QuinStreet SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QuinStreet Bundle

QuinStreet's digital marketing expertise is a significant strength, but understanding its competitive landscape and potential regulatory challenges is crucial for informed decisions. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

QuinStreet's proprietary technology, the QuinStreet Media Platform (QMP), combined with its data-driven approach, is a significant strength. This platform allows for the precise targeting of consumers demonstrating high intent, a crucial factor in today's competitive digital landscape. For instance, in the first quarter of fiscal year 2024, QuinStreet reported a 13% increase in revenue, driven in part by the efficiency gains from these advanced targeting capabilities.

QuinStreet's performance-based business model is a significant strength, as it directly ties the company's revenue to client success, earning income when a lead converts into a paying customer. This alignment fosters strong client relationships by demonstrating clear, measurable value and shared goals.

This approach significantly reduces upfront marketing risk for clients, making QuinStreet an attractive partner by ensuring a direct return on investment. For instance, in fiscal year 2023, QuinStreet reported revenue of $177.4 million, reflecting the success of this client-centric model.

QuinStreet's dominance in the auto insurance vertical is a major strength, evidenced by impressive year-over-year revenue growth. This sector alone provides a solid foundation and significant market traction.

Broad Client and Media Footprints

QuinStreet boasts a significant advantage through its extensive client and media footprints, enabling it to connect a vast array of consumers with diverse service providers. Its proprietary QuinStreet Marketing Platform (QMP) facilitates access to thousands of targeted media sources, encompassing SEM, SEO, social, mobile, and email marketing. This allows for broad reach and diversified lead generation, reinforcing its competitive edge in the performance marketing sector.

The company's established networks are crucial for its lead generation capabilities. For instance, in the fiscal year 2023, QuinStreet reported a substantial increase in its customer acquisition efforts, with a focus on expanding its reach across key verticals like financial services and higher education. This broad client engagement translates directly into a robust media presence, allowing for highly targeted campaigns that efficiently capture consumer interest.

- Extensive Network: Connects numerous consumers with a wide range of service providers.

- QMP Capabilities: Leverages thousands of targeted media sources for broad reach.

- Diversified Lead Generation: Utilizes SEM, SEO, social, mobile, and email channels.

- Competitive Advantage: Enhances market position through wide-reaching performance marketing.

Solid Financial Performance and Outlook

QuinStreet has demonstrated robust financial performance, with significant revenue growth and expanding adjusted EBITDA. The company has also raised its fiscal year 2025 outlook, signaling confidence in its ongoing strategy and market position. This upward revision is supported by strong performance in key business segments.

Recent financial reports highlight substantial revenue increases, particularly in its high-margin verticals. For example, in Q3 FY24, QuinStreet reported a 15% year-over-year increase in revenue, reaching $138.6 million, with adjusted EBITDA growing by 68% to $26.3 million. This financial strength is a key advantage.

- Revenue Growth: Achieved 15% year-over-year revenue growth in Q3 FY24.

- Profitability Expansion: Saw adjusted EBITDA increase by 68% in Q3 FY24.

- Positive Outlook: Raised fiscal year 2025 financial guidance.

QuinStreet's proprietary technology, the QuinStreet Media Platform (QMP), is a core strength, enabling precise consumer targeting and driving efficiency. This is reflected in their Q1 FY24 revenue increase of 13%, partly attributed to these advanced capabilities.

The company's performance-based model, where revenue is tied to client success, fosters strong relationships and reduces client risk. This client-centric approach contributed to their FY23 revenue of $177.4 million.

Dominance in the auto insurance sector provides a significant foundation and market traction, evidenced by strong year-over-year revenue growth in this vertical.

QuinStreet's extensive client and media footprints, powered by QMP, allow for broad reach and diversified lead generation across SEM, SEO, social, mobile, and email marketing, enhancing its competitive edge.

Recent financial performance, including a 15% year-over-year revenue increase to $138.6 million and a 68% rise in adjusted EBITDA to $26.3 million in Q3 FY24, underscores the company's financial strength and positive outlook, with a raised FY25 guidance.

| Metric | Q3 FY24 | FY23 |

|---|---|---|

| Revenue | $138.6 million | $177.4 million |

| Adjusted EBITDA | $26.3 million | N/A |

| Revenue Growth (YoY) | 15% | N/A |

What is included in the product

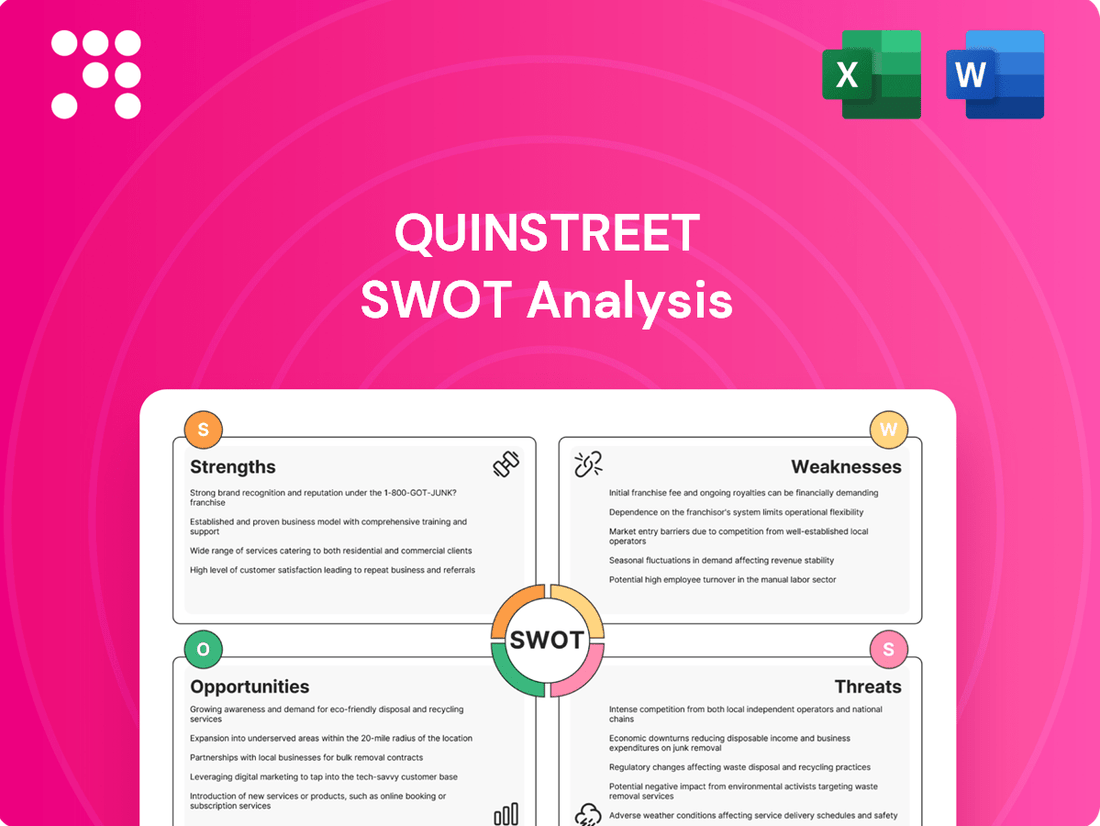

Analyzes QuinStreet’s competitive position through key internal and external factors, covering its strengths in lead generation, weaknesses in platform reliance, opportunities in new verticals, and threats from market saturation.

QuinStreet's SWOT analysis offers a clear, actionable framework to identify and address internal weaknesses and external threats, thereby alleviating strategic planning pain points.

Weaknesses

QuinStreet's revenue growth in recent periods, particularly through 2024, has been heavily influenced by its performance in specific sectors, notably auto insurance. This concentration, while beneficial during periods of high demand in that vertical, presents a notable weakness.

An overdependence on a single high-performing market, such as auto insurance, can leave QuinStreet susceptible to market volatility, shifts in consumer behavior, or intensified competitive pressures within that niche. For instance, a slowdown in the auto insurance market or new regulatory changes could disproportionately impact the company's overall financial health.

While QuinStreet is actively pursuing diversification strategies to broaden its revenue streams across various verticals, the current concentration remains a significant point of vulnerability. This lack of broad-based revenue generation across multiple sectors limits the company's resilience against sector-specific downturns.

QuinStreet operates in the performance marketing and lead generation space, an industry highly susceptible to shifting data privacy laws and government regulations. For instance, changes to Telephone Consumer Protection Act (TCPA) rules, often influenced by the FCC, can significantly impact how companies like QuinStreet engage with potential customers.

Adapting to these evolving regulatory landscapes necessitates ongoing investment in compliance measures and technological updates. These investments directly affect operational costs and can require substantial adjustments to existing business models, potentially squeezing profit margins.

The inherent uncertainty associated with regulatory shifts presents a notable weakness for QuinStreet. Such changes can introduce unforeseen operational challenges and create a less predictable business environment, making long-term strategic planning more complex.

Client marketing budgets are inherently sensitive to broader economic shifts, industry trends, and competitive landscapes. For QuinStreet, this means that external factors like potential tariff impacts or a general economic slowdown could prompt clients to adopt a more cautious approach to spending, potentially delaying or reducing marketing investments.

This variability in client spending directly translates to revenue volatility for QuinStreet. While the company strives for stability, the dependency on client budget allocations means that unforeseen economic headwinds can introduce unpredictability into revenue streams, impacting financial planning and performance.

Competition in the Online Marketing Space

The online marketing and media landscape is intensely competitive, with many companies seeking the same client dollars and access to advertising platforms. QuinStreet faces constant pressure to stay ahead.

To maintain its market position, QuinStreet must consistently innovate and prove its return on investment (ROI) to clients, outperforming both seasoned performance marketing firms and newer entrants. This competitive pressure can impact profitability.

- Intense Competition: The digital marketing sector is crowded, with numerous companies vying for market share and advertising spend.

- Need for Innovation: QuinStreet must continuously develop new strategies and technologies to differentiate itself.

- ROI Demonstration: Proving a clear and superior return on investment is crucial for client retention and acquisition in this environment.

- Margin Pressure: Fierce competition can lead to price wars, potentially squeezing profit margins for all players.

Need for Continuous Media Optimization

QuinStreet faces a significant challenge in its need for continuous media optimization to maintain and grow its profit margins. This isn't a one-time fix; it demands ongoing investment in sophisticated technology and skilled personnel to keep pace with the ever-shifting digital advertising world and evolving consumer habits. For instance, as of Q1 2025, the cost per acquisition (CPA) in competitive online verticals has seen a 7% increase year-over-year, making efficient media buying crucial.

Without this relentless focus on optimizing media supply and buying efficiency, QuinStreet risks seeing its marketing spend yield diminishing returns. This means that for every dollar spent on advertising, the company will acquire fewer valuable customers, directly impacting profitability. The company's ability to adapt its strategies to new platforms and changing audience behaviors is paramount to its success in the coming fiscal year.

Key areas requiring constant attention include:

- Algorithmic Bidding Strategies: Regularly refining algorithms to ensure the most cost-effective placement of ads.

- Creative Performance Analysis: Continuously testing and iterating on ad creatives to maximize engagement and conversion rates.

- Channel Mix Adjustment: Dynamically shifting budget allocation across different advertising channels based on real-time performance data.

- Data Privacy Compliance: Adapting media buying practices to adhere to evolving data privacy regulations, which can impact targeting capabilities.

QuinStreet's revenue concentration, particularly its strong reliance on the auto insurance sector through 2024, presents a significant weakness. This dependence makes the company vulnerable to market downturns or increased competition within that specific vertical, potentially impacting overall financial performance.

The company operates in a highly regulated industry, and changes to data privacy laws and consumer protection regulations, such as those influenced by the FCC, can create operational challenges and increase compliance costs. Adapting to these evolving legal landscapes requires continuous investment and can introduce unpredictability into business models.

QuinStreet's reliance on client marketing budgets makes it susceptible to economic fluctuations. A general economic slowdown or industry-specific budget cuts could lead to reduced spending by clients, directly impacting QuinStreet's revenue streams and creating financial unpredictability.

The intense competition in the online marketing space necessitates constant innovation and a strong demonstration of return on investment to clients. This competitive pressure can lead to margin compression as companies vie for market share and client budgets, requiring ongoing investment in technology and talent.

Full Version Awaits

QuinStreet SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an accurate glimpse into the comprehensive QuinStreet SWOT analysis. Once purchased, you’ll unlock the full, detailed report.

Opportunities

QuinStreet can significantly broaden its reach by venturing into new market verticals, moving beyond its established financial and home services sectors. This diversification offers substantial growth potential.

A key opportunity lies in introducing innovative lending products within the home services industry. For instance, offering financing for solar panel installations or major home renovations could tap into unmet consumer needs and create new revenue streams.

By strategically expanding its service offerings and targeting adjacent markets, QuinStreet can unlock significant new avenues for revenue generation and solidify its market position.

QuinStreet can significantly boost its performance marketing by integrating AI and machine learning. This allows for more precise audience targeting, dynamic creative generation, and streamlined workflow automation. For instance, in 2024, the global AI market in marketing was projected to reach over $50 billion, highlighting the substantial potential for growth and efficiency gains.

By leveraging AI for hyper-personalization, QuinStreet can craft more resonant campaigns, leading to higher conversion rates. This directly supports and optimizes its pay-for-performance model. Companies adopting AI in marketing have reported an average increase in conversion rates of up to 20% in recent studies.

Furthermore, AI-driven automation can free up resources, allowing QuinStreet to focus on strategic initiatives and client relationship management. This enhanced efficiency is expected to drive greater client satisfaction and retention, a crucial factor in the competitive digital marketing landscape.

The global lead generation market is experiencing robust expansion, projected to reach an estimated $10.9 billion by 2031, up from $5.8 billion in 2023. This growth is fueled by businesses prioritizing digital strategies and the continuous need for efficient customer acquisition.

This expanding market presents a significant opportunity for QuinStreet to capitalize on the increasing demand for qualified leads. By leveraging its expertise in digital marketing and lead generation, QuinStreet is well-positioned to scale its operations and increase its market share within this favorable environment.

Strategic Acquisitions and Partnerships

QuinStreet has a clear opportunity to bolster its capabilities and market presence through strategic acquisitions and partnerships. This approach can significantly enhance its existing technology stack, broaden its reach into new customer demographics, and secure access to additional valuable media channels.

The company's acquisition of Aqua Vida Media in early 2024 serves as a prime example of this strategy's success. This move demonstrably boosted QuinStreet's performance across display and social media platforms, highlighting the tangible benefits of integrating complementary businesses. Such moves are crucial for accelerating growth and deepening market penetration in the competitive digital landscape.

- Acquisition of Aqua Vida Media: Increased QuinStreet's performance in display and social media channels, contributing to revenue growth.

- Market Expansion: Opportunities exist to acquire companies with established presence in underserved or emerging markets.

- Technology Enhancement: Partnerships or acquisitions can bring in advanced AI, data analytics, or ad-tech capabilities.

- Synergistic Growth: Combining with entities that offer complementary services can create cross-selling opportunities and a more comprehensive offering to clients.

Adapting to Evolving Privacy Regulations and First-Party Data Focus

The ongoing shift away from third-party cookies and the increasing stringency of privacy laws present a significant opportunity for QuinStreet to enhance its first-party data collection and utilization. This strategic pivot allows for the development of more personalized and compliant marketing initiatives, directly addressing client needs in a privacy-conscious environment.

By concentrating on data directly provided by users, QuinStreet can cultivate stronger client relationships and offer more effective lead generation solutions. This focus on direct engagement is crucial for maintaining relevance and trust in the evolving digital marketing ecosystem. For example, as of early 2024, a significant portion of consumers express increased concern over data privacy, making transparent first-party data practices a key differentiator.

- Enhanced Data Accuracy: First-party data offers superior quality and relevance compared to third-party data.

- Improved Customer Trust: Transparent data handling builds stronger relationships with consumers.

- Compliance Advantage: Proactive adaptation to privacy regulations like GDPR and CCPA mitigates risk.

- Competitive Edge: Offering compliant, data-driven solutions positions QuinStreet favorably against competitors.

QuinStreet can expand into new market verticals beyond its core financial and home services sectors, offering significant growth potential. Innovative lending products, such as financing for home renovations or solar panels, could tap into unmet consumer needs and create new revenue streams, particularly within the home services industry.

Integrating AI and machine learning presents a substantial opportunity to enhance performance marketing. This allows for more precise audience targeting and dynamic creative generation, a trend supported by the global AI in marketing market projected to exceed $50 billion in 2024. Companies leveraging AI in marketing have seen conversion rate increases of up to 20%, directly benefiting QuinStreet's pay-for-performance model.

The expanding global lead generation market, expected to reach $10.9 billion by 2031, offers QuinStreet a chance to capitalize on increased demand for qualified leads. Strategic acquisitions and partnerships, like the early 2024 acquisition of Aqua Vida Media which boosted performance in display and social media, can further enhance technology, reach new demographics, and secure valuable media channels.

QuinStreet can leverage the shift away from third-party cookies by strengthening its first-party data collection and utilization. This allows for more personalized and compliant marketing, building stronger client relationships and offering effective solutions in a privacy-conscious environment, a key differentiator as consumer data privacy concerns grow.

Threats

QuinStreet faces increasing threats from intensified regulatory scrutiny, particularly concerning consumer privacy and marketing practices. For instance, ongoing interpretations and potential tightening of the Federal Communications Commission's Telephone Consumer Protection Act (TCPA) rules can significantly raise compliance burdens, forcing costly overhauls of lead generation and outreach strategies. This regulatory landscape, which saw significant enforcement actions against various lead generation companies in recent years, demands constant vigilance and investment in robust compliance infrastructure.

A general economic slowdown or recession poses a significant threat to QuinStreet by potentially shrinking clients' marketing budgets. This directly impacts QuinStreet's revenue streams as businesses cut back on advertising and lead generation services.

Industries that are particularly sensitive to economic fluctuations, such as financial services and home services, are key client segments for QuinStreet. A decline in consumer spending or investment within these sectors could lead to a sharp decrease in demand for QuinStreet's lead generation offerings, as seen during the projected 2024-2025 economic uncertainty where consumer confidence indices dipped.

The digital marketing landscape is constantly evolving, and QuinStreet faces a significant threat from the rapid advancement of technologies like AI and machine learning. These innovations can empower new entrants or existing competitors to develop disruptive business models and offer more sophisticated solutions, potentially challenging QuinStreet's established position. For instance, AI-driven personalization platforms can offer highly targeted advertising, a capability that could outpace QuinStreet's current offerings if not matched.

Existing competitors are also likely to leverage these technological advancements to enhance their own services, leading to a more intense competitive environment. This could result in price pressures and a need for QuinStreet to invest heavily in R&D to maintain its edge. Failure to innovate at a similar pace might erode market share, especially as new ad formats and platforms emerge that capture user attention and marketing spend.

Data Security Breaches and Reputational Damage

QuinStreet, like many digital platforms, faces a significant threat from data security breaches. As a company that collects and manages consumer information, a cybersecurity incident could result in substantial financial penalties and legal repercussions.

The impact of a breach extends beyond immediate costs, potentially causing severe reputational damage and eroding client trust, which is vital for its lead generation business model. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, according to IBM's Cost of a Data Breach Report. This highlights the financial vulnerability companies like QuinStreet face.

Maintaining advanced cybersecurity defenses is an ongoing and complex challenge, requiring continuous investment and adaptation to evolving threats. The company must prioritize robust security protocols to mitigate these risks effectively.

- Cybersecurity Risks: QuinStreet's reliance on consumer data makes it a target for cyberattacks.

- Financial and Legal Impact: Data breaches can lead to significant fines, lawsuits, and operational disruptions.

- Reputational Damage: A security incident can severely harm customer trust and QuinStreet's brand image.

- Continuous Security Investment: The need for ongoing upgrades to cybersecurity measures presents a persistent challenge.

Difficulty in Sustaining High Growth Rates in Key Segments

QuinStreet's impressive growth in areas like auto insurance, which saw a significant uptick in recent performance reports, faces a natural challenge in maintaining those elevated rates long-term. As these specific market segments mature, the easier gains become harder to replicate.

Sustaining momentum will necessitate a proactive approach, focusing on continuous innovation and refining market penetration strategies to capture remaining opportunities. This is a common concern, reflected in recent analyst inquiries specifically probing the longevity of these growth trends.

- Market Maturation: Key segments like auto insurance are approaching saturation points, making exponential growth more difficult to achieve.

- Increased Competition: As successful segments attract more players, QuinStreet will need to differentiate its offerings to maintain market share and growth.

- Innovation Imperative: Future growth hinges on QuinStreet's ability to develop new products or services, or to significantly enhance existing ones, to stay ahead of competitors.

QuinStreet faces escalating threats from stringent regulatory changes, particularly around data privacy and consumer protection laws like potential updates to TCPA, which could increase compliance costs and necessitate significant operational adjustments.

An economic downturn poses a substantial risk, as clients may reduce marketing expenditures, directly impacting QuinStreet's revenue, especially within cyclical sectors like financial services and home improvement, which are sensitive to consumer spending fluctuations.

The rapid evolution of digital marketing, driven by AI and machine learning, presents a competitive threat, as new technologies could empower rivals to offer more advanced solutions, potentially eroding QuinStreet's market position if it fails to innovate at a comparable pace.

Intensified competition from both existing players and new entrants leveraging advanced technologies could lead to pricing pressures and a greater need for R&D investment to maintain market share and differentiation.

SWOT Analysis Data Sources

This QuinStreet SWOT analysis is built upon a foundation of robust data, including publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded perspective.