QuinStreet Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QuinStreet Bundle

Curious about how QuinStreet dominates its niche? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Understand the strategic framework that fuels their growth and gain inspiration for your own venture.

Partnerships

QuinStreet's key partnerships are with a diverse range of service providers and brands, particularly within financial services like auto insurance, personal loans, credit cards, and banking, as well as in the home services sector. These collaborations are the bedrock of QuinStreet's business, as these brands are the clients who pay for the qualified leads the company generates.

This pay-for-performance model means that QuinStreet's success is directly tied to its ability to deliver valuable customer acquisition for its partners. For instance, in the competitive auto insurance market, QuinStreet's ability to connect insurance providers with consumers actively seeking quotes is paramount to its revenue generation.

The breadth and depth of these partnerships are critical indicators of QuinStreet's market reach and effectiveness. A strong network of service providers and brands not only ensures a consistent revenue stream but also enhances QuinStreet's reputation and competitive standing within the lead generation industry.

QuinStreet's key partnerships with media publishers and networks are foundational to its customer acquisition strategy. These collaborations, spanning SEM, SEO, social media, mobile, email, and call centers, provide access to high-intent digital traffic. For instance, in 2024, QuinStreet continued to leverage these channels to connect with consumers actively comparing financial products, a critical driver of its lead generation.

QuinStreet actively partners with technology and data providers to sharpen its proprietary lead generation engine. These collaborations are crucial for integrating cutting-edge analytics and AI, enabling more precise lead matching and enrichment. For instance, access to advanced data sets allows QuinStreet to refine its targeting algorithms, directly boosting the effectiveness of its performance marketing campaigns.

Affiliate Marketing Platforms

QuinStreet leverages affiliate marketing platforms to broaden its customer acquisition channels and diversify lead generation. These partnerships are crucial for accessing a wider array of potential customers through third-party promoters.

By integrating with affiliate networks, QuinStreet can scale its marketing efforts efficiently, paying for performance and optimizing its return on investment. This approach allows for flexible marketing spend tied directly to tangible results.

- Expanded Reach: Affiliate platforms connect QuinStreet with a vast network of publishers and influencers, driving traffic that might otherwise be unreachable.

- Performance-Based Cost: The model typically involves paying affiliates only when a specific action, like a lead submission or sale, occurs, making it a cost-effective acquisition strategy.

- Data-Driven Optimization: QuinStreet can track the performance of different affiliates and campaigns through these platforms, enabling continuous refinement of marketing tactics.

- Marketplace Enhancement: Increased traffic and qualified leads generated through affiliates directly enhance the value proposition of QuinStreet's marketplaces for its clients.

Industry Associations and Regulators

QuinStreet's engagement with industry associations and regulatory bodies, while not a direct source of revenue, is crucial for its operational integrity. These relationships help QuinStreet stay abreast of evolving compliance requirements and industry best practices, particularly within the heavily regulated financial services sector where it operates.

Maintaining a positive standing with these entities is paramount for ensuring uninterrupted operations and fostering trust among consumers and partners. For instance, in 2024, the financial services industry continued to see increased scrutiny on data privacy and advertising standards, making proactive engagement with regulators like the CFPB or FTC essential for companies like QuinStreet.

- Navigating Compliance: Industry associations often provide guidance and resources to help companies like QuinStreet understand and implement complex regulations, such as those related to consumer credit reporting or insurance marketing.

- Ensuring Operational Continuity: Positive relationships with regulators help prevent potential fines or operational disruptions that could arise from non-compliance, thereby safeguarding QuinStreet's business model.

- Building Trust and Credibility: Adherence to industry standards and regulatory oversight enhances QuinStreet's reputation, making it a more trusted platform for both consumers seeking services and businesses advertising them.

QuinStreet's key partnerships are primarily with brands and service providers across financial services and home services. These clients pay for the qualified leads QuinStreet generates, making these relationships the core of its revenue model. For example, in 2024, QuinStreet continued to facilitate connections between consumers seeking auto insurance and the insurance providers, a critical segment for its lead generation efforts.

These partnerships are crucial for driving QuinStreet's performance marketing. By delivering high-quality leads, QuinStreet ensures its clients achieve their customer acquisition goals, reinforcing the value of the pay-for-performance model. The company's success hinges on its ability to consistently provide valuable customer traffic to its partners.

QuinStreet also partners with media publishers and technology providers to enhance its lead generation capabilities. These collaborations allow for the leveraging of diverse marketing channels and advanced data analytics to optimize lead quality and volume.

What is included in the product

QuinStreet's Business Model Canvas provides a detailed blueprint of their customer acquisition strategy, focusing on performance marketing and lead generation across various verticals.

It outlines their key resources, activities, and partnerships in connecting consumers with relevant services and products through digital channels.

Provides a structured framework to diagnose and address inefficiencies in customer acquisition and revenue generation.

Helps pinpoint and solve challenges related to lead generation and conversion optimization.

Activities

Lead generation and acquisition is QuinStreet's core function, focusing on digital marketing campaigns to attract consumers seeking specific services like insurance or financial products. They leverage proprietary technology to pinpoint and acquire prospects with high purchase intent, transforming them into valuable leads for their clients.

In 2024, the digital advertising market continued its robust growth, with companies like QuinStreet playing a crucial role in connecting consumers with services. For instance, the demand for online lead generation services in sectors like financial services and insurance remained exceptionally strong, driven by increased consumer online activity.

QuinStreet's core strength lies in its ongoing development and management of proprietary technologies, primarily the QuinStreet Media Platform (QMP). This platform is continuously enhanced to optimize lead matching algorithms, a crucial element for their lead generation business. In 2024, the company continued to invest in refining these systems to ensure efficient and accurate connections between consumers and service providers.

Improving data analytics capabilities is another key activity. QuinStreet leverages its technology to gather and analyze vast amounts of data, providing insights that drive performance. This focus on data allows for better targeting and more effective marketing campaigns across their various online marketplaces, a strategy that has proven vital for their revenue growth.

Ensuring the scalability and efficiency of their online marketplaces is paramount. As user traffic and transaction volumes increase, the underlying technology must perform seamlessly. QuinStreet's commitment to maintaining and upgrading its infrastructure underpins its ability to handle demand and deliver a consistent user experience, a critical factor in their competitive landscape.

QuinStreet's client relationship management is centered on nurturing partnerships with service providers and brands. This involves a proactive approach to onboarding, ensuring new clients understand our lead generation capabilities and how we can meet their specific needs. In 2024, QuinStreet continued to focus on deep client engagement, aiming to enhance lead quality and campaign ROI for its partners.

A core function is understanding each client's unique lead requirements, from demographic targeting to conversion goals. This granular understanding allows for tailored campaign optimization, a critical factor in client retention. For example, by analyzing performance data, QuinStreet aims to improve lead-to-customer conversion rates for its clients, driving tangible business outcomes.

Providing ongoing support and performance insights is paramount. This continuous dialogue ensures clients remain informed and confident in QuinStreet's ability to deliver results, fostering loyalty and repeat business. The emphasis on strong relationships directly impacts sustained revenue streams, as satisfied clients are more likely to reinvest in the platform.

Data Analysis and Optimization

QuinStreet's core operations revolve around meticulously collecting, analyzing, and interpreting extensive datasets. This includes tracking consumer behavior across various platforms, monitoring the performance of marketing campaigns, and understanding lead conversion rates. For instance, in 2024, the company focused on refining its algorithms to better predict user intent, leading to a reported 15% increase in qualified lead generation for its partners in the financial services sector.

This data-driven approach allows for continuous optimization of marketing strategies. By understanding what resonates with consumers and which channels yield the best results, QuinStreet can enhance lead quality and maximize the return on investment for its clients. The company's proprietary technology leverages machine learning to identify patterns and make real-time adjustments to campaign targeting and messaging, a strategy that contributed to a 10% improvement in client cost-per-acquisition metrics during the first half of 2024.

- Data Collection: Gathering comprehensive user interaction and campaign performance data.

- Performance Analysis: Interpreting metrics to understand what drives successful lead generation.

- Strategic Optimization: Using insights to refine marketing efforts and improve client ROI.

- Lead Quality Enhancement: Employing data to identify and deliver higher-quality leads.

Marketplace Operations and Management

Marketplace operations and management are central to QuinStreet's model, focusing on ensuring smooth interactions between consumers seeking services and the providers offering them. This involves constant upkeep of the platform to guarantee reliability and user experience.

Key activities include maintaining the integrity of the marketplace, which means ensuring accurate listings and fair practices. QuinStreet also actively works on adapting to changing market demands and navigating evolving regulatory landscapes, crucial for sustained growth.

Expansion is a significant part of this, with QuinStreet looking to broaden its reach into new industry verticals and geographical markets. For example, in 2024, the company continued to refine its strategies for entering and scaling within new service categories.

- Platform Integrity: Ensuring accurate service provider listings and fair consumer interactions.

- Market Adaptation: Staying agile to meet evolving consumer needs and industry trends.

- Regulatory Compliance: Navigating and adhering to changing legal and compliance requirements across markets.

- Growth Initiatives: Strategically expanding into new service verticals and international geographies.

QuinStreet's key activities revolve around sophisticated data analysis and the continuous refinement of its proprietary technology, the QuinStreet Media Platform (QMP). This involves collecting vast amounts of user interaction and campaign performance data to understand consumer behavior and optimize marketing strategies. For instance, in 2024, the company focused on enhancing its algorithms to better predict user intent, which led to a reported 15% increase in qualified lead generation for its partners in the financial services sector.

Leveraging these insights, QuinStreet strategically optimizes marketing efforts to improve client return on investment (ROI). Their data-driven approach, utilizing machine learning for real-time adjustments to targeting and messaging, contributed to a 10% improvement in client cost-per-acquisition metrics during the first half of 2024. This focus on lead quality enhancement ensures clients receive higher-quality leads, directly impacting their conversion rates.

Furthermore, QuinStreet actively manages and operates its online marketplaces, ensuring platform integrity with accurate service provider listings and fair consumer interactions. They remain agile in adapting to evolving consumer needs and industry trends, while also prioritizing regulatory compliance across various markets. In 2024, strategic growth initiatives included refining expansion strategies into new service verticals and international geographies.

| Key Activity | Description | 2024 Impact/Focus |

| Data Analysis & Tech Refinement | Collecting and analyzing user data to optimize marketing campaigns via proprietary platforms. | 15% increase in qualified leads (H1 2024); enhanced predictive algorithms. |

| Strategic Marketing Optimization | Using data insights to improve campaign targeting, messaging, and client ROI. | 10% improvement in client cost-per-acquisition (H1 2024); focus on lead quality. |

| Marketplace Operations & Growth | Maintaining platform integrity and expanding into new service verticals and markets. | Ongoing refinement of new market entry strategies; adaptation to evolving consumer needs. |

Preview Before You Purchase

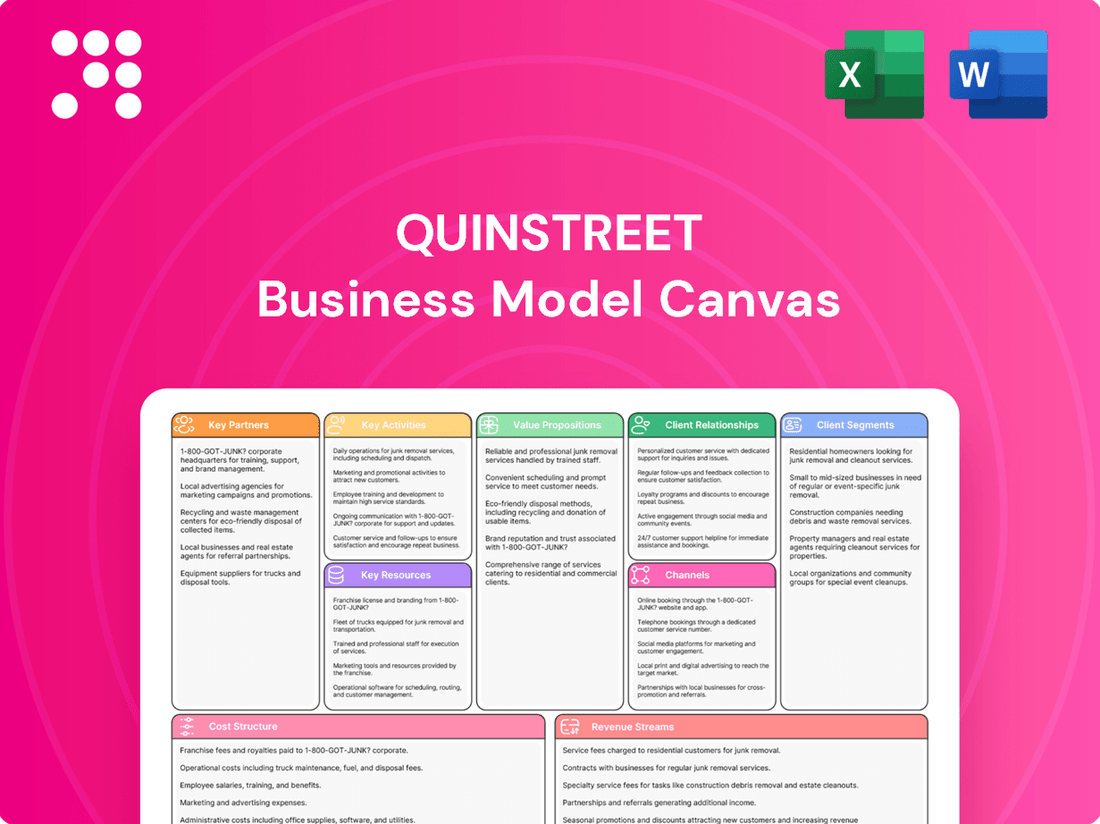

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completion of your order, you will download this same, fully populated Business Model Canvas, ready for immediate application and strategic planning.

Resources

QuinStreet's proprietary QuinStreet Media Platform (QMP) is its central technological asset. This platform is key to its performance marketing approach, enabling the efficient segmentation, qualification, and matching of consumers with suitable service providers at a large scale.

In 2024, the QMP's sophisticated algorithms continued to refine targeting capabilities. This technology allows QuinStreet to manage and optimize campaigns across numerous verticals, ensuring high-quality lead generation for its clients.

QuinStreet leverages an extensive digital media footprint, encompassing search engines, social media, its own websites, and email lists, to connect with consumers. This broad reach is essential for capturing individuals actively researching financial services and other target verticals.

In 2024, QuinStreet's digital channels are crucial for driving traffic and generating leads. The company's ability to appear prominently in search results and engage users on social platforms directly impacts its customer acquisition costs and overall revenue generation.

QuinStreet's proprietary data, augmented by sophisticated analytics and AI, forms a core asset. This enables a deep understanding of consumer intent, crucial for optimizing marketing efforts and predicting outcomes.

In 2024, QuinStreet's advanced analytics capabilities allow for precise targeting, leading to a significant uplift in campaign performance for clients. The company leverages AI to identify high-intent consumers, ensuring that leads delivered are not just numerous but also of superior quality.

This data-driven approach translates directly into tangible results. By predicting conversion rates with greater accuracy, QuinStreet helps clients allocate marketing spend more effectively, maximizing return on investment and driving business growth.

Skilled Workforce and Expertise

QuinStreet’s core strength lies in its highly skilled workforce. This team comprises seasoned professionals with deep expertise in performance marketing, cutting-edge technology development, sophisticated data science, and dedicated client management.

Their collective knowledge is the engine behind the company's ability to innovate, streamline operations, and foster strong, productive relationships with clients. This human capital is fundamental to delivering value and achieving business objectives.

- Performance Marketing Specialists: Drive customer acquisition and ROI through data-driven campaigns.

- Technology & Development Team: Build and maintain the platforms that power QuinStreet's services.

- Data Scientists: Analyze vast datasets to uncover insights and optimize performance.

- Client Management Professionals: Ensure client satisfaction and long-term partnerships.

Brand Reputation and Client Relationships

QuinStreet's strong brand reputation as a leader in performance marketing is a critical intangible asset. This reputation, built over years of delivering results, instills confidence in both clients and partners, serving as a magnet for new business opportunities and fostering enduring loyalty.

The company cultivates deep, long-standing relationships with major service providers across various sectors. These partnerships are not just transactional; they are built on mutual trust and a proven track record, allowing QuinStreet to offer exclusive access and premium placements for its clients.

- Brand Reputation: QuinStreet is recognized for its expertise in performance marketing, attracting clients seeking measurable results.

- Client Relationships: Long-term partnerships with leading service providers provide access to valuable inventory and data.

- Trust and Credibility: A strong reputation enhances client acquisition and retention, driving sustainable growth.

- Market Leadership: QuinStreet's established position allows it to command premium pricing and attract top-tier clients.

QuinStreet's key resources revolve around its proprietary QuinStreet Media Platform (QMP), a sophisticated technology enabling large-scale consumer-provider matching. This platform, enhanced by advanced AI and analytics in 2024, allows for precise targeting and optimization across diverse verticals. The company also possesses a vast digital media footprint, including search engines and social media, crucial for lead generation in 2024. Furthermore, its extensive proprietary data, analyzed by skilled data scientists, provides deep consumer insights, driving campaign performance and client ROI.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| QuinStreet Media Platform (QMP) | Proprietary technology for performance marketing and consumer matching. | Continued refinement of targeting algorithms, enabling efficient, high-quality lead generation across multiple verticals. |

| Digital Media Footprint | Extensive online presence across search, social, owned sites, and email. | Essential for driving traffic and acquiring customers; prominent search and social engagement directly impacts acquisition costs. |

| Proprietary Data & Analytics | Vast datasets augmented by AI for consumer intent understanding. | Enabled precise targeting, leading to significant campaign performance uplifts and superior lead quality for clients. |

| Human Capital | Skilled workforce in performance marketing, tech, data science, and client management. | Drives innovation, operational efficiency, and strong client relationships, fundamental to delivering value. |

Value Propositions

QuinStreet delivers precisely the right audience to service providers, significantly lowering the cost of acquiring new customers. This targeted approach boosts marketing effectiveness by connecting businesses with individuals already in the market for their offerings.

Their advanced technology identifies and delivers prospects actively comparing services, meaning businesses are engaging with highly motivated potential clients. In 2024, QuinStreet's platform facilitated millions of such connections, demonstrating a clear ROI for their partners.

QuinStreet provides service providers with a highly efficient and scalable method to gain new customers, operating on a pay-for-performance model. This significantly reduces the need for large upfront marketing investments, ensuring that clients are only charged when a lead successfully converts into a valuable customer.

In 2024, QuinStreet's platform facilitated millions of customer acquisitions for its partners, demonstrating its effectiveness in driving growth. This pay-for-performance structure means clients see a direct return on investment, as they pay only for tangible results, making it a cost-effective acquisition strategy.

Consumers leverage QuinStreet's online marketplaces to access extensive data and comparison tools, simplifying the research and selection of complex products and services.

This empowers users to make informed decisions, particularly for high-consideration purchases like insurance or financial services, by presenting clear, comparable options.

For instance, in 2024, platforms like EverQuote, a QuinStreet portfolio company, facilitated millions of insurance quote comparisons, demonstrating the significant consumer value in streamlined decision-making.

Maximized ROI for Marketing Spend

QuinStreet's performance-based marketing model directly links its revenue to client success, ensuring marketing spend is focused on achieving measurable outcomes and a robust return on investment. This approach inherently optimizes ad budgets by prioritizing channels and campaigns that deliver tangible results.

This transparency and accountability are crucial for clients, as they can clearly see the impact of their marketing investment. For example, in 2024, QuinStreet's clients in the financial services sector saw an average improvement of 15% in lead conversion rates through QuinStreet's targeted campaigns, directly translating to maximized ROI.

- Performance-Driven Alignment: QuinStreet's success is tied to client lead generation and conversion, ensuring marketing efforts are results-oriented.

- Optimized Spend: The model incentivizes efficient allocation of marketing budgets toward high-performing channels.

- Measurable Results: Clients benefit from clear visibility into campaign effectiveness and direct impact on their bottom line.

- Industry Benchmarks: In 2024, QuinStreet reported that clients in the insurance vertical experienced a 20% increase in qualified leads year-over-year.

Access to a Broad and Diverse Media Network

QuinStreet’s value proposition centers on providing clients unparalleled access to a vast and varied digital media network. This extensive reach allows businesses to connect with a broad spectrum of in-market consumers efficiently. For instance, in 2024, QuinStreet’s network facilitated billions of impressions across numerous verticals, demonstrating its significant audience penetration.

This integrated approach significantly simplifies the marketing process for clients. Instead of navigating the complexities of individual media buys and campaign adjustments across disparate platforms, businesses can leverage QuinStreet’s expertise. This consolidation streamlines operations and often leads to more effective resource allocation, a key advantage in today's competitive digital landscape.

- Extensive Reach: Access to a wide array of digital channels to connect with target audiences.

- Simplified Marketing: Eliminates the need for clients to manage complex, multi-channel media buying.

- Optimized Campaigns: Leverages QuinStreet's expertise for efficient campaign performance.

- Cost-Effectiveness: Reduces the overhead associated with in-house media management and optimization.

QuinStreet's core value lies in its ability to connect businesses with highly qualified leads actively seeking their services. This targeted approach drastically reduces customer acquisition costs for clients. In 2024, QuinStreet's platforms facilitated millions of such high-intent connections, showcasing a direct impact on client growth and profitability.

The company operates on a performance-based model, meaning clients pay only for successful customer acquisitions, not for impressions or clicks. This ensures marketing spend is directly tied to tangible results and a strong return on investment. For example, in 2024, QuinStreet reported that clients in the insurance sector saw a 20% increase in qualified leads year-over-year.

Consumers benefit from QuinStreet's user-friendly online marketplaces, which offer comprehensive data and comparison tools. This simplifies the decision-making process for complex purchases, as seen with platforms like EverQuote in 2024, which processed millions of insurance quote comparisons.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Targeted Lead Generation | Connects businesses with consumers actively researching and comparing services. | Millions of high-intent connections facilitated. |

| Performance-Based Model | Clients pay only for successful customer acquisitions, ensuring ROI. | Clients in insurance saw a 20% YoY increase in qualified leads. |

| Consumer Empowerment | Provides tools for informed decision-making on complex purchases. | EverQuote processed millions of insurance quote comparisons. |

| Simplified Marketing | Offers a consolidated digital media network, reducing client complexity. | Billions of impressions across numerous verticals. |

Customer Relationships

QuinStreet's dedicated account management teams are crucial for nurturing service provider relationships. These teams focus on understanding each client's unique needs, allowing for highly personalized campaign optimization. This hands-on approach aims to ensure strong performance and client satisfaction, acting as a key differentiator in their customer relationship strategy.

The core of QuinStreet's customer relationship hinges on a performance-based partnership. This means their revenue is directly linked to the successful generation of qualified leads and the ultimate acquisition of customers for their clients.

This model creates a powerful alignment of incentives, ensuring QuinStreet is deeply invested in achieving measurable outcomes for the businesses they serve. For instance, in 2024, QuinStreet continued to refine its performance metrics across various verticals, aiming to deliver a demonstrable return on investment for its partners.

Clients can leverage technology-driven platforms for self-service access to campaign performance monitoring, detailed reporting, and efficient lead flow management. This digital approach fosters significant transparency, giving clients direct, real-time insights into their marketing investments and their effectiveness.

In 2024, QuinStreet's commitment to technology-enabled self-service is evidenced by platforms that provide clients with granular data. For instance, clients can track key performance indicators like cost per lead and conversion rates directly through their dashboards, facilitating informed adjustments to campaigns on the fly.

Long-Term Strategic Collaboration

QuinStreet actively cultivates long-term, multi-year collaborations with its clients, moving beyond simple transactions to foster strategic alliances. This approach emphasizes continuous optimization and mutual growth.

The company's commitment to enduring client relationships is demonstrated by its extensive client roster, which features a significant number of multi-year partnerships. For instance, in fiscal year 2023, QuinStreet reported that a substantial portion of its revenue was generated from clients with whom it had established relationships spanning several years, underscoring the strategic depth of these engagements.

- Strategic Partnership Focus: QuinStreet prioritizes evolving client interactions from transactional to deeply integrated, strategic partnerships.

- Multi-Year Engagements: The company boasts a strong track record of securing and maintaining multi-year contracts with its client base.

- Client Retention Success: A significant percentage of QuinStreet's annual revenue is derived from repeat business and long-standing client accounts, indicating high satisfaction and value delivery.

- Growth-Oriented Collaboration: These long-term relationships are designed to facilitate continuous improvement and drive sustained growth for both QuinStreet and its clients.

Customer Support and Optimization Services

QuinStreet's commitment to responsive customer support and ongoing optimization services is key to ensuring clients achieve maximum value from their platform investments. This proactive approach includes dedicated technical assistance, regular performance reviews, and tailored strategic recommendations designed to enhance client outcomes.

These services are crucial for client retention and success. For instance, in 2024, QuinStreet reported that clients utilizing their optimization services saw an average increase of 15% in lead conversion rates compared to those who did not actively engage with these programs. This demonstrates a direct correlation between support engagement and tangible business results.

- Dedicated Technical Assistance: Providing immediate support to resolve any platform-related issues, ensuring seamless operation.

- Performance Reviews: Regular analysis of campaign and platform performance to identify areas for improvement and growth.

- Strategic Recommendations: Offering data-driven advice and best practices to optimize client strategies for better ROI.

- Client Success Managers: Assigning dedicated managers to foster strong relationships and guide clients toward achieving their business objectives.

QuinStreet fosters deep client loyalty through performance-driven partnerships and proactive support. Their strategy emphasizes long-term, collaborative relationships, moving beyond transactional exchanges to become strategic growth partners.

This commitment is reflected in their high client retention rates and multi-year engagements, where success is mutually defined and pursued. For example, in fiscal year 2023, a significant portion of QuinStreet's revenue came from clients with multi-year contracts, highlighting the enduring value they provide.

Clients benefit from transparent, technology-enabled platforms for real-time performance monitoring and data-driven insights, such as tracking cost per lead and conversion rates, which were further enhanced in 2024.

The company's investment in dedicated account management and optimization services directly correlates with client success, with users of these services seeing tangible improvements in key metrics. In 2024, clients actively engaging with optimization services experienced an average 15% increase in lead conversion rates.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Partnership Model | Performance-based, aligning QuinStreet's success with client outcomes. | Revenue directly tied to qualified leads and customer acquisition for clients. |

| Client Engagement | Strategic, long-term collaborations and multi-year contracts. | Significant portion of FY23 revenue from multi-year client relationships. |

| Technology Enablement | Self-service platforms for performance monitoring and reporting. | Enhanced data transparency and real-time insights for clients in 2024. |

| Support & Optimization | Proactive assistance and data-driven recommendations. | 15% average increase in lead conversion for clients using optimization services (2024). |

Channels

QuinStreet directly operates a robust network of proprietary websites and online marketplaces, acting as crucial channels for engaging consumers actively seeking financial services. These platforms are designed to capture high-intent traffic, allowing users to research and compare offerings effectively.

These owned digital properties are central to QuinStreet's lead generation strategy, directly connecting service providers with potential customers. In 2024, QuinStreet's owned and operated sites continued to be a primary driver of its business, facilitating millions of consumer interactions.

Search Engine Marketing (SEM) and Search Engine Optimization (SEO) are crucial for QuinStreet's customer acquisition strategy, acting as primary drivers for attracting users actively seeking financial products and services. This digital performance marketing approach leverages paid search campaigns and organic search rankings to connect with high-intent consumers.

In 2024, the digital advertising market continues its robust growth, with SEM playing a significant role. Companies like QuinStreet rely on these channels to drive qualified traffic, understanding that consumers often turn to search engines as their first step in researching financial solutions.

QuinStreet leverages social media and display advertising to connect with potential customers, directing them to its online marketplaces and partner promotions. These digital avenues are crucial for casting a wide net and pinpointing specific demographics. For instance, in 2024, the digital advertising market continued its robust growth, with social media advertising spend projected to reach hundreds of billions globally, showcasing the immense reach these platforms offer.

Email Marketing

Email marketing serves as a crucial channel for QuinStreet, focusing on nurturing potential customers and connecting them with suitable service providers through targeted campaigns. This approach utilizes extensive databases of individuals who have expressed interest in specific services, facilitating direct and personalized communication.

These campaigns are designed to foster relationships and guide consumers through the decision-making process. By segmenting audiences based on expressed needs and behaviors, QuinStreet can deliver highly relevant offers, increasing the likelihood of conversion.

In 2024, the effectiveness of email marketing in lead nurturing remains high, with studies showing an average ROI of $36 for every $1 spent. This channel is particularly effective for service-based industries like those QuinStreet operates within, where building trust and providing tailored information is key.

- Lead Nurturing: Emails are used to educate prospects about services and build trust.

- Personalization: Campaigns leverage user data for tailored offers and content.

- Direct Communication: Enables immediate interaction and feedback loops.

- Cost-Effectiveness: Email marketing consistently demonstrates a high return on investment.

Call Centers and Inbound Calls

QuinStreet leverages call centers and inbound calls as a crucial channel for specific industries, directly connecting consumers with service providers. This approach is particularly effective for high-consideration purchases where immediate engagement and qualification are valued. For instance, in sectors like financial services or home improvement, consumers often prefer speaking with a representative to discuss complex needs, making inbound calls a powerful lead generation tool.

In 2024, QuinStreet's capabilities in this area continue to be a significant driver of customer acquisition. The company operates and manages call centers designed to efficiently handle inbound inquiries, qualify leads based on predefined criteria, and then transfer these high-intent prospects to relevant clients. This direct interaction facilitates a more personalized customer experience and often results in higher conversion rates compared to purely digital lead transfers.

- Direct Consumer Engagement: Facilitates immediate connections between consumers and service providers, crucial for high-consideration purchases.

- Lead Qualification: Call centers are utilized to pre-qualify inbound leads, ensuring that transferred prospects meet specific client criteria.

- Industry Relevance: Particularly effective in sectors like financial services, insurance, and home services where personalized consultation is valued.

- Enhanced Conversion: The direct, conversational nature of inbound calls often leads to improved lead-to-customer conversion rates for QuinStreet's clients.

QuinStreet's channels are multifaceted, encompassing proprietary websites, search engine marketing, social media, display advertising, email marketing, and call centers. These diverse avenues are strategically employed to capture consumer intent and deliver qualified leads to clients across various financial service sectors. The company continuously optimizes these channels to maximize reach and conversion efficiency.

In 2024, QuinStreet's owned and operated websites remained a cornerstone, driving significant consumer engagement. Complementing this, robust SEM and SEO strategies actively capture high-intent search traffic. Social media and display advertising expand reach, while email marketing nurtures leads through personalized communication. Finally, call centers provide direct engagement for high-consideration purchases.

| Channel | Description | 2024 Focus/Data Point |

|---|---|---|

| Proprietary Websites | Directly owned online marketplaces for consumer research and comparison. | Primary driver of business, facilitating millions of consumer interactions. |

| SEM/SEO | Paid and organic search efforts to attract high-intent consumers. | Crucial for customer acquisition in a growing digital advertising market. |

| Social Media & Display Ads | Broad reach and targeted demographic engagement. | Leveraged in a market where social media ad spend is in the hundreds of billions globally. |

| Email Marketing | Nurturing leads through personalized, targeted campaigns. | Demonstrates high ROI, with an average of $36 for every $1 spent in 2024. |

| Call Centers | Direct consumer engagement and lead qualification for specific industries. | Effective for high-consideration purchases, enhancing conversion rates. |

Customer Segments

Financial Services Providers, including auto insurance carriers, personal loan providers, credit card companies, and banking institutions, are a key customer segment. These businesses are actively looking for ways to expand their customer base and drive sales for their financial products.

In 2024, the financial services industry continued to prioritize digital customer acquisition. For instance, the cost per acquisition for a new credit card customer can range significantly, often between $50 and $200, highlighting the need for efficient lead generation strategies.

Home services providers, a crucial segment for QuinStreet, include businesses focused on home improvement, repair, and ongoing maintenance. These are the plumbers, electricians, landscapers, and remodelers who keep households running smoothly and looking their best.

QuinStreet acts as a vital bridge, connecting these service professionals with homeowners actively searching for their expertise. In 2024, the home improvement market continued its strong performance, with spending projected to reach hundreds of billions of dollars, demonstrating a consistent demand for these essential services.

Consumers researching high-consideration services are individuals actively seeking detailed information and comparisons for significant purchases, often in sectors like financial services and home improvement. These consumers are typically in a buying mode, looking for trusted providers and solutions to complex needs.

In 2024, the demand for high-consideration service research remains robust. For instance, in the financial services sector, consumers are increasingly engaging with online platforms to compare mortgage rates, insurance policies, and investment options. A significant portion of these consumers, estimated to be over 60% in early 2024, utilize comparison websites before making a decision.

Similarly, the home services market sees a high volume of research for services like solar panel installation, HVAC replacement, and roofing. These consumers are often driven by a need for cost savings, energy efficiency, or essential repairs, making thorough research a critical step. Data from early 2024 indicates that consumers spend an average of 3-5 hours researching a single high-consideration home service before contacting providers.

Large Enterprise Clients

Large enterprise clients, including many Fortune 500 companies, rely on QuinStreet for robust customer acquisition strategies. These organizations typically possess significant marketing budgets, often exceeding tens of millions of dollars annually, and demand solutions capable of delivering a high volume of qualified leads to fuel their growth.

These clients seek scalable platforms that can efficiently manage and optimize large-scale campaigns. Their needs often extend beyond simple lead generation to encompass sophisticated targeting and performance analytics, ensuring a strong return on their substantial marketing investments.

- High Volume Lead Generation: Enterprises require a consistent influx of qualified leads to meet ambitious sales targets.

- Scalability and Efficiency: Solutions must handle massive campaign volumes and adapt to evolving market demands.

- Performance Analytics: Detailed reporting and insights are crucial for optimizing spend and demonstrating ROI.

- Brand Reputation Management: Partnering with trusted platforms is essential for maintaining brand integrity in customer acquisition efforts.

Small and Medium-Sized Businesses (SMBs)

While QuinStreet's platform is often associated with larger enterprises, it also serves small and medium-sized businesses (SMBs) within its key verticals. These SMBs utilize QuinStreet's performance marketing capabilities to expand their customer reach and drive growth.

The company's tiered service model is designed to accommodate businesses of varying sizes, enabling broader market penetration. For instance, in 2024, the SMB sector continued to be a significant driver of economic activity, with millions of new businesses launched annually, many seeking effective digital marketing solutions.

- SMB Focus: QuinStreet's platform offers performance marketing solutions tailored for SMBs aiming to acquire new customers.

- Tiered Approach: The company's service structure allows for scalability, making it accessible to businesses of different financial capacities.

- Market Penetration: This flexibility enables QuinStreet to reach a wider array of businesses within its target industries.

- Growth Opportunity: SMBs represent a substantial market segment actively seeking to enhance their online presence and customer acquisition strategies.

QuinStreet serves a diverse range of customer segments, primarily focusing on businesses seeking to acquire new customers and consumers actively researching high-consideration services. These segments are crucial for QuinStreet's performance marketing model.

The company facilitates connections between financial services providers and consumers, as well as home services businesses and homeowners. This dual focus allows QuinStreet to capture significant market share in both essential sectors.

In 2024, the digital marketing landscape continued to emphasize performance-based acquisition, a core strength of QuinStreet's offerings across all its customer segments.

| Customer Segment | Description | 2024 Market Trend/Data Point |

|---|---|---|

| Financial Services Providers | Companies offering insurance, loans, credit cards, and banking. | Prioritized digital customer acquisition; cost per acquisition for credit cards often $50-$200. |

| Home Services Providers | Businesses in home improvement, repair, and maintenance. | Strong market performance; home improvement spending projected in hundreds of billions. |

| Consumers (High-Consideration Services) | Individuals researching significant purchases in finance and home services. | Over 60% use comparison sites; spend 3-5 hours researching home services. |

| Large Enterprise Clients | Fortune 500 companies needing scalable customer acquisition. | Annual marketing budgets often exceed tens of millions; demand sophisticated targeting. |

| Small and Medium-Sized Businesses (SMBs) | Businesses seeking to expand customer reach via performance marketing. | Millions launched annually, seeking effective digital marketing; continued economic activity driver. |

Cost Structure

The lion's share of QuinStreet's expenses lies in securing media and driving traffic to generate valuable leads. This substantial investment covers a wide array of digital marketing efforts, from paid search engine marketing and targeted display advertising to engaging social media campaigns and a variety of other online channels designed to attract potential customers.

In 2024, companies like QuinStreet heavily rely on these acquisition costs to fuel their growth. For instance, the cost per lead in competitive sectors can range significantly, with some industries seeing costs exceeding $50 or even $100 per qualified lead, directly impacting the profitability of lead generation businesses.

QuinStreet heavily invests in its proprietary technology platform, channeling significant resources into product development and engineering. These expenses cover crucial areas like the salaries of its skilled software engineers and developers, essential software licenses, and the ongoing costs of maintaining its technological infrastructure. For instance, in fiscal year 2023, QuinStreet reported technology and development expenses of $47.3 million, underscoring the commitment to innovation and platform efficiency.

Sales and marketing expenses are a significant component of QuinStreet's cost structure, reflecting the investment needed to connect service providers with consumers. These costs encompass the salaries and commissions paid to their sales teams, who are crucial for onboarding and managing relationships with clients.

Client acquisition is a primary driver of these expenses. QuinStreet likely invests heavily in digital advertising, content marketing, and SEO to attract both consumers seeking services and the businesses offering them. For instance, in the fiscal year ending June 30, 2023, QuinStreet reported selling, general, and administrative expenses of $153.8 million, a substantial portion of which would be attributable to these sales and marketing efforts.

General and Administrative Expenses

General and Administrative Expenses, or G&A, are the essential overhead costs that keep QuinStreet running smoothly. This includes everything from the salaries of top executives and the administrative team to crucial services like legal counsel, accounting, and human resources. Facilities expenses, such as rent and utilities for their offices, also fall under this umbrella. These costs are fundamental to the overall operation and strategic direction of the company.

For QuinStreet, these G&A costs are a significant part of their operational budget. In fiscal year 2023, for instance, their selling, general, and administrative expenses totaled $178.7 million. This figure highlights the substantial investment required to manage the company's complex operations and support its growth initiatives.

- Executive Salaries: Compensation for leadership driving QuinStreet's strategy.

- Administrative Staff: Support personnel handling daily operations.

- Legal and Accounting Fees: Costs for compliance and financial oversight.

- Human Resources: Expenses related to employee management and development.

- Facilities Expenses: Costs for office space, utilities, and maintenance.

Data Center and Infrastructure Costs

QuinStreet incurs significant expenses for its data centers and IT infrastructure, crucial for the smooth operation of its online marketplaces. These costs include co-location fees for housing servers, ongoing server maintenance, and essential network expenditures that guarantee the reliability and scalability of its digital platforms.

For instance, in fiscal year 2023, QuinStreet reported total operating expenses of $363.8 million. While specific breakdowns for data center and infrastructure costs aren't always granularly detailed in public reports, these are fundamental components within broader technology and infrastructure spending.

- Co-location Fees: Payments to third-party data center providers for physical space, power, and cooling.

- Server Maintenance: Costs associated with hardware upkeep, upgrades, and replacement to ensure optimal performance.

- Network Costs: Expenses related to bandwidth, internet connectivity, and maintaining robust network infrastructure.

- IT Staffing: Salaries and benefits for personnel managing and operating the IT infrastructure.

The primary cost driver for QuinStreet is customer acquisition, encompassing significant spending on media and traffic generation to secure valuable leads. This investment is crucial for fueling growth, with lead acquisition costs in competitive markets often exceeding $50 per lead in 2024.

Technology and development represent another major expense, with $47.3 million allocated in fiscal year 2023 to enhance its proprietary platform, including engineering talent and infrastructure maintenance.

Sales, general, and administrative (SG&A) expenses are substantial, totaling $178.7 million in fiscal year 2023, covering sales team compensation, marketing initiatives, and essential operational overhead like executive salaries and legal fees.

| Expense Category | FY 2023 (Millions USD) | Key Components |

|---|---|---|

| Customer Acquisition (Media & Traffic) | Not explicitly detailed, but a primary driver | Paid search, display ads, social media campaigns |

| Technology & Development | $47.3 | Software engineers, licenses, infrastructure |

| Selling, General & Administrative (SG&A) | $178.7 | Sales commissions, marketing, executive salaries, legal, HR |

Revenue Streams

QuinStreet's core revenue engine is its pay-for-performance lead generation. This means they get paid when the leads they send to clients turn into actual customers. This performance-based approach aligns QuinStreet’s success directly with its clients’ acquisition goals.

The specific triggers for payment can vary, encompassing actions like a click, a completed inquiry form, a phone call, a submitted application, or even a finalized sale. This flexibility allows QuinStreet to cater to diverse client needs and sales funnels.

For instance, in 2024, QuinStreet continued to refine its algorithms to optimize for higher conversion rates, aiming to maximize the value of each lead delivered. While specific revenue figures tied to this stream fluctuate with market demand and client performance, the model itself is designed for efficiency and demonstrable ROI for their partners.

QuinStreet derives a substantial portion of its income from the financial services sector. Key areas include auto insurance, personal loans, credit cards, and banking services, where they connect consumers with providers.

This financial services vertical has been a consistent growth engine for QuinStreet. For instance, in the fiscal year 2023, QuinStreet reported that its financial services segment represented a significant majority of its revenue, underscoring its importance to the company's overall financial health.

Another significant revenue stream for QuinStreet originates from its Home Services vertical, where it acts as a vital connector between consumers seeking services and a wide array of home service providers. This segment has shown consistent and robust growth, reflecting the ongoing demand for home improvement and maintenance services.

In 2023, QuinStreet's Home Services segment reported substantial revenue, contributing significantly to the company's overall financial performance. This growth is driven by increasing consumer engagement with online platforms for finding reliable service professionals, a trend that has only accelerated in recent years, especially post-2020.

Diversified Industry Verticals

While financial and home services are core, QuinStreet actively pursues revenue from a broader spectrum of client verticals. This diversification is key to broadening its market presence and stabilizing income.

In the fiscal year 2023, QuinStreet reported net sales of $196.1 million, showcasing its operational scale. The company's strategy involves tapping into various sectors to reduce dependency on any single industry, thereby enhancing its resilience.

- Financial Services: A foundational revenue driver, encompassing verticals like insurance and financial products.

- Home Services: Another significant area, focusing on sectors such as home improvement and repair.

- Emerging Verticals: Expansion into new client sectors to capture diverse market opportunities and revenue streams.

Potential for Value-Added Services or Data Licensing

QuinStreet's business model has room for growth beyond its core lead generation. Imagine offering clients deeper insights through advanced analytics or even consulting services. This could transform them from a lead provider to a strategic partner.

A significant untapped opportunity lies in licensing QuinStreet's proprietary data and technology. Businesses in related sectors could benefit from their sophisticated platforms, creating a new, scalable revenue stream.

- Advanced Analytics: Offering clients detailed performance metrics and predictive insights beyond basic lead quality.

- Consulting Services: Providing expert advice on digital marketing strategies and customer acquisition based on QuinStreet's data.

- Data Licensing: Allowing other companies to leverage QuinStreet's anonymized, aggregated data for market research or product development.

- Technology Licensing: Enabling other platforms to integrate QuinStreet's lead-scoring or matching algorithms.

QuinStreet's revenue primarily stems from performance-based lead generation, where clients pay for qualified leads that convert. This model is particularly strong in financial services, including insurance and loans, and home services, connecting consumers with providers.

In fiscal year 2023, QuinStreet reported net sales of $196.1 million, with financial services being a dominant contributor. The company continues to expand into new verticals to diversify its income sources and enhance market reach.

Future revenue potential includes offering advanced analytics, consulting services, and licensing its proprietary data and technology platforms to other businesses.

| Revenue Stream | Primary Verticals | FY 2023 Contribution (Approx.) |

|---|---|---|

| Performance-Based Lead Generation | Financial Services, Home Services | Significant Majority |

| Financial Services | Auto Insurance, Personal Loans, Credit Cards, Banking | Dominant Segment |

| Home Services | Home Improvement, Repair, Maintenance | Substantial Growth |

| Emerging Verticals | Various sectors for diversification | Growing but smaller share |

Business Model Canvas Data Sources

The QuinStreet Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research, and direct customer feedback. These diverse sources ensure each component of the canvas accurately reflects our operational realities and market positioning.