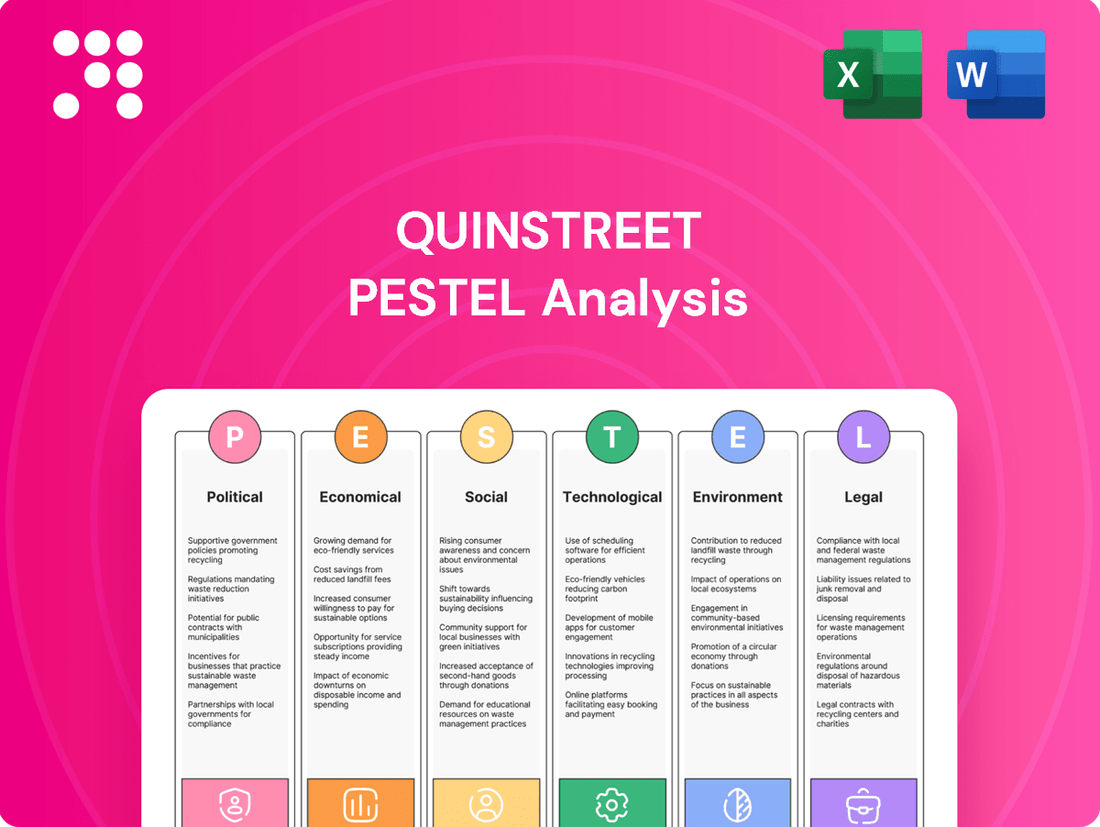

QuinStreet PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QuinStreet Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping QuinStreet's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to help you anticipate market shifts and capitalize on emerging opportunities. Download the full version now and gain a decisive competitive advantage.

Political factors

New data privacy regulations, such as the FCC's 'one-to-one' consent rule for lead generation, set to take effect in January 2025, represent a significant political factor for QuinStreet. This evolving legal landscape mandates explicit, individual consumer consent for marketing outreach, a departure from previous broader consent models.

For QuinStreet, a company deeply involved in performance marketing and lead generation, this shift necessitates a fundamental adaptation of its lead acquisition and distribution strategies. Compliance with these stricter rules could lead to increased operational costs and added complexity in managing consent processes.

Stricter consumer protection laws, like the proposed Consumer Protection (Electronic Trade Transaction) Regulations 2024, are set to significantly impact online marketplaces. These regulations will likely enforce more robust disclosure requirements for product and service information, alongside clearer complaint resolution mechanisms for consumers. For QuinStreet, this necessitates a thorough review of its platform and service provider agreements to ensure full compliance, thereby safeguarding its reputation and avoiding potential fines.

Government bodies and industry associations are tightening their grip on digital advertising, focusing on issues like misleading claims and ad fraud. For QuinStreet, whose business model hinges on delivering high-quality, performance-based leads, adhering to strict ethical advertising standards is paramount to maintaining client trust and the integrity of its lead generation process.

The digital advertising landscape is constantly evolving, and regulatory actions against major platforms for data mishandling or deceptive practices can create ripple effects. For instance, increased scrutiny on data privacy, as seen with ongoing discussions around the future of third-party cookies and evolving GDPR interpretations, directly impacts how lead generation companies like QuinStreet can operate and target audiences effectively.

Antitrust and Market Competition Policies

Global regulatory bodies, including the US Federal Trade Commission (FTC) and the European Commission, are intensifying scrutiny of digital marketplaces and dominant tech firms. For instance, in 2024, the FTC continued investigations into potential monopolistic practices by major online platforms, impacting the broader digital advertising ecosystem. This heightened focus on anti-competitive behavior could indirectly affect QuinStreet by altering the landscape of digital advertising and partnership opportunities.

Policies aimed at fostering fair competition may present both challenges and opportunities for QuinStreet. Stricter regulations on data usage and platform interdependencies could limit certain partnership models, but they might also level the playing field, potentially creating new avenues for growth. For example, proposed legislation in 2025 concerning digital markets could redefine how companies like QuinStreet engage with advertising partners and manage consumer data.

- Increased Regulatory Scrutiny: Global antitrust actions against major tech platforms are a significant political factor.

- Impact on Digital Advertising: Policies promoting fair competition could reshape the digital advertising market where QuinStreet operates.

- Potential for New Opportunities: Regulations aimed at increasing market transparency might benefit companies like QuinStreet by fostering a more competitive environment.

International Trade and Digital Services Taxes

Digital services taxes (DSTs) and evolving data transfer regulations globally present a significant political factor for companies like QuinStreet. For instance, as of early 2024, many European Union countries, including France, Italy, and Spain, have implemented or are in the process of implementing DSTs, typically levying a percentage on the revenue generated from digital services within their borders. These taxes can directly impact profitability for online marketing firms that rely on cross-border data flows and digital advertising revenue.

QuinStreet's international operations and its ability to serve global clients are directly affected by these policies. Navigating varying DST rates, which can range from 1% to 5% of revenue in some jurisdictions, and complex data localization requirements, which mandate that certain data must be stored within a country's physical borders, increases compliance burdens and operational costs. For example, the EU's General Data Protection Regulation (GDPR) has already set a precedent for stringent data handling, and DSTs add another layer of financial and regulatory complexity.

- Digital Services Taxes (DSTs): Many countries, particularly in Europe, have introduced or are considering DSTs, impacting revenue for digital service providers.

- Data Transfer Regulations: Cross-border data transfer restrictions and data localization laws can complicate global operations and increase compliance costs.

- Impact on QuinStreet: These policies can influence media acquisition strategies and client service delivery, potentially raising operating expenses and affecting profitability for international operations.

- Compliance Burden: Adhering to diverse international tax laws and data privacy regulations requires significant investment in legal and technical infrastructure.

New data privacy regulations, such as the FCC's 'one-to-one' consent rule for lead generation, effective January 2025, mandate explicit consumer consent, impacting QuinStreet's lead acquisition strategies and potentially increasing operational costs. Stricter consumer protection laws, like the proposed Consumer Protection (Electronic Trade Transaction) Regulations 2024, will enforce more robust disclosure and complaint resolution, requiring QuinStreet to review its platform agreements to ensure compliance and avoid fines.

Government bodies are increasing scrutiny on digital advertising, focusing on misleading claims and ad fraud. QuinStreet must adhere to strict ethical advertising standards to maintain client trust. Regulatory actions against major platforms for data mishandling, such as ongoing discussions around third-party cookies and GDPR interpretations, directly affect how QuinStreet operates and targets audiences.

Global regulatory bodies are intensifying scrutiny of digital marketplaces. For instance, the FTC continued investigations into potential monopolistic practices by major online platforms in 2024, impacting the broader digital advertising ecosystem and potentially affecting QuinStreet's partnership opportunities. Policies promoting fair competition could redefine how QuinStreet engages with advertising partners and manages consumer data, with proposed legislation in 2025 set to influence these dynamics.

Digital services taxes (DSTs) and evolving data transfer regulations globally present significant challenges. Many EU countries implemented DSTs by early 2024, levying a percentage on revenue from digital services, impacting QuinStreet's profitability. Navigating varying DST rates and data localization requirements increases compliance burdens and operational costs, as demonstrated by the GDPR's precedent for stringent data handling.

| Political Factor | Description | Potential Impact on QuinStreet | Example/Data Point |

| Data Privacy Regulations | Stricter consent requirements for lead generation. | Increased operational costs, adaptation of lead acquisition strategies. | FCC's 'one-to-one' consent rule (Jan 2025). |

| Consumer Protection Laws | Enhanced disclosure and complaint resolution for online transactions. | Need to review platform agreements, potential for fines. | Proposed Consumer Protection (Electronic Trade Transaction) Regulations 2024. |

| Digital Advertising Scrutiny | Focus on misleading claims and ad fraud. | Requirement for strict ethical standards, maintaining client trust. | Ongoing discussions on third-party cookies and GDPR. |

| Antitrust & Competition Policies | Investigations into monopolistic practices by tech giants. | Alteration of digital advertising landscape, potential impact on partnerships. | FTC investigations in 2024, proposed digital markets legislation (2025). |

| Digital Services Taxes (DSTs) | Taxes on revenue from digital services. | Reduced profitability, increased compliance costs for international operations. | EU countries implementing DSTs (e.g., France, Italy) by early 2024. |

What is included in the product

This QuinStreet PESTLE analysis systematically examines the impact of Political, Economic, Social, Technological, Environmental, and Legal forces on the company's operations and strategic positioning.

The QuinStreet PESTLE analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain point of wading through extensive detail.

Economic factors

QuinStreet's financial health is closely linked to the broader economic landscape, particularly consumer spending and advertising budgets. When the economy is strong, consumers tend to spend more on services like financial products and home improvements, which directly benefits QuinStreet's clients. This increased consumer confidence often translates into higher advertising expenditures from these clients, boosting QuinStreet's revenue streams.

For instance, in 2024, while inflation has shown signs of moderating, concerns about interest rates and consumer discretionary spending persist. A key indicator to watch is the US Personal Consumption Expenditures (PCE) price index, which provides insights into consumer spending habits and inflationary pressures. If consumer spending remains robust, QuinStreet's client base is likely to maintain or increase their marketing investments.

Conversely, an economic slowdown or persistent inflation can dampen consumer enthusiasm and reduce their purchasing power. This often leads businesses to tighten their belts, cutting back on marketing and advertising budgets. For QuinStreet, this means a potential decrease in demand for its services, impacting its revenue and overall performance.

High inflation, as seen with the US CPI reaching 3.4% year-over-year in April 2024, directly impacts QuinStreet's clients by reducing their customers' spending power and raising their own operational expenses. This economic pressure forces businesses to scrutinize their marketing investments more closely, seeking demonstrable returns.

The Federal Reserve's monetary policy, including interest rate adjustments, significantly affects QuinStreet's key financial services vertical. For instance, if interest rates remain elevated, consumer demand for loans and mortgages could soften, influencing how financial institutions allocate their marketing budgets.

These combined economic forces can lead QuinStreet's clients to re-evaluate their marketing return on investment (ROI) and potentially reduce overall spending, putting pressure on QuinStreet's performance-based revenue models. In 2023, QuinStreet reported revenue of $177.9 million, a figure that could be sensitive to shifts in client marketing expenditure.

The global digital advertising market is a significant driver for companies like QuinStreet. Projections show robust growth, with global digital ad spending expected to reach approximately $880 billion by the end of 2024 and potentially surpass $1 trillion by 2025. This expansion is fueled by consumers spending more time online and the continued rise of e-commerce.

This upward trend in digital ad expenditure creates a favorable environment for QuinStreet. The increasing investment in online advertising means more businesses are looking for effective ways to reach their target audiences digitally, directly benefiting QuinStreet's lead generation and marketing services.

Competition in Performance Marketing

The performance marketing sector is intensely competitive, with many companies vying for advertising spend and consumer engagement. QuinStreet navigates this crowded space, contending with other online marketplaces, advanced ad technology platforms, and the direct marketing initiatives of the very service providers they aim to connect with consumers.

This fierce competition directly impacts pricing strategies and demands ongoing investment in technological advancements and service enhancements. For instance, the digital advertising market saw global ad spend projected to reach $700 billion in 2024, with performance-based models a significant component, highlighting the scale of competition. To thrive, QuinStreet must continually innovate to secure and grow its market share and profitability.

- Intense Rivalry: Numerous players compete for client budgets and consumer attention in performance marketing.

- Diverse Competitors: QuinStreet faces competition from online marketplaces, ad tech platforms, and in-house marketing teams.

- Pricing Pressure: High competition can lead to downward pressure on pricing, impacting profit margins.

- Innovation Imperative: Continuous innovation in technology and services is crucial for maintaining market position.

Client Advertising Budget Allocation

Clients' decisions on where to spend their advertising dollars significantly impact QuinStreet's income. This involves choices between traditional advertising like TV and radio versus digital channels, and whether to focus on building brand awareness or driving immediate sales. The trend in 2024 and into 2025 strongly favors performance marketing, where clients want to see tangible returns on their investment.

For instance, a significant portion of digital ad spend is now performance-based. In 2024, projections indicated that performance marketing would continue to capture a larger share of the digital advertising pie, with many businesses prioritizing measurable outcomes. QuinStreet's success hinges on its ability to prove the return on investment (ROI) through its pay-for-performance model, which is crucial for attracting and retaining client budgets.

- Shift to Performance Marketing: Businesses are increasingly demanding measurable results, pushing advertising spend towards channels and strategies that demonstrate clear ROI.

- Digital Dominance: Digital advertising channels continue to grow, with a significant portion of client budgets being allocated here in 2024-2025.

- ROI Demonstration: QuinStreet's pay-for-performance model is a key differentiator, directly addressing client needs for demonstrable return on ad spend.

- Budget Allocation Trends: Client budget allocation decisions are dynamic, influenced by economic conditions and the perceived effectiveness of different marketing approaches.

Economic factors significantly shape QuinStreet's operating environment, influencing both client spending and consumer behavior. The ongoing moderation of inflation in 2024, while a positive sign, is still coupled with concerns about interest rates impacting consumer discretionary spending, a key driver for QuinStreet's clients in financial services and home improvement. Global digital ad spending is projected for substantial growth, reaching around $880 billion by the end of 2024 and potentially exceeding $1 trillion in 2025, creating a favorable market for performance marketing services like QuinStreet's.

The competitive landscape within performance marketing demands continuous innovation, as QuinStreet faces rivals ranging from online marketplaces to advanced ad tech platforms. This intense rivalry puts pressure on pricing strategies, making it crucial for QuinStreet to demonstrate a strong return on investment (ROI) to secure client budgets, especially as businesses increasingly prioritize measurable outcomes in their marketing efforts.

QuinStreet's revenue, which was $177.9 million in 2023, is sensitive to shifts in client marketing expenditures, which are influenced by broader economic conditions and the perceived effectiveness of different advertising channels. The strong trend towards performance-based marketing in 2024 and 2025 underscores the importance of QuinStreet's pay-for-performance model in attracting and retaining clients seeking demonstrable results.

Preview Before You Purchase

QuinStreet PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive QuinStreet PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping QuinStreet's strategic landscape.

Sociological factors

Consumers are heavily leaning on digital avenues for research and comparison before committing to purchases. In 2024, a significant majority of consumers, often exceeding 80%, will utilize online searches to explore options for services ranging from financial products to educational programs.

QuinStreet's core strategy directly addresses this shift by acting as a conduit, matching consumers actively seeking services with businesses ready to meet those needs. This online-first approach is crucial for capturing high-intent leads in today's digital marketplace.

The pervasive adoption of smartphones, with mobile internet usage projected to continue its upward trajectory in 2024-2025, coupled with an expectation for intuitive and frictionless online interactions, solidifies the essential role of platforms like QuinStreet. These user expectations drive the demand for efficient digital comparison tools.

The ongoing surge in global internet users, projected to surpass 5.3 billion by early 2024, directly broadens QuinStreet's potential customer base. Increased digital literacy means more consumers are comfortable researching and purchasing services online, expanding the addressable market for QuinStreet's lead generation services.

Consumer trust in online platforms is a critical sociological factor. In 2024, studies showed a significant portion of internet users express concerns about how their personal data is used by online services, with some actively limiting data sharing. This trend underscores the importance for companies like QuinStreet, which leverage consumer data for lead generation, to operate with utmost transparency regarding data collection and usage policies.

Maintaining robust data security is no longer just a technical requirement but a foundational element of consumer trust. A recent report indicated that data breaches continue to be a major concern for individuals, leading them to be more cautious about sharing information online. QuinStreet's ability to demonstrate strong data protection measures directly impacts its reputation and the willingness of consumers to engage with its services.

A deficit in trust can have a tangible impact on lead generation for businesses relying on online platforms. If consumers are hesitant to share their information due to privacy fears, the volume and quality of leads can diminish significantly. For QuinStreet, this means a proactive approach to building confidence through clear communication and demonstrable security practices is essential for sustained business success in the evolving digital landscape.

Influence of Social Media and User-Generated Content

Social media's sway on consumer choices is undeniable, with social commerce and influencer marketing gaining serious traction. By 2024, global social commerce sales were projected to reach over $1.2 trillion, highlighting a significant shift in how consumers discover and buy products.

While QuinStreet's core strength lies in its lead generation technology, staying attuned to these evolving social media trends could offer avenues to broaden its audience and refine engagement tactics. User-generated content, in particular, builds a powerful sense of trust and authenticity that directly impacts purchasing decisions.

- Social Commerce Growth: Global social commerce sales are expected to exceed $1.2 trillion by 2024.

- Influencer Marketing Impact: A significant percentage of consumers report making purchases based on influencer recommendations.

- User-Generated Content Trust: 90% of consumers trust user-generated content more than traditional advertising.

Demand for Personalization and Convenience

Consumers today demand tailored experiences and effortless interactions, a trend that directly impacts online service marketplaces. In 2024, nearly 70% of consumers expect personalized offers and content, a significant jump from previous years, highlighting the critical nature of this expectation.

QuinStreet's core business model, which focuses on segmenting and qualifying consumers to connect them with suitable service providers, directly addresses this demand for personalization. By acting as a sophisticated matchmaker, QuinStreet helps consumers navigate complex choices efficiently.

The convenience factor is equally paramount. An intuitive and user-friendly online platform is essential for attracting and retaining users. For instance, in the financial services sector, a key area for QuinStreet, research from 2024 indicates that over 80% of consumers will abandon a website if it's difficult to navigate, underscoring the importance of a seamless user journey.

- Personalization Expectation: 70% of consumers in 2024 expect personalized offers and content.

- Convenience Impact: 80% of consumers will leave a website if it's hard to use, especially in finance.

- QuinStreet's Alignment: The company's matching service directly caters to the need for personalized, efficient solutions.

Sociological factors significantly shape consumer behavior online, influencing how platforms like QuinStreet operate and thrive. The increasing reliance on digital channels for research and purchasing, with over 80% of consumers using online searches in 2024, directly plays into QuinStreet's model of connecting high-intent leads with businesses.

Consumer trust and data privacy are paramount; a significant portion of users in 2024 express concerns about data usage, making transparency and robust security essential for QuinStreet's reputation and lead generation success. Furthermore, the growing influence of social media and user-generated content, with social commerce sales projected to surpass $1.2 trillion in 2024, presents opportunities for QuinStreet to refine its engagement strategies.

Consumers also expect personalized and convenient digital experiences, with nearly 70% anticipating tailored offers in 2024. QuinStreet's core business of matching consumers with suitable service providers directly addresses this demand for efficient, personalized solutions, especially as over 80% of consumers abandon difficult-to-navigate websites.

| Sociological Factor | Trend/Impact | QuinStreet Relevance |

|---|---|---|

| Digital Research Dominance | 80%+ consumers use online searches for purchases (2024) | Core to QuinStreet's lead generation model |

| Data Privacy Concerns | Users wary of data usage; demand transparency | Requires robust security and clear policies |

| Social Commerce Growth | $1.2T+ projected social commerce sales (2024) | Potential for expanded audience and engagement |

| Personalization Expectation | 70% expect personalized content (2024) | QuinStreet's matching service aligns with this |

Technological factors

AI and machine learning are revolutionizing digital marketing, offering unprecedented capabilities in hyper-personalization, data analysis, and content generation. This allows businesses to connect with consumers on a much deeper level.

QuinStreet is at the forefront of this transformation, utilizing its own technology and AI algorithms to precisely segment, qualify, and match consumers with relevant service providers. This intelligent matching is key to their business model.

As AI continues to advance, QuinStreet is poised to further refine its lead generation processes, improve targeting accuracy, and boost media buying efficiency. For instance, in 2024, companies leveraging AI in marketing saw an average increase of 15% in conversion rates compared to those that didn't.

The ad tech sector is a rapidly shifting terrain, marked by increasingly advanced programmatic advertising, sophisticated measurement techniques, and refined attribution models. QuinStreet's QMP platform is central to this, linking clients with a vast network of targeted media sources, a critical advantage in this dynamic environment.

Staying ahead in ad tech innovation is paramount for QuinStreet. This ensures operational efficiency, boosts campaign effectiveness, and prepares the company for significant industry shifts, such as the ongoing deprecation of third-party cookies, which directly impacts targeting and measurement capabilities.

The global programmatic advertising market was valued at approximately $400 billion in 2023 and is projected to grow significantly, highlighting the importance of QuinStreet's investment in this area. As of early 2024, the industry is intensely focused on privacy-centric solutions and first-party data strategies, areas where QuinStreet's platform must demonstrate continued adaptability.

QuinStreet's performance marketing hinges on its ability to leverage data analytics. The company analyzes vast consumer data to understand user behavior and preferences, which is crucial for optimizing marketing campaigns. For instance, in 2023, QuinStreet reported that its data science team continuously refines algorithms to improve lead scoring and conversion rates, directly impacting client ROI.

Predictive modeling, increasingly powered by artificial intelligence, is another key technological factor. This allows QuinStreet to anticipate what consumers might be looking for, enabling more precise targeting and proactive campaign adjustments. The company's investment in AI-driven analytics is designed to enhance lead quality and ensure campaigns meet client objectives efficiently.

Mobile Technology and Cross-Device Usage

The widespread adoption of smartphones and tablets means QuinStreet must prioritize a mobile-first strategy. Consumers increasingly use multiple devices to research and purchase services, making cross-device optimization crucial for lead generation platforms. For instance, Statista projected that mobile devices would account for over 70% of internet traffic globally by 2025, highlighting the need for seamless user experiences across all screen sizes.

QuinStreet's online marketplaces and digital marketing campaigns need to be designed for effortless navigation and interaction on mobile devices. This includes ensuring fast loading times, responsive design, and intuitive user interfaces. As mobile commerce continues to grow, with global mobile retail sales expected to reach $3.5 trillion in 2025, adapting to these consumer behaviors is essential for QuinStreet's success in capturing leads.

- Mobile-First Design: Ensuring all QuinStreet digital assets are optimized for mobile devices.

- Cross-Device Continuity: Providing a consistent and seamless user experience as consumers switch between devices.

- App Integration: Exploring or enhancing app-based interactions for lead generation and service discovery.

- Mobile Analytics: Tracking user behavior across devices to refine marketing strategies and improve conversion rates.

Cybersecurity and Data Security Infrastructure

QuinStreet's reliance on handling sensitive consumer data makes robust cybersecurity and data security infrastructure a critical technological factor. Protecting against data breaches and evolving cyber threats is paramount for maintaining consumer trust, which directly impacts customer acquisition and retention rates. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks involved.

Compliance with data privacy regulations, such as GDPR and CCPA, is non-negotiable. Failure to secure data adequately can result in substantial fines and legal repercussions. For instance, the largest GDPR fine to date was €700 million imposed on a tech company in early 2023. QuinStreet's investment in advanced security infrastructure and protocols is therefore essential to safeguard its proprietary technology and vast amounts of consumer information.

Key aspects of QuinStreet's technological infrastructure investment likely include:

- Advanced encryption and access control measures to protect data at rest and in transit.

- Regular security audits and penetration testing to identify and remediate vulnerabilities proactively.

- Employee training and awareness programs to mitigate human error, a common vector for cyberattacks.

- Incident response planning and execution to minimize damage and restore services swiftly in the event of a breach.

Technological advancements, particularly in AI and machine learning, are fundamentally reshaping digital marketing. QuinStreet leverages these tools for hyper-personalization and sophisticated data analysis, enhancing consumer engagement. The company's AI-driven platform precisely matches consumers with services, a core element of its business. By integrating AI, QuinStreet aims to improve targeting and media buying efficiency, with AI adoption in marketing showing an average 15% conversion rate increase in 2024.

Legal factors

Global and regional data privacy laws like GDPR and CCPA significantly impact QuinStreet's operations by dictating how it collects, processes, and utilizes consumer data. These regulations, including evolving US state laws, necessitate clear consent mechanisms, data transparency, and robust consumer rights management. Failure to comply can lead to substantial penalties, with GDPR fines potentially reaching 4% of global annual revenue or €20 million, whichever is higher, underscoring the critical need for adherence to maintain market legitimacy.

The Federal Communications Commission's (FCC) updated Telephone Consumer Protection Act (TCPA) rules, taking effect in January 2025, will reshape lead generation. These changes mandate obtaining explicit, 'one-to-one' consent for telemarketing calls and texts, moving away from the previous 'one-to-many' model. This means QuinStreet's clients will need to adjust how they utilize purchased leads, requiring a thorough review and potential overhaul of their consent collection processes to ensure compliance and mitigate legal exposure.

Advertising content and disclosure laws, such as those enforced by the Federal Trade Commission (FTC), significantly shape how QuinStreet presents marketing messages. These regulations mandate truthfulness in advertising, proper disclosure of endorsements, and clarity in all promotional content. For instance, FTC guidelines require that any sponsored content or influencer endorsements clearly state their material connection to the advertiser, a standard QuinStreet must uphold across its platforms.

QuinStreet's responsibility extends to ensuring that advertisements from its service providers comply with these advertising standards. This means scrutinizing ad content for deceptive practices and verifying that all required disclosures, like terms and conditions or potential risks, are easily visible to consumers. A failure to adhere to these laws, such as misrepresenting a product's benefits or hiding crucial information, could result in substantial fines and damage QuinStreet's credibility, as seen in past FTC actions against companies for deceptive advertising practices, which have often involved penalties in the millions of dollars.

Intellectual Property Rights and Technology Licensing

QuinStreet's business model hinges on its proprietary technology and media management platform, making the protection of its intellectual property (IP) paramount. This includes safeguarding patents, trademarks, and trade secrets that underpin its competitive advantage in the digital marketing space. For instance, as of early 2024, QuinStreet's continued investment in platform innovation signals an ongoing commitment to securing and leveraging its IP portfolio.

Navigating the complexities of technology licensing and avoiding IP infringement are critical legal considerations for QuinStreet. The company must ensure compliance with all software licenses it utilizes, preventing potential legal disputes and associated financial penalties. This diligence is essential to maintain operational integrity and avoid disruptions to its service delivery.

- Intellectual Property Protection: QuinStreet's core assets are its proprietary technologies and platforms, necessitating robust protection of patents, trademarks, and trade secrets to maintain market leadership.

- Technology Licensing Compliance: Adherence to software license agreements and prevention of infringement on third-party IP are ongoing legal imperatives for QuinStreet's operations.

- Competitive Edge: Effective IP management directly contributes to QuinStreet's ability to differentiate itself and sustain its competitive edge in the digital marketing landscape.

Platform Liability and Online Marketplace Regulations

Online marketplaces like QuinStreet face growing legal obligations concerning third-party sellers. Regulations now often require platforms to verify sellers, manage customer complaints, and ensure advertised products or services comply with the law. This shift means QuinStreet must actively monitor and enforce seller conduct to mitigate legal risks and fulfill its operational duties.

For instance, the EU's Digital Services Act (DSA), fully applicable from February 17, 2024, places significant responsibility on online platforms to tackle illegal content and products. Platforms are mandated to have clear complaint mechanisms and to act swiftly on notices. QuinStreet must ensure its compliance framework aligns with such stringent requirements, potentially impacting its operational costs and seller vetting processes.

- Seller Verification: Implementing robust identity checks for all third-party sellers to prevent fraudulent activity.

- Complaint Resolution: Establishing efficient and transparent processes for handling user complaints against sellers.

- Content Moderation: Ensuring that all goods and services advertised on the platform are legal and adhere to terms of service.

- Regulatory Compliance: Staying updated with and adhering to evolving legislation like the DSA and similar frameworks globally.

QuinStreet's operations are heavily influenced by evolving legal frameworks, particularly concerning data privacy and consumer protection. Laws like GDPR and the forthcoming TCPA regulations demand stringent consent management and transparency, impacting lead generation strategies. Failure to comply with these regulations, which can include substantial fines, necessitates continuous adaptation of QuinStreet's data handling and marketing practices to maintain operational integrity and avoid legal repercussions.

Environmental factors

Growing stakeholder and investor demand for Corporate Social Responsibility (CSR) and sustainability reporting is increasingly relevant for companies like QuinStreet, even if their operations aren't directly manufacturing-heavy. This pressure means companies are expected to show their commitment to environmental care through their own day-to-day activities.

For QuinStreet, this could translate into expectations around managing the energy consumption of its data centers, a significant factor in the digital economy, and implementing effective waste management practices. For instance, in 2024, many tech companies are setting ambitious targets for renewable energy sourcing for their data infrastructure, with some aiming for 100% by 2030.

Consumers increasingly prioritize sustainability, with a significant portion of younger buyers factoring a company's environmental record into their choices. For instance, a 2024 survey indicated that over 60% of Gen Z consumers actively seek out brands with strong eco-friendly practices.

QuinStreet's business model, connecting consumers with service providers, means that the environmental credentials of its clients could indirectly impact user engagement. By highlighting or favoring service providers with demonstrable green initiatives, QuinStreet could attract environmentally conscious consumers, potentially boosting lead generation for those partners.

This focus on sustainability can serve as a strategic advantage. In 2024, businesses that effectively communicated their environmental, social, and governance (ESG) efforts saw an average increase in brand loyalty of 15%, suggesting a tangible benefit to aligning with consumer values.

Governments globally are increasingly scrutinizing the environmental impact of all industries, including the digital sector. While direct regulations on digital carbon footprints are still nascent, the trend suggests future pressures for companies like QuinStreet to report and mitigate energy consumption from data centers and digital operations. For instance, the European Union's Digital Product Passport initiative, while focused on physical goods, signals a broader regulatory intent towards environmental accountability across economic activities.

Impact of Climate Change on Industries Served

Climate change is increasingly shaping consumer demand within the home services sector, a key area for QuinStreet. For instance, growing concerns about energy efficiency and a push towards renewable energy sources are driving significant investment and consumer interest in solar panel installations and HVAC upgrades. By late 2024, the U.S. solar industry alone saw a substantial increase in residential installations, with projections indicating continued growth into 2025, directly impacting lead generation needs.

These environmental shifts also present opportunities and challenges for other industries QuinStreet supports, such as insurance. As climate-related risks like extreme weather events become more prevalent, insurers are re-evaluating risk assessments and potentially adjusting coverage or pricing. This could lead to a greater demand for leads related to climate risk mitigation services or specialized insurance products.

The evolving regulatory landscape, driven by climate action initiatives, further influences these industries. Governments are implementing policies to encourage sustainable practices, which in turn affects consumer behavior and the types of services they seek. This dynamic necessitates agile lead generation strategies to align with emerging market trends.

- Increased Demand for Energy-Efficient Home Upgrades: Driven by climate concerns and potential incentives, homeowners are actively seeking services like insulation, smart thermostats, and energy-efficient windows.

- Growth in Renewable Energy Services: The demand for solar panel installation and maintenance is projected to continue its upward trajectory through 2025, creating a robust market for related leads.

- Shifts in Insurance Risk Assessment: Insurers are adapting to climate-related risks, potentially increasing demand for leads in areas like floodproofing, storm damage repair, and specialized climate insurance.

- Regulatory Impact on Consumer Choices: New environmental regulations can accelerate the adoption of green technologies and services, influencing consumer spending patterns and lead generation priorities.

Supply Chain Sustainability (Indirect)

While QuinStreet's operations are largely digital, relying on media publishers and data providers, environmental sustainability within its indirect supply chain is becoming a consideration. For instance, if key data centers or major publishing partners have substantial carbon footprints, this could indirectly reflect on QuinStreet as businesses increasingly audit their entire value chains for environmental impact. By 2024, a significant portion of companies were reporting on their Scope 3 emissions, which include indirect supply chain impacts, highlighting a growing trend that QuinStreet may need to address.

As corporate environmental, social, and governance (ESG) initiatives gain momentum, QuinStreet could face rising expectations to align with partners demonstrating strong environmental stewardship. This means scrutinizing the sustainability practices of its digital infrastructure providers and content partners. For example, many cloud service providers, which QuinStreet might utilize, are setting ambitious renewable energy targets; Microsoft, a major player, aims to be carbon negative by 2030, a goal that influences its partners.

- Digital Supply Chain Scrutiny: Growing pressure on companies to assess the environmental impact of their digital partners and infrastructure.

- Partner ESG Alignment: QuinStreet may need to prioritize partnerships with entities that have robust sustainability commitments.

- Data Center Footprint: Indirect environmental impact through the energy consumption and waste generation of data centers used by partners.

- Industry Trend: Increasing corporate focus on Scope 3 emissions means indirect supply chain sustainability is a growing factor in business evaluations.

Growing stakeholder demand for sustainability reporting impacts QuinStreet, pushing for environmental care in daily operations. This includes managing data center energy consumption and waste, with many tech firms targeting 100% renewable energy for infrastructure by 2030.

Consumers, particularly younger demographics, increasingly factor a company's environmental record into purchasing decisions; a 2024 survey showed over 60% of Gen Z consumers favor eco-friendly brands.

QuinStreet's business model, connecting consumers with service providers, means its clients' environmental credentials can influence user engagement, potentially boosting leads for greener partners.

Businesses effectively communicating ESG efforts saw a 15% average increase in brand loyalty in 2024, highlighting a tangible benefit to aligning with consumer values.

| Environmental Factor | Impact on QuinStreet | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Energy Consumption (Data Centers) | Operational efficiency and cost, brand perception | Tech companies setting renewable energy targets for infrastructure, aiming for 100% by 2030. |

| Consumer Environmental Preferences | Lead generation quality and volume | Over 60% of Gen Z consumers actively seek eco-friendly brands (2024 survey). |

| Partner Sustainability | Indirect brand impact, supply chain risk | Increasing corporate focus on Scope 3 emissions, scrutinizing digital supply chains. |

| Climate-Related Risks (Home Services) | Demand for specific service leads | US residential solar installations saw substantial growth in 2024, with continued projections for 2025. |

PESTLE Analysis Data Sources

Our QuinStreet PESTLE Analysis is meticulously constructed using data from official government publications, leading economic research institutions, and reputable industry-specific reports. This ensures a comprehensive and accurate understanding of the macro-environmental factors influencing your market.