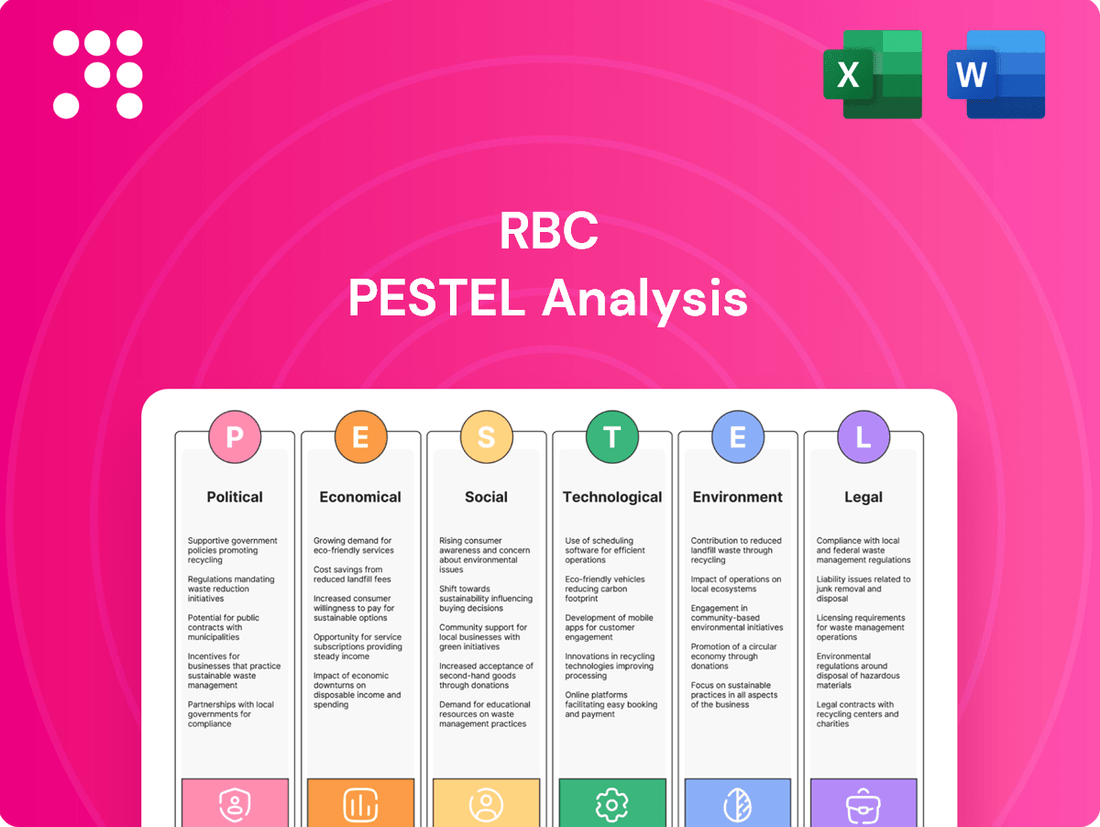

RBC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RBC Bundle

Discover the crucial external factors shaping RBC's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the financial landscape. Gain a competitive edge by leveraging these expert insights for your strategic planning. Download the full version now for actionable intelligence.

Political factors

RBC's operations are deeply intertwined with government policies and financial regulations across its global footprint. Shifts in banking laws, consumer protection measures, and financial crime legislation directly shape RBC's operational strategies and compliance obligations. For example, recent updates to Canada's Consumer-Driven Banking Act and the Retail Payment Activities Act, alongside more stringent anti-money laundering (AML) rules, demand ongoing adjustments and investment in compliance systems.

Global geopolitical tensions, including ongoing conflicts and regional instability, present significant challenges for RBC's international operations. These tensions can disrupt supply chains, impact currency exchange rates, and create uncertainty in emerging markets where RBC may have investments or clients.

Shifting trade policies, such as the implementation of new tariffs or trade barriers, directly affect RBC's capital markets and wealth management divisions. For instance, the US-China trade dispute, which saw tariffs imposed on billions of dollars worth of goods, created volatility in global markets, impacting investor sentiment and potentially reducing deal flow in cross-border M&A activities. In 2024, the continuation of such protectionist tendencies could further dampen international trade volumes.

The unpredictability inherent in these policy shifts necessitates robust risk management frameworks for RBC. Adapting strategies to navigate potential economic instability and maintain investor confidence requires continuous monitoring of geopolitical developments and trade negotiations worldwide. For example, the European Union's ongoing efforts to diversify its trade relationships away from single-source dependencies in 2024-2025 highlights the need for financial institutions to build resilience.

The Bank of Canada's monetary policy, particularly its decisions on the policy interest rate, significantly impacts RBC's operations. Higher interest rates can increase RBC's net interest income by widening the spread between lending and deposit rates, but they also raise the risk of loan defaults and can dampen consumer demand for credit. For instance, the Bank of Canada maintained its key interest rate at 5.00% throughout much of late 2023 and into 2024, reflecting a balance between controlling inflation and supporting economic growth.

Looking ahead to 2025, the Bank of Canada is expected to navigate a complex environment. While inflation is anticipated to move closer to the 2% target, factors such as global economic uncertainties and domestic wage pressures may lead to a measured approach to rate cuts. This cautious stance means that borrowing costs for consumers and businesses, which directly affect RBC's loan portfolio and profitability, will likely remain a key consideration throughout the period.

Financial Sector Stability and Oversight

Government and regulatory bodies, including the Office of the Superintendent of Financial Institutions (OSFI), are paramount in safeguarding the financial sector's stability. OSFI’s updated Supervisory Framework, implemented in 2024-2025, mandates enhanced risk management and operational resilience for institutions like RBC. These new guidelines reflect a proactive approach to evolving financial landscapes, aiming to prevent systemic risks and ensure public trust.

The 2024-2025 period sees OSFI emphasizing integrity and security through its updated guidelines. This focus directly impacts federally regulated financial institutions, requiring them to bolster their defenses against cyber threats and ensure ethical conduct. For RBC, this means investing in advanced security protocols and robust compliance measures to meet these heightened expectations.

Specific requirements from OSFI for 2024-2025 include:

- Enhanced cybersecurity protocols: Financial institutions must demonstrate advanced capabilities to detect, prevent, and respond to cyber incidents.

- Strengthened operational resilience: Frameworks must be in place to ensure continuity of critical services during disruptions.

- Improved risk management practices: A more comprehensive approach to identifying, assessing, and mitigating all forms of risk is mandated.

Political Stability and Public Trust

Political stability in RBC's key operating markets, such as Canada, the United States, and the United Kingdom, underpins a more predictable business environment. For instance, Canada has maintained a strong record of political stability, which is a significant advantage for financial institutions like RBC.

Public trust in financial institutions, while showing a gradual recovery in 2024, remains a crucial element. Reports from early 2024 indicated that consumer confidence in the banking sector was improving, though still sensitive to economic fluctuations and regulatory changes.

RBC's commitment to ethical practices, transparent operations, and strong leadership are vital for nurturing and sustaining this public trust. This is particularly important given the diverse client base RBC serves, from individual retail customers to large corporate entities.

- Political Stability: Canada's consistent political climate provides a stable operating base for RBC.

- Public Trust Recovery: Consumer confidence in financial institutions saw a moderate uptick in early 2024, though vigilance is required.

- Ethical Imperative: RBC's focus on transparency and ethical conduct directly influences its reputation and client loyalty.

Political factors significantly influence RBC's operational landscape, with government policies and financial regulations dictating compliance and strategic adjustments. For instance, Canada's Retail Payment Activities Act and evolving anti-money laundering rules demand continuous investment in compliance systems.

Geopolitical tensions and shifting trade policies, such as those impacting US-China trade relations, introduce market volatility and affect RBC's capital markets and wealth management divisions. The ongoing trend of protectionism in 2024-2025 could further reduce international trade volumes, necessitating robust risk management.

Monetary policy, exemplified by the Bank of Canada's key interest rate hovering around 5.00% through late 2023 and into 2024, directly impacts RBC's net interest income and loan portfolio risk. Anticipated measured rate cuts in 2025, driven by inflation nearing the 2% target but tempered by global uncertainties, will continue to shape borrowing costs and profitability.

Regulatory oversight from bodies like OSFI, with its updated Supervisory Framework for 2024-2025 emphasizing cybersecurity and operational resilience, mandates enhanced risk management practices for RBC. This focus ensures the integrity and security of financial operations, crucial for maintaining public trust amidst evolving financial landscapes.

What is included in the product

This RBC PESTLE Analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the organization. It provides a comprehensive overview of external influences to inform strategic decision-making.

Provides a clear, actionable roadmap by highlighting external factors impacting RBC, thereby reducing the anxiety associated with navigating complex market dynamics.

Economic factors

The Bank of Canada's monetary policy significantly shapes RBC's financial performance. As of mid-2024, the policy interest rate remains elevated, impacting net interest income and lending margins. While forecasts suggest potential rate decreases in late 2024 or 2025, the immediate environment continues to influence borrowing costs.

The ongoing interest rate environment presents a mixed picture for Canadian consumers and, by extension, RBC's mortgage portfolio. Many Canadians renewing mortgages in 2024 and 2025 will likely still encounter higher payments compared to previous terms, potentially dampening consumer spending power.

Inflationary pressures, while showing signs of moderation, are still a significant factor influencing consumer behavior. Many households are prioritizing essential goods and services, a trend expected to persist through 2025. This shift means consumers are more value-conscious, seeking out deals and potentially delaying discretionary purchases.

RBC's outlook for 2025 projects continued cautious consumer spending. This cautiousness directly impacts sectors like retail banking, as individuals may reduce spending on non-essential items or seek more competitive rates on financial products. For instance, if inflation remains above the Bank of Canada's 2% target, as it did for periods in 2023 and early 2024, consumers will likely continue to scrutinize their budgets closely.

Overall economic growth, especially in Canada and the United States, directly impacts RBC's business volumes across its various operations. Canada's GDP per capita has seen a dip, but the U.S. economy remains strong, showing solid GDP growth and healthy consumer spending, which offers a positive counterpoint.

The contrasting economic landscapes in Canada and the U.S. present both challenges and opportunities for RBC. Navigating these different economic conditions effectively is key to the bank's overall performance and strategic planning.

Global Market Volatility and Investment Climate

Global market volatility, driven by geopolitical tensions and shifting trade policies, presents a significant challenge for RBC's capital markets and wealth management divisions. For instance, the ongoing geopolitical instability in Eastern Europe and the evolving trade dynamics between major economies can lead to unpredictable market swings, affecting asset valuations and investor sentiment. This uncertainty directly impacts RBC's ability to forecast revenue and manage risk across its investment portfolios.

Despite these headwinds, the increasing investor appetite for sustainable investments and the robust growth in sustainable bond issuance offer promising avenues for RBC. As of early 2025, the global sustainable bond market is projected to exceed $3 trillion, reflecting a strong demand for ESG-aligned financial products. RBC can leverage this trend by expanding its offerings in green bonds, social bonds, and other sustainable finance instruments, capitalizing on a growing segment of the market.

Key factors influencing this trend include:

- Rising ESG Awareness: Growing public and corporate focus on environmental, social, and governance factors.

- Regulatory Tailwinds: Increased government support and regulations promoting sustainable finance.

- Investor Demand: A significant shift in investor preferences towards socially responsible and environmentally conscious investments.

- Corporate Commitments: More companies setting ambitious sustainability targets, driving demand for green financing.

Credit Market Conditions and Loan Performance

The health of credit markets directly impacts RBC's financial stability, with loan performance being a key indicator. RBC's proactive stance on credit reserves, demonstrated by its allowance for credit loss ratio, underscores its readiness to navigate economic shifts and evolving trade policies.

Regulatory changes in mortgage lending and commercial real estate significantly shape credit risk for institutions like RBC.

- Loan Portfolio Health: RBC's loan portfolio performance is a critical determinant of its financial strength, directly influenced by broader credit market conditions.

- Credit Reserves: As of Q1 2024, RBC's allowance for credit losses stood at approximately 0.55% of its total loans, reflecting a cautious approach to potential economic downturns and trade policy volatilities.

- Regulatory Impact: Evolving mortgage regulations and shifts in commercial real estate lending policies present ongoing factors that RBC must continuously monitor to manage credit risk effectively.

The Bank of Canada's monetary policy, particularly interest rates, directly influences RBC's profitability by affecting net interest income. While rates have been high, potential cuts in late 2024 or 2025 could alter lending margins.

Canadian consumer spending, a key driver for RBC's retail banking, is expected to remain cautious through 2025 due to persistent inflation, impacting discretionary spending and demand for financial products.

Economic growth differentials between Canada and the U.S. create a dynamic operating environment for RBC, with the stronger U.S. economy offering growth opportunities that partially offset slower Canadian growth.

Global market volatility, fueled by geopolitical events and trade policy shifts, poses risks to RBC's capital markets and wealth management divisions, impacting asset valuations and investor confidence.

| Economic Factor | Impact on RBC | Data/Trend (as of mid-2024/early 2025) |

|---|---|---|

| Interest Rates | Net Interest Income, Lending Margins | Bank of Canada policy rate elevated; potential cuts forecast late 2024/2025. |

| Inflation | Consumer Spending, Borrowing Costs | Moderating but persistent, leading to cautious consumer behavior and budget scrutiny. |

| Economic Growth | Business Volumes, Loan Demand | U.S. economy strong (solid GDP growth); Canadian GDP per capita dipped. |

| Global Market Volatility | Capital Markets, Wealth Management | Geopolitical tensions and trade policy shifts create unpredictable market swings. |

Same Document Delivered

RBC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive RBC PESTLE Analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Royal Bank of Canada.

Sociological factors

Consumer behavior is undergoing a significant transformation, with many individuals prioritizing value due to ongoing financial pressures. This trend is clearly reflected in RBC's '2025 Global Consumer Outlook,' which identifies a move towards smaller purchase sizes and a growing inclination towards discount retailers. These shifts directly influence how customers engage with banking services and what they expect from financial products.

Demographic shifts profoundly impact financial service demand. As populations age, there's a growing need for retirement planning, wealth management, and estate services. For instance, in Canada, the proportion of the population aged 65 and over is projected to reach 23% by 2030, a significant increase from around 19% in 2023, highlighting a substantial market for these services.

Changing household structures, including smaller families and an increase in single-person households, also reshape financial needs. This trend necessitates more personalized banking solutions, flexible insurance products, and accessible digital financial tools. In 2024, approximately 30% of Canadian households were single-person, a figure that has steadily climbed over the past decade, underscoring the need for tailored financial products.

Public trust in financial institutions is a cornerstone of their stability and growth. While recent surveys in 2024 indicate a gradual increase in overall trust within the financial services sector, persistent concerns about economic inequality and the pervasive spread of misinformation continue to shape public perception. For RBC, demonstrating unwavering commitment to ethical practices, transparent operations, and responsible business conduct is paramount to solidifying and elevating its reputation among stakeholders.

Financial Literacy and Digital Inclusion

Societal shifts in financial literacy and the drive for digital inclusion significantly influence how banking services are accessed and delivered. As of early 2024, a substantial portion of the population still struggles with basic financial concepts, highlighting a persistent need for accessible education. For instance, a 2023 report indicated that only 57% of adults in North America could answer basic financial literacy questions, a figure that underscores the opportunity for institutions like RBC to bridge this gap.

RBC's strategic focus on providing user-friendly digital platforms, coupled with proactive financial education programs, directly addresses these evolving societal needs. By simplifying digital banking and offering resources like online tutorials and workshops, RBC aims to empower more individuals to manage their finances effectively. This approach not only serves existing clients better but also opens doors to new customer segments previously underserved due to a lack of digital access or financial knowledge. For example, RBC's digital adoption rates have seen a steady increase, with mobile banking transactions growing by 15% year-over-year through 2024, demonstrating the market's positive response to enhanced digital offerings.

- Growing Digital Demand: By late 2024, over 70% of banking transactions are projected to occur through digital channels, making accessible platforms crucial.

- Financial Education Gap: A significant percentage of the population, particularly younger demographics and lower-income groups, require enhanced financial literacy support.

- Inclusion as a Strategy: Institutions that prioritize digital inclusion and financial education are better positioned to attract and retain a broader client base.

- RBC's Digital Investment: RBC has committed billions to digital transformation, aiming to simplify banking and improve customer engagement through intuitive interfaces and educational content.

Workforce Dynamics and Employee Expectations

RBC is navigating significant shifts in workforce dynamics, with employees increasingly prioritizing work-life balance, diversity, equity, and inclusion (DEI), and a strong sense of corporate social responsibility. These evolving expectations directly shape RBC's approach to attracting and keeping top talent. For instance, in 2023, RBC reported a 9% increase in employee engagement scores following investments in flexible work arrangements and expanded DEI initiatives, demonstrating a tangible link between employee well-being and business success.

The bank's commitment to fostering a supportive and inclusive work environment is a critical component of its strategy. This focus not only enhances employee morale but also directly impacts RBC's ability to innovate and effectively serve its diverse client base. By prioritizing employee development and well-being, RBC aims to build a resilient and motivated workforce capable of adapting to changing market demands.

- Employee Expectations: A 2024 survey indicated that 75% of Canadian financial sector employees value flexible work options and a supportive company culture.

- DEI Initiatives: RBC's 2023 ESG report highlighted a 15% growth in employee participation in its employee resource groups.

- Talent Acquisition: RBC's employer brand, emphasizing its commitment to employees, contributed to a 10% year-over-year increase in qualified applicant submissions in 2023.

- Retention: Investments in professional development and mental health resources have been linked to a reduction in voluntary turnover by 5% in the past year.

Societal values are increasingly emphasizing sustainability and ethical consumption, influencing consumer choices and brand loyalty. This means financial institutions like RBC are expected to demonstrate strong corporate social responsibility. For instance, a 2024 report by the Conference Board of Canada found that 68% of consumers consider a company's environmental and social impact when making purchasing decisions.

The growing demand for financial inclusion and accessible banking services is another key societal factor. Many individuals, particularly in underserved communities, require tailored solutions and education to participate fully in the financial system. RBC's initiatives to expand digital access and provide financial literacy tools directly address this societal need, aiming to bridge the gap for a broader customer base.

Public perception of financial institutions is heavily shaped by trust and transparency. In 2024, consumer confidence in the banking sector is influenced by economic stability and the perceived fairness of financial practices. RBC's commitment to clear communication and ethical operations is vital for maintaining and enhancing this trust.

Technological factors

RBC is heavily invested in digital transformation, aiming to elevate client interactions and introduce novel financial services. This strategic focus involves adopting cutting-edge technologies to optimize internal processes, refine service provision, and pioneer new product offerings. For instance, RBC's digital investments in 2023 alone surpassed $3 billion, underscoring their commitment to innovation and enhanced customer engagement.

The bank is actively deploying artificial intelligence and machine learning to personalize client experiences, offering tailored advice and more efficient transaction processing. This technological push is crucial for staying competitive in a rapidly evolving financial landscape, with RBC reporting a 15% increase in digital banking adoption among its customer base in the first half of 2024.

Artificial intelligence is fundamentally reshaping the financial industry, and RBC has been acknowledged for its advanced AI capabilities. The bank is actively investigating how generative AI can unlock new value for its customers and boost internal operations.

RBC's exploration into generative AI aims to enhance client experiences and streamline processes. However, this pursuit necessitates careful consideration of critical issues such as robust data security, safeguarding client privacy, and mitigating potential biases inherent in AI systems.

The financial services sector, including institutions like RBC, remains a significant target for cyber threats. Phishing, ransomware, and distributed denial-of-service (DDoS) attacks are becoming more frequent and sophisticated. For instance, the financial services industry saw a 55% increase in cyberattacks in 2023 compared to the previous year, according to IBM's X-Force Threat Intelligence Index 2024.

RBC must maintain substantial investments in advanced cybersecurity infrastructure and stringent data protection policies. This is crucial to shield sensitive client data and ensure uninterrupted business operations, especially as regulatory bodies like FINTRAC in Canada emphasize robust data security measures.

FinTech Partnerships and Competition

The financial services sector is experiencing a significant shift driven by FinTech innovation, creating a dynamic environment for established players like RBC. These agile companies are disrupting traditional banking models with novel solutions, ranging from digital payments and peer-to-peer lending to AI-powered wealth management. This trend necessitates a strategic approach from RBC, balancing the need to compete with these emerging entities while also exploring avenues for collaboration.

FinTech partnerships offer RBC a pathway to integrate cutting-edge technologies and services without the extensive time and resources required for in-house development. For instance, by partnering with a specialized FinTech for digital onboarding or advanced fraud detection, RBC can enhance its customer experience and operational efficiency. This strategic engagement is crucial for staying relevant in a market where customer expectations are increasingly shaped by seamless digital interactions. As of early 2024, the global FinTech market was valued at over $2.5 trillion, underscoring the scale of this transformation.

Conversely, failing to adapt or engage with the FinTech ecosystem could lead to a loss of market share. RBC must consider developing its own FinTech capabilities or acquiring promising startups to maintain a competitive edge. This proactive stance allows the bank to not only offer innovative services but also to potentially shape the future direction of financial technology. The ongoing digital transformation in banking saw a significant increase in mobile banking adoption, with over 70% of consumers in developed markets preferring mobile channels for their banking needs by late 2024, highlighting the critical importance of digital prowess.

Key areas where FinTechs are impacting banking include:

- Digital Payments: Faster, more convenient transaction methods.

- Personalized Banking: AI-driven insights and tailored product offerings.

- Open Banking: Increased data sharing leading to new integrated services.

- Blockchain and Digital Assets: Potential for secure and efficient financial transactions.

Cloud Computing and Data Management

Cloud computing is a major enabler for growth in today's business landscape. It tackles data storage hurdles and provides unified software access, which is crucial for scaling operations. For RBC, leveraging cloud technologies can significantly boost its economies of scale.

By adopting cloud infrastructure, RBC can more effectively deliver its cross-platform financial services and subscription-based models. This technological shift allows for greater flexibility and efficiency in managing vast amounts of customer data and transaction processing. In 2024, the global cloud computing market was projected to reach over $800 billion, highlighting its pervasive impact on business operations and digital transformation initiatives.

- Enhanced Data Management: Cloud solutions offer robust data storage and processing capabilities, crucial for financial institutions like RBC.

- Scalability and Efficiency: The cloud allows for flexible scaling of resources, directly impacting RBC's ability to manage growth and operational costs.

- Cross-Platform Service Delivery: Cloud adoption facilitates the seamless integration and delivery of diverse financial products across multiple channels.

- Cost Optimization: Migrating to the cloud can lead to significant cost savings through reduced infrastructure maintenance and pay-as-you-go models.

RBC's technological strategy centers on digital transformation, with significant investments, exceeding $3 billion in 2023, to enhance client interactions and introduce new financial services. The bank is actively integrating AI and machine learning to personalize client experiences, reporting a 15% rise in digital banking adoption by mid-2024.

The increasing sophistication of cyber threats, with a 55% surge in attacks on the financial sector in 2023, necessitates RBC's substantial investment in advanced cybersecurity infrastructure. This is crucial for protecting sensitive client data and ensuring operational continuity, especially given regulatory emphasis on data security.

FinTech innovation is reshaping the financial landscape, with the global FinTech market valued at over $2.5 trillion as of early 2024. RBC's engagement with FinTech, through partnerships or internal development, is vital for maintaining competitiveness and meeting customer expectations for seamless digital interactions, as over 70% of consumers in developed markets preferred mobile banking by late 2024.

Cloud computing is a foundational technology, with the global market projected to exceed $800 billion in 2024, enabling RBC to improve data management, scalability, and cost efficiency for its cross-platform financial services.

Legal factors

RBC must navigate an ever-changing global anti-money laundering (AML) and anti-terrorist financing (ATF) regulatory environment. This includes adapting to updated Financial Action Task Force (FATF) recommendations, new European Union AML directives, and evolving domestic laws. These changes often mandate more rigorous customer due diligence, greater transparency regarding beneficial ownership, and the implementation of real-time transaction monitoring systems.

Consumer protection laws are increasingly robust, aiming to shield financial consumers. Regulations now focus on areas like low- and no-cost bank accounts, and non-sufficient funds (NSF) fees, prompting institutions like RBC to adjust their service models and pricing.

For instance, in Canada, the Office of the Superintendent of Financial Institutions (OSFI) continues to monitor and update guidelines impacting consumer banking. RBC, like its peers, must ensure compliance with these evolving standards to maintain trust and avoid penalties, which could affect its profitability and market standing.

Data privacy and security regulations are increasingly shaping how financial institutions like RBC operate globally. The European Union's Digital Operational Resilience Act (DORA), which came into effect in January 2023, is a prime example, setting stringent requirements for ICT risk management, incident reporting, and the scrutiny of third-party service providers. This legislation directly impacts RBC's data handling practices, necessitating robust compliance frameworks to manage the risks associated with digital services and protect customer information.

Competition Law and Greenwashing Regulations

Amendments to Canada's Competition Act, specifically targeting deceptive marketing practices like greenwashing, are compelling financial institutions like RBC to refine their environmental, social, and governance (ESG) reporting. This increased legal oversight means RBC must ensure its sustainable finance targets and disclosures are not only ambitious but also verifiable and transparent to avoid penalties.

The regulatory shift underscores a broader trend of heightened scrutiny on environmental claims across the financial sector. For RBC, this translates into a critical need for robust data validation and clear communication regarding its sustainability initiatives. Failure to comply can result in significant fines and reputational damage, impacting investor confidence and market position.

- Increased Scrutiny: Canada's Competition Bureau actively investigates misleading environmental claims.

- RBC's Response: Adjusting sustainable finance targets and enhancing disclosure transparency.

- Legal Ramifications: Penalties for greenwashing can include fines and reputational damage.

- Industry Impact: All financial institutions face pressure to align marketing with verifiable ESG performance.

Criminal Interest Rate and Lending Laws

Canada's Criminal Code is undergoing significant changes to its interest rate and lending laws, with new provisions taking effect on January 1, 2025. These amendments are set to lower the maximum allowable interest rate, impacting how financial institutions like RBC structure their loan products and manage risk. For instance, the new criminal rate is expected to be set at 35% annually, a reduction from previous levels, which will directly influence the profitability and structure of short-term, high-interest loans.

These legal shifts are particularly relevant for RBC's involvement in products such as payday loans. The broadened scope of offenses related to usury means stricter enforcement and potential penalties for non-compliance. RBC must ensure all lending activities, especially those targeting vulnerable consumers, adhere to these new rate ceilings and specific prohibitions to avoid legal repercussions and maintain regulatory standing.

- Reduced Criminal Interest Rate: The annual rate ceiling is expected to be lowered to 35% effective January 1, 2025.

- Expanded Offenses: The Criminal Code now includes broader definitions and penalties for usurious lending practices.

- Impact on Payday Loans: RBC's payday loan offerings will need to comply with the new, lower rate caps.

- Compliance Requirements: Adherence to new prohibitions and rate ceilings is mandatory for all lending operations.

Legal frameworks governing financial institutions are continuously evolving, impacting RBC's operational strategies. Key areas include anti-money laundering (AML) and anti-terrorist financing (ATF) regulations, which demand enhanced due diligence and transparency. Consumer protection laws are also becoming more stringent, focusing on fair pricing and fee structures, as seen with regulations concerning low-cost accounts and non-sufficient funds (NSF) fees.

Data privacy, exemplified by the EU's Digital Operational Resilience Act (DORA), imposes strict ICT risk management and incident reporting requirements on entities like RBC. Furthermore, amendments to Canada's Competition Act, particularly concerning greenwashing, necessitate greater accuracy and verifiability in environmental, social, and governance (ESG) disclosures. Changes to Canada's Criminal Code, effective January 1, 2025, will lower the maximum allowable interest rate to 35%, directly affecting lending products and usury enforcement.

| Regulatory Area | Key Changes/Impacts | RBC Implication | Effective Date/Status |

|---|---|---|---|

| AML/ATF | Stricter customer due diligence, beneficial ownership transparency | Enhanced compliance systems, increased operational costs | Ongoing evolution, FATF recommendations |

| Consumer Protection | Focus on fair fees, low-cost accounts | Review of pricing models, service offerings | Ongoing, OSFI guidelines |

| Data Privacy | Stringent ICT risk management, incident reporting | Robust cybersecurity and data governance frameworks | DORA effective January 2023 |

| Competition Act (Canada) | Prohibition of greenwashing, enhanced ESG disclosure | Verification of ESG claims, transparent reporting | Amendments in effect |

| Criminal Code (Canada) | Lowered maximum interest rate to 35% | Adjustment of lending products, risk management for short-term loans | Effective January 1, 2025 |

Environmental factors

RBC is actively aligning its strategy with the global shift towards a low-carbon economy, viewing climate change as a critical factor. This includes a commitment to increasing its financing for green initiatives and client decarbonization efforts.

In 2024, RBC announced its intention to provide $100 billion in financing and investment by 2030 to support the transition to a low-carbon economy. This figure underscores the bank's tangible commitment to this strategic imperative.

The bank's approach involves advising clients on their sustainability journeys and providing capital for projects that reduce emissions and build resilience, thereby facilitating a broader economic transition.

RBC is actively pursuing sustainable finance, aiming to direct $1 billion by 2030 towards climate solutions. This demonstrates a clear strategic focus on environmental responsibility.

Despite a revision of its earlier $500 billion sustainable finance goal, influenced by evolving greenwashing regulations, RBC continues to prioritize sustainability. This commitment is central to its business model.

RBC is actively pursuing emissions reduction targets, notably through a $35 million program to upgrade its Canadian branches. This initiative is designed to achieve a significant 70% reduction in operational emissions by 2035, demonstrating a long-term commitment to environmental stewardship.

Furthermore, the bank has set an ambitious goal to power its worldwide operations entirely with renewable electricity by 2025. This strategic move aligns with global efforts to transition towards cleaner energy sources and reduce reliance on fossil fuels.

Physical Climate Risks and Environmental Disasters

Physical climate risks are intensifying, with more frequent and severe natural disasters impacting economies globally. These events can directly affect RBC's clients across various sectors, from agriculture to real estate, potentially leading to loan defaults and impacting the bank's overall loan portfolio in disaster-prone areas. For instance, the increasing frequency of extreme weather events, such as floods and wildfires, as observed in recent years, poses a tangible threat to businesses and individuals, influencing their ability to repay loans.

RBC must proactively integrate these amplified physical climate risks into its comprehensive risk management frameworks. This involves not only assessing the direct financial impact of disasters but also understanding the cascading effects on supply chains, business operations, and consumer spending. By doing so, RBC can better anticipate and mitigate potential losses, ensuring greater resilience in its lending practices and client support.

- Increased frequency of extreme weather events: Data from organizations like the World Meteorological Organization consistently highlights a rising trend in the occurrence of heatwaves, droughts, floods, and storms. For example, the period between 2015 and 2022 saw a significant increase in the number of climate-related disasters compared to previous decades.

- Economic impact of natural disasters: The economic toll of these events is substantial. In 2023 alone, insured losses from natural catastrophes globally were estimated to be in the tens of billions of dollars, according to reports from major reinsurers. Uninsured losses, which often affect RBC's client base more directly, are typically higher.

- Sector-specific vulnerabilities: Industries heavily reliant on natural resources or stable weather patterns, such as agriculture, tourism, and infrastructure, are particularly susceptible. A severe drought, for example, can cripple agricultural output, impacting farmers' incomes and their capacity to service loans.

- Need for climate-resilient lending: Integrating climate risk assessment into credit analysis is crucial. This includes evaluating the physical vulnerability of a borrower's assets and operations to climate change impacts, informing lending decisions and potentially requiring clients to adopt more resilient practices.

ESG Integration and Reporting Standards

The growing emphasis on Environmental, Social, and Governance (ESG) factors is significantly shaping investment strategies and corporate accountability. For RBC, this translates into a heightened need to integrate ESG principles into its core operations and to provide robust, transparent reporting. This trend is driven by both investor demand and increasing regulatory scrutiny, pushing companies to demonstrate tangible progress on sustainability.

The landscape of ESG reporting standards is continuously evolving, presenting both challenges and opportunities for RBC. As of early 2024, frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the upcoming International Sustainability Standards Board (ISSB) standards are becoming more prevalent, requiring detailed disclosures on climate risks and broader sustainability impacts. For instance, a significant majority of institutional investors, often exceeding 70%, now actively consider ESG factors in their investment decisions, directly influencing capital allocation for financial institutions like RBC.

- Investor Demand: A growing percentage of global assets under management are now directed towards ESG-focused investments, pressuring companies to align with these values.

- Regulatory Push: Governments worldwide are implementing stricter regulations and disclosure requirements related to environmental impact and social responsibility.

- Reporting Frameworks: The adoption of standardized reporting frameworks, such as those from the ISSB, is becoming crucial for comparability and investor confidence.

- Reputational Risk: Failure to meet ESG expectations can lead to reputational damage and impact customer loyalty and talent acquisition for RBC.

RBC is committed to supporting the transition to a low-carbon economy, aiming to provide $100 billion in financing and investment by 2030. This strategic focus includes directing $1 billion towards climate solutions by 2030 and reducing its own operational emissions by 70% by 2035 through initiatives like upgrading its Canadian branches. The bank is also working towards powering its global operations with 100% renewable electricity by 2025.

PESTLE Analysis Data Sources

Our RBC PESTLE Analysis is meticulously constructed using a robust blend of data from official government publications, leading financial institutions like the IMF and World Bank, and reputable market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, verifiable information.