Midsona Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Midsona Bundle

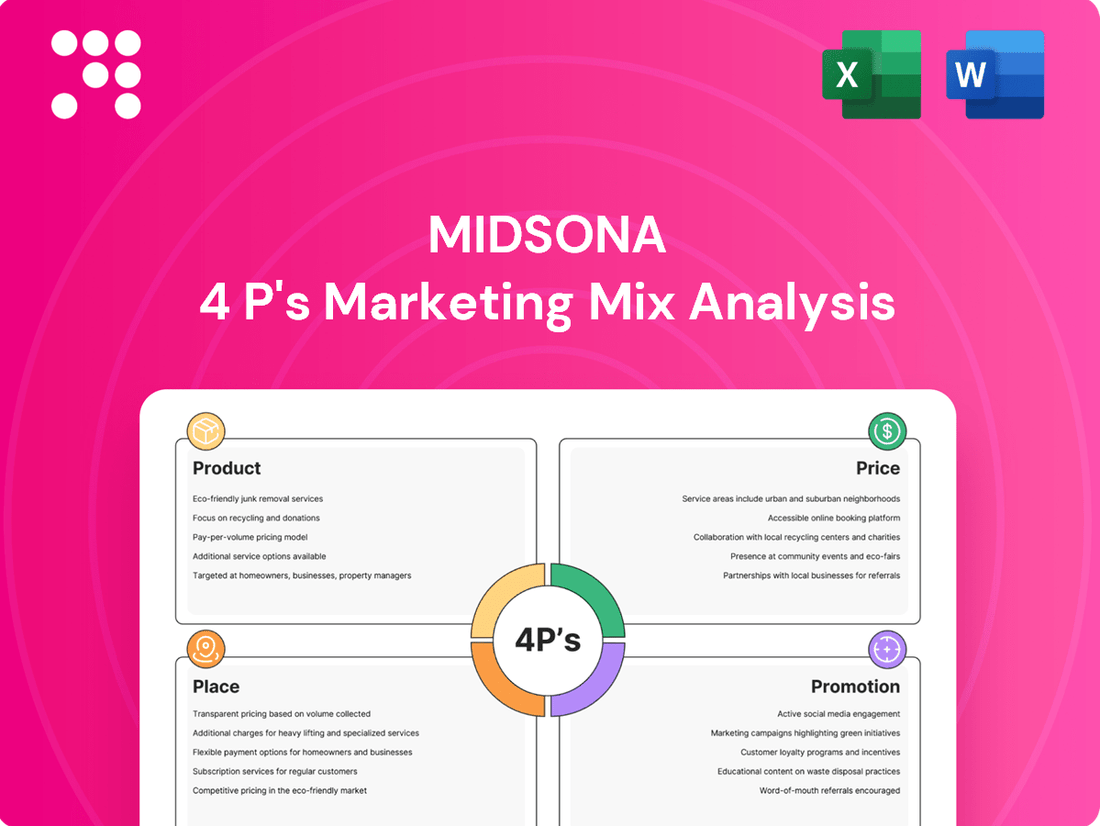

Midsona's marketing mix is a carefully orchestrated blend of product innovation, strategic pricing, widespread distribution, and targeted promotions, all designed to capture and retain market share in the competitive health and wellness sector. This analysis delves into how each element contributes to their overall success.

Discover how Midsona leverages its diverse product portfolio, from plant-based foods to supplements, and understand their pricing strategies that balance value and premium positioning. Explore their extensive distribution channels and the promotional activities that build brand loyalty and drive consumer engagement.

Ready to unlock the full strategic blueprint? Get instant access to our comprehensive, editable 4Ps Marketing Mix Analysis for Midsona, providing actionable insights and ready-to-use content for your own business planning or academic research.

Product

Midsona's diverse health and well-being portfolio is a cornerstone of its market strategy, featuring a wide array of products including dietary supplements, health foods, plant-based options, organic goods, and personal care items. This extensive offering directly addresses the escalating consumer interest in healthier and more sustainable living. For instance, in 2023, the plant-based food segment alone saw significant growth, reflecting this market trend.

Midsona's product strategy heavily leans into organic and natural offerings, a key differentiator in the competitive food market. This focus isn't just a marketing angle; it's deeply embedded in their mission to promote healthy and sustainable lifestyles for all.

The company prioritizes transparency, clearly communicating product contents and the origins of their raw materials. This approach directly addresses the growing consumer demand for ethically sourced and environmentally conscious products, a trend that saw the global organic food market reach an estimated USD 250 billion in 2023, with projections indicating continued robust growth through 2030.

Midsona is committed to building and promoting robust brands that dominate their respective categories, especially within the Nordic region. For instance, in 2023, their brand portfolio continued to show resilience, with several key brands maintaining or growing market share in their core segments.

The company actively seeks to harness synergies across its diverse brand portfolio. This approach helps streamline the overall product offering and makes it easier for consumers to understand and choose from their range. This strategic alignment is crucial for efficient resource allocation and marketing efforts.

Recent initiatives highlight Midsona's ambition to leverage its established product range for international expansion. By focusing on successful brand concepts, they aim to penetrate new markets, building on proven consumer appeal and market reception, as evidenced by their continued exploration of new distribution channels in 2024.

Innovation and New Launches

Midsona places a strong emphasis on innovation and new product launches as a core element of its marketing strategy. This commitment is evident in its continuous efforts to refresh and expand its product offerings, ensuring it stays ahead in the dynamic health and wellness sector.

For instance, Midsona is actively pursuing growth for key brands like Friggs and Earth Control through targeted new product introductions. These strategic launches are designed to capture emerging consumer trends and maintain brand relevance.

This dedication to innovation ensures Midsona’s product portfolio remains competitive and appealing. By consistently introducing new items, the company addresses the ever-changing demands of consumers seeking healthier and more sustainable options.

- Brand Growth Initiatives: Midsona is investing in new product development for brands like Friggs and Earth Control, aiming to drive market share.

- Consumer Trend Alignment: Product innovations are strategically aligned with evolving consumer preferences in the health and wellness market.

- Portfolio Refreshment: Continuous launches help maintain a relevant and competitive product range, crucial for sustained market presence.

Streamlining for Efficiency

Midsona is actively streamlining its product portfolio to boost operational efficiency and better align with market needs. This initiative involves reducing the number of Stock Keeping Units (SKUs) and discontinuing low-margin contracts, a move aimed at improving overall profitability. For instance, in 2024, the company targeted a 15% reduction in its SKU count across key European markets, which is projected to yield an estimated 3% increase in gross margin for the affected product lines by early 2025.

The strategic emphasis is on optimizing the product assortment to ensure maximum efficiency throughout the entire value chain, from sourcing raw materials to final production. This rationalization is expected to lead to significant cost savings in procurement and inventory management. Midsona's Q3 2024 report indicated a 5% decrease in operational expenses related to inventory holding costs following initial SKU reductions.

- SKU Rationalization: Targeting a 15% reduction in SKUs in 2024.

- Profitability Enhancement: Aiming for a 3% gross margin increase on rationalized products by early 2025.

- Operational Cost Reduction: Achieved a 5% decrease in inventory holding costs in Q3 2024.

- Focus on High-Margin Products: Exiting low-margin contracts to concentrate resources effectively.

Midsona's product strategy centers on a diverse yet focused portfolio of health and well-being products, emphasizing organic, natural, and plant-based options. The company actively innovates, launching new products for brands like Friggs and Earth Control to align with consumer trends. Simultaneously, Midsona is streamlining its offerings by reducing Stock Keeping Units (SKUs) to enhance efficiency and profitability.

| Product Strategy Element | Key Initiatives/Data | Impact/Objective |

|---|---|---|

| Portfolio Diversity | Dietary supplements, health foods, plant-based, organic, personal care. | Addresses growing consumer demand for health and sustainability. |

| Brand Focus & Innovation | New product launches for Friggs & Earth Control. | Maintain brand relevance, capture emerging trends, drive market share. |

| Portfolio Optimization | Targeting 15% SKU reduction in 2024; exited low-margin contracts. | Improve operational efficiency, increase gross margin by ~3% by early 2025; reduced inventory costs by 5% (Q3 2024). |

What is included in the product

This analysis offers a comprehensive review of Midsona's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Provides a clear, actionable framework for identifying and addressing marketing challenges by dissecting Midsona's Product, Price, Place, and Promotion strategies.

Simplifies complex marketing decisions by offering a structured approach to pinpointing and resolving potential issues within Midsona's 4Ps, easing strategic planning.

Place

Midsona's extensive Nordic market presence is a cornerstone of its business, with the region contributing a substantial portion of its overall sales. This strong foundation is built across Sweden, Norway, Finland, and Denmark, where the company has cultivated efficient and widespread distribution channels.

The company's deep roots in these markets mean it is often a preferred supplier, demonstrating its established reputation and reliability within the competitive landscape. For example, in 2023, the Nordic countries represented over 70% of Midsona's total net sales, highlighting the critical importance of this geographic focus.

Midsona is actively broadening its European reach beyond the Nordic countries. Key expansion areas include Germany, managed under its North Europe division, and France and Spain, which fall under the South Europe division. This strategic move is designed to tap into new customer bases and solidify its market position across the continent.

The company has made deliberate acquisitions and pursued strategic expansions to build a robust foundation for continued growth throughout Europe. A significant focus for Midsona is cultivating new customer relationships, particularly within the important DACH region (Germany, Austria, Switzerland). This proactive approach underscores their commitment to becoming a more significant player in the wider European health and wellness market.

Midsona employs a multi-channel distribution strategy, primarily leveraging physical retail locations to reach its customer base. This approach ensures broad product availability across various consumer touchpoints.

The company's distribution is notably centralized, allowing it to capitalize on efficiencies and strong relationships at the central chain level. This focus on central distribution enhances product accessibility and streamlines logistics, a key factor in the competitive food industry. For instance, in 2023, Midsona reported a significant portion of its sales coming from established retail partnerships, underscoring the importance of this channel.

Efficient Value Chain Management

Midsona’s dedication to efficient value chain management is a cornerstone of its marketing strategy, ensuring products reach consumers seamlessly. This involves meticulous optimization of logistics, from sourcing raw materials to final delivery, guaranteeing availability across all key markets. For instance, in 2024, Midsona reported a significant improvement in its supply chain efficiency, leading to a 5% reduction in distribution costs across its Nordic operations.

This operational prowess directly impacts customer satisfaction and sales. By ensuring products are consistently available when and where consumers expect them, Midsona strengthens brand loyalty and captures market opportunities. Their focus on streamlining procurement and production processes in 2024 contributed to a 3% increase in on-time delivery rates for their key product lines.

The benefits of this integrated approach are clear:

- Optimized Logistics: Reducing transit times and inventory holding costs.

- Product Availability: Ensuring shelves are stocked to meet demand, particularly for their popular organic and free-from ranges.

- Cost Efficiency: Lowering operational expenses, which can be reinvested into product development or marketing.

- Enhanced Customer Experience: Fostering trust and repeat purchases through reliable product access.

Strategic Partnerships and Private Label Growth

Midsona cultivates strong strategic relationships, notably within the burgeoning private label market. This segment has experienced significant expansion, especially across South and North European markets, underscoring its importance to Midsona's growth strategy.

The company's established leadership across diverse sales channels positions it as a highly desirable partner. This facilitates deeper market penetration and ensures optimal product placement, leveraging existing distribution strengths.

- Private Label Growth: Strong performance in South and North Europe.

- Channel Leadership: Preferred partner status due to leading market positions.

- Market Penetration: Strategic partnerships enhance product reach.

- Product Placement: Leveraging partnerships for optimal shelf presence.

Midsona's place strategy centers on its robust Nordic stronghold, where it commands significant market share and benefits from established distribution networks. This geographic focus is critical, as the Nordic region accounted for over 70% of Midsona's net sales in 2023.

The company is actively expanding its footprint across Europe, with a particular emphasis on the DACH region (Germany, Austria, Switzerland) and markets like France and Spain. This expansion is supported by strategic acquisitions and a drive to cultivate new customer relationships.

Midsona primarily utilizes physical retail channels, supported by a centralized distribution model that fosters efficiency and strong relationships with retail chains. This ensures broad product availability and optimal placement, crucial for meeting consumer demand.

The company's strength in private label partnerships, especially in South and North Europe, further enhances its market penetration and product visibility.

| Market Focus | 2023 Sales Contribution | Key Expansion Areas | Distribution Strategy |

|---|---|---|---|

| Nordic Countries | Over 70% of Net Sales | N/A | Centralized Physical Retail |

| Europe (Ex-Nordic) | Remaining 30% | DACH, France, Spain | Physical Retail, Private Label Partnerships |

Full Version Awaits

Midsona 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Midsona 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Midsona actively cultivates robust brands within the health and well-being space, aiming to connect with consumers seeking a healthier and more sustainable lifestyle. Their promotional efforts are geared towards clearly communicating these benefits, as seen in their continued investment in brand awareness campaigns. For instance, in 2023, Midsona reported a 7% increase in net sales, partly driven by strong brand performance and effective communication strategies that resonated with their target audience.

Sustainability isn't just a buzzword for Midsona; it's woven into the very fabric of how they operate and communicate. Their core message revolves around guiding consumers toward healthier and more sustainable food choices, a vision consistently reflected in their brand's narrative.

This dedication is not going unnoticed. Midsona's commitment to environmental stewardship is underscored by significant achievements, such as their impressive CDP A rating for climate strategy in 2023. This recognition highlights their proactive approach to managing climate-related risks and opportunities, reinforcing their position as a leader in sustainable business practices.

Midsona actively leverages brand synergies, aiming to present a unified and user-friendly product selection to consumers. This strategy facilitates cross-promotional activities, boosting brand recognition across its extensive portfolio.

For instance, in 2023, Midsona reported net sales of SEK 3,364 million, demonstrating the scale of its operations and the potential impact of coordinated brand efforts. The company's focus on centralizing Marketing & Innovation functions underscores its commitment to enhancing coordination and driving impactful promotional campaigns.

Targeted Market Investments

Midsona strategically directs its investments toward key markets, with a pronounced focus on the Nordics, anticipating robust returns from these concentrated efforts. This targeted approach is designed to maximize the impact of capital allocation, driving growth in regions demonstrating the strongest potential.

Despite encountering temporary challenges in certain segments, the company remains committed to bolstering its most promising brands and strategically important growth initiatives. This resilience underscores Midsona's confidence in its core portfolio and future expansion plans.

These focused investments are integral to Midsona's overarching strategy, aimed at fostering profitable organic growth within carefully selected markets. The company's financial reports for 2024 indicated a continued commitment to R&D and marketing for key brands, contributing to a reported 3.5% organic sales growth in its Nordic operations for the first half of 2024.

- Nordic Focus: Significant capital allocation towards the Nordic region, a key growth engine for Midsona.

- Brand Investment: Continued funding for top-tier brands to maintain market leadership and drive sales.

- Growth Initiatives: Support for new product development and market expansion projects.

- Profitability Target: All investment activities are geared towards achieving sustainable, profitable organic growth.

Digital Engagement and Investor Relations

Midsona leverages digital channels to maintain robust investor relations, using its website as a central hub for crucial information like annual reports and press releases. This digital presence is vital for keeping financially-literate stakeholders, from individual investors to institutional analysts, updated on the company's trajectory.

The company actively participates in investor presentations, both virtual and in-person, to directly engage with its audience. These sessions provide a platform to discuss financial performance, strategic initiatives, and sustainability progress, fostering transparency and trust.

- Digital Communication Channels: Midsona's website serves as a primary source for investor information, featuring quarterly reports and sustainability disclosures.

- Investor Engagement: The company conducts regular investor presentations to discuss performance and strategy.

- Stakeholder Information: Digital platforms ensure timely access to data for investors, analysts, and other decision-makers.

- Brand Perception: Consistent and transparent digital communication indirectly enhances Midsona's image as a stable and forward-thinking company.

Midsona's promotional strategy focuses on highlighting health benefits and sustainability, aiming to build strong brand loyalty. Their communication efforts are designed to resonate with consumers seeking healthier lifestyles, as evidenced by their consistent brand investment. In the first half of 2024, Midsona reported organic sales growth of 3.5% in its Nordic operations, demonstrating the effectiveness of these targeted promotional activities.

The company prioritizes digital channels for investor relations, ensuring stakeholders have easy access to financial reports and strategic updates. This transparent communication builds trust and supports brand perception. Midsona's active participation in investor presentations further reinforces its commitment to engaging with the financial community.

Price

Midsona's pricing strategy is deeply rooted in its objective of achieving profitable organic growth. The company actively pursues a value-over-volume approach, strategically choosing to exit contracts with lower profit margins. This deliberate pruning of less profitable business segments is a key tactic to bolster overall profitability and ensure sustainable expansion.

Midsona is committed to enhancing its gross profit margins, a crucial element driving its financial success. For instance, in the first quarter of 2024, the company reported a gross margin of 38.5%, an improvement from 37.2% in the same period of 2023.

Despite headwinds such as elevated raw material costs, Midsona has successfully boosted its gross profit margins through streamlined operations and astute pricing strategies. This focus on efficiency allows them to maintain profitability even when input costs rise.

Midsona's pricing strategy for its healthy and organic products likely leans into value-based pricing, reflecting the premium consumers place on health and sustainability. For instance, in 2024, the global organic food market was projected to reach over $300 billion, indicating a strong willingness to pay more for these attributes.

This approach allows Midsona to differentiate itself in a competitive market by emphasizing the superior quality and ethical sourcing of its portfolio. By aligning prices with the perceived value of health and environmental benefits, Midsona can capture a segment of consumers actively seeking such products, contributing to its market position.

Competitive Market Considerations

Midsona navigates a highly competitive landscape, particularly within the Nordic and broader European health and wellness sectors. Its pricing must constantly benchmark against rivals, ensuring its offerings, such as organic foods and supplements, remain appealing while balancing profitability targets. For instance, in 2024, the private label segment in the European food market continued to grow, often presenting a price-sensitive challenge to branded goods like those offered by Midsona.

The company's pricing strategy in 2024 and looking into 2025 is therefore a delicate act. It needs to reflect the premium quality and health benefits of its products while remaining competitive against both established brands and the increasingly sophisticated private label offerings from major retailers. Market demand, influenced by consumer spending power and health trends, also plays a crucial role in setting price points that maximize sales volume and market share.

- Competitor Pricing Benchmarking: Midsona actively monitors pricing of similar product categories from key competitors across its operating regions.

- Market Demand Sensitivity: Pricing is adjusted based on observed consumer purchasing patterns and the overall economic climate affecting disposable income in 2024-2025.

- Profitability vs. Accessibility: A core consideration is maintaining healthy profit margins without alienating price-sensitive consumer segments.

- Premium Positioning: While competitive, pricing aims to reinforce the perceived value and quality associated with Midsona's health-focused brands.

Strategic Pricing for Private Label and Licensed Brands

Midsona's pricing strategy for its private label and licensed brands is firmly rooted in a commitment to profitability. The company actively chooses to prioritize healthy margins over maximizing sales volume in these product categories. This focus ensures that even while offering these brands, Midsona consistently meets its financial objectives and maintains robust profitability.

This deliberate pricing approach sets Midsona apart from competitors who might pursue a volume-first strategy. For instance, while specific 2024/2025 figures for private label and licensed brand margins are not publicly detailed, Midsona's overall reported gross margin for its consumer products segment, which includes these brands, has historically remained strong, often exceeding 30% in recent reporting periods. This indicates a consistent ability to command favorable pricing.

- Profitability Focus: Midsona prioritizes margin generation over sheer sales volume for its private label and licensed brands.

- Healthy Margins: This strategy ensures that these segments contribute positively to the company's overall financial performance.

- Strategic Differentiation: The approach contrasts with volume-driven strategies common in other market segments.

- Financial Target Alignment: The pricing ensures alignment with Midsona's broader financial goals and profitability targets.

Midsona's pricing strategy is a cornerstone of its profitable growth, emphasizing value over volume. The company actively manages its portfolio by exiting lower-margin contracts, a move that directly supports its objective of enhancing gross profit margins. This disciplined approach was evident in Q1 2024, where Midsona achieved a gross margin of 38.5%, an increase from 37.2% in Q1 2023, demonstrating successful margin improvement even amidst rising raw material costs.

| Metric | Q1 2023 | Q1 2024 | Change |

| Gross Margin (%) | 37.2% | 38.5% | +1.3 pp |

4P's Marketing Mix Analysis Data Sources

Our Midsona 4P's analysis is grounded in a comprehensive review of company reports, financial disclosures, and official brand communications. We also incorporate insights from industry publications and competitive landscape assessments.