QuinStreet Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QuinStreet Bundle

QuinStreet's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of substitute products. Understanding these dynamics is crucial for navigating the digital marketing industry.

The complete report reveals the real forces shaping QuinStreet’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

QuinStreet's reliance on a limited number of dominant digital platforms for traffic generation, such as Google and Meta (Facebook), grants these suppliers significant bargaining power. In 2024, Google's share of the global digital advertising market remained substantial, exceeding 25%, while Meta also held a considerable portion. This concentration means these platforms can dictate terms and pricing, potentially increasing QuinStreet's customer acquisition costs.

Switching costs for QuinStreet's media buying and optimization are tied to the resources needed to move from one supplier to another. This involves re-integrating APIs, tweaking bidding algorithms, and re-optimizing campaigns on new platforms, all of which can demand significant effort and investment.

Although QuinStreet's proprietary QuinStreet Media Platform (QMP) allows access to numerous targeted media sources, substantial shifts in supplier relationships could still lead to costs and temporary disruptions in campaign efficiency.

Suppliers provide diverse digital traffic, including search engine marketing, social media, email, and call center leads. The distinctiveness of these offerings, especially regarding audience quality and intent, significantly impacts supplier bargaining power. For instance, in 2024, the demand for high-intent B2B leads through platforms like LinkedIn saw a 15% increase in average cost per lead, reflecting the value of specialized targeting.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant concern for QuinStreet. Large digital platforms, which are key suppliers in the performance marketing ecosystem, could decide to enter QuinStreet's core business of lead generation and performance marketing directly. This would transform them from partners into competitors, leveraging their existing infrastructure and customer base.

This potential for suppliers to move into QuinStreet's space grants them considerable bargaining power. QuinStreet must continuously prove its unique value proposition and the efficiency of its services to retain these crucial supplier relationships and avoid being bypassed. The increasing role of AI in advertising supply chains and workflows further amplifies this dynamic, as AI can streamline and automate many aspects of lead generation, making direct entry by platforms more feasible.

- Supplier Forward Integration: Large digital platforms may enter QuinStreet's performance marketing and lead generation markets directly.

- Increased Bargaining Power: This threat allows suppliers to negotiate more forcefully with QuinStreet.

- AI's Impact: Artificial intelligence is transforming advertising workflows, potentially lowering barriers for supplier integration.

- QuinStreet's Response: QuinStreet must emphasize its distinct value to prevent disintermediation.

Importance of QuinStreet to Suppliers

The bargaining power of suppliers in QuinStreet's ecosystem is largely influenced by the volume of traffic and advertising spend the company directs to its media partners. If QuinStreet represents a substantial portion of a publisher's revenue, that supplier has less leverage in negotiations. For instance, if QuinStreet is a primary driver for smaller niche websites, they are more dependent and thus have weaker bargaining power.

Conversely, for larger media entities where QuinStreet's contribution is a smaller percentage of their overall business, their individual importance to QuinStreet diminishes. This can shift the negotiation dynamic, giving these larger platforms more sway. In 2024, understanding the revenue concentration for key media partners would be crucial for assessing this leverage.

- Supplier Dependence: QuinStreet's ability to negotiate favorable terms with suppliers is directly tied to how critical its traffic and ad spend are to those suppliers' bottom lines.

- Publisher Size Matters: Smaller publishers relying heavily on QuinStreet for traffic have less bargaining power than larger media conglomerates for whom QuinStreet is a smaller revenue stream.

- Market Share Impact: If QuinStreet commands a significant share of a particular advertising vertical, it can increase its leverage over suppliers within that niche.

The bargaining power of QuinStreet's suppliers is considerable, particularly due to the dominance of a few major digital platforms like Google and Meta. In 2024, these platforms controlled a vast majority of the digital ad market, allowing them to dictate terms and pricing, which directly impacts QuinStreet's customer acquisition costs. High switching costs for QuinStreet, involving re-integrating systems and re-optimizing campaigns, further solidify supplier leverage.

| Supplier Type | Key Platforms (2024) | Impact on QuinStreet | Supplier Bargaining Power Factor |

|---|---|---|---|

| Search Engines | High; Dominant market share, dictates ad placement and pricing. | High | |

| Social Media | Meta (Facebook, Instagram) | High; Significant user base, controls targeting capabilities. | High |

| Niche Traffic Providers | Various specialized sites/apps | Variable; Depends on QuinStreet's revenue contribution. | Low to Medium |

What is included in the product

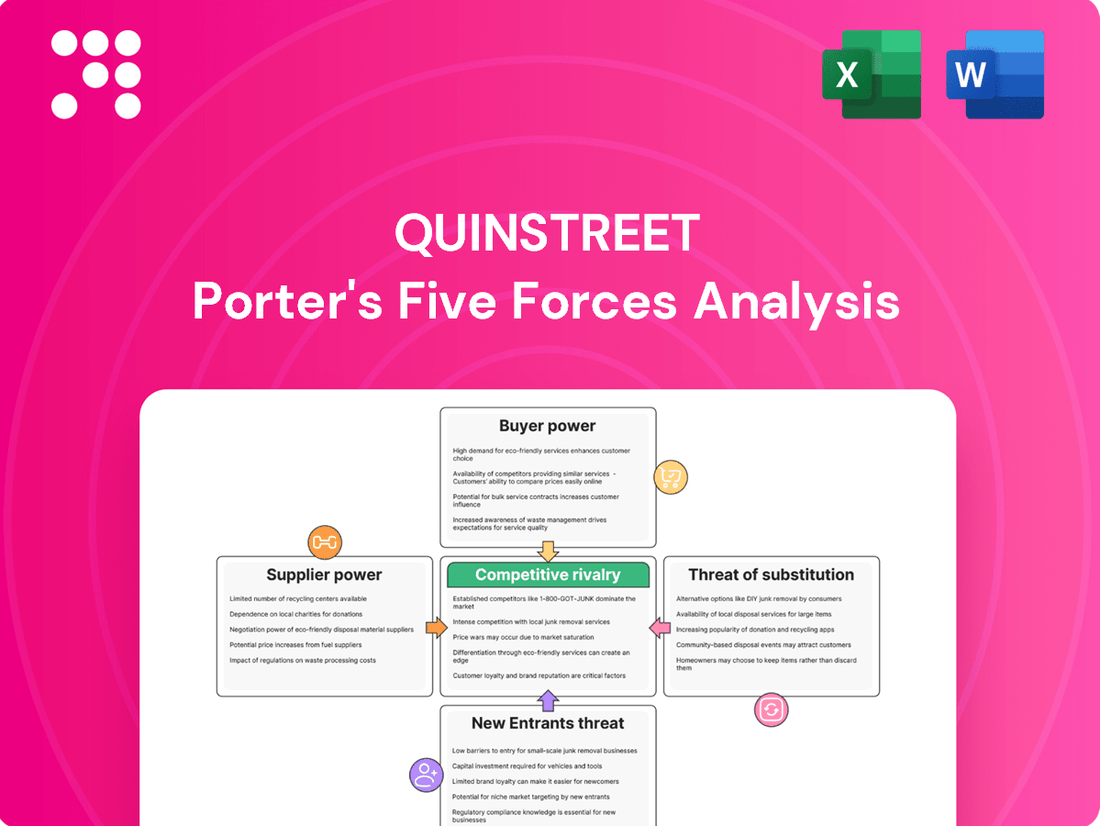

This analysis dissects QuinStreet's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products or services.

Effortlessly identify and address competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

QuinStreet's client base is heavily concentrated in sectors like financial services, which includes auto insurance and personal loans, and home services. This concentration means that a few significant clients, such as large insurance companies or national home service providers, could hold substantial sway over QuinStreet.

If these major clients account for a significant chunk of QuinStreet's overall revenue, they gain considerable bargaining power. This allows them to negotiate for better pricing or more favorable contract terms, leveraging their volume and importance to the company.

For service providers, the effort to switch from QuinStreet's lead generation services to a competitor or an in-house system involves expenses like integrating new technology, reconfiguring marketing pipelines, and training sales staff. If these transition costs are minimal, customers gain more leverage. For instance, a company might spend thousands of dollars on new software licenses and employee training to move away from a lead generation platform.

Service providers possess a multitude of avenues for customer acquisition, extending far beyond relying solely on platforms like QuinStreet. These alternatives include robust direct digital advertising campaigns on platforms such as Google Ads and various social media channels, alongside traditional advertising methods and the development of dedicated in-house marketing teams or direct sales forces.

The growing accessibility and increasing sophistication of these alternative customer acquisition strategies, significantly boosted by advancements in artificial intelligence, directly empower QuinStreet's clients. This enhanced client leverage means they can more readily negotiate terms or seek out more cost-effective solutions, thereby increasing their bargaining power.

For instance, in 2024, digital advertising spend globally was projected to reach over $600 billion, with AI-driven ad platforms showing significant growth in efficiency and targeting capabilities. This vast digital ecosystem provides service providers with readily available and often more granularly controllable customer acquisition channels, diminishing their dependence on lead generation intermediaries.

Price Sensitivity of Clients

QuinStreet's reliance on a pay-for-performance model, where revenue is tied to successful customer acquisitions from leads, means clients are acutely aware of their return on investment. This directly impacts their price sensitivity, as they scrutinize the cost per acquisition (CPA) and the quality of leads provided. Clients are essentially paying for results, not just exposure.

In highly competitive sectors, such as the insurance industry where QuinStreet is a significant player, clients possess substantial bargaining power. They actively push for more efficient and higher-converting leads to optimize their own marketing spend. This pressure can force QuinStreet to adjust its pricing or improve lead generation strategies to maintain client satisfaction and retention.

- Price Sensitivity: Clients are highly sensitive to the cost per acquisition (CPA) and lead quality, directly impacting their willingness to pay.

- Competitive Pressure: Industries with intense competition, like insurance, empower clients to demand more efficient and higher-converting leads.

- Performance Alignment: QuinStreet's pay-for-performance model inherently links client satisfaction to tangible acquisition results, amplifying client leverage.

Threat of Backward Integration by Clients

Large service providers, particularly those with substantial marketing expenditures and advanced technological infrastructure, might opt to build their own performance marketing or lead generation operations. This potential for backward integration empowers them to exert greater negotiation leverage over QuinStreet, as they can simply choose to forgo external service providers.

For instance, a major player in a sector where QuinStreet operates might allocate a significant portion of its marketing budget, potentially tens or hundreds of millions of dollars annually, towards developing proprietary lead generation systems. This strategic move directly diminishes their reliance on third-party vendors like QuinStreet.

- Client Capability Development: Large clients can invest in building in-house marketing technology stacks and data analytics teams.

- Cost Savings Potential: By bringing lead generation in-house, clients aim to reduce the per-lead cost compared to paying external providers.

- Control and Customization: Internal development offers greater control over campaign strategy, data privacy, and customization.

- Market Dynamics: In 2024, many industries saw increased investment in digital transformation, including marketing operations, making backward integration more feasible for larger enterprises.

QuinStreet's customers, especially those in competitive sectors like insurance, wield significant bargaining power due to their high price sensitivity and demand for efficient, high-converting leads. The company's pay-for-performance model inherently aligns client satisfaction with tangible acquisition results, amplifying this leverage. Furthermore, the increasing sophistication and accessibility of alternative customer acquisition channels, bolstered by AI advancements, empower clients to negotiate better terms or seek more cost-effective solutions.

| Factor | Impact on QuinStreet | Example/Data (2024) |

|---|---|---|

| Price Sensitivity | Clients scrutinize Cost Per Acquisition (CPA) and lead quality, impacting willingness to pay. | In competitive markets, clients push for lower CPAs to optimize their own marketing spend. |

| Switching Costs | Low transition costs empower customers to switch to competitors or in-house solutions. | Minimal costs for integrating new technology or training staff reduce client dependence. |

| Alternative Channels | Clients can leverage diverse digital advertising platforms and in-house teams. | Global digital ad spend exceeded $600 billion in 2024, with AI platforms enhancing efficiency. |

| Client Capabilities | Large clients may develop proprietary lead generation systems, reducing reliance on QuinStreet. | Major players might invest millions in in-house marketing tech, gaining control and potential cost savings. |

Full Version Awaits

QuinStreet Porter's Five Forces Analysis

This preview showcases the exact QuinStreet Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of competitive forces within the industry. You'll gain immediate access to this professionally formatted document, providing actionable insights into supplier power, buyer bargaining power, threat of new entrants, threat of substitutes, and industry rivalry. Rest assured, what you see is precisely what you get—a complete and ready-to-use strategic tool.

Rivalry Among Competitors

The performance marketing and lead generation sector is intensely competitive, featuring a wide array of participants from large, broad digital marketing agencies to highly focused lead generation specialists. QuinStreet navigates this crowded space, contending with both well-established industry giants and agile, niche newcomers, which results in a fragmented market where client acquisition is a constant battle.

The digital advertising and lead generation sectors are booming, fueled by widespread digitalization and the increasing use of digital marketing tools. This robust expansion offers ample room for various companies to thrive, which can help to moderate intense competition.

Global digital ad spending is anticipated to reach a substantial figure by 2025, and the B2B lead generation market is also showing strong upward momentum. For instance, Statista projected global digital ad spending to surpass $800 billion in 2024.

QuinStreet differentiates itself through its proprietary technology, the QuinStreet Marketing Platform (QMP), which leverages AI for precise targeting and lead quality. This technological sophistication, coupled with deep vertical expertise, allows them to connect high-intent consumers with service providers more effectively than competitors. For instance, in 2024, QuinStreet reported significant advancements in its AI capabilities, aiming to further refine lead scoring and matching algorithms.

Exit Barriers for Competitors

Exit barriers in the performance marketing space are significant, often trapping companies in a cycle of intense competition. These barriers include substantial investments in proprietary technology platforms, which are difficult to recoup if a company decides to leave. For instance, developing and maintaining sophisticated AI-driven bidding algorithms or advanced analytics dashboards requires millions in upfront and ongoing capital.

Furthermore, long-term contracts with major clients can lock competitors into the market, even if their performance falters. These agreements often stipulate penalties for early termination, making a clean exit financially unviable. The need to maintain a critical mass of publisher and advertiser relationships also acts as a deterrent; severing these ties can damage a company's reputation and future prospects in the broader digital advertising ecosystem.

- Specialized Technology: High costs associated with proprietary ad tech platforms and data analytics tools.

- Client Contracts: Long-term agreements with performance guarantees and early termination penalties.

- Media Relationships: The necessity of maintaining a broad network of publishers and advertisers to operate effectively.

- Brand Reputation: The risk of damaging brand equity by exiting a market prematurely, impacting future business opportunities.

Competitor Strategies and Aggressiveness

Competitive rivalry within the digital marketing technology sector is particularly fierce, driven by companies constantly pushing the boundaries with AI-powered personalization and automation. For instance, in 2024, many platforms are heavily investing in AI to enhance customer engagement and operational efficiency, aiming to capture market share through superior technology.

This intense competition is further fueled by strategic moves like expansion into adjacent market verticals and aggressive pricing strategies. Companies are not just competing on features but also on accessibility and reach, seeking to become comprehensive solutions providers. This dynamic is evident as firms broaden their service offerings to cater to a wider array of industries, often leveraging economies of scale to offer more competitive pricing structures.

The ongoing shift towards first-party data strategies and the adoption of omnichannel approaches are also significant drivers of competitive intensity. As regulatory landscapes evolve and consumer privacy concerns grow, companies that can effectively leverage first-party data and deliver seamless cross-channel experiences gain a distinct advantage. New measurement models are emerging to better quantify the impact of these strategies, adding another layer to the competitive landscape.

Key competitive strategies observed in 2024 include:

- AI-Driven Innovation: Continuous development and deployment of AI for personalization, predictive analytics, and automated campaign management.

- Market Expansion: Entry into new industry verticals and geographic regions to diversify revenue streams and customer bases.

- Pricing Agility: Implementation of flexible and competitive pricing models to attract and retain clients amidst market saturation.

- Data Strategy Evolution: Focus on building and utilizing first-party data sets and developing robust omnichannel customer engagement capabilities.

Competitive rivalry in the performance marketing sector is exceptionally high, with numerous players vying for client attention and market share. This intense competition is driven by the sector's growth, with global digital ad spending projected to exceed $800 billion in 2024, creating a dynamic environment where differentiation is key.

Companies like QuinStreet face pressure from both large, established agencies and smaller, specialized firms. This fragmentation necessitates continuous innovation, particularly in areas like AI-driven targeting and lead quality enhancement, as seen in QuinStreet's 2024 advancements in its QMP platform.

The market's attractiveness, fueled by digitalization, means new entrants can emerge, further intensifying competition. Strategic responses include expanding into new verticals and adopting aggressive pricing, as many firms in 2024 are focusing on AI for efficiency and customer engagement.

Exit barriers, such as significant investments in proprietary technology and long-term client contracts, can also trap companies in this competitive cycle, making it difficult to disengage even when facing strong rivalry.

| Factor | Description | Impact on Rivalry |

|---|---|---|

| Market Growth | Digital ad spending projected over $800 billion in 2024. | Attracts new entrants, increasing competition. |

| Number of Competitors | Fragmented market with large agencies and niche specialists. | Intensifies rivalry for clients and talent. |

| Technological Advancements | AI-driven personalization and automation are key differentiators. | Forces continuous investment and innovation. |

| Exit Barriers | High costs of proprietary tech and client contracts. | Can lead to prolonged competitive battles. |

SSubstitutes Threaten

Consumers in 2024 are more empowered than ever, directly researching and comparing service providers through search engines, review sites, and social media. This direct access bypasses the need for intermediaries like QuinStreet, making these self-service research channels a potent substitute.

For instance, the proliferation of platforms like Trustpilot and Google Reviews allows consumers to gather extensive information and peer feedback, directly challenging the value proposition of lead generation services. This trend was evident in 2023, with a significant portion of consumers reporting they begin their purchase journey with online search, often bypassing initial lead generation steps.

Larger service providers are increasingly building in-house digital marketing teams. For instance, many major financial institutions and large e-commerce players now manage their SEO, SEM, and content creation internally, reducing reliance on external performance marketing agencies. This trend directly impacts companies like QuinStreet by offering clients an alternative to outsourced lead generation and customer acquisition, potentially diminishing the need for their core services.

While digital advertising captures significant attention, traditional channels like television, radio, print, and outdoor advertising continue to function as substitutes for acquiring new customers. These channels are adapting; for instance, streaming TV advertising and the burgeoning retail media networks offer brands ways to connect with consumers, even if their measurement approaches differ from purely digital platforms.

Direct Sales and Referrals

For many businesses, especially those in B2B or high-value B2C markets, direct sales and customer referrals act as significant substitutes to digital lead generation platforms. These personal connections can bypass the need for outsourced lead acquisition.

The effectiveness of direct sales is evident in industries like enterprise software and luxury goods, where building trust through personal interaction is paramount. For instance, a 2024 study by Forrester indicated that 70% of B2B buyers prefer direct sales engagement for complex purchases.

Word-of-mouth marketing, fueled by satisfied customers, also presents a potent alternative.

- Direct sales teams can build deeper relationships and understand nuanced customer needs, offering a personalized alternative to aggregated lead lists.

- Customer referrals, often seen as highly qualified leads, reduce acquisition costs and increase conversion rates, with studies showing referral leads convert 30% higher than other lead types.

- In 2024, businesses continued to invest in building strong customer success programs to foster organic referrals and repeat business, recognizing their value as a substitute for paid lead generation.

- The human element in direct sales and referrals provides a level of trust and credibility that can be difficult for digital platforms to replicate, especially for high-consideration purchases.

Emerging Technologies and Platforms

The rapid advancement of technologies like AI-powered conversational assistants and shoppable content presents a significant threat of substitutes. These innovations offer consumers new ways to discover and purchase products, potentially bypassing traditional marketing and sales channels. For instance, the rise of integrated e-commerce within social media platforms allows for direct purchases without leaving the app, diminishing the need for external website visits.

New social commerce platforms are emerging, creating alternative pathways for consumer engagement and transactions. These platforms can streamline the buying process, offering a more seamless experience than many existing models. By 2024, the global social commerce market was projected to reach over $2 trillion, highlighting its growing influence as a substitute for conventional retail methods.

These technological shifts pose a long-term substitution threat by enabling direct consumer-brand interaction and purchase. They can disrupt established lead generation and customer acquisition strategies. Consider the impact of AI chatbots on customer service; they can handle inquiries and guide purchases, reducing reliance on human sales representatives.

- AI-driven conversational assistants offer personalized shopping experiences and direct purchase capabilities.

- Shoppable content integrates product discovery and purchase directly within media, reducing friction.

- New social commerce platforms facilitate seamless transactions, bypassing traditional online retail journeys.

- These emerging technologies can erode the effectiveness of existing lead generation models by offering more efficient alternatives.

Consumers increasingly bypass traditional intermediaries by directly researching providers online, turning search engines and review sites into powerful substitutes. This self-service trend, amplified in 2024, directly challenges lead generation services. For example, platforms like Google Reviews empower consumers with peer feedback, diminishing the need for outsourced lead acquisition.

Businesses are also building internal capabilities, with many large firms now managing their digital marketing in-house. This reduces reliance on external agencies for customer acquisition, presenting a direct alternative to services like QuinStreet's. The shift towards internal expertise was a notable trend throughout 2023 and into 2024.

Traditional advertising channels are adapting and continuing to serve as substitutes, with innovations in streaming TV and retail media networks offering new avenues for customer connection. Furthermore, direct sales and customer referrals remain strong alternatives, particularly in B2B markets where personalized engagement is key; a 2024 Forrester study noted 70% of B2B buyers prefer direct sales for complex purchases.

Emerging technologies like AI-powered assistants and shoppable content offer increasingly seamless consumer discovery and purchase paths, potentially bypassing existing marketing models. Social commerce, projected to exceed $2 trillion globally by 2024, exemplifies this, creating new transaction pathways that compete with traditional online retail.

Entrants Threaten

Establishing a competitive performance marketing company, similar to QuinStreet, demands substantial capital. This includes significant investment in proprietary technology, robust data infrastructure, and attracting top talent in marketing, data science, and engineering. High initial media spend is also crucial to achieve necessary scale.

These considerable financial barriers effectively deter many potential new entrants from entering the performance marketing space. For example, in 2024, the average cost for a startup to achieve significant market presence in digital advertising can easily run into millions of dollars, covering technology development, customer acquisition costs, and ongoing operational expenses.

QuinStreet's proprietary technology and vast data assets present a significant hurdle for potential new entrants. These sophisticated media management platforms, honed over years, are crucial for efficiently segmenting, qualifying, and matching consumers with clients. The sheer scale and complexity of accumulating and effectively utilizing such extensive datasets, a process that can take years and substantial investment, create a formidable barrier.

Building strong client relationships and a solid brand reputation is a major hurdle for new entrants in the financial and home services sectors. It takes considerable time and a demonstrated history of success to earn the trust of large, valuable clients.

Newcomers struggle to persuade major brands to switch from established providers, who have already built credibility. For instance, in the lead generation space, companies like QuinStreet rely on years of data and proven performance metrics to attract and retain clients, making it difficult for a new player to gain immediate traction.

The cost and effort required to establish brand recognition and prove reliability to enterprise-level clients are substantial. This deterrent significantly weakens the threat of new entrants, as they must overcome deeply entrenched trust and established performance benchmarks.

Regulatory Hurdles and Compliance

The lead generation and performance marketing sector faces a significant threat from new entrants due to stringent regulatory landscapes. Compliance with data privacy laws like GDPR and CCPA, along with consumer communication regulations such as TCPA, demands substantial investment and expertise. New companies must navigate these complex legal frameworks, which are constantly evolving, presenting a considerable barrier to entry.

QuinStreet's own experience in adapting to FCC-driven TCPA changes underscores the difficulty new players face. These regulatory hurdles require dedicated legal teams and robust compliance infrastructure, resources that nascent businesses may struggle to acquire. For instance, the cost of ensuring compliance with data protection regulations can run into millions of dollars annually for established companies, a prohibitive sum for startups.

- Data Privacy Compliance Costs: Companies are investing heavily in data privacy measures, with some reporting annual compliance costs exceeding $1 million.

- Consumer Communication Regulations: Adherence to TCPA and similar laws necessitates sophisticated consent management platforms and call-blocking technologies.

- Evolving Legal Landscape: The dynamic nature of regulations requires continuous monitoring and adaptation, adding to operational complexity and cost for new entrants.

Access to Qualified Traffic Sources

Gaining access to high-quality digital traffic sources at a reasonable cost is a significant hurdle for newcomers in performance marketing. Established companies often leverage existing relationships and extensive historical data to optimize their media spend, giving them a distinct advantage.

These existing players benefit from economies of scale in their media buying, making it challenging for new entrants to compete on cost and efficiency. For instance, in 2024, major performance marketing platforms reported significant year-over-year increases in customer acquisition costs across key channels, highlighting the increasing competition for premium traffic.

- High Customer Acquisition Costs: In 2024, average customer acquisition costs (CAC) for digital advertising in competitive sectors like finance and e-commerce frequently exceeded $100, demonstrating the expense of obtaining new customers.

- Established Partnerships: Leading companies often secure preferential rates and access to premium inventory on ad networks due to long-standing partnerships and high spending volumes.

- Data Advantage: Incumbents possess vast troves of historical performance data, enabling more precise targeting and efficient allocation of marketing budgets, a capability difficult for new entrants to build rapidly.

The threat of new entrants for QuinStreet is moderate, primarily due to high capital requirements and established brand loyalty. Significant investment in technology, data infrastructure, and talent, alongside substantial media spend, creates a formidable barrier. For example, in 2024, achieving market presence in digital advertising often demanded millions in initial investment.

QuinStreet's proprietary technology and extensive data assets are crucial competitive advantages, making it difficult for newcomers to replicate their efficiency and targeting capabilities. Building client trust and demonstrating a proven track record, especially with large brands in sectors like finance and home services, takes years and considerable effort, further deterring new players.

Regulatory compliance, particularly concerning data privacy and consumer communication laws, adds another layer of complexity and cost for potential entrants. Navigating evolving legal landscapes and investing in robust compliance infrastructure can be prohibitive for startups. For instance, annual data protection compliance costs can easily exceed $1 million for established firms.

Access to quality traffic sources at competitive prices is also a challenge, as incumbents benefit from economies of scale and established partnerships. In 2024, customer acquisition costs across key digital advertising channels saw significant increases, underscoring the difficulty new entrants face in competing on efficiency and cost.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data, including detailed financial reports from public companies, proprietary market research from leading firms, and extensive industry-specific publications.