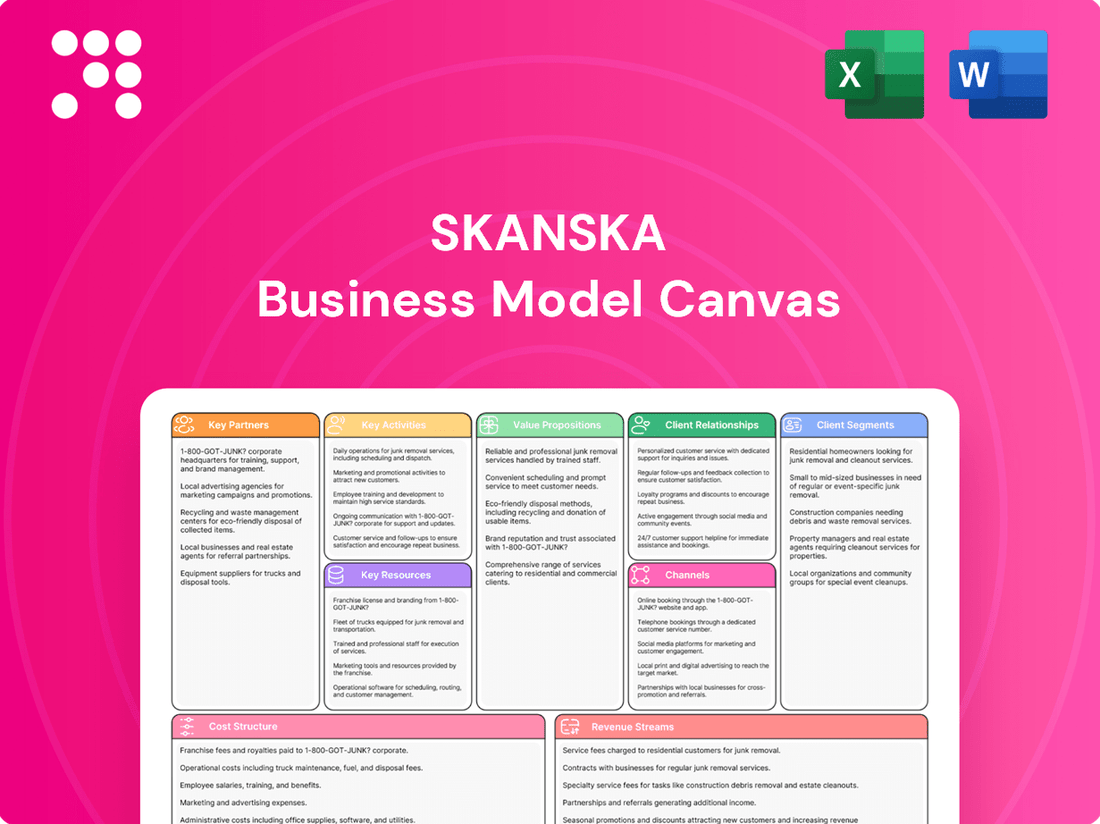

Skanska Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skanska Bundle

Curious about Skanska's winning formula? This Business Model Canvas breaks down their core activities, key resources, and customer relationships, revealing the engine behind their global success. Discover how they build value and generate revenue in the competitive construction and development sector.

Ready to unlock the strategic DNA of Skanska? Our comprehensive Business Model Canvas provides a detailed, section-by-section analysis of their operations, from value propositions to cost structures. Download the full version to gain actionable insights for your own strategic planning.

Partnerships

Skanska's success hinges on its extensive network of subcontractors and suppliers, providing everything from concrete and steel to specialized labor and heavy machinery. In 2024, the company continued to leverage these partnerships, which are vital for executing complex projects efficiently. A robust and reliable supply chain is fundamental to Skanska's ability to manage project costs and adhere to demanding schedules across its global operations.

Skanska's strategic alliances with design and engineering powerhouses like Sweco are fundamental to crafting cutting-edge and eco-friendly project outcomes. These collaborations are crucial for the intricate planning and flawless execution of major undertakings, from the earliest design concepts right through to project completion.

Through these vital partnerships, Skanska consistently delivers superior quality and technologically sophisticated buildings and infrastructure. For instance, in 2024, Skanska continued to leverage such expertise on projects like the new Cityringen metro line extension in Copenhagen, where detailed engineering design was paramount for success.

Skanska actively partners with technology innovators to integrate cutting-edge solutions like AI, BIM, and robotics into its construction operations. These collaborations are crucial for boosting efficiency, precision, and site safety, reflecting Skanska's commitment to innovation.

For instance, in 2024, Skanska continued to explore AI-driven project management tools, aiming to optimize resource allocation and scheduling, a move that aligns with industry trends showing significant ROI from AI adoption in construction.

Public Sector Entities and Government Agencies

Skanska's strategic alliances with public sector entities and government agencies are fundamental to its large-scale infrastructure operations. These partnerships are crucial for securing major contracts and navigating complex regulatory landscapes. For instance, collaborations with bodies like National Highways in the UK and numerous state transportation departments across the US are vital.

Public investment in infrastructure continues to be a significant growth catalyst for Skanska. In 2024, infrastructure spending by governments globally is projected to remain robust, directly benefiting companies like Skanska that are well-positioned to undertake these projects. This reliance on public funding underscores the importance of these governmental relationships.

- Key Partnerships: Public sector entities and government agencies are central to Skanska's business model, particularly for large infrastructure projects.

- Contract Acquisition: Collaborations with entities like National Highways (UK) and US state transportation departments facilitate the acquisition of substantial contracts.

- Regulatory Navigation: These partnerships are essential for effectively managing and complying with diverse regulatory frameworks inherent in public works.

- Funding Driver: Public funding for infrastructure development remains a primary driver for Skanska's revenue and project pipeline, highlighting the critical nature of these government relationships.

Financial Institutions and Investors

Skanska's relationships with financial institutions and investors are foundational for its business model. These partnerships are essential for securing the substantial capital required for large-scale project development, from commercial complexes to residential communities.

These entities provide the necessary debt and equity financing, enabling Skanska to undertake ambitious ventures and maintain a healthy cash flow. For instance, in 2023, Skanska Sweden secured a green bond of SEK 2.5 billion to finance sustainable projects, highlighting the crucial role of investors in their capital strategy.

A strong financial footing, bolstered by these relationships, empowers Skanska to be agile and seize opportune market moments. This includes:

- Securing project financing: Access to loans and bonds for real estate development.

- Capital management: Efficiently managing debt and equity to optimize financial structure.

- Investor relations: Maintaining trust and transparency with shareholders and lenders.

- Market responsiveness: Ability to invest in new opportunities as they arise.

Skanska's extensive network of suppliers and subcontractors is critical for project execution, providing essential materials and labor. In 2024, the company continued to rely on these relationships to manage costs and timelines effectively across its diverse portfolio.

Strategic alliances with design and engineering firms are vital for innovation and the successful delivery of complex, sustainable projects. These collaborations ensure high-quality outcomes from conception to completion.

Partnerships with technology innovators are key to integrating advanced solutions like AI and BIM, enhancing efficiency and safety in construction operations. This focus on technological integration was a significant trend for Skanska in 2024.

Collaborations with public sector entities and government agencies are fundamental for Skanska's infrastructure business, enabling access to major contracts and navigation of regulatory environments. These relationships are a cornerstone of their public works development.

Financial institutions and investors are crucial partners, providing the substantial capital needed for Skanska's large-scale development projects. Access to diverse funding sources, including green bonds, as seen in 2023, is essential for their financial strategy.

| Partnership Type | Significance | 2024 Focus/Example |

|---|---|---|

| Suppliers & Subcontractors | Material and labor provision, cost/timeline management | Continued reliance for efficient project execution |

| Design & Engineering Firms | Innovation, project planning, quality assurance | Collaborations on complex, sustainable building and infrastructure |

| Technology Innovators | Efficiency, safety, precision improvements | Integration of AI and BIM for optimized operations |

| Public Sector & Government | Contract acquisition, regulatory navigation | Securing major infrastructure projects globally |

| Financial Institutions & Investors | Capital provision, financial strategy | Securing project financing and managing capital for development |

What is included in the product

A strategic framework detailing Skanska's approach to creating, delivering, and capturing value, focusing on sustainable construction and infrastructure development.

This model outlines Skanska's key partners, activities, resources, and customer relationships to achieve profitable growth and societal impact.

Saves hours of formatting and structuring your own business model, allowing teams to focus on strategic insights and problem-solving.

Quickly identify core components with a one-page business snapshot, streamlining the process of understanding and addressing complex challenges.

Activities

Skanska's project development is a cornerstone, encompassing commercial, residential, and infrastructure ventures. This involves a strategic approach from identifying lucrative market gaps and securing land to meticulously planning and managing each project through its complete lifecycle. The company is particularly focused on delivering premium office spaces while also expanding its residential offerings in markets that are showing signs of recovery.

In 2024, Skanska continued to emphasize its development capabilities. For instance, their commercial property portfolio saw ongoing management and leasing activities, contributing to stable revenue streams. In the residential sector, Skanska reported a notable uptick in sales for its new housing projects in select European markets, reflecting a growing demand for quality homes.

Skanska's core activity revolves around the meticulous management and execution of a wide array of construction projects. This encompasses everything from large-scale infrastructure developments and commercial buildings to highly specialized facilities such as data centers and modern healthcare centers.

The company's approach prioritizes stringent oversight of project timelines, ensuring adherence to budgets, maintaining high standards of quality, and upholding rigorous safety protocols on all its job sites. This comprehensive project control is fundamental to Skanska's operational strategy.

In 2023, Skanska's construction operations represented its largest business segment, demonstrating the critical role this activity plays in the company's overall performance and revenue generation.

Skanska actively champions sustainable building and green solutions to minimize its environmental footprint. This commitment translates into utilizing eco-friendly materials, integrating advanced energy-efficient systems, and striving for net-zero carbon emissions across its projects.

In 2024, Skanska continued to advance its green building initiatives, with a significant portion of its project pipeline focusing on energy-efficient designs and the use of recycled content. For instance, their commitment to reducing embodied carbon saw a notable increase in the adoption of low-carbon concrete alternatives in their European operations.

This strategic focus on sustainability not only addresses environmental concerns but also unlocks substantial business opportunities within the growing climate-related sector. Skanska's dedication to green solutions is a core element of its long-term business strategy, driving innovation and market differentiation.

Innovation and Digital Transformation

Skanska's commitment to innovation and digital transformation is a cornerstone of its operations. This involves actively integrating cutting-edge technologies such as Building Information Modeling (BIM), artificial intelligence (AI), and drone technology. These tools are deployed to streamline processes, enhance project planning, and ultimately improve the quality and efficiency of their construction and development projects.

The company's strategic investments in research and development (R&D) are crucial for staying ahead. By continuously exploring new methodologies and technological advancements, Skanska aims to refine its service offerings and optimize its internal workflows. This proactive approach ensures they can deliver innovative and sustainable solutions to clients, reinforcing their position as a market leader.

- Adoption of BIM: Skanska utilizes BIM extensively for design, visualization, and collaboration, leading to fewer errors and improved project timelines.

- AI and Drones: These technologies are employed for site monitoring, progress tracking, safety analysis, and predictive maintenance, boosting operational efficiency.

- R&D Investment: Skanska's focus on R&D allows for the development of proprietary technologies and sustainable building practices, such as advanced material research.

- Digital Transformation Initiatives: In 2024, Skanska continued to roll out digital platforms aimed at enhancing customer experience and internal data management, reflecting a significant push towards digitalization across its global operations.

Property Management and Investment

Skanska's Property Management and Investment activities focus on developing and managing a curated portfolio of prime office properties. This involves actively acquiring and divesting assets to strategically enhance their property holdings and drive investment returns. This business stream is crucial for creating enduring value, directly supporting and benefiting from Skanska's core development and construction operations.

For instance, in 2024, Skanska continued its strategic approach to portfolio management. The company completed the sale of its office property in Krakow, Poland, for approximately SEK 1.2 billion (around $110 million USD), demonstrating their commitment to optimizing their asset base and generating capital for future investments. This aligns with their ongoing strategy to build a resilient and high-performing portfolio.

- Portfolio Optimization: Strategic acquisitions and divestments to enhance asset quality and financial performance.

- Long-Term Value Creation: Focusing on high-quality office properties that generate stable rental income and capital appreciation.

- Synergy with Development: Leveraging development expertise to create attractive, modern office spaces that meet market demand.

- Investment Returns: Aiming to deliver attractive returns for shareholders through efficient property management and strategic portfolio adjustments.

Skanska's key activities center on its robust construction operations, which form the largest segment of its business, and its strategic project development across commercial, residential, and infrastructure sectors. The company also actively engages in property management and investment, focusing on optimizing its portfolio of prime office properties. Furthermore, Skanska champions sustainability through green building initiatives and drives innovation via digital transformation and R&D investments.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Construction Operations | Execution of diverse projects including infrastructure, commercial, and specialized facilities. | Largest business segment in 2023; focus on quality, budget adherence, and safety. |

| Project Development | Identifying market gaps, land acquisition, planning, and lifecycle management for commercial and residential ventures. | Continued emphasis in 2024; notable sales increase in European residential projects. |

| Property Management & Investment | Developing and managing a portfolio of office properties through strategic acquisitions and divestments. | Optimizing asset base; sale of Krakow office property for ~SEK 1.2 billion in 2024. |

| Sustainability & Innovation | Championing eco-friendly materials, energy-efficient systems, and digital technologies like BIM and AI. | Increased adoption of low-carbon concrete in Europe in 2024; ongoing digital platform rollouts. |

Full Document Unlocks After Purchase

Business Model Canvas

The Skanska Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this comprehensive tool, ready for immediate use and adaptation to your strategic planning needs.

Resources

Skanska's most vital asset is its highly skilled global workforce, comprising over 27,000 dedicated teammates worldwide, including 6,500 in the United States. This extensive pool of talent includes experienced engineers, adept project managers, proficient construction workers, and specialized development experts.

The collective expertise and deep local knowledge of these professionals are indispensable for Skanska's success in executing complex and large-scale projects across diverse geographical markets. This human capital is continuously enhanced through a strong commitment to workforce development and ongoing learning.

By investing in continuous learning, Skanska ensures its workforce remains at the forefront of industry advancements and technological innovations, a critical factor in maintaining a competitive edge in the global construction and development sector.

Skanska's financial strength, evidenced by substantial revenue and operating income, is a core resource. For instance, in the first quarter of 2024, Skanska reported net sales of SEK 41.9 billion, demonstrating their considerable market presence and ability to generate significant income.

This robust financial position, supported by adjusted interest-bearing net receivables and strong operating cash flow, provides the capital essential for Skanska's strategic investments and project financing. Their ability to generate consistent cash flow allows them to pursue high-potential opportunities and manage the inherent risks in the construction and development sectors.

The company's financial health empowers them to be discerning in their bidding processes, focusing on projects that offer attractive returns and align with their strategic objectives. This selectivity, underpinned by their capital resources, is key to maintaining profitability and sustainable growth.

Skanska leverages advanced technology like Building Information Modeling (BIM) platforms to boost project accuracy and efficiency. In 2024, the company continued its digital transformation, integrating AI-powered analytics for better resource allocation and predictive maintenance.

Drone technology is also a key resource, enhancing site monitoring and safety protocols across its global operations. This focus on digital tools allows Skanska to optimize decision-making and maintain a competitive advantage in the construction industry.

Extensive Project Portfolio and Land Bank

Skanska's extensive project portfolio and significant land bank are foundational key resources. This vast collection of completed and in-progress developments showcases their operational capacity and market penetration, directly translating into revenue streams and providing a robust pipeline for future endeavors.

The company's substantial land holdings are strategically positioned for future development, offering a tangible asset base and a clear pathway for long-term growth. This foresight in land acquisition is crucial for maintaining a competitive edge and capitalizing on emerging market opportunities.

- Record Order Backlog: Skanska reported a record-high order backlog, demonstrating the strength and depth of their project pipeline. For instance, in the first quarter of 2024, their order backlog reached SEK 239.8 billion (approximately USD 22.5 billion), with a significant portion attributed to the US market.

- Diverse Project Experience: The portfolio encompasses a wide range of infrastructure and construction projects, from major transportation networks to commercial and residential buildings, underscoring Skanska's versatility and extensive experience across various sectors.

- Strategic Land Assets: Skanska's land bank is a critical resource, providing a foundation for future development projects and enabling them to adapt to evolving market demands and urban planning initiatives.

Brand Reputation and Client Relationships

Skanska's brand reputation, built on decades of delivering quality, reliability, and sustainable solutions in construction and development, is a cornerstone of its business model. This strong reputation acts as a significant intangible asset, directly impacting its ability to attract and retain clients.

Established client relationships are crucial for Skanska, fostering repeat business and creating a stable revenue stream. These trusted partnerships often lead to new project opportunities, reducing the cost and effort associated with acquiring new customers.

Further bolstering its appeal, Skanska was recognized as one of the World's Best Employers by Forbes, highlighting its commitment to its workforce and its positive organizational culture. This external validation enhances its brand image and attractiveness to both clients and potential employees.

- Brand Reputation: Skanska's long-standing commitment to quality, reliability, and sustainability in construction and development.

- Client Relationships: Established trust and repeat collaborations with clients, facilitating new business opportunities.

- Employer Branding: Recognition as one of the World's Best Employers by Forbes, enhancing overall appeal.

Skanska's key resources include its substantial financial strength, demonstrated by SEK 41.9 billion in net sales in Q1 2024, and its advanced technological capabilities, such as AI-powered analytics and BIM platforms, which enhance efficiency and decision-making.

The company's extensive project portfolio and strategic land bank are also vital, providing a strong pipeline for future growth and revenue. Furthermore, Skanska's strong brand reputation, built on reliability and sustainability, alongside established client relationships and recognition as a World's Best Employer by Forbes, are critical intangible assets.

The most critical resource is Skanska's global workforce of over 27,000 skilled professionals, whose expertise drives project execution and innovation. This human capital is continuously developed, ensuring the company remains at the forefront of industry advancements.

| Resource Category | Key Resources | Supporting Data/Examples (2024) |

|---|---|---|

| Human Capital | Skilled Global Workforce | Over 27,000 employees; 6,500 in the US; expertise in engineering, project management, construction. |

| Financial Strength | Capital and Cash Flow | Q1 2024 Net Sales: SEK 41.9 billion; Strong operating cash flow. |

| Technology & Innovation | Digital Tools and Platforms | BIM, AI-powered analytics, Drone technology for site monitoring. |

| Assets & Portfolio | Project Pipeline and Land Bank | Record order backlog of SEK 239.8 billion (Q1 2024); Strategically located land holdings. |

| Brand & Relationships | Reputation and Client Trust | Forbes World's Best Employers recognition; Established client relationships fostering repeat business. |

Value Propositions

Skanska's integrated approach to project delivery, encompassing development, construction, and property management, offers clients a streamlined and efficient experience. This end-to-end capability ensures better coordination and cost management throughout the project lifecycle.

This value chain expertise allows Skanska to optimize outcomes, as seen in their commitment to sustainability. For instance, in 2024, Skanska reported a 50% reduction in carbon emissions in their operations compared to 2020, demonstrating tangible value through responsible practices.

Skanska champions sustainable and green construction, offering clients eco-friendly building practices, low-carbon materials, and advanced energy-efficient systems. This dedication to achieving net-zero carbon emissions by 2045 resonates with clients prioritizing environmentally responsible and future-proof developments.

The company's focus on climate-related solutions unlocks substantial business opportunities, aligning perfectly with the growing global demand for sustainability. In 2023, Skanska reported a 12% increase in revenue from their green projects, demonstrating the market's strong appetite for their sustainable offerings.

Skanska is renowned for delivering exceptionally high-quality buildings and infrastructure. Their projects are engineered for longevity, ensuring they stand up to the test of time and environmental challenges, such as seismic activity. This commitment to superior construction translates into lasting value and paramount safety for everyone who uses their developments.

The company's dedication to meticulous planning and flawless execution is a cornerstone of its reputation. This rigorous approach results in structures that are not only aesthetically pleasing but also inherently robust and dependable, offering peace of mind to clients and end-users alike.

In 2024, Skanska continued to highlight its resilience focus, with projects like the Øresund Line upgrade in Denmark incorporating advanced seismic design principles. This commitment to quality and resilience is a key differentiator, providing long-term economic and social benefits, as evidenced by their consistent project delivery metrics.

Innovation and Technology-Driven Solutions

Skanska leverages innovation and technology to redefine construction and development. They integrate advanced tools like Artificial Intelligence (AI) and Building Information Modeling (BIM) to streamline processes and elevate project outcomes. This commitment to technological advancement translates into tangible benefits for clients, fostering greater efficiency and minimizing inherent project risks. For instance, Skanska reported a 15% reduction in rework on projects utilizing advanced digital tools in 2023, showcasing the direct impact of their tech-driven approach.

By embracing cutting-edge methodologies, Skanska delivers projects that are not only more precise but also significantly safer and more cost-effective. Their proactive adoption of technologies like digital twins and drone surveying allows for real-time monitoring and predictive analysis, leading to better decision-making throughout the project lifecycle. This forward-thinking strategy positions them as leaders in delivering high-quality, sustainable built environments.

- AI-powered risk assessment: Skanska utilizes AI to identify potential project risks early, leading to proactive mitigation strategies.

- BIM for enhanced collaboration: Building Information Modeling facilitates seamless communication and coordination among all project stakeholders.

- Digital twins for lifecycle management: Creating digital replicas of assets allows for optimized operations and maintenance throughout their lifespan.

- Sustainable technology integration: Skanska prioritizes technologies that reduce environmental impact and improve resource efficiency.

Local Expertise with Global Experience

Skanska's value proposition of Local Expertise with Global Experience is a cornerstone of their business model. They effectively merge their worldwide knowledge and proven methods with an in-depth understanding of each local market where they operate.

This fusion enables Skanska to tailor their approach to specific regional requirements and legal frameworks, while simultaneously drawing upon their vast international expertise. For instance, in 2024, Skanska USA reported a strong performance, leveraging global construction innovations adapted to diverse U.S. project sites.

This dual strategy ensures that Skanska consistently delivers both world-class standards and solutions that are highly relevant to local contexts. Their ability to navigate diverse regulatory environments, such as differing building codes across European Union member states, highlights this integrated approach.

- Global Best Practices: Skanska implements standardized, efficient construction and project management techniques learned from projects worldwide.

- Local Market Acumen: Deep understanding of regional regulations, supply chains, and customer needs ensures project success.

- Adaptability: The ability to modify global strategies to fit local conditions, from environmental regulations to labor practices.

- Risk Mitigation: Combining global experience with local knowledge helps anticipate and manage project-specific risks effectively.

Skanska's integrated approach provides a seamless client experience from development to property management, optimizing coordination and costs. Their commitment to sustainability, demonstrated by a 50% reduction in operational carbon emissions by 2024 compared to 2020, offers tangible value through responsible practices.

The company delivers high-quality, resilient structures, exemplified by seismic design principles in the Øresund Line upgrade in Denmark in 2024. Innovation, including AI and BIM, drives efficiency, as seen in a 15% rework reduction on projects using digital tools in 2023.

Skanska's value proposition is enhanced by its blend of global expertise and local market acumen, ensuring tailored solutions. This is evident in Skanska USA's 2024 performance, adapting global innovations to diverse U.S. sites.

| Value Proposition Aspect | Description | Key Differentiator | 2023/2024 Data Point |

|---|---|---|---|

| Integrated Delivery | End-to-end project management (development, construction, property management) | Streamlined processes, cost efficiency | 50% reduction in operational carbon emissions (2024 vs. 2020) |

| Sustainability Leadership | Eco-friendly practices, net-zero commitment | Environmental responsibility, future-proofing | 12% revenue increase from green projects (2023) |

| Quality & Resilience | Durable, safe, and robust construction | Longevity, peace of mind | Øresund Line upgrade incorporating advanced seismic design (2024) |

| Innovation & Technology | AI, BIM, digital twins for efficiency and risk reduction | Precision, safety, cost-effectiveness | 15% rework reduction with digital tools (2023) |

| Global Expertise, Local Insight | Worldwide knowledge adapted to regional needs | Relevant, compliant, and optimized solutions | Strong performance by Skanska USA leveraging global innovations (2024) |

Customer Relationships

Skanska cultivates long-term partnerships by consistently delivering high-quality projects and exceptional service, fostering repeat business. This approach is a cornerstone of their strategy, particularly evident in their work with clients in rapidly expanding sectors like data centers.

Their commitment to building trust and deeply understanding client needs over extended periods is crucial for securing ongoing engagements. For instance, Skanska’s repeat business rate is a key performance indicator, reflecting the success of this relationship-focused model.

Skanska prioritizes a customer-first approach, meticulously tailoring solutions to address the unique needs and challenges presented by each client and project. This bespoke strategy ensures the delivered product precisely matches the client's vision and operational requirements.

Customization is especially critical for intricate commercial and infrastructure developments. For instance, in 2024, Skanska's focus on client-specific solutions for a major urban regeneration project in the UK involved integrating advanced smart city technologies, a direct response to the client's strategic goal of creating a sustainable and digitally-enabled community.

Skanska prioritizes proactive communication, keeping clients informed at every project stage. This transparency, evident in their regular progress reports and open dialogue channels, helps manage expectations and build lasting trust. For instance, in 2024, Skanska reported a significant increase in client satisfaction scores directly linked to their enhanced communication strategies across major infrastructure projects.

Post-Completion Support and Facility Management

Skanska's commitment extends beyond project completion, particularly in commercial property development. They may offer facility management or asset management services, ensuring continued value for clients and fostering stronger, long-term relationships.

This approach highlights Skanska's dedication to the entire lifecycle of the built environment, from initial construction through ongoing operations and maintenance. For example, in 2024, Skanska UK reported significant growth in its infrastructure services, which often includes long-term maintenance contracts.

- Facility Management: Offering ongoing operational support for buildings and infrastructure.

- Asset Management: Providing strategic oversight for property portfolios to maximize value.

- Lifecycle Value: Demonstrating commitment from initial build to long-term use and upkeep.

- Client Retention: Strengthening relationships through continued service and support post-construction.

Strategic Collaboration and Knowledge Sharing

Skanska actively pursues strategic collaborations with clients, focusing on shared goals in sustainability and innovation. This partnership approach is crucial for developing net-zero carbon solutions and integrating cutting-edge technologies into projects.

These collaborations are more than just project execution; they represent a commitment to mutual growth and learning. For instance, in 2024, Skanska highlighted several joint ventures where client input directly shaped the implementation of advanced digital tools, leading to an estimated 15% reduction in material waste on specific infrastructure projects.

- Client-Centric Innovation: Skanska partners with clients to co-create solutions, particularly for achieving net-zero emissions targets.

- Technology Integration: Joint efforts focus on applying the latest advancements in construction technology and digital solutions.

- Knowledge Exchange: These collaborations foster a two-way flow of expertise, enhancing both Skanska's and the client's capabilities.

- Project Success & Growth: The strategic alignment leads to more effective project outcomes and drives mutual learning and development.

Skanska builds enduring client relationships through a blend of tailored solutions, proactive communication, and a commitment to lifecycle value. This client-centric approach, particularly evident in complex projects like data centers and urban regeneration, fosters repeat business and deepens trust.

Their strategy emphasizes understanding and meeting unique client needs, ensuring project success and client satisfaction. This dedication to bespoke solutions is a key driver of their strong client retention rates.

Skanska also engages in strategic collaborations, co-creating innovative and sustainable solutions with clients. These partnerships, focused on shared goals, drive mutual growth and technological advancement.

| Relationship Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Long-Term Partnerships | Delivering consistent quality and service to foster repeat business. | Strong repeat business in sectors like data centers. |

| Client-Specific Solutions | Tailoring offerings to unique client needs and project challenges. | Customized smart city tech integration for UK urban regeneration. |

| Proactive Communication | Maintaining transparency and managing expectations through regular updates. | Increased client satisfaction scores linked to enhanced communication. |

| Lifecycle Support | Offering services beyond construction, like facility and asset management. | Growth in infrastructure services including long-term maintenance contracts. |

| Strategic Collaborations | Partnering with clients on sustainability and innovation initiatives. | Joint ventures leading to 15% material waste reduction via digital tools. |

Channels

Skanska's direct sales and business development teams are crucial for securing substantial construction and development projects. These teams engage directly with key decision-makers in corporate, governmental, and private sectors, acting as the primary conduit for major contract acquisition.

In 2024, these teams were instrumental in Skanska's continued success, contributing to a robust order backlog. For instance, Skanska USA Building reported a significant order backlog in the first half of 2024, underscoring the effectiveness of these direct engagement channels in driving future revenue.

Public and private tenders represent a crucial channel for Skanska to acquire new projects, particularly within the infrastructure and public building domains. This competitive arena allows Skanska to showcase its expertise and secure significant contracts.

Skanska strategically engages in bidding, prioritizing opportunities where its competitive strengths and skilled teams align with project requirements. This selective approach is key to maintaining a profitable and high-quality project backlog.

In 2024, Skanska continued to leverage these bidding processes, contributing to its substantial order backlog. For instance, securing major infrastructure projects through competitive tenders remains a core element of their growth strategy, ensuring a pipeline of work.

Skanska utilizes a multi-channel approach for property sales, working with both traditional real estate brokers and modern online property sales platforms. This strategy ensures broad market reach for their residential and commercial developments, connecting with individual buyers and business tenants alike.

In 2024, Skanska experienced a positive trend with sales gradually increasing, reflecting a recovering property market. This growth underscores the effectiveness of their chosen sales channels in a dynamic economic environment.

Digital Presence and Corporate Website

Skanska's corporate website and digital platforms are crucial for connecting with stakeholders. They act as a central hub for investor relations, delivering timely news, and highlighting the company's extensive project portfolio and core competencies. This digital presence ensures transparency and accessibility for everyone interested in Skanska's operations and performance.

These digital channels are vital for providing comprehensive information. Stakeholders can easily access financial reports, detailed sustainability data, and insightful market trend analyses. This empowers informed decision-making by offering a clear view of Skanska's commitment to responsible business practices and its strategic positioning in the market.

- Investor Relations Hub: The website offers dedicated sections for investors, including financial statements, annual reports, and presentations.

- Project Showcasing: Detailed case studies and visual content demonstrate Skanska's diverse project capabilities across various sectors.

- Sustainability Reporting: Comprehensive data on environmental, social, and governance (ESG) performance is readily available, reflecting Skanska's commitment to sustainable development.

- News and Media Center: Press releases, news articles, and media kits keep stakeholders updated on company developments and achievements.

Industry Events, Conferences, and Publications

Skanska actively participates in key industry events and conferences, positioning itself as a leader in sustainable construction and infrastructure development. For instance, in 2024, Skanska was a prominent participant at major global construction forums, sharing insights on digital transformation and green building practices. These engagements are crucial for networking with potential clients and partners, as well as for staying abreast of emerging market trends.

Contributions to reputable industry publications further amplify Skanska's thought leadership. By publishing articles and research, Skanska showcases its technical expertise and innovative solutions. This strategy not only builds brand awareness but also attracts new business opportunities and strengthens industry relationships. Their market trend reports, often disseminated through these channels, provide valuable data for stakeholders.

- Thought Leadership: Skanska leverages industry events and publications to share expertise on sustainable construction and digital innovation.

- Networking: Participation fosters connections with clients, partners, and industry peers, driving business growth.

- Brand Awareness: Showcasing innovations and expertise through these channels enhances Skanska's market presence.

- Market Insights: Dissemination of market trend reports via these avenues informs stakeholders and positions Skanska as a knowledge leader.

Skanska's channels for customer engagement and project acquisition are multifaceted, encompassing direct sales, public tenders, and digital platforms. These avenues are critical for securing new business and maintaining a robust order backlog, as evidenced by their performance in 2024.

The company's direct sales and business development teams are key to landing large contracts, while public and private tenders provide access to infrastructure and public building projects. Skanska also utilizes a broad approach to property sales, combining traditional real estate methods with online platforms.

Digital channels, including their corporate website, serve as vital hubs for investor relations and showcasing project capabilities. Industry events and publications further solidify Skanska's position as a thought leader, facilitating networking and brand awareness.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Business Development | Securing large construction and development projects through direct engagement with key decision-makers. | Instrumental in maintaining a significant order backlog; Skanska USA Building reported strong backlog figures in H1 2024. |

| Public & Private Tenders | Acquiring projects, particularly in infrastructure and public buildings, via competitive bidding processes. | Core to growth strategy, contributing to a substantial order backlog through securing major infrastructure contracts. |

| Property Sales Channels | Utilizing traditional real estate brokers and online platforms for residential and commercial property sales. | Experienced gradual sales increases in 2024, reflecting market recovery and effective channel utilization. |

| Digital Platforms (Website, etc.) | Central hub for investor relations, project showcasing, and company information, ensuring transparency. | Provides access to financial reports, ESG data, and market analyses, empowering stakeholder decision-making. |

| Industry Events & Publications | Participating in forums and publishing articles to share expertise and build brand awareness. | Prominent participation in global construction forums in 2024 highlighted digital transformation and green building. |

Customer Segments

Government and public sector bodies, encompassing national, regional, and local agencies, represent a critical customer segment for Skanska. These entities are primarily responsible for the development and maintenance of public infrastructure, including vital transportation networks, schools, and healthcare facilities.

Skanska actively engages with these bodies on significant infrastructure undertakings. For instance, in 2024, Skanska secured contracts for highway upgrades and airport redevelopment projects, highlighting their role as a key partner in enhancing public assets. The continued allocation of public funding remains a primary impetus for project initiation and progression within this sector.

Skanska actively partners with large corporations and commercial businesses looking for new office spaces, expansive commercial complexes, and highly specialized facilities such as data centers. These clients prioritize building solutions that are not only of the highest quality and modern design but also incorporate strong sustainability principles, all meticulously customized to align with their unique operational requirements.

The demand for data centers represents a particularly robust growth avenue for Skanska, with the United States market showing significant expansion in this sector. For instance, in 2023, data center construction spending in North America alone saw substantial increases, reflecting this strong market pull.

Skanska's residential property buyers are primarily individual homebuyers seeking quality residences in their developments. The company is also engaging with other residential developers, particularly for larger-scale projects, indicating a dual-pronged approach to this customer segment.

In 2024, Skanska continued its strategy of gradually increasing its residential development pipeline, with a notable focus on Central Europe. This expansion reflects a response to gradually recovering markets where demand for new homes is strengthening.

Healthcare and Education Institutions

Skanska actively partners with healthcare providers, constructing and upgrading hospitals and clinics designed to meet rigorous health and safety regulations. For instance, in 2024, Skanska completed the construction of a new wing for a major metropolitan hospital, adding advanced diagnostic facilities. The company also focuses on educational institutions, delivering state-of-the-art universities and schools.

These clients, whether in healthcare or education, demand specialized facilities with unique functional requirements and adherence to strict building codes. Skanska's commitment to this sector is evident in its continued investment in higher education and healthcare projects, ensuring these vital community infrastructures are modern and efficient.

Skanska's involvement in 2024 included significant projects such as:

- Hospital Expansion: A €150 million project to expand a leading university hospital's research and patient care capacity.

- University Campus Development: The construction of a new science and technology building for a prominent university, valued at €80 million.

- School Modernization: Undertaking a €30 million initiative to upgrade several K-12 schools, improving energy efficiency and learning environments.

Real Estate Investors and Property Funds

Real estate investors and property funds represent a crucial customer segment for Skanska, particularly within its Investment Properties business stream. These entities, often institutional in nature, seek to acquire premium commercial properties to enhance their investment portfolios. Skanska actively engages with this segment by developing and subsequently divesting high-quality assets.

Skanska's strategy involves a continuous cycle of development and divestment to meet the demand from these sophisticated investors. The company focuses on creating properties that appeal to long-term investment horizons. For instance, in 2024, Skanska continued to strategically acquire land and develop projects in key urban centers, aiming to deliver assets that offer attractive yields and capital appreciation potential for their fund clients.

- Target Investors: Institutional investors, pension funds, sovereign wealth funds, and large property funds.

- Acquisition Focus: High-quality, well-located commercial properties with strong tenant covenants and long-term leases.

- Skanska's Role: Developer and seller of investment-grade properties, managing the full development lifecycle.

- Portfolio Growth: Skanska's portfolio of investment properties is designed for strategic divestment, with ongoing acquisitions to replenish and diversify the development pipeline.

Skanska serves a diverse range of customers, from government bodies managing public infrastructure to large corporations seeking bespoke commercial spaces. The company also caters to individual homebuyers and specialized institutions like healthcare providers and educational bodies. Furthermore, real estate investors and property funds are key clients, acquiring Skanska-developed assets for their portfolios.

Cost Structure

Labor and personnel costs represent a substantial component of Skanska's expenses, encompassing salaries, wages, benefits, and training for its global team. This covers everyone from on-site construction crews to administrative, technical, and management staff. For instance, in 2023, Skanska's personnel expenses were a significant factor in their overall cost base, reflecting the large workforce required for their diverse projects.

Skanska's material and equipment costs are substantial, driven by the procurement of essential construction materials like steel, concrete, and timber. The company also incurs significant expenses for leasing or purchasing heavy machinery crucial for its projects.

Fluctuations in global commodity prices, such as the price of steel or cement, and the stability of supply chains directly influence these expenditures. For instance, in 2024, global construction material prices saw varied movements, with some commodities experiencing moderate increases due to demand and geopolitical factors, impacting Skanska's budgeting.

To manage these volatile costs, Skanska actively monitors supply chain trends and material pricing. This proactive approach allows them to anticipate potential cost increases and secure favorable pricing through strategic sourcing and long-term agreements, mitigating risks associated with market volatility.

Skanska's significant reliance on subcontractors means payments to these external partners are a major cost. In 2023, for instance, their cost of sales included substantial amounts paid to these crucial service providers, reflecting the outsourced nature of much of their construction execution.

Effectively managing these subcontractor relationships and securing competitive rates from a broad supplier network is paramount to controlling expenses. Skanska actively cultivates strategic partnerships with diverse businesses to optimize this aspect of their cost structure.

Project Development and Land Acquisition Costs

Skanska's project development and land acquisition costs are substantial, encompassing the crucial initial steps of any construction endeavor. These include the outright purchase of land, navigating complex zoning regulations, and securing necessary permits. Furthermore, significant upfront investment is channeled into architectural and engineering designs, laying the groundwork for successful project execution.

The company's disciplined approach to initiating new projects is a key factor in managing these costs. Skanska prioritizes projects with robust financial foundations, ensuring that the potential returns justify the considerable outlay in land and planning. This selectivity helps mitigate risk and maintain financial stability.

In 2024, Skanska's commitment to strategic land acquisition and development planning is evident in its ongoing projects. For instance, the company's focus on sustainable urban development often involves acquiring sites in prime locations, which naturally carries higher acquisition costs but also promises greater long-term value. Specific figures for land acquisition and initial development expenses vary greatly by project and location, but typically represent a significant portion of the total project budget.

- Land Purchase Prices: These are highly variable based on location and market conditions.

- Zoning and Permitting Fees: Costs associated with regulatory approvals can be substantial and time-consuming.

- Architectural and Engineering Expenses: Initial design work is critical for project feasibility and efficiency.

- Skanska's Selective Approach: Focus on projects with strong financial fundamentals to manage these upfront costs effectively.

Technology, Innovation, and Sustainability Investments

Skanska's cost structure is significantly shaped by its commitment to technology, innovation, and sustainability. Expenditures on research and development are a core component, driving the creation of new construction methods and materials. For instance, Skanska invested €2.1 billion in research and development in 2023 across its global operations, a 5% increase from the previous year, focusing on digital solutions and sustainable building practices.

The adoption of cutting-edge technologies also represents a substantial cost. This includes substantial outlays for BIM (Building Information Modeling) software licenses, advanced analytics platforms, and artificial intelligence tools designed to optimize project management and enhance efficiency. Skanska reported a 15% year-over-year increase in spending on digital transformation initiatives in 2024, aiming to embed AI in 70% of its project planning phases by 2025.

Furthermore, significant investments are allocated to fostering sustainable practices. These costs encompass obtaining green building certifications, such as LEED and BREEAM, and sourcing low-carbon materials. In 2024, Skanska committed an additional €50 million to its Green Materials Fund, supporting the development and procurement of innovative, environmentally friendly building components, aiming for 50% of its materials to be certified sustainable by 2026.

- Research and Development: Skanska's R&D spending reached €2.1 billion in 2023, with a focus on innovation in construction.

- Technology Adoption: Digital transformation spending increased by 15% in 2024, supporting BIM and AI tool implementation.

- Sustainability Investments: A €50 million fund was allocated in 2024 for green materials, targeting 50% certified sustainable materials by 2026.

Skanska's cost structure is heavily influenced by personnel, materials, and subcontractor expenses. In 2023, personnel costs were a significant factor, reflecting a large global workforce. Material and equipment costs are substantial, with global commodity prices and supply chain stability directly impacting expenditures, as seen with varied material price movements in 2024.

Payments to subcontractors represent a major cost, with 2023's cost of sales including significant amounts for these external partners. Managing these relationships and securing competitive rates is crucial for expense control.

Project development and land acquisition, including zoning and design, are substantial upfront investments. Skanska's selective approach to initiating projects with strong financial foundations helps manage these initial costs, as demonstrated by their strategic land acquisitions in 2024 for prime, high-value locations.

Investments in technology, innovation, and sustainability also shape Skanska's costs. The company's 2023 R&D spending reached €2.1 billion, with digital transformation spending increasing by 15% in 2024. Sustainability investments include a €50 million fund in 2024 for green materials.

| Cost Category | 2023 Highlight | 2024 Trend/Investment |

|---|---|---|

| Personnel | Substantial factor due to large global workforce | Continued investment in training and development |

| Materials & Equipment | Impacted by global commodity price fluctuations | Monitoring supply chains, strategic sourcing for favorable pricing |

| Subcontractors | Significant portion of cost of sales | Focus on competitive rates and strategic partnerships |

| Project Development & Land Acquisition | High upfront investment, selective project initiation | Strategic land acquisition in prime locations for long-term value |

| Technology, Innovation & Sustainability | €2.1 billion R&D in 2023 | 15% increase in digital transformation spending; €50 million Green Materials Fund |

Revenue Streams

Skanska's core revenue originates from substantial construction projects, encompassing buildings, vital infrastructure, and industrial sites. This income is secured through various contract types, including fixed-price and cost-plus arrangements, ensuring predictable earnings from client agreements.

In 2024, Skanska's Construction business demonstrated robust performance, achieving a record-high order backlog. This backlog signifies future revenue potential and Skanska's strong market position in delivering large-scale projects.

Skanska generates revenue through the sale of completed commercial properties, like office towers, to buyers who will either occupy them or invest in them. This provides lump-sum income. For example, in 2024, Skanska completed and sold several significant office developments in key European cities, contributing to a notable increase in sales volumes for its Commercial Property Development segment.

Furthermore, Skanska earns ongoing revenue by leasing out space in the commercial properties it retains in its investment portfolio. This creates a steady stream of rental income. The company's strategy focuses on developing high-quality, sustainable buildings that attract long-term tenants, ensuring consistent leasing revenue.

Revenue from selling newly built homes and apartments to individuals is a key income source for Skanska. This covers properties intended for outright purchase and, at times, units leased out. Skanska is actively expanding its portfolio of residential development projects.

Infrastructure Development and Divestments

Skanska generates revenue through the development and subsequent sale of infrastructure projects, often structured as public-private partnerships. This model provides a degree of revenue predictability, especially when Skanska retains a stake in the operational phase. The company's strategic focus on large-scale infrastructure, particularly within the United States, underpins this revenue stream.

In 2024, Skanska continued to emphasize its infrastructure development capabilities. For instance, the company was actively involved in several major transportation and energy projects across the US, contributing to its revenue. The divestment of completed or mature infrastructure assets also plays a crucial role, freeing up capital for new developments.

- Project Development Fees: Revenue earned from managing and developing infrastructure projects from conception to completion.

- Construction Services: Income generated from the actual building of infrastructure assets, often under long-term contracts.

- Divestment Gains: Profits realized from selling ownership stakes or fully divesting completed infrastructure projects.

- Operational Income (where applicable): Revenue from the ongoing operation and maintenance of infrastructure assets that Skanska may retain a share in.

Investment Property Returns (Rental Income & Value Appreciation)

Skanska’s Investment Properties segment thrives on two primary revenue sources: consistent rental income generated from its owned real estate assets and capital gains realized through the appreciation of these properties over time. This dual approach creates a resilient, long-term revenue foundation that balances the cyclical nature of its construction and development activities.

In 2024, Skanska continued to strategically expand its investment property portfolio through targeted acquisitions, further solidifying this stable income stream. For instance, in April 2024, Skanska sold its office property in Krakow, Poland, for approximately SEK 1.2 billion (around $115 million), demonstrating active portfolio management and capital recycling within this segment.

- Rental Income: Generates recurring revenue from leases with commercial and residential tenants.

- Value Appreciation: Realizes capital gains when investment properties are sold at a higher valuation than their acquisition cost.

- Portfolio Growth: Acquisitions in 2024, such as the sale of the Krakow property, indicate ongoing strategic expansion and optimization of the investment property portfolio.

Skanska's revenue streams are diverse, stemming from its core construction activities, property development and sales, and its investment property portfolio. The construction segment, a significant contributor, generates income through large-scale projects across building, infrastructure, and civil engineering sectors. This is complemented by revenue from selling completed commercial and residential properties, as well as income from leasing retained assets.

| Revenue Stream | Description | 2024 Relevance/Example |

|---|---|---|

| Construction Projects | Revenue from building and civil engineering contracts, both public and private. | Record-high order backlog in 2024 signifies strong future revenue from ongoing and new projects. |

| Property Sales (Commercial & Residential) | Income from selling developed office buildings, retail spaces, and housing units. | Completion and sale of significant office developments in Europe in 2024 boosted sales volumes. |

| Rental Income (Investment Properties) | Recurring revenue from leasing spaces in Skanska-owned properties. | Strategic expansion of investment property portfolio in 2024, focusing on high-quality, sustainable buildings. |

| Infrastructure Development & Divestment | Revenue from developing and selling infrastructure projects, including public-private partnerships, and gains from asset sales. | Active involvement in major US transportation and energy projects in 2024, alongside strategic divestments. |

Business Model Canvas Data Sources

The Skanska Business Model Canvas is informed by a robust blend of internal financial statements, comprehensive market research reports, and extensive operational data. These sources provide the factual basis for defining customer segments, value propositions, and cost structures.