Midsona SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Midsona Bundle

Midsona's strong brand portfolio and growing demand for healthy foods present significant opportunities, yet the company faces challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Midsona's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Midsona AB commands a leading position within the Nordic health and well-being sector, a significant advantage that underpins its business. This strong regional foothold, contributing 65% of its total sales in 2024, allows Midsona to benefit from established brand loyalty and extensive distribution channels.

Midsona's strength lies in its diverse portfolio of organic and natural products, spanning dietary supplements, health foods, plant-based options, and personal care items. This broad offering effectively taps into a growing consumer demand for healthier and more sustainable lifestyle choices, a trend that has significantly accelerated in recent years.

This diversification positions Midsona favorably to capture market share across multiple segments of the health and wellness industry. For instance, the plant-based food market alone was valued at approximately $7.4 billion in 2023 and is projected to grow substantially, demonstrating the significant opportunity within Midsona's product categories.

Midsona's dedication to sustainability is a significant strength, underscored by its climate goals validated by the Science Based Targets initiative (SBTi). This commitment is further recognized by a strong rating from CDP for its climate strategy, indicating robust environmental management.

The company's forward-looking targets, including achieving 100% recyclable plastic packaging by 2025 and a 100% plant-based or vegetarian product range by 2030, appeal directly to a growing segment of environmentally aware consumers. This focus positions Midsona favorably in the market, offering a clear competitive edge.

Strong Brand Portfolio

Midsona benefits from a robust portfolio of proprietary brands, including highly regarded names such as Urtekram, Kung Markatta, and Friggs. These brands hold significant recognition and trust within their respective product categories, particularly in the growing market for healthy and sustainable foods.

The strength of these established brands is a key driver of Midsona's commercial success. They not only contribute substantially to the Group's overall sales figures but also solidify its market position as a leader in the healthy food sector. For instance, Urtekram, a prominent organic skincare and food brand, consistently demonstrates strong consumer demand, reflecting the broader trend towards natural and eco-conscious products.

- Well-recognized proprietary brands: Urtekram, Kung Markatta, Friggs.

- Market leadership: Strong presence in healthy and sustainable food categories.

- Sales contribution: Brands significantly drive Group sales and profitability.

- Consumer trust: Established brands foster loyalty and demand.

Improved Financial Position and Strategic Focus

Midsona has bolstered its financial standing with a new SEK 950 million long-term financing agreement with Nordea. This provides crucial stability as the company executes its strategy for profitable growth.

The company is actively streamlining operations and enhancing production efficiency. These efforts are key to achieving sustainable expansion and reinforcing its market position.

- Secured SEK 950 million credit line with Nordea.

- Focus on profitable growth strategy implementation.

- Streamlining processes and optimizing production efficiency.

Midsona's established market leadership in the Nordic health and well-being sector, particularly its 65% sales contribution from the region in 2024, provides a solid foundation. This strong regional presence is complemented by a diverse and appealing product portfolio focused on organic, natural, and plant-based options, aligning with significant consumer trends.

The company's commitment to sustainability, evidenced by SBTi-validated climate goals and strong CDP ratings, resonates with an increasingly eco-conscious consumer base. Furthermore, Midsona benefits from a stable financial position, recently enhanced by a SEK 950 million financing agreement with Nordea, supporting its strategic growth initiatives.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Dominant position in Nordic health and well-being. | 65% of total sales from the Nordic region in 2024. |

| Diverse Product Portfolio | Focus on organic, natural, and plant-based products. | Taps into growing consumer demand for healthier lifestyles. |

| Sustainability Commitment | Validated climate goals and strong environmental ratings. | SBTi validation and CDP rating for climate strategy. |

| Financial Stability | Secured long-term financing. | SEK 950 million financing agreement with Nordea. |

What is included in the product

Delivers a strategic overview of Midsona’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Midsona's strategic challenges and opportunities.

Weaknesses

Midsona faced a tough start to 2025, reporting a dip in both net sales and operating profit during the first half. This trend continued into the second quarter, where organic net sales saw a 2.0% decrease.

The company's operating profit, even before accounting for one-off items, was notably lower than the prior year. This performance suggests Midsona is grappling with reduced sales volumes and a decline in its ability to generate profits from its core operations.

Midsona experienced a dip in its gross margin during the second quarter of 2025. This was primarily driven by a less favorable sales mix, where private label products saw stronger sales growth compared to the company's proprietary brands.

This shift in product performance, combined with rising production expenses in specific geographical areas, has put a strain on Midsona's overall profitability. For instance, in Q2 2025, the gross margin was reported as 38.5%, a slight decrease from 39.2% in the same period of the previous year, partly attributed to this sales mix dynamic.

Midsona's Nordic operations, the company's largest sales contributor, faced temporary difficulties in the second quarter of 2025. This period saw weaker-than-expected demand and specific challenges arising from a business model adjustment for a key health food brand. These regional issues were a primary driver behind the overall sales decline experienced by the company.

Impact of Discontinued Distribution Agreements

Midsona's reliance on certain distribution agreements proved to be a significant vulnerability. The company experienced a notable 23.5% drop in its license business during the second quarter of 2025, directly attributable to the discontinuation of key distribution partnerships. This downturn underscores a potential weakness in its go-to-market strategy, suggesting an overdependence on external partners for reaching specific markets or product segments.

The impact of these terminated agreements extends beyond the license segment, affecting overall sales performance. This situation highlights the need for Midsona to diversify its distribution channels and potentially develop more direct sales capabilities to mitigate risks associated with the loss of crucial third-party relationships.

- 23.5% decline in Midsona's license business in Q2 2025.

- Discontinued distribution agreements were the primary cause of this decline.

- Negative impact on total sales development across the company.

- Potential over-reliance on external distribution for certain product categories.

Vulnerability to External Factors and Economic Uncertainty

Midsona's reliance on consumer spending makes it vulnerable to economic downturns. For instance, the first half of 2025 presented a challenging environment due to elevated inflation and interest rates, directly impacting consumers' disposable income and, consequently, Midsona's sales volumes.

This sensitivity to macroeconomic shifts means that broader economic uncertainty, such as unexpected changes in inflation or interest rate policies, can significantly hinder the company's financial performance, even if the underlying market for its products remains robust.

The company's financial results for the first half of 2025, which reflected these economic headwinds, underscore this weakness.

- Economic Headwinds: High inflation and interest rates in early 2025 reduced consumer purchasing power.

- Sales Impact: This economic climate directly affected Midsona's sales volumes.

- Market Resilience vs. Economic Reality: Despite a strong underlying market for healthy foods, macroeconomic factors created a challenging operating environment.

Midsona's profitability is hampered by a less favorable sales mix, with private label products outperforming proprietary brands, leading to a dip in gross margin to 38.5% in Q2 2025 from 39.2% a year prior. The company's Nordic operations, its largest market, faced unexpected demand weakness and specific brand challenges in early 2025, directly contributing to overall sales declines. Furthermore, the discontinuation of key distribution agreements resulted in a significant 23.5% drop in Midsona's license business in Q2 2025, exposing a potential over-reliance on external partners.

| Metric | Q2 2025 | Q2 2024 | Change |

|---|---|---|---|

| Organic Net Sales | -2.0% | N/A | Decrease |

| Gross Margin | 38.5% | 39.2% | Decrease |

| License Business Sales | -23.5% | N/A | Significant Decline |

Preview Before You Purchase

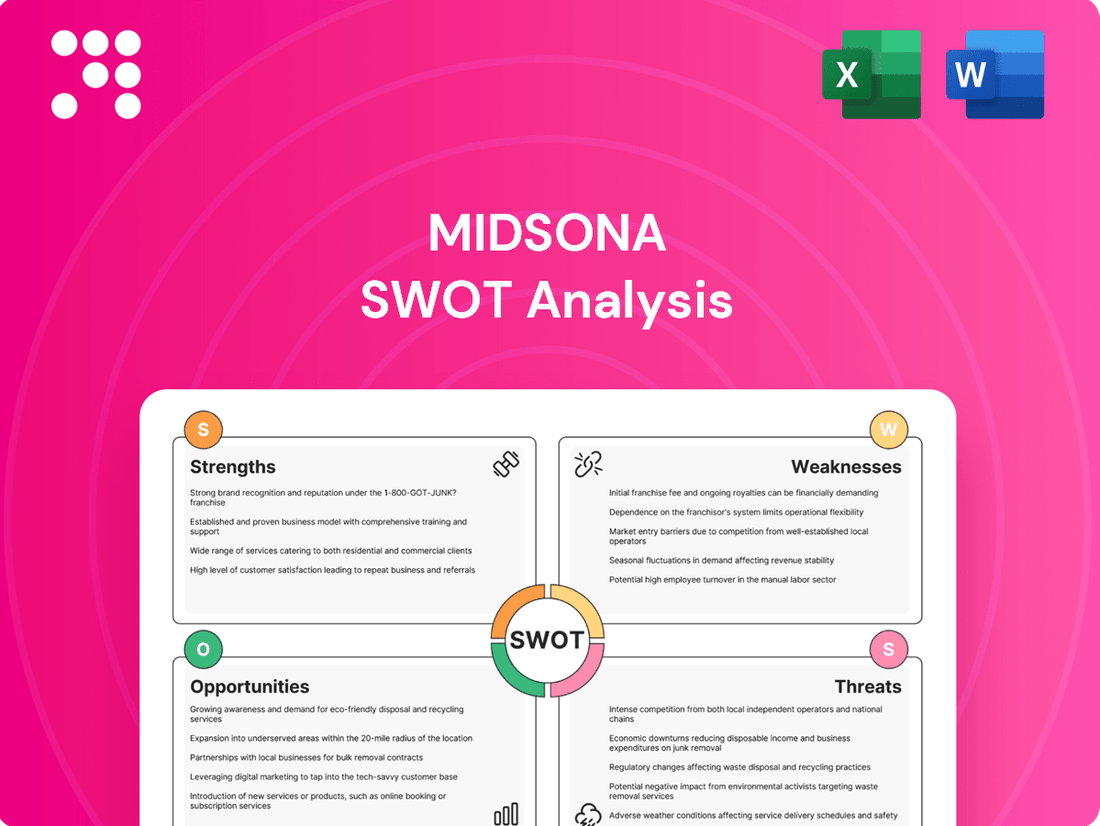

Midsona SWOT Analysis

This is the actual Midsona SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the detailed breakdown of Strengths, Weaknesses, Opportunities, and Threats that will help you understand the company's strategic position.

The preview below is taken directly from the full Midsona SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive overview of the company's internal and external factors.

This preview reflects the real Midsona SWOT analysis document you'll receive—professional, structured, and ready to use. It offers a clear snapshot of the key elements impacting Midsona's business strategy.

Opportunities

The market for healthy, organic, and plant-based foods is experiencing robust growth, fueled by consumers prioritizing personal well-being and environmental consciousness. This upward trend presents a substantial opportunity for Midsona to broaden its product portfolio and enhance its market presence.

In 2024, the global plant-based food market was valued at approximately $40 billion, with projections indicating continued expansion. Midsona's focus on these segments aligns perfectly with this consumer shift, allowing for increased market share and brand loyalty.

Despite some headwinds in the Nordic markets, Midsona experienced notable growth in both North and South Europe during the first half of 2025. This positive trend offers a significant opportunity for continued geographical expansion.

By capitalizing on this momentum, Midsona can further solidify its presence in existing European markets and actively pursue new customer relationships, particularly in strategic regions like the DACH area (Germany, Austria, Switzerland). This expansion is crucial for diversifying revenue streams and reducing reliance on any single market.

The global plant-based food market is booming, projected to reach over $160 billion by 2030, a significant increase from its 2023 valuation of approximately $60 billion. Midsona is well-positioned to leverage this expansion, given its existing strong presence in the plant-based sector.

By focusing on new product development, Midsona can introduce innovative plant-based options that align with growing consumer demand for healthier and more sustainable food choices. This includes exploring novel ingredients and product formats to capture a larger market share.

Strategic Acquisitions and Partnerships

Midsona's strategic acquisition of Internatural AB in 2022 for approximately SEK 1.1 billion and Bringwell in 2023 for SEK 1.3 billion demonstrates a clear pattern of growth through consolidation. These moves have significantly expanded its brand portfolio and market reach within the health and wellness sector.

The company's new financing agreement, secured in late 2023, offers enhanced financial flexibility. This is crucial for pursuing further strategic acquisitions, which could target complementary brands or technologies to bolster its competitive standing and market leadership in the evolving consumer landscape.

- Acquisition History: Midsona has a proven track record, notably acquiring Internatural AB (2022, ~SEK 1.1B) and Bringwell (2023, ~SEK 1.3B).

- Financial Flexibility: A recent financing agreement (late 2023) provides capital for future strategic moves.

- Market Expansion: Potential acquisitions can broaden its brand offering and strengthen its position in key health and wellness segments.

- Synergistic Growth: Future partnerships or acquisitions could unlock new revenue streams and operational efficiencies.

Leveraging Sustainability Leadership for Market Advantage

Midsona's robust dedication to sustainability, evidenced by its strong CDP performance and ambitious climate targets, presents a significant opportunity to stand out in the market. This commitment, particularly its focus on reducing environmental impact and championing ethical operations, resonates with a growing segment of consumers who prioritize these values. By effectively communicating these initiatives, Midsona can cultivate deeper brand loyalty and attract environmentally and socially conscious customers.

Leveraging this leadership can translate into tangible market advantages:

- Enhanced Brand Reputation: Highlighting sustainability efforts, such as achieving a strong CDP score (e.g., a B rating in 2023), reinforces Midsona's image as a responsible corporate citizen.

- Attracting Conscious Consumers: With a significant portion of consumers, particularly younger demographics, willing to pay more for sustainable products, Midsona can capture a growing market share. For instance, a 2024 Nielsen report indicated that over 70% of consumers globally consider sustainability when making purchasing decisions.

- Investor Appeal: Strong Environmental, Social, and Governance (ESG) credentials are increasingly attractive to investors, potentially leading to better access to capital and higher valuations.

- Product Innovation: Continued investment in sustainable sourcing and production methods can drive innovation, leading to new product lines that appeal to niche markets and command premium pricing.

Midsona is well-positioned to capitalize on the expanding plant-based food market, which is projected to exceed $160 billion by 2030. Its strategic acquisitions, like Internatural AB in 2022 and Bringwell in 2023, have broadened its portfolio and market reach. The company's financial flexibility, bolstered by a late 2023 financing agreement, enables further growth through potential acquisitions, strengthening its competitive edge in health and wellness segments.

Threats

The health and well-being sector is a crowded space, with many companies vying for consumer attention with organic, natural, and plant-based options. This fierce competition puts pressure on pricing and can chip away at market share if Midsona doesn't consistently innovate and stand out.

For example, the global health and wellness market was valued at approximately $4.5 trillion in 2022 and is projected to reach $7.0 trillion by 2025, indicating significant growth but also intense rivalry. Midsona must continually differentiate its product portfolio to maintain its competitive edge amidst this dynamic landscape.

Midsona has grappled with persistently elevated raw material prices and rising production expenses in certain operational areas. This has directly pressured its gross profit margins, making it harder to maintain profitability. For instance, in early 2024, the company noted that the cost of key ingredients like oats and certain plant-based proteins saw significant year-over-year increases, impacting the cost of goods sold.

The inherent volatility in these input costs presents a substantial threat. Unpredictable price swings can significantly squeeze profit margins, forcing Midsona to consider passing these increases onto consumers through higher product prices. Such price adjustments, however, risk dampening consumer demand, especially in price-sensitive markets, creating a delicate balancing act for the company.

A fire at Midsona's Spanish production facility in July 2025 underscored the significant threat posed by operational incidents and potential supply chain disruptions. While the company had insurance coverage, the event directly impacted sales, leading to a temporary decline and incurring substantial costs, demonstrating the inherent risks in maintaining a global production footprint.

Economic Downturn and Reduced Consumer Purchasing Power

Ongoing economic uncertainty, characterized by persistent inflation and elevated interest rates, is significantly eroding consumer purchasing power across Midsona's primary markets. This economic pressure forces consumers to re-evaluate their spending habits, potentially leading to a decline in demand for premium organic and health-focused products.

Consumers are increasingly seeking out more budget-friendly options, which could divert sales away from Midsona's higher-priced offerings. For instance, in 2024, inflation in key European markets where Midsona operates remained a concern, impacting disposable incomes.

- Inflationary Pressures: Persistent inflation in 2024 and early 2025 has reduced the real value of household incomes.

- Interest Rate Hikes: Higher interest rates increase borrowing costs for consumers, further constraining discretionary spending.

- Shift to Value: Consumers are demonstrating a clear preference for value-for-money products, potentially impacting sales of premium brands like Midsona's.

- Market Data: Retail sales data from late 2024 indicated a slowdown in non-essential goods, a trend that could extend to specialized food categories.

Shifts in Consumer Preferences and Dietary Trends

Consumer tastes are notoriously fickle, and even within the booming health food market, preferences can change on a dime. This means Midsona must constantly monitor and adapt to evolving trends. For example, a growing concern about "ultra-processed" foods, even those that are plant-based, could pose a significant threat if Midsona's offerings are perceived in that light. This necessitates ongoing innovation and a keen understanding of emerging dietary philosophies to maintain market relevance.

The demand for plant-based alternatives, while strong, is not monolithic. As of early 2024, while the global plant-based food market was valued at over $40 billion and projected to grow significantly, specific sub-segments can experience rapid shifts. A negative perception surrounding certain ingredients or processing methods, even if scientifically unfounded, can quickly impact consumer choices. Midsona needs to be agile in its product development and marketing to address these nuanced shifts, ensuring its portfolio remains aligned with evolving consumer sentiment and avoids being categorized unfavorably.

- Rapidly Shifting Consumer Tastes: The health food sector, while growing, is subject to swift changes in consumer preferences.

- Stigma Around Ultra-Processed Foods: A potential negative perception of Midsona's plant-based products as "ultra-processed" could hinder sales.

- Need for Continuous Adaptation: Midsona must remain agile in product development and marketing to align with evolving dietary trends.

Intense competition within the health and wellness sector threatens Midsona's market share, as numerous companies offer similar organic and plant-based products, leading to pricing pressures. Furthermore, volatile raw material costs, exemplified by rising oat and protein prices in early 2024, directly impact gross profit margins, forcing difficult decisions on price adjustments that could deter consumers.

Operational disruptions, such as the July 2025 fire at its Spanish facility, highlight the significant risk of supply chain interruptions and associated costs, despite insurance coverage. Economic headwinds, including persistent inflation and higher interest rates throughout 2024 and into 2025, are eroding consumer purchasing power, driving a shift towards more budget-friendly alternatives and away from premium health-focused brands.

Evolving consumer tastes present another challenge; a growing aversion to "ultra-processed" foods could negatively impact Midsona's offerings if perceived as such, requiring constant product innovation and adaptation to emerging dietary trends. The plant-based market, while expanding, is segmented, and negative perceptions of certain ingredients or processing methods can quickly affect consumer choices, necessitating agility in product development and marketing.

| Threat Category | Specific Example/Data | Impact on Midsona |

|---|---|---|

| Competition | Global health and wellness market projected to reach $7.0 trillion by 2025. | Market share erosion, pricing pressure. |

| Cost Volatility | Increased costs for oats and plant-based proteins in early 2024. | Reduced gross profit margins, potential price increases. |

| Operational Risk | Fire at Spanish facility in July 2025. | Sales impact, increased costs, supply chain disruption. |

| Economic Factors | Persistent inflation in key European markets during 2024. | Reduced consumer spending power, shift to value brands. |

| Consumer Trends | Growing concern over "ultra-processed" foods. | Potential negative perception of products, need for adaptation. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Midsona's official financial reports, comprehensive market research, and expert analyses of the health and wellness sector.