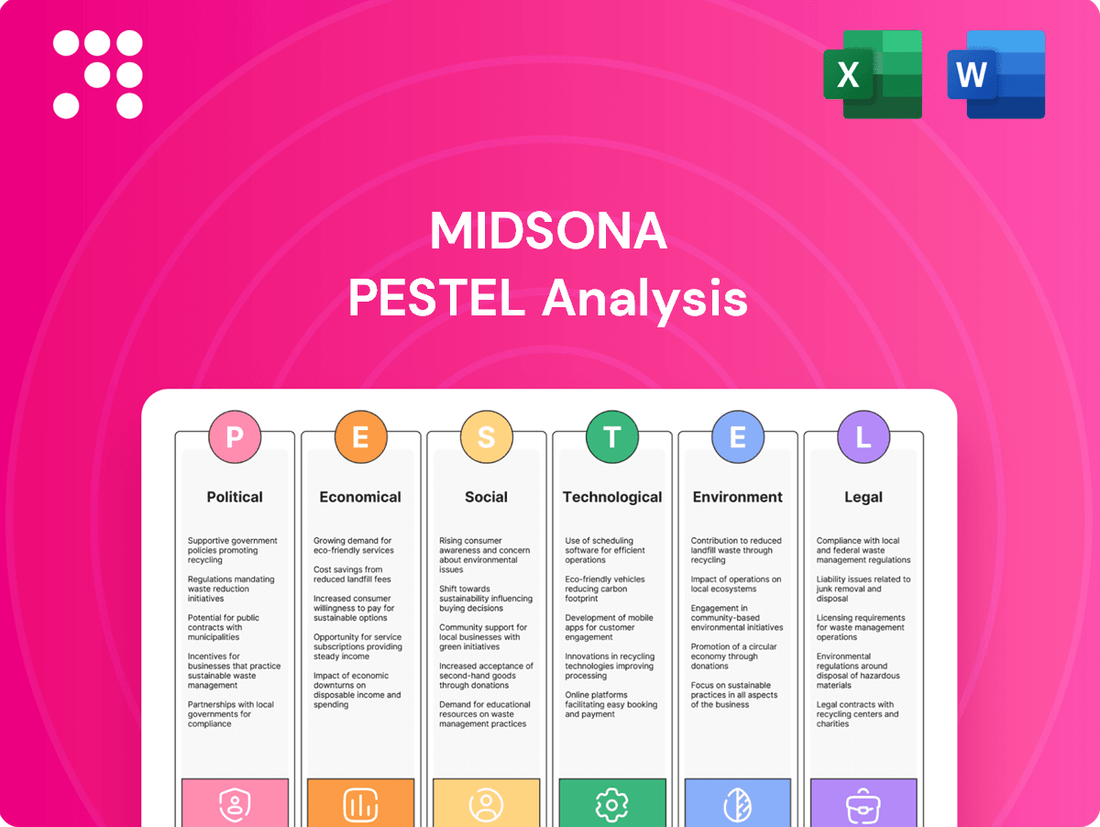

Midsona PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Midsona Bundle

Discover the critical political, economic, social, technological, legal, and environmental factors impacting Midsona's trajectory. Our meticulously researched PESTLE analysis provides the essential context for strategic decision-making. Uncover hidden opportunities and potential threats that could redefine the market. Download the full PESTLE analysis now to gain a decisive advantage.

Political factors

Government policies actively shape the health and wellness landscape where Midsona operates. For instance, Sweden, a key market for Midsona, has seen increased focus on public health campaigns promoting plant-based diets and reduced sugar intake, potentially driving demand for Midsona's healthier product lines.

These government initiatives, such as updated dietary recommendations or subsidies for healthy food options, can directly influence consumer purchasing behavior. In 2023, the Swedish National Food Agency continued to emphasize recommendations for increased consumption of fruits, vegetables, and whole grains, aligning with Midsona's product portfolio.

Conversely, stricter regulations on food labeling or ingredient restrictions, if introduced, could necessitate adjustments in Midsona's product development and marketing strategies. For example, potential future EU regulations on sugar content or specific additives could impact existing product formulations.

As a Nordic company operating across Europe, Midsona navigates a complex web of EU-wide and individual national food regulations. These rules are crucial, dictating everything from food safety standards and precise labeling requirements to the approval process for new ingredients, directly impacting how Midsona develops, produces, and sells its products.

For instance, the EU's General Food Law (Regulation (EC) No 178/2002) establishes a harmonized framework for food safety, while specific directives and national laws add further layers of compliance. Adapting to evolving regulations, such as the 2023 update to the EU Organic Regulation (Regulation (EU) 2018/848) which tightened rules on organic farming and processing, or new approvals for novel foods, necessitates ongoing vigilance and operational adjustments for Midsona.

Trade agreements and tariffs significantly influence Midsona's operations. For instance, the EU's Common Agricultural Policy and various free trade agreements within Europe can affect the cost of sourcing raw materials like oats and berries, key ingredients in Midsona's products. Favorable terms can lower import costs, boosting profitability.

Conversely, potential trade disputes or the imposition of new tariffs on agricultural goods entering or leaving the EU could increase Midsona's operational expenses. For example, a hypothetical tariff increase on imported grains could directly impact the cost of goods sold for their cereal and muesli lines, potentially forcing price adjustments for consumers in markets like Sweden and Denmark.

Sustainability and Green Deal Initiatives

The European Green Deal, a major policy initiative aiming for climate neutrality by 2050, significantly impacts the food sector by promoting sustainable production and consumption patterns. This includes a focus on reducing food waste and encouraging organic farming practices. For Midsona, whose portfolio emphasizes organic and natural products, these political tailwinds are advantageous, potentially attracting government incentives and a growing consumer base prioritizing eco-friendly options.

National sustainability programs across Europe often mirror the Green Deal's objectives, creating a consistent regulatory environment that favors environmentally conscious businesses. For instance, many countries are implementing targets for increased organic land use and reduced pesticide application, directly aligning with Midsona's core product offerings. This alignment can translate into preferential market access and consumer trust.

However, the evolving regulatory landscape also presents challenges. Increasingly stringent environmental standards, such as those related to packaging waste reduction and carbon footprint measurement, could lead to higher operational and compliance costs for Midsona. For example, as of early 2024, several EU member states are introducing or tightening regulations on single-use plastics and food packaging recyclability, requiring investment in new materials and processes.

- European Green Deal targets climate neutrality by 2050, influencing food production and consumption.

- Midsona's organic and natural product focus aligns with these sustainability drivers.

- National initiatives support organic farming and reduced pesticide use, benefiting Midsona.

- Stricter environmental regulations, like packaging waste rules, may increase compliance costs.

Political Stability and Consumer Confidence

Political stability across Midsona's core markets, including the Nordics, Germany, France, and Spain, significantly influences consumer confidence and their willingness to spend on health-focused products. A predictable political landscape typically supports economic growth, which in turn boosts consumer purchasing power for items like supplements and specialized foods. For instance, a stable political climate in Sweden, a key market for Midsona, encourages consumer spending on premium health products. Conversely, periods of political uncertainty can dampen consumer sentiment, leading to a cautious approach to discretionary spending.

The economic policies enacted by governments also play a crucial role. Favorable tax policies or subsidies for health and wellness products can directly stimulate demand. For example, if a government implements incentives for healthy eating or dietary supplements, Midsona could see increased sales. Conversely, changes in trade regulations or import/export tariffs between these European nations could impact Midsona's supply chain efficiency and product pricing, potentially affecting consumer affordability.

Government regulations concerning food safety, labeling, and marketing of health products are paramount. Strict adherence to these standards is essential for market access and consumer trust. In 2024, the European Union continued to emphasize stringent food safety regulations, requiring companies like Midsona to maintain high product quality and transparent labeling practices. Compliance ensures that Midsona's products meet consumer expectations for safety and efficacy in all its operating regions.

Government policies, particularly those related to public health and sustainability, significantly shape the market for Midsona's products. For example, the European Green Deal, aiming for climate neutrality by 2050, promotes sustainable food practices that align well with Midsona's focus on organic and natural offerings. Many European nations are reinforcing these goals with national programs that encourage organic farming and reduce pesticide use, creating a favorable environment for Midsona.

However, evolving regulations, such as stricter rules on packaging waste and carbon footprint reporting, could increase Midsona's operational costs. For instance, as of early 2024, several EU countries are implementing tighter controls on single-use plastics and packaging recyclability. These political factors, including trade agreements and tariffs, also influence the cost of raw materials and market access across Midsona's operating regions.

What is included in the product

This Midsona PESTLE analysis dissects the influence of political, economic, social, technological, environmental, and legal factors on the company's strategic landscape.

It provides actionable insights for stakeholders to navigate external challenges and capitalize on emerging opportunities within Midsona's operating environment.

A concise, PESTLE-driven overview of Midsona's external landscape, simplifying complex market dynamics for rapid strategic decision-making.

Economic factors

Rising inflation, particularly in the costs of raw materials and energy, directly impacts Midsona's production expenses and profitability. Despite Midsona's reported improvements in gross margin, persistent high raw material prices continue to present a significant hurdle.

Furthermore, a decline in consumer purchasing power, a direct consequence of inflation, may compel shoppers to seek more budget-friendly options. This shift could negatively affect sales volumes for Midsona's premium organic product lines.

Economic growth in the European Union is anticipated to reach 0.9% in 2024 and accelerate to 1.5% in 2025, fueled by rising consumption and investment. This upward trend is favorable for Midsona, as a healthier economy typically correlates with increased consumer spending on health and wellness items, which are often considered discretionary purchases.

While Midsona experienced growth in North and South Europe during early 2025, its performance in the Nordics presented challenges. This highlights the varied impact of regional economic conditions on the company's sales, demonstrating that broad economic growth doesn't always translate uniformly across all markets.

Midsona's operations across Europe mean it's directly impacted by fluctuating exchange rates. For instance, a stronger Euro could make its products more expensive for buyers in countries outside the Eurozone, potentially hurting export sales. Conversely, a weaker Euro could increase the cost of raw materials purchased in other currencies.

These currency swings directly influence Midsona's profitability. In 2024, the Euro experienced periods of volatility against currencies like the Swedish Krona, given Midsona's Swedish origins and significant presence in the Nordic region. Such movements affect the reported value of foreign subsidiaries' earnings when translated back into the reporting currency, creating accounting gains or losses.

For example, if Midsona imports a significant portion of its ingredients from the UK, a depreciation of the Euro against the British Pound would directly increase Midsona's cost of goods sold, squeezing its profit margins unless it can pass these costs onto consumers or find alternative suppliers.

Interest Rates and Access to Financing

Changes in interest rates directly impact Midsona's expenses for any new or existing debt used for investments, daily operations, or growth initiatives. For instance, a rise in benchmark rates could increase the cost of servicing their existing variable-rate debt or make new long-term financing more expensive.

Midsona's recent success in securing a new long-term financing agreement, announced in early 2024, suggests a current environment of stable access to credit for the company. This new agreement likely provides more predictable borrowing costs for the foreseeable future, offering a degree of insulation from immediate rate fluctuations.

However, the broader economic landscape and decisions by central banks, such as the European Central Bank (ECB) or the Swedish Riksbank, will continue to shape the interest rate environment. These policies influence the overall cost of capital and the availability of financing, remaining a key consideration for Midsona's long-term financial planning and strategic investment decisions throughout 2024 and into 2025.

- Midsona's financing costs are directly tied to prevailing interest rates, affecting profitability.

- The company secured a new long-term financing agreement in early 2024, indicating current credit accessibility.

- Central bank policies on interest rates, such as those from the ECB, will continue to influence Midsona's financial strategy.

- Expected interest rate trends in 2024-2025 will be a crucial factor in Midsona's capital allocation and investment decisions.

Supply Chain Costs and Efficiency

The broader economic climate significantly impacts supply chain expenses, encompassing everything from shipping and warehousing to workforce wages. For instance, rising fuel prices in late 2024 and early 2025 have directly increased transportation costs for companies like Midsona.

Midsona's strategic focus on process optimization and operational excellence initiatives is designed to boost efficiency and counteract these rising costs. These programs are vital for preserving profit margins in today's highly competitive marketplace.

Key areas of focus for improving supply chain efficiency include:

- Inventory Management: Implementing just-in-time or optimized inventory strategies to reduce holding costs and waste.

- Logistics Optimization: Leveraging technology for route planning, load consolidation, and carrier selection to lower transportation spend.

- Supplier Relationships: Negotiating better terms and exploring collaborative forecasting with key suppliers to stabilize input costs.

- Automation and Technology: Investing in warehouse automation and digital tracking systems to improve throughput and reduce labor dependency.

Economic conditions significantly influence Midsona's cost structure and consumer demand. Rising inflation, particularly for raw materials and energy, directly impacts production expenses, while reduced consumer purchasing power can shift demand towards more budget-friendly alternatives, potentially affecting sales of premium organic products.

The projected economic growth in the European Union for 2024 (0.9%) and 2025 (1.5%) offers a more favorable backdrop for Midsona, as increased consumption and investment generally correlate with higher spending on health and wellness items. However, regional economic disparities, as seen in Midsona's varied performance across European markets in early 2025, mean that broad economic trends do not uniformly benefit all operations.

Fluctuating exchange rates and interest rate policies from central banks like the ECB remain critical economic factors. These elements directly affect Midsona's financing costs, the cost of imported goods, and the profitability of international sales, necessitating careful financial planning and risk management throughout 2024 and 2025.

What You See Is What You Get

Midsona PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Midsona PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company. It provides a strategic overview to inform business decisions.

Sociological factors

Consumers worldwide are increasingly prioritizing their health and wellness, actively seeking ways to manage their well-being and embrace 'aging well.' This significant shift directly supports Midsona's business model, as the company specializes in products designed to foster healthier and more sustainable lifestyles. For instance, in 2024, the global health and wellness market was projected to reach over $5.8 trillion, with a notable surge in demand for dietary supplements and plant-based alternatives.

Consumer interest in organic and plant-based foods is on the rise, fueled by growing awareness of personal well-being and environmental impact. This trend is evident in market growth figures, with the global plant-based food market projected to reach $162 billion by 2030, up from $27 billion in 2022. Midsona's strategic focus on these segments places it favorably to benefit from this sustained consumer shift.

Consumers are increasingly looking for food that fits their specific health needs, like gut health or immunity. This is driving demand for functional foods, which are foods with added health benefits. For example, a 2024 report indicated that the global functional foods market reached over $200 billion, with a projected compound annual growth rate of around 8% through 2030. This shows a clear societal shift towards proactive health management through diet.

This trend offers a significant avenue for Midsona to develop and market products that cater to these evolving consumer preferences. By focusing on personalized nutrition and incorporating ingredients that support specific wellness goals, Midsona can tap into a growing market segment. For instance, products fortified with probiotics for gut health or vitamins for immune support are becoming highly sought after, reflecting a deeper consumer understanding of the link between diet and well-being.

Sustainability and Ethical Consumption

Consumers are increasingly scrutinizing the environmental and social footprint of their food purchases, driving a demand for greater transparency and sustainably sourced goods. This trend directly benefits companies like Midsona that prioritize ethical practices throughout their supply chains.

Midsona's commitment to sustainability, evident in their sourcing of organic ingredients, efforts to reduce emissions, and adherence to ethical labor standards, resonates strongly with this evolving consumer sentiment. For instance, in 2024, Midsona reported a 15% increase in sales for their organic product lines compared to the previous year, reflecting this growing consumer preference. Their sustainability initiatives are not just ethical choices but also strategic business advantages in the current market landscape.

- Growing Demand for Organic: In 2024, the global organic food market was valued at over $250 billion, with a projected compound annual growth rate of 9.5% through 2030, underscoring the significant consumer shift.

- Transparency Expectations: A 2024 survey indicated that 70% of consumers are more likely to purchase from brands that clearly label their sustainability efforts and ethical sourcing practices.

- Midsona's Sustainability Focus: Midsona aims to achieve carbon neutrality in its operations by 2030, a target that aligns with increasing societal pressure for corporate environmental responsibility.

Changing Lifestyle and Dietary Preferences

Consumer lifestyles are shifting dramatically, impacting how and what people eat. Busy schedules are a major driver, fueling a demand for convenient, ready-to-eat or easily prepared healthy meals. This trend is evident in the growth of the global convenient food market, which was valued at approximately USD 139.5 billion in 2023 and is projected to reach USD 201.2 billion by 2030, according to some market analyses.

Alongside convenience, there's a notable resurgence of interest in traditional dietary patterns, particularly the Nordic diet. This diet, emphasizing whole grains, fruits, vegetables, fish, and healthy fats, is gaining traction for its health benefits and sustainability. Midsona, with its focus on health and wellness, is well-positioned to capitalize on these dual trends.

- Demand for Convenience: Busy lifestyles drive the need for quick, healthy food options.

- Nordic Diet Popularity: Growing consumer interest in traditional, healthy eating patterns.

- Product Adaptation: Midsona can leverage these trends by offering convenient, health-focused products aligned with popular diets.

- Market Opportunity: The expanding market for convenient foods presents significant growth potential.

Societal shifts towards health and wellness are paramount, with consumers actively seeking products that support 'aging well' and healthier lifestyles. This aligns perfectly with Midsona's core business. For instance, the global health and wellness market was projected to exceed $5.8 trillion in 2024, highlighting a significant consumer focus on well-being.

There's a pronounced consumer preference for organic and plant-based foods, driven by both personal health and environmental concerns. The global plant-based food market is expected to reach $162 billion by 2030, a substantial increase from its 2022 valuation of $27 billion, indicating a strong market trend Midsona can leverage.

Consumers are increasingly interested in functional foods that offer specific health benefits, such as improved gut health or immunity. The global functional foods market surpassed $200 billion in 2024, with an anticipated compound annual growth rate of around 8% through 2030, reflecting a societal move towards proactive dietary health management.

Consumers are demanding greater transparency regarding the environmental and social impact of their food choices, favoring sustainably sourced goods. Midsona's commitment to sustainability, including organic sourcing and emission reduction efforts, resonates with this trend. In 2024, Midsona saw a 15% year-over-year increase in sales for its organic product lines, demonstrating this consumer preference.

Technological factors

Innovations in food biotechnology, such as precision fermentation and enzymatic technologies, are paving the way for novel functional foods and sustainable protein alternatives. These advancements allow for the creation of ingredients with enhanced nutritional profiles and improved taste, directly impacting product development.

For Midsona, these technological factors present significant opportunities to develop new product lines and ingredients that cater to growing consumer demand for healthier and more sustainable options. For example, advancements in enzymatic technology can improve the digestibility and bioavailability of nutrients in their existing product portfolio.

The global market for alternative proteins is projected to reach $290 billion by 2035, according to Bloomberg Intelligence, highlighting the immense potential for companies like Midsona to leverage fermentation and biotechnology to capture market share. This growth underscores the strategic importance of investing in these areas to reduce reliance on conventional agricultural inputs.

Digital transformation is revolutionizing the food industry's supply chain. For instance, AI-powered forecasting tools can reduce food waste by an estimated 10-15% by improving demand prediction. Midsona can harness these advancements, like advanced supply chain tracking systems, to gain real-time visibility, optimize inventory levels, and streamline production, ultimately boosting efficiency and reducing operational costs.

The growing reliance on e-commerce and digital marketing presents a significant opportunity for Midsona. By leveraging these channels, the company can connect with a broader audience and foster more direct customer relationships, a crucial aspect in the health and wellness market. For instance, in 2023, global e-commerce sales reached an estimated $6.3 trillion, highlighting the vast reach available through online platforms.

Midsona's strategic investments in its digital infrastructure and data-driven online advertising campaigns are key to amplifying brand recognition and driving sales. In 2024, digital ad spending is projected to exceed $600 billion globally, with a substantial portion allocated to e-commerce-related marketing, indicating a fertile ground for growth for companies like Midsona that can effectively navigate this space.

Product Innovation and Formulation

Technological advancements are a significant driver for Midsona's product innovation, particularly in formulation. For instance, breakthroughs in plant-based protein extraction and processing allow Midsona to develop novel ingredients and finished products that cater to the growing demand for meat alternatives. This innovation extends to enhancing the functional properties of foods, such as improving texture, taste, and nutritional profiles in their gluten-free or lactose-free offerings.

Furthermore, Midsona leverages technology to extend the shelf life of its products naturally, reducing reliance on artificial preservatives. This aligns with consumer preferences for cleaner labels and healthier options. For example, advancements in food preservation techniques, such as modified atmosphere packaging or natural antimicrobial compounds, enable Midsona to maintain product quality and safety while appealing to health-conscious consumers. In 2023, the global plant-based food market was valued at approximately $40 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030, highlighting the market opportunity for Midsona's innovative formulations.

Midsona's commitment to technological integration in product development is evident in its ability to respond to evolving consumer demands. The company actively invests in research and development to create products that are not only healthier and more natural but also more sustainable. This includes exploring innovative packaging solutions and optimizing production processes to minimize environmental impact. For example, Midsona's focus on plant-based ingredients supports a more sustainable food system, a key consideration for environmentally aware consumers.

Key technological factors influencing Midsona's product innovation include:

- Advancements in plant-based protein processing: Enabling the creation of high-quality meat alternatives.

- Natural food preservation technologies: Allowing for extended shelf life without artificial additives.

- Nutritional enhancement techniques: Improving the health profile of existing product lines.

- Sustainable packaging innovations: Reducing environmental footprint and appealing to eco-conscious consumers.

Smart Packaging and Food Safety Technology

Emerging smart packaging technologies, including biodegradable materials and advanced biosensors, are set to revolutionize food safety and traceability. These innovations not only enhance product integrity but also address the growing global concern over plastic waste. For instance, the development of active packaging that can detect spoilage early is a significant advancement.

Midsona's strategic focus on sustainability is evident in its commitment to achieving 100% recyclable plastic packaging by 2025. This initiative directly incorporates advancements in packaging technology, aligning the company with crucial environmental objectives and the increasing consumer demand for transparent and eco-friendly product lifecycles. This move is particularly important as consumer awareness regarding packaging waste continues to rise, influencing purchasing decisions.

- Smart Packaging Innovations: Development of biodegradable films and edible coatings to extend shelf life and reduce chemical preservatives.

- Biosensor Integration: Use of sensors that can detect microbial contamination or temperature abuse in real-time, providing immediate safety alerts.

- Traceability Enhancements: Technologies like QR codes and blockchain integration for end-to-end supply chain visibility, ensuring product authenticity and safety.

- Midsona's Packaging Goal: Midsona aims for 100% recyclable plastic packaging by 2025, reflecting a commitment to technological adoption in sustainability.

Technological advancements are reshaping the food sector, with innovations in biotechnology and digital solutions offering significant growth avenues for Midsona. The global alternative protein market is expected to hit $290 billion by 2035, underscoring the potential of fermentation and biotech for market capture. AI-driven supply chain tools can slash food waste by up to 15%, enhancing Midsona's operational efficiency.

E-commerce growth, with global sales reaching $6.3 trillion in 2023, provides Midsona with a broader reach and deeper customer engagement. Digital ad spending is projected to surpass $600 billion globally in 2024, offering substantial marketing opportunities. Midsona's investment in plant-based protein processing and natural preservation techniques allows for the development of healthier, more sustainable products.

The company's commitment to 100% recyclable plastic packaging by 2025 integrates smart packaging technologies, aligning with consumer demand for eco-friendly solutions. These technological integrations are crucial for Midsona to innovate and meet the evolving needs of health-conscious consumers.

| Key Technological Area | Impact on Midsona | Market Data/Projection |

| Biotechnology & Fermentation | New functional foods, sustainable proteins | Alt. protein market: $290B by 2035 |

| Digital Supply Chain | Reduced food waste, improved efficiency | AI waste reduction: 10-15% |

| E-commerce & Digital Marketing | Expanded reach, direct customer relations | Global e-commerce: $6.3T (2023) |

| Sustainable Packaging | Eco-friendly products, reduced waste | Midsona goal: 100% recyclable by 2025 |

Legal factors

Midsona operates under stringent food safety and quality regulations across its key markets, particularly within the Nordic region and the wider European Union. These regulations dictate everything from product ingredients and manufacturing hygiene to acceptable levels of contaminants, all designed to safeguard consumers and maintain product integrity.

For example, the EU's General Food Law (Regulation (EC) No 178/2002) establishes overarching principles for food safety, including traceability and hazard analysis. In 2023, the European Food Safety Authority (EFSA) continued its work on risk assessments for various food additives and contaminants, influencing updated guidelines that Midsona must follow.

Compliance with these evolving legal frameworks is crucial for Midsona's market access and reputation. Failure to meet standards, such as those related to allergen labeling or maximum residue limits for pesticides, could result in product recalls, fines, and significant damage to brand trust, impacting sales and profitability.

Laws governing product labeling and advertising claims are paramount for Midsona, particularly in its health and organic product segments. For instance, in the EU, the Food Information to Consumers (FIC) Regulation (EU) No 1169/2011 mandates clear and comprehensive ingredient lists and allergen information, impacting how Midsona communicates product benefits. Failure to comply can lead to significant fines and reputational damage, as seen in instances where food companies have faced penalties for misleading health claims.

Consumer protection laws are a critical legal factor for Midsona. These regulations ensure that consumers receive products that are safe, of good quality, and that trade practices are fair. For instance, in the EU, the Consumer Rights Directive mandates clear information about products and services, and provides rights for returns and refunds, which directly impacts Midsona's e-commerce operations and customer service policies. Failure to comply can lead to significant fines and damage to brand trust.

Intellectual Property Rights

Midsona heavily relies on intellectual property to safeguard its market position. Protecting brand names like Urtekram, Kung Markatta, and Davert through trademarks is paramount, as these are significant assets in the competitive food and health sector. Any novel product developments or unique manufacturing techniques could also be protected by patents, further solidifying their competitive edge.

The company's strategy involves actively defending its intellectual property rights against infringement. This proactive approach ensures that their innovations and brand equity are not diluted or exploited by competitors. For instance, in 2024, Midsona continued to monitor the market for potential trademark violations related to its key brands.

- Brand Protection: Trademarks for Urtekram, Kung Markatta, and Davert are vital for brand recognition and loyalty.

- Innovation Safeguarding: Patents are sought for new product formulations and proprietary manufacturing processes.

- Legal Enforcement: Midsona actively pursues legal avenues to prevent intellectual property infringement.

Labor Laws and Human Rights Compliance

Midsona, like any employer, must navigate a complex web of labor laws. These regulations cover everything from ensuring fair wages and safe working conditions to upholding fundamental employee rights. Compliance here isn't just about avoiding penalties; it's about building a stable workforce.

The company actively demonstrates its commitment to human rights through diligent practices. This includes aligning with internationally recognized standards like the UN Global Compact and OECD guidelines. This commitment isn't limited to its direct operations; it extends throughout Midsona's supply chain and value chain, fostering ethical conduct and mitigating legal and reputational exposure.

- Compliance with labor laws ensures fair treatment of employees regarding wages and working conditions.

- Adherence to UN Global Compact and OECD guidelines underscores a commitment to human rights due diligence.

- Extending ethical standards to suppliers helps mitigate risks across the entire value chain.

- Proactive human rights compliance safeguards against legal challenges and protects brand reputation.

Midsona operates within strict food safety and labeling regulations across Europe, such as the EU's FIC Regulation. In 2023, EFSA's ongoing risk assessments for food additives and contaminants directly influenced updated guidelines Midsona must adhere to, impacting product formulation and marketing claims.

Consumer protection laws, including the EU's Consumer Rights Directive, are critical for Midsona's e-commerce and customer service, dictating information transparency and return policies. Intellectual property laws are also vital, with Midsona actively protecting brands like Urtekram and Kung Markatta through trademarks and seeking patents for new product innovations in 2024.

Labor laws and human rights due diligence, aligned with the UN Global Compact, are essential for Midsona's operational integrity and supply chain management. Ensuring fair wages and safe working conditions, and extending ethical standards to suppliers, helps mitigate legal risks and protect brand reputation.

Environmental factors

Midsona is actively addressing climate change by aiming for a substantial 42% reduction in greenhouse gas emissions across Scope 1, 2, and 3 by 2030, using 2022 as its baseline. This aggressive target acknowledges the food industry's considerable environmental footprint.

The company's commitment to emissions reduction is a strategic imperative, particularly as global pressure mounts for businesses to align with climate goals. Achieving these targets will likely involve investments in sustainable sourcing, energy efficiency, and potentially renewable energy adoption.

Midsona's reliance on organic and natural ingredients means that the availability and sustainable sourcing of these materials are paramount to its success. Factors like climate change directly threaten agricultural yields, potentially disrupting supply chains. For instance, in 2024, reports highlighted increased volatility in the supply of certain organic grains due to extreme weather events in key growing regions.

To mitigate these risks, Midsona must implement robust strategies focused on responsible purchasing and diversifying its supplier base. This ensures resilience against localized environmental impacts. The company's commitment to sustainability in 2025 will likely involve deeper partnerships with farmers employing climate-resilient agricultural practices, aiming to secure long-term access to quality raw materials.

Growing pressure from both regulators and consumers to cut down on plastic waste and embrace a circular economy is significantly shaping Midsona's approach to packaging. This trend is particularly evident in the Nordic region, where sustainable takeaway packaging solutions are becoming the norm, driven by ambitious environmental goals.

Midsona is actively responding to these pressures, setting a clear target of achieving 100% recyclable plastic packaging by the year 2025. This commitment aligns with the pioneering efforts of Nordic countries in sustainable packaging and the broader environmental directives being implemented across the European Union, aiming to create more closed-loop systems for materials.

Water Usage and Waste Management

Efficient water usage and responsible waste management are critical environmental concerns for food manufacturers like Midsona. The company actively pursues sustainability by focusing on minimizing operational waste and optimizing resource utilization throughout its entire value chain.

Midsona's commitment to environmental stewardship is evident in its ongoing initiatives. For instance, in 2023, the company reported a continued focus on reducing its environmental footprint, with specific targets for waste reduction and water conservation across its production facilities.

- Waste Reduction: Midsona aims to decrease the amount of waste sent to landfill, prioritizing recycling and upcycling opportunities for production byproducts.

- Water Efficiency: The company implements technologies and processes to reduce water consumption in manufacturing, particularly in areas like cleaning and ingredient processing.

- Circular Economy Principles: Midsona explores ways to incorporate circular economy principles, seeking to reuse or repurpose materials that would otherwise be discarded.

- Supply Chain Impact: Efforts extend to the supply chain, encouraging sustainable water and waste management practices among suppliers.

Biodiversity and Land Use Impact

Midsona's dedication to organic products naturally aligns with preserving biodiversity. Organic farming methods, by their nature, tend to foster more robust and varied ecosystems compared to conventional agriculture. This focus means Midsona's supply chain is less likely to contribute to habitat degradation.

The company's forward-looking commitment to eliminating deforestation in its primary commodity sourcing by the end of 2025 is a significant environmental stance. This policy directly addresses land use impact, ensuring that Midsona's operations do not drive the clearing of vital forest areas. For instance, by December 31, 2025, Midsona aims for 100% of its palm oil, soy, and cocoa to be deforestation-free, a crucial step in protecting natural habitats.

- Organic Farming Support: Midsona's organic product range inherently promotes biodiversity by utilizing farming techniques that enhance soil health and reduce chemical inputs.

- Deforestation-Free Commitment: The company's pledge to achieve deforestation-free sourcing for key commodities by December 31, 2025, directly mitigates negative land use impacts.

- Ecosystem Health: By avoiding deforestation and supporting organic practices, Midsona contributes to the maintenance of healthier ecosystems and the species they support.

Midsona's environmental strategy is deeply intertwined with climate action, targeting a 42% reduction in greenhouse gas emissions by 2030 from a 2022 baseline, reflecting the food industry's significant footprint.

The company's commitment to organic ingredients means that climate change impacts on agriculture, such as extreme weather events seen in 2024 affecting grain supply, pose direct risks to its supply chain resilience.

Midsona is also addressing packaging waste, aiming for 100% recyclable plastic by 2025, aligning with Nordic and EU initiatives for a circular economy.

Furthermore, Midsona is actively working to eliminate deforestation in its sourcing of key commodities like palm oil and soy by the end of 2025, thereby mitigating land use impacts and supporting biodiversity.

| Environmental Focus Area | 2025 Target/Status | 2030 Target | Baseline Year | Key Initiatives |

|---|---|---|---|---|

| Greenhouse Gas Emissions Reduction | N/A | 42% reduction (Scopes 1, 2, 3) | 2022 | Sustainable sourcing, energy efficiency, renewable energy adoption |

| Recyclable Plastic Packaging | 100% | N/A | N/A | Alignment with Nordic and EU packaging regulations |

| Deforestation-Free Sourcing (Palm Oil, Soy, Cocoa) | 100% | N/A | N/A | Responsible purchasing and supplier diversification |

PESTLE Analysis Data Sources

Our Midsona PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable financial news outlets, and leading market research firms. We incorporate insights from international organizations and industry-specific reports to ensure comprehensive coverage of all relevant macro-environmental factors.