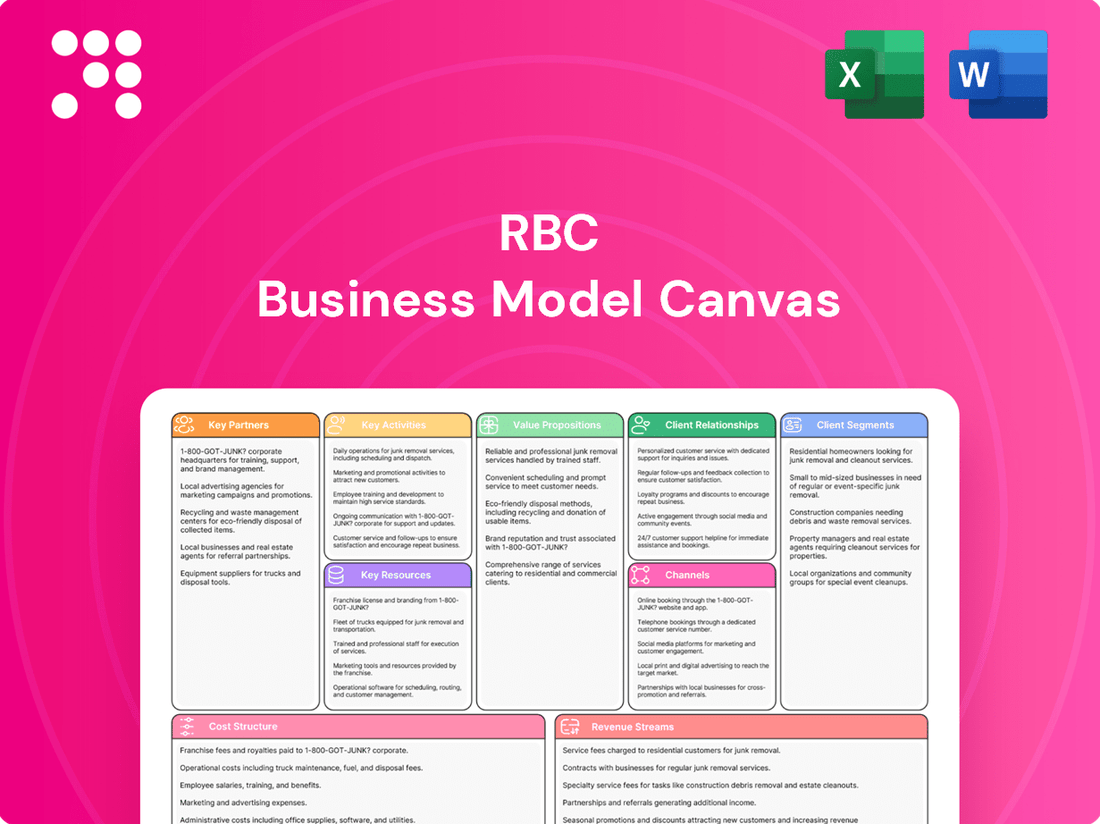

RBC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RBC Bundle

Curious about the engine driving RBC's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic framework that fuels their market position.

Ready to gain a competitive edge? Unlock the full RBC Business Model Canvas, detailing their value propositions and cost structure. This actionable blueprint is perfect for strategic planning and market analysis.

Partnerships

RBC actively cultivates fintech and technology alliances to bolster its digital capabilities and streamline operations. These collaborations are crucial for delivering advanced client solutions and maintaining a competitive edge in the evolving financial landscape.

Key partnerships include integrations with leading digital payment platforms such as Mastercard, Stripe, Apple Pay, Google Pay, and Samsung Pay. These alliances ensure clients can conduct transactions smoothly and conveniently across various channels. By Q1 2024, RBC reported a significant increase in digital transaction volume, underscoring the success of these integrations.

Furthermore, RBC leverages its strategic alliance with technology leader Microsoft for its cloud computing infrastructure. This partnership is fundamental to RBC's ongoing digital transformation, providing the scalable and robust systems necessary to support its expanding digital services and data management needs.

RBC actively partners with academic institutions like MIT through programs such as FinTechAI@CSAIL. This collaboration is crucial for exploring cutting-edge AI applications in finance, including advancements in machine learning and predictive analytics.

These academic ties are designed to foster innovation, allowing RBC to stay at the forefront of technological advancements in financial services. The bank specifically targets the development of AI-driven solutions to enhance customer experience and operational efficiency.

By engaging with leading researchers, RBC aims to translate early-stage discoveries into tangible business value. This strategic approach is key to achieving their objective of significant financial returns from their AI investments by 2025.

RBC's insurance offerings are significantly enhanced by its key partnerships with major insurance providers such as Aviva Canada, Manulife Financial, and Sun Life Financial. These collaborations are crucial for expanding RBC's product portfolio, which now encompasses a wide array of life, health, home, and auto insurance solutions. This extensive network not only diversifies the client value proposition but also solidifies RBC's competitive standing within the Canadian insurance landscape.

Government and Industry Collaborations

RBC actively engages with government bodies and industry associations to foster economic growth and deliver tailored financial solutions. These collaborations are crucial for extending the reach of specialized financing programs to a wider audience.

A prime example is RBC's partnership with the Business Development Bank of Canada (BDC). Through this alliance, they work together to enhance access to capital for Canadian entrepreneurs, particularly those in underserved sectors. In 2023, BDC reported facilitating over $4.5 billion in financing to Canadian businesses, a testament to the impact of such collaborations.

- Government Support: Partnering with government agencies to leverage programs that stimulate investment and job creation.

- Industry Alliances: Collaborating with industry groups to understand sector-specific needs and develop relevant financial products.

- BDC Financing: Working with institutions like BDC to expand the availability of loans and venture capital for small and medium-sized enterprises.

- Community Impact: Aligning these partnerships with RBC's broader mission of supporting community prosperity and promoting economic inclusion across Canada.

Credit and Data Service Providers

RBC collaborates with credit and data service providers, notably fintech firms like Nova Credit, to improve financial accessibility for newcomers. This partnership leverages Nova Credit's Global Credit Connect and Credit Passport, enabling RBC to access standardized, real-time credit histories from immigrants' home countries. This initiative directly addresses a significant barrier for new residents, allowing them to secure essential financial services more readily by mitigating the challenge of a non-existent local credit record.

These partnerships are crucial for RBC’s strategy to onboard and serve a growing immigrant population. For instance, by providing a more complete financial picture, RBC can offer products like secured credit cards or lines of credit, which are vital for establishing credit in a new country. This data integration not only benefits the newcomers but also strengthens RBC's risk assessment capabilities.

- Enhanced Access to Financial Services: RBC can offer credit products to newcomers by accessing their international credit data.

- Mitigation of Credit History Gaps: Nova Credit's platform bridges the gap caused by a lack of local credit history for immigrants.

- Strategic Fintech Collaboration: Partnerships with companies like Nova Credit are key to RBC's customer acquisition and service expansion goals.

RBC's strategic alliances with fintech innovators and established technology giants are fundamental to its digital transformation and service enhancement. These partnerships, including those with Microsoft for cloud infrastructure and various payment platforms, ensure seamless transactions and advanced client solutions. By Q1 2024, RBC observed a notable uplift in digital transaction volumes, directly attributable to these integrated collaborations.

Further strengthening its financial services, RBC partners with major insurance providers like Aviva Canada and Manulife Financial, broadening its product offerings to include comprehensive insurance solutions. These collaborations are vital for diversifying RBC's client value proposition and reinforcing its market position.

RBC actively collaborates with entities like the Business Development Bank of Canada (BDC) to improve capital access for entrepreneurs, particularly in underserved sectors. This partnership exemplifies RBC's commitment to fostering economic growth and inclusion, with BDC facilitating over $4.5 billion in financing to Canadian businesses in 2023.

Additionally, RBC's alliance with Nova Credit enhances financial accessibility for newcomers by leveraging international credit data, enabling better risk assessment and product offerings. This fintech collaboration is critical for RBC's customer acquisition strategy.

| Partnership Type | Key Partners | Strategic Importance | 2023/2024 Impact/Data |

|---|---|---|---|

| Technology & Digital Platforms | Microsoft, Mastercard, Stripe, Apple Pay, Google Pay, Samsung Pay | Enhance digital capabilities, streamline operations, improve client experience | Significant increase in digital transaction volume (Q1 2024) |

| Insurance Providers | Aviva Canada, Manulife Financial, Sun Life Financial | Expand product portfolio, diversify client value | Broadened range of life, health, home, and auto insurance solutions |

| Government & Development Agencies | Business Development Bank of Canada (BDC) | Enhance capital access for entrepreneurs, foster economic growth | BDC facilitated over $4.5 billion in financing to Canadian businesses (2023) |

| Fintech & Data Services | Nova Credit | Improve financial accessibility for newcomers, enhance credit assessment | Facilitates access to international credit histories for immigrants |

What is included in the product

A visual framework that breaks down a business into nine key building blocks, from customer segments to revenue streams.

It provides a structured approach to understanding, designing, and communicating a business model.

Simplifies complex business strategies into a single, actionable page, alleviating the pain of overwhelming information.

Provides a structured framework to identify and address critical business model weaknesses, reducing the risk of strategic missteps.

Activities

RBC's key activities center on delivering comprehensive personal and commercial banking services. This includes managing customer deposits, providing a wide array of lending solutions like mortgages and business loans, and handling everyday transactional needs. These operations are the bedrock of RBC's diversified model, serving the essential financial requirements of individuals and businesses.

In the first quarter of 2025, RBC demonstrated robust performance, with personal banking income experiencing significant growth. This highlights the effectiveness of their core banking operations in driving financial results and meeting customer demands.

A core activity for RBC involves delivering extensive wealth management and financial advisory services. This encompasses managing investments, creating financial plans, and providing personalized guidance to affluent individuals and their families.

RBC's wealth management segment demonstrated robust performance, with net income experiencing a substantial increase. This growth was primarily fueled by a rise in fee-based client assets, highlighting the effectiveness of their advisory approach.

RBC's Capital Markets and Investor Services segment is a powerhouse, offering a comprehensive suite of financial solutions. This includes vital corporate and investment banking functions, alongside robust global markets services, underwriting, and trading operations. They serve a diverse clientele, from public and private companies to institutional investors, governments, and central banks across the globe.

In 2024, RBC Capital Markets demonstrated significant activity. For instance, they were a leading bookrunner on numerous debt and equity offerings, facilitating billions in capital raising for their clients. Their global markets division saw strong performance in trading revenues, particularly in fixed income and currencies, reflecting active client engagement in volatile market conditions.

Furthermore, RBC Investor and Treasury Services plays a critical role, providing essential custodial services. They manage complex cash and liquidity solutions for a vast array of institutional clients, ensuring efficient operations and risk management. This segment is key to RBC's ability to support global financial flows and maintain strong relationships with major asset owners and managers.

Insurance Underwriting and Sales

RBC's insurance operations are central to its business model, focusing on meticulously assessing risk and then underwriting a wide array of insurance products. This includes everything from life and health insurance to coverage for homes and vehicles, ensuring a comprehensive offering for clients.

The core activities involve both the development of these insurance policies and their subsequent sale. RBC effectively utilizes its vast distribution network, reaching a broad customer base to market and sell these essential financial products.

This insurance segment is a significant contributor to RBC's diversified revenue streams. As of recent reporting, the insurance arm serves a substantial customer base, with over 5 million clients relying on their products and services.

- Risk Assessment and Underwriting: Evaluating and pricing potential insurance risks for various products.

- Policy Creation and Sales: Developing insurance contracts and actively selling them through multiple channels.

- Client Base: Serving a significant market, with over 5 million individuals and businesses utilizing their insurance solutions.

- Revenue Diversification: Providing a stable and important income stream that complements other banking services.

Digital Transformation and AI Integration

RBC is heavily focused on digital transformation and weaving artificial intelligence into its core functions. This commitment translates into significant investments aimed at making banking smoother and more personalized for clients.

The bank's strategy includes bolstering its digital banking platforms and leveraging AI to tailor customer interactions, which is crucial for staying competitive. These efforts are also designed to streamline operations and bolster security measures.

- Digital Investment: RBC has consistently allocated substantial capital towards technology upgrades. For instance, in fiscal 2023, the bank reported technology and operations expenses of $4.8 billion, reflecting a commitment to innovation.

- AI-Driven Personalization: The integration of AI aims to provide more relevant product recommendations and enhanced customer service, moving beyond generic offerings.

- Efficiency Gains: By automating processes and improving data analytics through AI, RBC seeks to achieve greater operational efficiency and cost optimization.

- Cybersecurity Enhancement: A key aspect of digital transformation is strengthening defenses against cyber threats, ensuring the safety of client data and financial transactions.

RBC's key activities extend to managing its investment portfolio and treasury operations. This involves strategic allocation of capital, managing liquidity, and ensuring efficient financial resource management across the entire organization. These functions are vital for maintaining financial stability and supporting business growth.

In 2024, RBC's treasury operations were instrumental in navigating fluctuating interest rate environments, with the bank actively managing its balance sheet to optimize net interest income. The bank reported a net interest margin of 1.65% for fiscal year 2024, demonstrating effective management of its lending and deposit portfolios.

A significant ongoing activity is RBC's commitment to corporate social responsibility and sustainability initiatives. This includes environmental, social, and governance (ESG) reporting and integrating sustainable practices into its business operations and investment strategies.

RBC's ESG performance in 2024 saw the bank setting new targets for reducing its operational carbon footprint, aiming for a 40% reduction by 2030 compared to a 2019 baseline. They also increased their sustainable finance commitments to $500 billion by 2025.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Portfolio & Treasury Management | Strategic capital allocation and liquidity management. | Net Interest Margin of 1.65% in FY2024. |

| ESG & Sustainability | Integrating ESG principles and reporting. | Targeting a 40% operational carbon footprint reduction by 2030. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you're previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the final, ready-to-use file. Once your order is processed, you'll gain full access to this exact Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Financial capital is RBC's most crucial resource, acting as the foundation for its extensive operations, lending, and strategic investments as a global financial institution.

This robust financial strength is clearly demonstrated by RBC's market capitalization of CAD 241 billion. Furthermore, the bank achieved a record net income of $5.1 billion in the first quarter of 2025, highlighting its solid financial standing.

This substantial capital base empowers RBC to maintain a strong balance sheet, enabling it to effectively manage risks and actively pursue various growth opportunities across its diverse business segments.

RBC's extensive global workforce, numbering over 98,000 employees as of early 2024, represents a cornerstone of its business model. This vast pool of talent brings diverse expertise essential for navigating the complexities of the financial services industry and delivering a comprehensive suite of offerings to clients.

The collective knowledge and skills of these employees are instrumental in fostering strong client relationships, providing specialized financial advice, and ensuring the seamless operational execution across RBC's various business segments. Their insights drive innovation and client satisfaction.

RBC actively invests in continuous talent development programs, recognizing that nurturing its human capital is a key differentiator. This commitment to internal expertise allows the bank to maintain a competitive edge and adapt to evolving market demands.

RBC's advanced technology and data infrastructure is a cornerstone of its business model. This includes sophisticated digital platforms, strong cybersecurity measures, and substantial investments in AI and data analytics, all crucial for delivering personalized client experiences and ensuring operational efficiency.

In 2024 alone, RBC committed $1.8 billion to technology advancements. This significant outlay is directed towards enhancing client interactions, broadening service offerings, and bolstering risk management capabilities across the organization.

Strong Brand Reputation and Trust

RBC's brand is a cornerstone of its business model, fostering deep customer loyalty and trust. In 2024, RBC was recognized as the most valuable brand in Canada, a testament to its enduring reputation.

This strong brand equity translates directly into a competitive advantage, making it easier to attract new clients and retain existing ones. The perception of reliability and security associated with the RBC name is a critical intangible asset.

- Brand Value: Recognized as Canada's most valuable brand in 2024.

- Customer Trust: The brand is synonymous with reliability and security in financial services.

- Market Leadership: Strong brand reputation reinforces RBC's position in the market.

- Client Acquisition: Brand strength aids in attracting and retaining a broad customer base.

Extensive Physical and Digital Network

RBC's extensive physical and digital network is a cornerstone of its business model, offering clients a seamless banking experience. This dual approach ensures broad accessibility, catering to diverse customer preferences for interaction.

The bank maintains a significant physical presence with over 1,200 branches across Canada, providing essential in-person services. This physical footprint is complemented by a robust digital ecosystem, including its highly-rated mobile app and online banking platform.

This comprehensive network serves more than 19 million clients, demonstrating RBC's commitment to convenience and reach. The integration of physical and digital channels allows for efficient service delivery and client engagement.

- Physical Network: Over 1,200 branches in Canada.

- Digital Channels: Sophisticated online banking and mobile applications.

- Client Reach: Serves over 19 million clients globally.

- Geographic Presence: Operations in Canada, the U.S., and 27 other countries.

RBC's brand equity is a critical intangible asset, fostering significant customer loyalty and trust. In 2024, RBC was recognized as the most valuable brand in Canada, underscoring its strong market reputation and competitive advantage in attracting and retaining clients.

Value Propositions

RBC provides a broad spectrum of financial services, encompassing personal and commercial banking, wealth management, insurance, investor services, and capital markets. This integrated model ensures clients can access a complete set of solutions designed for their varied needs, from everyday banking to sophisticated investment planning.

In 2024, RBC continued to leverage this diversified structure, with its Personal & Commercial Banking segment reporting strong results, contributing significantly to the bank's overall profitability. This segment’s performance underscores the value proposition of offering a comprehensive financial ecosystem.

The bank’s wealth management division also saw substantial growth in assets under management throughout 2024, reflecting client confidence in RBC’s ability to provide integrated wealth and investment solutions. This expansion highlights the effectiveness of a holistic approach in meeting diverse client financial objectives.

RBC's core value proposition centers on delivering personalized financial advice and expert guidance to a broad client base. This commitment is clearly demonstrated in their wealth management services, where clients benefit from dedicated relationship managers who craft bespoke financial plans and investment strategies. In 2024, RBC continued to emphasize this human-centric approach, aiming to foster enduring client trust.

The bank actively harnesses the deep expertise of its workforce to create customized solutions. This internal knowledge base allows RBC to address the unique financial needs of individuals and businesses alike, solidifying its reputation for tailored support and advice. This focus on leveraging employee expertise is a cornerstone of their client relationship strategy.

RBC champions digital convenience, offering seamless online and mobile banking. In 2024, RBC continued its substantial investments in AI and digital solutions, aiming to provide personalized client interactions and efficient self-service options. This focus enhances security and anticipates evolving client needs with cutting-edge financial tools.

Global Reach and Market Insights

For institutional and high-net-worth clients, RBC leverages its extensive global network, spanning Canada, the U.S., and 27 other countries, to offer unparalleled market access. This broad presence facilitates the delivery of sophisticated cross-border solutions, a critical advantage in today's interconnected financial landscape.

RBC's global reach translates into deep, actionable insights into evolving economic and market trends worldwide. This intelligence is crucial for clients navigating international capital markets and investor services, enabling more informed strategic decisions.

Specifically, for the fiscal year ending October 31, 2023, RBC reported total revenue of CAD 57.7 billion, underscoring its significant operational scale and capacity to serve a global clientele.

Key aspects of RBC's Global Reach and Market Insights:

- Access to International Markets: Facilitates cross-border transactions and investments for clients.

- Specialized Expertise: Offers deep knowledge in capital markets and investor services across diverse geographies.

- Global Presence: Operations in Canada, the U.S., and 27 additional countries provide broad reach.

- Market Trend Analysis: Delivers valuable insights into global economic and market dynamics.

Security, Trust, and Risk Management

RBC prioritizes security and trust, embedding robust risk management into its operations. This focus is crucial for protecting client assets and sensitive data, a paramount concern in today's digital landscape.

The bank's dedication to strong cybersecurity measures and its long-established reputation for reliability are foundational to building client confidence. For instance, in 2023, RBC reported significant investments in technology and cybersecurity, aiming to safeguard its digital infrastructure against evolving threats.

- Cybersecurity Investment: RBC continues to allocate substantial resources to advanced cybersecurity solutions, enhancing its defenses against sophisticated attacks.

- Risk Management Framework: A disciplined approach to risk assessment and mitigation underpins all business activities, ensuring financial stability and client protection.

- Reputation for Reliability: Decades of consistent performance and client-centric service have cemented RBC's image as a trustworthy financial institution.

- Data Protection: Stringent protocols are in place to ensure the privacy and security of client information, adhering to the highest industry standards.

RBC offers a comprehensive suite of financial services, integrating personal and commercial banking, wealth management, insurance, and capital markets. This allows clients a single point of access for all their financial needs, from daily transactions to complex investment strategies.

In 2024, RBC's diversified business model proved resilient, with its Personal & Commercial Banking segment showing robust performance, contributing significantly to overall profitability. This highlights the strength of providing a complete financial ecosystem for clients.

The bank's commitment to personalized advice and leveraging employee expertise enables the creation of tailored financial solutions. This human-centric approach, emphasized in 2024 through continued investment in relationship managers, fosters deep client trust and satisfaction.

RBC champions digital innovation, offering seamless online and mobile banking experiences enhanced by significant 2024 investments in AI and digital solutions. This focus ensures efficient self-service options and personalized client interactions, anticipating future needs with advanced financial tools.

RBC's extensive global network, covering Canada, the U.S., and 27 other countries, provides unparalleled market access and sophisticated cross-border solutions for institutional and high-net-worth clients. This broad presence facilitates deep insights into global economic trends, empowering informed strategic decisions in international capital markets.

Customer Relationships

RBC places a strong emphasis on personalized relationship management, particularly for its wealth management and commercial banking segments. Dedicated relationship managers act as a primary point of contact, offering tailored advice and ongoing support to a diverse client base. This high-touch strategy is designed to cultivate long-term trust and loyalty by addressing individual client needs and financial goals with customized solutions.

RBC offers robust digital self-service through its online banking and mobile apps, letting clients manage accounts and transactions anywhere. In 2023, RBC reported over 15 million digital clients, highlighting the widespread adoption of these platforms.

To further enhance customer experience, RBC integrates AI-powered chatbots and virtual assistants. These tools provide instant support, streamlining query resolution and improving accessibility for a significant portion of their digital user base.

RBC actively engages with communities through a variety of initiatives, including significant donations and widespread employee volunteerism. For instance, in 2023, RBC employees contributed over 100,000 volunteer hours across Canada, underscoring a deep commitment to local well-being.

These community-focused efforts are instrumental in building a positive brand reputation and cultivating a strong sense of connection with its diverse customer base. Such engagement helps reinforce RBC's dedication to the prosperity and social fabric of the regions it serves.

Advisory and Educational Content

RBC offers a wealth of advisory and educational content designed to equip clients with the financial knowledge needed for sound decision-making. This encompasses expert insights into market trends, crucial planning considerations, and effective investment strategies.

Through a multi-channel approach, including publications and personalized guidance from financial advisors, RBC is committed to fostering financial literacy among its clientele. This educational focus helps clients navigate the intricacies of the financial world with greater confidence.

- Market Outlooks: RBC's publications often feature analyses of current economic conditions and projections for future market performance, helping clients understand potential opportunities and risks. For instance, in early 2024, many financial institutions like RBC highlighted the ongoing impact of inflation and interest rate policies on global markets.

- Planning Considerations: Content frequently addresses retirement planning, wealth management, and estate planning, providing frameworks for clients to build robust financial futures.

- Investment Strategies: RBC disseminates information on various investment approaches, from diversification techniques to sector-specific opportunities, enabling clients to tailor strategies to their individual goals.

- Client Education: By offering webinars, articles, and direct advisor support, RBC aims to demystify complex financial topics, empowering clients to take control of their financial well-being.

Proactive Client Solutions through Data and AI

RBC is actively using advanced data analytics and artificial intelligence to get ahead of client needs. This means they can offer solutions that are just right for each person, like suggesting specific products or making service quicker. For instance, by helping advisors access information faster, they've managed to cut down on how long clients wait on hold, improving the overall experience.

This focus on data not only streamlines operations but also directly impacts client satisfaction. By understanding client behavior and preferences, RBC can deliver more relevant and timely assistance. In 2024, RBC reported significant investments in AI and data capabilities, aiming to enhance personalized client interactions across all channels.

- Personalized Product Recommendations: AI algorithms analyze client data to suggest financial products tailored to individual needs and life stages.

- Improved Service Delivery: Data analytics helps optimize resource allocation, leading to reduced wait times and more efficient issue resolution.

- Proactive Issue Identification: Predictive analytics can flag potential client issues before they escalate, allowing for preemptive outreach.

- Enhanced Advisor Support: AI-powered tools provide advisors with instant access to client information and relevant solutions, boosting efficiency and client satisfaction.

RBC employs a multi-faceted approach to customer relationships, blending personalized high-touch service with advanced digital capabilities. This strategy aims to foster deep, long-term loyalty by meeting clients where they are, whether through dedicated relationship managers or intuitive self-service platforms. The bank's commitment extends to empowering clients through financial education and proactive, data-driven support.

Channels

RBC leverages an extensive branch network as a crucial channel for customer interaction and service delivery. This physical presence, spanning Canada, the U.S., and international markets, facilitates in-person banking, personalized financial advice, and support for intricate transactions.

The strategic acquisition of HSBC Bank Canada in early 2024 was a significant move, bolstering RBC's physical footprint by adding over 100 new branches. This expansion enhances RBC's reach and accessibility for a broader customer base, reinforcing its commitment to physical service alongside digital offerings.

RBC's official website and mobile banking applications are central channels for all client interactions. These digital platforms facilitate daily banking, investment management, and wealth advisory services, offering a convenient, remote experience.

Through these robust digital channels, clients can effortlessly manage accounts, execute payments, and utilize a comprehensive suite of financial tools. This digital-first approach is key to RBC's client engagement strategy.

In 2023, RBC served a significant user base, with 6.2 million active digital banking users. This highlights the widespread adoption and reliance on their digital platforms for financial needs.

RBC's widespread ATM network serves as a crucial component of its customer channels, offering convenient 24/7 access for essential banking. These machines facilitate cash withdrawals and deposits, directly supporting customer self-service for routine transactions. In 2024, RBC operates thousands of ATMs across Canada, a testament to their commitment to physical accessibility alongside digital offerings.

Contact Centers and Customer Service

RBC's contact centers are a cornerstone of its customer service, offering round-the-clock support through phone, email, and chat. These hubs are vital for addressing client inquiries, facilitating service access, and resolving problems, acting as a primary touchpoint for customer engagement.

The integration of AI has demonstrably enhanced efficiency. For instance, in 2024, many leading financial institutions reported significant reductions in average call handling times, with some seeing improvements of up to 15% due to AI-powered routing and agent assistance tools.

- 24/7 Availability: Ensures clients can access support anytime, anywhere.

- Multi-Channel Support: Caters to diverse client preferences via phone, email, and chat.

- AI-Driven Efficiency: Reduces wait times and improves resolution rates, boosting client satisfaction.

- Issue Resolution: Acts as the primary point for addressing and resolving customer concerns.

Dedicated Financial Advisors and Relationship Managers

RBC leverages dedicated financial advisors and relationship managers as key channels for specialized services like wealth management, commercial banking, and capital markets. These professionals are the direct link to clients, offering expert guidance and fostering enduring partnerships.

These advisors engage clients through a mix of in-person meetings, phone calls, and virtual consultations, ensuring personalized attention. This direct interaction is crucial for understanding complex client needs and delivering tailored financial solutions.

- Personalized Advice: Dedicated advisors provide bespoke financial strategies, crucial for high-net-worth individuals and businesses.

- Relationship Building: These managers focus on cultivating long-term trust and understanding client life stages and business cycles.

- Service Specialization: They offer deep expertise in areas like wealth management, commercial lending, and investment banking.

- Client Retention: In 2024, banks emphasizing personalized relationship management reported higher client retention rates, often exceeding 90% for premium segments.

RBC's channel strategy is a multi-faceted approach, combining a robust physical presence with advanced digital platforms and personalized advisory services. This ensures accessibility and tailored support across diverse client needs.

The bank's extensive branch network, significantly bolstered by the 2024 acquisition of HSBC Bank Canada, provides essential in-person banking services. Complementing this, digital channels like the RBC website and mobile app, used by 6.2 million active users in 2023, offer seamless self-service banking and investment management.

Further enhancing accessibility, RBC's widespread ATM network provides 24/7 cash services, while contact centers offer multi-channel support, increasingly leveraging AI for efficiency. Dedicated financial advisors and relationship managers deliver specialized expertise, fostering strong client relationships and driving retention, which in 2024 saw banks with strong relationship management exceeding 90% retention in premium segments.

| Channel | Key Features | 2023/2024 Data Point |

|---|---|---|

| Branch Network | In-person banking, financial advice, complex transactions | Over 100 new branches added via HSBC acquisition (2024) |

| Digital Platforms (Website/Mobile) | Daily banking, investment management, remote advisory | 6.2 million active digital banking users (2023) |

| ATM Network | 24/7 cash access, deposits, self-service | Thousands of ATMs across Canada (2024) |

| Contact Centers | Phone, email, chat support, AI-driven efficiency | Reported up to 15% reduction in call handling times due to AI (leading institutions, 2024) |

| Financial Advisors/Relationship Managers | Specialized advice, wealth management, commercial banking | Client retention exceeding 90% for premium segments (banks with strong relationship management, 2024) |

Customer Segments

RBC's individual clients represent a broad spectrum of the population, utilizing everyday banking essentials like chequing and savings accounts, credit cards, mortgages, and personal loans. This segment is a cornerstone of RBC's operations, with millions of Canadians relying on the bank for their financial needs.

In 2024, RBC continued to serve a massive retail customer base, leveraging its extensive physical presence with over 1,200 branches and more than 4,000 ATMs across Canada. This network is complemented by a robust digital offering, enhancing accessibility and convenience for these clients.

The bank's commitment to this segment is evident in its ongoing investment in digital innovation, aiming to provide seamless banking experiences. This focus ensures RBC remains a primary financial partner for individuals seeking to manage their daily finances and achieve their personal financial goals.

RBC actively supports a vast number of small and medium-sized businesses (SMBs) by providing specialized banking solutions. These include essential credit facilities and efficient cash management services that are crucial for daily operations and future expansion.

These offerings are specifically crafted to foster business growth and streamline operational requirements, covering vital functions like payroll processing and payment systems. In 2024, RBC's commercial banking division reported a notable increase in net income, largely attributable to heightened lending activity directed towards the SMB sector.

High-net-worth individuals and families represent a crucial customer segment for RBC, seeking sophisticated wealth management, private banking, and all-encompassing financial planning. These clients benefit from personalized attention through dedicated relationship managers and expert advisors who craft bespoke investment strategies, estate plans, and trust services.

RBC's commitment to this segment is underscored by its substantial wealth management assets, managing $755 billion for 4.3 million clients as of recent reporting. This demonstrates a significant capacity to cater to the complex financial needs of affluent households.

Institutional Clients (Corporations, Governments, Financial Institutions)

RBC's institutional clients, encompassing corporations, governments, and other financial institutions, are served through specialized divisions like Investor and Treasury Services and Capital Markets. These clients rely on RBC for sophisticated financial solutions tailored to their complex needs.

The range of services offered to this segment is extensive, including critical functions such as custodial services, comprehensive asset management, corporate and investment banking, and dynamic global market solutions. These offerings are designed to support the intricate financial operations of large organizations.

Demonstrating the scale of RBC's engagement with these clients, the Global Asset Servicing division reported holding approximately CAD 4.6 trillion in assets under administration as of 2024. This significant figure underscores RBC's vital role in supporting the global financial infrastructure.

- Target Clients Corporations, Governments, Financial Institutions

- Key Services Custodial Services, Asset Management, Corporate & Investment Banking, Global Markets

- 2024 Metric CAD 4.6 trillion in assets under administration (Global Asset Servicing)

Newcomers to Canada

Recognizing Canada's significant immigration rates, RBC has pinpointed newcomers as a crucial customer segment. In 2023, Canada welcomed over 470,000 new permanent residents, highlighting the substantial market opportunity.

To ease their financial integration, RBC has developed initiatives like the Global Credit Connect program, partnering with Nova Credit. This allows immigrants to leverage their international credit history, a common hurdle they face upon arrival due to a lack of local credit history in Canada.

This approach directly addresses the challenges newcomers experience in accessing essential banking services, including credit, which is vital for establishing financial stability and participating fully in the Canadian economy.

- Target Segment: Newcomers to Canada

- Challenge Addressed: Lack of local credit history

- RBC Solution: Global Credit Connect program with Nova Credit

- Market Context: Over 470,000 permanent residents welcomed in 2023

RBC's customer segments are diverse, ranging from individual retail clients and small to medium-sized businesses (SMBs) to high-net-worth individuals and large institutions. The bank also actively targets newcomers to Canada, recognizing the significant market opportunity presented by immigration.

In 2024, RBC continued to serve millions of individual clients with a vast branch network and robust digital offerings. Its commercial banking division saw increased lending activity in the SMB sector, contributing to net income growth. The wealth management segment manages substantial assets for affluent clients, while institutional clients benefit from specialized services in areas like global asset servicing.

| Customer Segment | Key Offerings | 2024/Recent Data Point |

|---|---|---|

| Individual Clients | Everyday banking, credit cards, mortgages, personal loans | Over 1,200 branches and 4,000 ATMs in Canada |

| Small & Medium-sized Businesses (SMBs) | Credit facilities, cash management, payroll, payment systems | Notable increase in net income from SMB lending |

| High-Net-Worth Individuals | Wealth management, private banking, financial planning | CAD 755 billion in wealth management assets for 4.3 million clients |

| Institutional Clients | Custodial services, asset management, capital markets | CAD 4.6 trillion in assets under administration (Global Asset Servicing) |

| Newcomers to Canada | Global Credit Connect program, assistance with credit history | Leveraging international credit history for financial integration |

Cost Structure

Employee compensation and benefits represent a significant cost driver for RBC, reflecting its extensive global workforce. In 2024, the bank employed over 98,000 individuals, encompassing a wide range of roles from frontline financial advisors to specialized IT professionals and administrative support staff. This substantial investment in human capital is crucial for delivering services across all its business segments, making efficient human resource management a core operational focus.

RBC's commitment to staying ahead involves substantial spending on technology and innovation. This includes pushing forward with digital upgrades, developing advanced AI capabilities, and bolstering cybersecurity defenses.

In 2024 alone, RBC allocated $1.8 billion to technology initiatives. These funds are specifically earmarked for improving how clients interact with the bank and for strengthening risk management processes.

These significant investments are vital for RBC to maintain its competitive position in the market and to boost its operational efficiency across the board.

RBC's extensive network of physical branches, ATMs, and corporate offices incurs substantial costs. These include expenses for rent, utilities, property taxes, and ongoing maintenance, all crucial for the operation and upkeep of its physical presence.

In fiscal year 2023, RBC reported total operating expenses of CAD 15.5 billion. A significant portion of this is attributable to the costs associated with its vast physical infrastructure, ensuring accessibility and service delivery across its network.

Marketing, Advertising, and Brand Development

RBC invests heavily in marketing and advertising to build its brand and attract customers. In 2024, the financial services sector saw significant spending on digital marketing, with banks like RBC leveraging social media and targeted online campaigns to reach a wider audience. This includes promoting their diverse range of products, from everyday banking to investment services.

These marketing efforts are crucial for client acquisition and retention. RBC's brand development strategy often involves sponsorships and community engagement, aiming to foster trust and loyalty. For instance, their support for sports and cultural events enhances brand visibility and aligns with their commitment to community well-being.

- Marketing Spend: RBC's marketing budget is a substantial operational cost, reflecting the competitive nature of the financial services industry. While specific figures for 2024 are proprietary, industry trends show a continued increase in digital advertising spend.

- Brand Visibility: Campaigns across television, digital platforms, and print media are designed to reinforce RBC's image as a reliable and innovative financial institution.

- Client Acquisition Costs: The expense of acquiring new customers through these channels is a key component of their overall cost structure.

- Customer Retention: Marketing also plays a vital role in retaining existing clients through loyalty programs and personalized communication.

Regulatory Compliance and Risk Management

RBC faces significant expenses in maintaining regulatory compliance within the financial sector. These costs are driven by the need to adhere to evolving legal frameworks and implement sophisticated risk management systems. For instance, in 2023, Canadian banks collectively spent billions on compliance, reflecting the complexity and breadth of regulatory requirements.

These expenditures are crucial for mitigating various risks, including credit, market, and operational risks. A strong risk management framework, often involving advanced analytics and dedicated teams, helps prevent financial losses and ensures the stability of operations. These investments directly contribute to protecting the bank from financial crime and maintaining stakeholder trust.

- Regulatory Compliance Costs: Significant investments in legal, advisory, and technology to meet banking regulations.

- Risk Management Frameworks: Expenses for credit risk assessment, market risk monitoring, and operational risk mitigation.

- Financial Crime Prevention: Costs associated with anti-money laundering (AML) and know-your-customer (KYC) initiatives.

- Legal and Audit Fees: Ongoing costs for legal counsel and external audits to ensure adherence to standards.

RBC's cost structure is heavily influenced by its extensive operational footprint and the competitive financial landscape. Key cost drivers include employee compensation, technology investments, physical infrastructure maintenance, marketing, and regulatory compliance. These expenses are managed to ensure service delivery, innovation, and adherence to stringent industry standards.

The bank's commitment to its large workforce and continuous technological advancement are particularly significant cost areas. Furthermore, maintaining a widespread physical presence and engaging in robust marketing campaigns are essential for client acquisition and retention. Meeting complex regulatory requirements also necessitates substantial financial outlay.

In 2024, RBC's investment in technology initiatives reached $1.8 billion, underscoring the importance of digital transformation and cybersecurity. For fiscal year 2023, total operating expenses were CAD 15.5 billion, a portion of which directly relates to the upkeep of its physical branches and offices.

| Cost Category | Estimated 2024 Impact | Notes |

|---|---|---|

| Employee Compensation & Benefits | Significant portion of operating expenses | Reflects over 98,000 employees globally. |

| Technology & Innovation | $1.8 billion | Includes digital upgrades, AI, and cybersecurity. |

| Physical Infrastructure | Part of CAD 15.5 billion total operating expenses (FY2023) | Covers rent, utilities, maintenance for branches, ATMs, offices. |

| Marketing & Advertising | Substantial, with increased digital spend | Focus on client acquisition and brand visibility. |

| Regulatory Compliance & Risk Management | Billions collectively spent by Canadian banks | Includes legal, technology, and personnel for adherence and risk mitigation. |

Revenue Streams

Net Interest Income is RBC's main way of making money. It comes from the difference between what they earn on loans, like mortgages and business loans, and what they pay out on customer deposits. More loans and deposits mean more net interest income.

In the first quarter of 2025, RBC saw an increase in its net interest income. This boost was driven by strong growth in both their loan and deposit portfolios, demonstrating the bank's ability to expand its core business activities.

RBC's wealth management segment is a key revenue generator, primarily through fees tied to assets under management and advisory services. In the first quarter of 2025, this segment reported a notable increase in net income, driven by growth in fee-based client assets, indicating a strong performance in this area.

RBC generates revenue from its capital markets division through various fees. These include income from underwriting new securities issues, advising on mergers and acquisitions (M&A), and profits from trading activities. This revenue stream is quite sensitive to the overall health of the economy and the volume of corporate transactions.

In 2024, RBC's capital markets segment demonstrated robust performance, with reported earnings growth. For instance, during the first quarter of fiscal 2024, RBC Capital Markets saw its net income increase by 20% compared to the prior year, reflecting strong advisory mandates and increased underwriting activity.

Insurance Premiums and Investment Income

RBC generates substantial revenue from insurance premiums across a wide array of products, encompassing life, health, home, and auto coverage. This core business is further bolstered by investment income derived from the substantial assets managed to support these insurance obligations.

The insurance segment demonstrated robust performance, reporting a significant increase in earnings during the first quarter of 2025, underscoring the strength of its premium and investment income streams.

- Insurance Premiums: Revenue from the sale of life, health, home, and auto insurance policies.

- Investment Income: Earnings generated from the investment of assets backing insurance liabilities.

- Q1 2025 Performance: Significant increase in earnings for the insurance segment.

Service Charges and Other Banking Fees

Service charges and other banking fees represent a significant revenue stream for RBC, encompassing a wide array of charges for everyday banking activities. These include fees for account maintenance, such as monthly service charges on certain chequing or savings accounts, and transaction fees, which can apply to wire transfers, ATM withdrawals outside of RBC's network, or overdrafts.

Credit card fees also form a crucial part of this category. This can involve annual fees on premium credit cards, foreign transaction fees, or late payment fees. In fiscal year 2023, RBC reported substantial non-interest income, with service charges and other fees playing a notable role in its overall financial performance.

- Account Maintenance Fees: Charges for the ongoing upkeep of various personal and business accounts.

- Transaction Fees: Costs associated with specific banking activities like transfers, ATM usage, and bill payments.

- Credit Card Fees: Revenue generated from annual fees, late payments, and other credit card-related charges.

- Miscellaneous Service Charges: Fees for services such as stop payments, certified cheques, and account research.

RBC's revenue streams are diverse, encompassing traditional banking, wealth management, capital markets, and insurance. Net interest income, derived from the spread between loan earnings and deposit costs, remains a cornerstone. This was evident in Q1 2025, where strong loan and deposit growth boosted this income.

Beyond interest income, fee-based services are critical. Wealth management fees, tied to assets under management, saw a notable increase in Q1 2025 due to growing client assets. Capital markets revenue, generated from underwriting, M&A advisory, and trading, also showed strength in 2024, with a 20% net income increase in Q1 2024 for RBC Capital Markets.

Insurance premiums and investment income from insurance assets are significant contributors, with the insurance segment reporting a substantial earnings increase in Q1 2025. Additionally, service charges and other banking fees, including credit card fees, form a substantial part of non-interest income, as seen in RBC's 2023 performance.

| Revenue Stream | Primary Drivers | Q1 2025 Highlight |

| Net Interest Income | Loan and deposit growth | Increased income due to portfolio expansion |

| Wealth Management Fees | Assets under management, advisory services | Notable increase in net income |

| Capital Markets Fees | Underwriting, M&A advisory, trading | Robust performance in 2024 (20% net income growth in Q1 2024) |

| Insurance Premiums & Investment Income | Insurance policy sales, investment of assets | Significant increase in segment earnings |

| Service Charges & Other Fees | Account maintenance, transactions, credit cards | Substantial contribution to non-interest income |

Business Model Canvas Data Sources

The RBC Business Model Canvas is informed by a blend of internal financial performance data, customer feedback surveys, and competitive landscape analysis. These sources provide a comprehensive view of our current operations and market positioning.