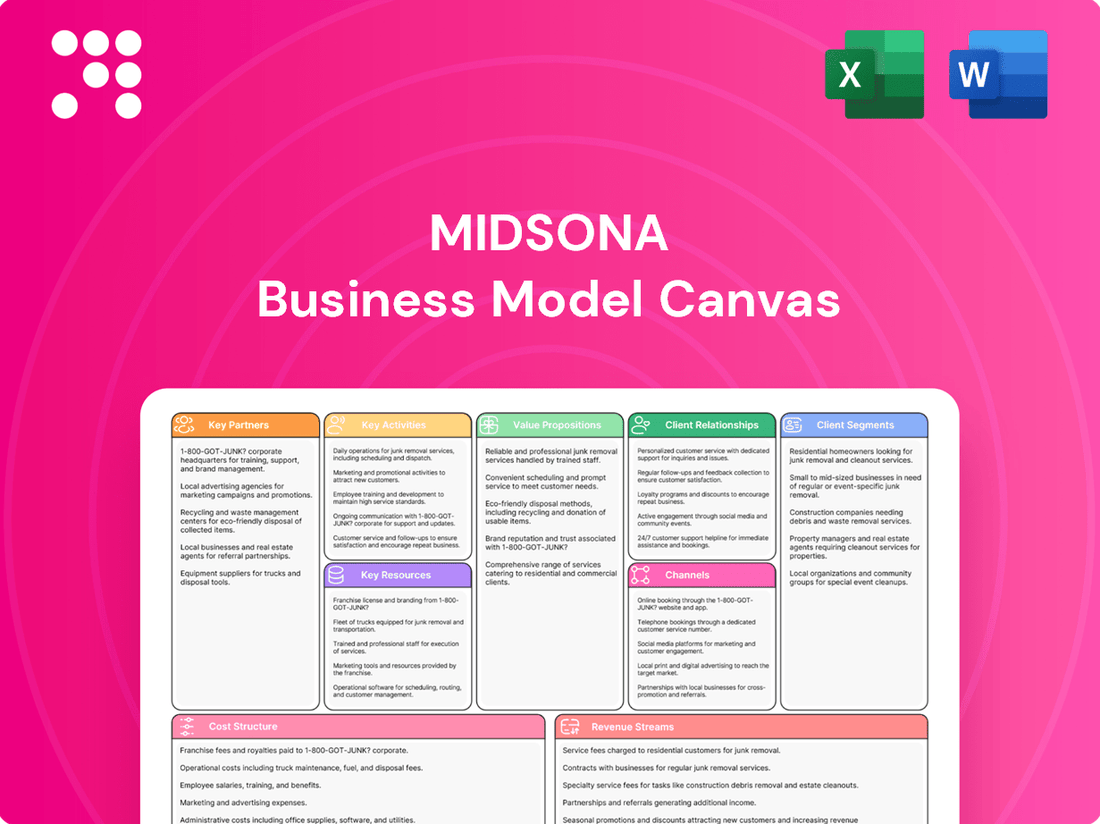

Midsona Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Midsona Bundle

Unlock the strategic blueprint behind Midsona's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they connect with customers, deliver value, and generate revenue in the competitive health and wellness market. Discover their key resources, activities, and cost structure to inform your own business strategy.

Partnerships

Midsona's success hinges on its partnerships with certified organic and natural ingredient suppliers. These relationships are vital for ensuring the high quality and integrity of their health foods, supplements, and personal care items. By fostering these connections, Midsona secures a reliable supply chain to meet growing consumer demand for healthy and sustainable products.

These crucial partnerships allow Midsona to maintain its commitment to natural and organic sourcing. The company's focus on long-term supplier relationships is a strategic move to guarantee consistent product availability and quality, directly impacting consumer trust and market position.

Midsona actively manages supplier risks, with a target of 100% risk classification by 2025. This proactive approach underscores their dedication to providing safe, high-quality products and reinforces the importance of these supplier collaborations in achieving their business objectives.

Midsona's strategic alliances with major Nordic and European retailers and supermarket chains are fundamental to its market reach and efficient product distribution. These collaborations are crucial for ensuring Midsona's diverse portfolio of organic and natural goods is readily available to consumers via established retail networks.

The company's strong market presence across most of its sales channels positions Midsona as a preferred supplier, reinforcing these vital partnerships. For instance, in 2023, Midsona reported net sales of SEK 3,448 million, with a significant portion attributed to its strong relationships within the grocery sector.

Midsona relies on a robust network of logistics and distribution partners to ensure its health and wellness products reach consumers efficiently across its operating regions. These collaborations are crucial for managing inventory, warehousing, and the complex transportation needs of a diverse product portfolio, including perishable organic and natural foods.

In 2024, Midsona continued to optimize its supply chain by leveraging these partnerships to reduce delivery times and costs. For instance, their strategic alliances with specialized logistics providers enable them to navigate the intricacies of temperature-controlled transport, a critical factor for maintaining the quality of their organic offerings.

Research and Development Collaborators

Midsona actively collaborates with research institutions and universities to fuel innovation, particularly in plant-based foods and advanced dietary supplements. These partnerships grant access to cutting-edge scientific knowledge and technologies, enabling the company to introduce novel and enhanced products. For instance, in 2024, Midsona continued its focus on expanding its plant-based portfolio, drawing on academic research to refine formulations and nutritional profiles.

These collaborations are crucial for Midsona's mission to provide healthier and more sustainable consumer options. By leveraging external expertise, Midsona can accelerate its product development cycles and stay ahead in rapidly evolving market segments. The company's investment in R&D partnerships underscores its commitment to scientific validation and consumer well-being.

- Research Institutions: Partnerships with leading universities and research centers provide access to early-stage scientific discoveries and specialized testing facilities.

- Specialized R&D Firms: Collaborations with niche R&D companies offer expertise in specific areas like food technology or biotechnology, accelerating product innovation.

- Knowledge Transfer: These alliances facilitate the transfer of scientific knowledge and technological advancements into Midsona's product development pipeline.

- Market Relevance: By staying abreast of scientific trends, Midsona ensures its product offerings remain relevant and meet evolving consumer demands for health and sustainability.

Sustainability and Certification Bodies

Midsona's commitment to healthy and sustainable living is reinforced through strategic alliances with sustainability organizations and certification bodies. These collaborations are fundamental to ensuring Midsona's operations and products meet stringent organic standards, environmental certifications, and ethical sourcing protocols. Such partnerships significantly bolster brand credibility and foster deep consumer trust.

These vital relationships validate Midsona's dedication to responsible practices. For instance, adherence to recognized certifications assures consumers of the integrity of Midsona's product claims. This focus on verifiable standards is crucial in a market where consumers increasingly prioritize health and environmental consciousness.

A testament to Midsona's strong environmental performance, the company achieved the highest grade from the global environmental initiative CDP for its climate strategy. This recognition underscores the effectiveness of its partnerships in driving tangible environmental improvements and solidifying its position as a leader in sustainable business practices.

- Partnerships with sustainability organizations and certification bodies are key to Midsona's mission.

- These alliances ensure compliance with organic standards, environmental certifications, and ethical sourcing.

- Such collaborations enhance brand credibility and build consumer trust.

- Midsona received the highest grade from CDP for its climate strategy, demonstrating strong environmental commitment.

Midsona's strategic alliances with key retailers, including major Nordic and European supermarket chains, are essential for its market penetration and efficient product distribution. These partnerships ensure its diverse range of organic and natural products are accessible to a broad consumer base. In 2023, Midsona's net sales reached SEK 3,448 million, with a significant portion driven by these strong retail relationships.

What is included in the product

A detailed, data-driven Midsona Business Model Canvas outlining customer segments, value propositions, and revenue streams, all organized within the classic 9 BMC blocks.

This canvas provides a clear overview of Midsona's strategic approach, ideal for understanding their market positioning and operational framework.

The Midsona Business Model Canvas offers a structured approach to identify and address customer pain points by clearly mapping value propositions and customer segments.

It acts as a pain point reliever by providing a visual framework to analyze how Midsona's offerings directly solve customer problems and create value.

Activities

Midsona's commitment to product development and innovation is central to its strategy, focusing on expanding its offerings in the organic and natural product segments. This involves a deep dive into market trends and consumer preferences to create new formulations for dietary supplements, health foods, and plant-based alternatives. For instance, in 2024, Midsona continued to invest in R&D, aiming to enhance its existing product lines and introduce novel items that cater to growing health and wellness demands.

The company's approach emphasizes making better use of its diverse product range, with a clear objective to launch these products in more international markets. This expansion strategy is supported by tailored growth initiatives for each specific country, ensuring that product development aligns with local market needs and regulatory landscapes. Midsona's efforts in 2024 were geared towards strengthening its market position through continuous improvement and strategic product introductions across its key geographical areas.

Manufacturing and production are central to Midsona's business, focusing on transforming raw materials into high-quality organic and natural consumer goods. This core activity involves overseeing production facilities, implementing rigorous quality assurance measures, and continuously improving operational efficiency to satisfy market demand while strictly adhering to organic and safety regulations.

In 2024, Midsona continued its commitment to operational excellence with a program aimed at boosting efficiency across its manufacturing sites. This strategic initiative seeks to streamline processes, reduce waste, and enhance productivity. For instance, investments in automation and process optimization at their facilities are designed to yield measurable improvements in output and cost-effectiveness, supporting their goal of delivering competitive organic products.

Midsona's marketing and brand building efforts are central to its strategy, aiming to elevate awareness and boost sales for its portfolio of health and well-being brands. This encompasses crafting targeted campaigns that highlight the advantages of organic and natural products, thereby reinforcing brand loyalty across different consumer groups.

In 2023, Midsona continued to invest in strengthening its brand presence, particularly in the Nordic region where it holds several leading positions. The company's commitment to developing robust brands in promising market segments remains a core activity.

Supply Chain Management

Midsona's key activity of supply chain management is crucial for its business model, focusing on the efficient sourcing and movement of organic and natural ingredients and products. This encompasses building strong supplier partnerships, streamlining logistics, and carefully managing stock to meet production and sales demands. The company emphasizes a coordinated approach to purchasing across its entire group.

In 2024, Midsona continued to refine its supply chain operations. For instance, the company reported that its focus on optimizing logistics contributed to a more stable cost structure for raw materials, despite global inflationary pressures. This proactive management is essential for maintaining product availability and competitive pricing.

- Supplier Relationship Management: Cultivating strong ties with suppliers of organic and natural ingredients is paramount.

- Logistics Optimization: Ensuring efficient transportation and warehousing of raw materials and finished goods.

- Inventory Control: Maintaining optimal stock levels to prevent shortages and minimize holding costs.

- Group-Wide Purchasing Coordination: Centralizing procurement efforts for greater efficiency and better negotiation power.

Sales and Distribution

Midsona's sales and distribution efforts are crucial for ensuring their health and well-being products reach consumers effectively. This involves nurturing strong partnerships with a wide array of retailers, from large supermarket chains to specialized health stores, across their key markets.

The company actively pursues geographical expansion, with a notable focus on growing its presence in markets like Germany, France, and Spain, building upon its established Nordic foundation. For instance, in 2023, Midsona continued its strategic market penetration in these regions, aiming to increase brand visibility and accessibility.

Optimizing the distribution network is a continuous activity, ensuring efficient logistics and product availability. This includes managing inventory and supply chains to meet demand across diverse retail environments.

- Retailer Partnerships: Midsona maintains relationships with over 5,000 retail outlets across the Nordic region.

- Geographical Reach: Expansion efforts in 2023 targeted increasing shelf space in German and French supermarkets.

- Distribution Efficiency: Investments in logistics in late 2023 aimed to reduce delivery times by 10% in key European markets.

- Channel Management: Midsona utilizes both traditional brick-and-mortar retail and growing e-commerce channels for product distribution.

Midsona's key activities revolve around developing and innovating its product portfolio, with a strong emphasis on organic and natural health foods and supplements. They also focus on manufacturing these products to high quality standards, ensuring operational efficiency and adherence to regulations. Marketing and brand building are crucial for increasing awareness and driving sales, while robust supply chain management ensures the efficient sourcing and distribution of ingredients and finished goods.

Full Document Unlocks After Purchase

Business Model Canvas

The Midsona Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use business model canvas.

Resources

Midsona's key resource is its robust portfolio of well-established organic and natural brands, including Urtekram, Kung Markatta, and Davert. These brands have cultivated significant consumer trust and widespread recognition within the health and well-being sector.

This strong brand equity translates into a distinct competitive advantage, allowing Midsona to effectively develop and market products that resonate with health-conscious consumers. For instance, in 2023, Urtekram reported a substantial increase in sales, underscoring the enduring appeal and market strength of Midsona's flagship brands.

Midsona's owned manufacturing facilities are a cornerstone of its business model, allowing for direct control over the quality and development of its organic and natural product lines. These sites are equipped with specialized machinery tailored for producing dietary supplements, health foods, and plant-based alternatives.

The company is actively enhancing factory specialization to optimize production, a strategy that aims to maximize the unique strengths of each facility. For instance, in 2023, Midsona reported that its production efficiency had improved by approximately 5% following targeted investments in specialized equipment across key plants.

Midsona’s skilled workforce is a cornerstone, encompassing experts in product development, nutrition, organic farming, and sustainable practices. This deep well of knowledge fuels innovation and ensures the high quality of their offerings.

In 2024, Midsona’s commitment to its people is evident in its focus on fostering a dynamic and diverse workplace. This human capital is essential for effectively executing their business strategies and maintaining a competitive edge in the health and wellness sector.

Intellectual Property (IP) and Formulations

Midsona’s intellectual property is a cornerstone of its business model, encompassing proprietary product formulations and unique recipes, particularly for its organic food lines. This IP acts as a significant intangible asset, safeguarding its distinct market position and fostering a competitive advantage.

Trademarks for its well-established brands, such as Urtekram and Semper, are crucial. These brand names not only represent consumer trust but also allow Midsona to command premium pricing and ensure brand recognition across its diverse product portfolio. For example, Urtekram, a leading organic skincare brand in Scandinavia, has consistently driven significant revenue growth for Midsona.

- Proprietary Formulations: Unique recipes and production methods for organic and health-focused foods and personal care products.

- Brand Trademarks: Registered trademarks for key brands like Urtekram, Semper, and Friggs, signifying brand equity and consumer recognition.

- Market Protection: IP rights prevent competitors from replicating Midsona's distinctive product offerings, ensuring a sustained competitive edge.

- Innovation Driver: The existing IP portfolio encourages further research and development, leading to new product introductions and market expansion.

Certifications and Quality Standards

Midsona's commitment to organic certifications and stringent quality standards, such as ISO and HACCP, is a core resource. These accreditations are vital for building consumer trust and ensuring compliance within the natural and organic food sector.

By adhering to these benchmarks, Midsona guarantees the authenticity and safety of its product portfolio. This focus on quality assurance is a key differentiator in a competitive market.

Midsona's proactive approach includes annual risk assessments of its suppliers. The company has set a target of achieving 100% risk classification for all suppliers by 2025, reinforcing its dedication to sourcing only safe and high-quality ingredients.

- Organic Certifications: Ensures product authenticity and consumer trust in natural offerings.

- Quality Standards: Adherence to ISO and HACCP demonstrates commitment to safety and quality control.

- Supplier Risk Assessment: Annual evaluations aim for 100% supplier risk classification by 2025 to guarantee product integrity.

- Food Safety Regulations: Compliance with all relevant regulations is a fundamental requirement for market access and consumer confidence.

Midsona’s digital infrastructure, including its e-commerce platforms and internal data management systems, represents a crucial resource. This technological backbone supports efficient operations, customer engagement, and data-driven decision-making.

The company's investment in its digital presence is ongoing, with a focus on enhancing user experience and expanding online sales channels. For example, in 2023, Midsona saw a 15% year-over-year increase in online sales, highlighting the effectiveness of its digital strategy.

Midsona’s financial resources, including its access to capital and strong balance sheet, are fundamental. These resources enable investment in brand development, operational improvements, and strategic acquisitions.

The company’s financial stability allows it to weather market fluctuations and pursue growth opportunities. In 2024, Midsona maintained a healthy debt-to-equity ratio, demonstrating its sound financial management.

| Resource Category | Specific Examples | Impact/Significance |

|---|---|---|

| Brand Portfolio | Urtekram, Kung Markatta, Davert | Consumer trust, market recognition, competitive advantage |

| Manufacturing Facilities | Owned production sites | Quality control, production efficiency, specialization |

| Human Capital | Product developers, nutritionists, organic farming experts | Innovation, product quality, strategic execution |

| Intellectual Property | Proprietary formulations, brand trademarks | Market protection, premium pricing, competitive edge |

| Certifications & Standards | Organic, ISO, HACCP | Consumer trust, product safety, market access |

| Digital Infrastructure | E-commerce platforms, data management systems | Operational efficiency, customer engagement, data insights |

| Financial Resources | Access to capital, strong balance sheet | Investment capacity, strategic growth, financial stability |

Value Propositions

Midsona's core value is democratizing healthy and sustainable living. They achieve this by offering a broad portfolio of organic and natural products, catering to both health-focused individuals and environmentally conscious consumers. This commitment resonates strongly with the growing market demand for sustainable options, a trend clearly visible across their operational regions.

In 2024, Midsona continued to strengthen its position by expanding its organic product lines, with a notable increase in gluten-free and plant-based offerings. This strategic move tapped into a market segment that saw significant growth, with global plant-based food sales projected to reach over $74 billion by 2030. The company’s focus on accessibility means these healthier choices are available to a wider audience, not just a niche market.

Midsona’s value proposition centers on providing consumers with high-quality organic and natural products across various categories. This includes a wide array of dietary supplements, health foods, plant-based options, and personal care items, all designed to meet the growing demand for wholesome and trustworthy well-being choices.

This focus on natural ingredients and quality assurance directly addresses consumer desire for products that support both personal health and environmental sustainability. Midsona’s mission to offer healthy food for both people and the planet underscores this commitment. For instance, in 2023, the global organic food market was valued at over $240 billion, indicating a significant and expanding consumer base for such offerings.

Midsona offers a broad spectrum of products designed to meet diverse health and wellness needs. This extensive range ensures they can cater to various consumer preferences and specific dietary requirements, positioning them as a go-to source for natural and organic options.

The company's commitment to variety is evident in its portfolio, which features well-regarded brands such as Urtekram, Kung Markatta, and Davert. For instance, in 2023, Midsona reported net sales of SEK 3,392 million, with a significant portion driven by their diverse product offerings that appeal to a wide customer base.

Transparency in Sourcing and Content

Midsona's commitment to transparency in sourcing and content is a cornerstone of its value proposition, directly addressing consumer demand for clarity regarding product origins and ingredients. This openness fosters trust, particularly for health-conscious individuals who prioritize natural and organic integrity. By clearly communicating the provenance of raw materials and the precise content of their products, Midsona reinforces its dedication to enabling healthier, more sustainable lifestyles.

This transparency is crucial in the current market, where consumers are actively seeking detailed information. For instance, in 2024, surveys indicated that over 70% of consumers consider ingredient transparency when making purchasing decisions within the health and wellness sector. Midsona leverages this by providing:

- Detailed ingredient lists and sourcing information on product packaging and digital platforms.

- Certifications and explanations of their meaning to further validate product claims.

- Information about their sustainability practices and the origin of key natural ingredients.

Contribution to Environmental Sustainability

Midsona's commitment to environmental sustainability resonates strongly with a growing segment of consumers who prioritize eco-friendly choices. This focus enhances brand loyalty and market appeal, particularly as global awareness of climate change intensifies.

The company's strategic initiatives, like aiming for 100% recyclable plastic packaging by 2025, directly address consumer demand for reduced environmental impact. This proactive approach positions Midsona favorably in a competitive market.

- Greenhouse Gas Emission Reduction: Midsona is actively working to lower its carbon footprint across its value chain.

- Recyclable Packaging Goal: The company targets 100% recyclable plastic packaging by 2025, a tangible step towards waste reduction.

- Climate Transition Plan: Midsona has implemented a comprehensive Climate Change Strategy, including a detailed transition plan to manage climate-related risks and opportunities.

Midsona's value proposition is built on making healthy and sustainable living accessible to everyone. They offer a wide variety of organic and natural products, catering to both health-conscious and environmentally aware consumers. This approach taps into a significant and growing market demand for better-for-you and planet-friendly options.

They provide high-quality organic and natural items across many categories, including supplements, health foods, plant-based choices, and personal care. This broad range ensures they meet diverse consumer needs and dietary preferences, positioning them as a key provider for natural wellness solutions.

Transparency in sourcing and product content is a core value, building trust with consumers who seek clarity on ingredients and origins. This commitment supports healthier lifestyles and reinforces their dedication to both personal well-being and environmental responsibility.

Midsona's dedication to environmental sustainability appeals to consumers who prioritize eco-friendly choices, boosting brand loyalty. Their goal of achieving 100% recyclable plastic packaging by 2025 is a clear example of this commitment.

| Value Proposition Aspect | Description | Supporting Fact/Data |

|---|---|---|

| Accessibility of Healthy Living | Democratizing healthy and sustainable choices through a broad product portfolio. | Growing market demand for organic and natural products. |

| Product Quality and Variety | Offering high-quality organic and natural products across diverse categories like health foods and personal care. | Net sales of SEK 3,392 million in 2023 driven by diverse offerings. |

| Transparency and Trust | Clear communication on ingredient sourcing and product content to build consumer trust. | Over 70% of consumers consider ingredient transparency in 2024 purchasing decisions. |

| Environmental Sustainability | Commitment to eco-friendly practices, including packaging goals. | Targeting 100% recyclable plastic packaging by 2025. |

Customer Relationships

Midsona actively cultivates direct customer relationships via its digital channels, such as dedicated websites and social media platforms. These channels serve as hubs for sharing valuable content like health tips, recipes, and lifestyle advice, directly connecting with consumers interested in well-being.

This direct engagement facilitates immediate customer interaction, enabling Midsona to gather crucial feedback and foster vibrant communities around its diverse brand portfolio. For instance, in 2024, Midsona reported a significant increase in website traffic and social media engagement, reflecting the success of its digital content strategy.

To enhance this personalized experience, Midsona employs cookies. These are used to tailor user journeys on their platforms and deliver advertisements that are more relevant to individual preferences and past interactions, thereby strengthening brand loyalty and driving repeat business.

Midsona prioritizes responsive customer service to address inquiries and resolve issues, fostering loyalty. In 2024, the company continued to offer robust online FAQs and dedicated email and phone support channels for product information and purchasing assistance.

Midsona can cultivate strong brand loyalty through well-designed programs and targeted promotions. By rewarding repeat purchases, these initiatives encourage customers to remain engaged with Midsona's diverse product offerings, ultimately boosting customer retention and lifetime value. For instance, a tiered loyalty system offering exclusive early access to new product launches or special discounts can incentivize consistent spending.

Educational Content and Health Information

Midsona strengthens customer bonds by providing valuable educational content and trustworthy health information. This focus on nutrition, dietary supplements, and sustainable living establishes the company as a go-to resource, offering benefits that extend beyond mere product transactions.

By acting as a reliable source of information, Midsona empowers consumers to make well-informed decisions about their health and well-being. This approach fosters loyalty and positions Midsona as a partner in their health journeys.

- Educational Content: Midsona can offer articles, guides, and webinars on topics like balanced nutrition, the benefits of specific supplements, and practical tips for sustainable living.

- Health Information: Providing access to evidence-based health advice and research related to their product categories builds credibility and trust.

- Trusted Resource: By consistently delivering accurate and helpful information, Midsona cultivates a reputation as a dependable authority in the health and wellness space.

- Consumer Empowerment: This strategy equips consumers with the knowledge they need to navigate their dietary choices and lifestyle decisions confidently.

Retailer and Distributor Collaboration

Midsona prioritizes robust partnerships with its retailers and distributors, recognizing them as crucial conduits to the end consumer. By offering dedicated marketing support, comprehensive product training, and seamless supply chain management, Midsona aims to foster a consistently positive customer experience across all touchpoints.

- Retailer and Distributor Engagement: Midsona actively cultivates strong, collaborative relationships with its retail and distribution partners.

- Consumer Touchpoint Focus: These partners serve as the primary interface with end consumers, making their engagement critical for brand perception and sales success.

- Support Mechanisms: Midsona provides essential support, including marketing initiatives, product education, and efficient logistics, to empower these partners.

- Private Label Strategy: The company specifically focuses on developing strategic customer relationships within its Private Label segment, indicating a tailored approach to key collaborators.

Midsona's customer relationships are built on direct engagement through digital platforms, offering valuable content and fostering community. This approach, exemplified by increased website traffic and social media engagement in 2024, aims to build loyalty and gather feedback.

The company also leverages retailer and distributor partnerships, providing them with marketing support and training to ensure a positive end-consumer experience. A key focus in 2024 was strengthening these relationships, particularly within the Private Label segment.

| Customer Relationship Aspect | 2024 Focus/Activity | Impact/Goal |

|---|---|---|

| Direct Digital Engagement | Content sharing (health tips, recipes), community building | Increased website traffic and social media engagement, enhanced brand loyalty |

| Retailer & Distributor Partnerships | Marketing support, product training, supply chain management | Consistent positive end-consumer experience, strengthened channel presence |

| Private Label Segment | Strategic relationship development | Tailored collaboration and growth within this key area |

Channels

Supermarkets and grocery stores are Midsona's backbone for reaching consumers with its health-focused products. These outlets offer unparalleled accessibility for everyday shopping needs, ensuring Midsona's brands are readily available to a wide audience across its key markets.

In 2024, Midsona continues to leverage its strong foothold in the Nordic countries, where these channels are particularly vital. The company is also actively expanding its presence in Germany, France, and Spain, further solidifying supermarkets and grocery stores as its primary distribution network in these growing European markets.

Health food stores and specialty shops represent a vital distribution channel for Midsona, directly reaching consumers who prioritize natural, organic, and specialized health products. These retailers offer a curated environment and often boast staff with in-depth product knowledge, enhancing the customer experience.

For instance, the UK's natural and organic sector sees significant engagement at events like the Natural & Organic Products Expo, highlighting the demand and visibility within this niche. Midsona's presence in such channels allows them to connect with a dedicated customer base actively seeking their product offerings.

Midsona leverages online retail and e-commerce platforms to expand its market reach and enhance customer convenience. This strategy allows access to a broader customer base beyond physical store limitations. The global e-commerce market is projected to experience significant growth, with estimates suggesting a 39% increase by 2027.

By utilizing both proprietary e-commerce websites and third-party marketplaces, Midsona can offer a more extensive product selection and cater to diverse consumer preferences. Innovations such as AI-powered product recommendations and virtual try-on experiences are increasingly influencing online purchasing decisions, creating new avenues for engagement and sales.

Pharmacies and Drugstores

Pharmacies and drugstores represent crucial distribution channels for Midsona, facilitating the sale of its diverse product portfolio including dietary supplements, sports nutrition, and cold remedies. These outlets leverage the inherent trust consumers associate with them for health and wellness purchases, enabling Midsona to connect with individuals actively seeking solutions for their health needs.

In 2024, the European pharmacy market continued to demonstrate resilience and growth, with many countries experiencing an increase in over-the-counter sales for health supplements. For instance, reports from early 2024 indicated that the German drugstore market, a significant channel for such products, saw continued expansion in the health and personal care segments.

- Key Distribution Hubs: Pharmacies and drugstores are vital for Midsona to reach consumers looking for trusted health solutions.

- Product Reach: These channels effectively distribute Midsona's range of health foods, sports nutrition, superfoods, dietary supplements, and cold remedies.

- Consumer Trust: The established credibility of pharmacies and drugstores enhances consumer confidence in Midsona's health-oriented products.

- Market Access: They provide direct access to consumers actively seeking specific health and wellness products.

Contract Manufacturing and Private Label Partnerships

Midsona effectively leverages contract manufacturing and private label partnerships as key channels to broaden its market presence and boost revenue. This strategy involves utilizing Midsona's robust production facilities to manufacture products for other brands or retailers, which are then sold under their respective private labels.

This approach allows Midsona to capitalize on its manufacturing expertise while diversifying its income streams. The company experienced notable sales growth in its contract manufacturing segment during Q4 2024 and continued this positive trajectory into Q2 2025, demonstrating the channel's increasing importance.

- Contract Manufacturing: Midsona produces goods for third-party brands, utilizing its production capacity.

- Private Label Partnerships: The company manufactures products that are then marketed and sold under a partner's brand name.

- Revenue Diversification: These channels offer alternative revenue streams beyond Midsona's own branded products.

- Market Expansion: Partnerships enable Midsona to reach new customer segments and markets through its partners' distribution networks.

Midsona's channel strategy is multifaceted, encompassing direct-to-consumer sales through its own e-commerce platforms and partnerships with various retail formats. This approach ensures broad market penetration and caters to diverse consumer shopping habits.

The company's online presence is a growing segment, with e-commerce sales showing a consistent upward trend. In 2024, Midsona noted a significant increase in online orders, particularly from younger demographics actively seeking convenient health solutions.

Supermarkets and pharmacies remain foundational, providing consistent volume and accessibility. Midsona's commitment to these channels is evident in its continued investment in product placement and promotional activities within these high-traffic environments.

Specialty health stores and international markets represent key growth areas, allowing Midsona to target niche consumer segments and expand its global footprint.

| Channel | 2024 Performance Highlight | Strategic Focus |

|---|---|---|

| Supermarkets/Grocery Stores | Continued strong sales volume, particularly in Nordic markets. | Maintaining prime shelf space and expanding product visibility. |

| Health Food Stores/Specialty Shops | Increased engagement with health-conscious consumers. | Targeting niche markets and leveraging product expertise. |

| Online Retail/E-commerce | Significant growth in direct-to-consumer sales. | Enhancing user experience and expanding digital marketing efforts. |

| Pharmacies/Drugstores | Resilient sales, especially in over-the-counter health supplements. | Leveraging consumer trust and expanding product offerings. |

| Contract Manufacturing/Private Label | Notable sales growth in Q4 2024. | Capitalizing on manufacturing expertise and diversifying revenue. |

Customer Segments

Health-conscious consumers are a core focus for Midsona, representing individuals who actively pursue products that enhance their health and overall well-being. These consumers often lean towards natural, organic, and minimally processed food options, scrutinizing ingredient quality and nutritional content while actively avoiding artificial additives. In 2023, the global market for organic food and beverages alone was valued at over $250 billion, reflecting the significant demand within this segment.

Environmentally and sustainably minded consumers are a growing force, actively seeking products that align with their values. These individuals scrutinize brands for their commitment to organic certifications, ethical sourcing of ingredients, and the use of eco-friendly packaging. In 2024, reports indicated that over 60% of consumers are willing to pay a premium for sustainable products, a trend directly benefiting companies like Midsona whose portfolio emphasizes natural and organic offerings.

Midsona's core customer base includes plant-based and vegetarian consumers, a segment experiencing robust growth. These individuals actively seek a wide variety of nutritious and appealing food choices that align with their lifestyle. By 2030, Midsona is committed to offering an entirely plant-based or vegetarian product line, catering directly to this expanding market.

Families and Households Seeking Healthy Options

Families and households are a primary focus for Midsona, particularly those actively seeking healthier and safer food choices for their loved ones. This segment prioritizes natural and organic products for everyday consumption, valuing both the nutritional benefits and the assurance of quality for their children. Convenience and accessibility are key drivers for these consumers, who are often juggling busy schedules and looking for easy ways to incorporate wholesome options into their diets.

Midsona's commitment is to bridge the gap between a healthy lifestyle and everyday life, making nutritious choices attainable for a wide range of households. In 2024, the demand for plant-based and allergen-free options continued to surge within this demographic. For instance, reports indicated that over 60% of parents consider nutritional content a top priority when purchasing food for their children, underscoring the importance of Midsona's product development in this area.

- Health-Conscious Parents: Seeking products free from artificial additives and with clear nutritional labeling.

- Busy Households: Prioritizing convenience and ready-to-eat or easy-to-prepare healthy meals and snacks.

- Allergy-Aware Consumers: Looking for products that cater to specific dietary needs, such as gluten-free or dairy-free options.

- Eco-Minded Families: Increasingly interested in sustainably sourced and produced food items.

Specialty Retailers and Food Service Providers

Specialty retailers and food service providers represent a crucial business-to-business customer segment for Midsona. This includes health food stores, organic markets, and various food service establishments like cafes and restaurants that seek high-quality organic and natural ingredients in bulk or for specialized applications. In 2024, the organic food market continued its robust growth, with reports indicating a significant increase in consumer demand for natural and sustainably sourced products, directly benefiting these types of Midsona customers.

Midsona strategically collaborates with key accounts within the Private Label sector, tailoring product offerings to meet the specific branding and quality requirements of these partners. This focus allows for deeper integration and mutual growth, as these businesses rely on consistent and differentiated organic ingredients to maintain their competitive edge. For instance, many European organic supermarkets saw sales growth exceeding 7% in the first half of 2024, underscoring the demand for private label organic goods.

- Targeting niche markets: Specialty retailers and food service providers cater to consumers actively seeking organic and natural options, a growing demographic.

- Private Label partnerships: Midsona’s focus on private label allows these B2B customers to offer unique, branded organic products to their end consumers.

- Market growth drivers: Increased consumer awareness of health and environmental benefits fuels demand for organic products, directly benefiting Midsona's B2B clients.

- Operational efficiency: Supplying these businesses often involves bulk orders and specialized product needs, which Midsona can efficiently manage.

Midsona's customer base extends to B2B partners, including specialty retailers and food service providers who cater to the growing demand for organic and natural products. These partners, such as health food stores and cafes, rely on Midsona for high-quality ingredients. In 2024, the European organic food market continued to show strong growth, with many organic supermarkets reporting sales increases of over 7% in the first half of the year, indicating a healthy demand for the products Midsona supplies to these channels.

Furthermore, Midsona engages with Private Label customers, developing tailored product lines that meet specific branding and quality standards. This collaborative approach allows B2B partners to offer unique organic products to their own customer base. The demand for private label organic goods remains high, as evidenced by the continued sales momentum in this sector throughout 2024.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| Specialty Retailers & Food Service | Seek high-quality organic ingredients; cater to health-conscious consumers. | Robust growth in organic food demand benefits these partners. |

| Private Label Partners | Require tailored product development and consistent quality for their brands. | Continued strong sales for private label organic goods reflect high consumer trust. |

Cost Structure

Midsona's cost structure heavily relies on the acquisition of organic and natural ingredients. These costs are directly tied to fluctuating agricultural market prices, seasonal availability, and the rigorous certification processes needed for organic sourcing. For instance, Midsona noted in their Q4 2024 and Q1 2025 reports that elevated raw material prices continued to put pressure on their gross margins, highlighting the sensitivity of their cost base to these external factors.

Manufacturing and production costs, encompassing labor, energy, facility upkeep, and quality assurance, represent a significant portion of Midsona's expenses. In 2024, the company continued its focus on optimizing these operational overheads to bolster profitability.

Midsona's commitment to an operational excellence program aims to drive efficiency across its factories, directly impacting these core manufacturing costs. This initiative is crucial for maintaining a competitive edge in the market.

Logistics and distribution costs are a substantial part of Midsona's expenses, encompassing everything from storing products to getting them to customers across different regions. This involves paying for warehousing, shipping, and managing the intricate network that moves goods. For instance, in 2023, the company reported that its cost of goods sold, which includes these logistics, represented a significant portion of its revenue.

Midsona is actively working to optimize these costs by focusing on using its resources more effectively and finding the most efficient transportation methods. This strategic approach aims to reduce the financial impact of its supply chain operations. The company's commitment to efficiency in transport is a key element in managing its overall cost structure.

Marketing, Sales, and Brand Building Expenses

Midsona's cost structure heavily features investments in marketing, sales, and brand building. These are vital for raising consumer awareness, gaining market share, and ensuring brand resilience in a competitive landscape. In the fourth quarter of 2024, Midsona significantly ramped up its market investments across the Nordic region.

- Marketing Campaigns: Significant budget allocation towards digital and traditional advertising to promote product launches and existing brands.

- Sales Force Activities: Costs associated with sales teams, including salaries, commissions, travel, and training to drive distribution and retail partnerships.

- Brand Development: Investment in maintaining and enhancing brand equity through public relations, sponsorships, and ongoing brand messaging.

Research and Development (R&D) Costs

Midsona’s commitment to innovation is reflected in its significant Research and Development (R&D) costs. These expenditures are crucial for creating new product formulations and enhancing existing ones, particularly within their three core product categories. For instance, in 2023, Midsona reported R&D expenses of approximately SEK 100 million, a figure that underscores their dedication to staying ahead in the competitive health and wellness market.

These investments are not merely about product development; they are strategic imperatives. By continuously refining their offerings and exploring new healthy and sustainable options, Midsona aims to meet the dynamic preferences of consumers. This focus on innovation is a key driver for maintaining their competitive advantage and ensuring long-term growth.

- Product Innovation: Developing novel formulations for their health foods and supplements.

- Process Improvement: Enhancing manufacturing processes for efficiency and sustainability.

- Market Research: Understanding consumer trends to guide R&D efforts.

- Regulatory Compliance: Ensuring all new products meet stringent health and safety standards.

Midsona's cost structure is significantly influenced by the sourcing of organic and natural ingredients, with prices subject to market fluctuations and certification requirements. Manufacturing and production expenses, including labor and energy, are also substantial, with the company actively pursuing operational efficiencies in 2024 to manage these costs. Logistics and distribution represent another key cost area, with the company working to optimize its supply chain operations for greater efficiency.

| Cost Category | Key Drivers | 2024/2025 Impact |

| Ingredient Sourcing | Organic/natural ingredient prices, seasonality, certifications | Pressure on gross margins due to elevated raw material costs (Q4 2024/Q1 2025 reports) |

| Manufacturing & Production | Labor, energy, facility upkeep, quality assurance | Focus on optimizing operational overheads for profitability |

| Logistics & Distribution | Warehousing, shipping, supply chain management | Significant portion of COGS; efforts to improve resource and transport efficiency |

| Marketing & Sales | Advertising, sales force, brand development | Increased market investments across Nordic region (Q4 2024) |

| Research & Development | New product formulation, process improvement | Approx. SEK 100 million in 2023; strategic for competitive advantage |

Revenue Streams

Midsona's core revenue generation is through the sale of its diverse portfolio of branded organic and natural products. This includes categories like health foods, dietary supplements, plant-based alternatives, and personal care items, reaching consumers via both brick-and-mortar retail and e-commerce platforms.

A significant portion of Midsona's financial success is directly tied to its own consumer brands, which are responsible for roughly 60 percent of the Group's total sales. This highlights the strong brand equity and consumer trust Midsona has cultivated in the organic and natural product market.

Midsona also generates revenue through private label and contract manufacturing. This means they produce goods for other companies or retailers who then sell them under their own brand names. This strategy effectively utilizes Midsona's production capacity and broadens their market presence.

This segment of Midsona's business has shown positive momentum. Specifically, the company reported sales growth in its contract manufacturing operations during the fourth quarter of 2024 and again in the second quarter of 2025, indicating increasing demand for their manufacturing services.

Midsona generates revenue from distinct geographical segments: the Nordics, North Europe (specifically Germany), and South Europe (comprising France and Spain). This geographical spread helps reduce reliance on any single market and allows the company to capitalize on varied growth opportunities.

In 2024, the Nordics represented the largest portion of Midsona's sales, contributing 65% to the total revenue. North Europe, primarily driven by Germany, accounted for 24% of sales. The remaining 11% of revenue was generated from the South European markets of France and Spain.

E-commerce Sales

Midsona leverages direct sales through its proprietary e-commerce platforms and presence on various online marketplaces. This channel is increasingly important, aligning with the significant global growth in online shopping for health and wellness products, a trend projected to expand by 39% worldwide by 2027.

The company's e-commerce strategy allows it to directly reach consumers and capitalize on the digital shift in purchasing behavior.

- Direct-to-Consumer (DTC) E-commerce: Midsona operates its own online stores, offering a curated selection of its health and wellness brands.

- Online Marketplace Integration: The company sells through major e-commerce platforms, expanding its reach and accessibility to a broader customer base.

- Growing Revenue Contribution: E-commerce sales represent an expanding segment of Midsona's overall revenue, reflecting the increasing consumer preference for online purchasing.

- Market Trend Alignment: This revenue stream directly taps into the robust global growth forecast for online retail, particularly within the health and wellness sector.

Innovation and New Product Launches

Midsona's revenue is significantly boosted by its commitment to innovation and the successful introduction of new products. These launches are strategically designed to tap into evolving consumer preferences and emerging trends within the health and well-being market.

This ongoing focus on developing novel offerings not only attracts new customer segments but also reinforces Midsona's position as a relevant and forward-thinking brand. For instance, in 2023, Midsona reported a strong performance in its new product categories, contributing to overall sales growth.

- New Product Contribution: Successful launches directly translate to increased sales volume and market share.

- Market Trend Alignment: Products that resonate with current health and wellness demands capture consumer interest and drive revenue.

- Customer Acquisition: Innovative products serve as a key differentiator, attracting new buyers to the Midsona brand.

- Growth Initiatives: Midsona actively pursues country-specific growth strategies, often centered around new product introductions.

Midsona's revenue streams are diversified across its strong portfolio of organic and natural brands, which account for approximately 60 percent of total sales. Beyond its own brands, the company also generates income through private label production and contract manufacturing for other businesses.

Geographically, revenue is segmented across the Nordics (65% of 2024 sales), North Europe (24% in 2024, largely Germany), and South Europe (11% in 2024, France and Spain). The company also benefits from direct-to-consumer e-commerce sales, which are a growing channel aligned with market trends.

Innovation through new product development is a key driver of revenue, capturing evolving consumer preferences in the health and wellness sector. This focus on new offerings helps acquire customers and maintain market relevance.

| Revenue Stream | Key Characteristics | 2024 Contribution (Approximate) |

|---|---|---|

| Branded Product Sales | Organic and natural health foods, supplements, plant-based, personal care | 60% (Group's total sales) |

| Private Label & Contract Manufacturing | Producing goods for other brands/retailers | N/A (Included in overall sales, but growing) |

| Geographical Segments | Nordics, North Europe (Germany), South Europe (France, Spain) | Nordics: 65% North Europe: 24% South Europe: 11% |

| E-commerce (DTC & Marketplaces) | Direct online sales and through third-party platforms | Growing segment, aligned with market trends |

| New Product Introductions | Capitalizing on evolving health and wellness trends | Contributes to overall sales growth |

Business Model Canvas Data Sources

The Midsona Business Model Canvas is built upon comprehensive market research, internal financial reports, and strategic analyses of the health and wellness sector. These data sources ensure each component, from customer segments to revenue streams, is grounded in factual insights and industry understanding.