QuinStreet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QuinStreet Bundle

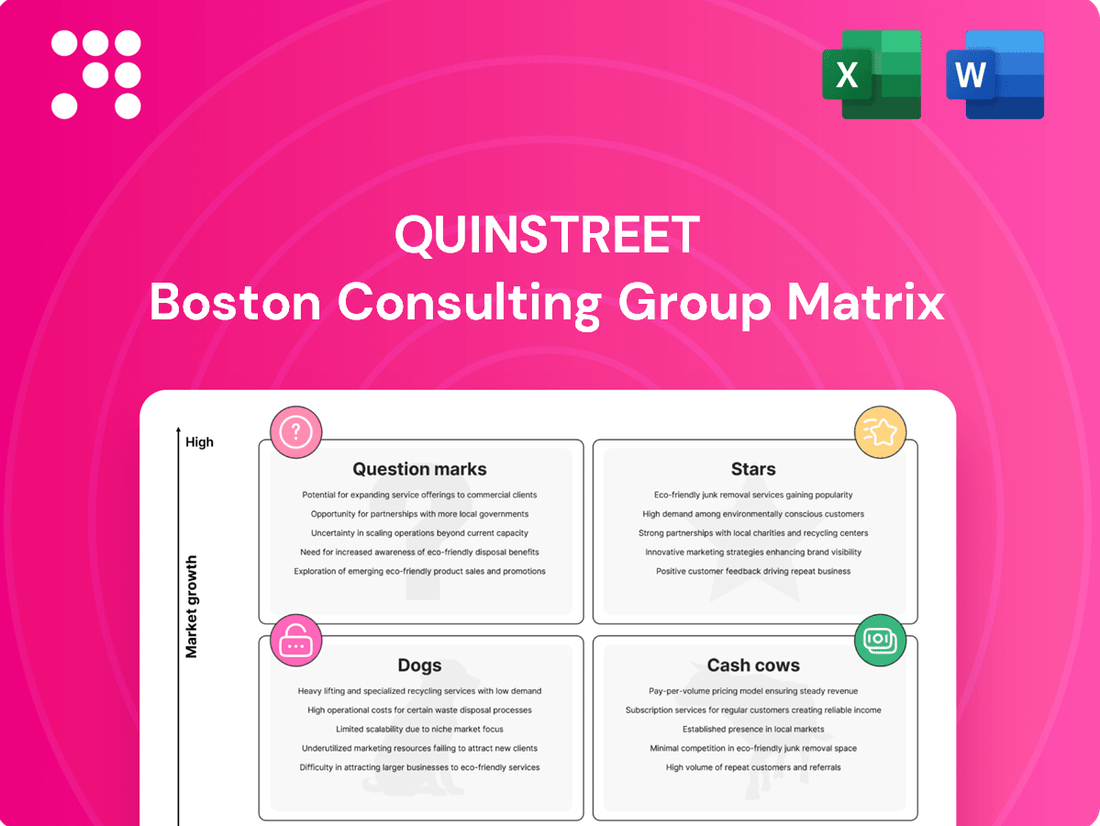

Curious about QuinStreet's strategic positioning? This glimpse into their BCG Matrix reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't settle for a partial view; purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

QuinStreet's auto insurance vertical is a standout performer, demonstrating explosive growth. Revenue surged by an impressive 664% year-over-year in Q1 fiscal 2025 and continued its strong trajectory with 615% growth in Q2 fiscal 2025. This remarkable expansion highlights QuinStreet's dominant position in the rapidly expanding digital insurance distribution market.

The company is strategically investing in increasing and optimizing its media supply to satisfy the high demand from carriers in this segment. This focus is geared towards achieving further margin expansion, solidifying auto insurance's status as a Star in QuinStreet's portfolio. Its substantial growth indicates a high market share in a booming sector, justifying significant investment for future returns.

The non-insurance financial services sector, encompassing personal loans, credit cards, and banking, demonstrated robust expansion. QuinStreet reported a remarkable 192% year-over-year revenue increase in Q1 fiscal 2025 and a significant 78% growth in Q3 fiscal 2025. This performance is largely attributed to a favorable interest rate environment, which stimulates demand for these financial products.

QuinStreet's success in driving substantial growth across such a varied range of financial offerings highlights its strong market presence and the considerable expansion opportunities within this vertical. The company's strategic emphasis on these information-rich, high-value markets solidifies its position as a Star in the BCG matrix.

QuinStreet's proprietary media management technology platform, QMP, is a significant advantage, allowing clients to connect with high-intent digital traffic efficiently and at a large scale. This technology is central to the performance of its rapidly expanding business sectors, as it refines media acquisition and lead generation processes.

The company's ongoing commitment to enhancing QMP with new services, features, and artificial intelligence capabilities underscores its strategic value and its role in staying ahead in a constantly evolving marketplace. For instance, in fiscal year 2023, QuinStreet reported a 10% increase in revenue, partly attributed to the ongoing optimization driven by QMP.

Expanded Client and Media Footprints

QuinStreet's strategy centers on broadening its client roster and boosting media supply to satisfy increasing demand across its various business sectors.

This expansion is fueled by diversifying media sources, incorporating search engine marketing (SEM), search engine optimization (SEO), social media, mobile, email, and call centers to consistently fulfill client requirements.

The company's aggressive push, especially within the insurance vertical, highlights a growth-oriented approach aimed at securing substantial market share. For instance, in 2024, QuinStreet reported a significant increase in lead volume generated across its insurance verticals, demonstrating the success of its expanded media footprint.

- Client Base Expansion: QuinStreet is actively acquiring new clients, particularly in high-demand sectors like insurance.

- Media Supply Augmentation: The company is increasing its media inventory through diverse channels to meet client needs.

- Vertical Focus: A key element of their strategy involves aggressive growth in specific verticals, such as insurance, to capture market share.

- 2024 Performance: Reports indicate a substantial uptick in lead generation in 2024, validating the effectiveness of their client and media expansion strategies.

New Lending Products within Home Services

QuinStreet's strategic move to introduce new lending products within its home services division positions these offerings as Stars in the BCG matrix. This expansion leverages the established strength of the home services vertical, which is already a Cash Cow, by offering enhanced financing solutions to clients undertaking projects.

This initiative is designed to capture a larger share of a burgeoning market, specifically targeting the growing demand for accessible financing in home improvement and repair. The home services sector is projected to see continued growth, with some reports indicating a market size exceeding $500 billion in the US by 2024.

- Star: New lending products within QuinStreet's home services division.

- Market Potential: Tapping into the growing demand for project financing in the home services sector.

- Strategic Rationale: Leveraging the existing Cash Cow status of home services to introduce high-growth lending products.

- Investment Focus: Requiring investment to secure new market share and capitalize on lending opportunities.

QuinStreet's auto insurance and non-insurance financial services verticals are firmly positioned as Stars in its BCG matrix. The auto insurance segment experienced explosive revenue growth, with a 664% year-over-year increase in Q1 fiscal 2025 and 615% in Q2 fiscal 2025, driven by strategic media investment and high carrier demand. Similarly, non-insurance financial services saw robust expansion, with 192% year-over-year revenue growth in Q1 fiscal 2025 and 78% in Q3 fiscal 2025, benefiting from favorable interest rates.

| Vertical | BCG Category | Key Growth Drivers | Fiscal Q1 2025 YoY Growth | Fiscal Q3 2025 YoY Growth |

| Auto Insurance | Star | High demand from carriers, strategic media investment | 664% | N/A (Strong Q2 performance noted) |

| Non-Insurance Financial Services | Star | Favorable interest rate environment, strong demand for financial products | 192% | 78% |

What is included in the product

This BCG Matrix analysis provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of QuinStreet's business units, simplifying strategic decision-making.

Cash Cows

The Home Services vertical is a clear Cash Cow for QuinStreet, demonstrating robust and consistent performance. In fiscal year 2025, it achieved a significant 32% year-over-year growth in Q1, followed by 21% growth in both Q2 and Q3.

This segment is generating record revenue and is projected to sustain its double-digit growth trajectory. This strong, stable cash flow is crucial for QuinStreet, as it provides the necessary capital to invest in and nurture other promising areas of the business.

QuinStreet's established performance marketing model, centered on paying for successful outcomes like clicks, leads, or customers, is a significant cash cow. This efficiency translates into robust profit margins and predictable revenue streams, as QuinStreet is compensated for delivering tangible results to its clients.

The company's deep-rooted, multi-year client partnerships underscore the stability and market dominance of this core business. In 2024, QuinStreet continued to leverage this model, with its financial reports indicating a strong and consistent contribution from these established performance marketing verticals, reinforcing its position in a mature industry.

QuinStreet's diversified media sourcing acts as a robust cash cow, consistently feeding its business with a steady stream of qualified leads. This strategy, honed over years, leverages a mix of owned organic sites, paid search, social media, and email marketing to attract visitors.

In 2024, QuinStreet continued to benefit from this established traffic generation capability. This broad media footprint means the company can efficiently connect clients with potential customers without needing substantial new capital outlays for market expansion, a key characteristic of a cash cow.

Optimized Media Supply and Margins

QuinStreet's commitment to optimizing media supply and enhancing margins in its established business areas solidifies their position as cash cows. This strategic focus on operational efficiency and financial discipline allows the company to extract maximum cash from mature, high-market-share offerings.

By continuously improving how they manage their media resources and cost structures, QuinStreet ensures these segments remain highly profitable. This approach minimizes the need for significant investment in new market development, directly contributing to the cash generated.

- Focus on operational effectiveness: QuinStreet actively refines its processes to improve media supply chain efficiency.

- Margin expansion initiatives: The company implements strategies to broaden profit margins in its core, mature businesses.

- Maximizing cash generation: These optimized segments are key drivers of consistent cash flow for QuinStreet.

- Reduced reliance on new market development: The cash cow status means these areas are self-sustaining and profitable without extensive new investment.

Strong Balance Sheet and Cash Flow Generation

QuinStreet demonstrates exceptional financial strength, notably maintaining a robust balance sheet. As of early 2024, the company reported substantial cash reserves and notably, no outstanding bank debt. This financial discipline underpins its capacity for sustained operations and strategic investments.

The company's ability to generate significant operating cash flow is a key indicator of its "Cash Cow" status within the BCG framework. This strong cash generation, fueled by its established and profitable market segments, means QuinStreet consistently produces more cash than it needs for its day-to-day operations.

- Strong Cash Position: QuinStreet ended recent quarters with significant cash on hand, providing financial flexibility.

- Zero Bank Debt: The absence of bank debt highlights a healthy balance sheet and reduced financial risk.

- Robust Operating Cash Flow: Profitable operations in mature segments consistently generate substantial cash.

- Strategic Capital Deployment: Surplus cash allows for funding new growth opportunities or shareholder returns.

QuinStreet's Home Services vertical is a prime example of a Cash Cow, showing impressive year-over-year growth. In fiscal year 2025, Q1 saw 32% growth, followed by 21% in both Q2 and Q3, indicating sustained strength. This segment consistently generates substantial revenue, providing vital capital for other business areas.

The company's core performance marketing model, which focuses on paying for tangible outcomes like leads or customers, is a significant Cash Cow. This efficiency leads to strong profit margins and predictable revenue, as QuinStreet is compensated for delivering concrete results to its clients.

QuinStreet's diversified media sourcing consistently supplies qualified leads, acting as another Cash Cow. This strategy, combining owned organic sites, paid search, social media, and email marketing, efficiently connects clients with potential customers without requiring extensive new capital for market expansion.

The company's financial health, including substantial cash reserves and no outstanding bank debt as of early 2024, further supports its Cash Cow status. This strong operating cash flow, generated from established and profitable segments, allows for strategic capital deployment.

| Segment | FY25 Q1 Growth | FY25 Q2 Growth | FY25 Q3 Growth | Status |

| Home Services | 32% | 21% | 21% | Cash Cow |

| Performance Marketing | N/A (Model) | N/A (Model) | N/A (Model) | Cash Cow |

| Media Sourcing | N/A (Strategy) | N/A (Strategy) | N/A (Strategy) | Cash Cow |

Delivered as Shown

QuinStreet BCG Matrix

The QuinStreet BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means you can confidently assess the strategic insights and professional presentation of the report, knowing it's precisely what you'll download. You're not seeing a sample or a mockup; this is the actual, analysis-ready BCG Matrix ready for your business planning.

Dogs

Underperforming niche verticals within QuinStreet's portfolio, while not explicitly itemized in recent public disclosures, would represent segments with minimal market share and low growth potential. These areas typically drain resources without generating substantial revenue or profit, fitting the description of low market share in low-growth markets according to the BCG Matrix framework. For example, if QuinStreet had a small presence in a highly specialized, declining B2B software category, it would likely be categorized here.

QuinStreet might still carry legacy products whose demand is on the decline. These are offerings that have been overtaken by newer technologies or market shifts, leading to a shrinking market share. For instance, if QuinStreet had a significant presence in a specific print advertising channel that has seen its readership plummet by, say, 15% year-over-year in 2024, those related product lines would fall into this category.

Products in this segment typically operate in stagnant or contracting markets, contributing little to overall revenue while potentially still requiring maintenance expenses. The company's business model evolution, which focuses on digital transformation and high-growth areas, implies a strategic effort to sunset or de-emphasize these less relevant offerings.

Segments facing significant regulatory hurdles and slow adaptation are categorized as Dogs in the QuinStreet BCG Matrix. For instance, if QuinStreet struggles to adjust its lead generation strategies to comply with evolving Federal Communications Commission (FCC) Telephone Consumer Protection Act (TCPA) regulations, a segment heavily reliant on telemarketing could falter.

Should these regulatory changes substantially hinder client acquisition and QuinStreet's ability to pivot its approach, such a segment risks losing market share. For example, if a specific vertical within QuinStreet's portfolio, like insurance lead generation, experiences a sharp decline in inbound calls due to stricter consent requirements, and the company's digital acquisition efforts in that area are not yet robust enough to compensate, it would represent a Dog.

Non-Strategic Acquisitions Failing to Integrate

Non-strategic acquisitions that struggle with integration or fail to capture market share represent potential Cash Cows that are beginning to falter. If QuinStreet has acquired businesses outside its core financial and home services sectors, and these ventures haven't met growth or profitability targets, they could be categorized here. For instance, if an acquisition made in 2023 for $50 million, intended to expand into a new tech vertical, is only generating $5 million in annual revenue by mid-2024 and showing no signs of significant improvement, it would fit this description.

These are ventures where the initial investment hasn't translated into a sustained market presence or profitability, essentially becoming a drain on resources without contributing significantly to the company's overall growth. Without specific public disclosures of failed integrations, this classification remains hypothetical but is a critical consideration in portfolio management.

- Struggling Integration: Acquisitions that haven't been smoothly integrated into QuinStreet's existing operations, leading to operational inefficiencies or missed market opportunities.

- Underperformance: Ventures that have failed to achieve their projected market share or revenue growth targets post-acquisition, particularly those outside core verticals.

- Resource Drain: Businesses that consume significant capital and management attention without generating commensurate returns, potentially impacting other, more successful parts of the portfolio.

Markets with Intense, Unsustainable Competition

Markets characterized by intense, unsustainable competition can quickly become Dogs in the BCG Matrix. If QuinStreet finds itself in a digital marketing niche where advertising costs are prohibitively high, perhaps due to a bidding war for keywords that drives up Cost Per Click (CPC) beyond profitability, its market share and margins will suffer.

This intense rivalry, often seen in crowded performance marketing sectors, can erode profitability. For instance, if a particular lead generation vertical sees dozens of players bidding aggressively, the Cost Per Acquisition (CPA) might rise to a point where even a strong conversion rate yields minimal profit. This unsustainable environment, coupled with an inability for QuinStreet to establish a unique value proposition or operational efficiency advantage, would classify it as a Dog.

Consider a scenario where QuinStreet operates in a segment where customer acquisition costs exceed the lifetime value of a customer due to fierce competition. In 2024, many digital advertising platforms reported significant increases in ad spend, with some industry reports indicating a 15-20% year-over-year rise in CPCs across major networks for competitive terms. If QuinStreet cannot command premium pricing or achieve superior conversion rates in such a market, it risks becoming a low-growth, low-market-share business.

- Unsustainable Media Costs: Intense competition drives up advertising expenses, making customer acquisition unprofitable.

- Compressed Margins: High operational costs and price pressure leave little room for profit.

- Lack of Differentiation: Inability to offer unique value makes it difficult to stand out and command better terms.

- Resource Drain: A market segment that requires significant investment but yields minimal returns becomes a drain on company resources.

Dogs in QuinStreet's portfolio represent business segments with low market share in low-growth markets. These are often legacy products or ventures struggling with integration and intense competition, draining resources without significant returns. For instance, a digital marketing niche with prohibitively high advertising costs, where CPCs rose by 15-20% year-over-year in 2024, could be a prime example if QuinStreet cannot achieve profitability.

These underperforming areas might include specific verticals where QuinStreet has minimal market presence and faces declining demand, such as print advertising channels that saw readership plummet by 15% in 2024. Such segments require ongoing maintenance but contribute little to overall revenue.

Segments facing significant regulatory hurdles, like adapting to stricter FCC TCPA regulations for lead generation, could also be classified as Dogs. If QuinStreet's digital acquisition efforts aren't robust enough to compensate for challenges in areas like telemarketing, these segments risk losing market share.

Non-strategic acquisitions that fail to integrate or capture market share, like a $50 million acquisition in 2023 only generating $5 million in revenue by mid-2024, also fit this category. These ventures consume capital and management attention without delivering commensurate returns.

Question Marks

QuinStreet is strategically targeting business insurance for expansion, recognizing it as a significant growth avenue. This sector is characterized by a high growth rate, yet QuinStreet currently holds a minimal market share, positioning it as a classic Question Mark in the BCG matrix.

The company anticipates substantial investment will be necessary to establish a strong market presence and attract customers within this emerging segment. For instance, the U.S. commercial insurance market was valued at approximately $270 billion in 2023 and is projected to grow, presenting a substantial opportunity for QuinStreet to capture a share.

QuinStreet's focus on agent-driven insurance distribution represents a significant expansion into a market segment where it's currently under-indexed, estimated to be nearly half of the total addressable insurance market. This strategic push aims to capture substantial growth by tapping into this largely unaddressed channel.

The company's increased exposure to agent-driven carriers signals a clear intent to move this segment from a Question Mark to a Star in the BCG Matrix. This transition, however, necessitates dedicated investment to build market share and capitalize on the identified opportunity.

In 2024, the insurance industry saw continued evolution in distribution models. While direct-to-consumer channels remain strong, the agent channel continues to hold significant sway, particularly for complex products and personalized advice. QuinStreet's move acknowledges this persistent market reality.

Expanding into new geographic markets, whether within the United States or internationally, would classify as a Question Mark for QuinStreet. These ventures present the allure of high growth potential, aligning with QuinStreet's stated interest in 'big market opportunities.' However, they necessitate significant upfront capital for market entry, brand building, and customer acquisition to carve out a competitive position.

Early-Stage AI-Powered Product Features

QuinStreet's strategy of integrating AI into its products positions these features as potential Stars in the BCG matrix. While still in early adoption, these AI-powered tools, such as personalized lead scoring and predictive analytics for customer behavior, are designed to significantly enhance platform capabilities and user experience.

- AI-driven lead qualification: Enhances conversion rates by identifying high-intent prospects.

- Predictive analytics for customer churn: Proactively addresses retention challenges.

- Personalized content delivery: Improves user engagement and campaign effectiveness.

- Automated campaign optimization: Drives efficiency and ROI for clients.

The investment in these nascent AI features reflects a forward-looking approach, aiming to capture future market share in an increasingly data-driven landscape. By focusing on innovation, QuinStreet seeks to differentiate its offerings and establish a strong competitive advantage as AI adoption matures across the digital marketing sector.

Emerging Digital Media Channels

Emerging digital media channels represent new avenues for reaching consumers, and QuinStreet's strategic approach to these is key. By actively exploring and investing in these evolving platforms, QuinStreet positions itself to capture future growth. This adaptability is crucial in a dynamic digital landscape where consumer attention shifts rapidly.

QuinStreet's focus on building and partnering with vertical content websites indicates a commitment to leveraging these emerging channels. This strategy allows them to establish a presence in new, potentially high-growth areas of digital media. Early adoption can lead to significant market share gains as these channels mature.

- Question Marks: Emerging Digital Media Channels

- QuinStreet's Strategy: Adapting media mix, building/partnering with vertical content websites.

- Classification: Star (in BCG Matrix terms, due to high growth potential and early investment).

- Market Context: The digital ad spending in the US was projected to reach $375.5 billion in 2024, with a significant portion flowing into emerging platforms.

QuinStreet's ventures into new geographic markets, whether domestic or international, are classic Question Marks. These areas offer high growth potential, aligning with the company's pursuit of significant market opportunities. However, they demand substantial upfront investment for market entry, brand establishment, and customer acquisition to gain a competitive foothold.

The company's strategic investment in AI-driven features, such as personalized lead scoring and predictive analytics, positions these as potential Stars. While adoption is still in its early stages, these tools are designed to significantly enhance platform capabilities and user experience, aiming to capture future market share as AI adoption grows.

Emerging digital media channels represent another area where QuinStreet is strategically investing. By actively exploring and developing presence on these evolving platforms, the company aims to capture future growth. This adaptability is crucial in the dynamic digital landscape, with US digital ad spending projected to reach $375.5 billion in 2024, a significant portion of which will flow into these newer channels.

| BCG Category | QuinStreet's Focus Area | Market Potential | QuinStreet's Current Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | New Geographic Markets | High Growth | Low | Requires significant investment to build market share. |

| Star | AI-Driven Features | High Growth (emerging) | Low to Moderate (early stage) | Potential for future market leadership with continued innovation and investment. |

| Question Mark/Star (potential) | Emerging Digital Media Channels | High Growth | Low | Strategic investment and partnerships are key to capturing market share in a growing digital ad spend environment. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, competitor analysis, and industry growth projections, to provide a clear strategic overview.