Skanska Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skanska Bundle

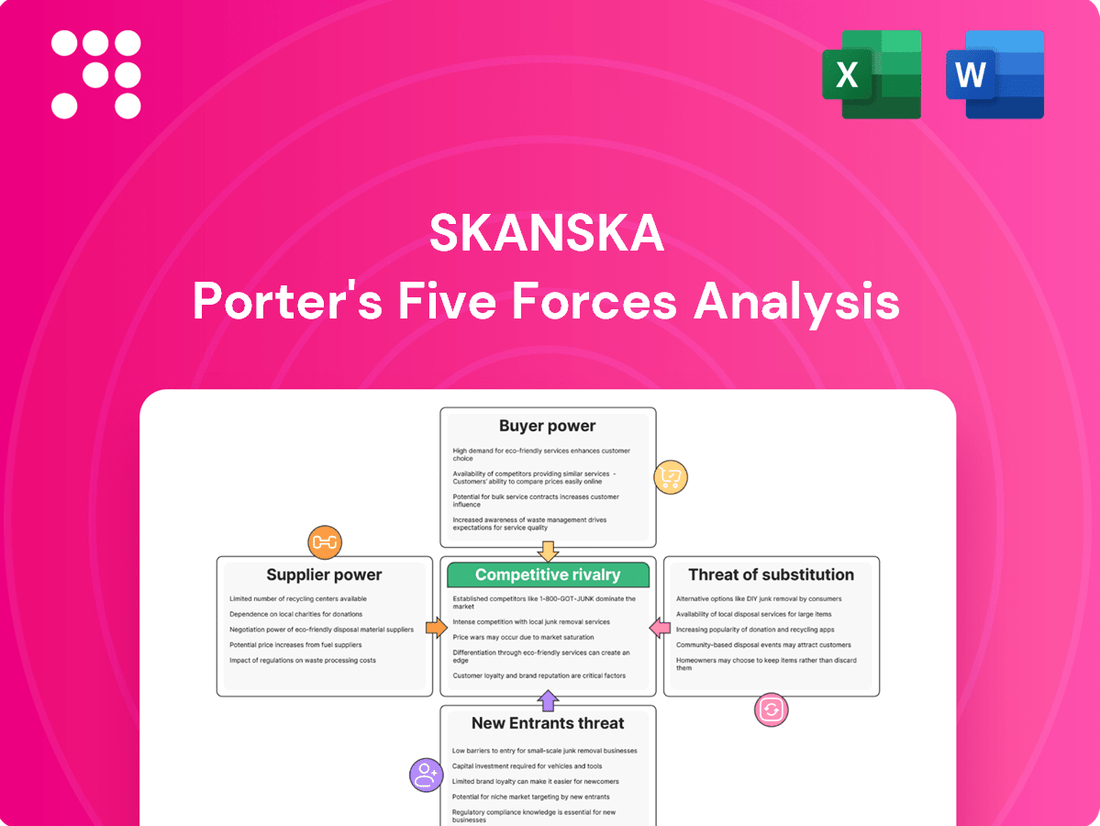

Skanska operates in a dynamic construction sector, facing significant competitive pressures. Understanding the interplay of buyer power, supplier leverage, the threat of new entrants, and the intensity of rivalry is crucial for strategic success. This brief overview hints at the complexities at play.

The complete report reveals the real forces shaping Skanska’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The construction industry's dependence on specialized and innovative materials, especially those for sustainable building, often means a limited pool of suppliers. Skanska's focus on green building practices naturally leads them to these specialized materials, where a concentrated supplier base can exert greater influence.

This concentration is particularly evident in the burgeoning green building sector. For example, in 2024, the demand for certified sustainable materials like low-carbon concrete or recycled steel has outpaced supply for some niche products, giving their producers increased leverage. This can translate to higher material costs for eco-conscious projects, impacting overall project budgets.

The construction industry's ongoing struggle with labor shortages, particularly for skilled trades, dramatically boosts the leverage of workers and subcontractors. This scarcity means that specialized professionals can negotiate for higher pay and more favorable contract conditions.

For instance, a 2024 survey by the Associated General Contractors of America found that over 70% of construction firms reported difficulty finding skilled labor, a persistent issue that has been exacerbated in recent years.

This tight labor market directly translates to increased labor costs for companies like Skanska, potentially impacting project budgets and timelines as they compete for a limited pool of qualified talent.

Tariffs on imported construction materials like steel and aluminum can significantly escalate costs for companies such as Skanska. This situation inherently boosts the bargaining power of domestic suppliers or those insulated from such trade policies. For instance, in early 2024, steel prices saw fluctuations due to ongoing trade disputes, directly impacting project budgets.

Global supply chain disruptions remain a persistent threat. Many suppliers anticipate moderate to severe challenges in material availability and extended lead times throughout 2024. This uncertainty grants suppliers greater leverage, as they can dictate terms and pricing when demand outstrips immediate supply.

Skanska proactively addresses these challenges by closely monitoring tariff impacts and supply chain vulnerabilities. The company utilizes its dedicated supply chain management team to foster strong supplier relationships and implement risk mitigation strategies, aiming to secure materials at competitive prices and ensure project continuity.

Proprietary Technology and Equipment

Suppliers providing proprietary construction technologies, specialized equipment, or unique software solutions can wield significant bargaining power. This is due to the substantial costs and complexities involved in switching to alternative providers, as well as the competitive edge these innovations offer. For instance, while Skanska is actively pursuing digitalization and advanced methodologies like Building Information Modeling (BIM), it still relies on external vendors for state-of-the-art tools.

The pace of digital transformation across the broader construction industry remains relatively slow, allowing innovative technology suppliers to set favorable terms. This dynamic means that companies like Skanska, even as they develop internal capabilities, must carefully manage relationships with these key technology providers to ensure access to critical advancements and avoid being disadvantaged by outdated systems.

- High Switching Costs: Adopting new proprietary technology often involves significant investment in training, integration, and potential disruption to ongoing projects, making it difficult for buyers to switch.

- Competitive Advantage: Unique technologies can provide a distinct edge in project execution, efficiency, and project bidding, increasing their value and supplier leverage.

- Industry Digitalization Lag: The slower adoption of digital tools in construction compared to other sectors means that early adopters of advanced technology by suppliers can command premium pricing and terms.

Supplier Integration and Relationship Management

Skanska actively works to reduce supplier bargaining power by cultivating robust, long-term relationships with its critical supply partners. Initiatives like the Supply Chain Sustainability School aim to foster collaboration and shared values, thereby lessening the leverage individual suppliers might otherwise wield.

By championing sustainability and ethical practices throughout its supply chain, Skanska endeavors to build a more cooperative ecosystem. This approach helps to align supplier interests with Skanska's own strategic goals, potentially reducing the likelihood of adversarial negotiations.

However, the reality of large-scale, complex construction projects often necessitates reliance on specialized partners. This dependence can inadvertently grant these integrated suppliers a notable degree of influence, particularly when specific expertise or capacity is scarce. For instance, in 2023, the global construction materials market saw significant price volatility, with some specialized components experiencing supply constraints.

- Supplier Integration: Skanska's focus on deep relationships with key suppliers.

- Sustainability Initiatives: The role of the Supply Chain Sustainability School in fostering collaboration.

- Mitigation of Power: How ethical conduct and shared values can reduce supplier leverage.

- Potential Influence: The inherent power of specialized suppliers in complex projects, especially during periods of market tightness.

The bargaining power of suppliers for Skanska is influenced by the concentration of specialized material providers and the increasing demand for sustainable building components. For instance, in 2024, the market for low-carbon concrete saw limited suppliers, leading to higher costs for projects prioritizing sustainability.

Furthermore, the construction industry's persistent skilled labor shortage, with over 70% of firms struggling to find qualified workers in 2024 according to the Associated General Contractors of America, significantly increases the leverage of specialized subcontractors and their ability to negotiate higher rates.

Suppliers of proprietary technologies also hold considerable power due to high switching costs and the competitive advantage these innovations provide, especially as the industry's digital transformation progresses at a measured pace.

| Factor | Impact on Skanska | 2024 Data/Trend |

|---|---|---|

| Specialized Materials for Green Building | Increased costs and potential supply constraints | Demand for low-carbon concrete outpaced supply for niche products. |

| Skilled Labor Shortage | Higher labor costs and project delays | Over 70% of construction firms reported difficulty finding skilled labor. |

| Proprietary Technology Providers | Reliance on external vendors for advanced tools | Slow industry digitalization allows tech suppliers to set favorable terms. |

What is included in the product

A comprehensive Porter's Five Forces analysis for Skanska, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on the construction and infrastructure industry.

Quickly identify and mitigate competitive threats with a visual breakdown of each Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Skanska's customer base is quite varied, ranging from government bodies and major corporations to individual homeowners. This diversity means the bargaining power of customers isn't uniform across all its projects. For instance, when Skanska undertakes massive public infrastructure projects or significant commercial buildings, the clients involved are often large entities with considerable financial clout.

These major clients, due to the sheer size of contracts and the potential for ongoing business, can exert substantial influence. They frequently negotiate for better pricing, demand very specific project requirements, and seek terms that align with their long-term strategic goals. In 2023, Skanska reported significant revenue from its infrastructure development segment, highlighting the importance of these large-scale client relationships.

In today's competitive construction landscape, customers often exhibit significant price sensitivity, particularly for standardized services or in markets experiencing economic slowdowns, such as the Nordic housing sector. For instance, reports from early 2024 indicated a noticeable slowdown in new housing starts across several Nordic countries, leading to increased price competition among developers.

However, this price focus shifts when projects are complex or critical. In these scenarios, clients prioritize factors like quality craftsmanship, dependable execution, and adherence to project timelines, which can mitigate the sole emphasis on the lowest bid. Skanska's established reputation for delivering high-quality, innovative, and reliable construction solutions directly addresses this dual customer need, allowing them to command value beyond just price.

The construction industry, while global, presents a landscape with many significant and competent contractors. This abundance of choice directly empowers customers, allowing them to compare and negotiate terms, especially for projects that don't require highly specialized skills. For instance, in 2024, the global construction market was valued at approximately $14.4 trillion, highlighting the sheer scale and number of players involved.

This competitive environment means customers can effectively leverage the availability of alternative contractors to secure more favorable pricing and project conditions. Skanska, recognizing this dynamic, employs a deliberate strategy of selective bidding, focusing on projects that align with its expertise and can be pursued without succumbing to excessive price pressure from a multitude of competing firms.

Customer's Ability to Self-Perform

Large corporate or governmental clients might have the internal expertise to manage certain construction or development projects themselves. This capability, though less common for Skanska's major undertakings, offers a degree of leverage by reducing their need for external contractors.

For instance, a sophisticated client with a dedicated in-house project management team and access to specialized equipment could potentially bypass a general contractor for specific phases of a project. This self-performance option acts as an implicit bargaining chip, especially for clients accustomed to managing complex operations.

- Limited Self-Performance by Sophisticated Clients: Some major clients possess internal resources to handle specific project aspects.

- Reduced Reliance on Contractors: This capability lessens their dependence on external firms like Skanska.

- Implicit Bargaining Leverage: The option to self-perform provides a negotiation advantage for knowledgeable clients.

- Context for Skanska: While less applicable to Skanska's large-scale projects, it's a factor for certain client segments.

Demand for Sustainable and Innovative Solutions

Customers are increasingly prioritizing sustainable and innovative building solutions. This shift in demand directly impacts their bargaining power, especially for companies like Skanska that are at the forefront of these trends.

When customers seek out advanced, eco-friendly construction, their options narrow if fewer competitors can offer comparable quality and integrated solutions. This can diminish their ability to negotiate lower prices or dictate terms, as the value proposition of sustainability and innovation becomes a key differentiator.

Skanska's strong commitment to Environmental, Social, and Governance (ESG) principles and its proven track record in green building practices position it to effectively capture this demand. For instance, in 2023, Skanska reported that 88% of its revenue came from green-certified projects, highlighting its alignment with customer preferences for sustainable development.

- Growing Customer Demand: A significant portion of the global construction market now actively seeks sustainable and technologically advanced building options.

- Reduced Bargaining Power: Companies that can reliably deliver these specialized solutions may face less pressure on pricing and terms from customers.

- Skanska's Competitive Edge: Skanska's established leadership in ESG and green building practices allows it to meet this evolving customer need, potentially strengthening its market position.

- Market Alignment: Skanska's focus aligns with a market trend where sustainability is becoming a non-negotiable factor for many clients, influencing their purchasing decisions and supplier selection.

Skanska's customer bargaining power is influenced by the diversity of its client base, from large governmental bodies to individual homeowners. While large clients on major infrastructure projects can exert significant pressure due to contract size, this is often balanced by Skanska's reputation for quality and expertise, particularly in complex or critical projects. The sheer number of competitors in the global construction market, valued at approximately $14.4 trillion in 2024, also empowers customers to seek favorable terms, a dynamic Skanska navigates through selective bidding.

| Customer Type | Influence Level | Key Negotiation Factors | Skanska's Mitigation Strategy |

|---|---|---|---|

| Large Government/Corporate Clients | High | Price, Specific Requirements, Long-term Goals | Focus on value beyond price, selective bidding |

| Individual Homeowners | Low to Moderate | Price, Quality, Timeliness | Standardized offerings, reputation |

| Clients Seeking Sustainability | Moderate to High | ESG Compliance, Green Building Practices | Leveraging strong ESG credentials (88% revenue from green projects in 2023) |

Same Document Delivered

Skanska Porter's Five Forces Analysis

This preview showcases the complete Skanska Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the construction industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You'll gain instant access to this professionally formatted analysis, ready for your strategic planning and decision-making.

Rivalry Among Competitors

The global construction sector is a sprawling landscape, characterized by a high degree of fragmentation. However, within this vastness, a select group of formidable international companies, including Skanska, VINCI, and Bechtel, exert significant influence. This dynamic fosters a fiercely competitive environment where these giants vie intensely for high-value, large-scale construction and infrastructure projects worldwide.

Skanska, a prominent example, consistently features among the top global construction and project development firms. In 2023, Skanska reported net sales of approximately SEK 200 billion (around $19 billion USD), underscoring its substantial market presence and capacity to compete on a global scale.

The global construction market is expanding, but this growth isn't uniform. For instance, the United States is showing robust activity, particularly in civil infrastructure projects and the construction of data centers, a trend expected to continue through 2024. This regional strength can intensify competition as companies vie for these lucrative opportunities.

Conversely, some European and Nordic markets are experiencing more subdued building sectors. When growth falters in certain areas, companies may redirect their efforts and resources to more promising regions, or they might engage in more aggressive pricing and bidding within those weaker markets to secure any available work, thereby heightening competitive rivalry.

The construction sector faces intense competitive rivalry, largely due to substantial fixed costs. Companies invest heavily in heavy machinery, skilled labor, and sophisticated project management systems. These significant upfront investments create high exit barriers; once committed, it's difficult and costly for firms to leave the industry.

This situation compels construction companies to aggressively pursue new projects to keep their expensive assets utilized and their workforce employed. For example, in 2024, many construction firms reported operating at lower margins to secure contracts, a direct consequence of needing to cover their high fixed overheads.

During economic slowdowns or periods of reduced infrastructure spending, this dynamic intensifies rivalry. Firms are essentially locked into the market, incentivized to compete fiercely for a smaller pool of projects rather than withdrawing, which can lead to price wars and further pressure on profitability.

Differentiation through Sustainability and Technology

Companies like Skanska are actively differentiating themselves by championing sustainability and embracing cutting-edge technologies. This approach moves beyond simple price wars, attracting clients who prioritize environmental responsibility and long-term value. For instance, Skanska reported a 10% increase in revenue from green projects in 2024, highlighting client demand for sustainable solutions.

Advanced construction methods, including Building Information Modeling (BIM) and modular construction, are central to this differentiation strategy. These innovations not only enhance efficiency but also contribute to reduced waste and improved project outcomes. Skanska’s investment in digital transformation, including AI-driven project management tools, further solidifies its competitive edge.

- Sustainability Leadership: Skanska's commitment to net-zero emissions by 2045 and its significant investment in green building certifications set it apart.

- Technological Adoption: The company's widespread use of BIM and modular construction techniques streamlines processes and improves project quality.

- Client Value: Differentiation through sustainability and technology appeals to a growing segment of clients seeking long-term value and reduced environmental impact.

- AI Integration: The strategic implementation of AI in operations is a key factor in optimizing performance and maintaining a competitive advantage.

Competition for Skilled Labor and Resources

The intense competition for skilled labor significantly impacts companies like Skanska. This rivalry extends beyond winning bids to securing the necessary talent for project execution. For instance, in 2024, the construction industry continued to grapple with a persistent shortage of skilled tradespeople, with reports indicating a deficit of over 500,000 workers in the US alone. This scarcity drives up wages and benefits, directly affecting project costs and timelines.

This competition for talent is a crucial element of competitive rivalry, as it adds a layer of strategic challenge beyond traditional project bidding. Companies that can attract and retain a highly skilled workforce gain a substantial advantage in delivering projects efficiently and to a high standard. The ability to access and maintain a robust talent pool is therefore a key determinant of success in the construction sector.

- Skilled Labor Shortage: The construction sector in 2024 faced a critical deficit of skilled workers, impacting project execution.

- Wage Inflation: Competition for talent led to increased labor costs, affecting profitability and project pricing.

- Talent as a Competitive Edge: Companies with strong workforce acquisition and retention strategies hold a significant advantage.

- Impact on Project Delivery: Labor availability directly influences a company's capacity to deliver projects on time and within budget.

Competitive rivalry in the construction sector is fierce, driven by high fixed costs and the need to utilize expensive assets. Companies like Skanska must constantly secure projects to cover overheads, leading to aggressive bidding, especially when markets soften. For example, many firms in 2024 operated on thinner margins to win contracts, a direct result of needing to maintain operations and workforce engagement despite high fixed costs.

Differentiation through sustainability and technology is becoming a key strategy to stand out. Skanska's focus on green projects, which saw a 10% revenue increase in 2024, demonstrates client demand for environmentally conscious solutions. This strategic move helps them avoid direct price competition and appeal to a growing market segment.

The intense competition for skilled labor is another major factor. In 2024, the industry faced a significant shortage, with over 500,000 skilled workers needed in the US alone. This scarcity drives up labor costs, directly impacting project profitability and timelines, making talent acquisition a critical competitive battleground.

| Company | 2023 Net Sales (approx. USD) | Key Competitive Strategy Example | 2024 Market Trend Impact |

|---|---|---|---|

| Skanska | $19 billion | Sustainability & Technology Adoption | Increased demand for green projects |

| VINCI | N/A (Global Leader) | Diversified Operations | Strong performance in infrastructure |

| Bechtel | N/A (Global Leader) | Large-scale Project Management | Focus on major infrastructure development |

SSubstitutes Threaten

The rise of modular and prefabricated construction offers a compelling alternative to traditional building methods, promising quicker project timelines, lower expenses, and enhanced quality. This shift is notably impacting sectors like residential and healthcare construction.

Skanska, a major player in the construction industry, is actively involved in modular construction, demonstrating a strategic adaptation to this evolving market rather than solely facing it as a threat. For instance, Skanska USA Building's 2024 projects are increasingly incorporating off-site fabrication techniques to improve efficiency.

Clients increasingly choose to renovate, retrofit, or adaptively reuse existing buildings instead of new construction. This trend is particularly strong in developed markets and is driven by sustainability goals and economic considerations. For instance, the global building renovation market was valued at approximately $1.4 trillion in 2023 and is projected to grow significantly, indicating a strong preference for upgrading existing structures.

These options act as functional substitutes for new builds, especially when economic downturns or government incentives encourage maximizing the utility of current assets. The growing emphasis on decarbonization further fuels this movement, as retrofitting existing buildings often presents a more carbon-efficient solution than demolition and new construction.

Large corporations and government bodies with significant financial backing and in-house expertise can opt to manage their construction projects internally. This internal development acts as a direct substitute for engaging external firms like Skanska. For instance, in 2024, several major infrastructure projects initiated by national governments, such as those focused on renewable energy expansion, saw increased consideration for in-house management to retain greater control and potentially reduce long-term costs.

Technological Alternatives and Digital Twins

Advanced technologies like digital twins, sophisticated analytics, and generative AI are emerging as significant substitutes in the construction industry. These tools empower clients to optimize designs and manage projects more independently, potentially reducing their need for traditional construction services. For instance, clients can leverage digital twins to simulate various construction scenarios, identify cost-saving opportunities, and even pre-fabricate components off-site, thereby streamlining the on-site construction phase.

This trend towards data-driven project management alters the traditional reliance on contractors for every stage of development. Clients can increasingly manage aspects of their projects internally or through specialized technology providers. For example, in 2024, the global digital twin market was valued at approximately $10.5 billion, with significant growth projected in the construction sector as firms and clients seek greater efficiency and predictive capabilities.

- Digital Twins: Allow for virtual prototyping and simulation, reducing the need for physical mock-ups and on-site adjustments.

- Advanced Analytics: Enable data-driven decision-making for design optimization, material selection, and construction sequencing.

- Generative AI: Can automate design processes and identify potential construction challenges before they arise.

- Client Empowerment: Clients can gain more control over project outcomes, potentially insourcing services traditionally provided by contractors.

Focus on Services over New Physical Assets

The threat of substitutes is evolving as industries increasingly prioritize services over new physical assets. This shift can significantly impact demand for traditional infrastructure. For instance, advancements in telecommunications and the widespread adoption of remote work are diminishing the need for certain types of commercial office buildings.

While this trend might reduce demand for new physical construction in some areas, it simultaneously fuels the need for different types of infrastructure. Think about the increased demand for data centers to support cloud computing and remote connectivity. In 2024, the global data center market was valued at approximately $275 billion, with projections indicating continued growth driven by digital transformation initiatives.

- Service-based models: A move towards offering solutions as services rather than tangible products can reduce reliance on physical infrastructure.

- Virtualization: Technologies enabling remote access and virtual environments can substitute for physical presence and associated infrastructure needs.

- Data centers: Increased reliance on digital services and remote work directly correlates with a higher demand for data center capacity.

- Telecommunications: Robust communication networks are essential substitutes for physical travel and in-person meetings, impacting office space demand.

The threat of substitutes for Skanska's traditional construction services is multifaceted, encompassing alternative construction methods, renovation, in-house project management, and technological solutions that reduce the need for new builds.

Modular construction, for example, offers faster and often cheaper alternatives, with Skanska USA Building actively integrating these techniques in 2024 projects. Similarly, the global building renovation market, valued at approximately $1.4 trillion in 2023, highlights a strong client preference for adapting existing structures over new construction, driven by sustainability and cost-efficiency.

Furthermore, large organizations increasingly manage projects internally, especially in sectors like renewable energy infrastructure development in 2024, to retain control and reduce costs. The burgeoning digital twin market, valued at $10.5 billion globally in 2024, also empowers clients with advanced analytics and AI, enabling them to optimize designs and manage projects more independently, thereby lessening reliance on external contractors.

| Substitute Type | Description | Impact on Skanska | Relevant 2024 Data/Trend |

|---|---|---|---|

| Modular/Prefabricated Construction | Off-site fabrication for faster, cheaper, and higher-quality builds. | Reduces demand for traditional on-site construction. | Skanska USA Building incorporating off-site fabrication in 2024 projects. |

| Renovation/Retrofitting/Adaptive Reuse | Upgrading or repurposing existing buildings. | Shifts focus from new builds to refurbishment. | Global building renovation market ~ $1.4 trillion (2023), growing. |

| In-house Project Management | Clients managing construction internally. | Directly bypasses external construction firms. | Increased consideration for in-house management in 2024 infrastructure projects. |

| Advanced Technologies (Digital Twins, AI) | Tools for design optimization, simulation, and independent project management. | Empowers clients, potentially reducing contractor reliance. | Global digital twin market ~ $10.5 billion (2024), growing in construction. |

Entrants Threaten

Entering the large-scale construction and property development sector, where Skanska operates, demands substantial financial resources. Think about the sheer cost of acquiring land, purchasing heavy machinery, securing project financing, and investing in cutting-edge technology. This upfront investment acts as a significant hurdle.

Skanska's robust financial standing and its vast portfolio of assets present a formidable barrier to entry. For instance, in 2023, Skanska reported operating income of SEK 13.4 billion (approximately $1.2 billion USD), demonstrating the financial muscle required to compete. This financial strength deters many smaller or less-capitalized companies from even attempting to enter the market.

Established construction giants like Skanska leverage substantial economies of scale, which are incredibly challenging for new entrants to replicate. This scale impacts everything from bulk material purchasing to the efficient deployment of specialized equipment, driving down per-unit costs. For instance, in 2024, major infrastructure projects often involve billions in capital, making it difficult for smaller, less capitalized firms to compete on price.

The experience curve further solidifies this advantage. Skanska's decades of navigating complex projects, from initial design through to completion and maintenance, have honed their operational efficiency and risk mitigation strategies. This accumulated knowledge allows them to bid more competitively and deliver projects with greater predictability, a significant hurdle for newcomers still learning the intricacies of the market.

The construction and property development industries present formidable regulatory hurdles that significantly deter new entrants. Navigating a complex web of permitting processes, stringent environmental standards, and rigorous safety compliance demands specialized expertise and substantial financial investment. For instance, in 2024, the average time to obtain all necessary building permits in major US cities often exceeds several months, coupled with significant application fees, creating a substantial initial barrier.

Access to Talent and Skilled Labor Shortages

The construction industry continues to grapple with a critical shortage of skilled labor, a significant barrier for any new company looking to enter the market. New entrants will find it exceptionally difficult to assemble a capable team, as they must compete with established players like Skanska for a limited pool of talent. This makes attracting and retaining essential workers a major hurdle.

Skanska benefits from its established global presence and robust employer brand, which significantly aids in securing the necessary human capital. This established reputation and existing workforce provide a distinct advantage in a sector already experiencing a pronounced labor deficit. For instance, reports from 2024 indicated that over 70% of construction firms were experiencing moderate to substantial difficulties in finding skilled workers.

- Skilled Labor Shortage: The construction sector faced widespread challenges in 2024 due to a lack of qualified workers.

- Talent Acquisition Difficulty: New entrants struggle to attract and retain skilled personnel against established, reputable firms.

- Skanska's Advantage: Skanska's global reach and strong employer brand facilitate access to essential human capital.

- Industry-Wide Impact: The persistent labor shortfall impacts the overall capacity and growth potential for all industry participants.

Established Client Relationships and Reputation

Skanska's established client relationships and strong reputation present a significant barrier to new entrants. The company boasts a proven track record of successfully delivering complex, large-scale projects across the globe, fostering deep trust and loyalty among its clientele. This hard-earned credibility, built over decades, is not easily replicated by newcomers.

New construction firms often struggle to gain traction in an industry where trust and a history of successful delivery are paramount. Skanska's existing network and positive brand image allow it to secure initial contracts and build momentum, while new entrants must overcome the challenge of proving their reliability and capability from scratch.

For instance, in 2024, Skanska secured major infrastructure projects valued in the hundreds of millions, demonstrating the continued reliance of clients on their expertise and established performance. This ability to consistently win bids for high-value work highlights the protective moat created by their reputation.

- Strong Brand Recognition: Skanska is a globally recognized name in construction and infrastructure development.

- Long-Term Client Partnerships: Decades of successful project execution have cultivated enduring relationships with key clients.

- Proven Track Record: A history of delivering complex and large-scale projects instills confidence in potential clients.

- Industry Trust: Skanska's reputation for quality, reliability, and safety makes it a preferred partner, a difficult advantage for new firms to overcome.

The threat of new entrants for Skanska is generally moderate to low due to significant barriers. High capital requirements for large-scale projects, estimated in the hundreds of millions or even billions for major infrastructure, present a substantial initial hurdle. For example, in 2024, the cost of acquiring land and specialized equipment alone can be prohibitive for smaller firms.

Skanska's established economies of scale, as evidenced by their 2023 operating income of SEK 13.4 billion (approximately $1.2 billion USD), allow for cost efficiencies that new entrants struggle to match. Furthermore, the deep experience curve and regulatory complexities, including lengthy permitting processes that can take months in 2024, add layers of difficulty for any new player.

The persistent skilled labor shortage in construction, affecting over 70% of firms in 2024, makes it challenging for new companies to build capable teams, while Skanska's strong employer brand aids talent acquisition. Finally, Skanska's decades-long client relationships and proven track record, demonstrated by securing major projects in 2024, create a significant barrier of trust and credibility that newcomers must overcome.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Skanska leverages data from Skanska's annual reports and investor presentations, alongside industry-specific market research from firms like Statista and IBISWorld.