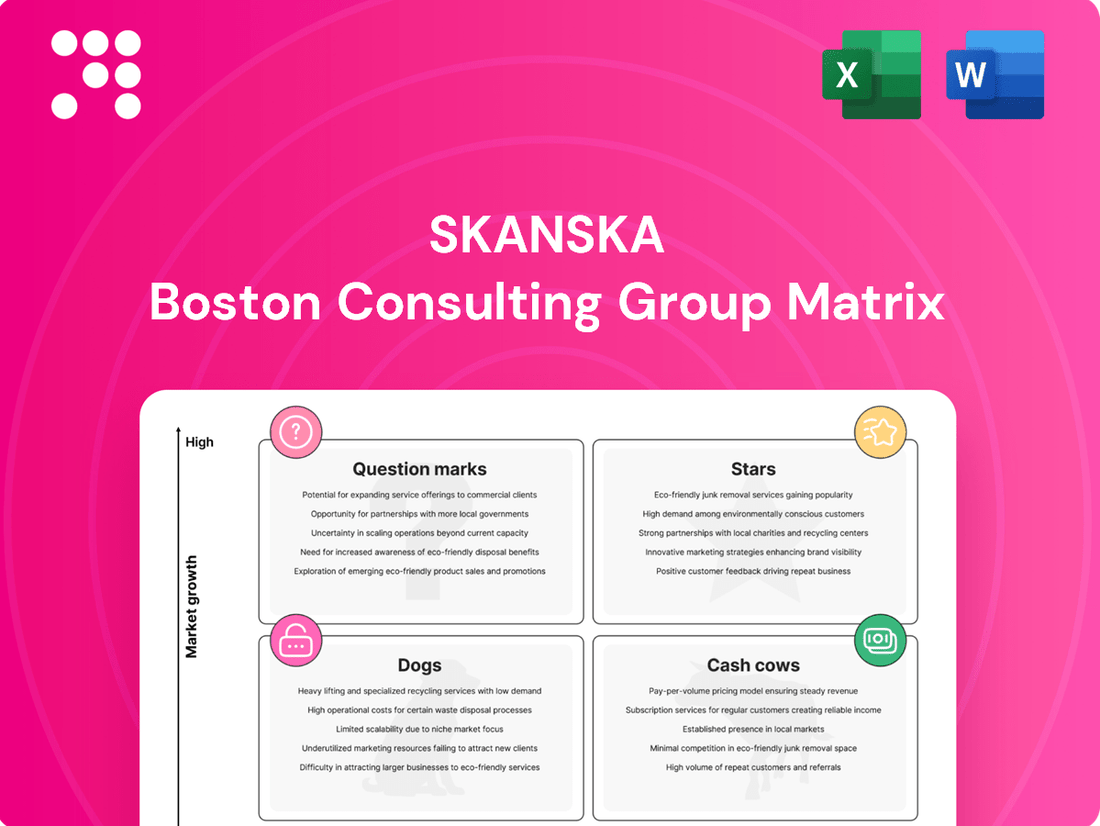

Skanska Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skanska Bundle

Discover how Skanska's diverse portfolio aligns with the BCG Matrix, revealing which projects are fueling growth and which require careful consideration. This preview offers a glimpse into their strategic positioning, but the full BCG Matrix report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete analysis for actionable insights and a clear roadmap to optimizing Skanska's investments and future development.

Stars

Skanska's US Civil infrastructure development is a star in its portfolio, exhibiting high growth and a commanding market share. This success is fueled by significant federal investment, such as the Bipartisan Infrastructure Law, which is injecting billions into the sector. The company's ability to secure large, multi-year projects, including vital road and bridge construction, underpins its strong market standing.

Skanska stands out in the green projects sector, particularly in sustainable construction and offshore wind. This area is booming due to worldwide climate objectives and a growing need for environmentally sound infrastructure. Skanska's dedication to achieving net-zero carbon emissions by 2045, with substantial progress already made in 2024, underscores their strong market presence and capabilities.

The company's involvement in projects like the Portland International Airport redevelopment, which utilizes mass timber and incorporates natural design elements, exemplifies their innovative spirit and leadership. This segment represents a high-growth opportunity for Skanska, aligning with the global shift towards greener development.

Skanska's significant investment in digitalization, encompassing Building Information Modeling (BIM) and advanced data analytics, firmly places its technology initiatives in the Star quadrant of the BCG matrix. The recent launch of its Skanska Advanced Technology (SAT) unit in the US underscores this strategic focus, targeting the high-growth niche of construction technology.

These technological advancements are designed to optimize construction processes, improve quality, and drive down costs, offering a distinct competitive advantage. For instance, Skanska reported a 15% reduction in project delays by implementing BIM on a major infrastructure project in 2023.

The company's exploration of AI and robotics for data center construction further solidifies its position as a leader in adopting cutting-edge solutions. This forward-thinking approach is crucial in a sector where technological integration is becoming increasingly vital for efficiency and innovation.

Data Center Construction

Data center construction is a key growth driver for Skanska, positioned as a star in the BCG matrix due to the immense demand for AI and cloud services. Skanska's Advanced Technology unit is actively expanding its data center portfolio, reflecting a strong market presence in this high-potential sector.

The company's significant capital investments and positive earnings outlook for data center projects underscore its strategic commitment and the segment's promising trajectory. For example, Skanska USA reported a substantial increase in its backlog for specialized projects, including data centers, in its 2024 financial reports, indicating robust demand and execution capabilities.

- High Growth Potential: Driven by AI and cloud computing, the data center market is experiencing exponential growth, making it a star performer for Skanska.

- Skanska's Market Share: Skanska's Advanced Technology unit demonstrates a growing footprint in data center development, capturing a significant portion of this expanding market.

- Financial Indicators: Strong capital expenditure and favorable earnings forecasts for data center projects highlight the segment's current and future profitability.

- 2024 Performance: Skanska USA's backlog for specialized construction, including data centers, saw a notable year-over-year increase in 2024, validating the segment's strength.

Life Sciences & Multifamily Rental Housing (US)

Skanska is strategically expanding its commercial property development into life sciences and multifamily rental housing across the United States. This diversification targets sectors with robust demand, anticipating strong performance through 2025 and beyond. The company's selective approach to bidding indicates a clear objective to capture substantial market share in these growth areas.

The US life sciences real estate market, for instance, saw significant investment activity. In 2024, the sector continued to attract substantial capital, driven by advancements in biotechnology and pharmaceutical research. Multifamily rental housing also remained a resilient asset class, with vacancy rates in many major US markets staying relatively low throughout 2024, supported by ongoing demographic shifts and housing affordability concerns.

- Life Sciences Growth: The US life sciences sector is projected to experience continued expansion, fueled by innovation and increased R&D spending.

- Multifamily Demand: Demand for rental housing remains strong, supported by favorable demographics and economic conditions.

- Strategic Focus: Skanska's targeted investments in these segments aim to leverage high market growth potential.

- Market Share Ambition: The company's bidding strategy reflects a commitment to becoming a significant player in these key real estate sectors.

Skanska's US Civil infrastructure development is a star, benefiting from high growth and strong market share due to substantial federal investment like the Bipartisan Infrastructure Law. The company's success in securing large, multi-year projects, including road and bridge construction, reinforces its leading position.

The green projects sector, particularly sustainable construction and offshore wind, is another star for Skanska. This growth is driven by global climate goals and the increasing demand for eco-friendly infrastructure. Skanska's commitment to net-zero emissions by 2045, with significant 2024 progress, highlights its capability.

Skanska's technology initiatives, including its investment in digitalization and the launch of its Skanska Advanced Technology (SAT) unit in the US, firmly place it in the Star quadrant. These advancements optimize processes and offer a competitive edge, with a reported 15% reduction in project delays in 2023 due to BIM implementation.

Data center construction is a key growth driver, positioned as a star due to immense demand from AI and cloud services. Skanska USA's backlog for specialized projects, including data centers, saw a notable year-over-year increase in 2024, demonstrating robust demand and execution.

| Segment | BCG Category | Key Drivers | 2024 Highlight |

| US Civil Infrastructure | Star | Federal Investment (BIL), Large Projects | Secured major multi-year contracts |

| Green Projects (Sustainable Construction, Offshore Wind) | Star | Climate Objectives, Net-Zero Goals | Progress towards 2045 net-zero targets |

| Technology Initiatives (Digitalization, BIM, AI) | Star | Process Optimization, Efficiency Gains | 15% reduction in project delays via BIM (2023) |

| Data Center Construction | Star | AI/Cloud Demand, Capital Investment | Significant backlog increase for specialized projects |

What is included in the product

The Skanska BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Skanska BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of complex strategic analysis.

Cash Cows

Skanska's traditional construction in Europe and the Nordics, especially in civil infrastructure, acts as a reliable cash cow. These operations consistently generate strong profits and healthy margins, providing a significant portion of Skanska's total revenue and cash flow.

While these mature markets might not offer explosive growth, their established presence and efficient operations ensure stable and predictable earnings for Skanska. For instance, Skanska reported a strong performance in its Infrastructure Services segment in the first quarter of 2024, highlighting the continued resilience of these established business areas.

Skanska's Investment Properties, a key component of its business, acts as a cash cow within the BCG matrix. This segment focuses on a portfolio of premium office properties, consistently generating stable income and reliable cash flows.

These mature markets allow Skanska to hold properties for steady returns, divesting them strategically when conditions are favorable. This approach yields strong cash flow without necessitating significant new investments for expansion.

For instance, Skanska's 2023 annual report highlighted that its investment properties contributed significantly to the company's overall profitability, with a focus on long-term value creation. The recent acquisition of office buildings in Sweden further bolsters this segment's stability and income-generating capacity.

Established Commercial Property Development in Europe is a prime example of a cash cow for Skanska. This segment benefits from stable European markets where transaction volumes are showing a gradual but positive improvement, especially as interest rates begin to stabilize.

While the US property market is still catching up, Europe is experiencing a resurgence in both property transactions and consistent leasing activity. This environment allows Skanska to effectively develop and then profitably divest its commercial properties, capitalizing on steady demand.

Skanska's continued focus on developing high-quality office spaces remains a key driver for this cash cow status. These premium properties consistently attract strong tenant interest, ensuring reliable revenue streams and supporting Skanska's overall financial performance.

Selective Bidding Strategy in Construction

Skanska's Construction segment functions as a Cash Cow due to its disciplined, selective bidding strategy. By focusing on project quality and strong financial fundamentals, Skanska ensures stable profit margins and a healthy order backlog, even when market conditions are tough.

This operational maturity prioritizes efficiency and risk mitigation, allowing the Construction business to reliably generate cash. For instance, in 2024, Skanska reported a strong performance in its Construction operations, with reported revenues of SEK 145.5 billion (approximately USD 13.5 billion), demonstrating the segment's consistent cash-generating ability.

- Disciplined Bidding: Prioritizes project quality and financial health over volume.

- Stable Margins: Ensures consistent profitability even in challenging markets.

- Robust Backlog: Maintains a strong order book, guaranteeing future revenue streams.

- Operational Maturity: Focuses on efficiency and de-risking for reliable cash generation.

Maintenance of Existing Infrastructure Assets

Maintenance and upgrading of existing infrastructure assets, such as roads, bridges, and hospitals, likely serve as a cash cow for Skanska. This segment benefits from predictable, long-term contracts and a lower degree of market volatility compared to new construction projects. The consistent demand for upkeep in mature markets ensures a steady revenue stream.

Skanska's established expertise in managing and executing these essential maintenance and upgrade projects positions them to secure a significant share of this stable business. For instance, in 2024, infrastructure maintenance spending in many developed nations continues to be a priority, driven by aging assets and the need for enhanced resilience.

- Stable Revenue: Long-term contracts for infrastructure maintenance offer predictable income.

- Low Volatility: Less susceptible to market fluctuations than new development.

- Expertise Advantage: Skanska's proficiency secures consistent project wins.

- Ongoing Demand: Aging infrastructure necessitates continuous upkeep and upgrades.

Skanska's investment properties, particularly its portfolio of premium office buildings in established European markets, function as a cash cow. These assets consistently generate stable rental income and reliable cash flows, requiring minimal new investment for growth.

The company's disciplined approach to developing and divesting these properties capitalizes on steady demand and favorable market conditions, as evidenced by Skanska's 2023 annual report highlighting significant profitability contributions from investment properties.

Skanska's infrastructure services, including the maintenance and upgrading of existing assets like roads and bridges, also represent a cash cow. This segment benefits from predictable, long-term contracts and a consistent demand driven by aging infrastructure, a trend reinforced by continued infrastructure spending priorities in developed nations throughout 2024.

The company's expertise in managing these essential projects ensures a steady revenue stream with lower market volatility compared to new construction.

| Segment | BCG Classification | Key Characteristics | 2024 Data Insight |

|---|---|---|---|

| Investment Properties (Europe) | Cash Cow | Stable rental income, premium office portfolio, strategic divestments | Contributed significantly to profitability in 2023; recent acquisitions bolster stability. |

| Infrastructure Services | Cash Cow | Predictable long-term contracts, maintenance focus, low volatility | Ongoing demand due to aging infrastructure and government spending priorities in 2024. |

Full Transparency, Always

Skanska BCG Matrix

The Skanska BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis, meticulously crafted to provide actionable insights, will be delivered in its final, fully formatted state, ensuring no surprises or additional work is required. You can confidently use this preview as a direct representation of the professional-grade Skanska BCG Matrix report that will be yours to download and implement. Once acquired, this document will be fully editable, allowing you to seamlessly integrate its strategic framework into your business planning and decision-making processes.

Dogs

Skanska's Residential Development in the Nordics is navigating a challenging market. Lower activity and heightened macroeconomic uncertainty have dampened homebuyer confidence, leading to sluggish sales. This translates to a significant decline in revenue for this segment.

The Nordic residential development sector for Skanska is currently characterized as a low-growth market with potentially low market share. This situation presents a strategic challenge, demanding careful recalibration or even consideration of divestment to optimize the company's portfolio.

Legacy projects with significant cost overruns, like the ones impacting Skanska's UK Construction business, are classic examples of 'dogs' in a BCG matrix. These projects tie up capital and resources, often yielding minimal or negative returns, thereby draining cash flow that could be better utilized elsewhere.

The financial strain from such projects can directly depress a segment's overall profitability. For instance, while precise figures for Skanska's specific legacy UK projects are not publicly detailed for early 2025, the general trend in the UK construction sector has seen profitability pressures. In 2023, for example, the average operating margin for UK construction firms hovered around 2-3%, a figure that can be easily eroded by unexpected cost escalations on older, fixed-price contracts.

These situations highlight historical challenges in project management or forecasting, leading to underperformance. Skanska's strategic focus often involves identifying and managing these legacy issues to prevent them from hindering growth in more promising areas of the business.

If Skanska retains outdated building technologies or construction practices in any of its divisions, these segments would fall into the 'dog' category of the BCG matrix. These older methods often lead to reduced efficiency and increased costs. For instance, a 2024 report indicated that construction projects still relying heavily on manual labor and traditional materials can see cost overruns of up to 20% compared to those utilizing prefabrication and digital modeling.

Such inefficiencies make these parts of Skanska less competitive, especially in an industry that is rapidly adopting innovative and sustainable solutions. The global green building market, for example, was valued at over $1.1 trillion in 2023 and is projected to grow significantly, highlighting the disadvantage of outdated approaches. Therefore, these 'dog' areas would require substantial investment in modernization or strategic divestment to maintain Skanska's overall market position.

Non-Core Geographical Markets (Divested or Exited)

Skanska's strategic divestments from several Latin American markets, including Argentina, Brazil, Peru, Chile, Colombia, and Venezuela, clearly position these as 'dogs' within its business portfolio. These regions likely represented low market share and faced stagnant or declining growth prospects for Skanska's core construction and development activities.

The company's earlier exit from the Indian market further reinforces this classification. Such divestitures are typical when a business unit struggles to gain traction or achieve profitability in a given geography, prompting a reallocation of capital and management attention towards more lucrative opportunities.

For instance, Skanska's withdrawal from Latin America was part of a broader strategy to streamline operations and focus on core European and US markets. In 2023, Skanska reported a significant reduction in its construction operations in Latin America, a move driven by the challenging economic and political environments in these countries, which impacted profitability and future growth potential.

- Divested Latin American Markets: Argentina, Brazil, Peru, Chile, Colombia, Venezuela.

- Past Divestment: India (Asia).

- Reason for Classification: Low market share and low growth prospects for Skanska.

- Strategic Implication: Resource reallocation to more promising markets.

Commercial Property Development (US)

The US commercial property development sector, particularly for offices, has faced significant headwinds. High inflation has squeezed development margins, while persistently low return-to-office rates have dampened demand and led to a slowdown in transactions. This environment has resulted in divestments lagging, keeping overall market activity notably subdued throughout much of 2024.

Skanska, while maintaining a long-term conviction in the office market's potential, acknowledges the current challenges. This segment is exhibiting low growth prospects in the near to medium term. Consequently, Skanska's market share within this specific, currently struggling segment may be relatively low, reflecting the broader industry's difficulties.

Key data points illustrating this trend include:

- Office Vacancy Rates: National office vacancy rates remained elevated in 2024, with some major markets exceeding 20%, impacting rental growth and property valuations.

- Transaction Volume: Commercial real estate transaction volumes for office properties in the US saw a significant decline in 2023 and continued to be sluggish in early 2024 compared to pre-pandemic levels.

- Construction Costs: Rising material and labor costs, driven by inflation, have increased the expense of new commercial property development, further pressuring profitability.

- Return-to-Office Mandates: While some companies have implemented return-to-office policies, the overall adoption rate has not reached pre-pandemic levels, impacting the utilization and perceived value of office space.

Skanska's divested Latin American markets, including Argentina, Brazil, Peru, Chile, Colombia, and Venezuela, along with its past exit from India, clearly represent 'dogs' in its business portfolio. These regions likely exhibited low market share and stagnant or declining growth prospects for Skanska's core construction and development activities.

The US commercial property development sector, particularly for offices, has also faced significant headwinds. High inflation and persistently low return-to-office rates have dampened demand and led to a slowdown in transactions, impacting Skanska's market share in this segment.

These 'dog' segments are characterized by low growth and low market share, requiring careful strategic management, potentially involving further divestment or significant restructuring to improve performance.

The strategic implication for Skanska is the need to reallocate capital and management attention away from these underperforming areas toward more lucrative opportunities.

| Segment | Market Growth | Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Divested Latin American Markets (Argentina, Brazil, Peru, Chile, Colombia, Venezuela) | Low/Stagnant | Low | Dog | Divestment/Resource Reallocation |

| India (Asia) | Low/Stagnant | Low | Dog | Divestment/Resource Reallocation |

| US Office Development (Current Market Conditions) | Low (near to medium term) | Low (within struggling segment) | Dog | Monitor, Restructure, or Divest |

Question Marks

Skanska's strategic foray into new, high-growth emerging markets, where its market share is still developing, positions these ventures as question marks in its BCG matrix. These markets offer substantial long-term growth prospects, but they demand considerable upfront investment to build brand recognition and achieve sustainable profitability.

For instance, Skanska's reported revenue from its operations in Latin America, a region characterized by emerging economies and infrastructure development needs, has shown growth, but profitability in these nascent markets remains a key focus. The company's success in these question mark territories will depend on its ability to conduct thorough market research to identify the most promising opportunities and to execute its expansion strategies with financial discipline.

Public-Private Partnerships (P3) for new infrastructure often fall into the question mark category for Skanska. While the infrastructure sector is robust, these complex, often early-stage P3s with novel financing present high growth potential driven by government initiatives and demand. For instance, in 2024, global infrastructure spending is projected to reach trillions, with P3s playing a significant role in delivering critical projects. Skanska's market share in these specific, evolving P3 structures may still be growing, necessitating considerable initial investment and meticulous risk mitigation.

Skanska's exploration into niche sustainable solutions, such as expanding mass timber construction beyond flagship projects like the Portland International Airport, represents a significant growth opportunity. The global demand for eco-friendly building materials is on the rise, with the mass timber market projected to reach approximately $30 billion by 2030, indicating strong future potential.

However, these innovative green technologies, while promising, currently hold a relatively small market share. The substantial investment required for research, development, and scaling up production for these less-established solutions places them in the question mark category of the BCG matrix. This means they have high growth potential but require careful strategic consideration and significant capital infusion to move towards market leadership.

Integration of Generative AI in Construction Processes

Generative AI's integration into construction, particularly for tasks like optimized design and scheduling, represents a high-growth potential area for Skanska. While Skanska is actively exploring these technologies, their full market penetration is likely in its nascent stages. This necessitates significant ongoing research and development investment to achieve broad adoption and establish a dominant market share. For instance, a 2024 report indicated that while AI adoption in construction is growing, only about 15% of firms reported using AI for design optimization.

Skanska's strategic position with generative AI in construction aligns with a "question mark" in the BCG matrix. The potential for market disruption and increased efficiency is substantial, but the current investment required for full integration and the relatively early stage of market adoption mean its market share is not yet established. The company's continued focus on R&D in this domain is crucial for capitalizing on this high-growth opportunity.

- High Growth Potential: Generative AI offers transformative capabilities in construction, from design optimization to predictive scheduling.

- Early Market Penetration: Despite its promise, widespread adoption of generative AI in construction is still in its early phases.

- Significant R&D Investment: Realizing the full benefits and market share requires substantial and sustained investment in research and development.

- Strategic Focus: Skanska's exploration positions it to potentially capture significant future market share in this evolving sector.

New Energy Infrastructure (e.g., Green Hydrogen Facilities)

New energy infrastructure, like green hydrogen facilities, would likely be classified as question marks for Skanska. While the global energy transition is driving rapid growth in these sectors, Skanska's current market share and specialized expertise in areas beyond wind power might still be in development.

These ventures require substantial capital investment and a dedicated strategic focus to establish a leading position. For instance, the global green hydrogen market was valued at approximately USD 2.4 billion in 2023 and is projected to grow significantly, reaching an estimated USD 45.8 billion by 2030, according to some market analyses. Skanska's participation in such markets, while potentially lucrative, carries inherent risks due to their nascent stage.

- Market Potential: High growth expected due to global energy transition initiatives.

- Skanska's Position: Current market share and specialized expertise may still be emerging.

- Investment Required: Significant capital and strategic commitment needed to achieve leadership.

- Risk Factor: Nascent markets present inherent uncertainties and competitive challenges.

Skanska's investments in emerging technologies like advanced modular construction and smart city infrastructure solutions are prime examples of question marks. These areas exhibit high growth potential, driven by increasing demand for efficiency and sustainability in urban development.

However, Skanska's market share in these specific niches is still being established, requiring substantial initial investment in research, development, and market penetration strategies. For instance, the global modular construction market is projected to grow substantially, with some forecasts indicating it could reach over $200 billion by 2027, highlighting the significant opportunity.

The company's success hinges on its ability to navigate these evolving markets, adapt to new building methodologies, and secure a competitive foothold. Skanska's strategic allocation of resources to these areas reflects a calculated approach to capturing future market leadership.

| Initiative | Market Growth Potential | Skanska's Current Market Share | Investment Needs | Strategic Implication |

| Advanced Modular Construction | High | Developing | Significant R&D and scaling | Build market leadership in efficient building |

| Smart City Infrastructure | High | Emerging | Technology integration & partnerships | Capture growth in urban tech solutions |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.