RBC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RBC Bundle

Unlock the full strategic potential of RBC with our comprehensive SWOT analysis. This in-depth report reveals critical insights into their strengths, weaknesses, opportunities, and threats, providing a clear roadmap for navigating the competitive financial landscape.

Want to truly understand RBC's market position and future trajectory? Purchase the complete SWOT analysis to gain access to actionable data, expert commentary, and an editable format perfect for strategic planning, investment analysis, and competitive benchmarking.

Strengths

RBC's strength lies in its remarkably diversified business model, spanning personal and commercial banking, wealth management, insurance, investor services, and capital markets. This wide reach, serving over 18 million clients globally, is a significant advantage.

This diversification allows RBC to effectively mitigate risks and achieve steady earnings growth. For instance, the bank reported record earnings in the fourth quarter of 2024, underscoring the resilience and profitability of its varied operations.

RBC has showcased impressive financial strength, achieving a record net income of $16.2 billion for the fiscal year ending October 31, 2024. This represents a substantial 11% jump compared to the previous year, highlighting effective operational management and market positioning.

The bank's capital foundation remains exceptionally solid, evidenced by its Common Equity Tier 1 (CET1) ratio standing at 13.2% as of the first quarter of 2025. This figure comfortably exceeds regulatory minimums, providing RBC with significant capacity for strategic investments, acquisitions, and maintaining operational stability even in fluctuating economic conditions.

RBC's strategic acquisitions, notably the March 2024 deal to acquire HSBC Bank Canada for $13.5 billion, significantly bolster its market position. This move is expected to enhance RBC's presence among commercial clients, newcomers, and affluent individuals by offering integrated global banking and wealth management services.

Leadership in Digital Transformation and AI

RBC stands out as a leader in harnessing digital transformation and artificial intelligence within the financial industry. The bank's commitment is evident in its substantial technology investments, reaching $1.8 billion in 2024. This strategic funding fuels the integration of AI across various functions.

The application of AI at RBC is multifaceted, aiming to significantly improve customer experiences and operational efficiency. By leveraging AI-powered data analytics, the bank can offer more personalized financial solutions. Furthermore, automation driven by AI is actively reducing customer wait times and accelerating processes like insurance claims handling.

- Digital Leadership: Recognized for pioneering digital transformation initiatives in finance.

- AI Investment: Allocated $1.8 billion in 2024 to advance AI and technology capabilities.

- Enhanced Customer Experience: Utilizing AI for personalized banking and reduced service delays.

- Operational Efficiency: Employing AI to streamline risk assessment and automate key processes, such as insurance processing.

Commitment to Sustainability and ESG Initiatives

RBC demonstrates a strong commitment to sustainability, evidenced by its 2024 Sustainability Report. The bank has set ambitious goals, including tripling lending for renewable energy in Capital Markets and Commercial Banking by 2030 and investing $1 billion in climate solutions by the same year.

These initiatives highlight RBC's proactive approach to environmental, social, and governance (ESG) factors. A significant step is the $35 million program to upgrade its Canadian branches, aiming for a substantial reduction in its carbon footprint.

- Renewable Energy Lending: Aiming to triple by 2030.

- Climate Solutions Investment: $1 billion allocation by 2030.

- Branch Retrofitting: $35 million initiative for carbon footprint reduction.

RBC's diversified business model, encompassing banking, wealth management, and insurance, provides significant resilience. Its robust financial performance, marked by a record net income of $16.2 billion in fiscal 2024, up 11% year-over-year, underscores this strength.

The bank's solid capital position, with a CET1 ratio of 13.2% in Q1 2025, offers substantial capacity for growth and stability. Strategic acquisitions, like the $13.5 billion HSBC Canada deal in March 2024, further enhance its market standing and client offerings.

RBC is a leader in digital transformation, investing $1.8 billion in 2024 for AI and technology. This focus improves customer experience through personalization and boosts operational efficiency via automation, as seen in streamlined insurance processing.

The bank's commitment to ESG is evident in its sustainability goals, including tripling renewable energy lending by 2030 and a $1 billion investment in climate solutions. A $35 million program to upgrade branches also targets significant carbon footprint reduction.

| Strength | Description | Supporting Data |

| Diversified Business Model | Broad range of financial services | Personal & Commercial Banking, Wealth Management, Insurance, Investor Services, Capital Markets |

| Financial Strength | Record earnings and solid capital ratios | $16.2 billion net income (FY2024), 13.2% CET1 ratio (Q1 2025) |

| Strategic Acquisitions | Market expansion and enhanced services | HSBC Canada acquisition (March 2024) for $13.5 billion |

| Digital & AI Leadership | Investment in technology for efficiency and customer experience | $1.8 billion technology investment (2024), AI for personalization and automation |

| ESG Commitment | Focus on sustainability and climate action | Triple renewable energy lending by 2030, $1 billion climate solutions investment |

What is included in the product

Analyzes RBC’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address critical business challenges, transforming potential weaknesses into actionable strategies.

Weaknesses

RBC's significant footprint in Canada, while a strength, also presents a vulnerability. The Canadian economy has been experiencing headwinds, with per capita GDP growth seeing a decline for six consecutive quarters as of the third quarter of 2024. This economic slowdown directly impacts RBC's core operations.

A sustained downturn in Canada could lead to a deterioration in loan portfolios across both personal and commercial banking. This would translate into higher provisions for credit losses and slower revenue growth, directly affecting RBC's profitability and financial performance.

RBC's provisions for credit losses (PCL) have seen a notable uptick. For the first quarter of 2024, RBC reported total PCL of $1.01 billion, a significant jump from $774 million in the prior year period. This rise, particularly in commercial and personal banking segments, suggests an increasing risk of loan defaults.

The PCL on impaired loans ratio also climbed, signaling a growing concern about the quality of RBC's loan portfolio. This trend could directly affect the bank's profitability by reducing net interest income and requiring higher capital reserves to absorb potential losses.

While RBC's acquisition of HSBC Bank Canada, valued at $13.5 billion, is a strategic move to bolster its domestic presence, it introduces significant integration risks. Merging complex IT systems, disparate corporate cultures, and distinct client bases demands meticulous planning and substantial investment. For instance, a smooth integration of customer data and banking platforms is crucial to avoid service disruptions and maintain client trust.

Regulatory Scrutiny and Compliance Costs

The financial sector operates under a complex and ever-changing web of regulations. As a major global player, RBC consistently faces intense regulatory oversight. For instance, new greenwashing regulations in Canada prompted the bank to withdraw its sustainable finance target, highlighting the direct impact of evolving compliance landscapes on strategic goals.

Adhering to these diverse and often updated rules necessitates substantial financial investment and can restrict the scope of certain operations. This ongoing compliance burden represents a significant operational challenge and potential cost center for the bank.

- Evolving Greenwashing Regulations: Canada's new rules led RBC to abandon its sustainable finance target, demonstrating direct regulatory impact.

- Increased Compliance Costs: Meeting stringent financial regulations requires significant ongoing investment in systems, personnel, and processes.

- Potential Business Limitations: Compliance requirements can sometimes restrict the bank's ability to pursue certain business strategies or product offerings.

Competition in Key Markets

RBC navigates intensely competitive landscapes, contending with formidable domestic and global financial institutions across its diverse service offerings. This fierce rivalry, particularly in areas like retail banking and wealth management, can compress profit margins and erode market share, necessitating ongoing strategic investment in technology and customer experience to sustain its competitive edge. For instance, in the Canadian market, RBC faces robust competition from other major banks like TD, Scotiabank, and BMO, each vying for customer loyalty and deposit growth.

The pressure intensifies in international markets, where RBC competes with global banking giants and specialized fintech firms. This dynamic environment demands constant innovation to differentiate its products and services. By Q1 2024, Canadian banks collectively reported strong earnings, but market share gains are hard-won amidst aggressive pricing and product development from peers.

- Intense Rivalry: RBC faces significant competition from established banks and emerging fintech players in all its operating segments.

- Margin Pressure: High competition can lead to reduced profitability and a constant need to optimize costs and enhance efficiency.

- Market Share Defense: Maintaining and growing market share requires substantial investment in digital transformation, product innovation, and customer retention strategies.

- Canadian Market Dynamics: Competition within Canada is particularly acute, with major domestic banks actively pursuing growth and customer acquisition.

RBC's substantial exposure to the Canadian economy, which has shown a slowdown with per capita GDP growth declining for six consecutive quarters as of Q3 2024, presents a significant vulnerability. This economic deceleration directly impacts the bank's core operations, potentially leading to increased loan defaults and reduced profitability.

The bank's provisions for credit losses (PCL) have risen, with Q1 2024 PCL reaching $1.01 billion, up from $774 million in the prior year, indicating growing concerns about loan portfolio quality. This trend could negatively affect net interest income and necessitate higher capital reserves.

The $13.5 billion acquisition of HSBC Bank Canada, while strategic, introduces considerable integration risks, including the complex merging of IT systems, corporate cultures, and client bases, which could lead to service disruptions and client attrition if not managed flawlessly.

RBC faces intense competition from both domestic and international financial institutions, as well as fintech firms. This rivalry, particularly in retail banking and wealth management, can compress profit margins and requires continuous investment in technology and customer experience to maintain market share.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Provisions for Credit Losses (PCL) | $1.01 billion | $774 million | +30.5% |

| Canadian Per Capita GDP Growth (Quarterly) | Declining | Declining | N/A |

Preview Before You Purchase

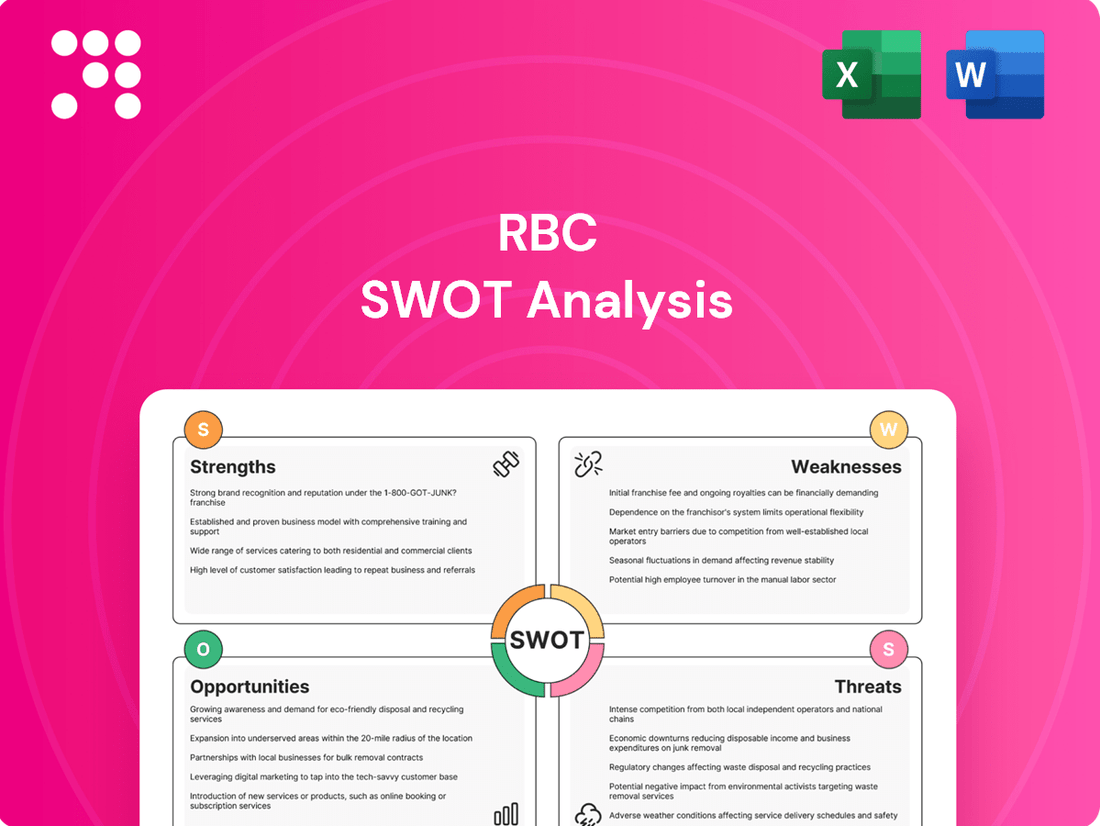

RBC SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and that you know exactly what you're getting.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the RBC SWOT Analysis.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive look at RBC's strategic position.

Opportunities

RBC's Wealth Management and Capital Markets divisions are showing robust growth, with Capital Markets achieving record earnings and Wealth Management seeing an increase in fee-based client assets. This presents a significant opportunity to broaden these successful operations on a global scale, capitalizing on RBC's established expertise and market standing.

RBC's continued investment in artificial intelligence and digital solutions offers a prime opportunity to elevate customer experiences. By developing new digital platforms and embedding AI across various banking functions, from personalized financial planning to more robust fraud detection, RBC can significantly enhance client engagement and operational efficiency.

For instance, RBC's 2024 digital banking adoption rates, reaching over 70% for many services, underscore the strong client preference for digital channels. This trend creates a fertile ground for AI-driven personalization, potentially leading to increased customer loyalty and new revenue streams through tailored product offerings and proactive financial advice.

Despite a recalibration of specific sustainable finance targets due to evolving regulatory landscapes, the market for ESG investments continues its robust expansion. Global sustainable investment assets reached $37.7 trillion in early 2024, demonstrating sustained investor appetite for environmentally and socially conscious portfolios.

RBC can leverage this trend by innovating its product offerings, potentially launching new green bonds or impact investment funds. Furthermore, enhancing advisory services to guide clients through complex ESG criteria presents a significant opportunity to capture market share and meet growing demand for responsible financial solutions.

Targeting New Client Segments and International Markets

The acquisition of HSBC Canada in early 2024 for $13.5 billion offers RBC a significant opportunity to tap into new client segments, particularly newcomers to Canada. This integration is expected to bolster RBC's international banking capabilities, providing a stronger foundation for cross-border financial services. By leveraging HSBC's existing customer base and infrastructure, RBC can more effectively cater to the unique needs of immigrants and international businesses operating in Canada.

Expanding into underserved global markets represents another key opportunity for RBC. The bank can strategically target regions exhibiting robust economic growth and identify niche client segments that are currently overlooked by competitors. This diversification strategy can lead to new revenue streams and a more resilient business model, especially as RBC aims to enhance its international presence.

- Newcomer Focus: The HSBC Canada acquisition positions RBC to attract and serve the growing population of immigrants, a segment often requiring specialized banking services.

- International Expansion: RBC can leverage the acquired international banking infrastructure to deepen its reach in global markets, potentially increasing its share of international wealth and business banking.

- Underserved Markets: Identifying and entering niche or underserved markets globally offers a pathway for diversification and capturing untapped growth potential.

Strategic Partnerships and Ecosystem Development

RBC can forge strategic partnerships with FinTech innovators to accelerate its digital transformation and introduce novel financial products. For instance, a collaboration with a leading payments FinTech could streamline cross-border transactions, tapping into the estimated $156 trillion global trade finance market. Such alliances allow RBC to expand its digital offerings beyond core banking services, creating a more comprehensive and sticky client experience.

Developing a robust ecosystem through partnerships can unlock new revenue streams and deepen customer relationships. By integrating with complementary service providers, such as wealth management platforms or insurance technology firms, RBC can offer bundled solutions. This integrated approach is crucial as the digital banking market is projected to reach $36.6 billion by 2026, according to some market analyses, indicating significant growth potential for well-positioned players.

- FinTech Collaboration: Partnering with FinTechs can enhance digital capabilities and product development speed.

- Ecosystem Expansion: Integrating with other businesses creates a more holistic client value proposition.

- New Revenue Streams: Bundled offerings and expanded services can diversify income sources.

- Enhanced Loyalty: Superior, integrated digital experiences foster greater client retention.

RBC's robust performance in Wealth Management and Capital Markets presents a clear avenue for global expansion, building on existing strengths. The bank's significant digital adoption rates, exceeding 70% for many services in 2024, highlight a strong customer preference for digital channels, which can be further leveraged with AI for personalized experiences and new revenue generation.

The acquisition of HSBC Canada in early 2024 for $13.5 billion is a strategic move to capture the growing newcomer market and enhance international banking capabilities. Expanding into underserved global markets offers further diversification and new revenue streams, capitalizing on economic growth in targeted regions.

Strategic partnerships with FinTech companies can accelerate digital transformation and introduce innovative financial products, potentially tapping into the vast global trade finance market, estimated at $156 trillion. Building a comprehensive ecosystem through integrations with complementary service providers can unlock new revenue streams and deepen customer relationships in the rapidly growing digital banking sector, projected to reach $36.6 billion by 2026.

| Opportunity Area | Key Action | Supporting Data/Fact |

|---|---|---|

| Global Expansion | Leverage Wealth Management & Capital Markets growth | Record earnings in Capital Markets, increased fee-based assets in Wealth Management. |

| Digital & AI Enhancement | Personalize customer experiences via AI | Over 70% digital banking adoption in 2024, AI can drive loyalty and new revenue. |

| Market Penetration | Attract newcomers and international clients | HSBC Canada acquisition ($13.5B) targets immigrant segment. |

| FinTech Collaboration | Accelerate digital offerings | Potential to tap into $156T global trade finance market. |

Threats

A significant economic downturn, whether in Canada or globally, poses a substantial threat to RBC. Such a downturn could trigger a rise in loan defaults across its portfolio, dampening profitability. Furthermore, reduced consumer spending directly impacts the demand for various financial services RBC offers, from mortgages to wealth management.

Interest rate volatility presents another key challenge. Divergent monetary policies between the Bank of Canada and the U.S. Federal Reserve could significantly affect RBC's net interest income. For instance, if the Bank of Canada maintains lower rates while the Federal Reserve raises them, it could compress RBC's margins on cross-border operations.

As a major financial institution with extensive digital operations, RBC faces intensifying cyber security risks. The increasing sophistication of cyberattacks means that even robust defenses can be challenged, posing a significant threat. For instance, in 2023, the financial services sector globally saw a notable rise in ransomware attacks, with average recovery costs escalating.

Data breaches at an institution like RBC could result in substantial financial losses, stemming from regulatory fines, legal settlements, and the cost of remediation. Furthermore, the reputational damage from a significant breach can be profound, eroding client trust, which is a cornerstone of the banking industry. Reports from 2024 indicate that the average cost of a data breach for organizations in the financial sector continues to be among the highest across all industries.

The financial landscape is increasingly crowded with nimble FinTechs and non-traditional lenders. These disruptors often provide specialized, more affordable, and digitally-driven services. This can chip away at RBC's customer base in key areas such as payments, lending, and wealth management. For instance, by the end of 2024, FinTech adoption in Canada was projected to continue its upward trend, with a significant portion of consumers already utilizing these services for banking and payments.

Evolving Regulatory Landscape and Geopolitical Risks

Changes in banking regulations, such as evolving capital requirements and new environmental, social, and governance (ESG) reporting mandates, pose a significant threat to RBC's operational efficiency and profitability. For instance, stricter capital adequacy ratios could necessitate increased capital reserves, potentially impacting lending capacity and return on equity.

Geopolitical instability, including trade protectionism and international conflicts, creates considerable uncertainty for RBC, which has a global presence. These events can disrupt cross-border transactions, currency exchange rates, and overall market stability, directly affecting RBC's international revenue streams and investment portfolios.

- Regulatory Impact: Increased compliance costs associated with new banking regulations, such as those stemming from the Basel III framework or evolving consumer protection laws, could add millions to RBC's operating expenses annually.

- Geopolitical Disruption: Trade disputes or sanctions involving countries where RBC has significant operations could lead to asset write-downs or reduced business activity, impacting earnings by hundreds of millions of dollars.

- Cybersecurity Threats: Heightened geopolitical tensions often correlate with an increase in sophisticated cyberattacks targeting financial institutions, presenting a substantial risk to RBC's data integrity and customer trust.

Talent Acquisition and Retention Challenges

RBC, like many in the financial and technology sectors, faces a fierce battle for skilled professionals, particularly in high-demand fields such as artificial intelligence, cybersecurity, and digital transformation. This intense competition for talent can make it difficult to attract and retain the best employees. For instance, in 2024, the demand for AI specialists saw a significant surge, with reported salary increases of up to 20% in some markets, putting pressure on companies like RBC to offer competitive compensation and benefits.

The ability to secure and keep top-tier talent is crucial for RBC's strategic execution. Without the right expertise, the bank may struggle to implement its digital innovation roadmaps and maintain its competitive standing in an increasingly tech-driven financial landscape. This talent gap could directly impact the pace of new product development and the efficiency of existing operations, potentially slowing down growth and market responsiveness.

Key talent acquisition and retention challenges for RBC include:

- Intensified competition for AI and cybersecurity expertise: Banks are vying with tech giants for a limited pool of highly skilled individuals.

- Rising salary expectations: The market for specialized tech roles saw continued upward pressure on compensation throughout 2024.

- Need for continuous upskilling and reskilling: Ensuring the existing workforce possesses the latest digital competencies is as vital as hiring new talent.

- Employee value proposition: RBC must offer more than just salary, focusing on career development, innovative projects, and a strong company culture to retain staff.

Intensifying competition from FinTechs and non-traditional lenders presents a significant threat, as these agile players often offer specialized, cost-effective digital services. By late 2024, FinTech adoption in Canada was projected to continue its rise, with a substantial portion of consumers already leveraging these services for their banking and payment needs.

SWOT Analysis Data Sources

This RBC SWOT analysis is built upon a foundation of robust data, drawing from official financial reports, comprehensive market intelligence, and expert industry forecasts to provide a well-rounded strategic perspective.