RBC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RBC Bundle

RBC operates within a dynamic financial landscape, shaped by intense competition, evolving customer demands, and the ever-present threat of new entrants. Understanding the interplay of these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping RBC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of technology and software providers presents a moderate to high challenge for RBC. Given RBC's extensive reliance on specialized software for critical functions like core banking operations, robust cybersecurity measures, advanced data analytics, and efficient payment processing, these suppliers hold significant sway.

The substantial costs associated with switching vendors, coupled with the fact that some providers offer unique, integrated solutions, grant them considerable leverage. This allows them to influence pricing and negotiate favorable contract terms with RBC, impacting the bank's operational expenses and flexibility.

Data and information service providers wield considerable influence because their offerings are essential for operations. RBC relies heavily on real-time market data, credit bureau insights, and economic projections for everything from daily trading to long-term strategy, making these suppliers critical.

The specialized and often unique nature of this data, coupled with its accuracy, can restrict RBC's ability to switch providers easily. This lack of readily available alternatives strengthens the bargaining position of these data suppliers, allowing them to command higher prices and favorable terms.

The bargaining power of suppliers for RBC, particularly concerning specialized talent and consulting services, is moderate. While RBC employs a vast number of individuals, it frequently engages external consultants for highly specific areas such as keeping up with evolving regulations, driving digital advancements, and tackling intricate IT initiatives.

The limited availability of professionals with these highly specialized skill sets can lead to increased costs for RBC, thereby granting these suppliers significant leverage. For instance, in 2024, the demand for cybersecurity and AI expertise continued to outstrip supply, driving up consulting fees in these critical sectors.

Supplier Power 4

Payment network operators, such as Visa and Mastercard, wield considerable bargaining power over financial institutions like RBC. These networks are essential for facilitating global card transactions, making it difficult for banks to operate without them. In 2024, the dominance of these networks means RBC has few viable alternatives for core payment processing, leading to substantial fees and the necessity of adhering to network-imposed rules and regulations.

The essential nature of these payment networks for modern commerce grants them significant leverage. RBC, like its peers, is dependent on these global infrastructures to serve its customers' payment needs. This reliance translates into a situation where suppliers dictate terms, impacting RBC's operational costs and strategic flexibility.

- Visa and Mastercard's Dominance: These two networks process a vast majority of global card transactions, creating a near-monopoly in many markets.

- Essential Infrastructure: Banks cannot effectively offer credit and debit card services without participating in these networks.

- Limited Alternatives: For core payment processing, the options outside of Visa and Mastercard are significantly less developed or globally integrated, forcing banks into their ecosystems.

- Cost Implications: This dependency results in significant transaction fees and interchange fees paid by banks to the networks, impacting profitability.

Supplier Power 5

Regulatory bodies and governmental agencies act as powerful forces, similar to suppliers with high bargaining power, shaping RBC's operational landscape. These entities set critical rules, compliance standards, and capital requirements that RBC must adhere to. Failure to comply can lead to substantial fines and operational restrictions, compelling significant investments in regulatory technology and specialized staff.

For instance, in 2024, the financial services industry continued to grapple with evolving regulations such as those related to data privacy (e.g., GDPR, CCPA) and anti-money laundering (AML) efforts. RBC, like its peers, likely allocated considerable resources to ensure compliance, impacting its cost structure and strategic flexibility. The constant need to adapt to these mandates effectively increases the operational cost imposed by these non-traditional but influential entities.

- Regulatory Compliance Costs: Banks often spend billions annually on compliance, a significant portion driven by governmental mandates.

- Impact on Innovation: Strict regulatory environments can sometimes slow down the pace of innovation as new products and services require extensive approval processes.

- Capital Adequacy Ratios: Regulators determine capital requirements, directly influencing how much capital RBC must hold, thereby affecting its ability to lend and invest.

The bargaining power of suppliers for RBC is a significant factor, particularly for essential services and specialized expertise. Key suppliers like payment network operators and data providers hold substantial leverage due to the critical nature of their services and limited alternatives. This power translates into higher costs and dictates terms that impact RBC's operational efficiency and financial performance.

What is included in the product

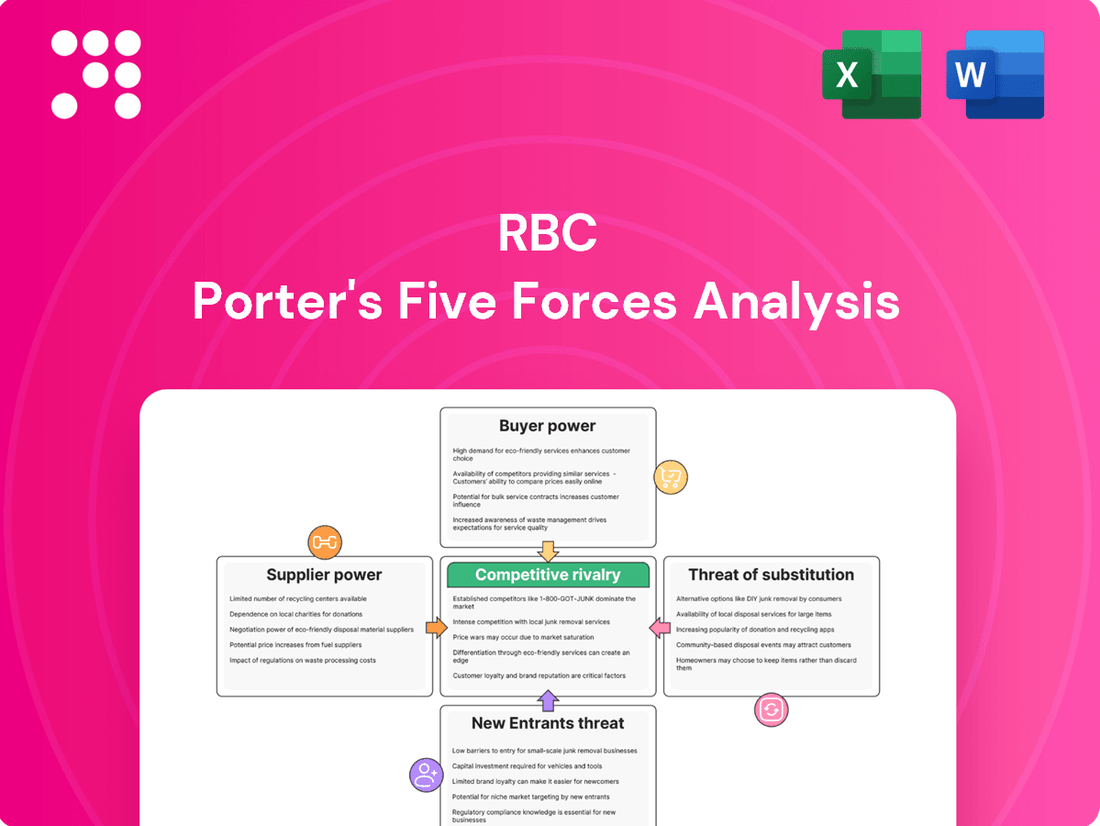

This analysis examines the five competitive forces shaping RBC's industry: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

The bargaining power of individual retail customers for core banking services is typically quite low. While digital advancements have simplified account switching, the inertia created by bundled financial products like mortgages and investment accounts often keeps customers from moving frequently.

Customers generally base their decisions on factors like convenience, branch accessibility, and straightforward fee structures, rather than engaging in price negotiations. For instance, in 2024, the average customer retention rate for major banks remained high, indicating limited customer-driven price pressure.

Small to medium-sized business (SMB) clients generally possess moderate bargaining power. They frequently seek competitive pricing for essential banking services like loans, lines of credit, and payment processing. In 2024, the average interest rate for small business loans hovered around 7-8%, creating an environment where SMBs can negotiate for better terms.

Their capacity to compare offerings from numerous financial institutions, coupled with a demand for tailored service, grants them leverage. For instance, a business with a strong credit history and consistent revenue streams can often secure more favorable loan conditions than a less established entity.

Large corporate and institutional clients wield considerable bargaining power. Their sophisticated financial requirements, encompassing capital markets, syndicated loans, and intricate wealth management, mean they can demand tailored terms and pricing. For instance, in 2024, major corporations often negotiate fees on large syndicated loans, potentially securing basis point reductions based on their creditworthiness and the deal's size, which can amount to millions in savings.

Buyer Power 4

Wealth management and investment clients possess significant bargaining power, especially those with large asset bases. Their ability to negotiate fees and demand superior performance is a key factor. For instance, in 2024, the average advisory fee for high-net-worth individuals often falls within the 0.5% to 1.0% range, with larger clients frequently securing even lower rates.

Client sensitivity to fees and advisor expertise is pronounced. A slight difference in performance or a perceived lack of specialized knowledge can prompt a client to seek alternatives. This is underscored by the fact that a 1% difference in annual returns can amount to tens of thousands of dollars for a million-dollar portfolio over several years.

The expanding landscape of wealth management options amplifies client leverage. The rise of independent advisory firms and sophisticated robo-advisors, which often offer lower fee structures and accessible technology, provides clients with readily available alternatives. By mid-2024, robo-advisors managed an estimated $1.5 trillion in assets globally, demonstrating their growing appeal and the competitive pressure they exert on traditional advisors.

- Client Leverage: High-net-worth individuals can negotiate lower fees due to the substantial assets they bring to wealth management firms.

- Performance Sensitivity: Clients closely monitor investment performance, with even minor deviations impacting their satisfaction and retention.

- Fee Pressure: In 2024, advisory fees for substantial portfolios often range from 0.5% to 1.0%, with potential for further reduction for very large accounts.

- Provider Options: The increasing availability of independent advisors and robo-advisors empowers clients to switch providers if dissatisfied, intensifying competition.

Buyer Power 5

Customers increasingly wield significant power, especially those who are digitally adept and favor online-only banking. This trend means clients are less bound to traditional brick-and-mortar branches, making it simpler for them to explore and switch between digital banking solutions or FinTech alternatives. In 2024, the global FinTech market was valued at over $1.1 trillion, highlighting the competitive landscape RBC navigates.

This digitally savvy customer base actively seeks out smooth digital interactions and competitive online pricing. Consequently, RBC faces ongoing pressure to enhance its digital services and product offerings to meet these evolving expectations. For instance, a significant portion of banking transactions in developed markets are now conducted digitally, a trend that continued to accelerate through 2024.

- Digital fluency empowers customers to easily compare and switch providers.

- Demand for seamless digital experiences drives innovation in banking services.

- Competitive online pricing is a key factor for digitally-oriented customers.

- The growing FinTech sector intensifies buyer power in banking.

The bargaining power of customers in the banking sector varies significantly by segment. While individual retail customers have low power due to inertia and bundled services, large corporate clients and high-net-worth individuals wield considerable influence, negotiating favorable terms and fees. The rise of digital banking and FinTech options further empowers customers, increasing price sensitivity and the demand for superior digital experiences.

| Customer Segment | Bargaining Power | Key Factors | 2024 Data Point |

|---|---|---|---|

| Individual Retail | Low | Inertia, bundled products, convenience focus | High customer retention rates for major banks |

| Small to Medium Businesses (SMBs) | Moderate | Price comparison, demand for tailored service | Average small business loan interest rates around 7-8% |

| Large Corporate/Institutional | High | Sophisticated needs, creditworthiness, deal size | Negotiated basis point reductions on syndicated loan fees |

| Wealth Management/Investment | High | Large asset bases, performance sensitivity, fee awareness | Advisory fees for HNWIs often 0.5%-1.0%, lower for larger clients |

| Digitally Savvy | Increasingly High | Ease of switching, FinTech alternatives, online pricing | Global FinTech market valued over $1.1 trillion |

Same Document Delivered

RBC Porter's Five Forces Analysis

This preview showcases the complete RBC Porter's Five Forces Analysis, providing a thorough examination of the competitive landscape impacting the bank. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

Competitive rivalry within the Canadian banking sector, where RBC holds a significant position, is exceptionally strong. The landscape is dominated by a handful of large, established institutions, often referred to as the Big Six, which includes RBC itself. These major players engage in aggressive competition for customers and market share across all banking services.

This oligopolistic market structure means that strategic decisions made by one bank, such as adjustments to interest rates or the introduction of innovative financial products, are typically met with swift and similar responses from its rivals. For instance, in 2023, Canadian banks saw net interest margins fluctuate, with competitive pricing on mortgages and deposit accounts being a key battleground.

RBC's competitive landscape is broad, extending far beyond traditional banking. It faces intense rivalry not only from other universal banks but also from specialized firms excelling in wealth management, insurance, and capital markets. This means RBC must simultaneously compete on multiple fronts, demanding tailored strategies and substantial investment across its diverse business lines.

For instance, in wealth management, RBC competes with dedicated players like Fidelity or Vanguard, which may offer highly specialized investment products or lower fee structures. In insurance, it goes head-to-head with giants like Manulife and Sun Life. This multi-faceted competition requires RBC to maintain excellence across its entire portfolio, a significant undertaking given the dynamic nature of each sector.

Digital transformation is a major front in the battle among banks. Companies are pouring money into AI, data analysis, and digital tools to make things better for customers, run smoother, and offer new things. For instance, in 2024, many major banks announced significant increases in their tech budgets, with some allocating over $10 billion annually to digital initiatives.

Keeping up with new technology and using data smartly is vital to stay ahead. This applies not just to other banks but also to new financial technology companies, or FinTechs, that are entering the market. The speed at which banks adopt these innovations directly impacts their ability to compete and attract customers in the evolving financial landscape.

Competitive Rivalry 4

Competitive rivalry in the banking sector is intense, even in a commoditized environment. Banks are actively seeking differentiation through exceptional customer service, tailored financial guidance, bundled product offerings, and reward programs. For instance, in 2024, many major banks continued to invest heavily in digital platforms and AI-driven customer service to gain an edge.

Despite these efforts, the rapid replication of innovations means that differentiation is often short-lived, creating continuous pressure for banks to develop novel strategies. This dynamic is evident as many banks rolled out new mobile banking features and personalized investment tools throughout 2024, only to see competitors quickly adopt similar functionalities.

- Focus on Service: Banks are differentiating through superior customer service and personalized advice.

- Product Bundling: Offering specialized product packages is a key strategy.

- Loyalty Programs: Initiatives to retain customers are crucial in a competitive landscape.

- Rapid Innovation Replication: New features are often quickly copied by rivals, necessitating ongoing innovation.

Competitive Rivalry 5

RBC's competitive rivalry is significantly amplified by its international expansion and global market presence. While the bank boasts a robust domestic foundation in Canada, its operations extend across numerous countries, placing it in direct competition with other large, globally-oriented financial institutions. This global arena involves intense rivalry in crucial areas such as capital markets and investor services, where major international banks vie for market share and client relationships.

The intensity of this global competition is evident in various metrics. For instance, as of early 2024, major global banks like JPMorgan Chase, Bank of America, and HSBC are all actively expanding their international footprints and competing for cross-border deals and investment banking mandates. RBC's participation in these global markets means it must constantly innovate and adapt to stay ahead of these formidable competitors.

- Global Reach: RBC competes with over 20 major international banks in key markets like the United States and Europe.

- Capital Markets Competition: In 2023, the global investment banking fees were estimated to be in the hundreds of billions of dollars, a market segment where RBC directly contends with global giants.

- Investor Services: The custody and fund administration business, a significant area for RBC Investor & Treasury Services, sees intense competition from global players managing trillions in assets.

- Digital Transformation: To counter global rivals, RBC is investing heavily in digital platforms and AI, aiming to enhance customer experience and operational efficiency in its international operations.

Competitive rivalry within the Canadian banking sector, where RBC holds a significant position, is exceptionally strong, characterized by the dominance of the Big Six institutions. These major players engage in aggressive competition for customers and market share across all banking services, with strategic decisions like interest rate adjustments often prompting swift responses from rivals. For example, in 2023, Canadian banks saw intense competition on mortgage and deposit rates, impacting net interest margins.

RBC faces a broad competitive landscape, extending beyond traditional banking to include specialized firms in wealth management, insurance, and capital markets, demanding tailored strategies and significant investment across diverse business lines. Digital transformation is a key battleground, with banks investing heavily in AI and data analytics; in 2024, many major banks increased their tech budgets, some allocating over $10 billion annually to digital initiatives to enhance customer experience and operational efficiency.

Banks are differentiating through superior customer service, personalized advice, product bundling, and loyalty programs, though the rapid replication of innovations means differentiation is often short-lived, necessitating continuous strategic development. For instance, throughout 2024, many banks introduced new mobile banking features and personalized investment tools, which competitors quickly adopted.

RBC's global presence amplifies competitive rivalry, as it contends with major international financial institutions in areas like capital markets and investor services. As of early 2024, global banks like JPMorgan Chase and HSBC are actively expanding internationally, competing for cross-border deals. The global investment banking fees in 2023 were estimated in the hundreds of billions of dollars, a market where RBC directly competes with these giants.

| Key Competitors | Primary Areas of Competition | 2024 Digital Investment Focus |

| Canadian Big Six Banks | Retail banking, mortgages, deposits, wealth management | AI-driven customer service, mobile banking enhancements |

| Global Banks (e.g., JPMorgan Chase, HSBC) | Capital markets, investment banking, cross-border transactions | Advanced analytics, cloud computing, cybersecurity |

| Specialized Financial Firms (e.g., Fidelity, Manulife) | Wealth management, insurance, specific investment products | Personalized digital advice platforms, low-fee product innovation |

SSubstitutes Threaten

FinTech companies offering specialized digital payment solutions present a substantial threat of substitution for traditional banking services. Platforms like PayPal, Square, and numerous mobile payment apps enable consumers and businesses to transact without requiring traditional bank accounts or credit cards. This effectively bypasses conventional banking channels, particularly for smaller, frequent transactions.

Robo-advisors and online investment platforms are increasingly offering a viable alternative to traditional wealth management. These digital services, known for their lower fees and accessibility, are attracting a significant portion of the market, particularly younger demographics and those preferring passive investment approaches. For instance, the global robo-advisory market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in investor preference.

This trend directly challenges RBC's wealth management division by reducing the perceived need for expensive human financial advisors. As more investors opt for automated, cost-effective solutions, RBC faces pressure to adapt its service model to remain competitive and retain its client base, especially among emerging wealth segments.

Peer-to-peer (P2P) lending and crowdfunding platforms represent a significant threat of substitutes for RBC’s traditional lending business. These platforms directly connect borrowers with a pool of individual or institutional investors, effectively disintermediating traditional financial institutions like banks.

For instance, by mid-2024, the global P2P lending market was projected to reach over $150 billion, demonstrating substantial growth and offering a viable alternative for individuals and small businesses seeking capital. This expansion directly siphons potential customers and revenue away from established banks.

These alternative financing channels often provide faster approval processes and potentially more competitive interest rates, especially for underserved segments of the market. This competitive pressure forces traditional lenders to innovate and adapt their service offerings to retain market share.

4

Cryptocurrencies and blockchain technology represent a burgeoning threat of substitutes for traditional banking and payment systems. While still niche, these digital assets offer alternative ways to store value and conduct transactions, potentially bypassing established financial intermediaries.

The volatility of cryptocurrencies remains a significant barrier to widespread adoption as a direct substitute for fiat currency. However, the underlying blockchain technology is being explored for more stable applications like cross-border payments and decentralized finance (DeFi).

By mid-2024, the total market capitalization of cryptocurrencies fluctuated significantly, but the underlying technology continued to gain traction. For instance, reports indicated substantial growth in DeFi lending protocols, demonstrating a tangible alternative to traditional banking services, even if still a small fraction of the overall financial market.

- Decentralized Finance (DeFi) Growth: DeFi lending and borrowing platforms saw billions of dollars locked in smart contracts throughout 2023 and into 2024, offering alternatives to traditional bank loans and savings accounts.

- Cross-Border Payment Innovation: Blockchain-based solutions are increasingly being piloted and adopted by financial institutions for faster and cheaper international remittances, challenging the dominance of established correspondent banking networks.

- Stablecoin Adoption: The rise of stablecoins, pegged to fiat currencies, addresses the volatility issue, making them more viable substitutes for everyday transactions and store of value for a growing user base.

5

Big tech firms like Apple, Google, and Amazon are increasingly offering financial services, presenting a significant threat of substitutes for traditional banks such as RBC. These companies leverage their massive customer bases and sophisticated digital ecosystems to provide integrated solutions, including payment services, credit, and banking-like features.

Their ability to offer a seamless user experience and capitalize on vast data insights allows them to attract customers who might otherwise use traditional banking services. For instance, Apple Pay has seen substantial growth, with reports indicating it processed over 3 billion transactions in the first quarter of 2024 alone, demonstrating its competitive edge in payment solutions.

- Big Tech Expansion: Companies like Apple, Google, and Amazon are broadening their reach into financial services, offering integrated payment, credit, and banking-like features.

- Customer Base & Data: They utilize their extensive customer data and digital ecosystems to create convenient and personalized financial solutions.

- Seamless User Experience: The ease of use and integration within their existing platforms can draw customers away from traditional financial institutions.

- Market Impact: This expansion challenges incumbent banks by providing accessible and often lower-cost alternatives, potentially eroding market share.

The threat of substitutes for traditional banking services is multifaceted, encompassing digital alternatives and new financial models. These substitutes often offer greater convenience, lower costs, and specialized functionalities that can attract customers away from incumbent institutions like RBC.

Fintech innovations, peer-to-peer lending, and even big tech's foray into financial services all represent significant alternative channels for transactions, investments, and borrowing. The increasing adoption of these substitutes highlights a shift in consumer preferences towards more agile and digitally-native financial solutions.

By mid-2024, the global P2P lending market was projected to exceed $150 billion, showcasing a substantial alternative to traditional bank loans. Similarly, Apple Pay's transaction volume surpassed 3 billion in Q1 2024, demonstrating the growing power of non-bank payment solutions.

| Substitute Category | Key Players/Examples | Impact on Traditional Banks | Market Trend (Mid-2024 Projection/Recent Data) |

|---|---|---|---|

| Digital Payments | PayPal, Square, Apple Pay | Bypass traditional banking infrastructure, reduced transaction fees | Apple Pay processed over 3 billion transactions in Q1 2024 |

| Wealth Management | Robo-advisors (e.g., Betterment, Wealthfront) | Lower fees, increased accessibility, challenge human advisors | Global robo-advisory market valued at ~$1.5 billion in 2023, with substantial growth projected |

| Lending & Borrowing | P2P Lending Platforms (e.g., LendingClub), Crowdfunding | Disintermediation, faster approvals, potentially competitive rates | Global P2P lending market projected to exceed $150 billion |

| Digital Assets & DeFi | Cryptocurrencies, DeFi platforms | Alternative store of value and transaction methods, potential for decentralized finance | Billions of dollars locked in DeFi protocols throughout 2023-2024 |

| Big Tech Financial Services | Apple, Google, Amazon | Integrated ecosystems, data leverage, seamless user experience | Significant growth in integrated payment and credit solutions |

Entrants Threaten

The threat of new entrants into Canada's banking sector, including for a major player like RBC, is considerably low. This is primarily due to the substantial capital requirements necessary to even begin operations. Think billions of dollars just to get a financial institution off the ground and meet all the stringent regulatory demands.

For instance, the Bank of Canada's capital adequacy ratios, which banks must adhere to, are robust. These requirements ensure financial stability but also create a formidable barrier to entry. A new bank would need to demonstrate significant financial backing, making it extremely difficult for smaller or less capitalized entities to compete effectively with established giants like RBC.

The threat of new entrants into the Canadian banking sector is significantly low due to substantial regulatory barriers. Obtaining a banking license requires navigating a complex and time-consuming approval process overseen by the Office of the Superintendent of Financial Institutions (OSFI). For instance, in 2024, the average time to receive preliminary approval for a new bank charter remained lengthy, often extending over a year, underscoring the rigorous nature of the process.

Compliance costs associated with anti-money laundering (AML), data privacy, and consumer protection regulations are also exceptionally high. These extensive requirements demand significant investment in technology, personnel, and ongoing training. For example, the cost of implementing robust AML compliance systems alone can run into millions of dollars for a new institution, making it a prohibitive expense for many potential entrants.

The threat of new entrants in the banking sector, specifically concerning Royal Bank of Canada (RBC), is significantly mitigated by established brand loyalty and deep-rooted customer trust. For instance, RBC has cultivated decades of stability and reliability, which translates into a strong preference among consumers and businesses for its services. This long-standing reputation is a formidable barrier, as replicating such trust and brand recognition is a lengthy and capital-intensive endeavor for any new player aiming to enter the market.

Threat of New Entrants 4

The threat of new entrants into the Canadian banking sector, particularly for a giant like Royal Bank of Canada (RBC), is significantly mitigated by the substantial economies of scale and scope enjoyed by incumbents. RBC, with its vast customer base and extensive branch network, can spread its fixed costs across a wide range of services, from retail banking to wealth management and insurance. This allows them to offer more competitive pricing and invest heavily in technology and marketing, creating a high barrier for newcomers.

New entrants find it incredibly difficult to match the cost efficiencies that RBC achieves. For instance, RBC's 2023 annual report highlighted nearly $50 billion in revenue, a scale that allows for significant operational leverage. A new bank would need massive upfront capital to build a comparable infrastructure, acquire a significant customer base, and offer a diversified product suite, making it challenging to compete on price or service quality from day one.

Furthermore, regulatory hurdles and the need for established trust present additional challenges. New entrants must navigate complex licensing requirements and build a reputation for security and reliability, which takes considerable time and resources. This environment favors established players like RBC, who have decades of experience and a proven track record.

Key barriers for new entrants include:

- Economies of Scale: Incumbents like RBC benefit from lower per-unit costs due to their large operational size.

- Capital Requirements: Significant investment is needed to establish a competitive banking infrastructure and brand presence.

- Brand Loyalty and Trust: Established banks have built strong customer relationships and a reputation for security.

- Regulatory Compliance: Navigating stringent banking regulations requires substantial expertise and resources.

Threat of New Entrants 5

The threat of new entrants into the banking sector remains moderate, though significant hurdles exist. Access to highly specialized talent, particularly in cybersecurity, data science, and financial engineering, is a critical barrier. For instance, the global demand for AI and machine learning specialists in finance saw a significant uptick in 2024, with many institutions competing for a limited pool of qualified professionals.

Furthermore, the capital expenditure required for a robust and secure IT infrastructure is substantial. Establishing the complex systems necessary for global financial services, including advanced data analytics platforms and stringent cybersecurity measures, presents a formidable cost for new players. By mid-2024, estimates suggested that a new challenger bank would need to invest upwards of $500 million to establish a competitive technological foundation.

- High Demand for Specialized Talent: Cybersecurity and data science roles in finance experienced a 20% year-over-year increase in job postings in 2024.

- Significant IT Infrastructure Costs: Building a secure and scalable IT system for a financial institution can cost hundreds of millions of dollars.

- Regulatory Compliance: New entrants must navigate complex and costly regulatory frameworks, adding to the barrier of entry.

- Brand Reputation and Trust: Established banks benefit from decades of built-up trust, which is difficult for newcomers to replicate quickly.

The threat of new entrants into Canada's banking sector, impacting major players like RBC, is substantially low. This is largely due to the immense capital investment required, with billions needed to meet stringent regulatory demands and establish operations. For instance, by mid-2024, estimates indicated that a new challenger bank would need to invest upwards of $500 million for a competitive technological foundation alone.

The hurdles presented by regulatory compliance, including anti-money laundering and data privacy, are exceptionally high. These necessitate significant investment in technology and personnel, with AML compliance systems alone costing millions for a new institution. Furthermore, the need for specialized talent in areas like cybersecurity and data science, which saw a 20% year-over-year increase in job postings in 2024, adds another layer of difficulty for potential newcomers.

| Barrier | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Vast sums needed for operations and regulatory compliance. | Prohibitive for most, requiring billions to compete. | Estimated $500M+ for competitive IT infrastructure. |

| Regulatory Compliance | Navigating complex licensing, AML, and data privacy rules. | Time-consuming and costly, demanding expertise. | Lengthy approval times for new bank charters (often >1 year). |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to size. | New entrants struggle to match cost efficiencies. | RBC's 2023 revenue near $50 billion. |

| Brand Loyalty & Trust | Established reputation built over decades. | Difficult for new players to replicate quickly. | Decades of stability fostered by incumbents. |

| Specialized Talent | High demand for cybersecurity, data science, and AI experts. | Competition for limited talent pool drives up costs. | 20% YoY increase in finance job postings for AI/ML specialists. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company annual filings, and expert interviews to provide a comprehensive view of competitive dynamics.