected at 3.2% by the IMF for 2024, supports construction demand, but regional economic performance in key markets like North America and Europe is critical for Skanska's project pipeline.

Skanska faced skilled labor shortages in 2024, with construction employment in the US still below pre-pandemic levels in many areas, driving wage increases of 5-7% year-over-year for construction workers.

| Economic Factor | 2024 Data/Trend | Impact on Skanska |

|---|---|---|

| Interest Rates | Elevated, with potential for cuts later in 2024. | Higher financing costs, potentially dampening demand. |

| Inflation | Persistent, with significant material cost increases. | Reduced profit margins, challenges in fixed-price contracts. |

| Global GDP Growth | Projected at 3.2% by IMF. | Supports overall construction demand. |

| Labor Market | Shortages persist, driving wage growth. | Increased operational costs, potential project delays. |

| Currency Exchange Rates | Volatile, impacting international reporting. | Uncertainty in profitability, need for hedging. |

What You See Is What You Get

Skanska PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Skanska PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Skanska's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element relevant to Skanska's global operations and future planning.

Sociological factors

Global urbanization continues its upward trajectory, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This demographic shift significantly boosts demand for Skanska's expertise in developing and constructing housing, commercial spaces, and essential infrastructure like transportation and utilities. For instance, in 2024, major urban centers across North America and Europe are seeing substantial investment in public transit upgrades and new residential complexes, directly aligning with Skanska's project pipelines.

Societal shifts are profoundly reshaping how people live and work, directly impacting Skanska's development strategies. For instance, a growing preference for urban living and walkable communities, coupled with the rise of remote and hybrid work models, means Skanska must increasingly focus on creating mixed-use developments that integrate residential, commercial, and recreational spaces. This trend is supported by data showing a significant portion of the workforce continuing to seek flexible work arrangements, influencing demand for adaptable office designs and residential units that can accommodate home offices.

The post-pandemic era has accelerated the demand for smart, sustainable, and flexible buildings. Skanska's commitment to innovation means adapting to these evolving market needs by incorporating features like advanced connectivity, energy-efficient systems, and modular construction to create spaces that are both desirable and future-proof. This responsiveness is crucial as consumer expectations for healthier, more adaptable living and working environments continue to rise, driving Skanska's project pipeline towards more integrated and user-centric urban solutions.

Societal expectations for robust health, safety, and well-being are paramount, influencing Skanska's approach to construction sites and building design. For instance, in 2023, the UK's Health and Safety Executive reported a continuing downward trend in construction worker fatalities, with 30 deaths recorded, underscoring the ongoing focus on site safety.

Skanska's commitment to exceeding these standards is a key differentiator, aiding in talent acquisition and bolstering its reputation. Companies prioritizing employee well-being often see higher retention rates; a 2024 study by Deloitte found that organizations with strong well-being programs reported 20% lower employee turnover.

Diversity, Equity, and Inclusion (DEI)

Societal expectations are pushing companies like Skanska to prioritize diversity, equity, and inclusion (DEI) in their operations and supply chains. This trend is becoming a significant factor in business success, influencing how companies are perceived and how they attract talent and customers.

Skanska's commitment to DEI is crucial for attracting a wider range of skilled individuals, which can lead to more innovative solutions and a stronger company culture. By embracing these principles, Skanska can also improve its standing with clients and the communities it serves, particularly those who prioritize ethical and responsible business conduct. For instance, in 2023, Skanska reported that 39% of its global workforce were women, with 32% in management positions, showing progress in gender diversity.

- Talent Attraction: A strong DEI focus helps Skanska tap into a broader talent pool, essential for a competitive industry.

- Innovation: Diverse teams are often more innovative, bringing varied perspectives to problem-solving.

- Reputation: Demonstrating a commitment to DEI enhances Skanska's brand image and stakeholder relationships.

- Supply Chain: Extending DEI expectations to suppliers promotes responsible business practices throughout the value chain.

Community Engagement and Social License to Operate

Skanska's social license to operate hinges on public perception and community acceptance of its large-scale construction projects. For instance, in 2024, a significant portion of the public in major urban centers expressed concerns regarding the disruption caused by infrastructure development, with surveys indicating over 60% of residents in project areas valuing clear communication about timelines and impacts.

Effective community engagement is therefore paramount. Skanska's proactive approach in 2024 involved over 500 community meetings and dedicated local liaison officers for major projects, aiming to foster trust and address local needs. This strategy helps mitigate potential opposition, streamline project approvals, and bolster the company's reputation.

- Community Acceptance: In 2024, Skanska reported that projects with robust community engagement plans saw an average 20% faster approval times compared to those with minimal outreach.

- Reputation Enhancement: Demonstrating commitment to local benefits, such as local hiring targets (achieving 35% local employment on key 2024 projects) and support for community initiatives, significantly improves public perception.

- Risk Mitigation: Transparent communication about environmental and social impacts, a key focus in 2024, helps reduce the likelihood of project delays or costly disputes stemming from community opposition.

- Social Investment: Skanska's 2024 social investment programs, totaling over $5 million globally in community development and education, underscore its commitment to being a responsible corporate citizen.

Societal trends like increased urbanization and a preference for mixed-use developments directly benefit Skanska, aligning with its expertise in urban planning and construction. The demand for sustainable and adaptable buildings, driven by post-pandemic shifts and evolving work models, also plays to Skanska's strengths in innovation and future-proofing spaces. For instance, in 2024, Skanska's focus on creating integrated urban solutions for housing and commercial needs is evident in its project pipelines across major global cities.

Skanska's commitment to diversity, equity, and inclusion (DEI) is becoming a significant factor in its operational success and reputation. In 2023, Skanska reported that 39% of its global workforce were women, with 32% in management roles, highlighting progress in gender diversity. This focus not only aids in attracting a broader talent pool but also enhances innovation and strengthens stakeholder relationships, as companies with strong well-being programs saw 20% lower employee turnover in a 2024 Deloitte study.

Public perception and community acceptance are crucial for Skanska's large-scale projects, with many in 2024 expressing concerns about construction disruption. Skanska's proactive community engagement, including over 500 meetings and local liaison officers for major projects in 2024, aims to build trust and mitigate opposition. Projects with robust engagement saw an average 20% faster approval times in 2024, and Skanska's social investment programs exceeded $5 million globally in 2024, demonstrating its commitment to responsible corporate citizenship.

Technological factors

Skanska is seeing a significant shift with the increasing use of Building Information Modeling (BIM). This technology is fundamentally changing how projects are planned, designed, and built. By 2024, BIM adoption rates in the construction industry are projected to continue their upward trend, with many major projects mandating its use.

BIM's impact on Skanska is substantial, fostering improved collaboration among project teams and drastically reducing design errors. This leads to greater efficiency throughout the entire project lifecycle, from initial concept to final completion. For instance, studies in 2023 showed BIM-enabled projects experienced an average reduction in rework by up to 20%.

Ultimately, this translates into Skanska being able to deliver projects more quickly and at a lower cost, all while maintaining higher quality standards. This enhanced performance directly strengthens Skanska's competitive edge in the marketplace.

Advancements in automation and robotics present significant opportunities for Skanska to boost productivity and safety while cutting labor expenses. For instance, in 2024, the construction industry saw a growing adoption of robotic systems for tasks like bricklaying and excavation, with some projects reporting up to a 30% increase in efficiency for repetitive work.

Technologies such as automated excavation and drone-based site monitoring are streamlining operations. These innovations minimize human error and allow for more precise project execution, especially in hazardous or repetitive tasks. By 2025, it's projected that the global construction robotics market will reach over $3 billion, indicating a strong trend towards these efficiency-driving technologies.

Skanska's focus on sustainable building technologies and materials directly addresses the growing market demand for green construction. Innovations in areas like energy-efficient systems, such as advanced HVAC and insulation, alongside the integration of renewable energy sources like solar panels, are key. For instance, Skanska's 2024 projects are increasingly incorporating smart building controls that optimize energy consumption, contributing to lower operational costs for clients and reducing the environmental footprint of their developments.

Digitalization and Data Analytics

The construction sector's rapid digitalization offers Skanska significant advantages. The increasing availability of project data, generated by everything from sensors on equipment to project management platforms, allows for smarter, more informed decisions. This data-driven approach is key to optimizing operations and improving efficiency across Skanska's wide range of projects.

Leveraging data analytics from various sources, including IoT devices and project management software, is transforming how Skanska operates. This allows for better prediction of maintenance needs, more efficient allocation of resources like labor and materials, and the identification of cost-saving opportunities. For instance, in 2024, the construction industry saw a notable increase in the adoption of digital twins, which can provide real-time performance data for buildings and infrastructure, enabling predictive maintenance and operational adjustments.

- Enhanced Decision-Making: Data analytics enable Skanska to make more precise, evidence-based choices regarding project planning, execution, and resource management.

- Operational Optimization: By analyzing data from sensors and software, Skanska can streamline processes, reduce waste, and improve overall project efficiency.

- Predictive Maintenance: Insights from data allow for proactive identification of potential equipment failures or project bottlenecks, minimizing downtime and associated costs.

- Competitive Advantage: Early and effective adoption of digitalization and data analytics provides Skanska with a distinct edge in a traditionally slower-to-adapt industry.

Modular and Prefabricated Construction

Modular and prefabricated construction is a game-changer for companies like Skanska. These methods allow for components to be built off-site in a controlled factory setting. This significantly speeds up project timelines, as much of the work happens concurrently with site preparation.

The benefits are substantial. Skanska can achieve better quality control because the manufacturing process is standardized and monitored. Waste is also reduced considerably compared to traditional on-site building. This efficiency translates to fewer on-site disruptions and enhanced safety for workers.

In 2024, the global modular construction market was valued at approximately USD 165 billion, with projections indicating continued strong growth. Skanska itself has been actively investing in and utilizing these techniques. For instance, their work on the residential development at Queensway in London incorporated modular bathroom pods, streamlining the construction process.

- Faster Project Delivery: Off-site manufacturing reduces on-site construction time, leading to quicker project completion.

- Enhanced Quality Control: Factory-controlled environments ensure higher and more consistent product quality.

- Reduced Waste: Prefabrication minimizes material waste, contributing to sustainability goals.

- Improved Safety: Moving work to controlled factory settings lowers on-site safety risks.

Technological advancements are reshaping Skanska's operational landscape, with Building Information Modeling (BIM) adoption continuing to rise, projected to be a standard for many major projects by 2024. This digital approach enhances collaboration and reduces errors, with 2023 data showing up to a 20% decrease in rework for BIM-enabled projects.

Automation and robotics offer significant productivity gains, with construction robots for tasks like bricklaying seeing up to a 30% efficiency increase in 2024. The global construction robotics market is set to exceed $3 billion by 2025, highlighting a strong industry trend towards these technologies.

Skanska is also leveraging digitalization and data analytics, with IoT devices and project management platforms generating vast amounts of data. This enables smarter decision-making and operational optimization, a trend underscored by the growing use of digital twins in 2024 for real-time performance monitoring and predictive maintenance.

Modular and prefabricated construction methods are accelerating project delivery and improving quality control. The global modular construction market, valued around USD 165 billion in 2024, continues its strong growth trajectory, with Skanska actively integrating these techniques, such as using modular bathroom pods in their Queensway development.

| Technology | Impact | 2024/2025 Data Point |

| BIM | Reduced Rework, Enhanced Collaboration | Up to 20% rework reduction (2023 data) |

| Automation & Robotics | Increased Productivity, Safety | 30% efficiency boost for repetitive tasks (2024 data) |

| Digitalization & Data Analytics | Smarter Decisions, Operational Efficiency | Global construction robotics market > $3 billion by 2025 |

| Modular Construction | Faster Delivery, Better Quality | Global modular market ~ $165 billion (2024 data) |

Legal factors

Skanska faces a dynamic legal landscape shaped by constantly evolving building codes and construction standards. These regulations, which differ significantly across regions and countries, directly influence everything from architectural design and material selection to critical safety protocols. For instance, in 2024, many jurisdictions are tightening energy efficiency requirements, pushing for higher insulation standards and more sustainable material sourcing, as seen in the updated building codes in California mandating stricter performance metrics for new constructions.

Adhering to these shifting legal mandates is not merely a suggestion but a necessity for Skanska. Non-compliance can lead to substantial penalties, project delays, and reputational damage, undermining structural integrity and failing to meet essential performance benchmarks. To navigate this, Skanska invests in continuous staff training and robust internal compliance systems, ensuring all projects meet or exceed the latest legal obligations, such as those related to seismic retrofitting or advanced fire safety measures being implemented in parts of Europe.

Environmental regulations are becoming more rigorous globally, impacting Skanska's operations. For instance, in 2024, the EU continued to strengthen its Green Deal initiatives, pushing for stricter emissions standards and circular economy principles that affect construction materials and waste disposal. Companies like Skanska must invest in sustainable practices and technologies to comply, potentially increasing project costs but also fostering innovation.

Compliance with these evolving laws, which include obtaining permits and conducting environmental impact assessments, is non-negotiable. Failure to do so can lead to significant penalties; for example, in 2023, several large construction firms faced substantial fines for non-compliance with waste management regulations in the UK, highlighting the financial risks involved. Skanska's commitment to sustainability, therefore, is not just an ethical choice but a crucial risk mitigation strategy.

Skanska must navigate a complex web of labor laws across its global operations, impacting everything from minimum wages and overtime to collective bargaining agreements and employee rights. For instance, in 2024, the European Union continued to emphasize worker protections, with ongoing discussions around the directive on adequate minimum wages and the potential for stricter regulations on temporary agency work, directly affecting Skanska's workforce management.

Adherence to these diverse legal frameworks is not just a matter of compliance but a critical factor in operational stability and reputation. Failure to comply can lead to significant fines, legal battles, and damage to Skanska's brand, as seen in past cases where construction firms faced penalties for wage theft or unsafe working conditions, underscoring the financial and reputational risks involved.

Workplace safety regulations, a key component of labor laws, are particularly stringent in the construction industry. In 2025, expect continued scrutiny on accident prevention, with regulatory bodies likely to increase inspections and enforce stricter safety protocols, demanding robust training and equipment investments from companies like Skanska to minimize risks and ensure a secure working environment.

Contract Law and Dispute Resolution

Skanska's operations are heavily reliant on contract law, given the complex agreements it enters into with clients, subcontractors, and suppliers for its construction projects. These contracts are the bedrock of its business relationships, defining scope, timelines, and payment terms. Navigating these intricate legal frameworks is essential for managing risk and ensuring project success.

Effective dispute resolution is paramount. In 2024, Skanska, like other major construction firms, likely faced numerous contractual disputes. For instance, in early 2024, a major infrastructure project faced delays attributed to subcontractor performance, leading to arbitration proceedings that highlighted the importance of well-defined contract clauses and robust dispute management strategies. Such resolutions can involve negotiation, mediation, or arbitration, with the goal of minimizing financial impact and maintaining operational continuity.

- Contractual Complexity: Skanska's projects often involve multi-party agreements, requiring meticulous attention to detail in contract drafting and execution.

- Risk Management: Understanding and enforcing contract terms are key to mitigating financial and operational risks associated with project execution.

- Dispute Resolution: In 2024, the construction industry saw a continued reliance on alternative dispute resolution methods, with arbitration being a common avenue for resolving high-value contractual disagreements.

- Financial Protection: Adherence to and enforcement of contract law are critical for safeguarding Skanska's revenue streams and profitability.

Data Privacy and Cybersecurity Laws

Skanska operates in a landscape increasingly shaped by data privacy and cybersecurity regulations. As digitalization accelerates, the company must navigate a complex web of laws like the General Data Protection Regulation (GDPR) and its regional counterparts. These regulations are critical for safeguarding client data, employee information, and sensitive project details. Failure to comply can lead to significant legal penalties and reputational damage.

The increasing digitalization of operations means Skanska handles vast amounts of sensitive data. Maintaining robust cybersecurity measures is therefore paramount. Reports from 2024 indicate a rise in sophisticated cyber threats targeting the construction industry, making proactive defense essential. For instance, data breaches can result in substantial fines; under GDPR, penalties can reach up to €20 million or 4% of global annual turnover, whichever is higher.

- GDPR Compliance: Skanska must adhere to strict rules regarding the collection, processing, and storage of personal data for clients and employees.

- Cybersecurity Investments: Ongoing investment in advanced cybersecurity infrastructure and training is necessary to mitigate risks of data breaches and cyberattacks.

- Reputational Risk: A data breach could severely damage Skanska's reputation, impacting client trust and future business opportunities.

- Regulatory Fines: Non-compliance with data protection laws can result in significant financial penalties, as seen with GDPR enforcement actions.

Skanska's legal obligations extend to intellectual property rights, particularly concerning innovative construction techniques and proprietary software. Protecting these assets is vital for maintaining a competitive edge and preventing unauthorized use, with legal battles over patents and copyrights being a recurring concern in the industry. In 2024, the firm likely focused on reinforcing its IP portfolio through strategic patent filings and robust licensing agreements.

The company must also navigate anti-corruption and anti-bribery laws across all its operating regions. Compliance with regulations like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is crucial, given the global nature of Skanska's projects and the potential for significant penalties. Robust internal controls and training programs are essential to prevent and detect any illicit activities, safeguarding the company's integrity and financial standing.

Skanska's adherence to competition and antitrust laws is fundamental to fair market practices. This involves ensuring that its business dealings, from bidding processes to collaborations, do not stifle competition or lead to monopolistic behavior. Regulatory bodies globally, including the European Commission and the U.S. Department of Justice, actively monitor the construction sector for potential antitrust violations, making proactive compliance a necessity for Skanska.

Environmental factors

Skanska must integrate climate adaptation into its project planning as physical impacts like extreme weather events, such as the increased frequency of major floods seen in parts of Europe in 2024, directly affect infrastructure durability. Rising sea levels and changing precipitation patterns also demand resilient design, influencing choices in materials and engineering to ensure long-term project viability.

Skanska faces increasing pressure to slash carbon emissions and meet net-zero goals, influencing everything from material sourcing to construction methods. This push means a focus on lowering embodied carbon in materials like concrete and steel, and boosting energy efficiency on building sites. For instance, Skanska's commitment to decarbonization was evident in their 2023 sustainability report, highlighting a 15% reduction in Scope 1 and 2 emissions compared to 2022.

The company is actively developing and implementing low-carbon solutions, responding to both global climate targets and client demand for greener buildings. This strategic shift is crucial for maintaining competitiveness and attracting environmentally conscious clients. Skanska's investment in innovative, low-carbon materials and construction techniques is a direct response to these evolving environmental expectations.

Growing concerns over the availability of essential resources like water, aggregates, and energy are compelling Skanska to more actively embrace circular economy principles. This shift is driven by the need to reduce reliance on virgin materials and manage the environmental impact of construction.

Skanska's commitment to circularity means prioritizing the reuse of materials, effectively recycling construction and demolition waste, and designing buildings with future deconstruction in mind. For instance, in 2023, Skanska reported that it had achieved a 90% recycling rate for construction and demolition waste in several of its European projects, a testament to their efforts in minimizing resource depletion.

By integrating these practices, Skanska aims to significantly lower resource consumption and waste generation across its projects. This approach not only enhances resource efficiency but also directly contributes to reducing the company's overall environmental footprint, aligning with global sustainability goals and increasing resilience against future resource price volatility.

Biodiversity Protection and Ecosystem Impact

Skanska's construction activities directly influence local biodiversity and ecosystems, necessitating careful management of habitat disruption and pollution. For instance, a 2024 report highlighted that construction projects in sensitive areas can lead to a 15% increase in soil erosion, impacting water quality downstream.

Protecting endangered species and engaging in ecological restoration are becoming crucial for project approvals and Skanska's environmental standing. Many regulatory bodies now require detailed biodiversity impact assessments, with some projects in 2024 facing delays or increased costs due to inadequate mitigation strategies for local flora and fauna.

- Habitat Disruption: Construction can fragment or destroy natural habitats, impacting species survival.

- Endangered Species: Projects must often incorporate measures to protect species at risk, as mandated by environmental laws.

- Pollution Minimization: Efforts are made to reduce runoff, noise, and light pollution that can harm sensitive ecosystems.

- Ecological Restoration: Skanska may engage in replanting native species or restoring degraded areas post-construction.

Waste Management and Pollution Control

Skanska faces continuous environmental pressures regarding waste management and pollution control. Minimizing construction and demolition waste, a significant challenge, is crucial. For instance, in 2023, the construction industry generated millions of tons of waste globally, and Skanska actively works to divert a substantial portion from landfills through recycling and reuse initiatives. Preventing soil and water contamination from site operations and controlling air emissions are also paramount for regulatory compliance and maintaining a positive environmental footprint.

Effective waste segregation, recycling, and robust pollution prevention measures are not just best practices but are essential for Skanska's sustainable operations and adherence to increasingly stringent environmental regulations. The company's commitment to circular economy principles is reflected in its efforts to reduce virgin material use and maximize the lifespan of construction materials. Skanska reported a waste recycling rate of 85% across its European operations in 2023, demonstrating progress in this area.

- Waste Diversion: Skanska aims to significantly reduce landfill waste by prioritizing recycling and reuse of construction materials.

- Pollution Prevention: Implementing strict protocols to prevent soil and water contamination and control air emissions from all project sites.

- Regulatory Compliance: Adhering to and often exceeding local and international environmental standards for waste and pollution.

- Circular Economy Focus: Integrating circular economy principles to minimize resource consumption and maximize material value.

Skanska's environmental strategy must adapt to the increasing frequency of extreme weather events, as seen with significant flooding across Europe in 2024, which directly impacts infrastructure resilience. Climate adaptation is now a core component of project planning, influencing material selection and design to ensure long-term viability against changing precipitation and rising sea levels.

The company is under significant pressure to reduce its carbon footprint, with a focus on decarbonizing materials like concrete and steel and improving energy efficiency on construction sites. Skanska reported a 15% reduction in Scope 1 and 2 emissions in 2023 compared to 2022, underscoring its commitment to net-zero targets and client demand for greener solutions.

Resource scarcity, particularly for water and aggregates, is driving Skanska to embrace circular economy principles more aggressively. This involves prioritizing material reuse and recycling construction waste, with a reported 90% recycling rate for demolition waste achieved in several European projects in 2023.

Skanska's operations must carefully manage habitat disruption and pollution to protect local biodiversity, as construction can lead to increased soil erosion, impacting downstream water quality. Projects in sensitive areas in 2024 faced delays due to inadequate mitigation strategies for local flora and fauna, highlighting the growing importance of detailed biodiversity impact assessments.

PESTLE Analysis Data Sources

Our Skanska PESTLE Analysis is meticulously constructed using data from reputable sources such as the World Economic Forum, national statistical offices, and leading construction industry publications. This ensures a comprehensive understanding of global economic trends, environmental regulations, and technological advancements impacting the sector.