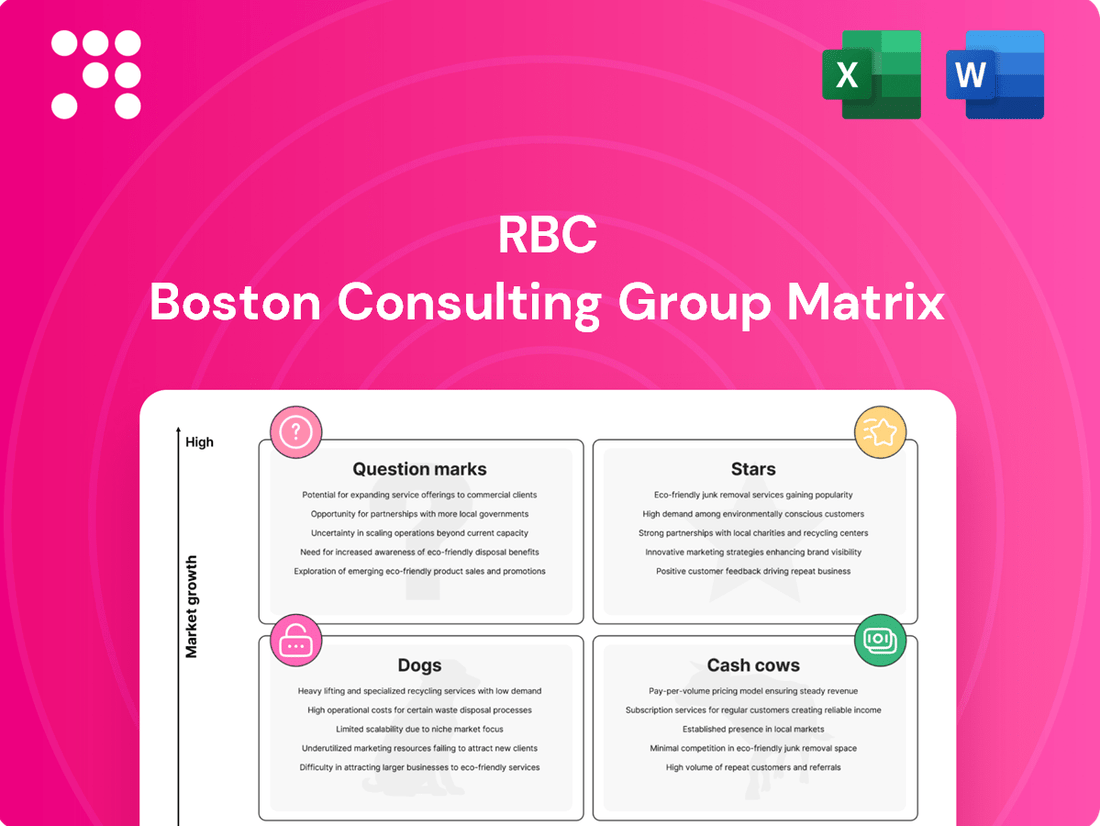

RBC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RBC Bundle

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This preview offers a glimpse into how these categories can illuminate strategic decisions. Ready to unlock the full potential of your product strategy and make informed investment choices?

Purchase the full BCG Matrix for a comprehensive breakdown of each product's position, providing actionable insights and a clear roadmap for resource allocation and future growth. Don't just understand the theory; implement a strategy that drives success.

Stars

RBC's Wealth Management segment is a shining star, experiencing robust expansion. In the first quarter of 2025, net income surged by an impressive 48%, building on a solid 27% profit increase for the entire fiscal year 2024. This growth is fueled by a rise in fee-based client assets, a direct result of favorable market conditions and consistent net sales, positioning it as a strong performer within the BCG matrix.

The Capital Markets segment is showing significant strength, with net income climbing 24% in the first quarter of 2025. This growth is largely thanks to strong performance in both Corporate & Investment Banking and Global Markets.

RBC has set aggressive goals to expand its footprint, aiming for over 2.5% market share in global markets and more than 2.75% in global investment banking. This international push, combined with solid operational results, marks Capital Markets as a vital engine for the company's future growth.

RBC's acquisition of HSBC Canada, finalized in March 2024, represents a significant strategic move, placing the Canadian banking giant firmly in the "Star" category within its own internal BCG matrix for international banking expansion. This $13.5 billion deal not only bolstered RBC's market share but also dramatically enhanced its service offerings for commercial clients requiring global reach and for the growing population of newcomers to Canada. The integration of 780,000 new clients and 4,500 employees from HSBC Canada is a clear indicator of future growth potential in these vital segments.

Digital Innovation and AI Leadership

RBC is making significant strides in digital innovation and artificial intelligence. A dedicated AI and Digital Innovation team was established within its Capital Markets division in May 2025, underscoring a strategic focus on these transformative technologies.

These forward-thinking AI initiatives are anticipated to deliver substantial financial benefits. Projections indicate they could generate between C$700 million and C$1 billion in enterprise value by 2027. This value creation is expected to stem from improvements in operational efficiency, enhanced client engagement, and more robust fraud detection capabilities.

- AI and Digital Innovation Team: Launched in May 2025 within Capital Markets.

- Projected Enterprise Value: C$700 million to C$1 billion by 2027.

- Key Drivers: Enhanced operational efficiency, client engagement, and fraud detection.

- Strategic Positioning: Reinforces RBC's commitment to future market leadership through technology.

Canadian Market Dominance

RBC's Canadian market dominance is a cornerstone of its BCG Matrix positioning, reflecting a strong hold across personal and business banking. This leadership is fueled by substantial investments in client engagement and digital platforms, including AI-driven personalization. For instance, in Q1 2025, RBC reported robust growth across all segments, underscoring its sustained high market share in the Canadian landscape.

Key indicators of RBC's Canadian market strength include:

- Leading market share across major personal and business banking products.

- Significant client engagement driven by enhanced digital experiences.

- Continued growth in Q1 2025 across all banking segments.

- Strategic focus on acquiring new clients and leveraging AI for personalized banking.

RBC's Wealth Management and Capital Markets segments are clear "Stars" in the BCG matrix, demonstrating exceptional growth and strategic importance. Wealth Management saw a 48% net income surge in Q1 2025, building on a 27% profit increase in fiscal 2024, driven by rising fee-based assets. Capital Markets also performed strongly, with a 24% net income increase in Q1 2025, supported by robust Corporate & Investment Banking and Global Markets performance.

The acquisition of HSBC Canada in March 2024 solidified RBC's position as a "Star" in international banking expansion, integrating 780,000 new clients and significantly boosting market share. Furthermore, the dedicated AI and Digital Innovation team launched in May 2025 within Capital Markets, with projected enterprise value of C$700 million to C$1 billion by 2027, highlights a commitment to technology-driven growth, further cementing these areas as stars.

| Segment | Growth Driver | Q1 2025 Performance | Fiscal 2024 Performance | Strategic Importance |

|---|---|---|---|---|

| Wealth Management | Fee-based client assets, market conditions, net sales | Net income +48% | Profit +27% | Robust expansion, strong performer |

| Capital Markets | Corporate & Investment Banking, Global Markets | Net income +24% | N/A | Vital engine for future growth, international expansion |

| International Banking (Post-HSBC Canada Acquisition) | Market share expansion, service offerings | N/A | Acquisition completed March 2024 | Key strategic move, significant client integration |

| AI & Digital Innovation | Operational efficiency, client engagement, fraud detection | Projected enterprise value C$700M-C$1B by 2027 | Team launched May 2025 | Future market leadership through technology |

What is included in the product

The RBC BCG Matrix categorizes business units based on relative market share and market growth rate, guiding strategic decisions for investment, divestment, or harvesting.

Quickly identify underperforming units and allocate resources effectively.

Cash Cows

RBC's established personal and commercial banking in Canada is a quintessential Cash Cow. It commands the leading market share, ensuring a consistent and robust cash flow for the bank.

Despite being a mature market with a slower growth rate compared to newer segments, this division consistently delivers high profits. Crucially, it requires minimal investment in promotion and placement, making it highly efficient.

In 2023, RBC's Canadian banking segment reported a net income of CAD 6.0 billion, underscoring its role as a foundational pillar and a significant contributor to the bank's overall financial strength.

RBC's mature wealth management base is a classic Cash Cow, boasting a high market share in a stable industry. This segment benefits from a substantial and loyal client base, translating into predictable, fee-based revenue streams. For instance, as of Q1 2024, RBC Wealth Management reported robust client asset growth, underscoring the stability of this mature business.

The consistent cash flow generated by this division is crucial, as it requires minimal investment for growth. Instead, the focus is on efficient management and client retention, allowing RBC to leverage these earnings to fund other strategic initiatives or growth areas. This mature segment provides a reliable financial foundation, a hallmark of a strong Cash Cow.

RBC Investor Services, recognized as the top performer in Fund Accounting as of Q4 2024, holds a significant position in a well-established market. This segment focuses on delivering core asset servicing solutions to a broad range of institutional clients, asset managers, and financial organizations.

These essential services generate a steady stream of fee-based revenue, acting as a reliable source of predictable cash flow for the company. While this area might not be characterized by explosive growth, its consistent contribution is vital for overall financial stability.

Core Insurance Operations

RBC's core insurance operations are a prime example of a Cash Cow within the BCG Matrix. Despite facing some headwinds in niche areas, the segment demonstrated robust performance, achieving a significant 33% earnings growth in 2024. This segment was a substantial contributor to RBC's overall net income in the first quarter of 2025, underscoring its stability and profitability.

The established market position and the breadth of its insurance product offerings in a mature industry allow for consistent and reliable revenue streams. This stability means the strategy here is centered on optimizing current operations and nurturing existing customer relationships, rather than pursuing costly, high-growth initiatives.

- Core Insurance Operations: Exhibited a 33% earnings growth in 2024.

- Q1 2025 Contribution: Significantly boosted net income.

- Market Position: Mature market with established presence ensures consistent revenue.

- Strategic Focus: Maintaining productivity and leveraging existing client relationships.

Strong Brand and Client Loyalty

RBC's formidable brand strength and exceptional client loyalty in Canada are cornerstones of its Cash Cow status. The bank has consistently garnered industry awards, underscoring high client satisfaction across its broad product suite. This deep-seated trust minimizes the need for aggressive marketing to retain its existing customer base.

This brand equity allows RBC to efficiently generate substantial profits from its established operations, a hallmark of a Cash Cow. For instance, RBC reported a net income of CAD 15.5 billion for fiscal 2023, demonstrating its robust profitability.

- Brand Recognition: RBC consistently ranks among the most valuable brands in Canada.

- Client Retention: High satisfaction scores translate into strong customer loyalty, reducing churn.

- Profitability: Established market position allows for consistent, high-margin revenue generation.

- Reduced Marketing Costs: Brand loyalty lowers the expense required to acquire and retain customers.

Cash Cows in the BCG Matrix represent established businesses with high market share in low-growth industries. They generate more cash than they consume, providing a stable revenue stream that can fund other business units. RBC's Canadian personal and commercial banking, for example, is a prime Cash Cow, consistently delivering strong profits with minimal investment.

The bank's mature wealth management segment also fits this description, benefiting from a loyal client base and predictable fee-based income. Similarly, RBC Investor Services, a leader in fund accounting, provides essential services that generate steady, reliable revenue without requiring significant growth capital. These segments are vital for RBC's overall financial health.

| RBC Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Canadian Personal & Commercial Banking | Cash Cow | High market share, mature market, stable cash flow | CAD 6.0 billion net income (2023) |

| Wealth Management | Cash Cow | High market share, loyal client base, predictable revenue | Robust client asset growth (Q1 2024) |

| Investor Services | Cash Cow | Top performer in fund accounting, steady fee-based revenue | Recognized as top performer (Q4 2024) |

| Core Insurance Operations | Cash Cow | Established market, consistent revenue, strong brand | 33% earnings growth (2024) |

What You’re Viewing Is Included

RBC BCG Matrix

The BCG Matrix analysis you are currently previewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report, designed for strategic decision-making, will be delivered directly to you, ready for immediate application in your business planning. You'll gain a fully formatted and professionally designed tool to assess your product portfolio's potential and guide future investments.

Dogs

Within a large, diversified institution like RBC, certain legacy products or services might not have kept pace with digital transformation or changing client demands. These offerings typically see declining usage and a small market share in slow-growing or shrinking sectors.

For instance, as of early 2024, traditional branch-based banking services, while still utilized, have seen a significant shift towards digital channels, with RBC reporting a continued increase in mobile banking transactions, which can put pressure on the profitability of older, less digitally integrated offerings.

These legacy products often break even or consume more resources than they generate, making them prime candidates for divestiture or a thorough re-evaluation of their strategic importance and future viability.

These are international ventures that, even before major strategic moves like the HSBC Canada acquisition, struggled to make a mark. Think of smaller banking operations or specialized financial services in foreign markets where competition is fierce and growth is minimal. They often represent a drain on resources, offering little return.

For instance, a bank might have had a small wealth management office in a country where local competitors are deeply entrenched and regulatory hurdles are high. Such an operation, with its low market share and dim growth outlook, would be a classic example of a non-strategic niche operation. In 2024, many such smaller international outposts continue to be evaluated for their true value contribution.

Within RBC's extensive product offerings, certain highly specialized or illiquid investment products might be categorized as Dogs. These products are designed for a very niche clientele and have experienced a decline in popularity. For instance, a hypothetical niche alternative investment fund launched in 2020 that has seen its assets under management shrink by 30% by Q3 2024 due to low investor interest would fit this description.

Outdated Technology Platforms

Even as RBC invests heavily in cutting-edge technology, some of its older, internal platforms could be considered 'Dogs' in the BCG matrix. These legacy systems, while potentially still functional for certain backend operations, are often expensive to maintain and lack the efficiency needed to drive innovation or gain a competitive edge.

These outdated platforms can significantly hinder the bank's agility, consuming valuable resources that could otherwise be directed towards more promising technological advancements. For instance, maintaining legacy mainframe systems can cost millions annually, diverting funds from crucial digital transformation initiatives.

The challenge lies in balancing the necessity of these older systems with the strategic imperative to modernize. While they might not offer significant market share or growth potential, their continued operation is sometimes unavoidable.

- High Maintenance Costs: Legacy systems can represent a substantial drain on IT budgets, with estimates suggesting that organizations spend up to 80% of their IT budget on maintaining existing systems, leaving less for innovation.

- Operational Inefficiencies: Outdated platforms often lead to slower processing times, increased error rates, and a lack of integration with newer technologies, impacting overall productivity.

- Limited Competitive Advantage: These systems typically do not offer unique features or functionalities that differentiate the bank from competitors, failing to contribute to market share growth.

- Resource Diversion: The ongoing need to support and update these older technologies diverts skilled IT personnel and financial capital away from developing and implementing forward-looking solutions.

Inefficient Physical Branch Locations

Inefficient physical branch locations, especially those experiencing low customer engagement and high operating expenses, can be categorized as Dogs within the RBC BCG Matrix. As digital banking continues to grow, some branches might find themselves in areas with decreasing foot traffic, making them less profitable. For instance, in 2024, many traditional banks are reviewing their branch networks, with some reporting a significant drop in in-branch transactions compared to digital channels.

- Declining Foot Traffic: Branches in areas with a shrinking local population or a strong shift towards online services may see fewer customers visiting.

- High Operational Costs: Maintaining a physical branch, including staffing, rent, and utilities, can become a significant expense if transaction volumes are low.

- Low Profitability: Branches with consistently low transaction volumes and a declining market share are unlikely to generate sufficient revenue to cover their costs.

- Strategic Consolidation: These underperforming locations are often candidates for consolidation into more efficient hubs or complete closure to reallocate resources to digital initiatives or more profitable branches.

Dogs in RBC's portfolio represent offerings with low market share in slow-growing industries. These are often legacy products or services that haven't adapted to changing market dynamics or technological advancements. For example, certain niche investment products with declining investor interest, or older internal IT systems requiring significant maintenance, fit this category. By early 2024, RBC, like many financial institutions, was actively evaluating such assets for potential divestment or strategic overhaul to free up resources for more promising ventures.

| Product/Service Category | Market Share | Industry Growth Rate | RBC's Strategic Consideration |

|---|---|---|---|

| Legacy Branch Network (select locations) | Low | Declining | Consolidation/Closure |

| Niche Alternative Investment Funds (low AUM) | Low | Stagnant/Declining | Divestiture/Re-evaluation |

| Outdated Internal IT Platforms | N/A (Internal) | N/A (Internal) | Modernization/Replacement |

Question Marks

RBC's FinSec Incubator, a joint venture with Rogers Cybersecure Catalyst, is designed to cultivate promising fintech and cybersecurity startups. These nascent companies exhibit substantial growth potential within the dynamic financial technology landscape, yet currently hold a minimal market share for RBC.

These ventures are positioned as Question Marks within the RBC BCG Matrix, signifying their high growth prospects but low current market share. For instance, the global fintech market was valued at over $11 trillion in 2023 and is projected to grow significantly, offering ample room for new entrants to gain traction.

Significant investment and dedicated strategic support are crucial for these startups to mature and potentially evolve into future Stars for RBC. Without this nurturing, their high growth potential may not be realized, leaving them vulnerable to market shifts or competitive pressures.

RBC's pivot away from its C$500 billion sustainable finance target by 2025 signals a strategic re-evaluation in this high-growth sector. This move reflects an industry-wide challenge in defining and measuring sustainable finance, creating a dynamic market where share is still being established.

The uncertainty surrounding market definitions means RBC's sustainable finance efforts could be positioned as a Question Mark on the BCG matrix. Strategic investment and clear direction are crucial to navigate this evolving landscape and prevent it from becoming a Dog, especially as competitors solidify their approaches.

RBC's Global Credit Connect, a partnership with Nova Credit, aims to ease financial onboarding for immigrants in Canada. This initiative targets a burgeoning demographic, as Canada welcomed over 300,000 permanent residents in 2023 alone, underscoring the market's expansion.

While this service is new, RBC's market share in cross-border credit data for newcomers is currently minimal. The bank's investment here represents a strategic play in a growing segment, acknowledging the potential for significant adoption.

The growth potential for Global Credit Connect is substantial, but achieving widespread adoption will necessitate considerable investment in marketing and seamless integration with existing banking services to truly resonate with the target audience.

Advanced AI Applications in Niche Capital Markets

RBC's foray into advanced AI for niche capital markets, like sophisticated algorithmic trading or predictive analytics for complex derivatives, signals a significant growth opportunity. These specialized applications, while holding high potential, currently have limited market penetration and demand substantial investment in research and development to demonstrate scalability and market acceptance.

The challenge lies in validating these cutting-edge AI solutions within specific, often illiquid, market segments. For instance, a 2024 report indicated that while AI adoption in broader financial services reached approximately 50%, its penetration in highly specialized derivative analytics was estimated to be below 15%, highlighting the nascent stage of these advanced applications.

- High R&D Investment: Developing AI for niche markets requires significant upfront capital for data acquisition, model training, and validation, often exceeding millions of dollars for specialized platforms.

- Low Current Market Penetration: While general AI in finance is growing, advanced applications in areas like exotic options pricing or bespoke credit default swap analysis are in early adoption phases.

- Scalability Hurdles: Proving that these advanced AI models can operate effectively and profitably across diverse, specialized market conditions is a critical step before widespread adoption.

- Regulatory Scrutiny: The complexity of these AI applications often attracts increased regulatory oversight, requiring robust explainability and risk management frameworks.

New Digital-Only Banking Offerings

New digital-only banking offerings from RBC, while leveraging their strong existing digital infrastructure, would likely be positioned as Stars or Question Marks within the BCG Matrix. These ventures would target a rapidly expanding market for digitally-native consumers, a segment that saw significant growth in 2024 with an increasing adoption of neobanks and fintech solutions. For instance, the global fintech market was projected to reach over $300 billion in 2024, indicating substantial opportunity.

These new platforms would require substantial investment to gain market share against agile competitors. Their initial market share would be low, necessitating aggressive marketing and continuous product innovation to attract and retain customers. This aligns with the characteristics of Question Marks, where high growth potential is offset by low current market share, demanding strategic decisions on whether to invest further or divest.

- Market Growth: The digital banking sector continues to expand, with projections indicating sustained double-digit growth through 2025.

- Competitive Landscape: Established fintechs and challenger banks already hold significant market share, creating a challenging entry environment.

- Investment Needs: Significant capital will be required for customer acquisition, technological development, and regulatory compliance.

- Potential: Success could lead to capturing a valuable, digitally-savvy customer base, driving future revenue streams.

Question Marks represent business units or products with low market share but operating in high-growth industries. These ventures, like RBC's FinSec Incubator or its Global Credit Connect initiative, require careful strategic consideration due to their uncertain future. Significant investment is needed to nurture their potential, as demonstrated by the global fintech market's valuation exceeding $11 trillion in 2023.

Without substantial support, these Question Marks risk remaining underdeveloped or becoming Dogs, unable to capitalize on market expansion. For example, RBC's sustainable finance efforts, facing market definition challenges, could falter if competitors solidify their approaches, highlighting the need for clear strategic direction in high-growth, uncertain sectors.

The success of these Question Marks hinges on strategic investment, innovation, and effective market penetration. RBC's exploration into advanced AI for niche capital markets, where adoption is below 15% in specialized derivative analytics as of 2024, exemplifies the high-risk, high-reward nature of these ventures.

Ultimately, the classification as a Question Mark underscores a critical decision point: either invest heavily to transform these units into Stars or consider divestment if the potential for growth and market share capture appears too low. This strategic evaluation is paramount for optimizing resource allocation and ensuring long-term portfolio health.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.